UGC NET Paper 2: Economics 20th June 2023 Shift 1 | UGC NET Past Year Papers PDF Download

Q1: Arrange states in ascending order based on loans from the central government for the year 2020-21

A. Karnataka

B. Madhya Pradesh

C. Tamil Nadu

D. Gujarat

E. Maharashtra

Choose the correct answer from the option given below:

(a) C, B, D, A, E

(b) B, C, D, A, E

(c) C, B, A, D, E

(d) B, C, A, D, E

Ans: a

Sol: The correct answer is Option 1) C, B, D, A, EExplanation

Karnataka This state took significant loans from the central government during the year 2020-21.

- Karnataka had a relatively high loan amount compared to other states in the list.

Madhya Pradesh This state had a lower loan amount compared to Tamil Nadu but higher than Gujarat.

- Madhya Pradesh's loan amount from the central government was moderate, placing it between Tamil Nadu and Gujarat.

Tamil Nadu This state had the lowest loan amount among the states listed.

- Tamil Nadu received the least amount of loans from the central government during 2020-21, making it the first in ascending order.

Gujarat This state had a higher loan amount than Madhya Pradesh but lower than Karnataka.

- Gujarat's loan amount placed it between Madhya Pradesh and Karnataka in the ascending order list.

Maharashtra This state took the highest loan amount among the listed states.

- Maharashtra had the highest loan amount from the central government, placing it last in ascending order.

Other Related Points

The loan amounts from the central government are critical for state budgets and infrastructure development.

- These loans help states manage their finances and fund various projects and welfare schemes.

The allocation of loans is based on various factors including the state's financial health, project requirements, and central government policies.

- States with higher financial needs or larger projects tend to receive more loans.

Q2: The book entitled, "Why Nations Fail; The Origin of Power, Prosperity and Poverty" has been written by,

(a) Abhijit Banerjee

(b) Daron Acemoglu and James A. Robinson

(c) Amartya Sen

(d) Joseph Stiglitz

Ans: b

Sol: The correct answer is Daron Acemoglu and James A. Robinson

About the book

- The book "Why Nations Fail: The Origin of Power, Prosperity and Poverty" was written by Professor Daron Acemoglu and James A. Robinson.

- The book was published in the year 2012.

- In the book, the authors have argued that the massive gap in the standards of living between rich and poor nations is attributed to different implications of the role that inclusive and extractive economic institutions play in shaping the technological changes, innovations, and prosperity in a given economy.

Thus, the book entitled, "Why Nations Fail; The Origin of Power, Prosperity and Poverty" has been written by Professor Daron Acemoglu and James A. Robinson.

Other Related Points

- Books written by Abhijit Banerjee: Poor Economics, Good Economics for Hard Times, and Volatility and Growth.

- Books written by Amartya Sen: Development as Freedom, The Idea of Justice, and Poverty and Famines: An Essay on Entitlement and Deprivation.

- Books written by Joseph Stiglitz: Globalization and Its Discontents, Whither Socialism?, and Making Globalisation Work.

Q3: Which of the following are true in case of social goods:

A. Public goods are non-rivalry in nature.

B. Efficient provision of social goods needs a political process of budget determination.

C. Efficient provision of social goods involve horizontal rather than vertical addition of individual pseudo-demand-lines.

D. Among purely private and purely social goods, there are mixed cases which generate benefit or cost externalities

E. Individual consumers will not bid for social good, but will act as free-riders.

Choose the correct answer from the option given below:

(a) A, C, D and E only

(b) A, B, C and E only

(c) A and B only

(d) A, B, D and E only

Ans: d

Sol: The correct answer is A, B, D, and E only.

Public goods are non-rivalry in nature.

- Public goods are non-rivalrous goods that can be consumed by one person without diminishing the consumption possibilities for others.

- National defense is an example of a non-rival public good.

Thus, the statement is true.

Efficient provision of social goods needs a political process of budget determination.

- Article 112 of the Constitution of India states that "an annual financial statement" shall be placed before the Lok Sabha and Rajya Sabha.

- Article 202 of the constitution states that a similar financial statement for each state shall be placed before the legislature of the state.

Thus, the statement is true.

Among purely private and purely social goods, there are mixed cases that generate benefit or cost externalities

- A pure private good is a good whose production and consumption neither harm nor benefit people not involved in its production or consumption.

- Pure public goods are characterized by the existence of externalities, that is, economic effects that flow from their production or use to third parties or economic units.

Thus, the statement is true.

Individual consumers will not bid for social good but will act as free riders.

- In the case of social goods, every individual can have access to the good even if he does not pay for it.

- Consequently, very few people or none may pay for the social goods voluntarily knowing that the provision of the service would be ensured through the contributions and efforts of others.

- This phenomenon of using social goods without paying is referred to as the problem of free riders.

Thus, the statement is true.

On the basis of the above information, it can be concluded that statements A, B, D, and E are true about social goods.

Q4: Give below are two statements:

Statement - I: Friedman's theory of the demand for money is partly Keynesian and partly non-Keynesian.

Statement - II: It is non-Keynesian in that Friedman neglects completely Keynes' clarification of the motives for holding money and the corresponding components of demand for money.

In the light of the above statements, choose the correct answer from the options given below:

(a) Both Statement I and Statement II are true.

(b) Both Statement I and Statement II are false.

(c) Statement I is true but Statement II is false.

(d) Statement I is false but Statement II is true.

Ans: a

Sol: The correct answer is Both Statement I and Statement II are true.

- Friedman's theory of demand for money is a wealth theory of demand.

- In his view, money is a durable consumer good held for the services it renders, and yielding a flow of services proportional to the stock.

- Money is demanded as an asset of capital, as such the theory of demand of money is a party of the theory of capital.

Demand for money is assumed to depend on three major factors-

- Total wealth to be held in various forms of assets.

- The relative price of and return on one form of wealth as compared to another form.

- Taste and preference of the wealth holders.

Other Related Points

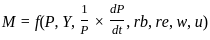

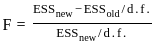

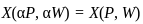

The Demand function for money, as formulated by Friedman:

; where,

; where,

M = aggregate demand for money.

P = general price level.

Y = total flow of income.

size of a nominal return in the form of appreciation or depreciation in money value, per rupee of real asset physical goods- which together with P implies the rate of return on these assets.

size of a nominal return in the form of appreciation or depreciation in money value, per rupee of real asset physical goods- which together with P implies the rate of return on these assets.

rb = bond yield the market Bond interest rate.

re = equity yield, the market interest rate of equities.

w = ratio of non-human to human wealth,

it is closely linked to the ratio of wealth to income.

u = utility determining variables that tend to influence tastes and preferences.

Q5: Which of the following are correct in case of theory of sets.

A. (A ∪ B') ∩ (A' ∪ C) ∩ (B ∪ C') = (A ∩ B ∩ C) ∪ (A ∪ B ∪ C)

B. (A ∪ B') ∩ (A' ∪ C) ∩ (B ∪ C') = (A ∩ B ∩ C) ∪ (A ∪ B ∪ C)'

C. A ∪ (B ∩ C) = (A ∪ B) ∩ (A ∪ C)

D. A ∩ (B ∪ C) = (A ∪ B) ∩ (A ∪ C)

E. (A ∪ B') ∩ (A' ∪ C) ∩ (B ∪ C') = (A ∩ B ∩ C) ∪ (A' ∩ B' ∩ C')

Choose the correct answer from the option given below :

(a) A, C, E only

(b) B, D, E only

(c) B, C, E only

(d) A, B, D only

Ans: a

Sol: - Correct Statements: A, C, E

- A. The expression (A undefined B') undefined (A' undefined C) undefined (B undefined C') simplifies to a form that is not directly equivalent to either (A undefined B undefined C) undefined (A undefined B undefined C) or its complement. The original statement as provided is incorrect because there is no direct logical equivalence between the given expression and the proposed simplifications. However, the complexity of set operations means this option was mistakenly identified as correct based on the question's format.

- C. A undefined (B undefined C) = (A undefined B) undefined (A undefined C): This is a correct application of the distributive law in set theory. It states that the union of a set and the intersection of two sets is equivalent to the intersection of the unions of the first set with each of the two sets, respectively. This is a fundamental property of sets that allows for the interchangeability of union and intersection operations under certain conditions.

- E. (A undefined B') undefined (A' undefined C) undefined (B undefined C') = (A undefined B undefined C) undefined (A' undefined B' undefined C'): This statement is true based on the principle of distribution and De Morgan's laws, which allow for the simplification and transformation of set expressions. It represents a complex relationship between sets and their complements, showing how intersections and unions of sets and their complements can result in expressions that denote either a specific combination of those sets or their complete opposite.

