6.1 Introduction

Unintentional omission or commission of amounts and accounts in the process of recording the transactions are commonly known as errors. These various unintentional errors can be committed at the stage of collecting financial information/data on the basis of which financial statements are drawn or at the stage of recording this information. Also errors may occur as a result of mathematical mistakes, mistakes in applying accounting policies, misinterpretation of facts, or oversight. To check the arithmetic accuracy of the journal and ledger accounts, trial balance is prepared. If the trial balance does not tally, then it can be said that there are errors in the accounts which require rectification thereof. Some of these errors may affect the Trial Balance and some of these do not have any impact on the Trial Balance although such errors may affect the determination of profit or loss, assets and liabilities of the business.

Illustrative Case of Errors and their Nature

We have seen that after preparing ledger accounts a trial balance is taken out where debit and credit balances are separately listed and totalled. If the two totals do not agree, it is definite that there have been some errors We shall now study the types of errors which may be committed and how they may be rectified. For this purpose, the working of the following illustrative cases should be carefully seen.

Question for ICAI Notes- Unit 6: Rectification of Errors - 1

Try yourself:

What are errors in accounting?Explanation

- Errors in accounting refer to unintentional mistakes made during the process of recording transactions.

- These errors can occur during the collection of financial information or at the stage of recording this information.

- They can result from mathematical mistakes, misinterpretation of facts, oversight, or mistakes in applying accounting policies.

- To identify these errors, a trial balance is prepared to check the arithmetic accuracy of the journal and ledger accounts.

- If the trial balance does not tally, it indicates the presence of errors that need to be rectified.

- Some errors may affect the trial balance, while others may impact the determination of profit or loss, assets, and liabilities of the business.

Report a problem

Illustrative Cases of Errors

(a) Wrong Entry: Let us start from the first phase in the accounting process. Wrong entry of the value of transactions and events in the subsidiary books, Journal Proper and Cash Book may occur.

Example 1: Credit purchases ₹17,270 are entered in the Purchases Day Book as ₹ 17,720. Credit sales of ₹15,000 gross less 1% trade discount are wrongly entered in Sales Day Book at ₹15,000. Cheque issued ₹19,920 are wrongly entered in the credit of bank column in the Cash Book as ₹19,290.

(b) Wrong casting of subsidiary books: Subsidiary books are totalled periodically and posted to the appropriate ledger accounts. There may arise totalling errors. Totalling errors may arise due to wrong entry or simply these may be independent errors. Example 2: For the month of January, 2016 total of credit sales are ₹ 1,75,700, this is wrongly totalled as ₹ 1,76,700 and posted to sales account as ₹ 1,76,700.

(c) In case of cash book, wrong castings result in wrong calculation of the balance c/d.

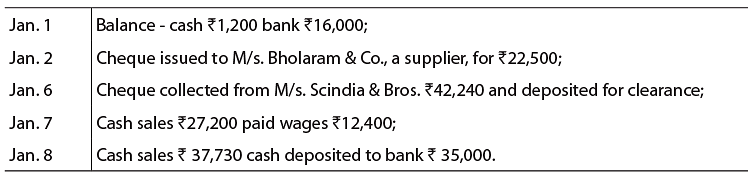

Example 3: The following cash transactions of M/s. Tularam & Co. occurred:

The following Cash Book entries are passed:

The following Cash Book entries are passed:

Wrong entries and wrong casting are shown in bold prints. However, errors of cash entries generally are not carried. Usually cash balances are tallied daily. So errors are identified at an early stage. But bank balance cannot be checked daily and thus errors may be carried until bank reconciliation is made. In the above example, there are four wrong entries and one wrong casting. Bank and cash balances are affected by these errors.

Wrong entries and wrong casting are shown in bold prints. However, errors of cash entries generally are not carried. Usually cash balances are tallied daily. So errors are identified at an early stage. But bank balance cannot be checked daily and thus errors may be carried until bank reconciliation is made. In the above example, there are four wrong entries and one wrong casting. Bank and cash balances are affected by these errors.

