ICAI Notes- Unit 3: Consignment - CA Foundation PDF Download

3.1 Meaning of Consignment Account

To consign means to send. In Accounting, the term "consignment account" relates to accounts dealing with a situation where one person (or firm) sends goods to another person (or firm) on the basis that the goods will be sold on behalf of and at the risk of the former. The following should be noted carefully:

(i) The party which sends the goods (consignor) is called principal.

(ii) The party to whom goods are sent (consignee) is called agent.

(iii) The ownership of the goods, i.e., the property in the goods, remains with the consignor or the principal - the agent or the consignee does not become their owner even though goods are in his possession. On sale, of course, the buyer will become the owner.

(iv) The consignor does not send an invoice to the consignee. He sends only a proforma invoice, a statement that looks like an invoice but is really not one. The object of the proforma invoice is only to convey information to the consignee regarding particulars of the goods sent.

(v) Usually, the consignee recovers from the consignor all expenses incurred by him on the consignment. This however can be changed by agreement between the two parties.

(vi) It is also usual for the consignee to give an advance to the consignor in the form of cash or a bill of exchange. It is adjusted against the sale proceeds of the goods.

(vii) For his work, the consignee receives a commission calculated on the basis of gross sale. For ordinary commission the consignee is not responsible for any bad debt that may arise. If the agent is to be made responsible for bad debts, he is to be paid a commission called del-credere commission. It is calculated on total sales, not merely on credit sales until and unless agreed.

(viii) Periodically, the consignees ends to the consignor a statement called Account Sales. It sets out the sales made by the consignee, the expenses incurred on behalf of the consignor, the commission earned by the consignee and the balance due to the consignor.

(ix) Firms usually like to ascertain the profit or loss on each consignment or consignments to each consignee.

Consignment Account relates to accounts dealing with such business where one person sends goods to another person on the basis that such goods will be sold on behalf of and at the risk of the former.

3.2 Distinctions

3.2.1 Consignment and Sale

3.2.2 Distinction between Commission and Discount

3.3 Accounting for Consignment Transactions and Events in the Books of The Consignor

For ascertaining profit or loss on any transaction (or series of transactions) there is one golden rule; open an account for the transaction (or series of transactions) and (i) put down the cost of goods and other expenses incurred or to be incurred on the debit side; and (ii) enter the sale proceeds as also the cost of goods remaining unsold on the right hand side or the credit side. The difference between the total of the two sides will reveal profit or loss. There is profit if the credit side is more.

The consignor often dispatches goods to various consignees and he would be interested to ascertain the profit or loss from each consignment separately. Therefore, a separate consignment account has to be prepared for each consignment. Each consignment account is a nominal-cum-personal account and constitutes a profit an loss account in respect of the transactions to which it relates. The consignor records the following transactions in his book of accounts:

1. When goods are consigned or dispatched: it is to be reiterated that when goods are sent to the consignee, the transaction does not result in a sale and only the possession of the goods changes. Therefore, the personal account of consignee is not debited and also sales account is not credited. The following entry is recorded by the consignor:

Consignment (say to Star trading) Account Dr.

To Goods Sent on Consignment Account

2. Expenses incurred by consignor: when consignor incurs some expenses relating to the consignment following entry is recorded:

Consignment (say to Star trading) Account Dr.

To Supplier Account/Bank/Cash

Unlike normal practice to debiting expense accounts first and then transferring to profit and loss account, expenses are directly debited to consignment account.

3. When advance is received from the consignee: The consignee may remit some advance to consignor. The following entry is recorded:

Bank/Cash Account Dr. To Consignee's Personal Account

4. On receipt of account sales from the consignee: Account sales contains details of sales made by consignee, expenses incurred by consignee. Following entries are recorded

For sales proceeds

Consignee’s Personal Account Dr.

To Consignment Account

For expenses incurred by consignee Consignment Account Dr.

To Consignee’s Personal Account

5. Cash or cheque or bank draft or bill of exchange/promissory note received from the consignee as settlement:

Cash/Bank/Bills Receivable Account Dr.