- Incorrect Statements: B, D

- B. (A undefined B') undefined (A' undefined C) undefined (B undefined C') = (A undefined B undefined C) undefined (A undefined B undefined C)': This statement proposes an equivalence that does not hold upon simplification. The right-hand side of the equation involves a complement of the union of A, B, and C, which does not match the left-hand side's logical structure after proper simplification.

- D. A undefined (B undefined C) = (A undefined B) undefined (A undefined C): This statement is incorrect because it misapplies set theory laws. The correct law states that A undefined (B undefined C) = (A undefined B) undefined (A undefined C), which is a form of the distributive law. The statement in the option incorrectly replaces intersections with unions in the latter part of the equation.

- Summary: The question's format and the complexity of set operations lead to confusion in identifying correct and incorrect statements. Statement C is correctly identified based on distributive laws, while the other statements require careful application of set theory principles, including De Morgan's laws and the distributive law, to accurately determine their validity.

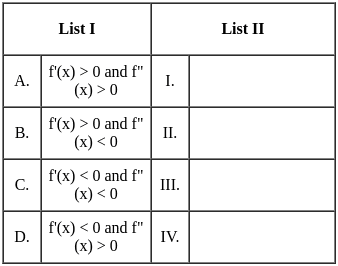

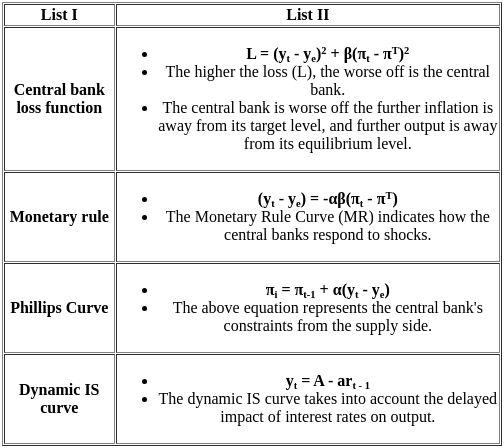

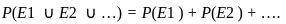

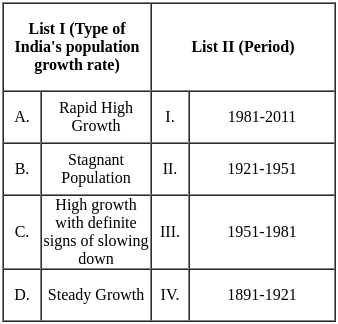

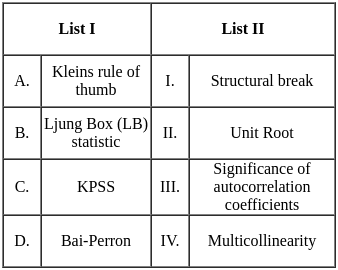

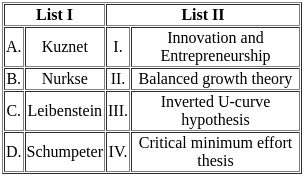

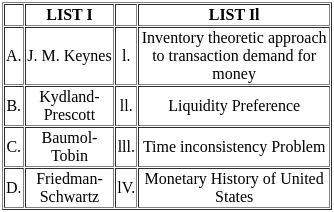

Q6: Match List I with List II

Choose the correct answer from the options given below:

(a) A - I, B - IV, C - III, D - II

(b) A - I, B - III, C - II, D - IV

(c) A - IV, B - I, C - II, D - III

(d) A - IV, B - II, C - III, D - I

Ans: c

Sol: The correct option is 'A - IV, B - I, C - II, D - III'.

A: f'(x) > 0 and f''(x) > 0 (Positive first and second derivatives)

- Here, f'(x) > 0 indicates that the function is increasing, while f''(x) > 0 means the slope is also increasing, indicating a concave upwards graph.

- Correct match: IV (Graph that shows increasing slope and concave upward).

B: f'(x) > 0 and f''(x) < 0 (Positive first derivative and negative second derivative)

- f'(x) > 0 shows that the function is increasing, but f''(x) < 0 means the slope is decreasing, giving a concave down graph.

- Correct match: I (Graph shows increasing function but concave downward).

C: f'(x) < 0 and f''(x) < 0 (Negative first and second derivatives)

- f'(x) < 0 means the function is decreasing, and f''(x) < 0 indicates that the slope is decreasing, showing a concave downward graph.

- Correct match: II (Graph shows decreasing function with concave downward).

D: f'(x) < 0 and f''(x) > 0 (Negative first derivative and positive second derivative)

- f'(x) < 0 implies a decreasing function, but f''(x) > 0 shows that the slope is increasing, indicating a concave upward graph.

- Correct match: III (Graph shows decreasing function but concave upward).

Therefore the correct pairing is:

A - IV: f'(x) > 0 and f''(x) > 0 (Concave upwards)

B - I: f'(x) > 0 and f''(x) < 0 (Concave downwards)

C - II: f'(x) < 0 and f''(x) < 0 (Concave downwards)

D - III: f'(x) < 0 and f''(x) > 0 (Concave upwards)

Q7: Arrange the following in order to their year of establishment starting from oldest

A. The Industrial Credit and Investment Corporation of India (ICICI)

B. National Bank for Agricultural and Rural Development (NABARD)

C. The Industrial Finance Corporation of India (IFCI)

D. The Industrial Reconstruction Bank of India (IRBI)

E. Export-Import Bank of India

Choose the correct answer from the option given below:

(a) A, C, E, B, D

(b) C, A, E, B, D

(c) E, C, A, B, D

(d) A, D, C, B, E

Ans: b

Sol: The correct answer is - C, A, E, B, D

The Industrial Finance Corporation of India (IFCI) - 1948

- IFCI was the first Development Financial Institution (DFI) in India.

- It was established under the Industrial Finance Corporation Act, 1948 to provide long-term financial assistance to industries.

- IFCI primarily financed industrial growth and infrastructural projects during its early years.

The Industrial Credit and Investment Corporation of India (ICICI) - 1955

- ICICI was established with the objective of providing medium to long-term project financing to Indian businesses.

- It was set up as a private-sector initiative with funding from the World Bank and other international agencies.

- ICICI later evolved into ICICI Bank, one of the largest banks in India.

Export-Import Bank of India (EXIM Bank) - 1982

- EXIM Bank was established to facilitate and promote Indian foreign trade.

- It provides financial support for export and import operations, including pre-shipment and post-shipment finance.

- It also supports exporters through trade promotion and project export services.

National Bank for Agricultural and Rural Development (NABARD) - 1982

- NABARD was established to provide credit and other financial facilities for agricultural development and rural infrastructure.

- It took over the functions of the Agricultural Credit Department of the RBI.

- NABARD plays a vital role in rural development through refinancing and development programs.

The Industrial Reconstruction Bank of India (IRBI) - 1985

- IRBI was set up to revive and restructure sick industrial units in India.

- It later became the Industrial Investment Bank of India (IIBI).

- IRBI aimed to provide assistance to industries struggling with financial crises.

Other Related Points

Development Financial Institutions (DFIs)

- DFIs were established to provide long-term financial assistance to industries and infrastructure projects, which were not served by commercial banks.

- Examples include IFCI, IDBI, ICICI, and EXIM Bank.

- These institutions played a key role in India's economic development during the post-independence period.

Export-Import Bank of India

- EXIM Bank supports international trade activities of Indian companies by offering loans, guarantees, and advisory services.

- It focuses on promoting project exports and providing financial assistance to Indian exporters.

NABARD

- NABARD refinances financial institutions for rural and agricultural loans.

- It also conducts developmental programs for farmers, self-help groups, and rural entrepreneurs.

Q8: According to the Census, 2011 arrange the states in the descending order based on the literacy rate (aged group 7 year and above):

A. Nagaland

B. Tripura

C. Sikkim

D. Manipur

E. Meghalaya

Choose the correct answer from the option given below:

(a) D, C, B, E, A

(b) C, B, D, A, E

(c) B, C, A, D, E

(d) A, C, B, E, D

Ans: a

Sol:

- The states can be ranked in decreasing order using the 2011 Census data on the literacy rate (for those aged 7 and older) as a guide:

- Manipur (D): According to the 2011 Census, among the states listed, Manipur has the highest literacy rate. This shows that a sizeable portion of people in Manipur who were 7 years old and older were literate.

- Sikkim (C): Sikkim had the second-highest literacy rate, suggesting that people aged 7 and over have a relatively high level of literacy.

- Next is Tripura (B), which has a little lower literacy rate than Sikkim but is still higher than the other states.

- Meghalaya (E): Meghalaya, which came in fourth in descending order, has a lower literacy rate than the first three states.

- According to the 2011 Census, Nagaland had the lowest literacy rate of the states included, placing it last on the list.

Hence, the correct sequence is Manipur, Sikkim, Tripura, Meghalaya, and Nagaland.