(d) Wrong posting from subsidiary books: In this case, the wrong amount may be posted to the ledger account or the amount may posted to the wrong side or to the wrong account. For example, purchases from A may be posted to B's account.

(e) Wrong casting of ledger balances: Likewise Cash Book, any ledger account balance may be cast wrongly. Obviously wrong postings make the balance wrong; but that is not wrong casting of balances. Whenever there arises independent casting error as in the case of bank column in the Cash Book of example (4), that is called wrong casting of ledger balances.

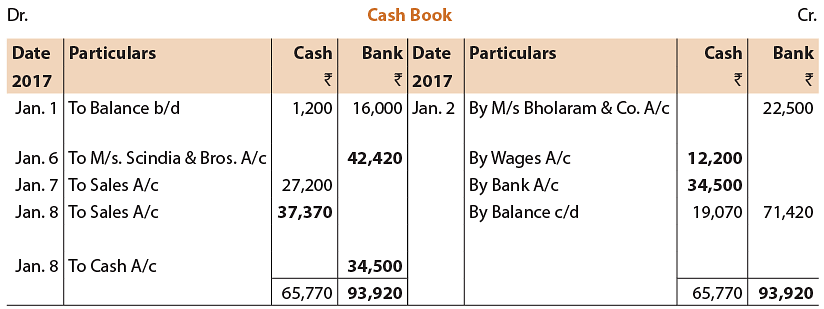

Example 4: The following are the credit purchases of M/s. Ballav Bros.:

2017

Jan. 1 Purchases from M/s. Saurabh & Co.- gross ₹1,00,000 less 1% trade discount.

Jan. 3 Purchases from M/s. Netai & Co.- gross ₹70,000 less 1% trade discount.

Jan. 6 Purchases from M/s. Saurabh & Co.- gross ₹ 60,000 less 1% trade discount

Let us cast M/s. Saurabh & Co.’s Account:

*While casting the credit side an error has been committed and so the account is wrongly balanced.

*While casting the credit side an error has been committed and so the account is wrongly balanced.

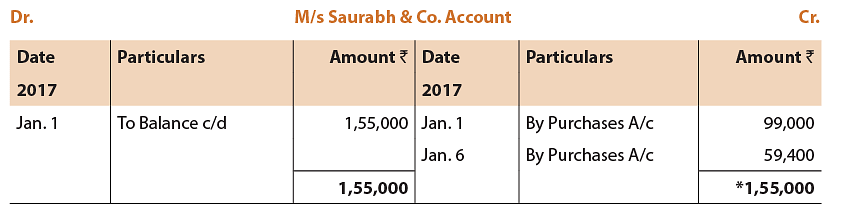

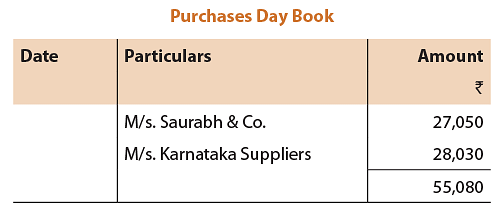

Example 5: Goods are purchased on credit from M/s. Saurabh & Co. for ₹ 27,030 and from M/s. Karnataka Suppliers for ₹ 28,050. The following Day Book is prepared:

In the Day Book both the transactions are entered wrongly but the first error has been compensated by the second. Even if these errors are not rectified Trial Balance would tally.

In the Day Book both the transactions are entered wrongly but the first error has been compensated by the second. Even if these errors are not rectified Trial Balance would tally.

6.2 Stages of Errors

Errors may occur at any of the following stages of the accounting process:

AT THE STAGE OF RECORDING THE TRANSACTIONS IN JOURNAL

Following types of errors may happen at this stage:

(i) Errors of principle,

(ii) Errors of omission,

(iii) Errors of commission.

AT THE STAGE OF POSTING THE ENTRIES IN LEDGER

(i) Errors of omission:

(a) Partial omission,

(b) Complete omission.

(ii) Errors of commission:

(a) Posting to wrong account,

(b) Posting on the wrong side,

(c) Posting of wrong amount.

