UGC NET Paper 2: Economics 2nd Mar 2023 Shift 2 | UGC NET Past Year Papers PDF Download

Q1: In case of two goods for which the MRS is zero or infinite, then the nature of goods is :

(a) Perfect substitutes

(b) Normal goods

(c) Perfect complements

(d) Close substitutes

Ans: c

Sol: The correct answer is Perfect Complements

- In the context of consumer theory, the Marginal Rate of Substitution (MRS) helps describe the rate at which a consumer is willing to substitute one good for another while maintaining the same level of utility. If the MRS is zero or infinite, it reflects extreme preferences regarding the substitution between the two goods.

- MRS Zero or Infinite: When the MRS is zero, the consumer has no interest in substituting one good for the other; when it's infinite, the consumer would swap any amount of one good for even the smallest quantity of the other.

- Nature of Goods: This behavior is indicative of perfect complements. For perfect complements, consumers consume the goods in fixed proportions, and the indifference curves are right-angled, meaning the MRS can be zero or infinite because consumers only value specific combinations of the two goods.

- Solution: Option 3: Perfect complements

Q2: Which of the following is not true?

(a) Total effect of price change on consumption of a good is a combination of income effect and substitution effect

(b) For inferior goods, income effect is always larger than substitution effect, in absolute terms.

(c) For corner solution

(d) For a normal good both the income and substitution effect hold

Ans: b

Sol: The correct answer is For inferior goods, income effect is always larger than substitution effect, in absolute terms.

- According to the inferior goods, the income effect is greater than the substitution effect, it is not always the case. The magnitude of each effect depends on the specific good and the consumer's budget constraint. In some cases, the substitution effect may even dominate the income effect, leading to a positive relationship between the price and consumption of inferior goods.

- The total effect of a price change on the consumption of a good is a combination of the income effect and substitution effect. The income effect is the change in consumption due to the change in the consumer's real income. The substitution effect is the change in consumption due to the change in the relative prices of goods.

Q3: The negative network externality in which a consumer wishes to own an exclusive or unique good such as specially designed sports car is:

(a) Bandwagon effect

(b) Tequila effect

(c) Snob effect

(d) Pigou effect

Ans: c

Sol: The correct answer is Snob effect.

- Bandwagon effect: The bandwagon effect is a positive network externality that occurs when a consumer's demand for a good increases as more people consume it. This is because the consumer wants to be part of the crowd and feel like they are fitting in.

- Tequila effect: The tequila effect is a term used to describe the whole are more likely to engage in risky behavior when they are in a group. This is because people are less likely to be inhibited when they are surrounded by others who are also doing the same thing.

- Pigou effect: The Pigou effect is a term used to describe the way in which businesses will overproduce goods and services when there are negative externalities associated with production. This is because businesses do not take the negative externalities they create into account when making their production decisions.

- Important Points: The negative network externality in which a consumer wishes to own an exclusive or unique good such as a specially designed sports car is called the snob effect.

Here's why:

- Negative network externality: The value of the good to the consumer decreases as more people own it. In this case, the exclusivity and prestige associated with owning a unique sports car diminishes as more people own the same model.

- Exclusivity and uniqueness: Consumers who value the snob effect derive satisfaction from owning a good that few others possess. They want to stand out from the crowd and project an image of wealth, status, or individuality.

- Decreasing marginal utility: As more people acquire the good, its perceived exclusivity and social signaling power decline, making it less desirable for consumers who seek distinction.

Q4: When each player has chosen his or her optimal strategy given the strategy chosen by other player, the situation is referred to as.

(a) Nash Equilibrium

(b) Wicksel's Equilibrium

(c) Prisoner's dilemma

(d) Co-operative Game

Ans: a

Sol: The correct answer is Nash Equilibrium.

- Nash equilibrium refers to the strategy in which the optimal strategy of each player, given other players' strategies, becomes the best possible response to those strategies. In other words, if all players adopt Nash equilibrium strategies, no player has an incentive to change their strategy unilaterally.

- This concept is fundamental in game theory and economics for analyzing situations where multiple players interact and make decisions that affect each other's outcomes.

- Wicksel's equilibrium is a concept in monetary economics that refers to the long-run equilibrium of the interest rate in a closed economy with a fixed exchange rate.

- Prisoner's dilemma is a classic game theory model that illustrates the conflict between individual rationality and cooperation.

- Co-operative game is a type of game in which players can form coalitions and make agreements to maximize their joint payoff.

Q5: The Keynes's animal spirits are closely associated with

(a) Past investment

(b) Current investment

(c) Aggregate income

(d) Aggregate expenditure

Ans: b

Sol: The correct response is Current investment.

- Keynes's Theory: John Maynard Keynes, a prominent economist of the 20th century, developed his theory during the Great Depression to explain the economic downturn and propose solutions to stimulate economic recovery.

- Animal Spirits: Keynes introduced the term "animal spirits" in his book "The General Theory of Employment, Interest, and Money" to describe the non-rational factors that influence economic decisions, particularly investment decisions. These animal spirits encompass emotions, instincts, and psychological factors that can't be easily quantified or predicted by traditional economic models.

- Relation to Investment: Keynes argued that investment decisions are not solely driven by rational calculations of expected returns and interest rates. Instead, they are heavily influenced by psychological factors such as confidence, optimism, pessimism, and risk aversion. These animal spirits can lead to fluctuations in investment levels, even in the absence of significant changes in economic fundamentals.

- Current Investment: When Keynes referred to animal spirits in the context of investment, he was primarily concerned with their impact on current investment decisions. This means that investors' sentiment and confidence levels at a given point in time can significantly influence their willingness to invest in new capital projects, expand businesses, or undertake entrepreneurial ventures.

- Implications: In times of optimism and confidence, investors may exhibit high levels of animal spirits, leading to increased investment activity and economic expansion. Conversely, during periods of pessimism or uncertainty, animal spirits may wane, resulting in reduced investment, economic contraction, and even recessions.

- Policy Response: Keynes argued that during economic downturns, when private investment is sluggish due to low animal spirits, government intervention through fiscal and monetary policies can help stimulate aggregate demand and restore confidence, thereby encouraging investment and economic recovery.

Q6: Which one of the following is not a component of M1 ?

(a) Currency

(b) Traveler's cheque

(c) Commercial paper

(d) Demand deposits

Ans: c

Sol: The correct answer is "Commercial paper."

M1 refers to a measure of the money supply that includes highly liquid assets that can be readily used for transactions. The components of M1 typically include:

- Currency: Physical cash in circulation, including coins and banknotes.

- Demand deposits: Funds held in checking accounts and other types of accounts that can be withdrawn on demand by the depositor, typically through checks, debit cards, or electronic transfers.

- Travelers' checks: These are prepaid checks that are widely accepted by merchants and banks and can be exchanged for local currency while traveling.

- "Commercial paper" refers to short-term debt instruments issued by corporations and financial institutions to raise funds for short-term financing needs. While commercial paper is an important financial instrument, it is not considered a component of M1 because it is not directly used for transactions by households and businesses in the same way as currency, demand deposits, and travelers' checks. Commercial paper falls under the category of M2 or M3, broader measures of the money supply that include less liquid assets.

M1 includes currency, demand deposits, and traveler’s checks, which are highly liquid assets used for transactions. Commercial paper, a short-term debt instrument issued by corporations, is not included in M1 (or M2/M3) as it is not a medium of exchange. Thus, the correct answer is (c) Commercial paper.

Q7: The condition of preferring a certain income to a risky income with same expected value is referred to as;

(a) Risk neutral

(b) Risk loving

(c) Risk averse

(d) Risk premium

Ans: c

Sol: The correct answer is Risk averse.

The condition of preferring a certain income to a risky income with the same expected value is called risk aversion. Risk-averse individuals prefer certainty over uncertainty, even if it means forgoing potential gains.

- Risk-neutral individuals are indifferent between certain and risky outcomes with the same expected value.

- Risk-seeking (not risk-loving) individuals prefer risky outcomes for potential higher rewards.

- Risk premium is the additional return demanded for holding a risky asset.

Thus, the correct answer is (c) Risk averse.

Q8: A firm has the following total cost and demand functions: C = 1/3 Q3 - 7Q2 + 111Q + 50, Q = 100 - P, then find the profit maximizing level of output (Q*) and maximum profit of the firm.

(a) 50 and 100

(b) 111 and 2150

(c) 11 and

(d) 7 and 84

Ans: c

Sol: To find the profit-maximising output and maximum profit:

- First, rewrite the demand function as P = 100 - Q, so revenue is R = P × Q = 100Q - Q².