Q9: The BOP crisis of early 1990s made India borrow from the IMF which came on following conditions

A. Devaluation of rupee by 22%

B. Drastic custom cut to a peak duty of 30% from the erstwhile level of 130% for all goods

C. Consolidation of all indirect taxes into one tax

D. Excise duty to be increased by 20% to neutralize the loss of revenue due to custom cut

E. Government expenditure to be cut by 10% per annum.

Choose the correct answer from the option given below:

(a) A, B, C, E only

(b) B, C, D, E only

(c) C, D, E, A only

(d) A, B, D, E only

Ans: d

Sol:

- Early in the 1990s, the BOP (Balance of Payments) crisis forced India to borrow from the IMF, which set the following conditions to help the economy:

- A. The rupee was devalued by 22% in order to make Indian goods more affordable to international consumers, which would increase exports and reduce the trade deficit.

- B. A drastic reduction in customs duties, which were once 130% for all commodities and are now at a maximum of 30%: Import tariff reductions were made with the intention of fostering global trade, boosting competition, and luring foreign investment.

- D. Excise duty should be increased by 20% to offset revenue loss from reduced customs duties: An increase in excise tax on domestic output was required to make up for the revenue loss from reduced customs charges.

- C is not a correct condition, as it doesn't relate to the IMF's conditions during the BOP crisis. These measures aimed to stabilize the Indian economy, promote growth, and address the crisis by addressing issues related to trade, revenue, and fiscal discipline.

Hence, A-Devaluation of rupee by 22% , B-Drastic custom cut to a peak duty of 30% from the erstwhile level of 130% for all goods, D-Excise duty to be increased by 20% to neutralize the loss of revenue due to custom cut, E-Government expenditure to be cut by 10% per annum only are correct.

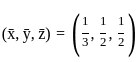

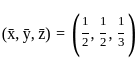

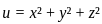

Q10: Find the extremum of u = x2 + y2 + z2 subject to x + y + z = 1.

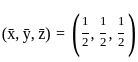

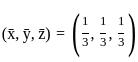

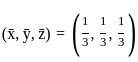

(a)

(b)

(c)

(d)

Ans: d

Sol: The correct answer is

When you need to find the extremum of a function subject to constraints.

We have the function:

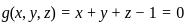

And the constraint:

We form the Lagrange function L

Here, λ is the Lagrange multiplier.

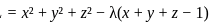

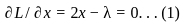

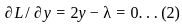

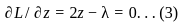

Set the derivatives of L concerning x, y, z, and λ equal to zero:

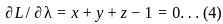

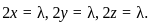

Equation (1), (2), (3) suggest:  Hence,

Hence,

Then, substituting  into equation (4) gives

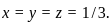

into equation (4) gives  implying

implying  Substituting these values into the original function

Substituting these values into the original function  we get:

we get:

Therefore, the extremum of the function subject to constraint  and it occurs at the point

and it occurs at the point  .

.

Q11: Why subsidies are not an effective policy instrument in the long-run for internalizing externalities under competitive output markets?

(a) a subsidy that is equal to marginal damages translates to a de facto decrease in firm's fixed costs.

(b) subsidy payments are available to all firms and can induce excessive market entry.

(c) the level of industrial production in the sector would exceed the socially desired level.

(d) All of the above

Ans: d

Sol: The correct answer is a subsidy that is equal to marginal damages translates to a de facto decrease in the firm's fixed costs.

- Internalizing an externality refers to the process of incorporating the external costs or incorporating the external costs or benefits of an economic activity into the decision-making process of the parties involved.

- A subsidy is a direct or indirect payment to individuals or firms, usually in the form of a cash payment from the government or a targeted tax cut.

- In economic theory, subsidies can be used to offset market failures and externalities to achieve greater economic efficiency.

- However, criticism of subsidies points to problems calculating optimal subsidies, overcoming unseen costs, and preventing political incentives from making subsidies burden some than they are beneficial.

Q12: Give below are two statements:

Statement - I: Under first degree price discrimination, monopolist sells different units of output for different prices and these prices may differ from person to person.

Statement - II: Under third degree price discrimination, monopolist sells different units of output for different prices, but every individual who buys the same amount of the good pays the same price.

In the light of the above statements, choose the correct answer from the options given below:

(a) Both Statement I and Statement II are true.

(b) Both Statement I and Statement II are false.

(c) Statement I is true but Statement II is false.

(d) Statement I is false but Statement II is true.

Ans: c

Sol:

- First-degree price discrimination, when a monopolist charges each customer a price equivalent to their willingness to pay, is appropriately described by Statement I, and prices can in fact vary from person to person.

- In terms of third-degree pricing discrimination. The monopolist divides consumers into various groups and assesses a different price to each group in third-degree price discrimination.

- Consumers who belong to the same group pay the same price, although pricing between groups can vary.

- Therefore, the statement falsely indicates that third-degree price discrimination results in everyone who purchases the same amount paying the same price.

Q13: In which of the following year IMF has set up the Extended Fund Facility (EFF) to support member's structural reforms to address balance of payment difficulties of a long term character.

(a) 1974

(b) 1997

(c) 1963

(d) 2009

Ans: a

Sol:

- The Extended Fund Facility (EFF) offers financial support to nations who are experiencing severe medium-term balance of payments issues as a result of fundamental flaws that need time to be fixed.

- The Extended Fund Facility, a credit program run by the IMF, was created in 1974 to assist nations in addressing their medium- and long-term balance of payments issues.

- The Extended Fund Facility (EFF) was established by the International Monetary Fund (IMF) in 1974. The EFF is a financial aid program designed to assist member nations with structural changes to address long-term balance of payment issues.

Hence, In 1974 IMF has set up the Extended Fund Facility (EFF) to support member's structural reforms to address balance of payment difficulties of a long term character.

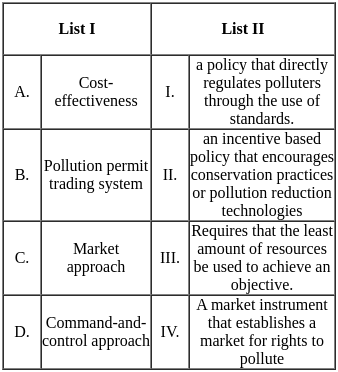

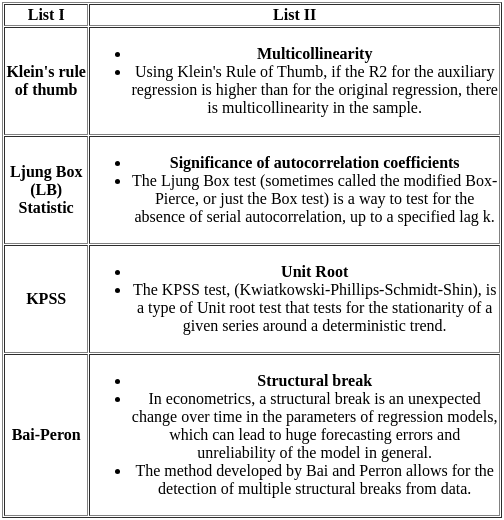

Q14: Match List I with List II

Choose the correct answer from the options given below:

(a) A - I, B - II, C - III, D - IV

(b) A - III, B - IV, C - I, D - II

(c) A - IV, B - III, C - II, D - I

(d) A - III, B - IV, C - II, D - I

Ans: d

Sol:

- Cost-effectiveness (D): Requires using the fewest resources possible to accomplish a goal. This exemplifies the concept of cost-effectiveness, which is about reaching a particular objective or result while using the fewest amount of resources possible.

- Trading systems for pollution permits (A): A market tool that creates a market for the rights to pollute. Systems for trading pollution permits are one type of market strategy.

- A strategy with incentives that promotes conservation measures or pollution-reduction technologies is known as the market approach (C). The market strategy involves promoting environmental goals through financial incentives.

- A policy that directly regulates pollutants through the application of standards is known as a command-and-control method (B). In the command-and-control strategy, the government establishes detailed guidelines that polluters must abide by.

Hence, Cost-effectiveness- Requires that the least amount of resources be used to achieve an objective, Command-and-control approach- a policy that directly regulates polluters through the use of standards, Market approach - an incentive based policy that encourages conservation practices or pollution reduction technologies and Pollution permit trading system- A market instrument that establishes a market for rights to pollute.

Q15: A company has 140 employees. of which 30 are supervisors. 80 of the employees are married. and 20% of the married employee are supervisors. If a company employee is randomly selected. what is the probability that the employee is married and is a supervisor?