AT THE STAGE OF BALANCING THE LEDGER ACCOUNTS

(a) Wrong Totalling of accounts,

(b) Wrong Balancing of accounts.

AT THE STAGE OF PREPARING THE TRIAL BALANCE

(a) Errors of omission,

(b) Errors of commission:

1. Taking wrong account,

2. Taking wrong amount,

3. Taking to the wrong side.

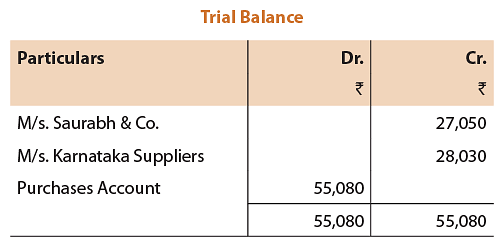

On the above basis, we can classify the errors in four broad categories:

1. Errors of Principle,

2. Errors of Omission,

3. Errors of Commission,

4. Compensating Errors.

6.3 Types of Errors

Basically errors are of two types:

(a) Errors of principle: When a transaction is recorded in contravention of accounting principles, like treating the purchase of an asset as an expense, it is an error of principle. In this case there is no effect on the trial balance since the amounts are placed on the correct side, though in a wrong account. Suppose on the purchase of a computer, the office expenses account is debited; the trial balance will still agree.

(b) Clerical errors: These errors arise because of mistake committed in the ordinary course of the accounting work. These are of three types:

(i) Errors of Omission: If a transaction is completely or partially omitted from the books of account, it will be a case of omission. Examples would be: not recording a credit purchase of furniture or not posting an entry into the ledger.

(ii) Errors of Commission: If an amount is posted in the wrong account or it is written on the wrong side or the totals are wrong or a wrong balance is struck, it will be a case of "errors of commission."

(iii) Compensating Errors: If the effect of errors committed cancel out, the errors will be called compensating errors. The trial balance will agree. Suppose an amount of ₹10 received from A is not credited to his account and the total of the sales book is ₹10 in excess. The omission of credit to A's account will be made up by the increased credit to the Sales Account.

From another point of view, error may be divided into two categories:

(a) Those that affect the trial balance - because of these errors ,trial balance does not agree; these are the following:

(i) Wrong casting of the subsidiary books.

(ii) Wrong balancing of an account.

(iii) Posting an amount on the wrong side.

(iv) Posting the wrong amount.

(v) Omitting to post an amount from a subsidiary book.

(vi) Omitting to post the totals of subsidiary book.

(vii) Omitting to write the cash book balances in the trial balance.

(viii) Omitting to write the balance of an account in the trial balance.

(ix) Writing a balance in wrong column of the trial balance.

(x) Totalling the trial balance wrongly.

(b) The errors that do not affect the trial balance are the following:

(i) Omitting an entry altogether from the subsidiary book.

(ii) Making an entry with the wrong amount in the subsidiary book .

(iii) Posting an amount in a wrong account but on the correct side, e.g., an amount to be debited to A is debited to B, the trial balance will still agree.

6.4 Steps to Locate Errors

Even if there is only a very small difference in the trial balance, the errors leading to it must be located and rectified. A small difference may be the result of a number of errors. The following steps will be useful in locating errors :

(i) The two columns of the trial balance should be totalled again. If in place of a number of accounts, only one amount has been written in the trial balance the list of such accounts should be checked and totalled again. List of Trade receivables is the example from which Trade receivable balance is derived.

(ii) It should be seen that the cash and bank balances have been written in the trial balance.

(iii) The exact difference in the trial balance should be established. The ledger should be gone through; it is possible that a balance equal to the difference has been omitted from the trial balance. The difference should also be halved; it is possible that balance equal to half the difference has been written in the wrong column.

(iv) The ledger accounts should be balanced again.

(v) The casting of subsidiary books should be checked again, especially if the difference is ' 1, ₹ 100 etc.

