UGC NET Paper 2: Commerce 7th Jan 2025 Shift 1 | UGC NET Past Year Papers PDF Download

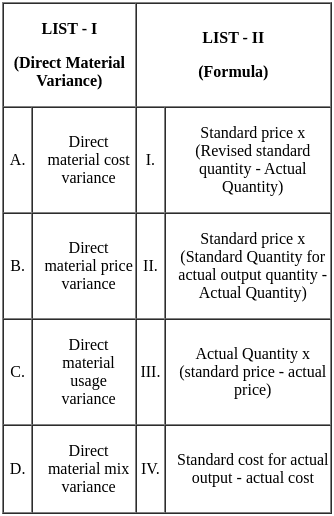

Q1: Match the LIST-I with LIST-II

Choose the correct answer from the options given below:

(a) A - I, B - II, C - III, D - IV

(b) A - IV, B - III, C - I, D - II

(c) A - IV, B - III, C - II, D - I

(d) A - III, B - IV, C - II, D - I

Ans: c

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

- Direct material cost variance (A) matches with Standard cost for actual output - actual cost (IV).

This variance measures the difference between the standard cost of the direct materials required for actual production and the actual cost incurred. It helps in identifying how well the cost control is being managed.

Key Point: It indicates the overall cost efficiency concerning direct materials. - Direct material price variance (B) matches with Actual Quantity x (standard price - actual price) (III)

This variance focuses on the difference between the standard price and the actual price paid for the materials, multiplied by the actual quantity of materials purchased. It helps in assessing the impact of price changes on material costs.

Key Point: It highlights price-related efficiencies or inefficiencies. - Direct material usage variance (C) matches with Standard price x (Standard Quantity for actual output quantity - Actual Quantity) (II).

This variance measures the difference between the standard quantity expected to be used for actual production and the actual quantity used, multiplied by the standard price. It helps in evaluating the efficiency of material usage.

Key Point: It identifies wastage or savings in material usage. - Direct material mix variance (D) matches with Standard price x (Revised standard quantity - Actual Quantity) (I).

This variance assesses the impact of changing the mix of materials used from what was planned, by comparing the standard cost for the revised mix to the actual quantity used. It helps in understanding the cost implications of using different material combinations.

Key Point: It analyzes the cost effects of changing material proportions.

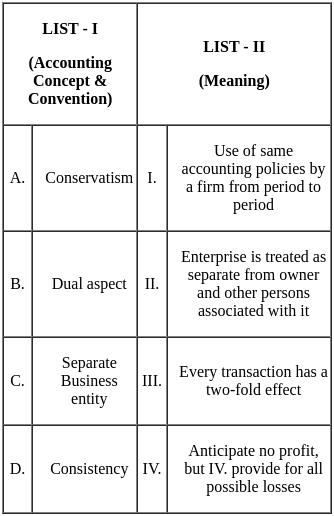

Q2: Match the LIST-I with LIST-II

Choose the correct answer from the options given below:

(a) A - IV, B - III, C - II, D - I

(b) A - I, B - II, C - III, D - IV

(c) A - II, B - III, C - I, D - IV

(d) A - III, B - IV, C - I, D - II

Ans: a

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

Conservatism (A) matches with Anticipate no profit, but provide for all possible losses (IV).

- Explanation: The conservatism principle in accounting advises that potential expenses and liabilities should be recognized as soon as possible, but revenues should only be recognized when they are assured. This approach ensures that financial statements are not overly optimistic.

- It helps in providing a buffer against future uncertainties and potential losses.

Dual aspect (B) matches with Every transaction has a two-fold effect (III).

- Explanation: The dual aspect concept is fundamental to accounting, stating that every financial transaction affects at least two accounts in the accounting records. This is the basis for the double-entry bookkeeping system, ensuring that the accounting equation (Assets = Liabilities + Equity) always remains balanced.

- For example, purchasing inventory for cash increases inventory (asset) and decreases cash (asset).

Separate Business Entity (C) matches with Enterprise is treated as separate from owner and other persons associated with it (II).

- Explanation: The separate business entity concept dictates that the business is a distinct entity from its owners and other entities. This means that the financial transactions of the business should be recorded separately from those of the owners or other businesses.

- This principle is crucial for accurate financial reporting and accountability.

Consistency (D) matches with Use of same accounting policies by a firm from period to period (I).

- Explanation: The consistency concept in accounting requires that companies use the same accounting methods and principles from period to period. This ensures comparability of financial statements over different periods, helping stakeholders make informed decisions.

- Any changes in accounting policies should be disclosed and justified to maintain transparency.

Q3: When all the factors of production are changed in same proportion, it is called as;

A. Long run production function

B. Law of equal proportion

C. Law of return to scale

D. Law of return to a factor

E. Law of Variable proportion

Choose the correct answer from the options given below:

(a) A, B, C Only

(b) B, C, D Only

(c) C, D, E Only

(d) C Only

Ans: d

Sol: The correct answer is A, C, E Only.

The term "Law of Returns to Scale" describes the relationship between changes in all inputs (factors of production) proportionally and the resulting change in output. When all factors are changed simultaneously and in the same proportion, it represents the long-run production function. This is because the long run allows for adjustments to all factors of production. The "Law of Variable Proportion" deals with the short-run scenario where only one factor is variable while others remain fixed. Therefore, options A, C, and E are all related to the concept of how output changes when inputs are adjusted, particularly in different timeframes.

Why other options are incorrect:

- A. Long run production function: While the long-run production function describes the relationship between output and all inputs when they can be adjusted simultaneously, it doesn't fully capture the concept of returns to scale. The law of returns to scale is a specific aspect of the long-run production function. It explains how output changes when all inputs are changed proportionally.

- B. Law of equal proportion: This term isn't commonly used in economics. The concept of "returns to scale" is more accurate.

- D. Law of return to a factor: This term refers to the change in output when only one factor of production is varied while others remain constant. It's a different concept from the law of returns to scale, which considers changes in all factors simultaneously.

- E. Law of Variable Proportion: This describes the relationship between output and the quantity of a variable input when other inputs are held constant. It's a short-run concept, distinct from the long-run law of returns to scale.

Q4: Which of the following are the features of F.E.M.A?

A. Central government can regulate payments to and from a person situated outside country.

B. Holding of immovable property outside India is restricted.

C. R.B.I can restrict the transaction from capital account even if it is done by authorized person.

D. All foreign financial transactions are to be done through F.E.M.A authorized person. E. F.E.M.A applies to Indian citizens living abroad.

Choose the correct answer from the options given below:

(a) A, B, C Only

(b) B, D, E Only

(c) A, B, E Only

(d) A, C, D Only

Ans: d

Sol: The correct answer is A, C, D Only.

Let's analyze each statement:

A. Central government can regulate payments to and from a person situated outside country.

- This is true under FEMA (Foreign Exchange Management Act), as the central government has the authority to regulate payments involving foreign exchange and transactions between residents and non-residents.

B. Holding of immovable property outside India is restricted.

- This statement is not entirely correct. FEMA does impose certain restrictions on the holding and acquisition of immovable property outside India, but it does allow certain transactions subject to specified conditions and permissions.

C. R.B.I can restrict the transaction from capital account even if it is done by authorized person.

- This is correct. Under FEMA, the Reserve Bank of India (RBI) has the authority to regulate and restrict capital account transactions, even if they are conducted by authorized persons.

D. All foreign financial transactions are to be done through F.E.M.A authorized person.

- This is true. FEMA mandates that all foreign exchange transactions must be carried out through authorized persons who are recognized by the act.

E. F.E.M.A applies to Indian citizens living abroad.

- This statement is not entirely correct. FEMA primarily applies to transactions conducted within India and by Indian residents. However, certain provisions can apply to Indian citizens living abroad in specific contexts.

Therefore, the statements that are strictly correct in the context of FEMA are A: Central government can regulate payments to and from a person situated outside country, C: R.B.I can restrict the transaction from capital account even if it is done by authorized person, and D: All foreign financial transactions are to be done through F.E.M.A authorized person. This makes option 4: "A, C, D Only" the correct choice.

