UGC NET Paper 2: Commerce 3rd Sept 2024 Shift 1 | UGC NET Past Year Papers PDF Download

Q1: Which one of the following is not a basic property of Indifference curve?

(a) Indifference curve slope downwards to right

(b) Indifference curve of imperfect substitutes are convex to the origin

(c) Indifference curve either intersect or are tangent to one another

(d) Upper indifference curves indicate a higher level of satisfaction

Ans: C

Sol: The correct answer is Indifference curve either intersects or are tangent to one another.

Indifference curve either intersect or are tangent to one another:

- This is incorrect. Indifference curves represent different levels of satisfaction or utility. If two indifference curves were to intersect, it would imply that the same bundle of goods provides two different levels of satisfaction, which is logically inconsistent. Therefore, indifference curves cannot intersect or be tangent to one another.

Other Related Points

Indifference curve slopes downwards to right:

- This is correct. Indifference curves slope downwards to the right because, to maintain the same level of satisfaction, an increase in the quantity of one good must be accompanied by a decrease in the quantity of another good.

Indifference curve of imperfect substitutes are convex to the origin:

- This is correct. Indifference curves are convex to the origin because of the diminishing marginal rate of substitution. As a consumer substitutes one good for another, the amount of the good being given up decreases at a diminishing rate.

Upper indifference curves indicate a higher level of satisfaction:

- This is correct. Higher indifference curves represent higher levels of satisfaction because they correspond to larger quantities of one or both goods.

Q2: Arrange the given steps involved in designing a channel system in the logical order -

A. Evaluating the distribution environment

B. Evaluating the short-listed alternative designs and selecting the one that suits the firm best

C. Matching the channel design to customer needs/characteristics

D. Choosing the channel intensity and number of tiers

E. Evaluating competitors channel design

Choose the correct answer from the options given below:

(a) A, C, E, B, D

(b) C, A, E, D, B

(c) C, E, D, A, B

(d) C, A, E, B, D

Ans: D

Sol: The correct answer is C, A, E, B, D.

Matching the channel design to customer needs/characteristics (C):

- This is the first step because understanding customer needs is fundamental to designing an effective channel system.

- It ensures that the channel design aligns with what the customers require, enhancing customer satisfaction and loyalty.

Evaluating the distribution environment (A):

- Next, it's crucial to assess the current distribution environment to understand existing capabilities and constraints.

- This helps in identifying potential opportunities and threats within the market.

Evaluating competitors' channel design (E):

- After understanding the environment, analyzing competitors' channel strategies provides insights into industry standards and best practices.

- This step is essential for benchmarking and identifying areas for differentiation.

Evaluating the short-listed alternative designs and selecting the one that suits the firm best (B):

- Based on the gathered information, the firm can now evaluate different channel designs and choose the most suitable one.

- This ensures that the selected design aligns with the firm’s goals and customer needs.

Choosing the channel intensity and number of tiers (D):

- The final step involves deciding on the intensity and tier structure of the channel, ensuring it is efficient and effective.

- This decision impacts the reach and depth of the distribution network.

Q3: Arrange the following steps of Activity Based Costing (ABC) in proper sequence -

A. Staff Training and Review Follow up

B. Identify Main Activities

C. Process specification

D. Identify Non-value adding Activity and cost pools

E. Selection of Activity Cost Drivers and Tracing of Costs with objects

Choose the correct answer from the options given below:

(a) C, B, D, E, A

(b) B, C, D, E, A

(c) D, B, C, A, E

(d) E, D, B, C, A

Ans: A

Sol: The correct answer is C, B, D, E, A.

Process Specification (C):

- This initial step involves detailing the essential processes within the organization. This includes mapping out each process to understand its components, workflow, and the sequence of activities involved.

- It helps in understanding the integral aspects of operations, which is crucial for accurate activity identification and cost allocation.

- Detailed process specification ensures consistency and completeness in documenting how tasks are performed.

Identify Main Activities (B):

- After the processes are specified, the next step is to identify the main activities within those processes. Main activities are the core functions or operations such as production, order processing, customer service, etc.

- This identification distinguishes between primary activities that add value and become the focal point for cost analysis.

- Main activities are essential for allocating direct costs accurately to various cost objects (products, services, etc.).

Identify Non-value Adding Activities and Cost Pools (D):

- Once the main activities are identified, it is important to evaluate all activities and distinguish non-value adding activities which do not contribute directly to the customer’s perception of worth.

- Non-value adding activities often involve waste, redundancy, or inefficiencies. Examples include rework, inspections, and waiting time.

- Creating cost pools involves grouping costs related to similar non-value adding activities, helping to focus on areas where cost reduction can be significantly impactful.

Selection of Activity Cost Drivers and Tracing of Costs with Objects (E):

- The fourth step involves selecting the most appropriate activity cost drivers, which are factors that drive the cost associated with an activity. These can include the number of hours worked, units produced, machine hours, or any measurable event that correlates with cost generation.

- Tracing costs with objects means associating the costs incurred in activities with specific cost objects, such as products, services, projects, or departments. This is done using the identified cost drivers to assign costs accurately.

- This step ensures that overhead costs are allocated based on actual consumption rather than arbitrary averages, leading to more precise product costing.

Staff Training and Review Follow-up (A):

- The final step is to implement training programs for staff to ensure they understand how to use the ABC system effectively. This includes learning how to identify activities, select cost drivers, and allocate costs.

- Ongoing review and follow-up are also critical to ensure that the ABC system remains accurate and effective. Regular reviews help in identifying areas for improvement, ensuring data accuracy, and maintaining the relevance of the cost drivers and activity analysis.

- Review and follow-up activities also help in refining the system over time based on feedback and changing organizational needs.

Other Related Points

- Activity Based Costing (ABC): This is a comprehensive costing method that provides a more accurate reflection of costs incurred by an organization in the production of its goods and services. It does this by tracing costs to activities and then to products based on their use of these activities, rather than just spreading costs uniformly.

- Benefits of ABC: The main advantages include more precise product costing, a better understanding of overheads, stimulated process improvements, and valuable data for strategic decisions. It helps companies identify and eliminate waste, better manage spending, and improve profitability.

- Implementation Challenges: Implementing ABC can be complex and resource-intensive. It requires detailed data collection and continuous monitoring to ensure accuracy. However, the insights gained typically justify the effort and expense.

Q4: The Narasimham Committee 1991 recommended the reforms with respect to the banking sector. These reforms are also known as:

(a) First generation reforms

(b) Second generation reforms

(c) Financial sector reforms

(d) Third generation reforms

Ans: A

Sol: The correct answer is First generation reforms.

First Generation Reforms:

- The Narasimham Committee (1991) was instrumental in recommending a series of reforms to modernize and liberalize the Indian banking sector.

- These reforms are commonly referred to as First Generation Reforms because they were the initial set of changes aimed at improving the efficiency and competitiveness of the banking sector.

- The focus was on reducing the fiscal deficit, liberalizing interest rates, enhancing prudential norms, improving the efficiency of public sector banks, and facilitating the entry of private and foreign banks.

Other Related Points

Second Generation Reforms:

- These were subsequent reforms aimed at further deepening the financial sector reforms initiated by the first generation.

- They focused on areas such as strengthening the regulatory framework, improving corporate governance, and enhancing the transparency and disclosure norms.

Financial Sector Reforms:

- While this term is broader and could encompass both first and second generation reforms, it is not specific to the recommendations of the Narsimhan Committee 1991 alone.

Third Generation Reforms:

- This term generally refers to the most recent phase of reforms targeting advanced financial instruments, technology integration, and more sophisticated risk management practices.

- It is not directly related to the initial reforms recommended by the Narsimhan Committee 1991.

Q5: Import of service means:

A. The Supplier of service is located in India

B. The Supplier of service is located outside India

C. The Recipient of service is located in India

D. The Recipient of service is located outside India

E. The place of Supply of service is in India

Choose the correct answer from the options given below:

(a) A, B & E Only

(b) A, D & E Only

(c) B, D & E Only

(d) B, C & E Only

Ans: D

Sol: The correct answer is B, C & E Only.

The supplier of service is located outside India (B):

- This criterion implies that the provider or seller of the service operates and is established in a location outside the territorial boundaries of India.

- For a service to be considered an "import," it must originate from an external source, which means the supplier's operations are based outside India.

- Examples include consultancy services provided by a US company, IT services delivered by a firm in Ireland, or marketing services offered by an entity in Singapore.

The recipient of service is located in India (C):

- The recipient being located in India indicates that the end user or the client of the service is based within the geographical confines of India.

- This ensures that the services consumed are for the benefit of an individual or business entity operating within India, thus falling under the purview of Indian regulations and policies.