- Profit is R - C, where total cost is C = (1/3)Q³ - 7Q² + 111Q + 50.

- Set the derivative of profit with respect to Q to zero to find the maximum point.

- After solving, you get the profit-maximising output: Q* = 11.

- For the maximum profit, substitute Q = 11 into the profit formula. The result is:

The correct answer is '11 and 111.3.

Q9: In the Mundell-Fleming model, the monetary policy will be more effective when there is

(a) Perfect capital mobility and flexible exchange rate

(b) Perfect capital mobility and fixed exchange rate

(c) Imperfect capital mobility and flexible exchange rate

(d) Imperfect capital mobility and fixed exchange rate

Ans: a

Sol: The correct answer is Perfect capital mobility and flexible exchange rate.

- The Mundell-Fleming Model (MFM) describes the workings of a small economy open to international trade in goods and financial assets and provides a framework for monetary and fiscal policy analysis. The basic framework is a static, non-micro founded model extending the Keynesian IS-LM model. Indeed, the MFM shares with the IS-LM model the philosophical and methodological approach, and the basic features: the model is linear and the main assumption is that consumer prices are fixed. The MFM nests the IS-LM model as a special case, for a particular parameterization

- Perfect capital mobility means that there are no restrictions on the flow of capital across borders. This means that investors can freely move their money between countries in search of the highest returns. A flexible exchange rate means that the exchange rate is determined by market forces, rather than being pegged to a fixed rate.

Q10: The chain-weighted index is

(a) The total market value of goods and services produced in each year

(b) The percentage growth in real GDP

(c) A method for calculating changes in prices that used an average of base year from neighbouring years

(d) An Index that measures how the prices of goods and services included in GDP change.

Ans: c

Sol: The correct answer is The total market value of goods and services produced in each year.

A chain index is an index number in which the value of any given period is related to the value of its immediately preceding period (resulting in an index for the given period expressed against the preceding period = 100); this is distinct from the fixed-base index, where the value of every period in a time series is directly related to the same value of one fixed base period.

- This index type is called a chain index because individual indices with a previous period = 100 can be chained together by multiplying (and dividing by 100) all consecutive indices, thus converting them into a series of indices with the first reference period = 100. This way, the consecutive values of the index numbers form a chain, as it were, from the first (reference) to the last period.

- Chain-weighted CPI takes real-word purchasing decisions into account to provide a more accurate picture of the cost of living.

- zChain-weighted CPI can capture both general changes in spending, as consumer preferences change, and substitution effects, when relative prices change.

- The adjustments in chain-weighted CPI make it a better measure of the cost of living, but a less accurate measure of inflation.

In 2017, chain-weighted CPI was substituted for regular CPI in setting federal income tax brackets.

The chain-weighted index is a method for calculating changes in prices that uses an average of base years from neighboring years to account for changes in consumption patterns and substitution effects. It provides a more accurate measure of price changes compared to fixed-base indices. Thus, the correct answer is (c).

Q11: If the two events A and B are not independent then which of the following is correct?

(a) P(A ∩ B) = P(A).P(B)

(b) P(A ∩ B) = P(A).P(B/A)

(c) P(A ∩ B) = P(A).P(A/B)

(d) P(A ∩ B) = 1 - P(AUB)

Ans: b

Sol: The correct answer is P(A ∩ B) = P(A).P(B/A)

The formula P(A ∩ B) = P(A) . P(B/A) represents the probability of events A and B occurring simultaneously, given that event A has already occurred. It's based on the concept of conditional probability, which considers the likelihood of one event happening in relation to another

Let's break down the formula:

- P(A ∩ B): This represents the probability of both event A and event B occurring together.

- P(A): This represents the probability of event A occurring.

- P(B/A): This represents the conditional probability of event B occurring, given that event A has already occurred. In other words, it's the likelihood of event B happening after knowing that event A has happened.

Q12: If the consumption function passes through the origin and APC = MPC then it must be:

(a) Linear without any intercept

(b) Non linear without any intercept

(c) Linear with a negative intercept on the income axis

(d) Linear with a positive intercept on the consumption axis

Ans: a

Sol: The correct answer is Linear without any intercept.

The consumption function is a concept from Keynesian economics that describes the relationship between total consumer spending and gross national income. It is used to determine the level of consumer expenditure that occurs in an economy for different levels of disposable income.

The difference between APC and MPC:

- APC (Average Propensity to Consume) is calculated by dividing total consumption expenditure by total disposable income.

- MPC (Marginal Propensity to Consume) is calculated by dividing the change in consumption expenditure by the change in disposable income.

- APC is a measure of the proportion of disposable income that is typically spent by households, while MPC is a measure of the responsiveness of consumption to changes in disposable income.

- APC is a static measure, while MPC is a dynamic measure.

- APC is always less than or equal to 1, as total consumption expenditure cannot exceed total disposable income.

- MPC can be greater than 1, if the change in consumption expenditure is greater than the change in disposable income.

- APC is useful for understanding the overall consumption behavior of households, while MPC is useful for understanding how changes in disposable income affect consumption.

Q13: Find the producer's surplus when

Pd = 3x2 - 20x + 5

Ps = 15 + 9x (x is the quantity)

(a) 400

(b) 350

(c) 450

(d) 500

Ans: c

Sol: The correct answer is '450'To find the producer's surplus:

First, set Pd = Ps to find the equilibrium quantity:

- 3x2 - 20x + 5 = 15 + 9x

- 3x2 - 29x - 10 = 0

- Solve for x (quantity): x = 10

At x = 10, equilibrium price: P = 15 + 9x = 105

Producer's surplus is area above supply curve and below equilibrium price:

Surplus = (Equilibrium price × quantity) - Area under supply curve

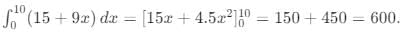

Area under supply curve:

Surplus = (105 × 10) - 600 = 1050 - 600 = 450

The calculation is correct, and the answer (c) is correct.

Q14: Which of the following is true in case of the non-marketed environmental resources?

(a) Non excludable and non-rival in consumption

(b) Excludable but not rival in consumption

(c) Excludable and rival in consumption

(d) Non-excludable but rival in consumption

Ans: a

Sol: The correct answer is Non excludable and non-rival in consumption.

Non-marketed environmental resources are typically non-excludable and non-rival in consumption. This means that it is difficult or impossible to prevent people from using these resources, and that one person's use of the resource does not diminish the availability of the resource for others.

- Excludability refers to the ability to prevent people from using a resource. Some environmental resources are excludable, such as national parks, which can be fenced in and visitors can be charged an entrance fee. However, many environmental resources are non-excludable, such as clean air and water. It is difficult or impossible to prevent people from breathing air or drinking water, even if they do not pay for it.

- Rivalry in consumption refers to the idea that one person's use of a resource diminishes the availability of the resource for others. Some environmental resources are rival in consumption, such as fish populations. If one person catches a fish, there is one fewer fish available for others to catch. However, many environmental resources are non-rival in consumption, such as clean air and water. One person's breathing of clean air does not diminish the availability of clean air for others.

Q15: Suppose 'X' places Rs. 8 value on one bread packet and 'Y' places Rs. 6 value on it. If there is no tax on bread, then price of bread packet is Rs. 5. so both X and Y choose to buy one packet each. Now suppose government levies a tax of Rs.. 2 per unit, the price of bread rises to Rs. 7. Then the deadweight loss and tax revenue collected respectively are :

(a) Rs. 1 and Rs. 2

(b) Rs. 2 and Rs. 4

(c) Rs. 2 and Rs. 2

(d) Rs. 1 and Rs. 4

Ans: a

Sol: The correct answer is Rs. 1 and Rs. 2

In this type of problem, deadweight loss refers to the decrease in economic efficiency that occurs when a good for which the market outcome is not Pareto optimal is taxed. The tax revenue is simply the amount of money collected by the government from the tax.

- Before the tax, 'X' and 'Y' both buy a packet of bread, each for Rs.5.

- After the tax of Rs.2 per unit is levied, the price of the bread rises to Rs.7.

After the tax is levied, 'X' still buys the bread because his value for it (Rs.8) is still more than the new price (Rs.7). However, 'Y' places a value of Rs.6 on the bread, which is less than the new price of Rs.7. Therefore, 'Y' chooses not to buy the bread.

- The tax revenue is the tax rate multiplied by the quantity sold. The tax rate is Rs.2 and one unit of bread is sold (to 'X'). Therefore, the tax revenue collected is Rs.2*1 = Rs.2.

The deadweight loss is the loss of economic activity caused by the tax. It's the value of the transaction that didn't happen because of the tax (the transaction involving 'Y'). 'Y' valued the bread at Rs.6 and the cost to produce the bread was Rs.5 (the original price before tax), so the deadweight loss is Rs.6 - Rs.5 = Rs.1.