To Consignee’s Personal Account

6. For bad debts: The accounting entry for bad debts will depend on whether del-credere commission is paid to the consignee

i. When del-credere commission is not paid to the consignee

Consignment Account Dr.

To Consignee’s Personal Account

ii. When del-credere commission is paid to the consignee

No entry is recorded as bad debts is to be borne by consignee.

7. For the goods taken over by the consignee

Consignee’s Personal Account Dr.

To Consignment Account

8. For unsold consignment stock: In case some of the goods sent on consignment are still unsold at the time of preparing final accounts, the unsold inventory is recorded as consignment stock with followingentry:

Consignment Stock Account Dr.

To Consignment Account

9. For commission payable to consignee

Consignment Account Dr.

To Consignee's Personal Account

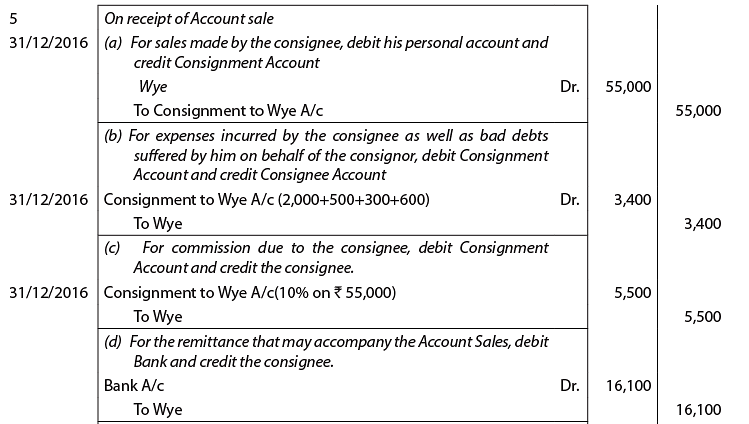

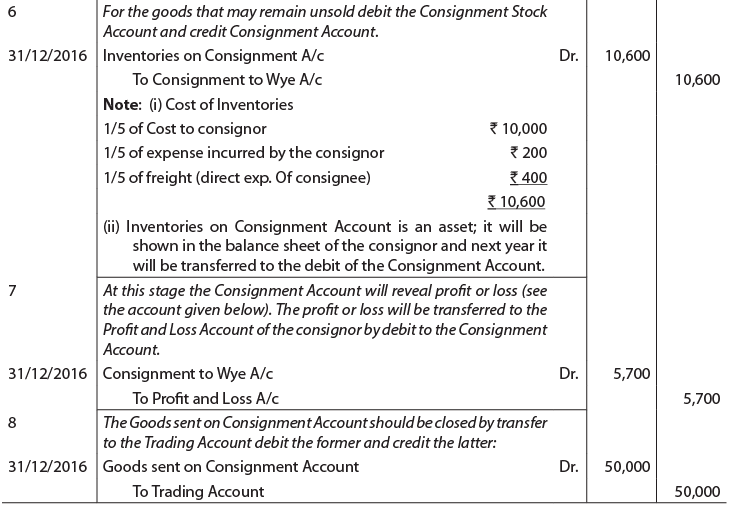

We shall illustrate the scheme of entries on the basis of the following information:

ILLUSTRATION 1

Exe sent on 1st July,2016 to Wye goods costing ₹ 50,000 and spent ₹ 1,000 on packing etc. On 3rd July,2016, Wye received the goods and sent his acceptance to Exe for ₹ 30,000 payable at 3 months. Wye spent ₹ 2,000 on freight and cartage, ₹ 500 on godown rent and ₹ 300 on insurance. On 31st December,2016 he sent his Account Sales (along with the amount due to Exe) showing that 4/5 of the goods had been sold for ₹ 55,000. Wye is entitled to a commission of 10%. One of the customers turned insolvent and could not pay ₹ 600 due from him. Show the necessary journal entries in the books of consignor. Also prepare ledger accounts.