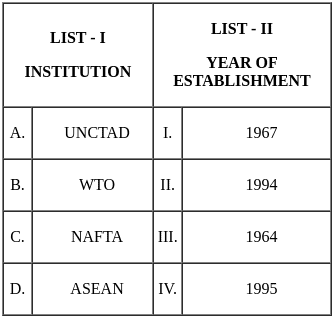

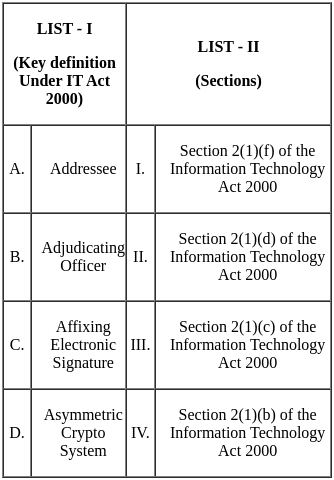

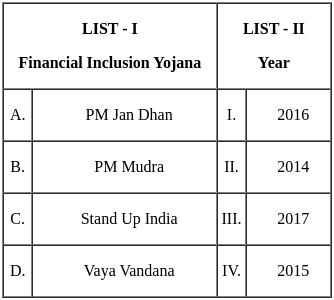

Q5: Match the LIST-I with LIST-II

Choose the correct answer from the options given below:

(a) A - I, B - II, C - III, D - IV

(b) A - III, B - IV, C - II, D - I

(c) A - I, B - III, C - IV, D - II

(d) A - I, B - II, C - IV, D - III

Ans: b

Sol: The correct answer is 'A-III, B-IV, C-II, D-I'.

UNCTAD (A) matches with 1964 (III).

- Explanation: The United Nations Conference on Trade and Development (UNCTAD) was established in 1964 to promote the interests of developing countries in world trade.

- Its primary goal is to integrate developing countries into the world economy and support sustainable development.

WTO (B) matches with 1995 (IV).

- Explanation: The World Trade Organization (WTO) was established on January 1, 1995, succeeding the General Agreement on Tariffs and Trade (GATT).

- The WTO aims to regulate international trade and ensure that trade flows as smoothly, predictably, and freely as possible.

NAFTA (C) matches with 1994 (II).

- Explanation: The North American Free Trade Agreement (NAFTA) came into effect on January 1, 1994, creating a trilateral trade bloc in North America among the United States, Canada, and Mexico.

- NAFTA aimed to eliminate trade barriers and facilitate the cross-border movement of goods and services among the three countries.

ASEAN (D) matches with 1967 (I).

- Explanation: The Association of Southeast Asian Nations (ASEAN) was established on August 8, 1967, with the signing of the ASEAN Declaration (Bangkok Declaration) by Indonesia, Malaysia, the Philippines, Singapore, and Thailand.

- ASEAN aims to promote political and economic cooperation and regional stability among its members.

Q6: Which of the following is not a monetary measure for correcting disequilibrium in Balance of Payment?

(a) Monetary Contraction

(b) Devaluation

(c) Exchange Control

(d) Abolition of Export Duties

Ans: d

Sol: The correct answer is - Abolition of Export Duties

Abolition of Export Duties

- This measure is considered a trade policy rather than a monetary measure.

- It involves removing taxes or duties on goods that are exported to encourage exports and improve the trade balance.

- While it can help in correcting a trade deficit, it does not directly influence the monetary supply or monetary policy.

Other Related Points

Monetary Contraction

- This involves reducing the money supply in the economy to curb inflation and stabilize the currency.

- It is a monetary policy tool used by central banks to correct imbalances in the economy.

Devaluation

- This refers to the deliberate reduction of the value of a country's currency relative to other currencies.

- Devaluation makes a country's exports cheaper and imports more expensive, which can help reduce trade deficits.

Exchange Control

- This involves the government controlling the amount of foreign currency that can be bought or sold.

- It helps manage the country's foreign exchange reserves and stabilize the balance of payments.

Q7: Arrange the following management research questions in the ascending order.

A. Management Question

B. Measurement Question

C. Management dilemma

D. Research Question

E. Investigative Question

Choose the correct answer from the options given below:

(a) C, A, B, D, E

(b) C, A, D, E, B

(c) A, C, D, E, B

(d) B, C, A, D, E

Ans: b

Sol: The correct answer is 'C, A, D, E, B'

Management Dilemma (C):

- This is the initial step where a problem or an opportunity is identified within the organization that requires management's attention.

- It serves as the foundational procedure, highlighting the issue that needs to be addressed and setting the stage for further inquiry.

Management Question (A):

- Following the identification of the management dilemma, the next step is to formulate precise management questions that narrow down the focus.

- These questions aim to understand the specifics of the dilemma and guide the direction of subsequent research.

Research Question (D):

- With the management questions defined, researchers then develop research questions to determine what information is needed.

- These questions are designed to investigate the problem deeply and gather relevant data to address the management dilemma.

Investigative Question (E):

- Once the research questions are in place, further detailed investigative questions are crafted to gather specific evidence.

- These questions help in breaking down the research problem into smaller components that can be analyzed individually.

Measurement Question (B):

- The final step involves developing measurement questions that set the criteria for data collection and analysis.

- These questions focus on how data will be measured, ensuring that the information collected is precise, reliable, and valid for making informed decisions.

Q8: Identify, which of the following statements are True.

A. Commuted pension received by a government employee is fully exempted from Income Tax

B. Section 30 of the Income Tax Act 1961 discusses deduction in respect of rent, rates, taxes, repairs and insurance of building used by the assessee for the purpose of business

C. Section 33 of the Income Tax Act 1961, defines provision regarding depreciation of tangible assets

D. Capital gain arises from transfer of any assets

E. Short term Capital assets is defined under section 2(42 A) of the Income Tax Act 1961

Choose the correct answer from the options given below:

(a) A, B, and E Only

(b) C, D and E only

(c) A and B only

(d) C and D only

Ans: a

Sol: The correct answer is 1) A, B, and E Only.

Let's analyze each statement:

A. Commuted pension received by a government employee is fully exempted from Income Tax

- Commuted pension received by a government employee is indeed fully exempt from income tax under the Income Tax Act, 1961.

- Reason for inclusion: This statement is true as per the tax provisions.

B. Section 30 of the Income Tax Act 1961 discusses deduction in respect of rent, rates, taxes, repairs and insurance of building used by the assessee for the purpose of business

- Section 30 of the Income Tax Act, 1961, indeed provides for the deduction of expenses related to rent, rates, taxes, repairs, and insurance for buildings used for business purposes.

- Reason for inclusion: This statement is accurate according to the Income Tax Act.

C. Section 33 of the Income Tax Act 1961, defines provision regarding depreciation of tangible assets

- Section 32 (not Section 33) of the Income Tax Act, 1961, deals with the provisions regarding depreciation on tangible and intangible assets.

- Reason for exclusion: The statement is incorrect because it misidentifies the section number.

D. Capital gain arises from transfer of any assets

- Capital gain typically arises from the transfer of capital assets, not just any assets. The term "capital assets" has a specific definition under the Income Tax Act.

- Reason for exclusion: The statement is too broad as it should specify "capital assets".

E. Short term Capital assets is defined under section 2(42 A) of the Income Tax Act 1961

- Section 2(42A) of the Income Tax Act, 1961, indeed defines "short-term capital assets".

- Reason for inclusion: This statement is true and correctly identifies the section.

Therefore, the statements that are true are A: Commuted pension received by a government employee is fully exempted from Income Tax, B: Section 30 of the Income Tax Act 1961 discusses deduction in respect of rent, rates, taxes, repairs and insurance of building used by the assessee for the purpose of business, and E: Short term Capital assets is defined under section 2(42 A) of the Income Tax Act 1961. This makes option 1: "A, B, and E Only" the correct choice.

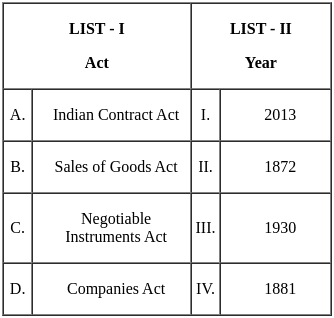

Q9: Match the LIST-I with LIST-II

Choose the correct answer from the options given below:

(a) A - II, B - III, C - IV, D - I

(b) A - I, B - II, C - III, D - IV

(c) A - IV, B - III, C - II, D - I

(d) A - III, B - IV, C - I, D - II

Ans: a

Sol: The correct answer is 'A-II, B-III, C-IV, D-I'.

Indian Contract Act (A) matches with 1872 (II).

- Explanation: The Indian Contract Act, 1872 is the key legal document that governs the law of contracts in India. It specifies the various provisions related to the formation, performance, and enforceability of contracts.

Sales of Goods Act (B) matches with 1930 (III).