- An example could be an Indian company utilizing the web design services of a UK-based firm for developing its corporate website, where the beneficiary is clearly the Indian company.

The place of supply of service is in India (E):

- The "place of supply" refers to the location where the service is utilized or where the benefits of the service are consumed. For imports, this place must be within India.

- This condition is critical for the services to qualify as imports because it establishes the jurisdiction for taxation and regulatory compliance. By defining the place of supply as India, the services become subject to Indian tax laws like GST.

- For instance, if an Indian company hires a foreign consultant to provide strategic advice and the advice is implemented and used in India, the place of supply is India.

Q6: A statistical statement in International business that shows at a point the value of financial assets of residents of an economy that are claims on non-residents or are gold bullion held as reserve assets and the liabilities of residents of an economy to non-residents is known as

(a) Currency Composition Table

(b) Special Purpose Entities (SPES)

(c) Cross Border Flows

(d) The International Investment Position (IIP)

Ans: D

Sol: The correct answer is The International Investment Position (IIP).

The International Investment Position (IIP):

- The International Investment Position (IIP) is a financial statement that provides a snapshot of an economy's external financial assets and liabilities at a specific point in time.

- It includes financial assets of residents that are claims on non-residents or are gold bullion held as reserve assets.

- Additionally, it accounts for the liabilities of residents to non-residents, such as foreign investments in the local economy.

- The IIP helps in assessing a country's financial stability and its economic relationships with the rest of the world.

Other Related Points

Currency Composition Table:

- This table typically provides information on the currency composition of a country's foreign exchange reserves, not the overall investment position.

Special Purpose Entities (SPES):

- Special Purpose Entities (SPES) are legal entities created for a specific, narrow purpose, often used in structured finance transactions to isolate financial risk.

- They do not provide a comprehensive snapshot of an economy's financial assets and liabilities to non-residents.

Cross Border Flows:

- Cross Border Flows refer to the movement of capital and financial assets between different countries, often tracked as part of the Balance of Payments.

- However, they do not provide a point-in-time snapshot of an economy's financial position.

Q7: If two regression lines are: 8x - 10y + 66 = 0 and 40x - 18y = 214, then X̅ & Y̅ are respectively

(a) 13, 14

(b) 16, 15

(c) 14, 13

(d) 13, 17

Ans: D

Sol: The correct answer is 13, 17.

Regression Lines:

- The given regression lines are: 8x - 10y + 66 = 0 and 40x - 18y = 214.

- The intersection of these lines represents the means (X̅ and Y̅) of the variables.

Finding the Point of Intersection:

- To find X̅ and Y̅, solve the two equations simultaneously:

- Simplify the first equation: 8x - 10y = -66

- Simplify the second equation: 40x - 18y = 214

- Multiply the first equation by 2 to align y coefficients: 16x - 20y = -132

- Solve the system of equations:

- 16x - 20y = -132

- 40x - 18y = 214

- Subtract the two equations to eliminate y:

- (16x - 20y) - (40x - 18y) = -132 - 214

- -24x - 2y = -346

- Solve for y: y = 17

- Substitute y = 17 back into one of the original equations to solve for x: x = 13

- Thus, the means are X̅ = 13 and Y̅ = 17.

Q8: Which of the following are true in case of Internal Reconstruction?

A. The existing company is liquidated

B. No new company is formed

C. There is certain reduction of capital and sometime liabilities are also reduced

D. The new company issues fresh capital

E. It is done as per section 66 of the Companies Act, 2013

Choose the correct answer from the options given below:

(a) A, D & E only

(b) A, C & E only

(c) B, C & E only

(d) B, C & D only

Ans: C

Sol: The correct answer is B, C & E Only.

B: No new company is formed:

- This point confirms that during internal reconstruction, the existing company undergoes restructuring but is not dissolved or liquidated.

- Internal reconstruction mainly involves reorganizing the financial structure of the same legal entity, without any necessity to create a new company.

C: There is certain reduction of capital and sometimes liabilities are also reduced:

- Internal reconstruction often involves altering the existing capital structure. This might include reducing share capital, writing off accumulated losses, or modifying debt obligations.

- Such measures are taken to present a healthier financial state of the company and potentially make it more attractive to investors and creditors.

- Reduction of liabilities can help in improving the company's balance sheet and financial ratios.

E: It is done as per section 66 of the Companies Act, 2013:

- Section 66 of the Companies Act, 2013, governs the reduction of share capital, which is a key aspect of internal reconstruction.

- This section outlines the legal framework and procedures required for a company to reduce its capital, ensuring that it is done in compliance with statutory regulations and safeguards the interests of creditors and shareholders.

Other Related Points

- Internal Reconstruction: It refers to the reorganization of a company’s financial structure without dissolving the existing company. The purpose is typically to reduce liabilities, adjust capital structure, and write off accumulated losses to rejuvenate the company financially.

- Key Features:

- Involves actions such as reduction of share capital, rearrangement of company debts, and sometimes change in ownership stakes.

- Does not involve the creation of a new company but focuses on reshaping the financial framework of the existing entity.

- Requires approval from shareholders and compliance with relevant sections of the Companies Act to ensure the legality of the processes.

- Legal Framework: Section 66 of the Companies Act, 2013, is pivotal as it details the procedures and legal requirements for the reduction of share capital, ensuring that the interests of stakeholders are protected and the company adheres to statutory compliance during its reconstruction efforts.

Q9: If selling price per unit is ₹56.00. Variable cost per unit is ₹32.00 and total fixed cost is ₹60,000, what is the number of units that used to be sold in order to achieve a profit of ₹84,000?

(a) 6000 units

(b) 8400 units

(c) 5000 units

(d) 6500 units

Ans: A

Sol: The correct answer is 6000 units.

- To achieve a profit of ₹84,000, the total revenue must cover both the total fixed costs and the desired profit.

Total fixed cost is ₹60,000.

Desired profit is ₹84,000.

Contribution per unit = Selling price per unit - Variable cost per unit = ₹56 - ₹32 = ₹24.

Number of units to be sold = (Total fixed cost + Desired profit) / Contribution per unit = (₹60,000 + ₹84,000) / ₹24 = 6000 units.

Q10: Arrange the following sequentially with respect to operating cycle of a manufacturing firm -

A. Payables Deferral Period

B. Finished Goods Conversion Period

C. Raw Material Conversion Period

D. Receivables Conversion Period

E. Work-in-progress Conversion Period

Choose the correct answer from the options given below:

(a) A, D, C, E, B

(b) C, E, B, D, A

(c) B, D, A, E, C

(d) D, B, E, A, C

Ans: B

Sol: The correct answer is C, E, B, D, A.

Raw Material Conversion Period (C):

- This is the initial phase where raw materials are procured and converted into work-in-progress items.

- It marks the beginning of the manufacturing process where raw materials are prepared for production.

Work-in-progress Conversion Period (E):

- During this phase, raw materials are further processed and converted into finished goods.

- This stage includes all activities involved in transforming raw materials into completed products.

Finished Goods Conversion Period (B):

- In this period, the finished goods are stored before being sold.

- It involves managing inventory until the products are ready for delivery to customers.

Receivables Conversion Period (D):

- This phase involves the time taken to collect payments from customers after the goods have been sold.

- It is crucial for maintaining cash flow and ensuring liquidity for the firm.

Payables Deferral Period (A):

- This final phase involves the time period in which the firm can defer payments to its suppliers.

- It helps in managing cash outflows and maintaining a balance between receivables and payables.

Q11: The current ratio of a company is 2 ∶ 1. Which one the following suggestions would improve the current ratio?

(a) Purchase of stock for cash

(b) Cash collection from debtors

(c) Pay a current liability

(d) Purchase of fixed assets

Ans: C

Sol: The correct answer is to Pay a current liability

Option 1: Purchase of stock for cash

- This transaction decreases cash (a current asset) and increases inventory (another current asset).

- The total current assets remain unchanged.

- Therefore, the current ratio remains the same.

- This does not improve the current ratio.

Option 2: Cash collection from debtors

- This transaction increases cash (a current asset) and decreases debtors (another current asset).

- The total current assets remain unchanged.

- Therefore, the current ratio remains the same.

- This does not improve the current ratio.

Option 3: Pay a current liability

- This transaction decreases cash (a current asset) and decreases current liabilities.

- As a result, the numerator (current assets) decreases, but the denominator (current liabilities) decreases as well.

- This generally results in an improvement in the current ratio.

- Therefore, this option improves the current ratio.

Option 4: Purchase of fixed assets

- This transaction decreases cash (a current asset) and increases fixed assets (a non-current asset).