To summarize, the tax revenue collected is Rs.2, and the deadweight loss is Rs.1

Q16: The component which distinguishes primary deficit from fiscal deficit is :

(a) Non-debt component of capital receipt

(b) Interest payment

(c) Debt component of capital receipt

(d) Revenue deficit

Ans: b

Sol: The correct answer is Interest payment.

The primary deficit is the difference between the government's total expenditure and its total revenue, excluding interest payments. The fiscal deficit is the difference between the government's total expenditure and its total revenue, including interest payments.

Therefore, the component that distinguishes primary deficit from fiscal deficit is interest payment. The primary deficit is calculated by subtracting interest payments from the fiscal deficit.

Q17: Which of the following is not an assumption or conclusion of the inflation targeting approach ?

(a) Interest rate is the major instrument of monetary policy

(b) Higher interest rate controls aggregate demand

(c) Inflation is a supply side phenomenon

(d) Quantity of money supply is not very effective in controlling inflation

Ans: c

Sol: The correct answer is Inflation is a supply-side phenomenon

- The inflation targeting approach is based on the assumption that inflation is primarily a demand-side phenomenon. It argues that inflation occurs when aggregate demand exceeds aggregate supply. In other words, when there is too much money chasing too few goods, prices will tend to rise.

Interest rate is the major instrument of monetary policy. This is a key assumption of the inflation-targeting approach. The central bank uses changes in interest rates to influence aggregate demand and control inflation.

A higher interest rate controls aggregate demand. This is a conclusion of the inflation-targeting approach. When the central bank raises interest rates, it becomes more expensive for businesses to borrow money. This can lead to a decrease in investment and hiring, which can slow down the economy and reduce aggregate demand.

Quantity of money supply is not very effective in controlling inflation. This is another conclusion of the inflation-targeting approach. While the quantity of money supply can have an impact on inflation, it is not a very precise or reliable tool for controlling inflation. The central bank has more direct control over inflation by using interest rates to influence aggregate demand.

Q18: In context of monetary policy, the sacrifice ratio refers to the _________

(a) Interest cost arising because of crowding out effect

(b) Loss of real value of money at the face of increasing inflation

(c) Output cost of reducing inflation

(d) Labour cost raising minimum wage

Ans: c

Sol: The correct answer is Output cost of reducing inflation.

The sacrifice ratio is a measure of the economic output that must be forgone to reduce inflation by one percentage point. It is calculated by dividing the percentage point reduction in inflation by the percentage point decline in real GDP.

Monetary policy is used to control inflation by raising or lowering interest rates. When the central bank raises interest rates, it makes it more expensive for businesses to borrow money, which can lead to a decrease in investment and economic growth. The sacrifice ratio is a way of measuring the trade-off between reducing inflation and maintaining economic growth.

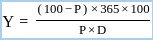

Q19: Marx refers to the concept of organic composition of capital. Which one of the following ratios is used for this (where C is constant capital, V is variable capital and S is surplus value)?

(a)

(b)

(c)

(d)

Ans: b

Sol: The correct answer is C/V

The organic composition of capital is the ratio of constant capital to variable capital, expressed as C/V. This ratio reflects the amount of capital invested in machinery, equipment, and raw materials (constant capital) compared to the amount invested in labor (variable capital).

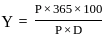

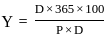

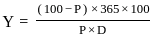

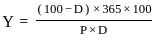

Q20: Which of the following formula is used to calculate the yield of treasury bills (T-bills) where

Y = Discounted yield

P = Price

D = Days to maturity

(a)

(b)

(c)

(d)

Ans: c

Sol: The correct answer is

The discount yield is calculated and returned when it is sold at a discount to its face value, expressed as a percentage. Discount yield is commonly used to calculate the yield on municipal notes, commercial paper, and treasury bills sold at a discount.

- Discount yield computes the expected return of a bond purchased at a discount and held until maturity.

- Discount yield is computed using a standardized 30-day month and 360-day year.

- This calculation is commonly used for evaluating Treasury bills and zero-coupon bonds

Q21: The faster growth and more equal distribution of income can be examined simultaneously by

(a) Gini ratio

(b) Poverty-weighted growth rate

(c) Kuznet curve

(d) None of the above

Ans: b

Sol: The correct answer is poverty-weighted growth rate (PWGR

The poverty-weighted growth rate (PWGR)

- It is a measure of economic growth that takes into account the distribution of income. It is calculated by multiplying the growth rate of income for each income quintile (the 20% of the population with the lowest income, the next 20%, and so on) by the weight of that quintile in the total population. The weights are chosen so that the poverty-weighted growth rate gives more weight to the growth of income for the poorest quintiles.

- The Gini ratio: also known as the Gini index or Gini coefficient, is a measure of statistical dispersion intended to represent the inequality of distribution of wealth, income, or any other measure of welfare.

- Kuznet curve:

Income inequality is not a constant phenomenon. It can change over time, depending on the stage of economic development and other factors.

There is no one-size-fits-all solution to income inequality. The best way to reduce income inequality will vary depending on the specific circumstances of each country.\

Government policies can play a role in reducing income inequality. By investing in social safety nets, education, and other programs, governments can help to create a more equitable society.

Q22: Equivalent variation for a price increase of a good can be interpreted as:

(a) Willingness to pay

(b) Willingness to accept

(c) Both 1 and 2

(d) None

Ans: a

Sol: The correct answer is Willingness to pay

- Equivalent variation (EV) is a measure used in economics to quantify the change in income needed to restore a consumer to their original utility level after a change in prices. Specifically, for a price increase of a good, the equivalent variation represents the amount of money a consumer would be willing to pay beforehand to avoid the price increase.

- This concept essentially captures the consumer's willingness to pay to maintain their initial level of utility when faced with a potential increase in the price of a good. It is a forward-looking measure that assesses how much a consumer values their current consumption bundle enough to avoid a deterioration in their welfare due to higher prices.

- Willingness to pay in this context means the amount of money the consumer is ready to give up to prevent the price rise and maintain their initial utility.

- Willingness to accept would typically be used to describe how much money a consumer would require to accept a worsening of their situation, which is not what EV measures in this scenario.

Hence, for a price increase of a good, the equivalent variation aligns with the concept of the consumer's willingness to pay to avoid that price increase.

Q23: According to the specific factors model, which of the following is correct?

(a) Trade benefits the factor specific to the export sector of each country but hurts the factor specific to the import-competing sectors with ambiguous effects on mobile factors

(b) Trade hurts the factor specific to the export sector of each country and also hurts the factor specific to the import-competing sectors, with ambiguous effects on mobile factors.

(c) Trade benefits the factor specific to the import sector of each country but hurts the factor specific to the export-competing sectors, with ambiguous effects on mobile factors.

(d) Trade benefits the factor specific to the export sector as well as import-competing sector of each country, with ambiguous effects on mobile factors.

Ans: a

Sol: The correct answer is Trade benefits the factor specific to the export sector of each country but hurts the factor specific to the import-competing sectors with ambiguous effects on mobile factors

- The benefits factors model is a variant of the Heckscher-Ohlin model that assumes that capital is specific to an industry, while labor is freely mobile between industries. In the specific factors model, trade benefits the factor specific to the export sector of each country.

Factors specific to the export sector: Trade benefits the factors specific to the export sector because it increases the demand for those factors. This is because the export sector expands as a result of trade. For example, if a country exports textiles, the demand for textile workers will increase as the country exports more textiles.

Factors specific to the import-competing sector: Trade hurts the factors specific to the import-competing sector because it decreases the demand for those factors. This is because the import-competing sector contracts as a result of trade. For example, if a country imports cars, the demand for car workers will decrease as the country imports more cars.

Mobile factors: The effects of trade on mobile factors are ambiguous. This is because mobile factors can move between industries in response to changes in demand. For example, if a country exports textiles and the demand for textile workers increases, textile workers can move from the import-competing sector to the export sector to take advantage of the higher wages.

Q24: ‘What does 'immiserising growth’ argued?

(a) Export-biased growth by poor nations would worsen their terms of trade so much that they would be worse off than if they had not grown at all

(b) Export-biased growth by rich nations would worsen their terms of trade so much that they would be worse off than if they had not grown at all

(c) Import-biased growth by poor nations would worsen their terms of trade so much that they would be worse off than If they had not grown at all

(d) Import-biased growth by Rich nations would worsen their terms of trade so much that they would be worsen off than if had not grown at all.

Ans: a

Sol: The correct answer is Export-biased growth by poor nations would worsen their terms of trade so much that they would be worse off than if they had not grown at all.