- Explanation: The Sale of Goods Act, 1930 governs the sale of goods in India. It lays down the essential elements for the sale of goods, the rights and obligations of the buyer and seller, and other aspects related to the sale of goods.

Negotiable Instruments Act (C) matches with 1881 (IV).

- Explanation: The Negotiable Instruments Act, 1881 provides the framework for the regulation of negotiable instruments such as promissory notes, bills of exchange, and cheques. It outlines the rights and responsibilities of the parties involved in negotiable instruments.

Companies Act (D) matches with 2013 (I).

- Explanation: The Companies Act, 2013 is the primary legislation that governs the incorporation, regulation, and dissolution of companies in India. It includes provisions for corporate governance, company management, and the rights of shareholders.

Q10: Arrange the following levels of economic integration in increasing order.

A. Political Union

B. Free Trade Area

C. Customs Union

D. Common Market

E. Economic Union

Choose the correct answer from the options given below:

(a) B, C, D, E, A

(b) B, A, C, D, E

(c) B, A, D, C, E

(d) E, D, B, A, C

Ans: a

Sol: The correct answer is 'B, C, D, E, A'

Free Trade Area (B):

- This is the first level of economic integration, where member countries agree to reduce or eliminate tariffs and other trade barriers on most goods and services traded between them.

- However, each member country maintains its own external trade policies with non-member countries.

Customs Union (C):

- The second level, a customs union builds on a free trade area by additionally adopting a common external tariff on imports from non-member countries.

- This integration level ensures that all member countries have a unified trade policy towards the rest of the world.

Common Market (D):

- In this third level, the common market incorporates all the elements of a customs union but goes further by allowing free movement of capital and labor among member countries.

- This level aims to enable a higher degree of economic collaboration and integration among the member states.

Economic Union (E):

- The fourth level, an economic union, adds another layer of integration by harmonizing economic policies, including monetary and fiscal policies, across member countries.

- This level often involves the adoption of common currency and deeper economic policy coordination for seamless functioning.

Political Union (A):

- The final level of economic integration, a political union, represents the highest form of integration where member countries not only integrate economically but also politically.

- This level may include a central political apparatus that coordinates the economic, social, and foreign policies of member states.

Q11: Which of the following research designs is the most precise one?

(a) Experimental

(b) Exploratory

(c) Diagnostic

(d) Descriptive

Ans: a

Sol: The correct answer is - Experimental

Experimental Research Design

- Involves manipulation of one or more independent variables to determine their effect on a dependent variable.

- Allows for control over extraneous variables, which enhances the precision and reliability of the results.

- Often considered the gold standard in research due to its ability to establish causal relationships.

- Random assignment of participants to different groups (control and experimental) ensures that the groups are comparable at the start of the experiment.

Other Related Points

Exploratory Research Design

- Primarily used to explore a research problem or issue when there are few or no earlier studies to refer to.

- Involves open-ended questions and a flexible approach to gather insights and understanding.

- Does not aim to provide conclusive answers but rather to identify key variables and new hypotheses.

Diagnostic Research Design

- Used to identify the causes of a problem or to diagnose conditions.

- Often involves detailed investigation and analysis of the symptoms or issues.

- Helps to provide solutions or recommendations based on the diagnosis.

Descriptive Research Design

- Used to describe characteristics of a population or phenomenon being studied.

- Involves systematically gathering information to present a clear picture of the current state of affairs.

- Does not focus on determining cause-and-effect relationships.

Q12: Arrange the prefatory information of report writing in a logical sequence.

A. Executive Summary

B. Authorization Statement

C. Title Page

D. Letter of transmittal

E. Table of Contents

Choose the correct answer from the options given below:

(a) A, B, C, D, E

(b) C, D, E, B, A

(c) D, C, B, A, E

(d) D, B, C, E, A

Ans: c

Sol: The correct answer is 'D, C, B, A, E'

Letter of Transmittal (D):

- This is the first document in the prefatory section, providing an initial communication between the author and the recipient.

- It includes a brief overview of the subject matter, the purpose of the report, and any acknowledgments or special circumstances related to the report's creation.

Title Page (C):

- Following the letter of transmittal, the title page comes next, which presents the report's title, the author's name, the date of submission, and any other pertinent information such as the organization's name.

- This page serves as the formal introduction to the report, making it clear and identifiable.

Authorization Statement (B):

- This document provides necessary details about the authorization of the report.

- It might include the authority under which the report was prepared, the purpose, and any directives given.

Executive Summary (A):

- The executive summary comes next and offers a brief synopsis of the entire report.

- This section includes the main findings, conclusions, and recommendations, allowing readers to quickly grasp the key points without reading the full document.

Table of Contents (E):

- The table of contents follows the executive summary and lists all sections and subsections of the report, along with their page numbers.

- This helps readers navigate through the report quickly and locate specific sections with ease.

Q13: Arrange the following Institutions in ascending order of their year of establishment.

A. SEBI

B. Reserve Bank of India

C. State Bank of India

D. SIDBI

E. NABARD

Choose the correct answer from the options given below:

(a) C, B, E, A, D

(b) B, C, E, D, A

(c) B, C, A, E, D

(d) E, B, C, D, A

Ans: b

Sol: The correct answer is 'B, C, E, D, A'

Reserve Bank of India (B):

- The Reserve Bank of India (RBI) was established in 1935. It serves as the central banking institution of India, which controls the issuance and supply of the Indian rupee and manages the country's main payment systems.

State Bank of India (C):

- The State Bank of India (SBI) traces its origins to the Bank of Calcutta in 1806, making it the oldest commercial bank in the Indian subcontinent. It was rebranded as the State Bank of India in 1955.

NABARD (E):

- The National Bank for Agriculture and Rural Development (NABARD) was established in 1982. It focuses on the development of agriculture and rural areas in India through credit support and other financial services.

SIDBI (D):

- The Small Industries Development Bank of India (SIDBI) was established in 1990. It primarily aims to aid the growth and development of micro, small, and medium enterprises (MSMEs) in India.

SEBI (A):

- The Securities and Exchange Board of India (SEBI) was established in 1992. It is the regulatory body for the securities and commodity market in India under the jurisdiction of the Ministry of Finance.

Other Related Points

- Each of these institutions plays a crucial role in the economic and financial architecture of India, contributing to various sectors such as banking, agriculture, rural development, MSME development, and capital markets.

- Understanding the establishment timeline of these institutions provides insights into the historical development of India's financial and regulatory framework.

Q14: Which of the following statements are true regarding the buying dynamics of individual consumers?

A. To successfully compete in the market and create customer value, managers must fully understand the reality rather than theory of consumer behavior.

B. In marketing, perceptions are more important than reality because they affect consumers actual behavior.

C. People emerge with same perceptions of the same object.

D. Consumers are constructive decision makers and are subject to many contextual influences.

E. A consumer's buying behavior is influenced by cultural, social and personal factors. Of theses personal factors exert the broadest and deepest influence on people's perception and desires.

Choose the correct answer from the options given below:

(a) B, D Only

(b) A, B, D Only

(c) A, C, E Only

(d) B, C, D, E Only

Ans: b

Sol: The correct answer is A, B & D Only.

- A. To successfully compete in the market and create customer value, managers must fully understand the reality rather than theory of consumer behavior:This is true because consumer behavior is complex and understanding how real consumers actually behave is crucial for creating effective marketing strategies. Marketers need to go beyond theoretical models and consider the practical realities of consumer decision-making.

- B. In marketing, perceptions are more important than reality because they affect consumers actual behavior:This is generally true. How consumers perceive a product or service often influences their buying decisions, even if the objective reality might be different. Perception plays a key role in shaping brand image, value perception, and ultimately purchasing behavior.

- D. Consumers are constructive decision makers and are subject to many contextual influences:Consumers actively participate in the decision-making process, considering various factors like their personal needs, social influences, and situational context. They are not passive recipients of information but actively construct their perceptions and choices.

- E. A consumer's buying behavior is influenced by cultural, social, and personal factors. Of these personal factors exert the broadest and deepest influence on people's perception and desires:While all three factors (cultural, social, and personal) significantly influence buying behavior, personal factors tend to have the most profound impact as they are deeply rooted in an individual's self-concept, values, and needs.

- C. A, C, E Only:"People emerge with same perceptions of the same object" is not true. Perceptions are subjective and influenced by individual experiences, biases, and cultural backgrounds. Different people will likely have different perceptions of the same object.

- d. B, C, D, E Only:"In marketing, perceptions are more important than reality" is a valid statement, but "People emerge with same perceptions of the same object" is not.