- The total current assets decrease.

- Therefore, the current ratio decreases.

- This does not improve the current ratio.

Q12: Which one of the following is NOT an issue (to be tackled) of conceptual component of a CRM programme?

(a) Choosing the technology

(b) Setting out the objectives in clear terms

(c) Processing all customer requests coming in through multiple channels

(d) Putting customers first

Ans: C

Sol: The correct answer is Processing all customer requests coming in through multiple channels.

Processing all customer requests coming in through multiple channels:

- This task falls under the operational or technical component of a CRM programme rather than the conceptual component. It involves the implementation of systems and processes to handle customer interactions efficiently.

- In a financial enterprise, this would include integrating various communication channels like phone, email, chat, and social media to ensure a seamless customer experience.

Other Related Points

Choosing the technology:

- This is indeed a conceptual issue because it involves strategic decisions about the type of CRM system that will best support the organization's goals and customer relationship strategies.

Setting out the objectives in clear terms:

- Another conceptual issue, setting clear objectives helps define the purpose and goals of the CRM programme, ensuring alignment with the overall business strategy of the financial enterprise.

Putting customers first:

- This is a key conceptual principle of any CRM programme. It emphasizes the importance of customer-centric strategies and aligning the organization's operations to meet customer needs effectively.

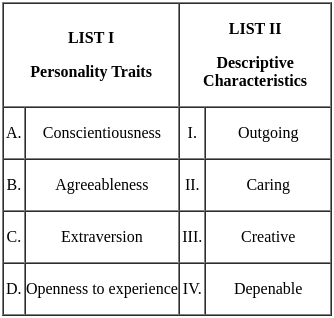

Q13: Which of the following are the characteristics of a Leader?

A. Focuses on systems and structure

B. Eye on the horizon

C. Asks how and when

D. Does things right

E. Originates

Choose the correct answer from the options given below:

(a) A, B & D Only

(b) B & E Only

(c) B, C & D Only

(d) A, B, D & E Only

Ans: B

Sol: The correct answer is B & E Only.

Eye on the horizon (B):

- Leaders are visionary and focus on the long-term goals and future direction of the organization.

- They anticipate future trends and prepare the organization to adapt and thrive in changing environments.

Originates (E):

- Leaders are innovative and original, often coming up with new ideas and approaches.

- They inspire and motivate others to follow their lead and embrace change and innovation.

Other Related Points

Focuses on systems and structure (A):

- This is typically a characteristic of managers rather than leaders.

- Managers ensure that organizational processes and structures are functioning efficiently.

Asks how and when (C):

- This is more of a managerial trait, focusing on the implementation and execution of tasks.

- Leaders, on the other hand, are more concerned with 'what' and 'why', setting the vision and direction.

Does things right (D):

- Again, this is a trait associated with managers who ensure that tasks are completed correctly and efficiently.

- Leaders focus on doing the right things, aligning actions with the overall vision and goals.

Q14: Which of the following item is included in the definition of the term "Goods" as per Sales of Goods Act, 1930?

(a) Purchase of lottery tickets

(b) The decree of Court of Law

(c) Actionable claims

(d) Immovable Property

Ans: B

Sol: The answer is The decree of Court of Law

The decree of Court of Law:

- A decree of Court of Law is considered a "good" under the Sales of Goods Act, 1930, because it represents a tangible, transferable document that can be bought and sold.

- It can be treated as personal property and falls under the definition of goods in the legal context.

Other Related Points

Purchase of lottery tickets:

- This option is incorrect because lottery tickets are considered gambling instruments and not "goods" under the Sales of Goods Act, 1930.

- Actionable claims:

- Incorrect as actionable claims refer to claims that can be enforced by a legal action and are excluded from the definition of goods under the Sales of Goods Act, 1930.

Immovable Property:

- This is not included in the definition of "goods" as the Sales of Goods Act, 1930, specifically pertains to movable property. Immovable property such as land and buildings are governed by different laws.

Q15: Compute the after-tax cost of capital of a company in case a perpetual bond (face value is ₹100) is sold as well as redeemed at par having coupon rate of interest being 7% and corporate tax rate is 30%.

(a) 2.1%

(b) 4.9%

(c) 7%

(d) 10%

Ans: B

Sol: The correct answer is 4.9%.

Given:

- Coupon rate (interest rate): 7% or 0.07

- Corporate tax rate: 30% or 0.30

Steps for Computation:

- Calculate the pre-tax interest:

Pre-tax interest = Coupon rate = 0.07 - Calculate the after-tax interest:

After-tax interest = 0.07 × (1 - 0.30) - Simplify:

After-tax interest = 0.07 × 0.70 - Final Calculation:

After-tax interest = 0.049 or 4.9%

Answer: 4.9%

Q16: Which of the following is NOT the assumption of Baumol's model of cash management?

(a) The firm is unable to forecast its cash needs with certainty

(b) The opportunity cost of holding cash is known

(c) The firm will incur the same transaction cost whenever it converts securities to cash

(d) The firm's cash payments occur uniformly over a period of time

Ans: A

Sol: The correct answer is The firm is unable to forecast its cash needs with certainty.

The firm is unable to forecast its cash needs with certainty:

- This statement is not an assumption of Baumol's model of cash management. The Baumol model assumes that the firm has predictable and stable cash flow requirements.

- The model aims to minimize the total cost of holding cash and the transaction costs of converting securities to cash, which relies on the predictability of cash needs.

- If a firm cannot forecast its cash needs, it would not be able to effectively apply the Baumol model to manage its cash holdings.

Other Related Points

The opportunity cost of holding cash is known:

- This is a correct assumption of Baumol's model. The opportunity cost represents the return that could be earned if the cash were invested in marketable securities instead.

The firm will incur the same transaction cost whenever it converts securities to cash:

- Baumol's model assumes a constant transaction cost for converting securities to cash, which simplifies the calculation of the optimal cash balance.

The firm's cash payments occur uniformly over a period of time:

- This is another assumption of Baumol's model. The uniform distribution of cash outflows allows for a more straightforward application of the model to calculate the optimal cash balance.

Q17: Which one of the following is NOT good for bargainers while bargaining with employees?

(a) Do not hurry

(b) Build a reputation for being fair but not firm

(c) Strive to keep some flexibility in your position

(d) Respect the importance of face saving for the other party

Ans: B

Sol: The correct answer is Build a reputation for being fair but not firm.

Build a reputation for being fair but not firm:

- In financial enterprises, being perceived as fair but not firm can be detrimental during bargaining processes.

- A firm stance is often necessary to ensure that negotiations lead to mutually beneficial agreements.

- Lack of firmness can lead to perceptions of weakness, potentially compromising future negotiations.

Other Related Points

Do not hurry:

- Not hurrying during negotiations allows for thorough consideration of all aspects of the agreement, leading to better outcomes.

Strive to keep some flexibility in your position:

- Flexibility can help in finding common ground and reaching a compromise, which is beneficial in a dynamic financial environment.

Respect the importance of face saving for the other party:

- Respecting the other party's need to save face helps in maintaining a positive relationship and can facilitate smoother future negotiations.

Q18: An exploratory study is finished when the researcher has achieved the following:

A. Established the major dimensions of the research task

B. Defined a set of subsidiary investigative questions that can be used as guides to a detailed research design

C. Developed several hypotheses about possible causes of a management dilemma

D. Learned that certain other hypothesis are such remote possibilities that they can be safely ignored in any subsequent study

E. Concluded additional research is needed and it is feasible

Choose the correct answer from the options given below:

(a) A & B only

(b) A, B & C only

(c) A, B, C & D only

(d) B, C, D & E only

Ans: C

Sol: The correct answer is A, B, C & D only.

Established the major dimensions of the research task (A):

- This involves identifying the key areas and boundaries of the research topic.

- It helps in setting a clear scope for the study and ensures that the research is focused and manageable.

Defined a set of subsidiary investigative questions that can be used as guides to a detailed research design (B):

- These questions break down the main research question into smaller, more manageable parts.

- They provide a roadmap for the detailed research design and help in addressing specific aspects of the research problem.

Developed several hypotheses about possible causes of a management dilemma (C):

- Hypotheses are tentative s that can be tested through further research.

- In an exploratory study, developing hypotheses helps in understanding potential reasons behind a management issue.

Learned that certain other hypotheses are such remote possibilities that they can be safely ignored in any subsequent study (D):

- This involves identifying and ruling out unlikely s.

- It streamlines the research process by focusing on more plausible hypotheses.

Other Related Points

- Exploratory studies are typically conducted when the researcher has a limited understanding of the topic and seeks to gain insights.

- They are often the initial phase of a larger research project, setting the stage for more detailed and structured research.