Solution:

Journal Entries in the books of Consignor

Important Ledger Accounts

Important Ledger Accounts

3.4 Valuation of Inventories

The principle is that inventories should be valued at cost or net realizable value whichever is lower, the same principle as is practised for preparing final accounts. In the case of consignment, cost means not only the cost of the goods as such to the consignor but also all expenses incurred till the goods reach the premises of the consignee. Such expenses include packaging, freight, cartage, insurance in transit, octroi, import duty etc. But expenses incurred after the goods have reached the consignee's godown (such as godown rent, insurance of godown, delivery charges,salesman salaries) are not treated as part of the cost of purchase for valuing inventories on hand. That is why in the case given above, inventories has been valued ignoring godown rent and insurance.

Note: Sometimes an examination problem states only that the consignor's expenses amounted to such amount and that consignee spent so much. If details are not available, then for valuing inventories the expenses incurred by the consignor should be treated as part of cost while those incurred by the consignee should be ignored.

If the expected selling price of inventories on hand is lower than the cost, the inventories should be valued at expected net selling price only, i.e. expected selling price less delivery expenses, etc.

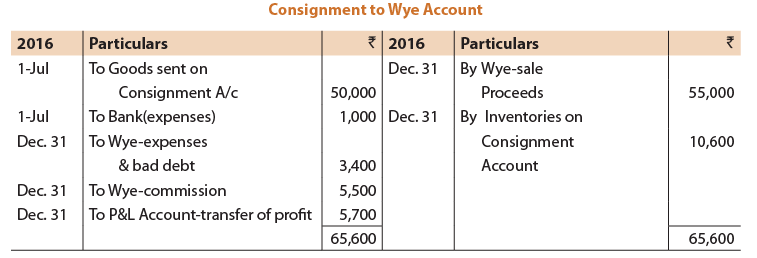

3.5 Goods Invoiced Above Cost

Sometimes the proforma invoice is made out at a value higher than the cost and entries in the books of the consignor are made out on that basis - even the inventories remaining unsold will initially be valued on the basis of the invoice price. It must be remembered, however, that the profit or loss can be ascertained only if sale proceeds (plus) inventories on hand, valued on cost basis, is compared with the cost of the goods concerned together with expenses. Hence, if entries are first made on invoice basis, the effect of the loading (i.e., amount added to arrive at the invoice price) must be removed by additional entries. Suppose in the example given above, if the invoice is cost plus 20%, i.e., ' 60,000 for the goods sent to Wye. The entries will be initially:

[Students will see that except for difference in the amounts in entries (i) and (ix), these and other entries are the same as those already given.]

[Students will see that except for difference in the amounts in entries (i) and (ix), these and other entries are the same as those already given.]

Additional entries (before ascertaining profit) to remove the effect of loading:

(a) Goods sent on Consignment A/c Dr. 10,000

To Consignment to Wye A/c 10,000

[Entry (i) reversed to the extent of loading in order to debit the Consignment A/c on cost basis].

(b) Consignment to Wye A/c Dr. 2,000

To Inventory Reserve Account 2,000

(The amount of loading included in the value of the closing Inventories is unrealised profit - hence reserve is created by debit to the Consignment Account).

The Consignment Account will now reveal a profit of ₹ 5,700 the same as before. It will be transferred to the P&L A/c. Similarly entry given in 8 in the earlier illustration will be made to transfer the balance in the Goods sent on Consignment Account in the earlier illustration ₹500,000) after entry in (a) above to the credit of Trading Account. The accounts (except for Wye whose account will be the same as already shown) are given below:

Consignment to Wye Account

The last two accounts will be carried forward to the next year and their balance will then be transferred to the Consignment Account – ₹ 12,600 on the debit side and ₹ 2,000 on the credit. This year in the balance sheet the net amount of ₹ 10,600 will be shown on the assets side as shown below:

The last two accounts will be carried forward to the next year and their balance will then be transferred to the Consignment Account – ₹ 12,600 on the debit side and ₹ 2,000 on the credit. This year in the balance sheet the net amount of ₹ 10,600 will be shown on the assets side as shown below: What would be the situation if the commission to Wye includes del-credere commission also?