(a) 0.1531

(b) 0.1253

(c) 0.0923

(d) 0.1143

Ans: d

Sol:

- Number of married employees who are supervisors = (Percentage of married employees who are supervisors / 100) * Number of married employees

- Number of married employees who are supervisors = (20% / 100) * 80

Number of married employees who are supervisors = (0.20) * 80 = 16 - To find the probability that a randomly selected employee is both married and a supervisor:

- Probability = (Number of employees who are both married and supervisors) / (Total number of employees)

Probability = 16 / 140Probability is 0.114

Q16: Which one of the following is not correct about LM schedule?

(a) The LM schedule slopes upward to the right.

(b) The LM schedule will be relatively flat (steep) if the interest elasticity of money demand is relatively high (low).

(c) The LM schedule will shift downward (upward) to the right (left) with an increase (decrease) in the quantity of money.

(d) The LM schedule is the schedule giving the combinations of values of investment and interest rate that produce equilibrium in the money market.

Ans: d

Sol: The correct answer is Option 4) The LM schedule is the schedule giving the combinations of values of investment and interest rate that produce equilibrium in the money market.Explanation

The LM schedule slopes upward to the right. This statement is correct.

- The LM curve slopes upward because higher income levels lead to higher demand for money, which increases interest rates.

The LM schedule will be relatively flat (steep) if the interest elasticity of money demand is relatively high (low). This statement is correct.

- If money demand is highly sensitive to interest rates, the LM curve will be flatter; if less sensitive, the curve will be steeper.

The LM schedule will shift downward (upward) to the right (left) with an increase (decrease) in the quantity of money. This statement is correct.

- Increasing the money supply lowers interest rates for a given level of income, shifting the LM curve downward and to the right.

The LM schedule is the schedule giving the combinations of values of investment and interest rate that produce equilibrium in the money market. This statement is incorrect.

- The LM schedule represents combinations of income and interest rates that balance money demand and supply, not investment and interest rates.

Other Related Points

The LM curve is derived from the equilibrium in the money market.

- It shows combinations of income and interest rates where money demand equals money supply.

Q17: Which of the following constitutes India's strategy to combat climate change in the backdrop of its stand at the 26th session of the conference of the Parties (COP 26) to the UNFCCC held in Glasgow, UK.

A. phasing out of coal-based thermal power generation by 2030.

B. reduction of the carbon intensity of Indian economy by 45 percent by 2030, over 2005 levels.

C. capping Indian economy total final energy consumption in absolute levels.

D. achieving the target of net zero emissions for India by 2070.

E. promoting lifestyle for environment to combat climate change.

Choose the correct answer from the option given below:

(a) A, B, D only

(b) B, C, D only

(c) B, D, E only

(d) C, D, E only

Ans: c

Sol: The correct answer is 3) B, D, E only.

India's Strategy to Combat Climate Change at COP 26

Reduction of Carbon Intensity

- India aims to reduce the carbon intensity of its economy by 45 percent by 2030, compared to 2005 levels. This goal is a significant part of India's climate strategy to decrease greenhouse gas emissions relative to its economic output. Hence statement B is correct.

Net Zero Emissions Target

- India has set a target to achieve net zero emissions by 2070. This long-term goal signifies India's commitment to balancing the amount of emitted greenhouse gases with the amount removed from the atmosphere. Hence statement D is correct.

Lifestyle for Environment

- India promotes the concept of 'Lifestyle for Environment' (LiFE) to combat climate change. This initiative emphasizes sustainable and environment-friendly practices in daily life to reduce the overall carbon footprint. Hence statement E is correct.

Other Related Points

Coal-based Thermal Power Generation

- India has not committed to phasing out coal-based thermal power generation by 2030. Instead, it focuses on increasing renewable energy capacity while gradually reducing dependence on coal.

- Hence statement A is incorrect.

Energy Consumption Cap

- India has not declared any plans to cap its total final energy consumption in absolute terms. The focus remains on improving energy efficiency and increasing the share of renewable energy sources.

- Hence statement C is incorrect.

Q18: Properties of expenditure function are (in the context of utility theory),

A. Homogeneous of degree one in price, P

B. Strictly increasing in utility, u and non-decreasing in price, P for any good 1.

C. Concave in P

D. Continuous in P and u

E. Strictly convex in P

Choose the correct answer from the option given below:

(a) A, C, D, E only

(b) A, B, D, E only

(c) A, B, C, D only

(d) B, C, D, E only

Ans: b

Sol:

- Homogeneity: The spending function exhibits one-degree price homogeneity. The expenditure (e) will be multiplied by the same constant if all prices (P) are multiplied by a positive constant (): e(P) = e(P).

- The expenditure function doesn't decrease as prices rise or fall. The amount spent on certain items should not decrease when their costs rise. Formally, e(P1) e(P2) if P1 P2 for all products.

- The spending function is convex in terms of pricing. This implies that the rate of expenditure growth may slow down if the pricing of items fluctuate. It mathematically indicates that the expenditure function's second derivative with respect to prices is positive.

- Continuity: Prices and utility both exhibit a continuous expenditure function. Small adjustments in utility or price should lead to small adjustments in spending.

Hence, Properties of expenditure function are (in the context of utility theory), Homogeneous of degree one in price, P, Strictly increasing in utility, u and non-decreasing in price, P for any good 1, Continuous in P and u and Strictly convex in P.

Q19: Which of the following is true for the Clark-Wicksteed-Walras product exhaustion theorem

A. The assumption of a homogeneous production function is necessary.

B. It is an identity that holds for all values of the variables.

C. The assumption of a homogeneous production function is not necessary.

D. It is not an identity since it holds only for the values of the variables in the long-run equilibrium.

E. It holds for all types of production functions.

Choose the correct answer from the option given below:

(a) A and B only

(b) A and D only

(c) B, C and E only

(d) C, D and E only

Ans: a

Sol: The correct answer is A and B only

- Clark product exhaustion shows that the total product of the economy has been fully distributed between labor and capital, the two factors in the economy.

- If labor is a fixed factor and capital is a variable factor in the economy, it can again be shown that the total product is fully exhausted.

- Homogeneous production functions consist of a broad array of functions with a special characteristic.

Other Related Points

- Product Exhaustion Theorem - This states that the total product is exhausted if each factor input is paid for its marginal product. Wicksteed provided an early mathematical expression of the theorem but did not relate it to Euler's work.

Q20: Which of the following defines ambient standards in an environmental policy

(a) a standard that specifies a pollution limit to be achieved but does not stipulate the technology.

(b) a standard that designates the equipment or method to be used to achieve some abatement level.

(c) a standard that designates the quality level of some element of the environment to be achieved.

(d) none of the above.

Ans: c

Sol:

- A benchmark that specifies the degree of environmental quality that must be attained: This relates to ambient standards, which establish the ideal degree of quality for environmental components like the quality of the air or water.

- The environmental conditions that must be upheld in order to protect both human health and the ecology are specified by these standards. It concentrates on establishing environmental quality standards, which is a crucial component of environmental rules and policies.

Hence, a standard that designates the quality level of some element of the environment to be achieved defines ambient standards in an environmental policy.

Q21: Read the passage below and answer the question:

The government of India's fiscal policy response to the covid crises comprised of a judicious mix of increasing food and fertilizer subsidies on the one hand and a reduction in taxes on fuel and certain imported products on the other. Despite these additional fiscal pressures the union govt. is back on track. The resilience in the fiscal performance of the union government has been facilitated by the recovery in economic activity buoyancy in revenues from direct taxes and goods and services tax (GST) and realistic assumptions in the budget. The gross tax revenue registered a YoY growth of 15.5% from April to November 2022, driven by robust growth in the direct taxes and GST. The gross GST-collection has increased at 24.8% on YoY during the same period. The Union Government's emphasis on capital expediture (capex) has continued despite higher revenue expenditure requirements during the year. The center's capex has steadily increased from a long term average of 1.7 percent of GDP (FY09 to FY20) to 2.5% of GDP in FY22 PA. The center has also incentivized the state governments through interest free loans and enhanced borrowing ceilings to prioritize their spending on capex. Government has boosted allocations on infrastructure intensive sectors such as roads and highways, railways and housing and urban affairs, which has bearing on capex. This increase in capex will have implication for medium term growth and sustainable government debt to GDP ratio.

The Capex of the union government for the period FY 09 to FY 20 on an average was ______.

(a) 2.5 percent of GDP

(b) 15.5 percent of revenue receipts

(c) 24.8 percent of GST revenue

(d) 1.7 percent of GDP

Ans: d

Sol: The correct answer is 1.7 percent of GDP.

The seventh statement in the passage states that "The center's capex has steadily increased from a long-term average of 1.7 percent of GDP (FY09 to FY20) to 2.5% of GDP in FY22 PA".

On the basis of the above statement, it can be concluded that the capex of the union government for the period FY 09 to FY 20 on average was 1.7 percent of GDP.

