UGC NET Paper 2: Commerce 3rd Sept 2024 Shift 2 | UGC NET Past Year Papers PDF Download

Q1: Matrix organisation violates which of the following management principles?

(a) Span of Management

(b) Scalar Chain

(c) Unity of Direction

(d) Unity of Command

Ans: D

Sol: The correct answer is Unity of Command

Unity of Command:

- In the context of a financial enterprise, the principle of unity of command asserts that each employee should receive orders from one superior only, ensuring clear and coherent instruction and responsibility.

- A matrix organization structure violates this principle as employees have dual reporting relationships—generally to both a functional manager and a project manager. This can create confusion, conflict, and an unclear prioritization of tasks and responsibilities.

- This can be particularly challenging in financial enterprises where clarity in decision-making and accountability is crucial for tasks such as compliance, risk management, and financial reporting.

Other Related Points

Span of Management:

- This principle refers to the number of subordinates that a manager can effectively control and oversee. It is not fundamentally violated by a matrix structure but rather redefined through multiple reporting paths.

Scalar Chain:

- The scalar chain is the line of authority from top management to the lowest ranks. While a matrix organization may modify the traditional hierarchy, it does not necessarily violate the scalar chain, as formal lines of communication still exist.

Unity of Direction:

- This principle entails that activities with the same objective should be directed by one manager using one plan. In a matrix organization, this principle can still be maintained through coordinated efforts from various managers, aligning around project objectives.

Q2: A company has Return on Assets (ROA) of 10% and profit margin of 2%. Compute the total assets turnover.

(a) 2.5%

(b) 5%

(c) 7.5%

(d) 10%

Ans: B

Sol: The correct answer is 5%.

- To compute the Total Assets Turnover, we use the formula:

- ROA = Profit Margin × Total Assets Turnover

- Rearranging for Total Assets Turnover:

- Total Assets Turnover = ROA / Profit Margin

- Given us;

- ROA = 10% = 0.10

- Profit Margin = 2% = 0.02

- Substitute these values into the formula:

- Total Assets Turnover = 0.10 / 0.02 = 5%

Other Related Points

- Total Assets Turnover significance in financial analysis:

- Total Assets Turnover is a key metric in financial analysis that measures a company's efficiency in using its assets to generate sales. A higher ratio indicates better performance and effective asset utilization.

- This ratio is particularly important for businesses with significant investment in assets, such as manufacturing firms, where maximizing asset productivity is crucial for profitability.

- Comparison with industry benchmarks:

- It is essential to compare the Total Assets Turnover ratio with industry benchmarks to understand the company's relative efficiency. Different industries have varying standards for what constitutes a good Total Assets Turnover ratio.

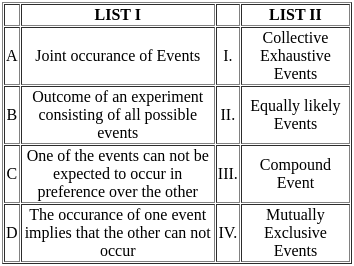

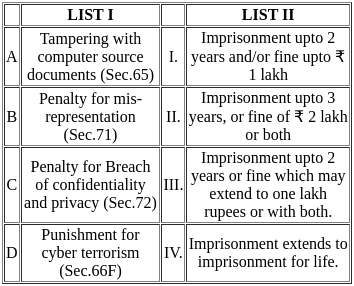

Q3: Match the List-I with List-II

Choose the correct answer from the options given below:

(a) A-III, B-I, C-II, D-IV

(b) A-IV, B-II, C-I, D-III

(c) A-III, B-II, C-I, D-IV

(d) A-I, B-II, C-III, D-IV

Ans: A

Sol: The correct answer is 'A-III, B-I, C-II, D-IV'.

Joint occurrence of Events (A) matches with Compound Event (III).

- A compound event is an event that involves the joint occurrence of two or more events. For example, rolling a die and getting an even number and a number greater than 3.

Outcome of an experiment consisting of all possible events (B) matches with Collective Exhaustive Events (I).

- Collective exhaustive events are a set of events that cover all possible outcomes of an experiment. For example, when rolling a die, the events 1, 2, 3, 4, 5, and 6 are collectively exhaustive.

One of the events cannot be expected to occur in preference over the other (C) matches with Equally likely Events (II).

- Equally likely events are events that have the same probability of occurring. For example, when flipping a fair coin, getting heads or tails are equally likely events.

The occurrence of one event implies that the other cannot occur (D) matches with Mutually Exclusive Events (IV).

- Mutually exclusive events are events that cannot occur at the same time. For example, when flipping a coin, getting heads and tails are mutually exclusive events.

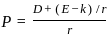

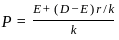

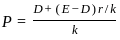

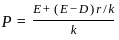

Q4: According to Dividend Growth Model, the cost of Equity is equal to :

(a) Retained Earning + Dividend yield

(b) Dividend yield + Expected Growth in Dividend

(c) Retained Earning + Expected Growth in Dividend

(d) Dividend yield + Intrinsic value

Ans: B

Sol: The correct answer is Dividend yield + Expected Growth in Dividend.

Dividend yield + Expected Growth in Dividend:

- This is the correct representation of the cost of equity according to the Dividend Growth Model (DGM). The DGM formula is given by:

Cost of Equity (Ke) = Dividend Yield + Growth Rate of Dividends

- Dividend Yield is calculated as the annual dividend per share divided by the current price per share.

- Expected Growth in Dividend refers to the anticipated annual rate at which the dividends will increase. This can be estimated based on historical dividend growth rates, or analysts' forecasts.

- The model assumes that dividends will continue to grow at a constant rate indefinitely.

- This method is useful for companies with a stable and predictable dividend policy.

Other Related Points

Retained Earning + Dividend yield:

- This is incorrect. Retained earnings reflect the portion of net income not paid out as dividends. They do not contribute to the current cost of equity directly.

Retained Earning + Expected Growth in Dividend:

- This option is incorrect. The cost of equity does not directly incorporate retained earnings, which represent cumulative historical profits kept within the company rather than being distributed to shareholders.

Dividend yield + Intrinsic value:

- This is incorrect. The intrinsic value of a stock is a separate concept used to evaluate if a stock is over or under-valued, but it does not directly correlate with calculating the cost of equity.

Q5: Who among the following has given this definition of CSR? "Wealth created from society has to be ploughed back into society."

(a) Milton Friedman

(b) Henry Ford

(c) Mahatma Gandhi

(d) Kay and Silberston

Ans: C

Sol: The correct answer is Mahatma Gandhi.

Mahatma Gandhi:

- Mahatma Gandhi, a prominent leader in the Indian independence movement and a proponent of non-violent civil disobedience, emphasized the moral responsibility of businesses toward society.

- He believed that businesses should act as trustees and use their wealth for the benefit of society. This concept aligns with his broader philosophy of trusteeship, where wealth is considered a trust of the community rather than a private possession.

- His view of corporate social responsibility (CSR) is reflected in the idea that the wealth generated from society should be reinvested into it, promoting social welfare and economic development.

- This perspective highlights the ethical obligation of businesses to contribute positively to societal progress, ensuring that economic gains are used to address social issues and improve the well-being of the community.

Other Related Points

Milton Friedman:

- Milton Friedman, an American economist, argued that the primary responsibility of a business is to increase its profits within the boundaries of the law and ethical customs. He did not advocate for reinvestment of corporate wealth into society as Gandhi did.

Henry Ford:

- Henry Ford, founder of the Ford Motor Company, believed in paying fair wages and producing affordable goods but did not specifically express the idea that wealth created from society should be returned to society in the manner Gandhi articulated.

Kay and Silberston:

- Kay and Silberston are known for their work in corporate governance and the role of companies, but they did not formulate the CSR concept that wealth generated from society must be returned to society in the way Mahatma Gandhi did.

Q6: According to section 17(2) of the Income Tax Act, 1961, which of the following is included in salary?

A. Wages

B. Perks

C. Benefits in lieu of salary

D. Compensation on termination of employment

Choose the correct answer from the options given below:

(a) Only A and B

(b) Only B and C

(c) Only A, B and C

(d) A, B, C and D

Ans: D

Sol: The correct answer is 4.

Let's analyze each factor:

Wages

- Wages are the fixed regular payments made by an employer to an employee, typically on a monthly or bi-weekly basis, and are considered a fundamental part of the salary.