(vi) If the difference is very big, the balance in various accounts should be compared with the corresponding accounts in the previous period. If the figures differ materially the cases should be seen; it is possible that an error has been committed. Suppose the sales account for the current year shows a balance of ₹ 32,53,000 whereas it was ₹ 36,45,000 last year; it is possible that there is an error in the Sales Account.

(vii) Postings of the amounts equal to the difference or half the difference should be checked. It is possible that an amount has been omitted to be posted or has been posted on the wrong side.

(viii) If there is still a difference in the trial balance, a complete checking will be necessary. The posting of all the entries including the opening entry should be checked. It may be better to begin with the nominal accounts.

6.5 Rectification of Errors

Errors should never be corrected by overwriting. If immediately after making an entry it is clear that an error has been committed, it may be corrected by neatly crossing out the wrong entry and making the correct entry. If however the errors are located after some time, the correction should be made by making another suitable entry, called rectification entry. In fact the rectification of an error depends on at which stage it is detected. An error can be detected at any one of the following stages:

(a) Before preparation of Trial Balance.

(b) After Trial Balance but before the final accounts are drawn.

(c) After final accounts, i.e., in the next accounting period.

6.5.1 Before preparation of Trial Balance

There are some errors which affect one side of an account or which affect more than one account in such a way that it is not possible to pass a complete rectification entry. In other words, there are some errors which can be corrected, if detected at this stage, by making rectification statement in the appropriate side(s) of concerned account(s). It is important to note here that such errors may involve only one account or more than one account. Read the following illustrations:

(i) The sales book for November is undercast by ₹ 200. The effect of this error is that the Sales Account has been credited short by ₹ 200. Since the account is posted by the total of the sales book, there is no error in the accounts of the customers since they are posted with amounts of individual sales. Hence only the Sales Accounts is to be corrected. This will be done by making an entry for ₹ 200 on the credit side: "By undercasting of Sales Book for November ₹ 200".

(ii) While posting the discount column on the debit side of the cash book the discount of ' 10 allowed to Ramesh has not been posted. There is no error in the cash book, the total of discount column presumably has been posted to the discount account on the debit side. The error is in not crediting Ramesh by ₹ 10. This should now be done by the entry "By omission of posting of discount on ----- ₹10".

(iii) ₹ 200 received from Ram has been entered by mistake on the debit side of his account. Since the cash book seems to have been correctly written, the error is only in the account of Ram - he should have been credited and not debited by ₹ 200. Not only is the wrong debit to be removed but also a credit of ₹ 200 is to be given. This can be done now by entering ₹ 400 on the credit side of his account. The entry will be "By Posting on the wrong side - ₹ 400".

(iv) ₹ 50 was received from Mahesh and entered on the debit side of the cash book but was not posted to his account. By the error, which affects only the account of Mahesh, ₹ 50 has been omitted from the credit side of his account. The rectification will be by the entry. "By Omission of posting on the ₹ 50."

(v) ₹ 51 paid to Mohan has been posted as ₹15 to the debit of his account. Mohan has been debited short by ₹36. The rectifying entry is "To mistake in posting on ₹ 36".

(vi) Goods sold to Ram for ₹1,000 was wrongly posted from sales day book to the debit of purchase account. Ram has however been correctly debited. Here the error affects two accounts, viz., purchases account and sales account but we cannot pass a journal entry for its rectification because both the accounts need to be credited. The rectification will be by the entry "By wrong posting on ₹ 1,000" in the credit of purchases account and also "By omission of posting on - ₹ 1,000" in the credit sales account.

(vii) Bills receivable from Mr. A of ₹ 500 was posted to the credit of Bills payable Account and also credited to A account. Here also although two accounts are involved we cannot pass a complete journal entry for rectification. The rectification will be by the entry "To wrong posting on ₹' 500" in debit of Bills payable Account and also "To omission of posting on ₹ 500" in the debit of Bills Receivable Account.

(viii) Goods purchased from Vinod for ₹ 1,000 was wrongly credited to Vimal account by ₹ 100. Again we cannot pass a complete journal entry for rectification even though two accounts are involved. The rectification will be done by the entry "To wrong posting on ₹ 100" in the debit of Vimal account and "By omission of posting on ₹ 1,000" in the credit of Vinod account.