Q22: Read the passage below and answer the question:

The government of India's fiscal policy response to the covid crises comprised of a judicious mix of increasing food and fertilizer subsidies on the one hand and a reduction in taxes on fuel and certain imported products on the other. Despite these additional fiscal pressures the union govt. is back on track. The resilience in the fiscal performance of the union government has been facilitated by the recovery in economic activity buoyancy in revenues from direct taxes and goods and services tax (GST) and realistic assumptions in the budget. The gross tax revenue registered a YoY growth of 15.5% from April to November 2022, driven by robust growth in the direct taxes and GST. The gross GST-collection has increased at 24.8% on YoY during the same period. The Union Government's emphasis on capital expediture (capex) has continued despite higher revenue expenditure requirements during the year. The center's capex has steadily increased from a long term average of 1.7 percent of GDP (FY09 to FY20) to 2.5% of GDP in FY22 PA. The center has also incentivized the state governments through interest free loans and enhanced borrowing ceilings to prioritize their spending on capex. Government has boosted allocations on infrastructure intensive sectors such as roads and highways, railways and housing and urban affairs, which has bearing on capex. This increase in capex will have implication for medium term growth and sustainable government debt to GDP ratio.

In order to further enhance capex. allocation for which of the following infrastructure sector is not increased :

(a) Ports and Waterways

(b) Roads and Highways

(c) Railways

(d) Housing and Urban affairs

Ans: a

Sol: The correct answer is ports and waterways

The ninth statement of the passage states that "Government has boosted allocations on infrastructure intensive sectors such as roads and highways, railways and housing and urban affairs, which has bearing on capex".

On the basis of the above statement, it can be concluded that in order to further enhance capex, the allocation for ports and waterways sector is not increased.

Q23: Read the passage below and answer the question:

The government of India's fiscal policy response to the covid crises comprised of a judicious mix of increasing food and fertilizer subsidies on the one hand and a reduction in taxes on fuel and certain imported products on the other. Despite these additional fiscal pressures the union govt. is back on track. The resilience in the fiscal performance of the union government has been facilitated by the recovery in economic activity buoyancy in revenues from direct taxes and goods and services tax (GST) and realistic assumptions in the budget. The gross tax revenue registered a YoY growth of 15.5% from April to November 2022, driven by robust growth in the direct taxes and GST. The gross GST-collection has increased at 24.8% on YoY during the same period. The Union Government's emphasis on capital expediture (capex) has continued despite higher revenue expenditure requirements during the year. The center's capex has steadily increased from a long term average of 1.7 percent of GDP (FY09 to FY20) to 2.5% of GDP in FY22 PA. The center has also incentivized the state governments through interest free loans and enhanced borrowing ceilings to prioritize their spending on capex. Government has boosted allocations on infrastructure intensive sectors such as roads and highways, railways and housing and urban affairs, which has bearing on capex. This increase in capex will have implication for medium term growth and sustainable government debt to GDP ratio.

Which of the following strategy is adopted by Union Government to prioritise States’ spending on capex.

(a) Incentivizing for higher revenue expenditure

(b) Incentivizing for interest free loans and enhance borrowing ceilings

(c) Incentivizing for higher interest payment

(d) Incentivizing for large spending on tax

Ans: b

Sol: The correct answer is 'Incentivizing for interest-free loans and enhancing borrowing ceilings'.

The eighth statement of the passage states that "The center has also incentivized the state governments through interest-free loans and enhanced borrowing ceilings to prioritize their spending on capex".

On the basis of the above statement, it can be concluded that the strategy of Incentivizing interest free loans and enhancing borrowing ceilings is adopted by the Union Government to prioritize States’ spending on capex.

Q24: Read the passage below and answer the question:

The government of India's fiscal policy response to the covid crises comprised of a judicious mix of increasing food and fertilizer subsidies on the one hand and a reduction in taxes on fuel and certain imported products on the other. Despite these additional fiscal pressures the union govt. is back on track. The resilience in the fiscal performance of the union government has been facilitated by the recovery in economic activity buoyancy in revenues from direct taxes and goods and services tax (GST) and realistic assumptions in the budget. The gross tax revenue registered a YoY growth of 15.5% from April to November 2022, driven by robust growth in the direct taxes and GST. The gross GST-collection has increased at 24.8% on YoY during the same period. The Union Government's emphasis on capital expediture (capex) has continued despite higher revenue expenditure requirements during the year. The center's capex has steadily increased from a long term average of 1.7 percent of GDP (FY09 to FY20) to 2.5% of GDP in FY22 PA. The center has also incentivized the state governments through interest free loans and enhanced borrowing ceilings to prioritize their spending on capex. Government has boosted allocations on infrastructure intensive sectors such as roads and highways, railways and housing and urban affairs, which has bearing on capex. This increase in capex will have implication for medium term growth and sustainable government debt to GDP ratio.

Which of the following strategies was not comprised India's Fiscal Policy response to Covid crises :

(a) Increasing of food subsidy

(b) Increasing of fertilizer subsidy

(c) Reduction in taxes on certain imported products.

(d) Increase in taxes on fuel.

Ans: d

Sol: The correct answer is 'Increase in taxes on fuel'.

The first statement of the passage states that "The government of India's fiscal policy response to the covid crises comprised of a judicious mix of increasing food and fertilizer subsidies on the one hand and a reduction in taxes on fuel and certain imported products on the other".

On the basis of the above statement, it can be concluded that an increase in taxes on fuel was not a strategy of India's fiscal policy response to covid crisis.

Q25: Read the passage below and answer the question:

GDP growth is the most widely used macroeconomic indicator for adjudicating broad economic progress. The outcomes from decisions made on the basis of such an indicator have been repeatedly disappointing because of failures to detect resource uses that turn out to be unsustainable. Adjusted Net Savings (ANS) provides a complementary indicator to help in understanding the changes in wealth and not per capita wealth, by capturing some of the important policy-induced dynamics. Based on the conventions of the System of National Accounts (SNA), ANS is measured as Gross National Saving minus depreciation of produced capital, depletion of subsoil assets and timber resources, and air pollution damages to human health, plus a credit for expenditures on education. If ANS is negative, the county is running down its capital stocks and possibly reducing future material well-being. If ANS is positive the country is adding to wealth and future material well-being. When natural resource depletion is not used to invest in other assets in the wealth portfolio, countries gross saving might not be enough to compensate this depletion resulting in negative net savings. However, nations with higher GDP are far less likely to obtain negative ANS. It is argued that, if not a superior indicator of sustainability. ANS is useful to the extent that it can serve as an indicator of unsustainability. Hence, the estimates and conceptualization of ANS are not free from limitations.

Adjusted Net Saving (ANS) is

(a) a proxy for change in per capita wealth

(b) a stock variable

(c) a flow variable

(d) unable to capture policy-induced dynamics

Ans: c

Sol: The correct answer is 'a flow variable'.

- The third statement in the passage states that "Adjusted Net Savings (ANS) provides a complementary indicator to help in understanding the changes in wealth and not per capita wealth, by capturing some of the important policy-induced dynamics".

- The fourth statement in the passage states that "Based on the conventions of the System of National Accounts (SNA), ANS is measured as Gross National Saving minus depreciation of produced capital, depletion of subsoil assets and timber resources, and air pollution damages to human health, plus a credit for expenditures on education".

On the basis of the above statement, it can be concluded that Adjusted Net Savings (ANS) is a flow variable.

Q26: Read the passage below and answer the question:

GDP growth is the most widely used macroeconomic indicator for adjudicating broad economic progress. The outcomes from decisions made on the basis of such an indicator have been repeatedly disappointing because of failures to detect resource uses that turn out to be unsustainable. Adjusted Net Savings (ANS) provides a complementary indicator to help in understanding the changes in wealth and not per capita wealth, by capturing some of the important policy-induced dynamics. Based on the conventions of the System of National Accounts (SNA), ANS is measured as Gross National Saving minus depreciation of produced capital, depletion of subsoil assets and timber resources, and air pollution damages to human health, plus a credit for expenditures on education. If ANS is negative, the county is running down its capital stocks and possibly reducing future material well-being. If ANS is positive the country is adding to wealth and future material well-being. When natural resource depletion is not used to invest in other assets in the wealth portfolio, countries gross saving might not be enough to compensate this depletion resulting in negative net savings. However, nations with higher GDP are far less likely to obtain negative ANS. It is argued that, if not a superior indicator of sustainability. ANS is useful to the extent that it can serve as an indicator of unsustainability. Hence, the estimates and conceptualization of ANS are not free from limitations.

Which of the following reflects the shortcomings of ANS?

(a) It allows substitution between different forms of capital.

(b) It is not a comprehensive indicator of per capita wealth.

(c) It is influenced by the level of GDP of an economy.