What would be the situation if the commission to Wye includes del-credere commission also?

In that case Wye would not be able to charge the bad debt of ₹ 600 to Exe; he will have to bear the loss himself. The student can see that then the profit on consignment will be ₹ 6,300.

In this regard it is to be noted that when del - credere commission is paid to the consignee, the consignee account is debited in the books of consignor for both cash and credit sales. But if no such del - credere commission is paid then consignee account cannot be debited for credit sales and in that case the following entry is passed in the books of consignor for credit sales.

Consignment Trade receivables A/c Dr.

To Consignment A/c

The difference is because in case del-credere commission is paid to consignee then consignee is responsible to bear any loss of bad debts and he will have to pay full amount of sales to consigner. Accordingly, in the books of consignor, whole amount (cash sales plus credit sales) is shown as receivable from consignee. On the other hand if del-credere commission is not paid than consignor is responsible to bear loss of bad debts, therefore, till the time consignee has not received money from customers, it is not shown as receivable from consignee.

3.6 Normal Loss

If some loss is unavoidable, it would be spread over the entire consignment while valuing inventories. The total cost plus expenses incurred should be divided by the quantity available after the normal loss to ascertain the cost per unit. Suppose 10,000 kg of apples are consigned to a wholesaler, the cost being ₹30 per kg, plus ₹ 40,000 of freight. It is concluded that a loss of 15% is unavoidable. The cost per kg will be ₹ 3,40,000/8,500 or ₹40. If the unsold inventory is 1,000 kg its value will be ₹ 40,000.

Accordingly, no entry is recorded for normal loss and same is considered as expense which is considered for valuation of remaining inventory.

3.7 Abnormal Loss

If any accidental or unnecessary loss occurs, the proper thing to do is to find out the cost of the goods thus lost and then to credit the Consignment Account and debit the Profit and Loss Account - this will enable the consignor to know what profit would have been earned had the loss not taken place.

Suppose 1,000 sewing machines costing ₹ 2,500 each are sent on consignment basis and ₹ 10,000 are spent on freight etc. 20 machines are damaged beyond repair. The amount of loss will be:

This amount should be credited to the Consignment Account and debited to the P&L A/c. If any amount, say, ₹ 40,000 is received from the insurers, then debit to the P&L A/c will be only ' 10,200. But the credit to the Consignment Account will still be ₹ 50,200. ₹ 40,000 will have been debited to the Bank Account.

Students shall note that abnormal loss is valued just like inventories in hand.

Students should be careful while valuing goods lost in transit and goods lost in consignee's godown. Both are abnormal loss but in case of former consignee's non-recurring expenses are not to be included whereas it is to be included in latter case.

Further, for the purpose of valuation of inventory in hand, it should be noted that while normal loss is considered as part of cost of remaining goods, whereas abnormal loss is ignored. In the example given above assume that 10,000 Kg apples were sent in 10 different trucks and out of which one truck met an accident and 500Kg apples were destroyed. In such case cost of remaining apples will be computed as below:

It is clear from above example that abnormal loss will not have impact on per unit cost, however, per unit cost will change due to normal cost as the remaining quantity will absorb cost of normal loss whereas abnormal loss will be immediately expensed off to profit or loss.

Distinctions between normal and abnormal loss

Following entry is recorded for abnormal loss:

Abnormal Loss Account Dr.

To Consignment Account

If abnormal loss is recoverable from the insurance company

Insurance Company’s Account Dr.

To Abnormal Loss Account

If abnormal loss is recoverable from the consignee

Consignee’s Personal Account Dr.

To Abnormal Loss Account

If abnormal loss is not recoverable, Abnormal Loss Account is transferred to profit & Loss Account.

