ICAI Notes- Unit 1: Basic Accounting Procedures - Journal Entries - 2 - CA Foundation PDF Download

1.7 Traditional Approach

Under traditional approach of recording transactions one should first understand the term debit and credit and their rules. The term debit and credit have already been explained in para 1.4 of this Unit. Transactions in the journal are recorded on the basis of the rules of debit and credit only. For the purpose of recording, these transactions are classified in three groups:

(i) Personal transactions.

(ii) Transactions related to assets and properties.

(iii) Transactions related to expenses, losses, income and gains.

1.7.1 Classification of Accounts

(i) Personal Accounts: Personal accounts relate to persons, trade receivables or trade payables. Example would be the account of Ram & Co., a credit customer or the account of Jhaveri & Co., a supplier of goods. The capital account is the account of the proprietor and, therefore, it is also personal but adjustment on account of profits and losses are made in it. This account is further classified into three categories:

(a) Natural personal accounts: It relates to transactions of human beings like Ram, Rita, etc.

(b) Artificial (legal) personal accounts: For business purpose, business entities are treated to have separate entity. They are recognised as persons in the eye of law for dealing with other persons. For example: Government, Companies (private or limited), Clubs, Co-operative societies etc.

(c) Representative personal accounts: These are not in the name of any person or organisation but are represented as personal accounts. For example: outstanding liability account or prepaid account, capital account, drawings account.

(ii) Impersonal Accounts: Accounts which are not personal such as machinery account, cash account, rent account etc. These can be further sub-divided as follows:

(a) Real Accounts: Accounts which relate to assets of the firm but not debt. For example, accounts regarding land, building, investment, fixed deposits etc., are real accounts. Cash in hand and Cash at the bank accounts are also real.

(b) Nominal Accounts: Accounts which relate to expenses, losses, gains, revenue, etc. like salary account, interest paid account, commission received account. The net result of all the nominal accounts is reflected as profit or loss which is transferred to the capital account. Nominal accounts are, therefore, temporary.

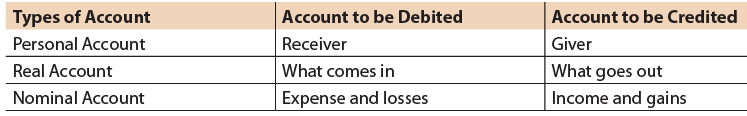

1.7.2 Golden Rules of Accounting

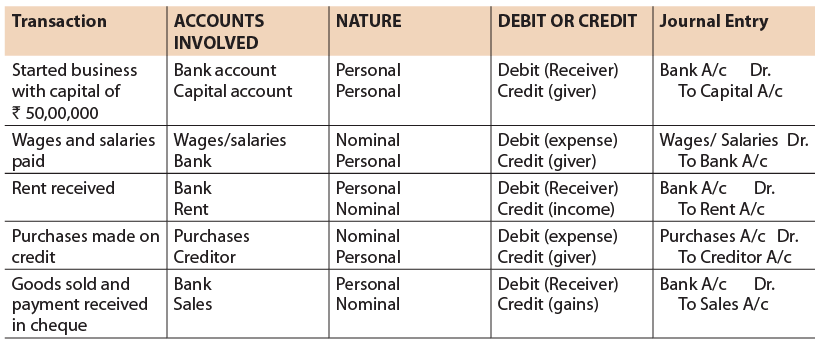

All the above classified accounts have two rules each, one related to Debit and one related to Credit for recording the transactions which are termed as golden rules of accounting, as transactions are recorded on the basis of double entry system. Example:-

Example:-

From the following information , state the nature of account and state which account will be debited and which will be credited.