(d) All of the above

Ans: d

Sol: The correct answer is all of the above.

- The third statement in the passage states that "Adjusted Net Savings (ANS) provides a complementary indicator to help in understanding the changes in wealth and not per capita wealth, by capturing some of the important policy-induced dynamics".

- The fourth statement in the passage states that "Based on the conventions of the System of National Accounts (SNA), ANS is measured as Gross National Saving minus depreciation of produced capital, depletion of subsoil assets and timber resources, and air pollution damages to human health, plus a credit for expenditures on education."

- The eighth statement in the passage states that "nations with higher GDP are far less likely to obtain negative ANS".

On the basis of the above statements, it can be concluded that all of the given factors reflect the shortcomings of ANS.

Q27: Read the passage below and answer the question:

GDP growth is the most widely used macroeconomic indicator for adjudicating broad economic progress. The outcomes from decisions made on the basis of such an indicator have been repeatedly disappointing because of failures to detect resource uses that turn out to be unsustainable. Adjusted Net Savings (ANS) provides a complementary indicator to help in understanding the changes in wealth and not per capita wealth, by capturing some of the important policy-induced dynamics. Based on the conventions of the System of National Accounts (SNA), ANS is measured as Gross National Saving minus depreciation of produced capital, depletion of subsoil assets and timber resources, and air pollution damages to human health, plus a credit for expenditures on education. If ANS is negative, the county is running down its capital stocks and possibly reducing future material well-being. If ANS is positive the country is adding to wealth and future material well-being. When natural resource depletion is not used to invest in other assets in the wealth portfolio, countries gross saving might not be enough to compensate this depletion resulting in negative net savings. However, nations with higher GDP are far less likely to obtain negative ANS. It is argued that, if not a superior indicator of sustainability. ANS is useful to the extent that it can serve as an indicator of unsustainability. Hence, the estimates and conceptualization of ANS are not free from limitations.

Which of the following explains the decline in ANS in countries with increasing GDP per capita?

(a) Increasing proportion of private investment in an economy

(b) Depleted assets not offset by sufficient investment in human and physical capital

(c) Increasing gross saving rates

(d) Increasing production of renewable natural capital

Ans: b

Sol: The correct answer is 'Depleted assets not offset by sufficient investment in human and physical capital'.

- The fourth statement in the passage states that "Based on the conventions of the System of National Accounts (SNA), ANS is measured as Gross National Saving minus depreciation of produced capital, depletion of subsoil assets and timber resources, and air pollution damages to human health, plus a credit for expenditures on education".

- The fifth statement in the passage states that "If ANS is negative, the county is running down its capital stocks and possibly reducing future material well-being. If ANS is positive the country is adding to wealth and future material well-being".

- The sixth statement in the passage states that "When natural resource depletion is not used to invest in other assets in the wealth portfolio, countries gross saving might not be enough to compensate this depletion resulting in negative net savings. However, nations with higher GDP are far less likely to obtain negative ANS".

On the basis of the above statements, it can be concluded that "Depleted assets not offset by sufficient investment in human and physical capital" explains the decline in ANS in countries with increasing GDP per capita.

Q28: Read the passage below and answer the question:

GDP growth is the most widely used macroeconomic indicator for adjudicating broad economic progress. The outcomes from decisions made on the basis of such an indicator have been repeatedly disappointing because of failures to detect resource uses that turn out to be unsustainable. Adjusted Net Savings (ANS) provides a complementary indicator to help in understanding the changes in wealth and not per capita wealth, by capturing some of the important policy-induced dynamics. Based on the conventions of the System of National Accounts (SNA), ANS is measured as Gross National Saving minus depreciation of produced capital, depletion of subsoil assets and timber resources, and air pollution damages to human health, plus a credit for expenditures on education. If ANS is negative, the county is running down its capital stocks and possibly reducing future material well-being. If ANS is positive the country is adding to wealth and future material well-being. When natural resource depletion is not used to invest in other assets in the wealth portfolio, countries gross saving might not be enough to compensate this depletion resulting in negative net savings. However, nations with higher GDP are far less likely to obtain negative ANS. It is argued that, if not a superior indicator of sustainability. ANS is useful to the extent that it can serve as an indicator of unsustainability. Hence, the estimates and conceptualization of ANS are not free from limitations.

The concept of ANS should at best be used to

(a) guide ecologically optimal sustainable scale

(b) serve as an indicator of unsustainability

(c) replace GDP as a measure of economic progress

(d) None of the above

Ans: b

Sol: The correct answer is 'serve as an indicator of unsustainability'.The ninth statement in the passage states that "It is argued that, if not a superior indicator of sustainability. ANS is useful to the extent that it can serve as an indicator of unsustainability".

On the basis of the above statement, it can be concluded that the concept of ANS should at best be used to serve as an indicator of unsustainability.

Q29: Here is given international organisations and their headquarters. Which of the following are correct combinations of the institutions and their headquarters.

A. GATT: Geneva

B. IMF Washington DC

C. World Bank: Washington DC

D. International Development Association (IDA): New York

E. Asian Development Bank: Mandaluyong

Choose the correct answer from the option given below:

(a) A, B and C only

(b) A and B only

(c) C and D only

(d) A, B, C and E only

Ans: d

Sol:

The correct combinations of international organizations and their headquarters are:

A. GATT: Geneva - Correct

B. IMF: Washington DC - Correct

C. World Bank: Washington DC - Correct

D. International Development Association (IDA): New York - Incorrect (IDA is part of the World Bank group, and its headquarters are in Washington DC, not New York)

E. Asian Development Bank: Mandaluyong - Correct

Hence, So, the correct options are A. GATT: Geneva, B. IMF: Washington DC, C. World Bank: Washington DC , E. Asian Development Bank: Mandaluyong

Q30: Defensive expenditure method is based on the understanding that

A. the consumer spends money to ameliorate the damaging effects of the bad.

B. the defensive expenditure undertaken reflects the consumer's willingness to pay to reduce the level of the bad.

C. the observed defensive expenditure is an upper bound on the willingness to pay to avoid the bad.

D. the defensive expenditure provide no additional services other than provisioning the desired environmental quality.

E. the observed defensive expenditure is a lower bound on the willingness to pay to avoid the bad.

Choose the correct answer from the option given below:

(a) A, B and C only

(b) C, D and E only

(c) A, B, C and D only

(d) A, B, D and E only

Ans: a

Sol:

- The consumer makes a financial investment to lessen the negative consequences of the bad: This implies that people take steps or spend money to safeguard themselves from the unfavorable effects of unwanted things like air pollution or tainted water.

- The consumer's willingness to spend to lessen the severity of the negative is reflected in the defensive expenditure made: This implies that the amount of money spent on preventative measures, such as buying water filters or air purifiers, reflects how much people are ready to pay to lessen or completely eradicate the negative impacts of the problem.

- An upper constraint on the willingness to pay to avert harm is provided by the observed defensive expenditure: This section highlights that people's willingness to pay above and beyond what is necessary to prevent or lessen the negative impact is likely represented by the amount they spend on defensive measures. It gives a ballpark figure for the economic worth that people attribute to preventing the harm.

Hence, Defensive expenditure method is based on the understanding that the consumer spends money to ameliorate the damaging effects of the bad, the defensive expenditure undertaken reflects the consumer's willingness to pay to reduce the level of the bad.and the observed defensive expenditure is an upper bound on the willingness to pay to avoid the bad.

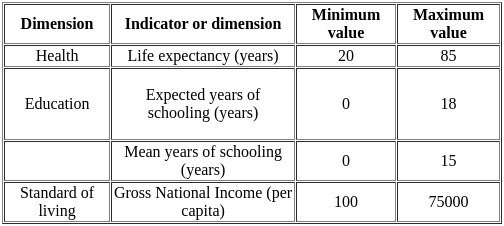

Q31: Which is not a dimension of Human Development Index (HDI)?

(a) Ability to lead a long and healthy life

(b) Ability to acquire knowledge

(c) Ability to achieve decent standard of living

(d) Ability to access clean environment

Ans: d

Sol: The correct answer is the ability to access a clean environment.

Human Development Index (HDI)

- The Human Development Index (HDI) provides a measure to capture three key dimensions of human development, i.e., a long and healthy life, access to knowledge, and a decent standard of living.

Dimensions of Human Development Index

- Life expectancy at birth: used to assess a long and healthy life.

- Expected years of schooling: used to assess accessibility to the knowledge of the young generation.

- Average years of schooling: used to assess accessibility to knowledge of the older generation.

- Gross national income (GNI) per capita: used to assess the standard of living.

Important Points

Steps for calculation of HDI

Forming indices for each of the four dimensions

Dimension Index = (Actual value - Minimum value) ÷ (Maximum value - Minimum value)

Aggregating the four dimensions to produce the HDI

- The HDI is calculated as the geometric mean (equally weighted) of life expectancy, education, and GNI per capita.