3.8 Commission

Commission is the remuneration paid by the consignor to the consignee for the services rendered to the former for selling the consigned goods. Three types of commission can be provided by the consignor to the consignee, as per the agreement, either simultaneously or in isolation. They are:

3.8.1 Ordinary Commission

The term commission simply denotes ordinary commission. It is based on fixed percentage of the gross sales proceeds made by the consignee. It is given by the consignor regardless of whether the consignee is making credit sales or not. This type of commission does not give any protection to the consignor from bad debts and is provided on total sales.

3.8.2 Del-credere Commission

To increase the sale and to encourage the consignee to make credit sales, the consignor provides an additional commission generally known as del-credere commission. This additional commission when provided to the consignee gives a protection to the consignor against bad debts. In other words, after providing the del-credere commission, bad debts is no more the loss of the consignor. It is calculated on total sales unless there is any agreement between the consignor and the consignee to provide it on credit sales only.

3.8.3 Over-riding Commission

It is an extra commission allowed by the consignor to the consignee to promote sales at higher price then specified or to encourage the consignee to put hard work in introducing new product in the market. Depending on the agreement it is calculated on total sales or on the difference between actual sales and sales at invoice price or any specified price. In order to encourage the consignee to earn higher margins, it can also be in the form of share of additional profits made by consignee on sale of goods.

3.9 Return of Goods from the Consignee

Consigned goods can be returned by the consignee because of many reasons like poor quality or not upto the specimen or destroyed in transit etc. In such a situation, the question arises what is the valuation of returned goods. Consigned goods returned by the consignee to the consignor are valued at the price at which it was consigned to the consignee. Expenses incurred by the consignee to send those goods back to the consignor are not taken into consideration while valuing it because the goods were already in a salable conditions and location and changing the location back from consignee to consignor is not a cost which must have to be incurred to sell the goods. This is generally called secondary freight in accounting terms.

3.10 Account Sales

An account sale is the periodical summary statement sent by the consignee to the consignor. It contains details regarding -

(a) sales made,

(b) expenses incurred on behalf of the consignor,

(c) commission earned,

(d) unsold inventories left with the consignee,

(e) advance payment or security deposited with the consignor and the extent to which it has been adjusted,

(f) balance payment due or remitted.

It is a summary statement and is different from Sales Account.

3.11 Accounting in the Books of the Consignee

The consignee is not concerned when goods are consigned to him or when the consignor incurs expenses. He is concerned only when he sends an advance to the consignor, makes a sale, incurs expenses on the consignment and earns his commission. He debits or credits the consignor for all these as the case may be. Following entries are recorded in the books of consignee:

1. On making sales

Cash/Bank Account/Debtors Dr.

To Consignor's Personal Account

2. For expenses incurred and his commission

Consignor's Personal Account Dr.

To Bank Account

3. For advance paid to consignor

Consignor's Personal Account Dr.

To Bank Account

4. For recording bad debts

Bad Debts Account Dr.

To Customer's Account

5. For writing off bad debts

(a) When del-credere commission is not allowed

Consignor's Personal Account Dr.

To Bad Debts Account

(b) When del-credere

commission is allowed Commission Account Dr.