Immiserizing growth is a theoretical concept in economics that suggests that economic growth can, under certain conditions, lead to a decrease in a country's overall welfare. This phenomenon is most likely to occur in poor countries that rely heavily on exports of primary goods.

When a poor country experiences export-biased growth, it produces more of its export goods and sells them on the international market. This increased supply of goods can drive down the prices of these goods, which in turn worsens the country's terms of trade. The terms of trade are a measure of how much a country's exports are worth in terms of its imports. A worsening of the terms of trade means that the country has to export more goods to buy the same amount of imports.

Q25: Compensating variation for a price decrease of a good can be interpreted as :

(a) Willingness to pay

(b) Willingness to accept

(c) Both 1 and 2

(d) None

Ans: a

Sol: The correct answer is: Willingness to pay

Compensating variation is a concept in welfare economics used to measure the change in welfare or utility due to a change in prices. It represents the amount of money one would need to reach their initial level of utility after a price change.

Definition of Compensating Variation:

- Compensating variation (CV) is the amount of money that needs to be given to a consumer to compensate them for a change in the price of a good, keeping their utility level constant.

Price Decrease Interpretation:

- When the price of a good decreases, the compensating variation can be interpreted as the consumer's willingness to pay to maintain their initial level of utility despite the price change.

Willingness to Pay:

- Willingness to pay (WTP) is the maximum amount a consumer is willing to pay to acquire a good or to avoid a price increase.

- In the context of a price decrease, CV reflects how much the consumer would be willing to pay to return to the original price, indicating their preference for the lower price.

Other Related Points

Equivalent Variation:

- In contrast to compensating variation, equivalent variation (EV) measures the amount of money that would need to be taken away from a consumer before a price change to maintain their initial utility level.

Application in Policy Analysis:

- Compensating variation is often used in cost-benefit analysis and policy evaluations to assess the impact of price changes on consumer welfare.

Consumer Surplus:

- Compensating variation is related to consumer surplus, which measures the difference between what consumers are willing to pay for a good and what they actually pay.

Q26: Which of the following is not true in the case of externality?

(a) It is related to human interactions

(b) It is tied to consumer sovereignty

(c) It is based on higher order judgements of right and wrong

(d) It is an amoral concept

Ans: c

Sol: The correct answer is It is related to human interactions

Externalities are costs or benefits affecting parties not directly involved in a transaction. They are:

- (a) True: Externalities arise from human interactions (e.g., pollution affecting others).

- (b) True: Externalities can conflict with consumer sovereignty, as one’s actions impact others.

- (c) False: Externalities are an amoral concept, not based on higher-order judgments of right and wrong.

- (d) True: Externalities are amoral, as they describe economic effects without moral judgment.

Thus, the correct answer is (c).

Q27: Which of the following is an example of depreciation of natural capital?

(a) Restoring rivers rendered unusable due to dumping of industrial effluents

(b) Representation of areas that have been cleared for years of open-cut mining

(c) Pollution-control activities by the public sector such as municipal waste treatment

(d) Detoxifying unusable soils for urban or rural development

Ans: b

Sol: The correct answer is ‘Representation of areas that have been cleared for years of open-cut mining’

Depreciation of natural capital refers to the depletion or degradation of natural resources, reducing their value and utility.

- (a) Restoring rivers is a remedial action, not depreciation.

- (b) Open-cut mining clears land, degrading natural capital (e.g., soil, ecosystems), making it a clear example of depreciation.

- (c) Pollution-control activities (e.g., municipal waste treatment) mitigate environmental damage, not cause depreciation.

- (d) Detoxifying soils is a restoration effort, not depreciation.

Thus, the correct answer is (b).

Q28: Which of the following postulates the Gravity Model correctly ?

(a) The smaller and the closer the two countries are, the smaller the volume of trade between them is expected to be

(b) The larger and the closer the two countries are, the larger the volume of trade between them is expected to be.

(c) The larger and the closer the two countries are, the smaller the volume of trade between them is expected to be

(d) The smaller and farther the two countries are, the larger the volume of trade between them is expected to be.

Ans: b

Sol: The correct answer is The smaller and the closer the two countries are, the smaller the volume of trade between them is expected to be.

- The gravity model of trade is a simple economic model that predicts the volume of trade between two countries based on their economic sizes and the distance between them. The model is based on the idea that trade is like gravity.

- The gravity model is a simple but powerful tool that can be used to understand the patterns of trade between countries.

The gravity model predicts that the volume of trade between two countries is proportional to their economic sizes (GDP) and inversely proportional to the distance between them. Thus, larger and closer countries are expected to have larger trade volumes.

The correct answer is (b).

Q29: If the nominal tariff rate (t) on consumers of the final commodity is 10 per cent, the ratio of the cost of the imported put to the price of the final commodity in the absence of tariffs (ai) is = 0.8, and the nominal tariff rate on the imported input (ti) = 0, then find the rate of effective protection.

(a) 5%

(b) 8%

(c) 50%

(d) 10%

Ans: c

Sol: The correct answer is: 50%

The rate of effective protection measures the actual protection given to domestic producers by considering both the tariffs on final goods and the tariffs on imported inputs. It indicates the percentage by which the value-added in the domestic production process is increased due to the tariffs imposed on imported goods and inputs.

Nominal Tariff Rate (t):

- The nominal tariff rate on the final commodity is given as 10%.

Cost Ratio (ai):

- The ratio of the cost of the imported input to the price of the final commodity in the absence of tariffs is 0.8.

Tariff on Imported Input (ti):

- The nominal tariff rate on the imported input is 0%.

The formula for calculating the rate of effective protection (ERP) is:

ERP = (t - ai * ti) / (1 - ai)

Substituting the given values:

t = 0.10 (10%)

ai = 0.8

ti = 0.0 (0%)

ERP = (0.10 - 0.8 * 0) / (1 - 0.8) = 0.10 / 0.2 = 0.50 = 50%

Other Related Points

Understanding Effective Protection:

- Effective protection considers the impact of tariffs on both the final product and the inputs used in production, providing a more accurate measure of protection for domestic industries compared to nominal tariffs.

Value-Added Concept:

- Effective protection focuses on the value-added by domestic producers. If tariffs on inputs are lower than tariffs on the final product, domestic producers are effectively more protected.

Policy Implications:

- Governments use effective protection to assess the true level of protection provided to domestic industries and to design tariff structures that promote domestic production and economic development.

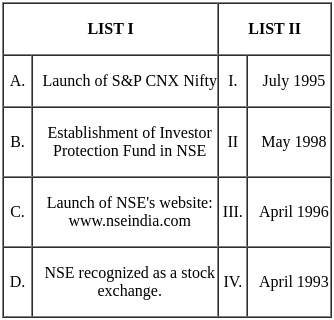

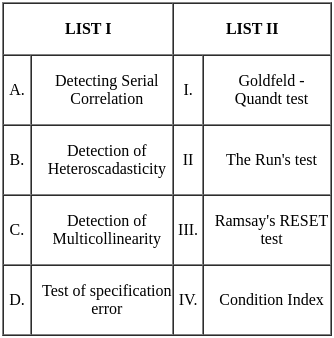

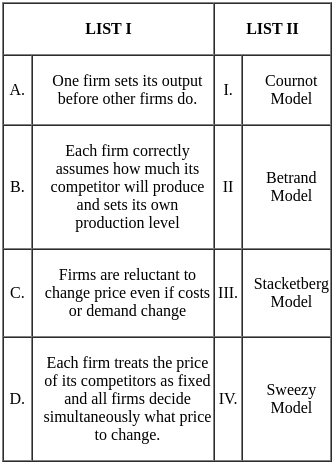

Q30: Match List I with List II

Choose the correct answer from the options given below:

(a) A - III, B - II, C - I, D - IV

(b) A - III, B - I, C - II, D - IV

(c) A - II, B - IV, C - III, D - I

(d) A - III, B - II, C - IV, D - I

Ans: b

Sol: A - III, B - I, C - II, D - IV is correct answer.