Q15: Which one of the following is the developmental role of RBI?

(a) Formulates, implements and monitors the monetary policy

(b) Prescribes broad parameters of banking operations

(c) Issues, exchanges end destroys currency notes

(d) Performs a wide range of promotional functions to support national objectives

Ans: d

Sol: The correct answer is - Performs a wide range of promotional functions to support national objectives

Performs a wide range of promotional functions to support national objectives

- The Reserve Bank of India (RBI) undertakes various developmental and promotional functions to support national objectives and the broader economic environment.

- It plays a critical role in the development of financial markets, including money, government securities, and forex markets.

- The RBI promotes financial inclusion by facilitating the establishment of banking infrastructure in underbanked areas and promoting digital transactions.

- It supports small and medium-sized enterprises (SMEs) by providing guidelines and schemes that assist in their growth and development.

- The RBI also conducts research and provides critical data and policy inputs to the government for effective economic planning and policy formulation.

Other Related Points

Formulates, implements and monitors the monetary policy

- The RBI is responsible for formulating and implementing monetary policy to maintain price stability and ensure adequate flow of credit to productive sectors.

- This involves setting benchmark interest rates, managing liquidity in the economy, and controlling inflation.

Prescribes broad parameters of banking operations

- The RBI lays down broad guidelines for banking operations to ensure financial stability and consumer protection.

- It regulates and supervises the banking sector, ensuring that banks adhere to prudent practices and maintain adequate capital.

Issues, exchanges, and destroys currency notes

- The RBI is the sole issuer of currency notes in India, except for one-rupee notes and coins issued by the Ministry of Finance.

- It ensures the availability of clean and authentic currency to the public and manages the currency in circulation.

- The RBI also withdraws and destroys currency notes that are no longer fit for circulation.

Q16: Which one of the following consists of comparing entries in the books of account with documentary evidence in support thereof.

(a) Internal check

(b) Internal control

(c) Vouching

(d) Verification

Ans: c

Sol: The correct answer is - Vouching

Vouching

- Vouching is the process of checking the entries in the books of account with the relevant documentary evidence to ensure their accuracy and authenticity.

- It involves verifying the validity of transactions recorded in the books by examining supporting documents such as invoices, receipts, vouchers, and other relevant records.

- This process helps in detecting errors, frauds, and ensuring that the transactions are recorded in the correct accounting period.

- Vouching is fundamental to auditing and helps in maintaining the integrity of financial records.

Other Related Points

Internal Check

- Internal check refers to the system of arranging the duties of staff members in such a way that the work performed by one person is automatically checked by another.

- This system helps in preventing and detecting errors and frauds in the course of business operations.

- It is an integral part of internal control but is more focused on the day-to-day operations and division of work.

Internal Control

- Internal control is a broader concept that includes all the policies and procedures adopted by the management to ensure the orderly and efficient conduct of business.

- It aims to safeguard assets, prevent fraud, ensure the accuracy and completeness of accounting records, and ensure compliance with applicable laws and regulations.

- Internal controls include internal checks, internal audits, and other control mechanisms.

Verification

- Verification is the process of confirming the existence, ownership, valuation, and presentation of assets and liabilities in the financial statements.

- It involves physical inspection of assets, reviewing documentation, and confirming balances with third parties.

- Verification ensures that the financial statements provide a true and fair view of the financial position of the entity.

Q17: Which of the following are the characteristics of a high customer centric Organization?

A. Market driven

B. Process Oriented

C. Value Driven

D. Price Driven

E. Making competitor irrelevant

Choose the correct answer from the options given below:

(a) A, B, E Only

(b) A, C, E Only

(c) B, C, D Only

(d) C, D, E Only

Ans: b

Sol: The correct answer is 2) A, C, E Only.

Let's analyze each characteristic:

Market Driven

- Market-driven organizations focus on understanding and meeting the needs and preferences of their customers.

- Reason for inclusion: This characteristic aligns with being customer-centric as it involves responding to market demands and prioritizing customer needs.

Process Oriented

- Process-oriented organizations emphasize optimizing and following set processes to achieve efficiency and consistency.

- Reason for exclusion: While important for operational efficiency, being process-oriented does not directly address the focus on customer needs and preferences.

Value Driven

- Value-driven organizations prioritize delivering exceptional value to their customers, often through superior products, services, and customer experiences.

- Reason for inclusion: This characteristic is central to customer-centricity as it focuses on creating and delivering value to customers.

Price Driven

- Price-driven organizations compete primarily on the basis of price, often focusing on cost-cutting and offering lower prices than competitors.

- Reason for exclusion: While price is a factor in customer decisions, being price-driven does not necessarily equate to a customer-centric approach, which involves a broader focus on value and customer satisfaction.

Making competitor irrelevant

- Organizations that aim to make competitors irrelevant focus on creating unique value propositions that set them apart in ways that competitors cannot easily replicate.

- Reason for inclusion: This characteristic aligns with customer-centricity by emphasizing innovation and differentiation that meet unique customer needs and preferences, thus reducing the focus on direct competition.

Therefore, the characteristics that fit a high customer-centric organization in this context are A: Market Driven, C: Value Driven, and E: Making competitor irrelevant. This makes option 2: "A, C, E Only" the correct choice.

Q18: What is the value of Standard Deviation of first seven natural numbers?

(a) √48

(b) 2

(c) √8

(d) 4

Ans: b

Sol: The correct answer is - 2

Calculating Standard Deviation of the first seven natural numbers:

The first seven natural numbers are 1, 2, 3, 4, 5, 6, and 7.

Calculate the mean (average) of these numbers:

- Mean = (1 + 2 + 3 + 4 + 5 + 6 + 7) / 7 = 28 / 7 = 4

- Calculate the variance:

- Variance = [(1-4)² + (2-4)² + (3-4)² + (4-4)² + (5-4)² + (6-4)² + (7-4)²] / 7

- Variance = [9 + 4 + 1 + 0 + 1 + 4 + 9] / 7

- Variance = 28 / 7 = 4

Standard Deviation is the square root of the variance:

- Standard Deviation = √4 = 2

Other Related Points

Standard Deviation:

- Standard Deviation is a measure of the amount of variation or dispersion of a set of values.

- A low standard deviation indicates that the values tend to be close to the mean, while a high standard deviation indicates that the values are spread out over a wider range.

Q19: Which of the following statements are true regarding admission of a new partner?

A. According to section 25 of the Indian Partnership Act, 1932, a person can be admitted as partner.

B. New Profit-sharing ratio is the ratio in which all partners, including new partners, will share future profits and losses of the firm.

C. New Profit Share = Profit Share Sacrificed - Old Profit Share

D. Sacrificing Ratio = Old Profit Share - New Profit Share

E. The Profit or loss which arises from Revaluation Account will be transferred to partner's capital account

Choose the correct answer from the options given below:

(a) B, D and E Only

(b) A, B and C Only

(c) B, C and D Only

(d) C, D and E Only

Ans: c

Sol: The correct answer is B, C, and D Only.

- C. New Profit Share = Profit Share Sacrificed - Old Profit Share:

- This is a key formula when calculating the new profit-sharing ratio after a new partner is admitted. The old partners have to "sacrifice" a portion of their profits to accommodate the new partner.

- D. Sacrificing Ratio = Old Profit Share - New Profit Share:

- This directly follows from statement C. The difference between the old profit share and the new profit share of an existing partner represents the amount they are sacrificing.

- E. The Profit or loss which arises from Revaluation Account will be transferred to partner's capital account:

When assets and liabilities are revalued upon the admission of a new partner, the resulting profit or loss is typically transferred to the capital accounts of the existing partners.

Why the other options are incorrect:

- A. According to section 25 of the Indian Partnership Act, 1932, a person can be admitted as partner:

- While Section 25 of the Indian Partnership Act deals with the powers and liabilities of partners, it doesn't specifically state that a person can be admitted as a partner. The consent of all existing partners is required for admission, as stated in other sources.

- B. New Profit-sharing ratio is the ratio in which all partners, including new partners, will share future profits and losses of the firm:

- While the new profit-sharing ratio will include the new partner, it doesn't necessarily mean all partners will share equally. The specific ratio is determined based on agreed-upon terms.

Q20: The Securities Exchange Board of India (SEBI) regulates and supervises the securities through

A. Regulations

B. Rules

C. Guidelines

D. Scheme

E. Orders

Choose the correct answer from the options given below:

(a) A, B, E Only

(b) B, C, D Only

(c) A, B, C, D, E

(d) A, C, D, E Only

Ans: c

Sol: The correct answer is A, B, C, D, E.