- Reason for inclusion: Wages are clearly a component of salary as per section 17g of the Income Tax Act, 1961.

Perks

- Perks (or perquisites) refer to the benefits provided by the employer to the employee in addition to regular salary. These could include things like company cars, housing, and other non-cash benefits.

- Reason for inclusion: Perks are considered part of the salary package under the provisions of the Income Tax Act.

Benefits in lieu of salary

- Benefits in lieu of salary refer to the compensation or other benefits provided to an employee instead of the traditional salary. This can include options like stock options or other financial compensations.

- Reason for inclusion: These benefits are recognized as part of the salary under section 17g of the Income Tax Act.

Compensation on termination of employment

- Compensation on termination of employment refers to the severance pay or other forms of compensation given to an employee when their employment is terminated.

- Reason for inclusion: This form of compensation is also included under the definition of salary as per the Income Tax Act.

Therefore, the factors that are included in the salary as per section 17g of the Income Tax Act, 1961 are A: Wages, B: Perks, C: Benefits in lieu of salary, and D: Compensation on termination of employment. This makes option 4: "A, B, C, and D" the correct choice.

Q7: Arrange the following process of incorporation of a new LLP in proper sequence.

A. Reserve LLP name

B. Procure Digital Signature Certificate

C. Prepare documents for incorporation of LLP

D. LLP incorporation and DIN Application

E. Drafting and Filing LLP Agreement

F. Apply for PAN and TAN

Choose the correct answer from the options given below:

(a) A, B, C, D, F, E

(b) B, A, D, C, E, F

(c) B, A, C, D, F, E

(d) A, B, C, D, E, F

Ans: C

Sol: The correct answer is B, A, C, D, F, E.

Procure Digital Signature Certificate (B):

- The first step in incorporating a new LLP is to procure a Digital Signature Certificate (DSC) for the designated partners. This is essential because all documents to be submitted to the Registrar of Companies (RoC) must be digitally signed.

- The DSC ensures the security and authenticity of the documents submitted electronically.

Reserve LLP name (A):

- After obtaining the DSC, the next step is to reserve a unique name for the LLP. This is done by submitting a name reservation request to the Ministry of Corporate Affairs (MCA).

- The proposed name must comply with the naming guidelines and should not be identical or similar to an existing company or LLP name.

Prepare documents for incorporation of LLP (C):

- Once the name is approved, the necessary documents for incorporation must be prepared. These include the LLP Agreement, partners' details, and other required forms.

- Proper documentation ensures that all legal requirements are met and facilitates a smooth incorporation process.

LLP incorporation and DIN Application (D):

- With the required documents in place, the incorporation application can be filed. This step involves submitting Form FiLLiP (Form for incorporation of Limited Liability Partnership) to the RoC along with the partners' details.

- During this step, the Designated Partner Identification Number (DIN) is also applied for the designated partners if they do not already have one.

Apply for PAN and TAN (F):

- After the LLP is incorporated, it is essential to apply for the Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN). These are required for tax-related purposes.

- Applying for PAN and TAN ensures that the LLP can legally conduct its financial transactions and comply with tax regulations.

Drafting and Filing LLP Agreement (E):

- The final step is to draft and file the LLP Agreement. This agreement outlines the rights, duties, and obligations of the partners and the LLP. It must be filed within 30 days of incorporation.

- Filing the LLP Agreement ensures that the LLP operates smoothly and in accordance with the agreed terms and legal requirements.

Other Related Points

- Incorporating a new LLP involves a series of legal and procedural steps to ensure compliance with the Companies Act and other relevant regulations.

- Each step in the incorporation process is crucial for establishing the LLP as a legally recognized entity and ensuring its smooth operation in the future.

- Proper documentation, timely filings, and adherence to legal requirements are essential for the successful incorporation of an LLP.

Q8: Which of the following capital budgeting Techniques follows the discounting criteria?

A. Net Present Value

B. Benefit- cost Ratio

C. Accounting Rate of Return

D. Internal Rate of Return

E. Payback Period

Choose the correct answer from the options given below:

(a) A, B, C, D Only

(b) B, C, D Only

(c) A, B, D Only

(d) A, C, D Only

Ans: C

Sol: The correct answer is A, B, D Only.

Let's analyze each capital budgeting technique:

Net Present Value (NPV)

- NPV calculates the difference between the present value of cash inflows and outflows over a period of time.

- It uses a discount rate to bring future cash flows to their present value.

- Reason for inclusion: Since it uses discounting to evaluate the profitability of a project, it follows the discounting criteria.

Benefit-Cost Ratio (BCR)

- BCR is the ratio of the present value of benefits to the present value of costs.

- It also uses a discount rate to bring future values to present values.

- Reason for inclusion: Because it involves discounting future cash flows, it follows the discounting criteria.

Accounting Rate of Return (ARR)

- ARR calculates the return on investment based on accounting information, such as net income.

- It does not use discounting; instead, it uses accounting profits and investments.

- Reason for exclusion: Since it does not involve discounting, it does not follow the discounting criteria.

Internal Rate of Return (IRR)

- IRR is the discount rate that makes the net present value of all cash flows from a project equal to zero.

- It uses discounting to measure and compare the profitability of investments.

- Reason for inclusion: Because it involves discounting future cash flows, it follows the discounting criteria.

Payback Period

- The Payback Period calculates the time required to recover the initial investment from the cash inflows generated by the investment.

- It does not take into account the time value of money and does not use discounting.

- Reason for exclusion: Since it does not involve discounting, it does not follow the discounting criteria.

Therefore, the capital budgeting techniques that follow the discounting criteria are A: Net Present Value, B: Benefit-Cost Ratio, and D: Internal Rate of Return. This makes option 3: "A, B, D Only" the correct choice.

Q9: In case of performance appraisal; the appraisal should focus on the following:

A. Technology for intervention between the assessor and the assessee

B. Personal Characteristics

C. Behaviour displayed by assessees

D. Knowledge / Skills Possessed

E. Results obtained

Choose the correct answer from the options given below:

(a) Only A, B, C and D

(b) Only A, B and C

(c) Only B, C and D

(d) Only B, C, D and E

Ans: D

Sol: The correct answer is Only B, C, D and E.

Let's analyze each factor:

Technology for intervention between the assessor and the assessee

- This factor involves the use of technological tools to facilitate the appraisal process.

- While it can enhance the efficiency and effectiveness of the appraisal process, it is not a core focus of performance appraisal itself.

- Reason for exclusion: The main aim of performance appraisal is to evaluate aspects directly related to the employee’s performance, which technology facilitates but does not constitute.

Personal Characteristics

- Personal characteristics refer to the inherent traits and qualities of an individual, such as attitude, personality, and work ethic.

- These characteristics can significantly influence an employee's performance and are important to consider in appraisals.

- Reason for inclusion: Evaluating personal characteristics helps in understanding how an employee’s traits impact their performance and interactions at work.

Behaviour displayed by assessees

- This factor involves evaluating how employees conduct themselves in the workplace, including their interactions with colleagues and adherence to company policies.

- Behavior is a critical component of performance as it can affect team dynamics and overall productivity.

- Reason for inclusion: Assessing behavior helps in identifying areas where employees excel or need improvement in their professional conduct.

Knowledge / Skills Possessed

- This factor examines the technical and professional capabilities that an employee brings to their role.

- Knowledge and skills are directly related to job performance and are essential for evaluating an employee's competency.

- Reason for inclusion: Understanding the knowledge and skills of employees helps in identifying their strengths and areas for professional development.

Results obtained

- This factor focuses on the outcomes and achievements of an employee's efforts.

- Evaluating results helps in measuring the effectiveness and efficiency of an employee’s work.

- Reason for inclusion: Results are a direct indicator of performance and are crucial for understanding an employee’s contributions to the organization.

Therefore, the factors that should be focused on during performance appraisal are B: Personal Characteristics, C: Behaviour displayed by assessees, D: Knowledge / Skills Possessed, and E: Results obtained. This makes option 4: "Only B, C, D and E" the correct choice.

Q10: Which of the following are included in Foreign Direct Investment?