The given options refer to different milestones in the history of the National Stock Exchange (NSE) of India. Let's match each event with its respective correct date:

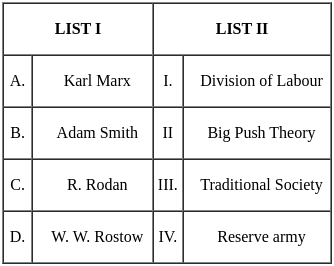

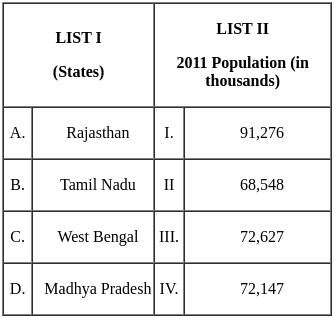

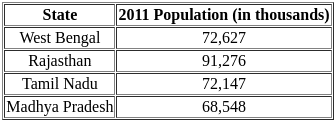

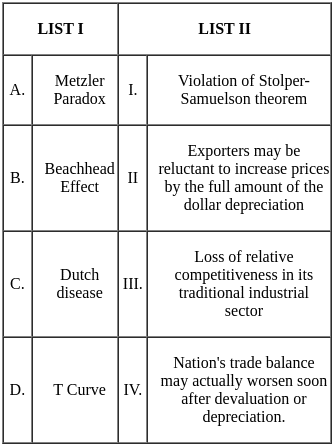

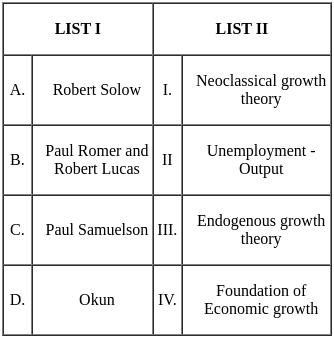

Q31: Match List I with List II

Choose the correct answer from the options given below:

(a) A - III, B - II, C - I, D - IV

(b) A - IV, B - I, C - III, D - II

(c) A - I, B - III, C - IV, D - II

(d) A - IV, B - I, C - II, D - III

Ans: d

Sol: The correct answer is A - IV, B - I, C - II, D - III

- The reserve army of labor is a crucial component of Marx's theory of surplus value. According to Marx, capitalists extract surplus value from workers by paying them less than the full value of their labor. This surplus value is what allows capitalists to accumulate profits.

- The concept of the division of labor has been explored by various thinkers throughout history, but it's widely attributed to Adam Smith, an 18th-century Scottish economist and philosopher. In his seminal work, "An Inquiry into the Nature and Causes of the Wealth of Nations," published in 1776, Smith elaborated on the division of labor and its role in economic advancement.

- The Big Push Theory was developed by Paul N. Rosenstein-Rodan, a Polish-American economist, in his 1943 paper titled "Notes on the Theory of the 'Big Push.'" The theory suggests that economic development in underdeveloped countries requires a significant initial investment to overcome the low levels of productivity and infrastructure that hinder growth.

- The term "traditional society" is a broad concept that has been used by various sociologists, anthropologists, and historians to describe societies that share certain characteristics.

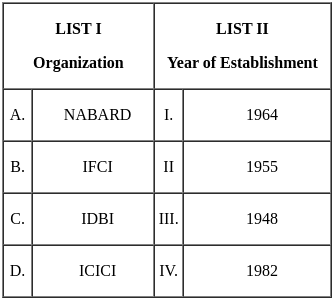

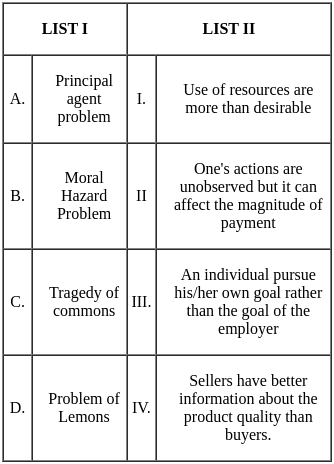

Q32: Match List I with List II

Choose the correct answer from the options given below:

(a) A - II, B - IV, C - I, D - III

(b) A - IV, B - II, C - I, D - III

(c) A - II, B - I, C - IV, D - III

(d) A - III, B - I, C - IV, D - II

Ans: a

Sol: The correct answer is A - II, B - IV, C - I, D - III

- A census is a systematic procedure of acquiring, recording, and calculating population information about the members of a given population. It is the official count of all people in a country or region. Censuses are conducted at regular intervals, typically every ten years, and provide detailed information about the population's age, sex, ethnicity, religion, occupation, education, housing, and other characteristics.

- In India, the first census was conducted in 1872 under Viceroy Lord Mayo. The first complete census was taken in 1881.

Q33: Match List I with List II

Choose the correct answer from the options given below:

(a) A - I, B - IV, C - III, D - II

(b) A - II, B - I, C - IV, D - III

(c) A - IV, B - III, C - I, D - II

(d) A - III, B - II, C - I, D - IV

Ans: c

Sol: The correct answer is

- NABARD - The National Bank for Agriculture and Rural Development. It is an Indian governmental agency responsible for the policy, planning, and operations that promote agriculture and rural development in India. It provides financial and other support to farmers, small-scale industries, and other such businesses. Established on 12 July 1982.

- IFCI - The Industrial Finance Corporation of India. It's the first developed financial institution in India, established in 1948. The primary aim of IFCI is to provide medium and long-term financial assistance to large-scale industries, especially when normal banking institutions are unable to do so.

- IDBI - Industrial Development Bank of India. Established in 1964 by an Act of Parliament, IDBI was intended to provide credit and other financial facilities for the development of India's fledgling industrial sector. It is currently one of the main commercial banks owned by the Indian government.

- ICICI - The Industrial Credit and Investment Corporation of India. Established in 1955, ICICI Bank offers a wide range of banking products and services to corporate and retail customers. It is one of India's largest private-sector banks.

Q34: According to the IMF's World Economic Outlook report, arrange the estimated real GDP Growth rate (YOY) of the following countries for the year 2021 in descending order.

A. USA

B. Germany

C. United Kingdom

D. China

E. India

Choose the correct answer from the options given below:

(a) D, E, C, B, A

(b) E, D, C, A, B

(c) E, C, D, A, B

(d) D, E, B, C, A

Ans: b

Sol: The correct answer is E, D, C, A, B

According to the IMF’s World Economic Outlook (October 2021), the estimated real GDP growth rates for 2021 are: India (9.5%), China (8.0%), UK (7.4%), USA (5.9%), Germany (2.9%). Arranged in descending order: E, D, C, A, B. The correct answer is (b).

The global economic recovery is continuing, even as the pandemic resurges. The fault lines opened up by COVID-19 are looking more persistent—near-term divergences are expected to leave lasting imprints on medium-term performance. Vaccine access and early policy support are the principal drivers of the gaps.

The global economy is projected to grow 5.9 percent in 2021 and 4.9 percent in 2022, 0.1 percentage point lower for 2021 than in the July forecast. The downward revision for 2021 reflects a downgrade for advanced economies—in part due to supply disruptions—and for low-income developing countries, largely due to worsening pandemic dynamics. This is partially offset by stronger near-term prospects among some commodity-exporting emerging market and developing economies. Rapid spread of Delta and the threat of new variants have increased uncertainty about how quickly the pandemic can be overcome. Policy choices have become more difficult, with limited room to maneuver.

These figures have been published in the official report published by IMF for year 2021.

Q35: Arrange the Nobel laureates in Economics as per their year of receiving award in descending order.

A. Amartya Sen

B. Paul Krugman

C. James Tobin

D. Friedrich Hayek

E. Milton Friedman

Choose the correct answer from the options given below:

(a) A, B, D, C, E

(b) E, C, A, B, D

(c) A, C, E, D, B

(d) B, A, C, E, D

Ans: d

Sol: The correct answer is B, A, C, E, D

- Amartya Sen was awarded the 1998 Nobel Prize in Economic Sciences for his contributions to welfare economics and social choice theory and for his interest in the problems of society's poorest members.

- Paul Krugman was awarded the 2008 Nobel Prize in Economic Sciences for his work associated with new trade theory and the New Economics Geography.

- James Tobin an American economist, was awarded the Nobel Prize in Economic Sciences in 1981.

- Friedrich Hayek an economist and philosopher, was awarded the Nobel Prize in Economic Sciences in 1974.

- Milton Friedman an American economist, was awarded the Nobel Prize in Economic Sciences in 1976.

Q36: Arrange the following in descending order on the basis of year of starting the scheme

A. Jal Jeevan mission

B. Swachh Bharat Mission (Gramin)

C. Pradhan Mantri Awas Yojana (Gramin)

D. Pradhan Mantri Sadak Yojana (Gramin)

E. Pradhan Mantri Koushal VikashYojana

Choose the correct answer from the options given below:

(a) D,B,E,C,A

(b) C, A, D, B, E

(c) B, E, C, A, D

(d) C, D, B, E, A

Ans: a

Sol: According to official answer key, this question was dropped because none of the options matched correct chronology.

D,B,E,C,A is the correct answer.