Let's analyze each factor:

Regulations

- Regulations are a key tool that SEBI uses to control and govern the securities market. They provide the framework within which securities must be issued, traded, and settled.

- Reason for inclusion: Regulations are fundamental to the functioning of SEBI and are explicitly mentioned as part of its mandate.

Rules

- Rules are detailed directives and guidelines that stem from the regulations. They provide specific instructions and standards for compliance.

- Reason for inclusion: Rules are an essential component of the regulatory framework that SEBI enforces.

Guidelines

- Guidelines are advisories issued by SEBI to ensure that market participants adhere to best practices. They often cover areas not explicitly detailed in regulations or rules.

- Reason for inclusion: Guidelines help in the smooth functioning and compliance of the securities market.

Scheme

- Schemes are structured plans or programs initiated by SEBI to achieve specific regulatory or developmental objectives within the securities market.

- Reason for inclusion: Schemes are part of SEBI's broader strategy to enhance market efficiency and protect investors.

Orders

- Orders are legally binding decisions and instructions issued by SEBI to enforce compliance and take corrective actions against violations.

- Reason for inclusion: Orders are critical enforcement tools that ensure adherence to SEBI’s regulations and rules.

Therefore, SEBI regulates and supervises the securities market through a combination of A: Regulations, B: Rules, C: Guidelines, D: Schemes, and E: Orders. This makes option 3: "A, B, C, D, E" the correct choice.

Q21: Which one of the following is value added service of EXIM Bank?

(a) Export Facilitation

(b) Export product Development

(c) Workshops and Seminars

(d) Export Marketing

Ans: c

Sol: The correct answer is - Workshops and Seminars

Workshops and Seminars

- EXIM Bank organizes workshops and seminars as part of its value-added services to educate and support exporters.

- These events provide information on international trade, export financing, and global market trends.

- They serve as platforms for networking and knowledge sharing among exporters, industry experts, and policymakers.

- Through these initiatives, EXIM Bank aims to enhance the competitiveness of Indian exporters in the global market.

Other Related Points

Export Facilitation

- EXIM Bank offers various services to facilitate exports, such as providing export credit, insurance, and advisory services.

- However, this is a core service rather than a value-added service.

Export Product Development

- This involves developing new products for export markets, often supported by R&D activities.

- While EXIM Bank may support product development through financing, it is not classified as a value-added service.

Export Marketing

- Export marketing involves strategies to promote products in foreign markets.

- EXIM Bank assists in this area through financial products and services, but it is not specifically a value-added service.

Q22: Arrange the organizational aspect of employees need hierarchy in the increasing order.

A. Cohesive and supportive co-workers

B. Work place conditions

C. Work safety

D. Responsibilities

E. Job Challenge

Choose the correct answer from the options given below:

(a) C, B, D, A, E

(b) B, C, A, D, E

(c) A, C, B, E, D

(d) B, A, C, D, E

Ans: b

Sol: The correct answer is 'B, C, A, D, E'

Work place conditions (B):

- This is the most basic and fundamental need for employees. It involves the physical conditions of the workplace such as cleanliness, lighting, and temperature.

- Ensuring good workplace conditions is essential for the basic comfort and health of employees, which is the foundation of their need hierarchy.

Work safety (C):

- After basic workplace conditions, the next priority is ensuring the safety of the employees.

- This includes measures to prevent accidents and injuries, providing a secure environment where employees feel protected.

Cohesive and supportive co-workers (A):

- Once safety is ensured, the focus shifts to social needs such as having supportive and friendly co-workers.

- This aspect is crucial for creating a positive and collaborative workplace culture, which enhances job satisfaction and team performance.

Responsibilities (D):

- As employees' basic and social needs are met, they start seeking higher-order needs such as responsibilities.

- Having clear and meaningful responsibilities gives employees a sense of purpose and importance within the organization.

Job Challenge (E):

- The highest level in the hierarchy involves the need for job challenge and personal growth.

- Employees seek roles that challenge their skills, provide opportunities for learning, and allow them to achieve their full potential.

Other Related Points

- Understanding the organizational aspect of employees' need hierarchy helps employers to create a better work environment that aligns with employees' needs and aspirations.

- By addressing these needs in the correct order, organizations can enhance employee satisfaction, motivation, and productivity.

- This hierarchical approach is inspired by Maslow's hierarchy of needs, which is widely used in organizational behavior and human resource management to understand and address employee motivation.

Q23: Arrange the following points step by step regarding computation of Gross Total Income

A. Computation of Gross Total Income

B. Set off and carry forward of Losses

C. Clubbing of Income of spouse, minor child etc.

D. Computation of Income under each head of Income

E. Determination of Residential Status

Choose the correct answer from the options given below:

(a) E, D, C, B, A

(b) A, B, C, D, E

(c) C, D, E, A, B

(d) B, C, D, E, A

Ans: a

Sol: The correct answer is 'E, D, C, B, A'

Determination of Residential Status (E):

- This is the initial step in computing Gross Total Income as the individual's residential status determines their tax liability under the Income Tax Act.

- Residential status helps in deciding the scope of income that will be taxable in India. For instance, residents are taxed on their global income, while non-residents are taxed only on income received or accrued in India.

Computation of Income under each head of Income (D):

- After determining the residential status, the next step is to compute income under the different heads of income, which include salaries, house property, business/profession, capital gains, and other sources.

- This step involves calculating the income separately for each head, taking into account all eligible deductions and allowances.

Clubbing of Income of spouse, minor child etc. (C):

- In this step, the income of certain other persons such as the spouse or minor child is included in the taxpayer's income, based on specific provisions under the Income Tax Act.

- This is done to prevent tax evasion through the transfer of income to family members who are in lower tax brackets.

Set off and carry forward of Losses (B):

- After computing the income and clubbing provisions, losses if any, are set off against eligible income. This involves both intra-head and inter-head adjustments.

- If losses cannot be fully set off in the current year, they are carried forward to subsequent years for set off against future income, as per the rules specified under the Income Tax Act.

Computation of Gross Total Income (A):

- The final step is to aggregate the income computed under all heads, after considering clubbing provisions and set-off and carry forward of losses, to arrive at the Gross Total Income.

- This Gross Total Income is the sum total before any deductions under Chapter VI-A (like 80C, 80D, etc.) are applied to compute the taxable income.

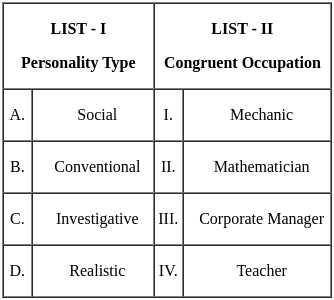

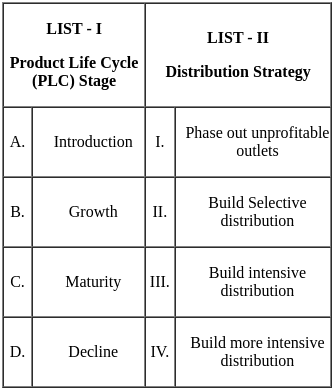

Q24: Match the LIST-I with LIST-II

Choose the correct answer from the options given below:

(a) A - IV, B - III, C - II, D - I

(b) A - III, B - IV, C - II, D - I

(c) A - IV, B - II, C - III, D - I

(d) A - II, B - IV, C - I, D - III

Ans: a

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

Social (A) matches with Teacher (IV).

- Explanation: Social personalities are typically outgoing, enjoy helping others, and are skilled at teaching and counseling. Therefore, they are well-suited for occupations like teaching, where they can engage with students and support their learning.

- These individuals often seek roles that involve interaction with people and providing service to the community.

Conventional (B) matches with Corporate Manager (III).

- Explanation: Conventional personalities are orderly, detail-oriented, and prefer structured tasks. Corporate Managers require these traits to manage operations, maintain order, and ensure organizational efficiency.

- Individuals with conventional personalities excel in roles that involve managing processes, adhering to rules, and maintaining order within an organization.

Investigative (C) matches with Mathematician (II).

- Explanation: Investigative personalities are curious, analytical, and enjoy solving complex problems. Mathematicians require these traits as they engage in research, analysis, and problem-solving in their field.

- These individuals thrive in roles that involve critical thinking, research, and the pursuit of knowledge.

Realistic (D) matches with Mechanic (I).