A. Wholly owned subsidiary

B. Joint venture

C. Investment in GDR

D. Acquisition

E. Investment by FIIs

Choose the correct answer from the options given below:

(a) A & B Only

(b) B, C & D Only

(c) C, D & E Only

(d) A, B & D Only

Ans: D

Sol: The correct answer is A, B & D Only.

Let's analyze each option:

Wholly owned subsidiary

- A wholly owned subsidiary is a company whose common stock is 100% owned by another company, making it a direct investment from the parent company into the subsidiary.

- Reason for inclusion: This is a clear example of Foreign Direct Investment (FDI) as it involves a direct ownership stake in a foreign company.

Joint venture

- A joint venture involves two or more parties coming together to undertake an economic activity, often including a foreign company and a local company.

- Reason for inclusion: This also qualifies as FDI because it involves significant investment and active participation from foreign companies in the local economy.

Investment in GDR (Global Depository Receipts)

- GDRs are a type of bank certificate issued in more than one country for shares in a foreign company, usually held by a foreign branch of an international bank.

- Reason for exclusion: Investment in GDRs is considered portfolio investment rather than direct investment, as it does not involve direct control or influence over the business operations.

Acquisition

- An acquisition occurs when one company purchases most or all of another company's shares to gain control of that company.

- Reason for inclusion: This is a form of FDI as it involves a direct and significant investment from a foreign company, leading to ownership and control over the acquired company.

Investment by FIIs (Foreign Institutional Investors)

- FIIs refer to the investment made by institutions or funds in the financial markets of another country.

- Reason for exclusion: These investments are considered portfolio investments, which involve buying securities rather than direct control or ownership of companies.

Therefore, the elements that qualify strictly as Foreign Direct Investments are A: Wholly owned subsidiary, B: Joint venture, and D: Acquisition. This makes option 4: "A, B & D Only" the correct choice.

Q11: Which of the following are the participants in T-Bills Market?

A. Reserve Bank of India

B. Commercial Banks

C. Foreign Banks

D. Provident Funds

E. Corporates

Choose the correct answer from the options given below:

(a) B, C, D & E Only

(b) A, B, C & E Only

(c) A, B, D & E Only

(d) A, B, C, D & E

Ans: D

Sol: The correct answer is A, B, C, D & E.

Let's analyze the participants in the T-Bills Market:

Reserve Bank of India

- The Reserve Bank of India (RBI) is the central bank of India and plays a crucial role in the issuance and regulation of T-Bills. The RBI conducts auctions of T-Bills on behalf of the Government of India and ensures the smooth functioning of the T-Bills market.

- Reason for inclusion: As the issuer and regulator, the RBI is a key participant in the T-Bills market.

Commercial Banks

- Commercial banks participate in the T-Bills market by buying and selling T-Bills. They use T-Bills as a secure investment option and as collateral for obtaining funds from the RBI.

- Reason for inclusion: Commercial banks are significant investors in T-Bills, making them key participants in the market.

Foreign Banks

- Foreign banks operating in India also invest in T-Bills. They participate in the market to manage their liquidity and to hold a portion of their investments in secure government-backed instruments.

- Reason for inclusion: Foreign banks are active participants in the T-Bills market.

Provident Funds

- Provident funds invest in T-Bills as a safe investment option to ensure the security and liquidity of their funds. T-Bills provide a risk-free return, making them an attractive investment for provident funds.

- Reason for inclusion: Provident funds are institutional investors in T-Bills, contributing to the demand in the market.

Corporates

- Corporates invest in T-Bills to manage their short-term liquidity needs. T-Bills are a secure and liquid investment option for corporates looking to park their surplus funds for short durations.

- Reason for inclusion: Corporates are among the investors in T-Bills, participating actively in the market.

Therefore, all the listed entities - Reserve Bank of India, Commercial Banks, Foreign Banks, Provident Funds, and Corporates - are participants in the T-Bills market. This makes option 4: "A, B, C, D & E" the correct choice.

Q12: The general consideration applicable to tax planning in the field of business deduction revolve around which of the following?

A. Allowability

B. Year of allowability

C. Extent of allowability

D. Carry forward to future years

Choose the correct answer from the options given below:

(a) A & B Only

(b) A & C Only

(c) A, B & C Only

(d) A, B, C & D

Ans: D

Sol: The correct answer is A, B, C & D.

Let's analyze each factor:

Allowability

- Allowability refers to whether a particular business expense is permitted as a deduction under tax laws.

- This is a critical consideration in tax planning because only allowable deductions can be used to reduce taxable income.

Year of Allowability

- Year of allowability determines the specific tax year in which a business expense can be claimed as a deduction.

- This is important for tax planning to ensure that deductions are claimed in the appropriate year to maximize tax benefits.

Extent of Allowability

- Extent of allowability refers to the amount or percentage of the expense that is allowable as a deduction.

- Some expenses might be partially deductible, and understanding the extent of allowability helps in accurate tax planning.

Carry Forward to Future Years

- Carry forward to future years allows businesses to carry forward certain deductions that cannot be fully utilized in the current tax year to subsequent years.

- This is important for tax planning as it helps in managing tax liabilities over multiple years.

Therefore, all four factors - Allowability, Year of Allowability, Extent of Allowability, and Carry Forward to Future Years - are relevant considerations in tax planning for business deductions. This makes option 4: "A, B, C & D" the correct choice.

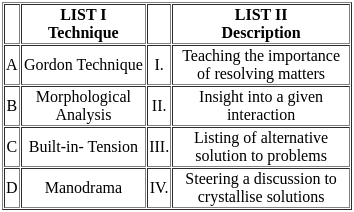

Q13: Match the List-I with List-II

Choose the correct answer from the options given below:

(a) A-I, B-II, C-III, D-IV

(b) A-II, B-III, C-I, D-IV

(c) A-III, B-IV, C-II, D-I

(d) A-IV, B-III, C-I, D-II

Ans: D

Sol: The correct answer is 'A-IV, B-III, C-I, D-II'.

Gordon Technique (A) matches with Steering a discussion to crystallise solutions (IV).

- The Gordon Technique is a method used in group discussions to guide the conversation towards generating and refining solutions. It helps in steering the discussion in a focused manner to crystallize actionable solutions.

- It is often used in brainstorming sessions and problem-solving meetings to ensure that the group stays on track and reaches a consensus on the best possible solutions.

- Key Point: Effective facilitation of discussions can lead to more innovative and practical solutions.

Morphological Analysis (B) matches with Listing of alternative solution to problems (III).

- Morphological Analysis is a technique used to explore all possible solutions to a problem by systematically varying different parameters. It involves listing and examining various alternatives to arrive at the best solution.

- This method is particularly useful in complex problem-solving scenarios where multiple factors need to be considered and combined.

- Key Point: Morphological Analysis helps in identifying a wide range of potential solutions, enhancing creativity and innovation.

Built-in-Tension (C) matches with Teaching the importance of resolving matters (I).

- Built-in-Tension refers to the natural conflicts or challenges within a team or organization that need to be addressed. Teaching the importance of resolving these matters is crucial for maintaining harmony and productivity.

- By understanding and addressing built-in tensions, organizations can foster a more collaborative and effective working environment.

- Key Point: Recognizing and resolving internal conflicts is essential for organizational health and success.

Manodrama (D) matches with Insight into a given interaction (II).

- Manodrama is a technique used to gain deeper insight into interactions and relationships within a group. It involves role-playing or dramatization to explore different perspectives and dynamics.

- This method helps in understanding underlying issues and improving communication and relationships within the group.

- Key Point: Manodrama can be a powerful tool for uncovering and addressing interpersonal issues, leading to better teamwork and collaboration.

Q14: Arrange the online registration process of a new private limited company in proper sequence.

A. Select and Reserve Company Name

B. Acquire DIN & DSC of promoters

C. Draft Memorandum and Articles of Association

D. Get Company Registration Certificate

E. File SPICE+ Application

Choose the correct answer from the options given below:

(a) A, B, C, E, D

(b) A, B, E, D, C

(c) B, A, C, E, D

(d) B, A, C, D, E

Ans: C

Sol: The correct answer is B, A, C, E, D.

Acquire DIN & DSC of promoters (B):

- This is the first step in the online registration process. The Director Identification Number (DIN) and Digital Signature Certificate (DSC) are essential for the promoters of the company. The DIN is a unique identification number for a director, while the DSC is used for digitally signing documents.

- Without these, the promoters cannot proceed with the company registration process.

