Unit 3: Summary - Issue of Debentures | Accounting for CA Foundation PDF Download

SUMMARY

- Debenture is one of the most commonly used debt instrument issued by the company to raise funds for the business. A debenture is a bond issued by a company under its seal, acknowledging a debt and containing provisions as regards repayment of the principal and interest. Money payable on debentures may be paid either in full with application or in instalments.

- Debenture holders are the creditors of the company whereas shareholders are the owners of the company. Debenture holders have no voting rights and consequently do not pose any threat to the existing control of the company. Shareholders have voting rights and consequently control the total affairs of the company.

- Debentures can be classified on the basis of: (1) Security; (2) Convertibility; (3) Permanence; (4) Negotiability; and (5) Priority.

- Issue of redeemable debentures can be categorized into the following:

1. Debenture issued at par and redeemable at par or at a discount;

2. Debenture issued at a discount and redeemable at par or at discount;

3. Debenture issued at premium and redeemable at par or at discount;

4. Debenture issued at par and redeemable at premium;

5. Debenture issued at a discount and redeemable at premium.

6. Debenture issued at premium and redeemable at premium.

Note: In practical life redemption at a discount is rare, - Collateral security means secondary or supporting security for a loan, which can be realised by the lender in the event of the original loan not being repaid on the due date. Under this arrangement, the borrower agrees that a particular asset or a group of assets will be realized and the proceeds there from will be applied to repay the loan in the event that the amount due, cannot be paid. Sometimes companies issue their own debentures as collateral security for a loan or a fluctuating overdraft.

- Debentures can also be issued for consideration other than for cash, such as for purchase of land, machinery, etc.

- The discount on issue of debentures is amortised over a period between the issuance date and redemption date. Loss on issue of debentures is also a capital loss and should be written off in a similar manner as discount on debentures issued. In the balance sheet both the items (Discount and Loss) are shown as Non-current/current assets depending upon the period for which it has to be written off.

- Interest payable on debentures is treated as a charge against the profits of the company. Interest on debenture is paid periodically and is calculated at coupon rate on the nominal value of debentures.

TEST YOUR KNOWLEDGE

1. Premium on redemption of debentures account appearing in the balance sheet is _______.

(a) A nominal account - expenditure

(b) A nominal account - income

(c) A personal account ______.

Ans: (c)

2. Debenture interest

(a) Is payable before the payment of any dividend on shares

(b) Accumulates in case of losses or inadequate profits

(c) Is payable after the payment of preference dividend but before the payment of equity dividend ___.

Ans: (a)

3. F Ltd. purchased Machinery from G Company for a book value of ₹ 4,00,000. The consideration was paid by issue of 10% debentures of ₹ 100 each at a premium of 25%. The debenture account was credited with ______.

(a) ₹4,00,000

(b) ₹ 5,00,000

(c) ₹3,20,000

Ans: (c)

4. Which of the following is not a characteristic of Bearer Debentures?

(a) They are treated as negotiable instruments

(b) Their transfer requires a deed of transfer

(c) They are transferable by mere delivery

Ans: (b)

5. When debentures are issued as collateral security, the final entry for recording the collateral debentures in the books is __________.

(a) Credit Debentures A/c and debit Cash A/c.

(b) Debit Debenture suspense A/c and credit Cash A/c.

(c) Debit Debenture suspense A/c and credit Debentures A/c.

Ans: (c)

6. When debentures are redeemable at different dates, the total amount of discount on issue of debentures should be written off

(a) Every year by applying the sum of the year’s digit method

(b) Every year by applying the straight line method

(c) To profit and loss account in full in the year of final or last redemption

Ans: (a)

Theoretical question

1. Distinguish between debentures and shares.

2. Explain the purpose for raising of debenture by the company. Also give the main features of debentures.

Practical questions

1 Country Crafts Ltd. issued 1,00,000, 8% debentures of ₹ 100 each at premium of 5% payable fully on application and redeemable at premium of ₹10 Pass necessary journal entries at the time of issue.

2 Koinal Chemicals Ltd. issued 20,00,000, 10% debentures of ₹50 each at premium of 10%, payable as ₹20 on application and balance on allotment. Debentures are redeemable at par after 6 years. All the money due on allotment was called up and received. Record necessary entries when premium money is included in allotment money.

3 Kapil Ltd. issued 50,000, 12% Debentures of ₹100 each at a premium of 10% payable in full on application by 1st March, 2017. The issue was fully subscribed and debentures were allotted on 9th March, 2017.

Pass necessary Journal Entries (including cash transactions).

4. On 1st April 2017 Sheru Ltd. issued 1,00,000 12% debentures of ₹100 each at a discount of 5%, redeemable on 31 March 2022. Issue was oversubscribed by 20,000 debentures, who were refunded their money. Interest is paid annually on 31 March. You are required to prepare:

i) Journal Entries at the time of issue of debentures.

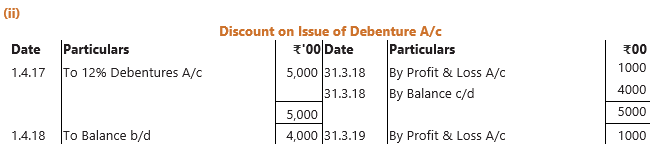

ii) Discount on issue of Debenture Account

iii) Interest account and Debenture holder Account assuming TDS is deducted @ 10%.

Theoretical Questions

1. Refer para for the distinction between Shares and Debentures.

2. Debenture is one of the most commonly used debt instrument issued by the company to raise funds for the business. The most common method of supplementing the capital available to a company is to issue debentures which may either be simple or naked carrying no charge on assets, or mortgage debentures carrying either a fixed or a floating charge on some or all of the assets of the company.

For features of debentures refer para 3.3.

|

68 videos|160 docs|83 tests

|

FAQs on Unit 3: Summary - Issue of Debentures - Accounting for CA Foundation

| 1. What is a debenture and how does it relate to the issue of debentures? |  |

| 2. What are the types of debentures that can be issued by a company? |  |

| 3. What is the process involved in the issue of debentures? |  |

| 4. What are the advantages of issuing debentures for a company? |  |

| 5. What are the risks associated with investing in debentures? |  |