1. Started business with a capital of ₹ 50,00,000.

2. Wages and salaries paid ₹ 50,000

3. Rent received ₹ 2,00,000

4. Purchased goods on credit ₹ 9,00,000

5. Sold goods for ₹ 8,16,000 and received payment in cheque.

Solution:

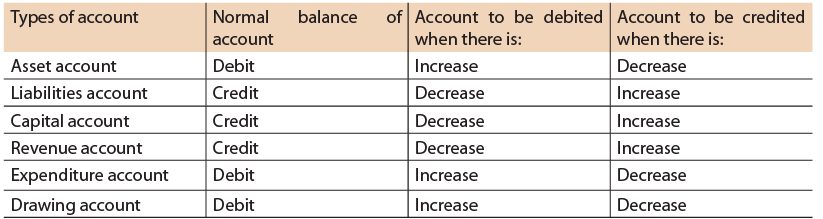

1.8 Modern Classification of Accounts

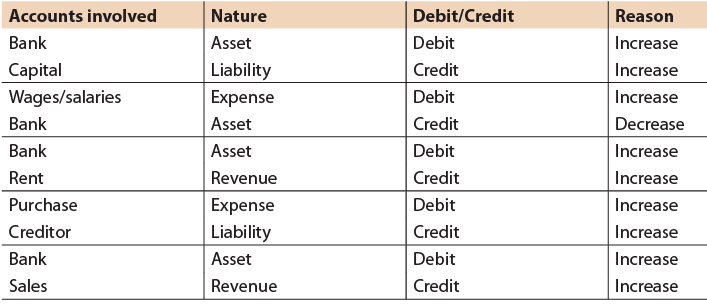

Real, nominal and personal accounts is the traditional classification of accounts. Now, let us see the modern and more acceptable classification of accounts:- Let us solve the same example with the modern approach now:-

Let us solve the same example with the modern approach now:-

1.9 Journal

Transactions are first entered in this book to show which accounts should be debited and which credited. Journal is also called subsidiary book. Recording of transactions in journal is termed as journalizing the entries. It is the book of original entry in which transactions are entered on a daily basis in a chronological order.

1.9.1 Journalising Process

All transactions may be first recorded in the journal as and when they occur; the record is chronological; otherwise it would be difficult to maintain the records in an orderly manner. Debits and credits are listed along with the appropriate explanations. There are basically two types of journals:-

1. General journal

2. Specialized journal

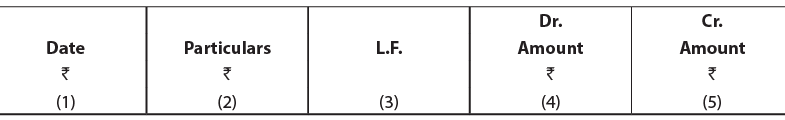

The latter is used when there are many repetitive transactions of the same nature. The form of the journal is given below:

Journal The columns have been numbered only to make clear the following but otherwise they are not numbered.

The columns have been numbered only to make clear the following but otherwise they are not numbered.

The following points should be noted:

(i) In the first column the date of the transaction is entered-the year is written at the top, then the month and in the narrow part of the column the particular date is entered.

(ii) In the second column, the names of the accounts involved are written; first the account to be debited, with the word "Dr" written towards the end of the column. In the next line, after leaving a little space, the name of the account to be credited is written preceded by the word "To" (the modern practice shows inclination towards omitting "Dr" and "To"). Then in the next line the explanation for the entry together with necessary details is given-this is called narration.

(iii) In the third column the number of the page in the ledger on which the account is written up is entered.

(iv) In the fourth column the amounts to be debited to the various accounts concerned are entered.

(v) In the fifth column, the amount to be credited to various accounts is entered.

1.9.2 Points to be taken into care while recording a Transaction in the Journal

1. Journal entries can be single entry (i.e. one debit and one credit) or compound entry (i.e. one debit and two or more credits or two or more debits and one credit or two or more debits and credits). In such cases, it is important to check that the total of both debits and credits are equal.

2. If journal entries are recorded in several pages then both the amount column of each page should be totalled and the balance should be written at the end of that page and also that the same total should be carried forward at the beginning of the next page.

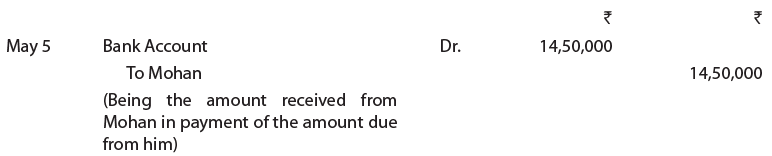

An entry in the journal may appear as follows: We will now consider some individual transactions.