Select and Reserve Company Name (A):

- Once the promoters have their DIN and DSC, the next step is to select a unique name for the company and get it approved by the Registrar of Companies (ROC).

- This involves checking the availability of the desired name and reserving it for the company.

Draft Memorandum and Articles of Association (C):

- After reserving the company name, the promoters need to draft the Memorandum of Association (MOA) and Articles of Association (AOA). The MOA outlines the company's scope and purpose, while the AOA defines the internal regulations and management structure.

- These documents are crucial as they lay down the rules governing the company's operations.

File SPICE+ Application (E):

- The next step is to file the SPICE+ (Simplified Proforma for Incorporating Company Electronically Plus) application, which includes filing various forms for company incorporation.

- This integrated web form is used for company registration and includes sections for name reservation, incorporation, DIN allotment, and more.

Get Company Registration Certificate (D):

- The final step in the process is to obtain the Certificate of Incorporation from the ROC. This certificate serves as official proof of the company's existence and includes the company's Corporate Identity Number (CIN).

- Once this certificate is issued, the company is legally recognized as a private limited company.

Q15: Which of the following are the main functions of UNCTAD?

A. Enhancing international trade with a view to boosting economic growth

B. Aiding the economic development of developing countries by promoting private enterprise

C. Negotiating multinational trade agreements

D. Make proposals to put your principles and policies into effect

Choose the correct answer from the options given below:

(a) Only A, B and C

(b) Only B. C and D

(c) Only A, B and D

(d) Only A, C and D

Ans: D

Sol: The correct answer is Only A, C and D.

Let's analyze each function:

A. Enhancing international trade with a view to boosting economic growth

- This is a core function of UNCTAD as it aims to integrate developing countries into the world economy through trade.

- Reason for inclusion: UNCTAD works to promote international trade to stimulate economic growth, particularly in developing countries.

B. Aiding the economic development of developing countries by promoting private enterprise

- While UNCTAD does support the economic development of developing countries, its primary focus is not on promoting private enterprise specifically.

- Reason for exclusion: This function is more aligned with other international organizations such as the World Bank or IFC, rather than UNCTAD.

C. Negotiating multinational trade agreements

- UNCTAD plays a role in fostering international trade negotiations and agreements, though it often provides support and analysis rather than direct negotiation.

- Reason for inclusion: UNCTAD helps facilitate and support trade agreements to benefit developing countries.

D. Make proposals to put your principles and policies into effect

- UNCTAD actively makes policy recommendations and proposals to support its principles and goals.

- Reason for inclusion: This is a significant part of UNCTAD's work, as it provides policy advice to developing countries.

Therefore, the main functions of UNCTAD that fit within the context provided are A: Enhancing international trade with a view to boosting economic growth, C: Negotiating multinational trade agreements, and D: Make proposals to put your principles and policies into effect. This makes option 4: "Only A, C and D" the correct choice.

Q16: Arrange the following phases of International Monetary System in chronological order (old to new).

A. Gold Bullion Standard

B. Gold Specie Standard

C. Floating Exchange Rate

D. Gold Exchange Standard

E. Bretton Woods System

Choose the correct answer from the options given below:

(a) A, B, E, D, C

(b) A, D, E, C, B

(c) B, A, D, E, C

(d) B, D, A, C, E

Ans: C

Sol: The correct answer is B, A, D, E, C.

Gold Specie Standard (B):

- The Gold Specie Standard was the earliest form of the gold standard, introduced in the 19th century. Under this system, the value of a country's currency was directly linked to a specific amount of gold coins.

- Countries under this standard had gold coins in circulation and currency notes that could be exchanged for a fixed amount of gold.

Gold Bullion Standard (A):

- Following the Gold Specie Standard, the Gold Bullion Standard emerged in the early 20th century. In this system, gold coins were no longer in circulation.

- Instead, currency could be exchanged for a fixed amount of gold bullion, not coins. This allowed countries to manage their gold reserves more effectively.

Gold Exchange Standard (D):

- The Gold Exchange Standard was introduced in the interwar period. Countries under this system held most of their reserves in currencies of countries that were still on the Gold Standard, rather than holding gold directly.

- This system facilitated international trade and reduced the cost of maintaining gold reserves.

Bretton Woods System (E):

- Post World War II, the Bretton Woods System was established in 1944. Under this system, currencies were pegged to the US dollar, which was convertible to gold at a fixed rate of $35 per ounce.

- This system aimed to provide stability and foster international economic cooperation.

Floating Exchange Rate (C):

- The Bretton Woods System collapsed in 1971, leading to the adoption of the Floating Exchange Rate system. Under this system, currency values are determined by market forces without direct government or central bank intervention.

- This system is the current standard in most countries, allowing exchange rates to fluctuate based on supply and demand dynamics in the foreign exchange market.

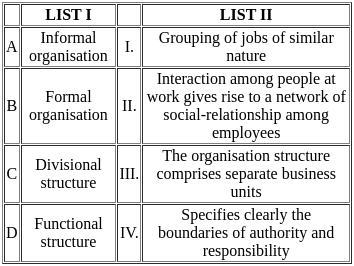

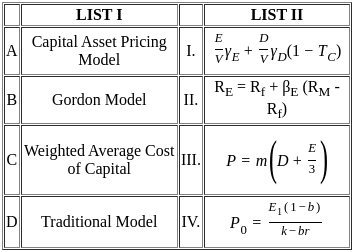

Q17: Match the List-I with List-II

Choose the correct answer from the options given below:

(a) A-II, B-III, C-IV, D-I

(b) A-II, B-III, C-I, D-IV

(c) A-II, B-IV, C-III, D-I

(d) A-II, B-IV, C-I, D-III

Ans: C

Sol: The correct answer is 'A-II, B-IV, C-III, D-I'.

Informal organisation (A) matches with Interaction among people at work gives rise to a network of social-relationship among employees (II).

- Informal organisation arises naturally as employees interact with each other. This leads to the formation of social networks and relationships that are not defined by the formal organisational structure.

- These informal networks can influence the work environment, communication, and overall organisational culture.

- Key Point: Understanding informal organisations can help managers leverage these networks for improved communication and collaboration.

Formal organisation (B) matches with Specifies clearly the boundaries of authority and responsibility (IV).

- Formal organisation is a structured and systematic arrangement of tasks and roles within an organisation. It clearly defines the hierarchy, authority, and responsibilities of each position.

- This structure helps in achieving organisational goals efficiently by ensuring clarity and order in operations.

- Key Point: A well-defined formal organisation is crucial for effective management and operational efficiency.

Divisional structure (C) matches with The organisation structure comprises separate business units (III).

- Divisional structure is an organisational design where the company is divided into semi-autonomous units or divisions, each focused on a specific product line, market, or geographic area.

- Each division operates independently and has its own set of functional departments, making it easier to respond to market changes and customer needs.

- Key Point: Divisional structures are beneficial for large organisations with diverse product lines or markets.

Functional structure (D) matches with Grouping of jobs of similar nature (I).

- Functional structure groups employees based on their roles, skills, or tasks. For instance, all marketing professionals might be grouped together in a marketing department.

- This structure allows for specialization and efficiency within each functional area, as employees can focus on their specific tasks and expertise.

- Key Point: Functional structures are common in organisations that benefit from specialized departments and clear functional divisions.

Q18: Arrange the following strategic decisions in international business in proper sequence.

A. Market Selection Decision

B. International Business Decision

C. Entry and Operating Decision

D. International organisation & HR Decisions

E. Marketing Mix Decision

Choose the correct answer from the options given below:

(a) A, B, C, D, E

(b) A, B, C, E, D

(c) B, A, C, E, D

(d) B, C, A, E, D

Ans: C

Sol: The correct answer is B, A, C, E, D.

International Business Decision (B):

- This is the initial step where a company decides whether or not to engage in international business. It involves evaluating the potential benefits and risks associated with entering the international market.

- This decision sets the foundation for all subsequent strategic decisions in international business.

Market Selection Decision (A):

- Once the decision to engage in international business is made, the next step is to choose which international markets to enter.

- This involves researching various potential markets, analyzing market size, growth potential, competitive landscape, and other relevant factors to select the most promising markets.

Entry and Operating Decision (C):

- After selecting the target markets, the company must decide on the mode of entry and how it will operate in those markets.