- Methods used in exploratory studies include literature reviews, expert interviews, and focus groups.

- The main goal is to generate ideas, identify key issues, and establish a foundation for future research.

Q19: Arrange the following Financial Institution in the increasing order of their date of establishment-

A. NABARD

B. EXIM Bank

C. UTI

D. SIDBI

E. ECGC

Choose the correct answer from the options given below:

(a) A, B, C, D, E

(b) C, B, A, D, E

(c) C, A, B, E, D

(d) E, C, B, A, D

Ans: D

Sol: The correct answer is 'E, C, B, A, D.

ECGC (Export Credit Guarantee Corporation) (E):

- Established in 1957, ECGC is a government-owned export credit provider. It provides export credit insurance, offering risk protection against non-payment by foreign buyers due to political or commercial risks, thereby supporting Indian exporters.

UTI (Unit Trust of India) (C):

- Founded in 1963, UTI is India’s oldest mutual fund, established to promote savings and investment among the public. It has played a significant role in the financial ecosystem, providing a variety of investment options to retail and institutional clients.

EXIM Bank (Export-Import Bank of India) (B):

- Established in 1982, EXIM Bank aims to provide financial assistance to exporters and importers and to function as the principal financial institution for coordinating the working of institutions engaged in financing export and import of goods and services.

NABARD (National Bank for Agriculture and Rural Development) (A):

- Formed in 1982, NABARD was created to promote sustainable and equitable agriculture and rural development. It provides credit for the promotion of agriculture, small-scale industries, and other economic activities in rural areas.

SIDBI (Small Industries Development Bank of India) (D):

- Established in 1990, SIDBI focuses on the growth and development of micro, small, and medium-scale enterprises (MSMEs) in India. It provides financial assistance and services to improve the performance and efficiency of MSMEs in the national economic scenario.

Other Related Points

- ECGC’s Role: ECGC supports Indian exporters by offering insurance covers to banks and financial institutions to enable them to extend better loan facilities to exporters.

- UTI’s Impact: UTI has significantly contributed to the Indian mutual fund industry, playing a pivotal role in channeling household savings into equity markets, thereby aiding the growth of the capital market.

- EXIM Bank’s Contributions: EXIM Bank fosters, promotes, and finances international trade of India and offers a range of services, including buyer’s credit, lines of credit, and export credit.

- NABARD’s Focus Areas: NABARD concentrates on providing and regulating credit for the promotion and development of agriculture, cottage, and village industries, emphasizing the credit needs of rural India.

- SIDBI’s Initiatives: SIDBI works through various schemes and programs to support the MSME sector, including credit and refinance solutions, developmental initiatives for capacity building, and creating a conducive business environment for small industries.

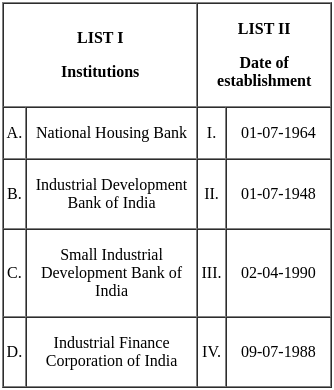

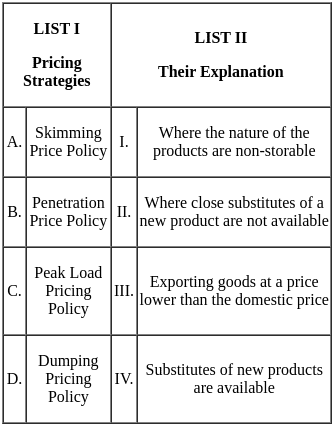

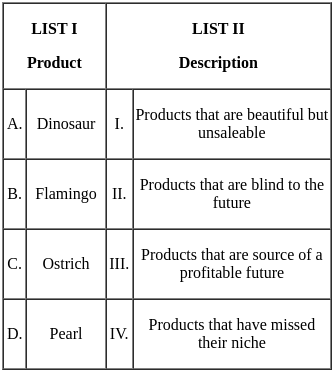

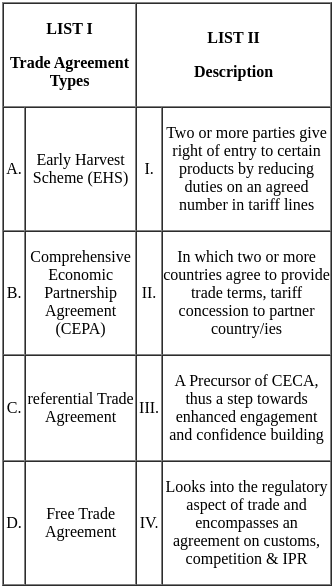

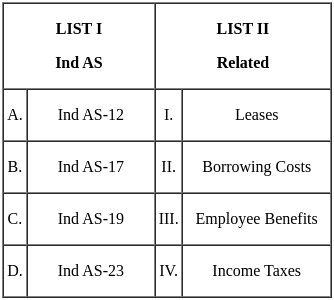

Q20: Match the List-I with List-II

Choose the correct answer from the options given below.

(a) A - I, B - II, C - III, D - IV

(b) A - III, B - I, C - IV, D - II

(c) A - I, B - IV, C - III, D - II

(d) A - IV, B - I, C - III, D - II

Ans: D

Sol: The correct answer is A-IV, B-I, C-III, D-II.

National Housing Bank (A) matches with 09-07-1988 (IV).

- The National Housing Bank (NHB) was established on July 9, 1988, under the National Housing Bank Act, 1987. It serves as the apex financial institution for housing in India, promoting housing finance institutions both at local and regional levels.

Industrial Development Bank of India (B) matches with 01-07-1964 (I).

- The Industrial Development Bank of India (IDBI) was established on July 1, 1964, as a wholly-owned subsidiary of the Reserve Bank of India. It was created to provide credit and other facilities for the development of industry in India.

Small Industrial Development Bank of India (C) matches with 02-04-1990 (III).

- The Small Industrial Development Bank of India (SIDBI) was established on April 2, 1990. It is the principal financial institution for the promotion, financing, and development of the Micro, Small, and Medium Enterprise (MSME) sector in India.

Industrial Finance Corporation of India (D) matches with 01-07-1948 (II).

- The Industrial Finance Corporation of India (IFCI) was established on July 1, 1948. It was the first development financial institution in India, created to provide long-term finance to industries in the country.

Other Related Points

- The National Housing Bank was set up with the mandate to promote housing finance institutions both at local and regional levels and to provide financial and other support to such institutions.

- IDBI was initially set up as a subsidiary of RBI but was later transferred to the Government of India. It has played a significant role in financing large industrial projects and infrastructure development.

- SIDBI operates under the Department of Financial Services, Government of India, and has been instrumental in the development of the MSME sector, which is crucial for the Indian economy.

- IFCI was established primarily to cater to the long-term financial needs of the industrial sector and has contributed significantly to the industrial development of the country.

Q21: Which of the following are the instruments of qualitative Credit Control Methods in India's Monetary Policy?

A. Cash Reserve Ratio

B. Consumer Credit Regulation

C. Altering Margin Requirements

D. Statutory Liquidity Ratio

E. Differential Rate of Interest

Choose the correct answer from the options given below:

(a) A, B & D only

(b) B, C & E only

(c) C, D & E only

(d) D, E & A only

Ans: B

Sol: The correct answer is B, C & E only.

Consumer Credit Regulation (B):

- This involves setting limits and guidelines on the terms and conditions under which credit is extended to consumers.

- It aims to control the volume of credit in specific sectors and ensure that credit is used for productive purposes.

Altering Margin Requirements (C):

- This refers to changing the amount of margin money required for purchasing securities.

- By altering margin requirements, the central bank can control the amount of speculative activity in the market, thereby influencing credit flow.

Differential Rate of Interest (E):

- This involves setting different interest rates for different sectors based on their importance and needs.

- It helps in directing credit towards priority sectors and away from non-essential sectors.

Other Related Points

Cash Reserve Ratio (A):

- This is a quantitative tool where banks are required to maintain a certain percentage of their deposits as reserves with the central bank.

Statutory Liquidity Ratio (D):

- This is another quantitative tool that mandates banks to maintain a certain percentage of their net demand and time liabilities in the form of liquid assets.

Q22: Arrange the steps of Sampling Design in a form of questions that are to be answered in securing a sample -

A. What is the appropriate sampling method?

B. What are the parameters of interest?

C. What size sample is needed?

D. What is the target population?

E. What is the sampling frame?

Choose the correct answer from the options given below:

(a) E, D, B, A, C

(b) B, E, A, C, D

(c) C, B, A, E, D

(d) D, B, E, A, C

Ans: D

Sol: The correct answer is D, B, E, A, C.