Each of these schemes were initiated at different times by the government of India. Here they are arranged in descending order based on their start year:

- D. Pradhan Mantri Sadak Yojana (Gramin): This scheme was launched by the Government of India on December 25, 2000. It aims to provide all-weather road connectivity to unconnected villages.

- B. Swachh Bharat Mission (Gramin): The Swachh Bharat Mission is a nation-wide campaign in India that aims to clean up the streets, roads and infrastructure of India's cities, towns, and rural areas. The campaign was officially launched on October 2, 2014.

- E. Pradhan Mantri Koushal Vikash Yojana: This was launched in July 2015 under the Ministry of Skill Development & Entrepreneurship (MSDE) with the aim of training over 40 crore individuals in different industry-relevant skills by 2022.

- C. Pradhan Mantri Awas Yojana (Gramin): The mission was launched on November 20, 2016 with an aim to provide affordable housing to the rural poor.

- A. Jal Jeevan mission: The Jal Jeevan mission was launched on August 15, 2019 with the aim to provide tap water supply to rural households by 2024.

Q37: Arrange the followings in ascending order on the basis of Fund Allocation (Budget 2022-23)

A. Ministry of Railways

B. Ministry of Defence

C. Ministry of Agriculture and Farmers Welfare

D. Ministry of Road Transport and Highways

E. Ministry of Rural Development.

Choose the correct answer from the options given below:

(a) A, C, D, B, E

(b) E, B, C, D, A

(c) C, E, A, D, B

(d) B, C, D, E, A

Ans: c

Sol: The correct answer is C, E, A, D, B

A budget is a financial plan that outlines how a government, organization, or individual will spend their money over a specific period of time, typically a year. It is a crucial tool for allocating resources, ensuring financial stability, and tracking progress towards goals.

The ministries based on the fund allocation for the Budget 2022-23:

- Ministry of Rural Development - 160,000 crores

- Ministry of Road Transport and Highways - 191,813 crores

- Ministry of Agriculture and Farmers Welfare - 200,000 crores

- Ministry of Defence - 523,600 crores

- Ministry of Railways - 1,400,000 crores

Based on the Union Budget 2022-23, fund allocations are: Defence (~₹5,25,166 crore), Road Transport and Highways (~₹1,99,108 crore), Railways (~₹1,40,367 crore), Rural Development (~₹1,38,204 crore), Agriculture and Farmers Welfare (~₹1,24,000 crore). Arranged in descending order: B, D, A, E, C. The correct answer is (c).

Q38: Arrange the following sources of revenue as per their share of contribution to total revenue in Union Budget 2022-23 in descending order.

A. Custom Duty

B. Income Tax

C. GST

D. Union Excise Duty

E. Non debt capital receipts.

Choose the correct answer from the options given below:

(a) E, B, C, D, A

(b) E, C, B, D, A

(c) C, B, D, A, E

(d) C, B, A, D, E

Ans: c

Sol: The correct answer is C, B, D, A, E

Based on the Union Budget 2022-23, approximate revenue shares are: GST (~31%), Income Tax (~23%), Union Excise Duty (~12%), Customs Duty (~8%), Non-debt Capital Receipts (~3%). Arranged in descending order: C, B, D, A, E. The correct answer is (c).

Here's a breakdown of the revenue contribution of each source:

- GST: 17% - The Goods and Services Tax (GST) is the largest source of revenue for the Indian government, accounting for 17% of total revenue in the Union Budget 2022-23.

- Income Tax: 15% - Income Tax is the second-largest source of revenue, contributing 15% to the total revenue.

- Custom Duty: 4% - Custom Duty, levied on imported goods, contributes 4% to the total revenue.

- Union Excise Duty: 7% - Union Excise Duty, levied on domestically manufactured goods, contributes 7% to the total revenue.

- Non-debt Capital Receipts: 2% - Non-debt Capital Receipts, which include receipts from disinvestment, dividends, and external grants, contribute 2% to the total revenue

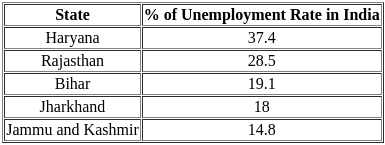

Q39: According to CMIE data (September 2022). arrange the states in descending order based on unemployment rate

A. Haryana

B. Rajasthan

C. Jammu Kashmir

D. Jharkhand

E. Tripura.

Choose the correct answer from the options given below:

(a) A, C, D, E, B

(b) B, C, A, D, E

(c) A, B, C, D, E

(d) B, C, A, E, D

Ans: d

Sol: The correct answer is B, C, A, E, D

The unemployment rate is the percentage of the labor force that is unemployed. It is a measure of the health of an economy, as it reflects the number of people who are willing and able to work but are unable to find a job.

The unemployment rate can vary for a number of reasons, including:

- Economic conditions: When the economy is doing well, there are more jobs available and the unemployment rate is lower. When the economy is doing poorly, there are fewer jobs available and the unemployment rate is higher.

- Demographic factors: The unemployment rate can also be affected by demographic factors, such as the age and education level of the population. For example, young people and people with less education are typically more likely to be unemployed.

- Government policy: Government policies can also affect the unemployment rate. For example, policies that promote job creation can help to lower the unemployment rate, while policies that restrict immigration can make it harder for people to find work.

Other Related Points

- According to the Centre for Monitoring Indian Economy (CMIE), India’s unemployment rate in March 2023 was 8.11%.

- The unemployment rate in urban India was 7.93%, while the unemployment rate in rural India was 7.44%.

- The states with the highest unemployment rates in India are Haryana, Rajasthan, Bihar, Jharkhand, Jammu & Kashmir.

- The state with the highest unemployment rate among union territories in India is Delhi.

- The unemployment rate in India rose to 8.30% in December from 8.00% in November. This was the highest level in 16 months...

- Unemployment rate in India State-wise 2023:

Q40: Arrange the following policy rate (as on 31-12-2022) of the RBI in the descending order of their magnitude.

A. Repo rate

B. Bank rate

C. CRR

D. SLR

E. Reserve repo Rate.

Choose the correct answer from the options given below:

(a) A, B, D, C, E

(b) D, A, B, C, E

(c) B, D, A, E, C

(d) D, B, A, C, E

Ans: d

Sol: The correct answer is D, B, A, C, E.

As of 31-12-2022, RBI policy rates are:

SLR (18%),

Bank Rate (6.75%),

Repo Rate (6.5%),

CRR (4.5%),

Reverse Repo Rate (3.35%).

Arranged in descending order: D, B, A, C, E. The correct answer is (d).

Q41: Arrange the states in ascending order based on population who are multidimensionally poor as per NITI Aayog Report 2021.

A. Punjab

B. Kerala

C. Sikkim

D. Goa

E. Tamil Nadu.

Choose the correct answer from the options given below:

(a) B, D, C, E, A

(b) D, E, B, C, A

(c) A, E, D, B, C

(d) C, B, A, D, E

Ans: a

Sol: The correct answer is B, D, C, E, A

NITI Aayog, or the National Institution for Transforming India, is a think tank of the Government of India. It was established in 2015 as a replacement for the Planning Commission. NITI Aayog's mission is to provide strategic and policy advice to the Government of India. It also serves as a platform for coordination between the central and state governments.

According to the NITI Aayog National MPI Baseline Report 2021, the percentage of the population that is multidimensionally poor is: Kerala (0.71%), Goa (3.76%), Sikkim (3.82%), Tamil Nadu (4.89%), Punjab (5.59%). Arranged in ascending order: B, D, C, E, A. The correct answer is (a).

Q42: Arrange the following chronologically in order to their year of first occurrence starting from oldest:

A. Liquidity Preference Theory

B. Multiplier by R.F. Kahn

C. Division of Labour. Adam Smith

D. Quantity theory of Money, Fisher

E. Great Depression.

Choose the correct answer from the options given below:

(a) C, E, B, A, D

(b) E, D, C, B, A

(c) B, C, D, E, A

(d) B, A, D, C, E

Ans: a

Sol: The correct answer is option 1) C, E, B, A, D.

Chronological Order of Economic Theories and Events

Division of Labour by Adam Smith Hence, C is the oldest event.

- Adam Smith's concept of the Division of Labour was introduced in his seminal work "The Wealth of Nations," published in 1776.

Quantity Theory of Money by Fisher Hence, D comes after C.

- Irving Fisher formulated the Quantity Theory of Money, which was extensively developed and popularized in the early 20th century, particularly around 1911.

Multiplier by R.F. Kahn Hence, B follows D.

- R.F. Kahn introduced the concept of the Multiplier in 1931, which was further developed by Keynes.

Liquidity Preference Theory by Keynes Hence, A comes after B.