To Bad Debts Account

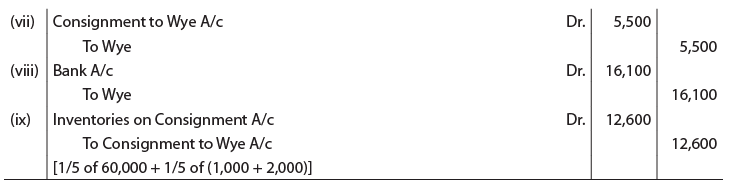

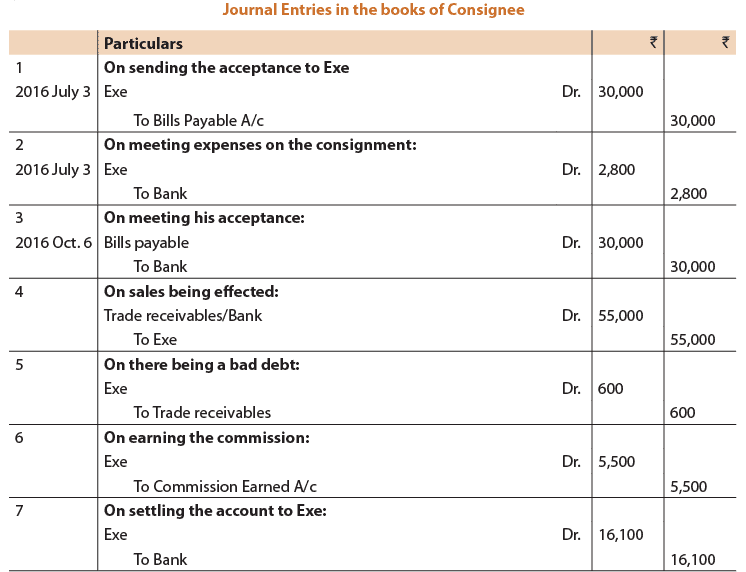

ILLUSTRATION 2

Exe sent on 1st July, 2016 to Wye goods costing ₹ 50,000 and spent ₹ 1,000 on packing etc. On 3rd July,2016, Wye received the goods and sent his acceptance to Exe for ₹ 30,000 payable at 3 months. Wye spent ₹ 2,000 on freight and cartage, ₹ 500 on godown rent and ₹ 300 on insurance. On 31st December,2016 he sent his Account Sales (along with the amount due to Exe) showing that 4/5 of the goods had been sold for ₹ 55,000. Wye is entitled to a commission of 10%. One of the customers turned insolvent and could not pay ' 600 due from him. Show the necessary journal entries in the consignee's book.

Solution: If the commission includes del-credere commission also, he would not be able to debit Exe for the bad debt. In that case the debit should be to the Commission Earned Account whose net balance will then be ₹4,900 and he will have to pay ₹16,700 to Exe.

If the commission includes del-credere commission also, he would not be able to debit Exe for the bad debt. In that case the debit should be to the Commission Earned Account whose net balance will then be ₹4,900 and he will have to pay ₹16,700 to Exe.

3.12 Advances by the Consignee Vs Security against the Consignment

Generally the consignor insist the consignee for some advance payment for the goods consigned at the time of delivery of goods. This advance payment is adjusted in full against the amount due by the consignee on account of the goods sold.

But if the advance money deposited by the consignee is in the form of security against the goods consigned then the full amount is not adjusted against the amount due by the consignee to the consignor on account of goods sold if, there is any unsold inventory left with the consignee. In that case proportionate security in respect of unsold goods is carried forward till the time the respective goods held with the consignee are sold.

ILLUSTRATION 3

Miss Rakhi consigned 1,000 radio sets costing ₹900 each to Miss Geeta, her agent on 1st July,2016. Miss Rakhi incurred the following expenditure on sending the consignment.

Freight ₹ 7,650

Insurance ₹ 3,250

Miss Geeta received the delivery of 950 radio sets. An account sale dated 30th November,2016 showed that 750 sets were sold for ₹9,00,000 and Miss Geeta incurred ₹ 10,500 for carriage.

Miss Geeta was entitled to commission 6% on the sales effected by her. She incurred expenses amounting to ₹2,500 for repairing the damaged radio sets remaining in the inventories.

Miss Rakhi lodged a claim with the insurance company which was admitted at₹35,000. Show the Consignment Account and Miss Geeta's Account in the books of Miss Rakhi.

Solution: In the books of Miss Rakhi Consignment Account

Note: It is assumed that the agent has remitted the amount due from her.

Note: It is assumed that the agent has remitted the amount due from her.