We will now consider some individual transactions.

(i) Mohan commences business with ₹ 50,00,000 in his bank account. This means that the firm has ₹ 50,00,000 in bank. According to the rules given above, the increase in an asset has to be debited to it. The firm also now owes ₹ 50,00,000 to the proprietor, Mohan as capital. The rule given above also shows that the increase in capital should be credited to it. Therefore, the journal entry will be: (ii) Out of the above, ₹ 25,000 is withdrawn from the bank. By this transaction the bank balance is reduced by ₹ 25,000 and another asset, cash account, comes into existence. Since increase in assets is debited and decrease is credited, the journal entry will be:

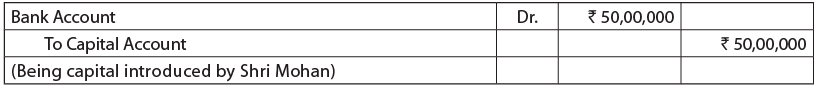

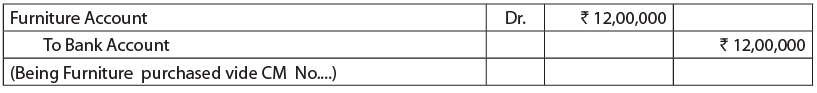

(ii) Out of the above, ₹ 25,000 is withdrawn from the bank. By this transaction the bank balance is reduced by ₹ 25,000 and another asset, cash account, comes into existence. Since increase in assets is debited and decrease is credited, the journal entry will be: (iii) Furniture is purchased for ₹ 12,00,000. Applying the same reasoning as above the entry will be:

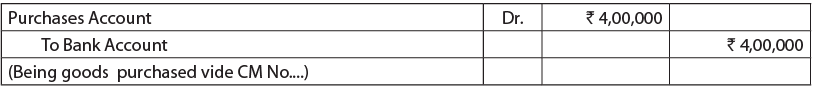

(iii) Furniture is purchased for ₹ 12,00,000. Applying the same reasoning as above the entry will be: (iv) Purchased goods for cash ₹ 4,00,000. The student can see that the required entry is:

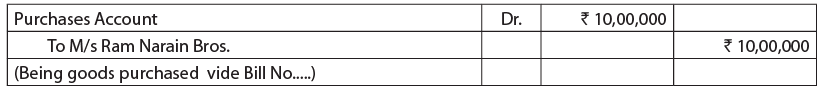

(iv) Purchased goods for cash ₹ 4,00,000. The student can see that the required entry is: (v) Purchased goods for ₹ 10,00,000 on credit from M/s Ram Narain Bros. Purchase of merchandise is an expense item so it is to be debited. ₹ 10,00,000 is now owing to the supplier; his account should therefore be credited, since the amount of liabilities has increased. The entry will be:

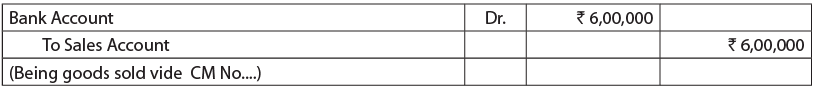

(v) Purchased goods for ₹ 10,00,000 on credit from M/s Ram Narain Bros. Purchase of merchandise is an expense item so it is to be debited. ₹ 10,00,000 is now owing to the supplier; his account should therefore be credited, since the amount of liabilities has increased. The entry will be: (vi) Sold goods to M/s Ram & Co. for ₹ 6,00,000. Amount is received in cheque. The amount of bank increases and therefore, the bank amount should be debited; sale of merchandise is revenue item so it is to be credited. The entry will be:

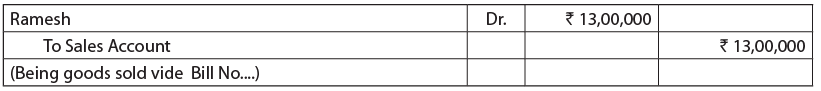

(vi) Sold goods to M/s Ram & Co. for ₹ 6,00,000. Amount is received in cheque. The amount of bank increases and therefore, the bank amount should be debited; sale of merchandise is revenue item so it is to be credited. The entry will be: (vii) Sold goods to Ramesh on credit for ₹ 13,00,000. The Inventories of goods has decreased and therefore, the goods account has to be credited. Ramesh now owes ₹ 13,00,000; that is an asset and therefore, Ramesh should be debited. The entry is:

(vii) Sold goods to Ramesh on credit for ₹ 13,00,000. The Inventories of goods has decreased and therefore, the goods account has to be credited. Ramesh now owes ₹ 13,00,000; that is an asset and therefore, Ramesh should be debited. The entry is: Note: There are two views on classification of "Purchase Account" and "Sales Account". One view is that they represents "flow of goods", so they should be classified as 'Real A/c'. However, others are of the opinion that only nominal a/cs are closed by transferring to 'Trading or Profit and Loss A/c'. Therefore, purchases and sales shall be classified as Nominal A/cs. However, in both the views, there will be debit balance of Purchase A/c and credit balance of Sales A/c.

Note: There are two views on classification of "Purchase Account" and "Sales Account". One view is that they represents "flow of goods", so they should be classified as 'Real A/c'. However, others are of the opinion that only nominal a/cs are closed by transferring to 'Trading or Profit and Loss A/c'. Therefore, purchases and sales shall be classified as Nominal A/cs. However, in both the views, there will be debit balance of Purchase A/c and credit balance of Sales A/c.

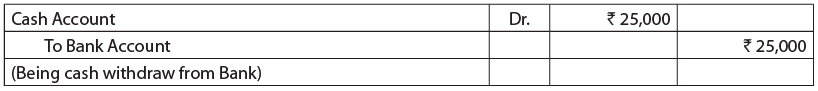

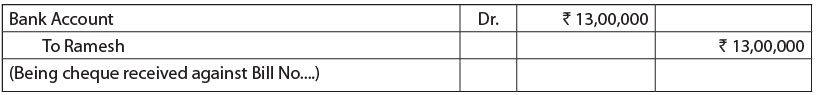

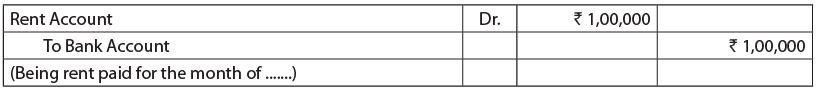

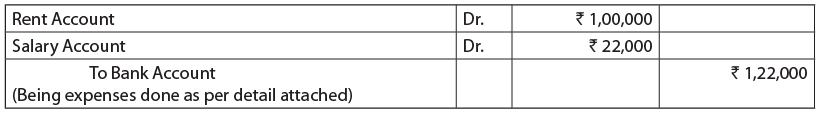

(viii)Received cheque from Ramesh ₹ 13,00,000. The amount of bank increased therefore the bank account has to be debited. Ramesh's liability towards firm has decreased infact in this case he no longer owes any amount to the firm, i.e., this particular form of assets has disappeared; therefore, the account of Ramesh should be credited. The entry is: (x) Paid rent ₹ 1,00,000. The bank balance has decreased and therefore, the bank account should be credited. No asset has come into existence because the payment is for services enjoyed and is an expense. Expenses are debited. Therefore, the entry should be:

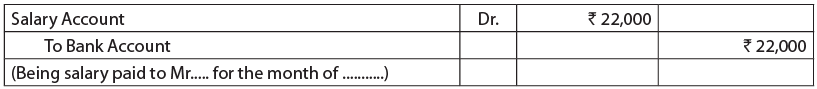

(x) Paid rent ₹ 1,00,000. The bank balance has decreased and therefore, the bank account should be credited. No asset has come into existence because the payment is for services enjoyed and is an expense. Expenses are debited. Therefore, the entry should be: (xi) Paid ₹ 22,000 to the clerk as salary. Applying the reasons given in (x) above, the required entry is:

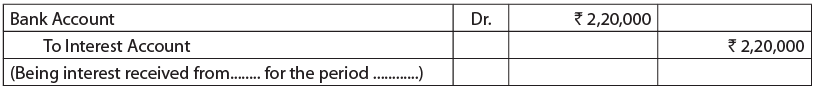

(xi) Paid ₹ 22,000 to the clerk as salary. Applying the reasons given in (x) above, the required entry is: (xii) Received ₹ 2,20,000 interest. The bank account should be debited since there is an increase in the bank balance. There is no increase in any liability; since the amount is not returnable to any one, the amount is an income, incomes are credited. The entry is :

(xii) Received ₹ 2,20,000 interest. The bank account should be debited since there is an increase in the bank balance. There is no increase in any liability; since the amount is not returnable to any one, the amount is an income, incomes are credited. The entry is : When transactions of similar nature take place on the same date, they may be combined while they are journalised. For example, entries (x) and (xi) may be combined as follows:

When transactions of similar nature take place on the same date, they may be combined while they are journalised. For example, entries (x) and (xi) may be combined as follows: When journal entry for two or more transactions are combined, it is called composite journal entry. Usually, the transactions in a firm are so numerous that to record the transactions for a month will require many pages in the journal. At the bottom of one page the totals of the two columns are written together with the words "Carried forward" in the particulars column. The next page is started with the respective totals in the two columns with the words "Brought forward" in the particulars column.

When journal entry for two or more transactions are combined, it is called composite journal entry. Usually, the transactions in a firm are so numerous that to record the transactions for a month will require many pages in the journal. At the bottom of one page the totals of the two columns are written together with the words "Carried forward" in the particulars column. The next page is started with the respective totals in the two columns with the words "Brought forward" in the particulars column.

ILLUSTRATION 4

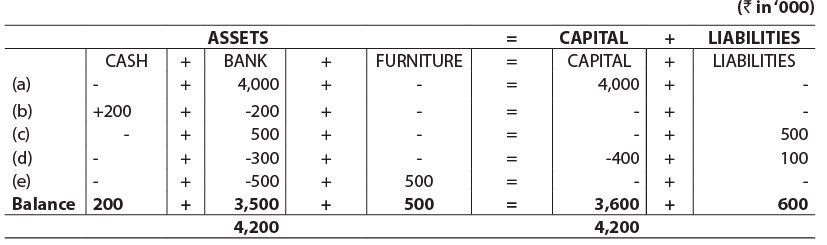

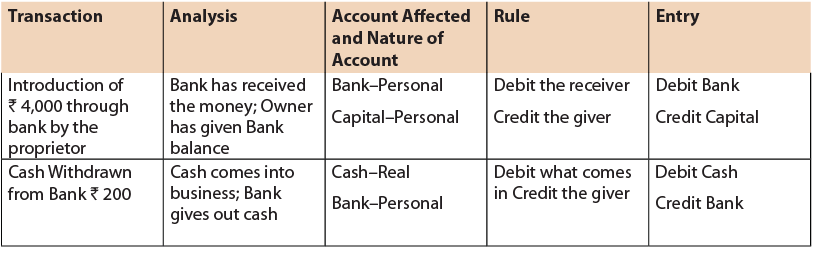

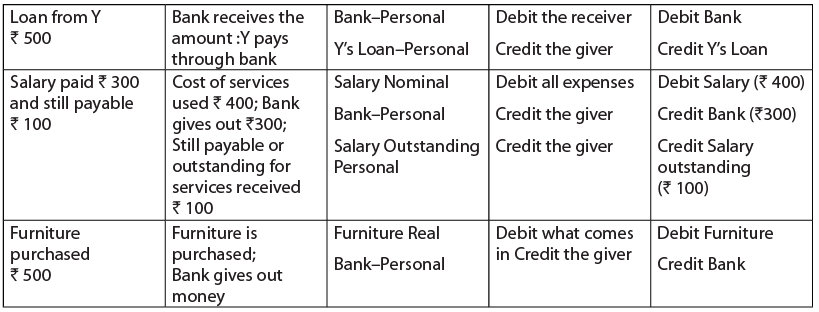

Analyse transactions of M/s Sahil & Co. for the month of March, 2017 on the basis of double entry system by adopting the following approaches:

(A) Accounting Equation Approach.