- John Maynard Keynes introduced the Liquidity Preference Theory in 1936 in his work "The General Theory of Employment, Interest, and Money."

Great Depression Hence, E comes last in the chronological order provided.

- The Great Depression was a severe global economic depression that took place mostly during the 1930s, beginning in the United States in 1929.

Other Related Points

Division of Labour

- This concept refers to the separation of tasks in any system so that participants may specialize.

- It is a key element in the work of Adam Smith and remains a foundational principle in economics.

Quantity Theory of Money

- This theory suggests that the general price level of goods and services is directly proportional to the amount of money in circulation.

Multiplier

- The multiplier effect explains how an initial change in spending leads to a larger change in overall economic activity.

Liquidity Preference Theory

- This theory explains the relationship between the interest rate and the demand for money, arguing that people prefer to hold their wealth in liquid form.

Great Depression

- The Great Depression was a period of worldwide economic downturn, with widespread unemployment, poverty, and significant economic disruption.

Q43: Arrange the following organizations as per their years of establishment starting from the oldest.

A. WTO

B. ADB

C. UNCTAD

D. World Bank

E. WIPO.

Choose the correct answer from the options given below:

(a) D, C, B, E, A

(b) D, B, C, E, A

(c) D, B, C, A, E

(d) D, B, A, C, E

Ans: a

Sol: The correct answer is D, C, B, E, A

- The World Bank was established in 1944 at the Bretton Woods Conference along with the International Monetary Fund (IMF). The World Bank's most recent stated goal is the reduction of poverty. The World Bank helps developing nations implement development projects. World Bank headquarters is in Washington, D.C., United States.

- The Asian Development Bank (ADB) is a regional development bank established on December 19, 1966, with its headquarters in Mandaluyong, Metro Manila, Philippines. The bank aims to promote social and economic development in Asia and the Pacific through inclusive economic growth, environmentally sustainable growth, and regional integration. It provides loans, grants, and technical assistance to its members, which include 68 countries, 48 from Asia and the Pacific, and 20 from outside the region.

- The United Nations Conference on Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the General Assembly of the United Nations to provide an institutional framework for international trade negotiations and to support developing countries in their efforts to trade more effectively on international markets.

- The World Intellectual Property Organization (WIPO) is a specialized agency of the United Nations that plays a leading role in developing and promoting international intellectual property (IP) law. It was established in 1967 and is headquartered in Geneva, Switzerland.

- The World Trade Organization (WTO) is an intergovernmental organization that regulates and facilitates international trade. It was established in 1995 and is headquartered in Geneva, Switzerland. The WTO is the only global international organization dealing with the rules of trade between nations.

The World Trade Organization (WTO) is an intergovernmental organization that regulates and facilitates international trade. It was established in 1995 and is headquartered in Geneva, Switzerland. The WTO is the only global international organization dealing with the rules of trade between nations

Q44: Given below are two statements :

Statement I : Countries always want to have foreign markets open for their exporters. But if a country limits access to its own market, foreign countries may take action to limit access to their own market.

Statement II : Trade agreement can help lower barrier to international commerce, but countries still have to believe that other countries are "playing fair".

In the light of the above statements, choose the correct answer from the options given below:

(a) Both Statement I and Statement II are true

(b) Both Statement I and Statement II are false

(c) Statement I is true but Statement II is false

(d) Statement I is false but Statement II is true

Ans: a

Sol: The correct answer is Both Statements I and Statement II are true.

Let's analyze the Statement:

- Countries often seek to protect their markets while taking advantage of others, leading to trade protections like tariffs. If a country eliminates reciprocal trade concessions and restricts its market, other countries may react similarly to protect their interests, leading to retaliatory trade restrictions.

- Trade agreements aim to lower barriers to international trading. They establish rules to ensure fair treatment of all participants, but countries must trust that others are adhering to those rules -- i.e., "playing fair."

Q45: Given below are two statements: One is labelled as Assertion A and the other is labelled as Reason R.

Assertion A: A form of market failure results when products of different qualities are sold at a single price.

Reason R : A buyer and a seller possess different information about the product transacted.

In the light of the above statements, choose the most appropriate answer from the options given below:

(a) Both A and R are true and R is the correct explanation of A

(b) Both A and R are true but R is not the correct explanation of A

(c) A is true but R is false

(d) A is false but R is true

Ans: a

Sol: The correct answer is Both A and R are true and R is the correct explanation of A.

- Form a market failure indeed occurs when products of different qualities are sold at a single price. This phenomenon is known as adverse selection or the lemons problem. It arises when sellers have more information about the quality of their products than buyers do. This information asymmetry leads to a situation where buyers are unwilling to pay a high price for a product, even if it is of high quality, because they fear that they are more likely to get a low-quality product.

- As a result, the market is flooded with low-quality products, driving out high-quality ones, and causing market inefficiency.

Q46: Given below are two statements :

Statement I : Capital deepening is the process by which capital grows at a faster rate than labour and the capital labour ratio rises.

Statement II : The growth of output per worker is result of technological change which decreases output per worker for a given capital/labour ratio.

In the light of the above statements, choose the most appropriate answer from the options given below:

(a) Both Statement I and Statement II are correct

(b) Both Statement I and Statement II are incorrect

(c) Statement I is correct but Statement II is incorrect

(d) Statement I is incorrect but Statement II is correct

Ans: c

Sol: The correct answer is Statement I is correct but Statement II is incorrect

Let's analyze the both statements:

- Capital deepening refers to an increase in the amount of capital per worker in an economy. This happens when capital investment grows more rapidly than the labor force, leading to a rise in the capital-to-labor ratio.

- Technological change usually leads to an increase in output per worker, not a decrease. Technological advancements typically result in enhanced efficiency and productivity, allowing for a higher output per worker for a given capital/labor ratio.

Q47: Given below are two statements :

Statement I : When the level of investment is itself determined within the system then the effectiveness of monetary policy is enhanced by an elastic investment and inelastic liquidity preference schedule, whereas the opposite holds for the effectiveness of fiscal policy.

Statement II : Monetary policy, by accommodating fiscal policy may forestall the crowding out effect.

In the light of the above statements, choose the correct answer from the options given below:

(a) Both Statement I and Statement II are true

(b) Both Statement I and Statement II are false

(c) Statement I is true but Statement II is false

(d) Statement I is false but Statement II is true

Ans: a

Sol: The correct answer is Both Statement I and Statement II are true.

- Statement I is true because an elastic investment schedule means that investment is sensitive to changes in interest rates. An inelastic liquidity preference schedule means that the demand for money is not sensitive to changes in interest rates. Therefore, when the level of investment is itself determined within the system, an elastic investment schedule and inelastic liquidity preference schedule will make monetary policy more effective, as changes in interest rates will have a greater impact on investment and a smaller impact on the demand for money. Conversely, fiscal policy will be less effective, as changes in government spending or taxes will have a smaller impact on investment.

- Statement II is also true because the crowding out effect is a phenomenon in which an increase in government spending leads to an increase in interest rates, which can then crowd out private investment. Monetary policy can accommodate fiscal policy by increasing the money supply, which can help to offset the increase in interest rates caused by the increase in government spending. Therefore, monetary policy can help to forestall the crowding out effect.

Q48: Given below are two statements :

Statement I : The IS curve is negatively sloped because an increase in the interest rate reduces planned investment spending and therefore reduces the equilibrium level of income.

Statement II : The smaller the multiplier and the less sensitive investment spending is to changes in the interest rate, the steeper is the IS curve.

In the light of the above statements, choose the correct answer from the options given below:

(a) Both Statement I and Statement II are correct

(b) Both Statement I and Statement II are incorrect

(c) Statement I is correct but Statement II is incorrect

(d) Statement I is incorrect but Statement II is correct

Ans: a

Sol: The correct answer is Both Statement I and Statement II are correct.

Let's analyze the statement:

- The IS (Investment-Saving) curve, part of the IS-LM model in macroeconomics, is indeed negatively sloped. Higher interest rates, all else being equal, make borrowing more expensive which tends to reduce investment spending, thus leading to lower overall income and output.

- This is also true. The steepness of the IS curve is determined by the responsiveness of investment to changes in the interest rate and the size of the multiplier. If the multiplier is small, or if the investment is less sensitive to interest rate changes, then changes in the interest rate will have a smaller effect on income. Therefore, the IS curve is steeper

Q49: The demand function for good A is given by QA = 100 - 2PA + 0.2 Y + 0.3 PB. Find the income elasticities of demand PA = 6, Y = 500, PB = 10

(a) 0.06

(b) 0.02

(c) 0.52

(d) -0.06

Ans: c

Sol: The correct answer is: 0.52.