Defining the target population (D):

- This is the first step where you identify the group of individuals or items you are interested in studying.

- It forms the basis for the entire sampling process as it sets the boundaries of the study.

Identifying the parameters of interest (B):

- Next, you determine what specific characteristics or metrics you want to measure within the target population.

- These parameters guide the selection process and ensure that the sample will be relevant to your study objectives.

Selecting the sampling frame (E):

- In this step, you identify a list or database from which the sample will be drawn.

- The sampling frame should accurately represent the target population to avoid selection bias.

Choosing the sampling method (A):

- Here, you decide on the technique to be used for selecting the sample, such as random sampling, stratified sampling, etc.

- The choice of method affects the accuracy and generalizability of the results.

Determining the sample size (C):

- The final step involves calculating the number of subjects or units to be included in the sample.

- Sample size affects the reliability and validity of the study results, making it a crucial consideration.

Q23: Which one of the following is known as backbone of auditing?

(a) Verification of assets

(b) Internal check

(c) Vouching

(d) Internal audit

Ans: C

Sol: The correct answer is Vouching.

Vouching:

- Vouching is the process of verifying the authenticity of accounting entries recorded in the books of accounts. It involves cross-checking transactions with supporting documents like invoices, receipts, and vouchers.

- It ensures that all recorded transactions are genuine and have been authorized properly, providing a strong foundation for accurate financial reporting.

- As the backbone of auditing, vouching helps auditors detect errors, frauds, and discrepancies in financial statements, ensuring their reliability and accuracy.

Other Related Points

Verification of assets:

- This involves confirming the existence, ownership, and valuation of assets recorded in the financial statements. While important, it is not considered the backbone of auditing as it is more specific to asset management.

Internal check:

- Internal check refers to the system of controls within an organization aimed at preventing errors and fraud. Although crucial for internal controls, it is not as comprehensive as vouching in terms of auditing.

Internal audit:

- Internal audit is an independent, objective assurance activity designed to add value and improve an organization's operations. It focuses on evaluating and improving the effectiveness of risk management, control, and governance processes. While significant, it supports the audit process rather than being the backbone itself.

Q24: Data preparation needs to ensure the accuracy of the data and their conversion from raw form to reduced and classified forms for analysis. It includes which of the following:

A. Coding

B. Data Entry

C. Editing

D. Stemming

E. Aliasing

Choose the correct answer from the options given below:

(a) A & C only

(b) B & D only

(c) A, B & C only

(d) C, D & E only

Ans: C

Sol: The correct answer is A, B, & C only.

Coding (A):

- Coding is the process of converting qualitative data into quantitative form by assigning numerical or other symbols to answers so that responses can be put into a limited number of categories or classes. This is essential for simplifying data handling and analysis.

- This step helps in organizing data into systematic categories, making it easier to analyze and draw conclusions. For instance, responses to open-ended questions can be coded into themes for easier analysis.

- Examples of coding include assigning a number to represent a gender (1 for male, 2 for female) or using numerical codes to categorize survey responses (1 for "Strongly Agree", 2 for "Agree", etc.).

Data Entry (B):

- Data entry is the act of transcribing information from surveys, interviews, or other data collection instruments into a database or spreadsheet. This is a critical step to ensure that data is captured accurately and can be used for analysis.

- The accuracy of data entry is paramount as any errors can lead to incorrect analysis and results. Various techniques such as double data entry (entering the same data twice and cross-checking) and automated tools can help minimize errors.

- An example of data entry is inputting survey responses into an Excel file or a statistical analysis software like SPSS or SAS. Each response is recorded accurately in the corresponding fields.

Editing (C):

- Editing involves reviewing and correcting collected data to identify and fix errors or inconsistencies. This ensures that the data set is clean, reliable, and suitable for accurate analysis.

- Editing can include checking for missing values, identifying outliers, correcting typographical errors, and ensuring consistency in data entry. For example, ensuring that all dates are in the same format or correcting entries that are out of range for a given variable.

- Tools for data editing range from simple spreadsheet functions to more sophisticated data validation and cleaning tools provided by statistical software like R or Python's Pandas library.

Other Related Points

Stemming (D):

- Stemming is the process of reducing words to their root form. For example, the words "running", "runner", and "ran" can be reduced to their root form "run". It is commonly used in natural language processing and text analysis to improve the consistency and efficiency of the analysis.

- While stemming is important in text data preprocessing, it is not typically involved in general data preparation processes that focus on structuring and cleaning raw data for analysis.

- Aliasing (E):

- Aliasing in the context of data refers to the effect that occurs when continuous signals are sampled and reconstructed inaccurately, leading to a distortion. In data science, aliasing is often a consideration in signal processing and time series analysis.

- Aliasing is not generally a part of standard data preparation tasks, which focus on ensuring data accuracy, cleaning data, and converting raw data into usable forms for analysis.

Q25: Which among the following is the correct value of Income Elasticity of Petrol consumption from the following information?

The Government announces a 10 per cent dearness allowance to its employees. As a result, average monthly salary of Government employees increases from Rs. 20,000 to Rs. 22,000. Following the pay hike, monthly petrol consumption of government employees increased from 150 litres per month to 165 litres per month:

(a) 0.5

(b) 1

(c) 2

(d) 0.1

Ans: B

Sol: The correct answer is 1

Calculation of Income Elasticity:

Income Elasticity of demand is calculated as the percentage change in quantity demanded divided by the percentage change in income.

Percentage change in quantity demanded = ((New Quantity - Old Quantity) / Old Quantity) * 100 = ((165 - 150) / 150) * 100 = 10%

Percentage change in income = ((New Income - Old Income) / Old Income) * 100 = ((22000 - 20000) / 20000) * 100 = 10%

Income Elasticity = Percentage change in quantity demanded / Percentage change in income = 10% / 10% = 1

Q26: How much per cent of income by way of interest received on compensation or on enhanced compensation is allowed as deduction while computing income under the head Income from Other Sources under the Income-tax Act, 1961?

(a) 25%

(b) 50%

(c) 75%

(d) 100%

Ans: B

Sol: The correct answer is 0.5

50 per cent of income by way of interest received on compensation or on enhanced compensation is allowed as deduction:

- According to the Income-tax Act, 1961, specifically under section 57(iv), 50% (or 0.5) of the income by way of interest received on compensation or on enhanced compensation is allowed as a deduction.

- This provision aims to provide relief to taxpayers who receive interest on compensation awarded by courts or tribunals, ensuring that only half of the interest income is taxed.

- This deduction helps to mitigate the tax burden on individuals who receive compensation for losses or damages, acknowledging that such interest income is somewhat compensatory in nature.

Other Related Points

0.25 per cent:

- This option is incorrect. The Income-tax Act does not provide for a 0.25% deduction on interest received on compensation or enhanced compensation.

0.75 per cent:

- This is also incorrect. The law specifically allows a 50% deduction, not 75%.

1 per cent:

- This is incorrect as well. The allowable deduction is set at 50% (or 0.5), not 1%.

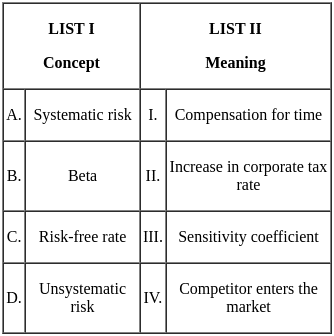

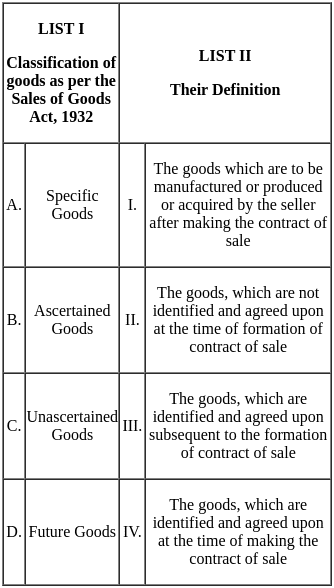

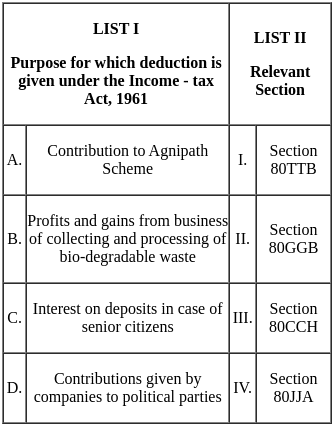

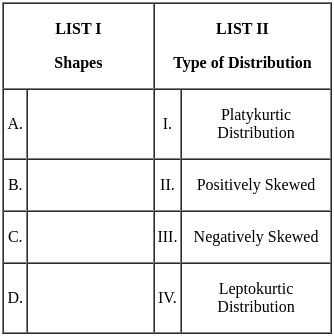

Q27: Match the List-I with List-II

Choose the correct answer from the options given below.