- Explanation: Realistic personalities are practical, hands-on, and enjoy working with tools and machinery. Mechanics need these traits to diagnose and repair mechanical issues effectively.

- Individuals with realistic personalities prefer roles that involve physical activity and tangible results.

Other Related Points

- Understanding personality types and their congruent occupations can help individuals choose careers that align with their strengths and preferences, leading to higher job satisfaction and success.

- Employers can use this information to assign roles that best match their employees’ personality traits, improving overall productivity and morale.

Q25: Arrange the following channels in the increasing order of value-addition of sales.

A. Retail Store

B. Sales force

C. Internet

D. Value-added partners

E. Distributors

Choose the correct answer from the options given below:

(a) A, E, C, D, B

(b) C, A, E, B, D

(c) C, A, E, D, B

(d) B, C, A, E, D

Ans: c

Sol: The correct answer is 'C, A, E, D, B'

Internet (C):

- The Internet is generally the channel with the least value addition in terms of sales. This is because it usually involves direct transactions with minimal additional services or personal interaction.

- It primarily involves automated processes and self-service options for customers, making it the most cost-effective and least value-added channel.

Retail Store (A):

- Retail stores add more value compared to the internet because they offer a physical space where customers can interact with products and receive in-person assistance from sales staff.This channel allows for a better customer experience, which can lead to increased customer satisfaction and loyalty.

Distributors (E):

- Distributors add further value by providing logistics, warehousing, and distribution services. They serve as intermediaries between manufacturers and retailers or end customers, ensuring products are available in various locations.

- They also help in managing inventory and providing credit facilities to retailers, adding more value in the supply chain.

Value-added partners (D):

- Value-added partners contribute more significantly by offering specialized services or enhancements to the product that add value beyond the basic offering.

- These partners often provide integration, customization, or additional services that enhance the overall value proposition of the product.

Sales force (B):

- The sales force represents the highest level of value addition in sales channels. They provide personalized service, build strong customer relationships, and offer tailored solutions that meet specific customer needs.

- This channel involves a high level of engagement and support, often leading to higher customer satisfaction and retention rates.

Other Related Points

- Value addition in sales refers to the process by which different channels enhance the basic product or service offering, providing additional benefits to the customer.

- The hierarchy of value addition typically depends on the level of personal interaction, customization, and additional services provided through each channel.

- Understanding the value addition of various sales channels helps organizations optimize their sales strategies and choose the most effective channels for their target market.

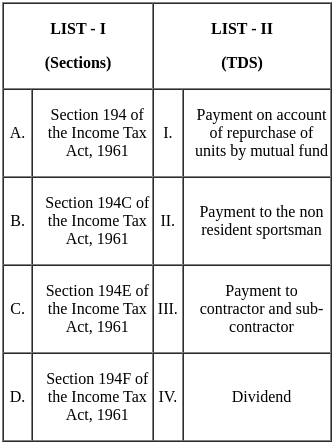

Q26: Match the LIST-I with LIST-II

Choose the correct answer from the options given below:

(a) A - IV, B - III, C - II, D - I

(b) A - I, B - II, C - III, D - IV

(c) A - I, B - III, C - II, D - IV

(d) A - III, B - IV, C - I, D - II

Ans: a

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

Section 194 of the Income Tax Act, 1961 (A) matches with Dividend (IV).

- Explanation: Section 194 of the Income Tax Act pertains to the deduction of tax at source on dividend payments made to shareholders.

- This section mandates companies to deduct TDS at the prescribed rate before distributing dividends to their shareholders.

- Key Point: It ensures that tax is collected at the time of payment itself, thus preventing evasion and ensuring timely collection of taxes.

Section 194C of the Income Tax Act, 1961 (B) matches with Payment to contractor and sub-contractor (III).

- Explanation: Section 194C deals with the deduction of TDS on payments made to contractors and sub-contractors.

- This section ensures that tax is deducted at source on payments made for carrying out any work, including supply of labor for carrying out any work.

- Key Point: This provision helps in bringing contractors and sub-contractors into the tax net and ensures tax compliance.

Section 194E of the Income Tax Act, 1961 (C) matches with Payment to the non-resident sportsman (II).

- Explanation: Section 194E pertains to the deduction of TDS on payments made to non-resident sportsmen, including athletes, sports associations, and institutions.

- This section ensures that tax is deducted at source on any income earned by non-resident sportsmen in India.

- Key Point: It helps in collecting tax on the earnings of non-resident sportsmen, ensuring they contribute to the Indian tax system.

Section 194F of the Income Tax Act, 1961 (D) matches with Payment on account of repurchase of units by mutual fund (I).

- Explanation: Section 194F deals with the deduction of TDS on payments made for the repurchase of units by mutual funds.

- This section mandates the deduction of tax at source on any amount distributed to investors upon repurchase of their units by mutual funds.

- Key Point: It ensures that tax is collected on the income received by investors from mutual funds, thereby preventing tax evasion.

Q27: Which of the following are the features of Treasury Bills?

A. Negotiable Securities

B. Issued at par and are repaid at premium on maturity.

C. High liquidity on account of short tenure

D. Assured Yield

E. High transaction cost

Choose the correct answer from the options given below:

(a) A, B, E Only

(b) A, C, D Only

(c) B, C, D Only

(d) A, C, D, E Only

Ans: b

Sol: The correct answer is A, C, D Only.

ExplanationLet's analyze each feature:

Negotiable Securities

- Treasury Bills are indeed negotiable instruments, meaning they can be bought and sold in the secondary market before their maturity.

- Reason for inclusion: This characteristic allows for liquidity and flexibility in trading, making it a key feature of Treasury Bills.

Issued at par and are repaid at premium on maturity

- Treasury Bills are not issued at par; instead, they are issued at a discount to their face value and redeemed at par on maturity.

- Reason for exclusion: This statement is incorrect as it does not accurately describe the nature of Treasury Bills.

High liquidity on account of short tenure

- Due to their short maturity periods (typically 91 days, 182 days, or 364 days), Treasury Bills are highly liquid instruments.

- Reason for inclusion: The short tenure ensures that investors can quickly convert them to cash without significant price risk.

Assured Yield

- Treasury Bills provide a guaranteed return since they are backed by the government, making the yield predictable.

- Reason for inclusion: The risk-free nature of these securities ensures that investors receive the promised return upon maturity.

High transaction cost

- Treasury Bills generally have lower transaction costs compared to other financial instruments.

- Reason for exclusion: This feature is not characteristic of Treasury Bills as they are known for their cost-effectiveness.

Therefore, the features that correctly describe Treasury Bills are A: Negotiable Securities, C: High liquidity on account of short tenure, and D: Assured Yield. This makes option 2: "A, C, D Only" the correct choice.

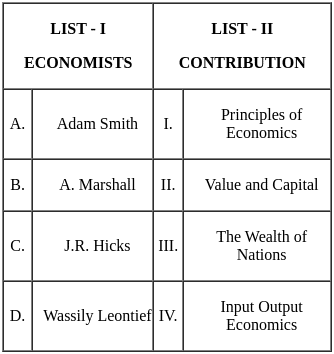

Q28: Match the LIST-I with LIST-II

Choose the correct answer from the options given below:

(a) A - I, B - III, C - II, D - IV

(b) A - I, B - II, C - IV, D - III

(c) A - III, B - I, C - II, D - IV

(d) A - III, B - II, C - I, D - IV

Ans: c

Sol: The correct answer is 'A-III, B-I, C-II, D-IV'.

Adam Smith (A) matches with The Wealth of Nations (III).

- Explanation: Adam Smith is considered the father of modern economics. His seminal work, "The Wealth of Nations," laid the foundations for classical economics and introduced important concepts such as the invisible hand and the division of labor.

- Smith's ideas on free markets and competition remain influential to this day.

A. Marshall (B) matches with Principles of Economics (I).

- Explanation: Alfred Marshall was a key figure in the development of microeconomics. His book, "Principles of Economics," introduced concepts such as price elasticity of demand and consumer surplus, which are fundamental in economic theory.

- Marshall's work helped to formalize economic analysis and bridge classical and neoclassical economics.

J.R. Hicks (C) matches with Value and Capital (II).

- Explanation: John Richard Hicks made significant contributions to general equilibrium theory and welfare economics. His book, "Value and Capital," is a cornerstone in economic theory, addressing issues of value, capital, and interest rates.

- Hicks' work laid the groundwork for later developments in economic theory, including the IS-LM model.

Wassily Leontief (D) matches with Input Output Economics (IV).