The demand function for good A is expressed as QA = 100 - 2PA + 0.2Y + 0.3PB. To determine the income elasticity of demand, we need to calculate how the quantity demanded of good A (QA) responds to changes in income (Y). The income elasticity of demand measures the responsiveness of demand to a change in income, and it is calculated using the following formula:

Income Elasticity of Demand (EY) = (ΔQA / QA) / (ΔY / Y)

Where:

- ΔQA: Change in quantity demanded

- QA: Quantity demanded at a specific level of income

- ΔY: Change in income

- Y: Current income level

Let's calculate the income elasticity step by step.

Step 1: Calculate QA using the demand function:

- Substituting PA = 6, Y = 500, and PB = 10 into the demand function:

- QA = 100 - 2(6) + 0.2(500) + 0.3(10)

- QA = 100 - 12 + 100 + 3 = 191

Step 2: Calculate the change in QA with respect to a change in income (Y):

- The coefficient of Y in the demand function is 0.2, which means for every unit increase in income, QA increases by 0.2 units.

Step 3: Calculate Income Elasticity:

- Using the previously mentioned elasticity formula:

- EY = (ΔQA / QA) / (ΔY / Y)

- Assuming a small change in income (ΔY = 1):

- EY = (0.2 / 191) / (1 / 500)

- EY = (0.2 * 500) / 191 = 100 / 191 ≈ 0.52

Other Related Points

Understanding Income Elasticity:

- A positive income elasticity indicates that the good is a normal good; as income increases, the demand for good A increases.

- An elasticity of 0.52 suggests that demand for good A is relatively inelastic concerning income changes, meaning that demand increases at a lower rate than income.

Application of Elasticity:

- Income elasticity is crucial for businesses to understand market behavior and forecast demand changes based on economic trends.

- It aids in making informed pricing and production decisions to align with consumer income changes.

Market Implications:

- Policy-makers can use income elasticity insights to design economic policies that target low-income groups effectively and enhance welfare through appropriate interventions.

Q50: A player tosses two fair coins. He wins Rs. 5 if 2 heads occur, Rs 2 if 1 head occurs and Rs. 1 if no head occurs. Find his expected gain.

(a) Rs. 2

(b) Rs. 2.25

(c) Rs. 2.75

(d) Rs. 2.50

Ans: d

Sol: Expected gain is Rs. 2.50

To find the expected gain in this scenario, we first list all the possible outcomes of tossing two fair coins and then calculate the probability of each outcome.

We'll multiply each outcome's probability by the corresponding gain and sum these products to get the expected gain.

Let's denote the outcomes as follows:

HH = Both coins show heads

HT or TH = One coin shows heads, and the other shows tails

TT = Both coins show tails

Since the coins are fair, the probability of landing a head (H) or a tail (T) for any single toss is 0.5.

Now, let's calculate the probability of each outcome:

Probability of getting 2 heads (HH): (0.5 \times 0.5 = 0.25)

Probability of getting 1 head (HT or TH): There are two ways this can happen (HT or TH), so the probability is (0.5 \times 0.5 + 0.5 \times 0.5 = 0.5)

Probability of getting no heads (TT): (0.5 \times 0.5 = 0.25)

Next, we multiply each probability by the corresponding gain.

Gain for 2 heads = Rs. 5, Probability = 0.25. So, expected gain = (5 \times 0.25 = Rs.\ 1.25)

Gain for 1 head = Rs. 2, Probability = 0.5. So, expected gain = (2 \times 0.5 = Rs.\ 1.00)

Gain for no heads = Rs. 1, Probability = 0.25. So, expected gain = (1 \times 0.25 = Rs.\ 0.25)

Finally, to find the total expected gain, we sum these expected gains: [Rs.1.25 (for HH) + Rs. 1.00 (for HT or TH) + Rs. 0.25 (for TT) = Rs. 2.50.

Therefore, the player's expected gain from tossing two fair coins under the given conditions is Rs. 2.50.

Q51: A card is thrown from a well shuffled pack of playing cards. Find the probability that it is either a diamond or a king.

(a) 17/52

(b) 16/52

(c) 18/52

(d) 15/52

Ans: b

Sol: The correct answer is 16/52

- A standard deck of playing cards contains 52 cards: 4 suits (hearts, diamonds, clubs, and spades) with 13 cards each (Ace through 10, and the face cards Jack, Queen, and King).

- To find the probability that a card drawn is either a diamond or a king from a well-shuffled pack of 52 playing cards, we'll follow these steps:

- Total number of possible outcomes: The deck has 52 cards.

- Favorable outcomes for a diamond: There are 13 diamonds in a deck.

- Favorable outcomes for a king: There are 4 kings in a deck.

- However, there's an overlap in our count since one of the kings is also a diamond (the King of Diamonds). To ensure we don't count this card twice, we need to subtract it from our total count of favorable outcomes.

- Total number of favorable outcomes = Number of diamonds + Number of kings - Overlap (King of Diamonds)

- Total favorable outcomes = 13 (diamonds) + 4 (kings) - 1 (King of Diamonds)

- Total favorable outcomes = 16

- The probability (P) of drawing either a diamond or a king is the total number of favorable outcomes divided by the total number of possible outcomes. It becomes 16/52

Q52: Who was the chairman of 14th Finance Commission in India ?

(a) Dr. Vijay Kelkar

(b) Dr Y.V. Reddy

(c) Dr. C. Rangarajan

(d) Dr. N.K. Singh

Ans: b

Sol: The correct answer is 'Dr Y.V. Reddy'

The 14th Finance Commission was constituted in January 2013, chaired by Dr. Y.V. Reddy, with recommendations for 2015–2020. Other options:

- (a) Dr. Vijay Kelkar: 13th Finance Commission (2010–2015).

- (c) Dr. C. Rangarajan: 12th Finance Commission (2005–2010).

- (d) Dr. N.K. Singh: 15th Finance Commission (2021–2026).

Correct answer: (b) Dr. Y.V. Reddy.

Other Related Points

Overview of Other Options:

Dr. Vijay Kelkar:

- He was the chairman of the 13th Finance Commission, which covered the period from 2010 to 2015.

Dr. C. Rangarajan:

- He was the chairman of the 12th Finance Commission, which covered the period from 2005 to 2010.

Dr. N.K. Singh:

- He was the chairman of the 15th Finance Commission, which covers the period from 2020 to 2025.

Q53: Zamindari Tenure was introduced by :

(a) Thomas Munro

(b) Lord Cornwallis

(c) H. Venkatasubbiah

(d) G. Myrdal

Ans: b

Sol: The correct answer is Lord Cornwallis

- Zamindari Tenure was introduced by Lord Cornwallis in 1793 during British rule in India. The system aimed to streamline revenue collection by establishing landlords, known as zamindars, as intermediaries between the British government and the peasants.

- To simplify the process of revenue collection: The British administration sought to establish a stable and efficient system for collecting land revenue.

- To create a class of loyal intermediaries: The zamindars were expected to act as intermediaries between the British government and the peasants.

- To promote agriculture: The British believed that private ownership of land would incentivize investment in agriculture and increase productivity.

Q54: ‘Which of the followings are true about a fair game or fair bet ?

A. The entry of a fair bet is zero

B. The person who accepts fair bet is said to be risk lover

C. expected value of income from the bet is equal to the same amount of income with certainty

D. The person who refuses a fair bet is said to be risk neutral

E. The person who refuses a fair bet is said to be risk averse.

Choose the correct answer from the options given below:

(a) A and C only

(b) B and E only

(c) C and D only

(d) C and E only

Ans: d

Sol: The correct answer is C and E only

In discussing the characteristics and implications of participating in a fair game or bet, key definitions and personality types related to risk preferences are considered. A fair bet is defined as a gamble where the expected value of the net winnings is zero. Let's look at each statement:

A. This statement seems to intend to say "The expected value of a fair bet is zero," which is true for a fair bet since the expected value of winnings minus losses sums to zero. However, the phrasing "entry of a fair bet" is unclear but might be interpreted in context as referring to the expected value.

B. The statement that a person who accepts a fair bet is a risk lover is accurate. Risk lovers are individuals who derive utility from the gamble itself, beyond the expected monetary gain. They are willing to participate in a fair (or even unfair) bet because the gamble increases their utility.

C. True, the expected value from a fair bet is equal to the same amount of income with certainty, by the definition of a fair bet.

D. The statement incorrectly attributes risk neutrality to the refusal of a fair bet. A risk-neutral person is indifferent between a certain outcome and a gamble with the same expected value. Therefore, a risk-neutral person might or might not accept a fair bet based on factors other than risk preference, making this statement inaccurate for describing refusal of a fair bet.