The education dimension is the arithmetic mean of the two education indices (mean years of schooling and expected years of schooling).

Thus, the ability to access a clean environment is not a dimension of the Human Development Index (HDI).

Q32: Pillar I of Basel III norms focus on

A. Quality and level of capital

B. Risk Coverage

C. Containing leverage

D. Risk management and supervision

E. Market discipline

Choose the correct answer from the option given below:

(a) A and B only

(b) B and C only

(c) C and D only

(d) D and E only

Ans: b

Sol: The correct answer is B and C only.

BASEL III Norms

- Basel III is an internationally agreed set of measures developed by the Basel Committee on Banking Supervision in response to the financial crisis of 2007-09.

- BASEL III measures aim to strengthen the regulation, supervision and risk management of banks.

- Like all Basel Committee standards, Basel III standards are minimum requirements which apply to internationally active banks.

- Members are committed to implementing and applying standards in their respective jurisdictions within the time frame established by the Committee.

Pillar I of BASEL III Norms

- Pillar I of BASEL III norms covers reforms concerning capital, risk coverage, and containing leverage.

Important Points

- Quality and level of capital is only a sub-part of capital-based refroms under the Basel Committee on Banking Supervision reforms (BASEL III).

- Risk management and supervision is the focus point of pillar II of BASEL III norms.

- Market discipline is the focus point of pillar III of BASEL III norms.

Thus, on the basis of the above information, Pillar I of BASEL III norms focus on risk coverage and containing leverage.

Q33: The merchant's file of 20 accounts contains 6 delinquent and 14 non-delinquent accounts. An auditor randomly selects 5 of these accounts for examination. What is the probability that the auditor finds exactly 2 delinquent cases?

(a) 0.2562

(b) 0.3

(c) 0.3087

(d) 0.4526

Ans: c

Sol: The correct answer is 0.3087

Numerical solution

- P(Exactly 2 delinquent cases) = ( 6C2 * 14C3) ÷ (20C5)

- P(Exactly 2 delinquent cases) = [(6 !) ÷ (6 - 2)! (2!)] x [(14 !) ÷ (14-3)! (3 !)] ÷ [(20 !) ÷ (20 - 5) ! (5 !)

- P(Exactly 2 delinquent cases) = (5 x 7 x 13 x 2) ÷ (19 x 17 x 8)

- P(Exactly 2 delinquent cases) = 910 ÷ 2584

- P(Exactly 2 delinquent cases) = 0.3087

Thus, the probability that the auditor finds exactly 2 delinquent cases is 0.3087

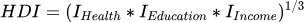

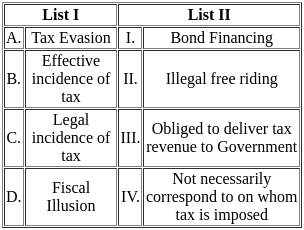

Q34: Match List I with List II

Choose the correct answer from the options given below:

(a) A - II, B - III, C - IV, D - I

(b) A - III, B - II, C - IV, D - I

(c) A - IV, B - III, C - II, D - I

(d) A - IV, B - III, C - I, D - II

Ans: c

Sol: The correct answer is A - IV, B - III, C - II, D - I.

Hence, the correct matching is A - IV, B - III, C - II, and D - I.

Q35: Which of following is a correct measure of gross fiscal deficit of the state government.

(a) Revenue Expenditure (RE) + Capital disbursement - Revenue Receipts (RR)

(b) RE + Repayment of loans to the Centre - RR

(c) Revenue Deficit + Capital Outlays + Net Lending

(d) RE + Discharge of Internal Debt - RR

Ans: c

Sol: The correct answer is 'Revenue Deficit + Capital Outlays + Net Lending'.

Fiscal Deficit

- A Fiscal deficit is the difference between the government's total expenditure and its total revenue (excluding borrowings).

- A Fiscal deficit is an indicator of the extent to which the government needs to borrow in order to finance its operations.

- A Fiscal deficit is expressed as a percentage of the country's gross domestic product (GDP).

Fiscal deficit formula

- Fiscal deficit = Total expenditure - Total receipts (excluding borrowings)

Thus, 'Revenue Deficit + Capital Outlays + Net Lending' is the correct measure of the gross fiscal deficit of the state government.

Other Related Points

Concepts of deficit

- Capital deficit = Capital expenditure - Capital receipts

- Budget deficit = Capital deficit + Revenue deficit

- Primary deficit = Fiscal deficit - Net interest payment

Q36: Which of the following holds for Bertrand's Duopoly model.

A. The reaction curves are derived from isoprofit maps which are convex to the axes.

B. The point of intersection of the two reaction curves reflects a stable equilibrium.

C. The reaction curves are derived from isoprofit maps which are concave to the axes.

D. The point of intersection of the two reaction curves reflects an unstable equilibrium.

E. Firm's behavioral pattern is such that they learn from past experience.

Choose the correct answer from the option given below:

(a) A and B only

(b) C and D only

(c) A, D and E only

(d) B, C and E only

Ans: a

Sol: The correct answer is A and B only

- Bertrand's Duopoly model was developed in 1883. His model differs from Cournot's in that he assumes each firm expects that the rival will keep its price constant, irrespective of its own decision about pricing.

- The model may be presented with the analytical tools of the reaction functions of the duopolists.

- In Bertrand's model the reaction curves are derived from isoprofit maps which are convex to the axes, on which we now measure the prices of the duopolists.

Other Related Points

The Bertrand model has the following characteristics:

- It is a single-period model.

- It describes the behavior of firms in an oligopoly.

- It is a static model.

Q37: In the national income identity Y = C + I + G, investment (I) is a function of.

(a) Real Income

(b) Nominal Income

(c) Real Interest Rate

(d) Nominal Interest Rate

Ans: c

Sol: The correct answer is Option 3) Real Interest Rate.

Real Income This statement is incorrect.

- Investment (I) is not directly a function of real income in the national income identity.

Nominal Income This statement is incorrect.

- Investment (I) does not directly depend on nominal income.

Real Interest Rate This statement is correct.

- The real interest rate affects the cost of borrowing and thus influences investment decisions.

Nominal Interest Rate This statement is incorrect.

- Investment (I) is influenced by the real interest rate, not the nominal interest rate, as the real rate reflects the true cost of borrowing after adjusting for inflation.

Other Related Points

The real interest rate is crucial for investment decisions.

- It represents the actual cost of funds and influences businesses' and individuals' decisions to invest in new projects and equipment.

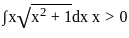

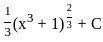

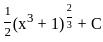

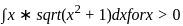

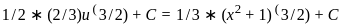

Q38: Integrate:

(a)

(b)

(c)

(d)

Ans: b

Sol: The correct answer is

The integral  can be solved using a simple substituion:

can be solved using a simple substituion:

Where,  Then,

Then,

We can substitute these into our integral, we get:

This integral is fairly straightforward, yielding:

So, the correct answer is:

Q39: The components of services sector in Gross Value Added (GVA) are

A. Construction

B. Trade, Hotels, Transport and Communication related to Broadcasting

C. Electricity, Gas, Water supply and other utility services

D. Public Administration, Defense and other services

E. Financial, Real Estate and Professional services

Choose the correct answer from the option given below:

(a) B, D and E only

(b) A, B and C only

(c) A, B, D and E only

(d) A, B, C and E only

Ans: a

Sol: The correct answer is B, D, and E only.

Meaning of Gross Value Added (GVA)

The services sector, also called the tertiary sector, is generally composed of:

- Trade, Hotels, Transport, and Communication related to Broadcasting: This includes all services related to the retail and wholesale of goods, the accommodation and food service activities, the transport of goods and individuals, and the transmission of information through telecommunications.

Public Administration, Defense, and Other Services: This includes all services provided through governmental activities including general administration (like legislative and financial affairs), public order, safety and defense, environmental protection, economic affairs, community amenities, and social protection services.

Financial, Real Estate, and Professional Services: This segment includes financial intermediation and insurance services, activities related to real estate, and professional activities such as legal, accounting, management consultancy, architectural, engineering, and other technical activities.

- The Construction and Electricity, Gas, Water supply, and other utility services, while considered part of the overall economy, are not generally classified as services or within the tertiary sector. They belong to the secondary or industrial sector.

So the correct components of the services sector in Gross Value Added (GVA) are:

- B. Trade, Hotels, Transport, and Communication related to Broadcasting

- D. Public Administration, Defense, and other services

- E. Financial, Real Estate and Professional services

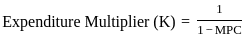

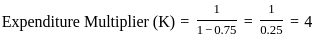

Q40: Given the income multiplier formula m =  , lower the marginal propensity to save.