Working Notes:

ILLUSTRATION 4

Vikram Milk Foods Co. Ltd. of Vikrampur sent to Sunder Stores, Sonepuri 5,000 kgs of baby food packed in 2,000 tins of net weight 1 kg and 6,000 packets of net weight 1/2 kg for sale on consignment basis. The consignee's commission was fixed at 5% of sale proceeds. The cost price and selling price of the product were as under: The consignment was booked on freight "To Pay"basis, and freight charges came to 2% of selling value. One case containing 50 (1kg. tins) was lost in transit and the transport carrier admitted a claim of ₹450.

The consignment was booked on freight "To Pay"basis, and freight charges came to 2% of selling value. One case containing 50 (1kg. tins) was lost in transit and the transport carrier admitted a claim of ₹450.

At the end of the first half-year, the following information is gathered from the "Account Sales" sent by the consignee: Find out the value of closing inventory on consignment.

Find out the value of closing inventory on consignment.

Show the Consignment A/c and the Consignee's A/c in the books of Vikram Milk Food Co. Ltd. assuming that the consignee had paid the amount due from him.

Solution:

Vikram Milk Foods Co. Ltd. Consignment to Sonepuri Account Sunder Stores, Sonepuri

Sunder Stores, Sonepuri Working Notes:

Working Notes:

ILLUSTRATION 5

Shri Mehta of Mumbai consigns 1,000 cases of goods costing ₹ 1,000 each to Shri Sundaram of Chennai. Shri Mehta pays the following expenses in connection with consignment: Shri Sundaram is entitled to a commission of 10% on gross sales. Draw up the Consignment Account and Sundaram’s Account in the books of Shri Mehta.

Shri Sundaram is entitled to a commission of 10% on gross sales. Draw up the Consignment Account and Sundaram’s Account in the books of Shri Mehta.

Solution:

Working Notes:

(i) Consignor's expenses on 1,000 cases amounts to ₹50,000; it comes to ₹50 per case. The cost of cases lost will be computed at ₹1,050 per case.

(ii) Sundaram has incurred ₹ 8,500 on clearing 850 cases, i.e., ₹10 per case; while valuing closing inventories with the agent ₹10 per case has been added to cases in hand with the agent.

(iii) It has been assumed that balance of ₹ 8,50,500 is not yet paid.

ILLUSTRATION 6

Ajay of Mumbai consigned to Vijay of Delhi, goods to be sold at invoice price which represents 125% of cost. Vijay is entitled to a commission of 10% on sales at invoice price and 25% of any excess realised over invoice price. The expenses on freight and insurance incurred by Ajay were ₹10,000. The account sales received by Ajay shows that Vijay has effected sales amounting to ₹ 1,00,000 in respect of 75% of the consignment. His selling expenses to be reimbursed were ₹ 8,000. 10% of consignment goods of the value of ₹12,500 were destroyed in fire at the Delhi godown and the insurance company paid ₹ 12,000 net of salvage. Vijay remitted the balance in favour of Ajay. Prepare consignment account and the account of Vijay in the books of Ajay along with the necessary calculations.

Solution:

Books of Ajay Consignment to Vijay Account

Working Notes:

Working Notes:

1. Calculation of value of goods sent on consignment:

Abnormal Loss at Invoice price = ₹ 12,500.

Abnormal Loss as a percentage of total consignment = 10%.

Hence the value of goods sent on consignment = ₹ 12,500 X 100/ 10 = ₹ 1,25,000.

Loading of goods sent on consignment = ₹ 1,25,000 X 25/125 = ₹ 25,000.

Note:

1. It has been assumed that final payment received from Vijay.

2. Abnormal loss is always calculated at cost even if invoice price of goods is given.

3. Value of inventories always valued at invoice price if invoice price is given.

FAQs on ICAI Notes- Unit 3: Consignment - CA Foundation

| 1. What is a consignment in the context of CA Foundation? |  |

| 2. How is consignment recorded in the books of accounts? |  |

| 3. What is the difference between consignment and sale? |  |

| 4. How is profit or loss on consignment calculated? |  |

| 5. What are the advantages of consignment for the consignor and consignee? |  |

|

Explore Courses for CA Foundation exam

|

|