- Options include exporting, franchising, joint ventures, wholly-owned subsidiaries, etc. This decision will impact the level of control, investment, and risk associated with the market entry.

Marketing Mix Decision (E):

- Once the mode of entry and operational strategies are in place, the company must develop its marketing mix (product, price, place, and promotion) to cater to the needs and preferences of the target market.

- This involves customizing the marketing strategy to align with local market conditions and consumer behavior.

International Organisation & HR Decisions (D):

- The final step involves setting up the organizational structure and human resource policies to support international operations.

- This includes decisions related to staffing, training, management structures, and ensuring that the organization's HR policies are in compliance with local laws and cultural norms.

Q19: Tax treaties are generally based on which of the following convention?

A. OECD Model Tax Convention

B. UN Model Tax Convention

C. WTO Model Tax Convention

D. IMF Model Tax Convention

Choose the correct answer from the options given below:

(a) A & B only

(b) A & C only

(c) B & D only

(d) A, B & C only

Ans: A

Sol: The correct answer is A & B only.

Let's analyze each option:

OECD Model Tax Convention

- The OECD Model Tax Convention is one of the most widely used frameworks for tax treaties globally. It provides guidelines to prevent double taxation and allocate taxing rights between countries.

- Reason for inclusion: Many countries base their bilateral tax treaties on the OECD Model Tax Convention, making it a significant reference point in international taxation.

UN Model Tax Convention

- The UN Model Tax Convention is another important framework, particularly for tax treaties involving developing countries. It emphasizes source-based taxation to ensure that developing countries receive a fair share of tax revenue.

- Reason for inclusion: The UN Model Tax Convention is also widely used in international tax treaties, especially in agreements between developed and developing countries.

WTO Model Tax Convention

- The WTO (World Trade Organization) does not provide a model tax convention. Its main focus is on trade rules and regulations, not on tax treaties.

- Reason for exclusion: The WTO does not have a model tax convention, making it irrelevant to the context of tax treaties.

IMF Model Tax Convention

- The IMF (International Monetary Fund) also does not provide a model tax convention. Its primary role is in economic stability and financial support to countries, not in drafting tax treaties.

- Reason for exclusion: The IMF does not have a model tax convention, thus it is not applicable to the context of tax treaties.

Therefore, the correct answer is 1) A & B only, as both the OECD Model Tax Convention and the UN Model Tax Convention are the primary frameworks used for international tax treaties.

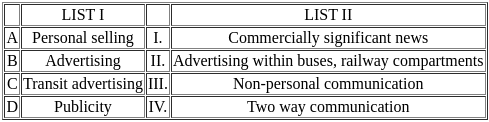

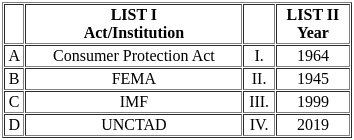

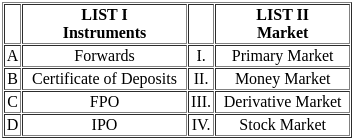

Q20: Match the List-I with List-II

Choose the correct answer from the options given below:

(a) A-I, B-II, C-III, D-IV

(b) A-II, B-III, C-IV, D-I

(c) A-I, B-III, C-II, D-IV

(d) A-IV, B-III, C-II, D-I

Ans: D

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

Personal selling (A) matches with Two way communication (IV).

- Personal selling involves direct interaction between the salesperson and the customer, allowing for immediate feedback and adjustment of the sales approach. This two-way communication helps in understanding customer needs and building relationships.

- Personal selling is often used in complex or high-value transactions where personalized attention can significantly impact the buying decision.

- Key Point: Effective personal selling can lead to higher customer satisfaction and loyalty due to the personalized service provided.

Advertising (B) matches with Non-personal communication (III).

- Advertising is a form of communication that is directed at a large audience through various media channels such as television, radio, print, and online platforms. It does not involve personal interaction with customers.

- The goal of advertising is to create awareness, generate interest, and persuade potential customers to take action, such as making a purchase.

- Key Point: Advertising can reach a wide audience and is effective for brand building and creating market presence.

Transit advertising (C) matches with Advertising within buses, railway compartments (II).

- Transit advertising involves placing ads in or on public transportation vehicles and in transit stations. This type of advertising reaches commuters and travelers who use these modes of transportation.

- It is an effective way to target a captive audience with repeated exposure to the ads during their daily commutes.

- Key Point: Transit advertising can be a cost-effective way to reach a large and diverse audience.

Publicity (D) matches with Commercially significant news (I).

- Publicity refers to the free dissemination of information about a company, product, or service through media coverage. This can include news articles, press releases, and media interviews.

- Publicity can enhance a company’s image and credibility, as it is perceived as more trustworthy than paid advertising.

- Key Point: Positive publicity can generate significant interest and attention without the costs associated with traditional advertising.

Q21: A company prices one litre bottle of its mineral water at ₹ 20/- but 100 ml of the same water in a moisturizer spray for ₹ 50/-. This is an example of which one of the following pricing practices?

(a) Customer-Segment Pricing

(b) Image Pricing

(c) Product-form Pricing

(d) Mark-up Pricing

Ans: C

Sol: The correct answer is Product-form Pricing.

Product-form Pricing:

- Product-form pricing involves setting different prices for different versions of a product, even though the cost to produce them may be similar. In this case, the company charges significantly more for the same water when it is packaged in a moisturizer spray form compared to a regular bottle. This demonstrates how the form or presentation of a product can justify a higher price.

Customer-Segment Pricing:

- This involves different prices for different customer segments, not based on the form of the product. For example, student discounts or senior citizen discounts are common forms of customer-segment pricing. This is not applicable here as the pricing difference is due to the product form, not the customer segment.

Image Pricing:

- Image pricing involves setting a price based on the perceived image or status of the product. For instance, luxury brands often use image pricing to justify higher prices. However, in this case, the price difference is due to the product form and its utility, not merely its image.

Mark-up Pricing:

- Mark-up pricing involves adding a standard markup to the cost of the product. While this could explain general pricing strategies, it does not specifically address the significant price difference between the two forms of the same product.

Other Related Points

Customer-Segment Pricing is not applicable here:

- The price difference is not based on different customer segments, but on the different forms of the product.

Image Pricing is not the reason for the price difference:

- While image pricing can justify higher prices for products with a perceived luxury or status, the significant price difference in this case is due to the product's form and utility.

Mark-up Pricing does not explain the significant price difference:

- Mark-up pricing generally involves a consistent addition to the cost price, but it does not account for the drastic difference seen in product-form pricing where the form and utility of the product lead to higher prices.

Q22: Match the List-I with List-II

Choose the correct answer from the options given below:

(a) A-IV, B-III, C-II, D-I

(b) A-II, B-III, C-I, D-IV

(c) A-III, B-IV, C-II, D-I

(d) A-I, B-II, C-III, D-IV

Ans: A

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

Consumer Protection Act (A) matches with 2019 (IV).

- The Consumer Protection Act was enacted in 2019 to replace the Consumer Protection Act of 1986. It aims to provide more comprehensive protection for consumers in India and address modern consumer concerns.

- It includes provisions for the establishment of the Central Consumer Protection Authority (CCPA) to promote, protect, and enforce the rights of consumers.

FEMA (B) matches with 1999 (III).

- The Foreign Exchange Management Act (FEMA) was enacted in 1999 to replace the Foreign Exchange Regulation Act (FERA) of 1973. It aims to facilitate external trade and payments and promote the orderly development and maintenance of the foreign exchange market in India.

- FEMA is designed to be more liberal and less stringent compared to FERA, focusing on the management of foreign exchange rather than its control.

IMF (C) matches with 1945 (II).

- The International Monetary Fund (IMF) was established in 1945 as part of the Bretton Woods Conference. It aims to promote international monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

- The IMF provides financial assistance and support to member countries facing economic difficulties.

UNCTAD (D) matches with 1964 (I).

- The United Nations Conference on Trade and Development (UNCTAD) was established in 1964 as a permanent intergovernmental body. It aims to promote the integration of developing countries into the world economy to ensure their development.

- UNCTAD works on trade, investment, and development issues, providing analysis, consensus-building, and technical cooperation.