(a) A - I, B - IV, C - III, D - II

(b) A - IV, B - I, C - II, D - III

(c) A - III, B - II, C - IV, D - I

(d) A - II, B - III, C - I, D - IV

Ans: D

Sol: The correct answer is A-II, B-III, C-I, D-IV.

Systematic Risk (A) matches with Increase in corporate tax rate (II).

- Systematic risk, also known as market risk, affects the entire market or economy and cannot be eliminated through diversification.

- An increase in the corporate tax rate is an example of a systematic risk because it impacts all businesses operating within the same economic environment.

- Other examples of systematic risk include changes in interest rates, inflation, and political instability.

Beta (B) matches with Sensitivity coefficient (III).

- Beta is a measure of a stock's volatility in relation to the overall market. It indicates how much a stock's price is expected to move in response to market changes.

- As a sensitivity coefficient, beta helps investors understand the risk associated with a particular stock compared to the market.

- A beta greater than 1 indicates that the stock is more volatile than the market, while a beta less than 1 means it is less volatile.

Risk-free Rate (C) matches with Compensation for time (I).

- The risk-free rate represents the return on an investment with zero risk, typically associated with government bonds.

- It serves as a benchmark for the minimum return investors require for any investment, compensating them for the time value of money.

- In financial models, the risk-free rate is used as a baseline to evaluate the attractiveness of other investments.

Unsystematic Risk (D) matches with Competitor enters the market (IV).

- Unsystematic risk, or specific risk, is unique to a particular company or industry and can be reduced through diversification.

- A competitor entering the market is an example of unsystematic risk, as it directly affects the competitive landscape and profitability of the existing company.

- Other examples include company management decisions, product recalls, and regulatory changes specific to an industry.

Q28: Which one of the following refers to the need on the part of the customer that gets satisfied by the service?

(a) Service Benefits

(b) Service Expectations

(c) Service Offer

(d) Service Level

Ans: A

Sol: The correct answer is Service Benefits

Service Benefits:

- Service benefits refer to the specific advantages or positive outcomes that a customer receives from using a service provided by a financial enterprise.

- These benefits satisfy the customer's needs and can include things like convenience, time savings, financial gains, or improved financial management.

- For example, a customer using a financial advisory service might benefit from better investment returns or more efficient tax planning.

Other Related Points

Service Expectations:

- This refers to what customers anticipate or hope to receive from a service. While important, expectations are not the same as the actual benefits received.

- In a financial enterprise, service expectations might include timely responses to inquiries or personalized financial advice.

Service Offer:

- This is the package or proposition made by the financial enterprise, detailing what services they provide. It includes the scope, features, and terms of the service.

- For instance, a bank might offer a service package that includes checking accounts, savings accounts, and loan products.

Service Level:

- Service level refers to the standard or quality of service provided. It often includes metrics like response time, accuracy, and customer satisfaction.

- In a financial context, service level agreements might specify the time within which a financial transaction should be processed or a customer query should be resolved.

Q29: Which of the following factors constitute the Economic Environment of a country?

A. Financial System

B. Socio-cultural environment

C. Economic Policies

D. Educational environment

E. Structural Equilibrium

Choose the correct answer from the options given below:

(a) A, B & C only

(b) A, C & E only

(c) B, D & E only

(d) C, D & E only

Ans: B

Sol: The correct answer is A, C & E only.

Financial System

- This is a crucial component of the economic environment. The financial system includes banks, financial markets, and institutions that facilitate economic transactions, influencing the availability and cost of credit, investments, and overall economic stability.

Socio-cultural Environment

- This factor is not directly a part of the economic environment. The socio-cultural environment pertains to the societal and cultural values, beliefs, and attitudes that can affect consumer behavior and business practices but is distinct from economic factors.

Economic Policies

- Economic policies, such as fiscal policy, monetary policy, and trade policy, are instrumental in shaping the economic environment. They determine government spending, taxation, interest rates, and trade regulations, impacting economic growth and stability.

Educational Environment

- While the educational environment affects human capital development and long-term productivity, it is not a direct component of the current economic environment. It falls more within the socio-cultural and structural aspects rather than immediate economic conditions.

Structural Equilibrium

- Structural equilibrium refers to the balance within an economy's structure, including sectoral composition and resource allocation. Maintaining structural equilibrium is key to economic stability and sustainable growth, making it a relevant factor in the economic environment.

In conclusion, the elements that directly constitute the economic environment of a country are the Financial System, Economic Policies, and Structural Equilibrium. Therefore, the correct answer is option 2: A, C & E only. This option accurately reflects the factors that directly influence a country's economic environment. Socio-cultural and educational environments, although important, are not primary components of the economic environment.

Q30: Which one of the following theory of capital structure discusses Arbitrage Process?

(a) Traditional Approach

(b) Modigliani and Miller (MM) Approach

(c) Net Operating Income (NOI) Approach

(d) Net Income (NI) Approach

Ans: B

Sol: The correct answer is Modigliani and Miller (MM) Approach.

Modigliani and Miller (MM) Approach:

- The MM approach to capital structure was developed by Franco Modigliani and Merton Miller in 1958.

- They proposed that, under certain conditions (e.g., no taxes, no bankruptcy costs, efficient markets), the value of a firm is unaffected by its capital structure.

- One key aspect of their theory is the arbitrage process, which suggests that if two firms are identical in every way except their capital structure, investors can create leverage on their own to achieve the same returns, thus neutralizing any advantage of one capital structure over another.

- This arbitrage process implies that the market value of a firm is determined by its earning power and the risk of its underlying assets, not by how it finances its operations.

Other Related Points

Traditional Approach:

- This approach suggests that there is an optimal capital structure where the cost of capital is minimized and the firm’s value is maximized.

- It assumes that the cost of debt remains constant up to a certain level of leverage, after which it starts to increase, reflecting the increasing risk of bankruptcy.

Net Operating Income (NOI) Approach:

- According to the NOI approach, the value of the firm is determined by the capitalization of its net operating income, and this value is independent of its capital structure.

- It assumes that the cost of equity increases linearly with leverage, offsetting the benefits of cheaper debt.

Net Income (NI) Approach:

- This approach posits that a firm can increase its value and decrease its overall cost of capital by increasing the proportion of debt in its capital structure, given that debt is usually cheaper than equity.

- It assumes that the cost of debt and equity remain constant regardless of the level of leverage.

Q31: Arrange the given component tasks to be handled in positioning in the logical sequence -

A. Developing the value proposition

B. Analysing competitors' positioning: Is there a gap somewhere?

C. Communicating the value proposition to target consumers

D. Deciding the locus in consumers' mind: Where to lodge the product/brand?

E. Ensuring the infrastructure/competitive advantage for delivering the premise

Choose the correct answer from the options given below:

(a) D, B, A, E, C

(b) D, B, E, A, C

(c) B, D, A, E, C

(d) B, D, C, A, E

Ans: B

Sol: The correct answer is B, D, A E, C.

B. Analyzing competitors' positioning

→ First, understand the market and where competitors are positioned. Look for gaps or opportunities.

D. Deciding the locus in consumers' mind

→ Next, decide where you want your product to be positioned in the customer’s mind — based on gaps found.

A. Developing the value proposition

→ Create a clear value proposition to support your desired position.

E. Ensuring infrastructure/competitive advantage

→ Ensure your organization can deliver the promised value effectively.

C. Communicating the value proposition

→ Finally, communicate the positioning to your target audience via marketing and branding.

Logical Sequence: B → D → A → E → C

Final Answer: (c) B, D, A, E, C

Q32: WTO in its 8th Ministerial conference adopted a decision allowing members to waive the provisions of Article II (most favored-National Treatment) of the GATS to allow the granting of preferential treatment to services and service supplies to which countries?

(a) Adjacent Countries

(b) Non-Nuclear Countries

(c) Least-Developed Countries

(d) SAARC Countries

Ans: C

Sol: The correct answer is Least-Developed Countries.

Least-Developed Countries (LDCs):

- The WTO's decision to allow waivers for Article II (Most-Favored-Nation Treatment) of the GATS is aimed at granting preferential treatment to services and service suppliers from Least-Developed Countries (LDCs).

- This move is designed to support LDCs in integrating more effectively into the global trading system by offering them better access to markets of more developed nations.