(B) Traditional Approach. Transactions for the month of March, 2017 were as follows (figures are in '000):

1. Sahil introduced capital through bank of ₹ 4,000.

2. Cash withdrawn from the City Bank ₹ 200.

3. Loan of ₹ 500 taken from Mr. Y.

4. Salaries paid for the month of March, 2017, ₹ 300 and ₹ 100 is still payable for the month of March, 2017.

5. Furniture purchased ₹ 500.

Required

What conclusion one can draw from the above analysis?

Solution: (A) Analysis of Business Transaction: Accounting Equation Approach The accounting equation is

Assets = Liabilities + Capital (B) Analysis of Business Transactions: Traditional Approach

(B) Analysis of Business Transactions: Traditional Approach

Conclusion:

Conclusion:

It is evident from above analysis that procedure for analysis of transactions, classification of accounts and rules for recording business transactions under accounting equation approach and traditional approach are different. But the accounts affected and entries in affected accounts remain same under both approaches. Thus, the recording of transactions in affected accounts on the basis of double entry system is independent of the method of analysis followed by a business enterprise. In other words, accounts to be debited and credited to record the dual aspect remain same under both the approaches.

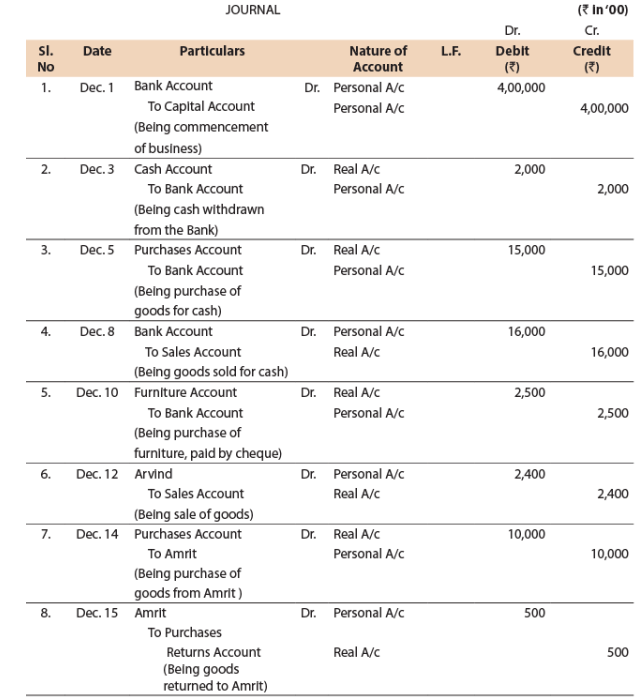

ILLUSTRATION 5

Journalise the following transactions. Also state the nature of each account involved in the Journal entry.

Following figures are given in ('00)