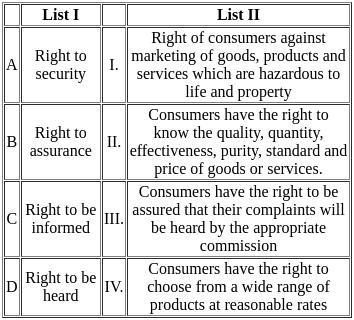

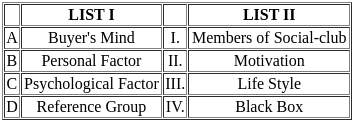

Q23: Match List I with List II

Choose the correct answer from the options given below:

(a) A-I, B-IV, C-II, D-III

(b) A-II, B-III, C-I, D-IV

(c) A-III, B-II, C-I, D-IV

(d) A-IV, B-III, C-II, D-I

Ans: A

Sol: The correct answer is 'A-I, B-IV, C-II, D-III'.

Right to security (A) matches with Right of consumers against marketing of goods, products and services which are hazardous to life and property (I).less Copy code

- This ensures that consumers are protected from goods and services that can potentially harm their life or property. It emphasizes stringent regulations on hazardous products and safety standards to avoid consumer exploitation.

Right to choose. (B) matches with Consumers have the right to choose from a wide range of products at reasonable rates (IV).

- This guarantees consumers the freedom to select from a variety of options in the marketplace, ensuring fair competition and affordability.

Right to be informed (C) matches with Consumers have the right to know the quality, quantity, effectiveness, purity, standard and price of goods or services (II).

- This right ensures transparency and allows consumers to make informed purchasing decisions, safeguarding them against misleading advertisements and claims.

Right to be heard (D) matches with Consumers have the right to be assured that their complaints will be heard by the appropriate commission (III).

- It provides consumers with the confidence that their grievances and issues will be addressed through proper channels, ensuring accountability.

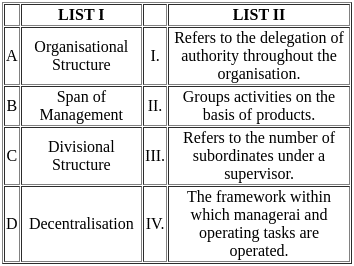

Q24: Match the List-I with List-II

Choose the correct answer from the options given below:

(a) A-I, B-II, C-III, D-IV

(b) A-III, B-II, C-I, D-IV

(c) A-II, B-III, C-IV, D-I

(d) A-IV, B-III, C-II, D-I

Ans: D

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

Organisational Structure (A) matches with The framework within which managerial and operating tasks are operated (IV).

- An organizational structure defines the framework within which managerial and operational tasks are carried out. It outlines the roles, responsibilities, and hierarchy within an organization, ensuring that tasks are systematically distributed and managed.

Span of Management (B) matches with Refers to the number of subordinates under a supervisor (III).

- The span of management, also known as the span of control, refers to the number of subordinates who report directly to a supervisor. It affects the manager's ability to effectively oversee and coordinate their team's work.

Divisional Structure (C) matches with Groups activities on the basis of products (II).

- A divisional structure is an organizational design that groups activities based on products, services, or geographic regions. Each division operates semi-autonomously and is responsible for its own resources and results.

Decentralisation (D) matches with Refers to the delegation of authority throughout the organisation (I).

- Decentralization involves distributing decision-making authority to lower levels within an organization. It empowers managers and employees at various levels to make decisions and take action within their areas of responsibility.

Q25: Arrange the following stages of investigation in proper sequence.

A. Plan work to be done and timing.

B. Obtain instructions from the client and prepare terms of reference.

C. Make necessary calculation to eliminate inconsistencies.

D. Collect necessary information and documents.

E. Formulate conclusions/ analysis of findings.

Choose the correct answer from the options given below:

(a) A, B, C, D, E

(b) A, C, B, D, E

(c) B, A, D, C, E

(d) A, B, D, C, E

Ans: C

Sol: The correct answer is B, A, D, C, E.

Obtain instructions from the client and prepare terms of reference (B):

- This initial step involves understanding the client's requirements and defining the scope, objectives, and limitations of the investigation.

- It sets the foundation for the entire investigation process, ensuring that the work aligns with the client's expectations.

Plan work to be done and timing (A):

- Following the establishment of terms of reference, the next step is to develop a detailed plan outlining the tasks to be performed and the timeline for each task.

- This planning phase ensures that the investigation is organized and that resources are allocated efficiently to meet deadlines.

Collect necessary information and documents (D):

- After planning, the next step is to gather all relevant data and documents required for the investigation.

- This data collection phase is crucial for ensuring that the investigation is based on accurate and comprehensive information.

Make necessary calculations to eliminate inconsistencies (C):

- Once the data is collected, the next step is to analyze it and perform calculations to identify and resolve any discrepancies or inconsistencies.

- This step is essential for ensuring the accuracy and reliability of the investigation's findings.

Formulate conclusions/ analysis of findings (E):

- The final step involves interpreting the analyzed data and drawing conclusions based on the findings.

- This concluding phase provides the client with a clear and concise summary of the investigation's results and any recommendations.

Q26: Arrange the following forums in correct sequence of first appeal to final appeal by an assessee under Income Tax Act-1961

A. Supreme Court

B. High Court

C. Appellate Tribunal

D. Joint Commissioner

Choose the correct answer from the options given below:

(a) A, B, C, D

(b) D, C, B, A

(c) B, D, A, C

(d) C, A, D, B

Ans: B

Sol: The correct answer is D, C, B, A.

Joint Commissioner (D):

- The first level of appeal under the Income Tax Act-1961 is made to the Joint Commissioner. This is where an assessee initially contests an assessment order.

- The Joint Commissioner reviews the appeal and makes a decision based on the merits of the case and the applicable tax laws.

Appellate Tribunal (C):

- If the assessee is not satisfied with the decision of the Joint Commissioner, the next level of appeal is to the Appellate Tribunal.

- The Appellate Tribunal is a quasi-judicial body that provides an independent review of the decisions made by the Joint Commissioner.

High Court (B):

- Should the assessee still be dissatisfied with the outcome at the Appellate Tribunal, they can take their appeal to the High Court.

- The High Court examines legal and substantial questions arising from the Tribunal's decisions.

Supreme Court (A):

- The final level of appeal is to the Supreme Court of India. This is the highest judicial authority and its decisions are binding.

- Appeals to the Supreme Court are generally on points of law that have significant implications or where there are conflicting decisions among High Courts..

Q27: Which of the following are the rights of the equity shareholders?

A. Right to Income

B. Right to claim Dividend

C. Right to Control

D. Right to Liquidation

E. Pre-emptive Rights

Choose the correct answer from the options given below:

(a) A, B, C, D & E

(b) B, C & E Only

(c) A, B, C & D Only

(d) A, C, D & E Only

Ans: D

Sol: The correct answer is A, C, D & E Only.

Let's analyze each of the rights of equity shareholders:

Right to Income

- This right pertains to shareholders receiving a portion of the company's profits, typically in the form of dividends.

- Reason for inclusion: Equity shareholders have a right to a share in the income generated by the company.

Right to claim Dividend

- Shareholders have the right to receive dividends declared by the company out of its profits.

- Reason for exclusion: Although shareholders can receive dividends, it is not a guaranteed right as dividends are declared at the discretion of the company's board of directors.

Right to Control

- Equity shareholders have voting rights which allow them to influence the company's management and decisions, typically through the election of the board of directors.

- Reason for inclusion: This right gives shareholders a degree of control over the company’s operations.

Right to Liquidation

- In the event of the company’s liquidation, shareholders have a right to receive a share of the residual assets of the company after all debts and obligations have been settled.

- Reason for inclusion: This is a fundamental right of equity shareholders during the liquidation process.

Pre-emptive Rights

- Shareholders have the right to maintain their proportional ownership in the company by purchasing additional shares before the company offers them to the public.

- Reason for inclusion: This right protects shareholders from dilution of their ownership stake in the company.

Therefore, the rights that equity shareholders possess are A: Right to Income, C: Right to Control, D: Right to Liquidation, and E: Pre-emptive Rights. This makes option 4: "A, C, D & E Only" the correct choice.

Q28: Which of the following are the schemes promoted by NABARD?