- Financial enterprises operating in developed countries can offer preferential terms to LDCs, fostering economic development and enhancing service sector growth in those regions.

- Such preferential treatment can include reduced tariffs, better market access, and more favorable regulatory conditions, all of which can help LDCs improve their economic standing and reduce poverty.

Other Related Points

Adjacent Countries:

- This option is incorrect because the preferential treatment under the WTO decision is not specifically aimed at adjacent countries but rather at LDCs, which may or may not be geographically close to the more developed nations.

Non-Nuclear Countries:

- This option is incorrect as the WTO's preferential treatment decision is not based on nuclear status but on the economic development status of the countries.

SAARC Countries:

- While some SAARC countries might be LDCs, the WTO decision is not specifically targeted at SAARC countries as a group but at all LDCs globally.

Q33: Which one of the following non-functional rewards does NOT fall under job design category?

(a) Compliment of work progress

(b) Flexible hours

(c) Participation in decisions.

(d) Flexible breaks

Ans: A

Sol: The correct answer is Compliment of work progress.

Compliment of work progress:

- Compliments and verbal recognition for work progress are generally considered a form of social reward or praise. These are non-functional rewards and do not directly influence the design of the job itself.

- These types of rewards are aimed at boosting employee morale and motivation through acknowledgment and appreciation, rather than altering the structural aspects of the job.

Other Related Points

Flexible hours:

- This is a component of job design, as it involves structuring the work schedule to allow flexibility. This can improve work-life balance and increase job satisfaction.

Participation in decisions:

- Participation in decision-making is also a part of job design. It gives employees a sense of ownership and control over their work, which can enhance engagement and motivation.

Flexible breaks:

- Flexible break times are another job design element. They allow employees to take breaks when they need them, which can improve productivity and reduce stress.

Q34: What is the correct sequence to be followed for the following while computing income under the head Capital Gains?

A. Deduction of indexed cost of acquisition

B. Determination of full value of consideration

C. Determination whether the asset is a capital asset or not

D. Determination whether the transaction is regarded as transfer or not

E. Exemption under section 54EC in respect of investment in the long-term specified asset

Choose the correct answer from the options given below:

(a) B, A, C, E, D

(b) E, A, D, C, B

(c) D, B, C, A, E

(d) C, D, B, A, E

Ans: D

Sol: The correct answer is C, D, B, A, E.

Determination whether the asset is a capital asset or not (C):

- This is the initial step to ascertain whether the asset under consideration qualifies as a 'capital asset' under the Income Tax Act.

- It is crucial because only capital assets are subject to capital gains tax.

Determination whether the transaction is regarded as transfer or not (D):

- After confirming the asset is a capital asset, the next step is to determine whether the transaction qualifies as a 'transfer'.

- Only transfers of capital assets result in capital gains or losses.

Determination of full value of consideration (B):

- Once the asset and transaction are verified, the full value of consideration received or accruing from the transfer needs to be determined.

- This value forms the basis for computing capital gains.

Deduction of indexed cost of acquisition (A):

- In this step, the indexed cost of acquisition is deducted from the full value of consideration to compute the capital gains.

- Indexation accounts for inflation and adjusts the cost of acquisition accordingly.

Exemption under section 54EC in respect of investment in the long-term specified asset (E):

- Finally, any applicable exemptions, such as those under section 54EC for investments in specified long-term assets, are considered.

- This can reduce the taxable capital gains.

Q35: Arrange the following banks in an increasing order of their year of formation-

A. State Bank of India

B. Imperial Bank of India

C. Reserve Bank of India

D. Regional Rural Banks

E. Small Finance Bank

Choose the correct answer from the options given below:

(a) E, D, C, B, A

(b) E, D, A, B, C

(c) B, C, A, D, E

(d) C, B, A, D, E

Ans: C

Sol: The correct answer is B, C, A, D, E.

Option 1 (E, D, C, B, A):

- Incorrect because Small Finance Banks (E) are the most recent, formed around 2015, not the earliest.

- Regional Rural Banks (D) were established in 1975, after the formation of the Reserve Bank of India (C) in 1935.

- Reserve Bank of India (C) was established in 1935, after the Imperial Bank of India (B) in 1921.

- Imperial Bank of India (B) predates the State Bank of India (A), which was established in 1955.

- Thus, this option does not follow the correct chronological order.

Option 2 (E, D, A, B, C):

- Incorrect because it places the State Bank of India (A) before the Imperial Bank of India (B).

- The State Bank of India (A) was established in 1955, after the Imperial Bank of India (B) in 1921.

- Reserve Bank of India (C) was established in 1935, before the State Bank of India (A).

- Regional Rural Banks (D) were established in 1975, much later than the Reserve Bank of India (C).

- Small Finance Banks (E) came into existence around 2015, making them the most recent.

Option 3 (B, C, A, D, E):

- Correct because it follows the correct chronological order of establishment.

- Imperial Bank of India (B) was established in 1921, making it the oldest.

- Reserve Bank of India (C) was established in 1935, following the Imperial Bank of India.

- State Bank of India (A) was established in 1955, succeeding the Reserve Bank of India.

- Regional Rural Banks (D) were established in 1975, after the State Bank of India.

- Small Finance Banks (E) were established around 2015, making them the most recent.

Option 4 (C, B, A, D, E):

- Incorrect because it places the Reserve Bank of India (C) before the Imperial Bank of India (B).

- Imperial Bank of India (B) was established in 1921, before the Reserve Bank of India (C) in 1935.

- State Bank of India (A) was established in 1955, succeeding the Reserve Bank of India.

- Regional Rural Banks (D) were established in 1975, after the State Bank of India.

- Small Finance Banks (E) were established around 2015, making them the most recent.

Q36: Which of the following methods have been prescribed by the Central Board of Direct Taxes (CBDT) for computation of Arm's Length Price required to compute income arising from an International transaction under Chapter X of the Income-tax Act, 1961?

A. Transactional Net Margin Method

B. Comparable Controlled Price Method

C. Profit Split Method

D. Resale Price Method

E. Cost Plus Method

Choose the correct answer from the options given below:

(a) B, D & E Only

(b) A, B & D Only

(c) C, D & E Only

(d) A, C & D Only

Ans: D

Sol: The correct answer is A, C & D Only.

Transactional Net Margin Method (A):

- This method compares the net profit margin relative to an appropriate base (e.g., sales, costs) that a taxpayer realizes from an international transaction with the net profit margins realized by comparable uncontrolled transactions.

- It is one of the most commonly used methods for transfer pricing analysis as prescribed by the CBDT.

Profit Split Method (C):

- This method is used where transactions are highly integrated and it is difficult to apply traditional transactional methods.

- It involves splitting the combined profits from the international transaction according to the relative value of each party’s contribution.

Resale Price Method (D):

- This method starts with the price at which a product is resold to an independent enterprise, and a resale price margin is subtracted to arrive at the Arm’s Length Price.

- It is particularly useful in cases involving the distribution of goods purchased from related parties.

Other Related Points

- The Central Board of Direct Taxes (CBDT) is responsible for formulating policies and laying down rules for the Income-tax Department in India.

- Chapter X of the Income-tax Act, 1961 deals with special provisions related to the computation of income from international transactions and specified domestic transactions to ensure that they are conducted at Arm’s Length Price.

- Other methods prescribed by the CBDT for determining the Arm’s Length Price include the Comparable Uncontrolled Price (CUP) Method and the Cost Plus Method.

Q37: The tool that International Development Association (IDA) uses to address the impact of severe natural disasters, public health emergencies by providing extra finances is known as

(a) Emergency Response Fund (ERF)

(b) Long term Lending system

(c) Crisis Response Window (CRW)

(d) Monetary Fund

Ans: C

Sol: The correct answer is Crisis Response Window (CRW).

Crisis Response Window (CRW):

- The CRW is a mechanism established by the IDA to provide additional financial resources to countries affected by severe natural disasters, public health emergencies, and other crises.

- It aims to help countries manage the immediate financial needs and support recovery efforts in the aftermath of a crisis.

- The CRW helps ensure that countries can maintain essential services and continue development activities despite the crisis.

Other Related Points

Emergency Response Fund (ERF):

- This is not a specific tool used by the IDA. While emergency response funds exist in various organizations, the IDA specifically uses the CRW for crisis-related funding.

Long term Lending system:

- This refers to the general practice of providing long-term loans, which is not specifically tailored for crisis response like the CRW.

Monetary Fund:

- This term is generally associated with organizations like the International Monetary Fund (IMF), which provides financial assistance but is not specific to the IDA’s crisis response tools.

Q38: Which of the following are the assumptions of Gordon's dividend-capitalization model?