- Explanation: Wassily Leontief developed the input-output model, which analyzes the relationships between different sectors of an economy. His work in "Input Output Economics" provides a method to study the flow of goods and services in an economy and has applications in economic planning and policy.

- Leontief's contributions have been used to understand economic structures and the impact of economic changes.

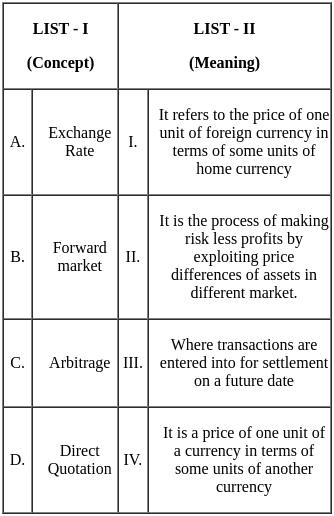

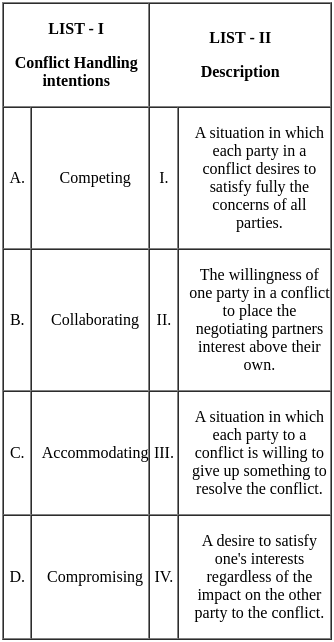

Q29: Match the LIST-I with LIST-II

Choose the correct answer from the options given below:

(a) A - IV, B - III, C - II, D - I

(b) A - III, B - IV, C - II, D - I

(c) A - I, B - II, C - III, D - IV

(d) A - I, B - III, C - II, D - IV

Ans: a

Sol: The correct answer is 'A-IV, B-III, C-II, D-I'.

Exchange Rate (A) matches with It is a price of one unit of a currency in terms of some units of another currency (IV).

- Explanation: The exchange rate is the rate at which one currency can be exchanged for another. It tells you how much of one currency you can get with a unit of another currency. For example, if the exchange rate between USD and EUR is 0.85, it means 1 USD can be exchanged for 0.85 EUR.

- Key Point: Exchange rates can be influenced by a variety of factors including interest rates, economic stability, and geopolitical events.

Forward market (B) matches with Where transactions are entered into for settlement on a future date (III).

- Explanation: The forward market is a financial market in which participants can enter into contracts to buy or sell assets at a specified future date for a price agreed upon today. It is commonly used for hedging risks and speculating.

- Key Point: Forward contracts are customizable and can be tailored to the needs of the parties involved, unlike futures contracts which are standardized.

Arbitrage (C) matches with It is the process of making risk less profits by exploiting price differences of assets in different market (II).

- Explanation: Arbitrage involves the simultaneous purchase and sale of an asset in different markets to profit from a difference in the asset's price. It is a strategy used by traders to exploit price discrepancies and make risk-free profits.

- Key Point: Arbitrage opportunities are usually short-lived as they get corrected quickly by market forces.

Direct Quotation (D) matches with It refers to the price of one unit of foreign currency in terms of some units of home currency (I).

- Explanation: In a direct quotation, the price of a unit of foreign currency is expressed in terms of the domestic currency. For example, if 1 EUR costs 1.12 USD, then the direct quotation for EUR/USD is 1.12.

- Key Point: Direct quotation is the most common method used in foreign exchange markets for quoting currency exchange rates.

Q30: Prepaid Insurance is which type of account?

(a) Real Account

(b) Personal Account

(c) Nominal Account

(d) Real and Nominal Both

Ans: b

Sol: The correct answer is - Personal Account

Prepaid Insurance

- Prepaid Insurance is classified as a Personal Account in accounting.

- Personal Accounts represent accounts that relate to individuals, companies, firms, or associations.

- Prepaid Insurance is considered a Personal Account because it represents an amount paid in advance to a person or entity (the insurance company) for services to be received in the future.

- In accounting terms, Personal Accounts adhere to the Golden Rule: "Debit the receiver, credit the giver."

Other Related Points

Real Account

- Real Accounts relate to tangible and intangible assets owned by the company, such as land, buildings, machinery, patents, etc.

- The Golden Rule for Real Accounts is: "Debit what comes in, credit what goes out."

Nominal Account

- Nominal Accounts pertain to income, expenses, losses, and gains within a specific accounting period.

- These accounts are closed at the end of each accounting period by transferring their balances to the Profit and Loss Account.

- The Golden Rule for Nominal Accounts is: "Debit all expenses and losses, credit all incomes and gains."

Real and Nominal Both

- Accounts cannot be classified as both Real and Nominal as they serve different purposes in accounting.

- Real Accounts deal with assets, while Nominal Accounts deal with income and expenses.

Q31: Which of the following tool is used for projecting supply of personnel?

(a) Trend Analysis

(b) Ratio Analysis

(c) Markov Analysis

(d) Managerial Judgement

Ans: c

Sol: The correct answer is - Markov Analysis

Markov Analysis

- Markov Analysis is a statistical technique used to predict the future behavior of a variable based on its past behavior.

- In the context of human resource planning, it is used to project the supply of personnel by analyzing the patterns of employee movement within an organization.

- This involves calculating the probabilities of employees moving from one state (e.g., job position, department) to another over a given period.

- It helps in understanding and predicting workforce trends, aiding in effective manpower planning.

Other Related Points

Trend Analysis

- Trend Analysis involves examining historical data to identify patterns or trends over time.In HR, it can be used to forecast future staffing needs based on past employment trends and business growth.

- However, it does not specifically project the supply of personnel but rather the demand.

Ratio Analysis

- Ratio Analysis involves using ratios to compare different financial metrics and make projections.

- In HR, it might be used to assess the ratio of employees to output or other performance metrics.

- It is more commonly used for financial analysis rather than projecting personnel supply.

Managerial Judgement

- Managerial Judgement relies on the intuition and experience of managers to make projections or decisions.

- While valuable, it is more subjective and less data-driven compared to techniques like Markov Analysis.

Q32: In which one of the following the effectiveness of brainstorming as group decision making technique is high?

(a) Social Pressure

(b) Task Orientation

(c) Potential for interpersonal conflict

(d) Money Costs

Ans: b

Sol: The correct answer is - Task Orientation

Task Orientation

- Task orientation focuses on the completion of tasks and achieving specific goals during brainstorming sessions.

- Groups with high task orientation are better able to stay on topic and generate relevant ideas, improving the effectiveness of brainstorming.

- Effective brainstorming requires a clear objective and structured approach to ensure that all participants contribute useful and actionable ideas.

- When participants are task-oriented, they are more likely to collaborate efficiently and maintain focus, thereby enhancing the quality and quantity of ideas produced.

Other Related Points

Social Pressure

- Social pressure can negatively impact brainstorming as it may inhibit participants from sharing unconventional or creative ideas due to fear of judgment or rejection.

- High social pressure can lead to conformity, where individuals align their opinions with the majority, reducing the diversity of ideas.

Potential for Interpersonal Conflict

- Interpersonal conflict during brainstorming can create a hostile environment, making it difficult for participants to collaborate effectively.

- Conflicts can distract the group from the main task, reducing the overall productivity and quality of ideas.

Money Costs

- While financial resources are important for many organizational activities, the cost of conducting brainstorming sessions is generally low.

- Effectiveness of brainstorming is more influenced by group dynamics and facilitation than by monetary investment.

Q33: The Capital Adequacy Ratio (CAR) for Indian Public Sector banks set by RBI is :

(a) 9%

(b) 10%

(c) 11%

(d) 12%

Ans: d

Sol: The correct answer is - 0.12

Capital Adequacy Ratio (CAR)

- The Capital Adequacy Ratio (CAR) is a measure of a bank's capital, ensuring that the bank can absorb a reasonable amount of loss and complies with statutory capital requirements.

- The Reserve Bank of India (RBI) has set the CAR for Indian Public Sector banks at 0.12 (12%). This requirement is aligned with international standards set by the Basel III guidelines.

- CAR is calculated as the ratio of a bank's capital to its risk-weighted assets.

- It serves as a key indicator of a bank's health and its ability to meet its obligations, protect depositors, and promote stability and efficiency of the financial system.

Other Related Points

Other Options:

0.09 (9%)

- This is below the minimum requirement set by the RBI and the Basel III norms.