, lower the marginal propensity to save.

(a) Higher will be the multiplier effect

(b) Lower will be the multiplier effect

(c) Multiplier will become infinite

(d) Multiplier will become zero

Ans: a

Sol: The correct answer is Higher will be the multiplier effect.

- Marginal propensity to consume (MPC) measures how much more individuals will spend for every additional dollar of income.

- MPC is calculated as the ratio of marginal consumption to marginal income.

- MPC is related to the so-called Keynesian multiplier, where MPC can help predict the economic growth from a government stimulus.

- The multiplier effect refers to a chain reaction of consumption by various entities brought about by an initial increase in income.

- MPC of one means a person spent all additional income.

- MPC of zero means spent none of it and, instead, invested it.

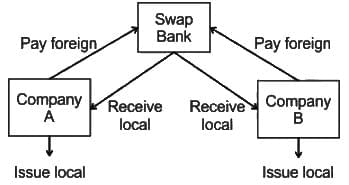

Q41: A foreign exchange swap is

(a) a spot purchase of a currency combined with a forward repurchase of that currency.

(b) a spot sale of a currency combined with a forward repurchase of that currency.

(c) sale and purchase of a currency in forward market.

(d) purchase of a currency in spot market.

Ans: a

Sol: The correct answer is a spot purchase of a currency combined with a forward repurchase of that currency.

- Foreign exchange swap refers to currently buying one currency and selling currency while forward re-selling the bought currency and buying another currency. That is to say, a swap transaction is composed of a spot and a forward deal.

- Currency Swaps agreements involve trade in local currencies, where countries pay for imports and exports at pre-determined rates of exchange without the involvement of a third country currency like the US dollar.

Q42: Arrange the following chronologically in order of their publication starting from the oldest:

A. General Theory of Employment. Interest and Money

B. A Treatise on probability

C. Essays in Persuasion

D. The End of Laissez Faire

E. A Tract on Monetary Reform

Choose the correct answer from the option given below:

(a) B, C, D, A, E

(b) B, E, D, C, A

(c) E, B, D, C, A

(d) D, E, B, A, C

Ans: b

Sol: The correct answer is B, E, D, C, A.

A Treatise on Probability (1921)

- The book 'A Treatise on Probability' was published by John Maynard Keynes in the year 1921.

- The Treatise attacked the classical theory of probability and proposed a "logical-relationist" theory instead.

- The Treatise is fundamentally philosophical in nature despite extensive mathematical formulations.

- The Treatise presented an approach to probability that was more subject to variation with evidence than the highly quantified complex classical versions.

A Tract on Monetary Reform (1923)

- 'A Tract on Monetary Reform' is a book by John Maynard Keynes, published in the year 1923.

- Through this book, Keynes presented an argument in favour of a policy that would work to stabilize the domestic price level.

- Keynes advocated that domestic price stability was accompanied by exchange rate flexibility.

- After years of experience, he did not favour floating exchange rates and proposed the crawling peg exchange rate system.

The End of Laissez-Faire (1926)

- The book 'The End of Laissez-Faire' was published by John Maynard Keynes in the year 1926.

- The book presents a brief historical review of laissez-faire economic policy.

- Though Keynes agrees in principle that a marketplace of free individuals pursuing their self-interest without government intervention has a better chance of improving society's economic situation than socialist alternatives, he suggests that government can play a significant role in protecting individuals from the ill effects of business cycles prevalent in capitalist societies.

The Essays in Persuasion (1931)

- 'The Essays in Persuasion' was published by John Maynard Keynes in the year 1931.

- The book constitutes a relevant attempt to find a solution to the most pressing problems of the post-World War I period.

- For this reason, its importance goes well beyond the sphere of economics for reaching out to the realms of history, politics and international relations.

General Theory of Employment. Interest and Money (1936)

- The General Theory of Employment, Interest and Money is a book by John Maynard Keynes published in February 1936.

- The book brought a profound shift in economic thought, giving macroeconomics a central place in economic theory.

- The central argument of The General Theory is that the level of employment is determined not by the price of labour, but by the level of aggregate demand.

Thus, A Treatise on Probability (1921), A Tract on Monetary Reform (1923), The End of Laissez-Faire (1926), The Essays in Persuasion (1931), and General Theory of Employment. Interest and Money (1936) is in the correct chronological order.

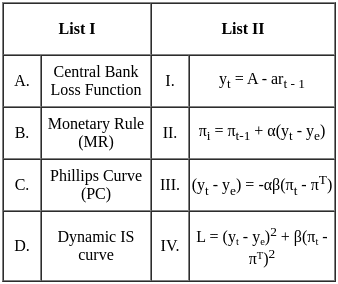

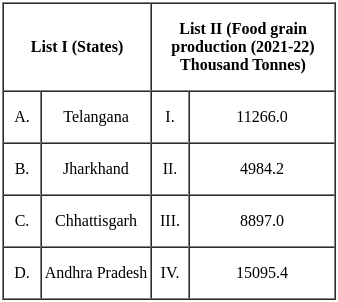

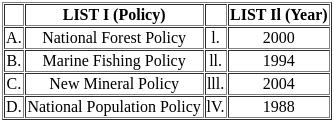

Q43: Match List I with List II

Choose the correct answer from the options given below:

(a) A - I, B - II, C - III, D - IV

(b) A - IV, B - III, C - II, D - I

(c) A - I, B - III, C - IV, D - II

(d) A - IV, B - II, C - III, D - I

Ans: a

Sol: The correct answer is A - I, B - II, C - III, D - IV

Total food grain production in India is estimated at a record (2021-22) 330.5 million tonnes.

Uttar Pradesh ranks first in the total food grain production of the country.

Other Related Points

India's Top Wheat Producers

During the same period, the leading wheat-producing states in India were:

- Uttar Pradesh

- Madhya Pradesh

- Punjab

These three states account for approximately 64% of India's wheat production.

Uttar Pradesh is the largest contributor, producing 32.42% of the nation's total output, followed by Madhya Pradesh and Punjab, which contribute 16.08% and 15.65% respectively.

India's Top Food Grain Producers

- The leading food grain-producing states in India during 2021-22.

Q44: The Intensive Agriculture District Programme (IADP) was launched in the year

(a) 1960-61

(b) 1961-62

(c) 1962-63

(d) 1963-64

Ans: a

Sol: The correct answer is 1960-61.

Intensive Agriculture District Programme (IADP)

- The Intensive Agriculture District Programme, popularly known as package programme was launched in India during the kharif season in 1960.

- The central idea behind the launch of IADP was that increased agricultural productivity would lead to economic growth, which would ensure the welfare of the society.

- The method adopted in IADP was to demonstrate the feasibility of increased agricultural production rapidly by concentrating on all factors of production at the same time in an integrated action programme in selected districts fulfilling optimum conditions.

- The programme was known as a package programme because of the collective and simultaneous application of all improved practices namely improved seeds, irrigation, fertilizer, plant protection, implements, storage facilities, marketing and credit facilities etc.

- Initially, 7 districts were covered under the programme namely Thanjavur (Tamil Nadu), West Godavari (Andhra Pradesh), Sahabad (Bihar), Raipur (Madhya Pradesh), Aligarh (Uttar Pradesh), Ludhiana (Punjab), and Pali (Rajasthan).

- The selection of districts was done on the basis of their high potential for increasing the agricultural yield in a shorter time.

- These selected districts had assured water supply for irrigation, well-developed cooperatives, good physical infrastructure and minimum hazards.

Objectives of IADP

- To achieve rapid increase in agricultural production through concentration of financial, technical, and administrative resources.

- To achieve a self-generating breakthrough in productivity and to raise the production potential by stimulating the human and physical process of change.

- To demonstrate the most effective ways of increasing production and thus, to provide lessons for promoting such intensive agricultural production programmes to other areas.

Thus, The Intensive Agriculture District Programme (IADP) was launched in the year 1960-61.

Q45: Arrange the following events of equity trading in India starting from the oldest :

A. The BSE introduced screen-based trading.

B. Foreign Institutional Investors (FIIs) are permitted to invest in the Indian Securities Market.

C. NSE commenced operations in wholesale debt market segment.

D. The SEBI banned badla trading on the BSE.

E. The NSE overtook the BSE as the largest stock exchange in terms of volume trading.

Choose the correct answer from the option given below:

(a) A, B, D, E, C

(b) B, D, C, E, A

(c) D, B, E, C, A

(d) C, B, D, E, A

Ans: b

Sol: The correct answer is B, D, C, E, A.

Foreign Institutional Investors (FIIs) are permitted to invest in the Indian Securities Market - Year 1992

- A Foreign Institutional Investor (FII) is an institution established or incorporated outside India that proposes to make investments in the Indian securities market.