A. No taxes

B. Cost of capital is less than the growth rate

C. No internal financing

D. Constant retention

E. Constant cost of capital

Choose the correct answer from the options given below:

(a) A, B & D only

(b) B, C & E only

(c) A, C & D only

(d) A, D & E only

Ans: D

Sol: The correct answer is A, D & E only.

Let's analyze each assumption:

No Taxes

- One of the assumptions of Gordon's dividend-capitalization model is that there are no taxes.

- This simplification helps in focusing on the relationship between dividends, growth rates, and discount rates without the complications introduced by taxes.

Cost of Capital is Less Than the Growth Rate

- This assumption is not correct. In Gordon's model, the growth rate (g) is assumed to be less than the cost of capital (k), because if the growth rate were higher than the cost of capital, the model would yield negative or non-feasible values.

- Hence, this assumption is incorrect as per Gordon's original framework.

No Internal Financing

- This assumption is not a part of Gordon's model.

- Rather, the model works under the scenario where retained earnings (internal financing) are considered, as they contribute to the growth rate of dividends.

Constant Retention

- An important assumption of Gordon's model is that the retention ratio (the portion of earnings not paid out as dividends) is constant.

- This influences the growth rate of dividends, which is assumed to remain steady.

Constant Cost of Capital

- Another assumption of the Gordon model is that the cost of capital (discount rate) remains constant over time.

- This allows the model to simplify the valuation of the firm's stock by maintaining a steady discount factor for future dividends.

Based on the evaluation above, the correct assumptions of Gordon's dividend-capitalization model are No Taxes, Constant Retention, and Constant Cost of Capital. Therefore, the correct answer is option 4: A, D & E only. This option accurately identifies the assumptions that align with Gordon's model, excluding the incorrect or non-related assumptions.

Q39: In which one of the following ratios, the share capital of RRBs is prescribed for the Central Government, State Government and Sponsoring bank?

(a) 50 ∶ 30 ∶ 20

(b) 50 ∶ 35 ∶ 15

(c) 60 ∶ 20 ∶ 20

(d) 50 ∶ 15 ∶ 35

Ans: D

Sol: The correct answer is 50 ∶ 15 ∶ 35.

The share capital ratio for Regional Rural Banks (RRBs) between Central Government, State Government, and Sponsoring Bank is 50 ∶ 15 ∶ 35:

- This distribution ensures that while the Central Government has a significant share, it is not the sole decision-maker, with substantial involvement from the sponsoring bank, highlighting a collaborative governance structure.

- The Central Government's substantial share (50%) reflects its crucial role in initiating and sustaining RRBs, ensuring these banks can fulfill their mandate of promoting financial inclusion in rural areas.

- The State Government's participation (15%) ensures that local interests and regional development priorities are adequately represented in the governance of RRBs.

- The Sponsoring Bank's share (35%) highlights its operational involvement and expertise in the management of RRBs, contributing to the professional and technical support needed for efficient banking operations.

Other Related Points

Regional Rural Banks (RRBs):

- RRBs were established under the Regional Rural Banks Act, 1976 with the aim to develop the rural economy by providing credit and other facilities, especially to the small and marginal farmers, agricultural laborers, artisans, and small entrepreneurs.

- They play a crucial role in promoting financial inclusion and providing banking services to rural and semi-urban areas.

- RRBs are designed to bridge the credit gap in rural areas and serve as a link between cooperative banks and commercial banks.

Sponsoring Bank:

- A sponsoring bank is a nationalized commercial bank that facilitates the establishment and operational management of Regional Rural Banks (RRBs).

- The sponsoring bank provides managerial and financial assistance and ensures that RRBs are effectively integrated into the broader banking network.

- They play a role in training the staff of RRBs, providing technical expertise, and helping in maintaining the stability and growth of these regional entities.

Q40: Which one of the following is Value Added Service of EXIM Bank?

(a) Line of Credit

(b) Pre-shipment Credit

(c) Buyers Credit

(d) Export Marketing Services

Ans: D

Sol: The correct answer is Export Marketing Services.

Export Marketing Services:

- Export Marketing Services are designed to help exporters market their products effectively in foreign markets. This includes market research, identifying potential buyers, and providing assistance in trade fairs and exhibitions.

- These services add value by enhancing the exporter's ability to reach international markets more efficiently and effectively.

- EXIM Bank offers these services to support the development and growth of export businesses, making it a value-added service rather than a direct financial product.

Other Related Points

Line of Credit:

- This is a financial product where EXIM Bank extends credit to foreign governments, financial institutions, or corporate entities to facilitate imports from India.

- It is a direct financial service and not considered a value-added service.

Pre-shipment Credit:

- This form of credit is provided to exporters to finance the purchase, processing, manufacturing, or packing of goods before the shipment takes place.

- It is a form of working capital financing, not a value-added service.

Buyers Credit:

- Buyers Credit is a short-term credit provided to an importer (buyer) by a bank to finance the purchase of goods and services.

- This is another financial product rather than a value-added service.

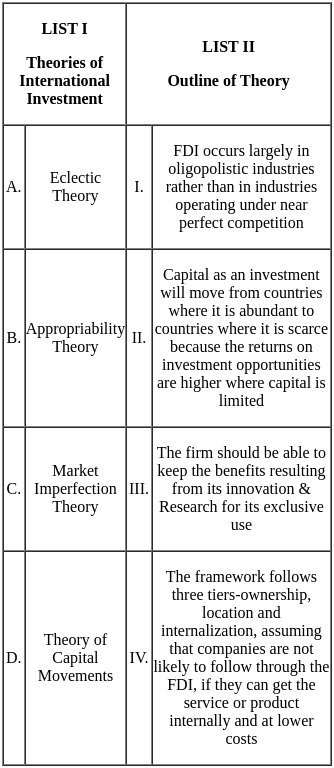

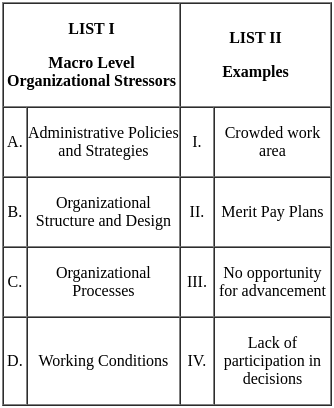

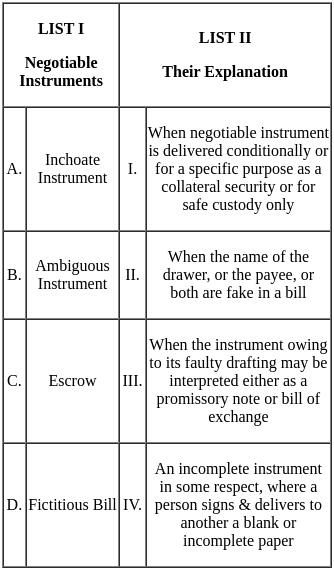

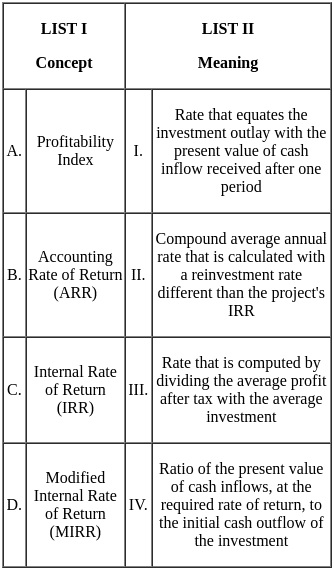

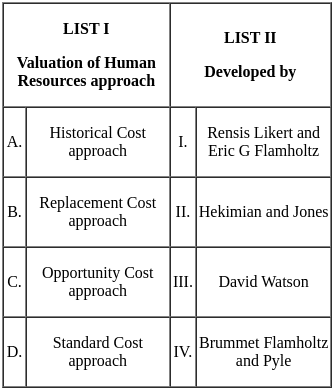

Q41: Match the List-l with List-Il

Choose the correct answer from the options given below.

(a) A - IV, B - I, C - III, D - II

(b) A - I, B - III, C - II, D - IV

(c) A - III, B - IV, C - II, D - I

(d) A - IV, B - III, C - I, D - II

Ans: D

Sol: The correct answer is A-IV, B-III, C-I, D-II.

Eclectic Theory (A) matches with The framework follows three tiers-ownership, location and internalization, assuming that companies are not likely to follow through the FDI, if they can get the service or product internally and at lower costs (IV).

- The Eclectic Theory, also known as the OLI framework, was proposed by John Dunning. It suggests that firms undertake Foreign Direct Investment (FDI) when they have ownership advantages, location advantages, and internalization advantages.