A. Kisan Credit Card (KCC)

B. Capital Investment Subsidy Scheme

C. Special Economic Zone Scheme

D. Rural Innovation Fund

E. Tribal Development Fund

Choose the correct answer from the options given below:

(a) A, B, C & D Only

(b) B, C, D & E Only

(c) A, B, D & E Only

(d) A, C, D & E Only

Ans: C

Sol: The correct answer is A, B, D & E Only.

Let's analyze each scheme:

Kisan Credit Card (KCC)

- The Kisan Credit Card (KCC) scheme was introduced to provide farmers with timely access to credit. NABARD plays a significant role in promoting and supporting this scheme.

- Reason for inclusion: The KCC scheme is promoted by NABARD to ensure farmers have the necessary credit for their agricultural needs.

Capital Investment Subsidy Scheme

- This scheme aims to promote investments in agriculture by providing subsidies for various capital investments.

- Reason for inclusion: NABARD supports the Capital Investment Subsidy Scheme to encourage agricultural investments and development.

Special Economic Zone Scheme

- The Special Economic Zone (SEZ) scheme is designed to attract foreign investments and promote exports, primarily handled by different government bodies and not NABARD.

- Reason for exclusion: This scheme is not directly related to NABARD's role and focus areas.

Rural Innovation Fund

- The Rural Innovation Fund (RIF) is a scheme to promote innovative ventures in rural areas, supported by NABARD.

- Reason for inclusion: NABARD promotes the RIF to encourage innovative projects that can benefit rural development.

Tribal Development Fund

- The Tribal Development Fund (TDF) is aimed at the development and welfare of tribal communities, and it is another initiative supported by NABARD.

- Reason for inclusion: NABARD supports the TDF to ensure the socio-economic development of tribal communities.

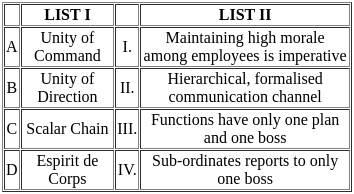

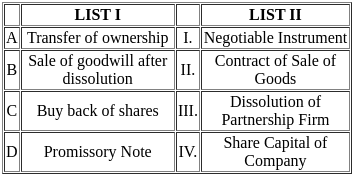

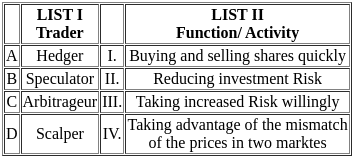

Q29: Match the List-I with List-II

Choose the correct answer from the options given below:

(a) A-I, B-II, C-III, D-IV

(b) A-I, B-IV, C-III, D-II

(c) A-IV, B-III, C-II, D-I

(d) A-II, B-III, C-IV, D-I

Ans: C

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

Unity of Command (A) matches with Sub-ordinates reports to only one boss (IV).

- Unity of Command is a principle in management where each employee should report to only one supervisor to avoid confusion and conflicts. This ensures clear lines of authority and responsibility.

- Key Point: Following Unity of Command helps in maintaining efficient communication and accountability within the organization.

Unity of Direction (B) matches with Functions have only one plan and one boss (III).

- Unity of Direction means that all activities aimed at the same objective should be directed by one manager using one plan. This principle ensures that the efforts of all members of the organization are aligned toward the same goals.

- Key Point: Unity of Direction helps in achieving organizational objectives efficiently by ensuring that all team members are working towards the same goal.

Scalar Chain (C) matches with Hierarchical, formalised communication channel (II).

- Scalar Chain refers to the formal line of authority within an organization, which moves from highest to lowest rank. It is the chain of command that ensures order and discipline within the organization.

- Key Point: Scalar Chain promotes organized communication and decision-making processes within an organization.

Espirit de Corps (D) matches with Maintaining high morale among employees is imperative (I).

- Espirit de Corps is a management principle that emphasizes the importance of high morale and unity among employees. It encourages team spirit and a sense of belonging to enhance cooperation and productivity.

- Key Point: Espirit de Corps fosters a positive work environment, leading to improved employee satisfaction and organizational success.

Q30: When the number of trials (n) is large but the probability of success (p) is small, Binomial probability distribution can be approximated using:

(a) Normal Distribution

(b) Hypergeometric Distribution

(c) Poisson Distribution

(d) Bernoulli Distribution

Ans: C

Sol: The correct answer is Poisson Distribution.

Poisson Distribution:

- When the number of trials (n) is large and the probability of success (p) is small, the Binomial distribution can be approximated by the Poisson distribution. This is particularly useful in financial enterprises for modeling rare events over a fixed period of time, such as the number of defaults on loans or insurance claims.

- The Poisson distribution simplifies the computation process, especially in cases where calculating factorials for large numbers in the Binomial formula is impractical.

- For a financial enterprise, using the Poisson approximation helps in better risk management and in creating more accurate predictive models for rare events.

Other Related Points

Normal Distribution:

- The Normal distribution is used to approximate the Binomial distribution when both n is large and p is not too close to 0 or 1. It is not suitable when p is very small, as it does not model the rare events accurately.

Hypergeometric Distribution:

- The Hypergeometric distribution is used for scenarios without replacement, where the probability of success changes with each trial. It is not appropriate for approximating a Binomial distribution with a large number of trials.

Bernoulli Distribution:

- The Bernoulli distribution is a special case of the Binomial distribution where there is only one trial (n=1). It cannot be used to approximate a Binomial distribution with a large number of trials.

Q31: What is the time limit within which an information is to be provided regarding the life and liberty of a person under RTI Act, 2005?

(a) 30 days

(b) 60 days

(c) 24 hours

(d) 48 hours

Ans: D

Sol: The correct answer is 48 hours.

48 hours:

- As per the Right to Information (RTI) Act, 2005, the Public Information Officer (PIO) is mandated to provide information relating to the life and liberty of a person within 48 hours of receiving the request.

- This provision ensures that any information crucial to the safety and rights of an individual is disclosed promptly, thus protecting the fundamental rights of individuals.

- The special 48-hour provision underscores the importance of timely access to information in situations where a person's life or liberty is at stake.

- This expedited response mechanism highlights the RTI Act's commitment to transparency, accountability, and quick redressal in critical situations.

Other Related Points

30 days:

- For standard information requests, the RTI Act stipulates a 30-day timeframe for the PIO to provide a response. This does not apply to urgent life and liberty cases.

60 days:

- The RTI Act does not specify a 60-day period for any standard or special information requests. This option is incorrect regarding the stipulated timelines under the Act.

24 hours:

- There is no provision under the RTI Act for a 24-hour response time, even for urgent matters pertaining to life and liberty. The correct urgent response period is 48 hours.

Q32: Which environment shapes the attitudes of human beings, though there may be great diversity in its impact?

(a) The Political Environment

(b) International Environment

(c) The Socio-Cultural Environment

(d) The Economic Environment

Ans: C

Sol: The correct answer is The Socio-Cultural Environment.

The Socio-Cultural Environment:

- This environment encompasses the customs, lifestyles, values, and norms of a society, which influence the behavior and attitudes of individuals.

- In the context of a financial enterprise, the socio-cultural environment can affect consumer behavior, investment decisions, and business practices.

- For example, societies that value saving over spending will influence financial enterprises to develop products that cater to savings and investment rather than consumption.

- Diversity in socio-cultural impacts can lead to varied financial behaviors and needs across different regions or demographic groups, necessitating tailored financial strategies and products.

Other Related Points

The Political Environment:

- While the political environment, including government policies and regulations, can impact business operations and economic conditions, it does not directly shape individual attitudes and behaviors to the extent that the socio-cultural environment does.

International Environment:

- This refers to the global context in which businesses operate, including international trade, global markets, and cross-cultural interactions. Although it influences business strategies and economic conditions, it does not primarily shape individual attitudes and behaviors.

The Economic Environment:

- The economic environment includes factors like inflation, unemployment, and economic growth that affect business performance and consumer purchasing power. While these factors influence economic behavior, they do not shape cultural attitudes and values.

Q33: Which of the following sections of the Income-Tax ACT- 1961, provide for double taxation relief in India?

A. Section- 89

B. Section- 90

C. Section- 91

D. Section- 92

E. Section- 93

Choose the correct answer from the options given below:

(a) A & B Only

(b) B & C Only

(c) C & D Only

(d) A, B & E Only

Ans: B

Sol: The correct answer is B & C Only.

Let's analyze each section:

Section 89

- This section of the Income-Tax Act deals with relief when salary, etc., is paid in arrears or in advance.