1. December 1,2016, Ajit started business with capital ₹ 4,00,000

2. December 3, he withdrew cash for business from the Bank ₹ 2,000.

3. December 5, he purchased goods making payment through bank ₹ 15,000.

4. December 8, he sold goods ₹ 16,000 and received payment through bank.

5. December 10, he purchased furniture and paid by cheque ₹ 2,500.

6. December 12, he sold goods to Arvind ₹ 2,400.

7. December 14, he purchased goods from Amrit ₹ 10,000.

8. December 15, he returned goods to Amrit ₹ 500.

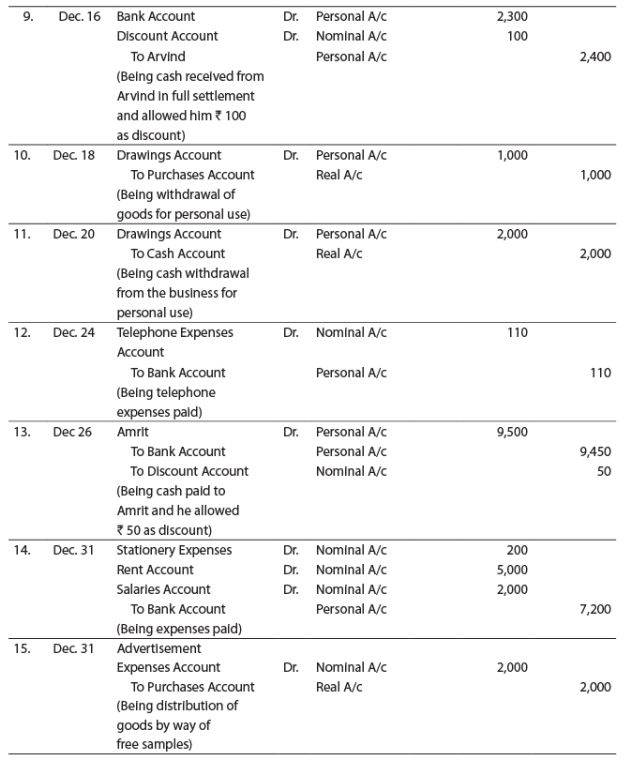

9. December 16, he received from Arvind ₹ 2,300 in full settlement.

10. December 18, he withdrew goods for personal use ₹ 1,000.

11. December 20, he withdrew cash from business for personal use ₹ 2,000.

12. December 24, he paid telephone charges ₹ 110.

13. December 26, amount paid to Amrit in full settlement ₹ 9,450.

14. December 31, paid for stationery ' 200, rent'5,000 and salaries to staff ₹ 2,000.

15. December 31, goods distributed by way of free samples ₹ 2,000.

Solution:

ILLUSTRATION 6

Show the classification of the following Accounts under traditional and accounting equation approach:

(a) Building; (b) Purchases; (c) Sales; (d) Bank Fixed Deposit; (e) Rent; (f) Rent Outstanding; (g) Cash; (h) Adjusted Purchases; (i) Closing Inventory; (j) Investments; (k) Trade receivables; (l) Sales Tax Payable, (m) Discount Allowed; (n) Bad Debts; (o) Capital; (p) Drawings; (q) Interest Receivable account; (r) Rent received in advance account; (s)

Solution:

Nature of Account

Sl. No. | Title of Account | Traditional Approach | Accounting Equation Approach |