0.1 (10%)

- This was a previous requirement but has been updated in line with international standards.

0.11 (11%)

- This figure also falls short of the current requirement by the RBI for public sector banks.

Basel III Norms

- Basel III is an international regulatory framework designed to improve the regulation, supervision, and risk management within the banking sector.The norms aim to strengthen bank capital requirements by increasing bank liquidity and decreasing bank leverage.

- The implementation of Basel III requires banks to hold a minimum CAR of 12%, ensuring better risk management and stability.

Q34: A proposal requires a cash outflow of Rs. 18,500 and is expected to generate cash inflows of Rs. 8,000, Rs. 6,000, Rs. 4,000, Rs. 2,000 and Rs. 2,000 over next 5 years respectively. The payback period is

(a) 4 Years

(b) 3.25 Years

(c) 3.50 Years

(d) 4.25 Years

Ans: b

Sol: The correct answer is - 3.25 Years

Payback Period Calculation

- The payback period is the time it takes for a project to recover its initial investment from its net cash inflows.

- Initial cash outflow: Rs. 18,500

Annual cash inflows:

- Year 1: Rs. 8,000

- Year 2: Rs. 6,000

- Year 3: Rs. 4,000

- Year 4: Rs. 2,000

- Year 5: Rs. 2,000

Cumulative cash inflows:

- End of Year 1: Rs. 8,000

- End of Year 2: Rs. 14,000 (Rs. 8,000 + Rs. 6,000)

- End of Year 3: Rs. 18,000 (Rs. 14,000 + Rs. 4,000)

- End of Year 4: Rs. 20,000 (Rs. 18,000 + Rs. 2,000)

- The initial investment of Rs. 18,500 is recovered between Year 3 and Year 4.

- The remaining amount to be recovered at the end of Year 3 is Rs. 500 (Rs. 18,500 - Rs. 18,000).

- In Year 4, the cash inflow is Rs. 2,000.

- Time to recover remaining Rs. 500 in Year 4 = Rs. 500 / Rs. 2,000 = 0.25 years.

- Therefore, total payback period = 3 years + 0.25 years = 3.25 years.

Other Related Points

Other Options Overview

- 4 Years: This assumes the entire amount is recovered at the end of Year 4, which is incorrect as it is recovered earlier.

- 3.50 Years: This is a miscalculation as the remaining amount is recovered in 0.25 years, not 0.50 years.

- 4.25 Years: This is an overestimation since the payback period is reached before the end of Year 4.

Q35: Which of the following is a situation of adverse balance of trade?

(a) Import more than exports

(b) Exports more than imports

(c) Exports equal to imports

(d) Export Surplus

Ans: a

Sol: The correct answer is - Import more than exports

Import more than exports

- An adverse balance of trade, also known as a trade deficit, occurs when a country's imports exceed its exports.

- This situation means the country is buying more from other countries than it is selling to them.

- A trade deficit can lead to a depletion of the country's foreign exchange reserves and may indicate economic issues such as lack of competitiveness in international markets.

- It may also result in the country accumulating debt to pay for the excess imports.

Other Related Points

Exports more than imports

- This situation is known as a trade surplus, where a country exports more than it imports.

- A trade surplus indicates a positive balance of trade, meaning the country is earning more from its exports than it is spending on imports.

Exports equal to imports

- This situation represents a balanced trade, where the value of exports is equal to the value of imports.

- A balanced trade indicates that a country is neither in a trade deficit nor a trade surplus.

Export Surplus

- Similar to "exports more than imports," it refers to a situation where the value of exports exceeds the value of imports.

- It signifies a favorable balance of trade and indicates the country is generating income from its international trade activities.

Q36: Which of the following are the disadvantages of Graphics rating scale as an appraisal tool?

A. Standards may be unclear

B. Halo Effect

C. Time consuming

D. Difficult to develop

E. Leniency

Choose the correct answer from the options given below:

(a) A, B, E Only

(b) A, B, C Only

(c) B, C, E Only

(d) A, C, D, E Only

Ans: a

Sol: The correct answer is 1) A, B, E Only.

Let's analyze each factor:

Standards may be unclear

- In a graphics rating scale, the standards for evaluation might not be clearly defined, leading to varied interpretations.

- Reason for inclusion: This ambiguity can result in inconsistent appraisals.

Halo Effect

- This occurs when the evaluator's overall impression of the employee influences ratings across all areas.

- Reason for inclusion: This bias can distort the accuracy of the appraisal.

Time consuming

- While some appraisal methods can be time-consuming, the graphics rating scale is generally considered efficient.

- Reason for exclusion: The graphics rating scale is not typically noted for being time-consuming.

Difficult to develop

- Developing the graphics rating scale itself is not inherently difficult compared to other appraisal tools.

- Reason for exclusion: This is not a common disadvantage of the graphics rating scale.

Leniency

- Evaluators may give higher ratings than warranted to avoid conflict or make the employee feel good.

- Reason for inclusion: This leniency can affect the reliability of the appraisal results.

Therefore, the disadvantages of the graphics rating scale as an appraisal tool that are most commonly noted are A: Standards may be unclear, B: Halo Effect, and E: Leniency. This makes option 1: "A, B, E Only" the correct choice.

Q37: Which section of the Income Tax Act 1961 mentions unilateral relief?

(a) 90

(b) 89

(c) 91

(d) 92

Ans: c

Sol: The correct answer is - 91

Section 91 of the Income Tax Act 1961

- Section 91 provides unilateral relief to taxpayers who have paid tax in a foreign country with which India does not have a double taxation avoidance agreement (DTAA).

- Unilateral relief is intended to avoid double taxation of the same income, ensuring that the income is not taxed twice, once in the foreign country and again in India.

- The relief is available if the taxpayer is a resident of India and has earned income from a foreign country.

- This section ensures that taxpayers can claim relief from the income tax paid in the foreign country by providing a credit against their Indian tax liability.

Other Related Points

Section 90 of the Income Tax Act 1961

- Section 90 deals with agreements with foreign countries or specified territories for the avoidance of double taxation of income and for the prevention of fiscal evasion.

- This section empowers the Indian government to enter into DTAA with other countries to provide relief from double taxation.

- The DTAA specifies the taxing rights of each country and helps in allocating the income between the countries.

Section 89 of the Income Tax Act 1961

- Section 89 provides relief to taxpayers who receive salary in arrears or in advance, which results in an increase in their taxable income and thereby a higher tax liability.

- This section allows for tax relief by spreading the income over the years to which it pertains, thereby reducing the tax burden on the taxpayer.

Section 92 of the Income Tax Act 1961

- Section 92 pertains to transfer pricing regulations and is aimed at ensuring that international transactions between associated enterprises are conducted at arm's length prices.

- The section ensures that the taxable income of entities involved in international transactions is computed based on fair market value to prevent profit shifting and tax evasion.

Q38: Which of the following refers to an attempt to avoid payment of taxes by using illegal means?

(a) Tax Management

(b) Tax Planning

(c) Tax Avoidance

(d) Tax Evasion

Ans: d

Sol: The correct answer is - Tax Evasion

Tax Evasion

- Tax evasion refers to the illegal practice of not paying taxes by not reporting all taxable income or by taking unallowed deductions.

- This practice involves deliberate misrepresentation or concealment of information to the tax authorities to reduce tax liability.

- Common methods include underreporting income, inflating deductions, hiding money in offshore accounts, and not filing tax returns.

- Tax evasion is a criminal offense and can result in substantial penalties, fines, and imprisonment.

Other Related Points

Tax Management

- Tax management involves the efficient handling of tax matters within the legal framework.

- This includes timely filing of returns, maintaining proper records, and compliance with tax regulations.

- The goal is to minimize tax liability through proper planning and adherence to tax laws.

Tax Planning

- Tax planning refers to the process of analyzing one's financial situation to maximize tax benefits and minimize tax liabilities within legal boundaries.

- This involves the strategic use of tax deductions, credits, and exemptions to reduce the amount of taxes owed.

- Effective tax planning can lead to significant savings and ensure compliance with tax laws.

Tax Avoidance

- Tax avoidance involves using legal methods to minimize tax liability.

- This includes utilizing tax deductions, credits, and loopholes in the tax code to reduce the amount of taxes owed.

- While tax avoidance is legal, it differs from tax evasion, which is illegal.

Q39: Which of the following are true for Skewness

A. It is a measure of symmetry of a frequency distribution.

B. For the right-skewed distribution, the mean is to be to the right of median.