- Reason for exclusion: This section is not related to double taxation relief, but rather to the relief in the case of salary received in arrears or in advance.

Section 90

- This section provides for the relief from double taxation by entering into an agreement with foreign countries or specified territories.

- Reason for inclusion: This section directly addresses the issue of double taxation relief by allowing India to enter into treaties with other countries.

Section 91

- This section provides unilateral relief from double taxation in cases where there is no agreement under section 90.

- Reason for inclusion: This section is also related to double taxation relief, providing relief in situations where no bilateral agreement exists.

Section 92

- This section deals with the computation of income from international transactions having regard to arm's length price.

- Reason for exclusion: This section is related to transfer pricing and not directly to double taxation relief.

Section 93

- This section deals with avoidance of income tax by transactions resulting in the transfer of income to non-residents.

- Reason for exclusion: This section is focused on preventing tax evasion rather than providing double taxation relief.

Therefore, the sections that specifically address double taxation relief are B: Section 90 and C: Section 91. This makes option 2: "B & C Only" the correct choice.

Q34: Which organisational structure promotes control and co-ordination within a department because of similarity in the tasks being performed?

(a) Divisional Structure

(b) Functional Structure

(c) Formal Structure

(d) Matrix Structure

Ans: B

Sol: The correct answer is Functional Structure

Functional Structure:

- This organizational structure groups employees based on specialized or similar tasks, leading to higher efficiency and productivity within departments.

- It promotes control and coordination as employees with similar skills and roles work closely together, facilitating better communication and management within the department.

- For a financial enterprise, this structure allows for focused expertise in areas such as accounting, finance, marketing, and human resources, enhancing operational efficiency and effectiveness.

- Managers in a functional structure have a clearer understanding of their specific area of expertise, which helps in better decision-making and resource allocation.

Other Related Points

Divisional Structure:

- This structure organizes employees based on products, services, or geographical locations rather than similar tasks. While it allows flexibility and focuses on specific markets or products, it may lead to duplication of resources and reduced coordination across divisions.

Formal Structure:

- This is a broad term that refers to the officially defined arrangement of roles, responsibilities, and relationships within an organization. It is not a specific type of structure like functional or divisional, and therefore does not inherently promote control and coordination within a department based on task similarity.

Matrix Structure:

- This structure combines elements of both functional and divisional structures, with employees reporting to multiple managers. While it can enhance flexibility and collaboration, it may also lead to confusion and power struggles due to dual reporting lines.

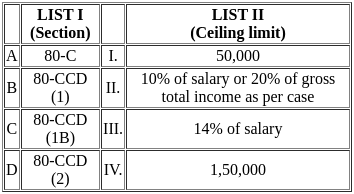

Q35: Match the List-I with List-II

Choose the correct answer from the options given below:

(a) A-I, B-II, C-III, D-IV

(b) A-II, B-III, C-IV, D-I

(c) A-III, B-IV, C-I, D-II

(d) A-IV, B-III, C-II, D-I

Ans: D

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

Buyer's Mind (A) matches with Black Box (IV).

- The 'Black Box' model refers to understanding the internal thought processes (mind) of the buyer, which are not directly observable. It focuses on how various factors influence the buyer's decision-making process.

- Understanding the buyer's mind is crucial for developing effective marketing strategies, as it helps predict consumer behavior and preferences.

- Key Point: Marketers need to study buyer behavior intricately to tailor their approaches accordingly.

Personal Factor (B) matches with Life Style (III).

- Personal factors, including lifestyle, significantly influence a consumer's purchasing behavior. Lifestyle encompasses activities, interests, and opinions that shape a person's choices and preferences.

- For example, a health-conscious lifestyle may lead to the purchase of organic food products or gym memberships.

- Key Point: Companies should consider the diverse lifestyles of their target market to offer relevant products and services.

Psychological Factor (C) matches with Motivation (II).

- Psychological factors such as motivation drive consumer behavior. Motivation stems from the desire to fulfill needs and wants, influencing the decision-making process.

- For instance, the need for security may motivate a person to purchase insurance.

- Key Point: Understanding consumer motivation helps in creating marketing messages that resonate with the target audience.

Reference Group (D) matches with Members of Social-club (I).

- A reference group, such as members of a social club, impacts an individual's attitudes, behavior, and purchasing decisions. These groups serve as a benchmark or standard for comparison.

- For example, a person might choose a specific brand of clothing because it is popular among their social club members.

- Key Point: Marketers leverage reference groups to influence potential customers by showcasing their products as popular or endorsed by such groups.

Q36: Compute the tax liability under default tax regime of Mr. X (35 year), having total income of Rs. 51,75,000 for the assessment year 2024-25. Assume that his total income comprises salary, income from house property and interest on fixed deposit:

(a) 13,75,000

(b) 13,77,750

(c) 14,30,000

(d) 14,75,000

Ans: C

Sol: The correct answer is - ₹14,30,000

Key Points

Income Tax Computation

- Tax is calculated as per the default tax regime applicable for AY 2024-25.

- The given tax slabs are:

- Up to ₹3,00,000: 0% (No tax)

- ₹3,00,001 – ₹6,00,000: 5%

- ₹6,00,001 – ₹9,00,000: 10%

- ₹9,00,001 – ₹12,00,000: 15%

- ₹12,00,001 – ₹15,00,000: 20%

- Above ₹15,00,000: 30%

- The total taxable income is ₹51,75,000.

Tax Calculation for Each Slab

- Up to ₹3,00,000: No tax (₹0)

- ₹3,00,001 – ₹6,00,000: ₹3,00,000 × 5% = ₹15,000

- ₹6,00,001 – ₹9,00,000: ₹3,00,000 × 10% = ₹30,000

- ₹9,00,001 – ₹12,00,000: ₹3,00,000 × 15% = ₹45,000

- ₹12,00,001 – ₹15,00,000: ₹3,00,000 × 20% = ₹60,000

- Above ₹15,00,000: ₹36,75,000 × 30% = ₹11,02,500

- Total Tax before Surcharge & Cess: ₹12,52,500

Surcharge and Cess Calculation

- Since the income is above ₹50,00,000, a 10% surcharge applies.

- Surcharge: 10% of ₹12,52,500 = ₹1,25,250

- Total Tax after Surcharge: ₹12,52,500 + ₹1,25,250 = ₹13,77,750

- Health & Education Cess (4%): 4% of ₹13,77,750 = ₹55,110

- Total Tax Liability: ₹13,77,750 + ₹55,110 = ₹14,32,860

- Rounded Off: ₹14,30,000

Additional Information

Surcharge Applicability

- The surcharge rate varies with income levels:

- ₹50 lakh - ₹1 crore: 10%

- ₹1 crore - ₹2 crore: 15%

- ₹2 crore - ₹5 crore: 25%

- Above ₹5 crore: 37%

- For Mr. X, the applicable surcharge is 10% since his income is ₹51,75,000.

- Health & Education Cess

- This cess is levied at 4% on the total tax (including surcharge).

- The collected amount is used for funding education and healthcare programs in India.

- Taxation in India

- The income tax system follows a progressive taxation model.

- Higher income leads to a higher tax rate, ensuring equitable tax distribution.

- Individuals can opt for the New Tax Regime for reduced tax rates but without exemptions.

Q37: From the following identify the measures of dispersion

A. Mean Deviation

B. Range

C. Standard Deviation

D. Coefficient of Variation

E. Coefficient of Correlation

Choose the correct answer from the options given below:

(a) B, C, D & E Only

(b) A, B, D & E Only

(c) A, C, D & E Only

(d) A, B, C & D Only

Ans: D

Sol: The correct answer is A, B, C & D Only.

Let's analyze each measure:

Mean Deviation

- Mean Deviation, also known as Average Deviation, measures the average absolute deviation of each data point from the mean of the data set.

- Reason for inclusion: It is a measure of dispersion as it quantifies the spread of data points around the mean.

Range

- Range is the difference between the maximum and minimum values in a data set.

- Reason for inclusion: It is a measure of dispersion as it indicates the extent of variability in the data set.

Standard Deviation

- Standard Deviation measures the average deviation of each data point from the mean, taking into account the squared deviations.

- Reason for inclusion: It is a widely used measure of dispersion that provides insight into the variability of a data set.

Coefficient of Variation