(a) | Building | Real | Asset |

(b) | Purchases | Real | Asset |

(c) | Sales | Real | Revenue |

(d) | Bank Fixed Deposit | Personal | Asset |

(e) | Rent | Nominal (Expense) | Expense |

(f) | Rent Outstanding | Personal | Liability |

(g) | Cash | Real | Asset |

(h) | Adjusted Purchases | Nominal (Expense) | Expense |

(i) | Closing Inventory | Real | Asset |

(j) | Investment | Real | Asset |

(k) | Trade receivables | Personal | Asset |

(l) | Sales Tax Payable | Personal | Liability |

(m) | Discount Allowed | Nominal (Expense) | Temporary Capital (Expense) |

(n) | Bad Debts | Nominal (Expense) | Temporary Capital (Expense) |

(o) | Capital | Personal | Capital |

(p) | Drawings | Personal | Temporary Capital (Drawings) |

(q) | Interest receivable | Personal | Asset |

(r) | Rent received in advance | Personal | Liability |

(s) | Prepaid salary | Personal | Asset |

(t) | Bad debts recovered | Nominal (Gain) | Temporary Capital (Gain) |

(u) | Depreciation | Nominal (Expense) | Temporary Capital (Expense) |

(v) | Personal Income Tax | Personal (Drawing) | Temporary Capital (Drawings) |

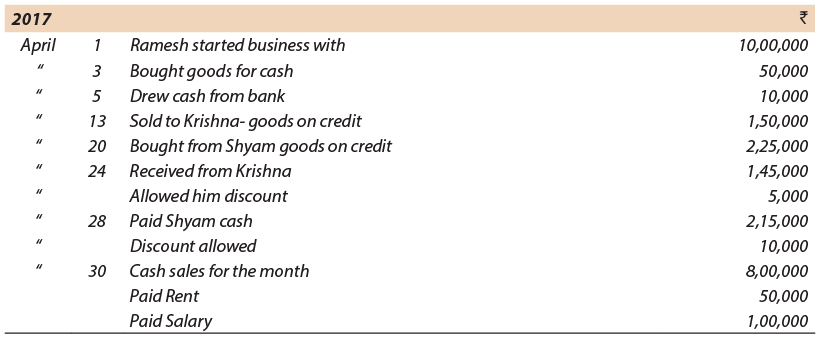

ILLUSTRATION 7

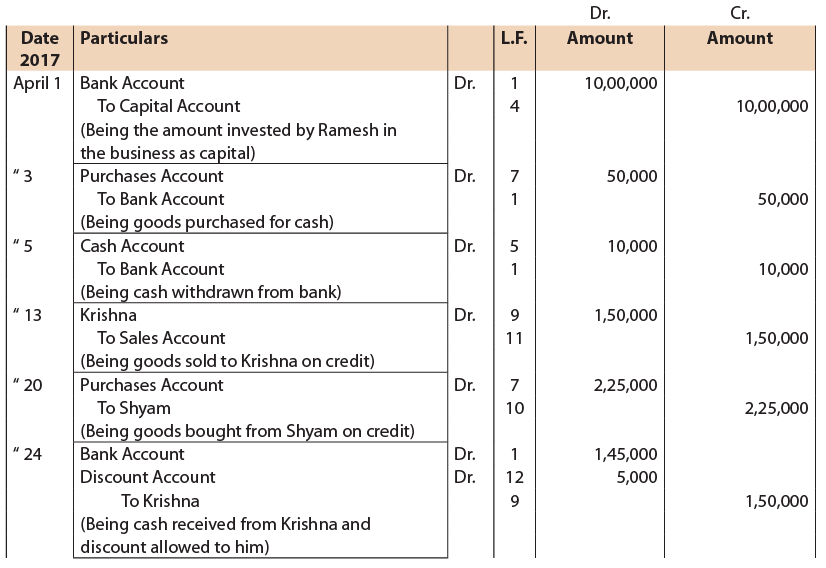

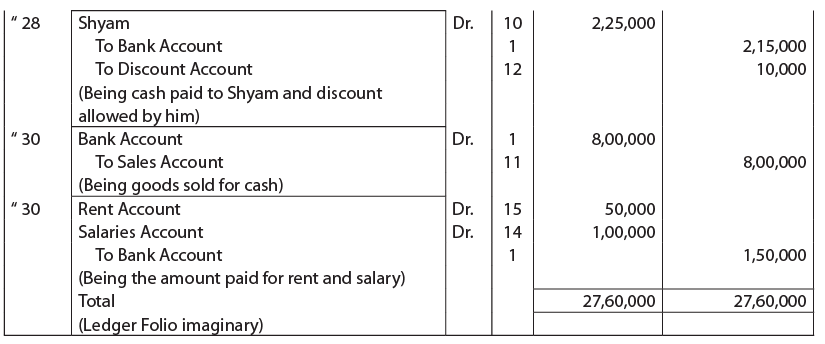

Transactions of Ramesh for April are given below. Journalise them. Solution:

Solution:

Journal

1.10 Advantages of Journal

In journal, transactions recorded on the basis of double entry system, fetch following advantages:

1. As transactions are recorded on chronological order, one can get complete information about the business transactions on time basis.

2. Entries recorded in the journal are supported by a note termed as narration, which is a precise explanation of the transaction for the proper understanding of the entry. One can know the correctness of the entry through these narrations.

3. Journal forms the basis for posting the entries in the ledger. This eases the accountant in their work and reduces the chances of error.

FAQs on ICAI Notes- Unit 1: Basic Accounting Procedures - Journal Entries - 2 - CA Foundation

| 1. What are journal entries in basic accounting procedures? |  |

| 2. How do I make journal entries for basic accounting procedures? |  |

| 3. What is the purpose of journalizing transactions in basic accounting procedures? |  |

| 4. Why is it important to maintain accurate journal entries in basic accounting procedures? |  |

| 5. Can journal entries be modified or deleted in basic accounting procedures? |  |