Thus, from the above illustrations we are convinced that the general rule that errors affecting two accounts can always be corrected by a journal entry is not always valid.

ILLUSTRATION 1

How would you rectify the following errors in the book of Rama & Co.?

1. The total to the Purchases Book has been undercast by ₹ 100.

2. The Returns Inward Book has been undercast by ₹ 50.

3. A sum of ₹ 250 written off as depreciation on Machinery has not been debited to Depreciation Account.

4. A payment of ₹ 75 for salaries (to Mohan) has been posted twice to Salaries Account.

5. The total of Bills Receivable Book ₹ 1,500 has been posted to the credit of Bills Receivable Account.

6. An amount of ₹ 151 for a credit sale to Hari, although correctly entered in the Sales Book, has been posted as ₹ 115.

7. Discount allowed to Satish ₹ 25 has not been entered in the Discount Column of the Cash Book. the amount has been postedcorrectly to the credit of his personal account.

Solution

1. The Purchases Account should receive another debit of ₹100 since it was debited short previously: "To Undercasting of Purchases Book for the month of --- ₹100."

2. Due to this error the Returns Inward Account has been posted short by ₹ 50 : the correct entry will be: "To Undercasting of Returns Inward Book for the month of --- '50."

3. The omission of the debit to the Depreciation Account will be rectified by the entry: "To Omission of posting on ₹ 250".

4. The excess debit will be removed by a credit in the Salaries Account by the entry: "By double posting on ₹ 75".

5. ₹1,500 should have been debited to the Bills Receivable Account and not credited. To correct the mistake, the Bills Receivable Account should be debited by ₹ 3,000 by the entry: "To Wrong posting of B/R received on ₹ 3,000"

6. Hari's personal A/c is debited ₹ 36 short. The rectification entry will be: "To Wrong posting ₹ 36".

7. Due to this error, the discount account has been debited short by ₹ 25. The required entry is : "To Omission of discount allowed to Satish on ₹ 25."

So far we have discussed the correction of errors which affected only one Account or more than one account but for which rectifying entries were not complete journal entries.We shall now take up the correction of errors which affect more than one account in such a way that complete journal entries are possible for their rectification. Read the following illustrations:

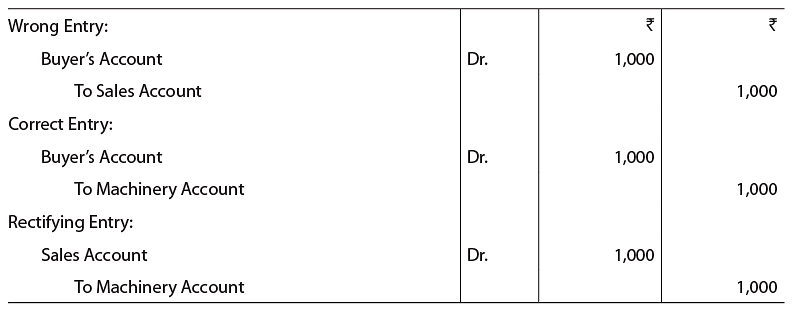

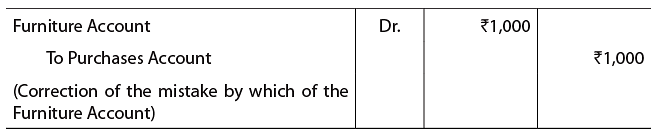

(i) The purchase of machinery for ₹ 2,000 has been entered in the purchases book. The effect of the entry is that the account of the supplier Ram & Co. has been credited by ₹ 2,000 which is quite correct. But the debit to the Purchases Account is wrong : the debit should be to Machinery Account. To rectify the error, the debit in the purchases Account has to be transferred to the Machinery Account. The correcting entry will be to Credit Purchases Account and debit the Machinery Account. Please see the three entries made below: the last entry rectifies the error:

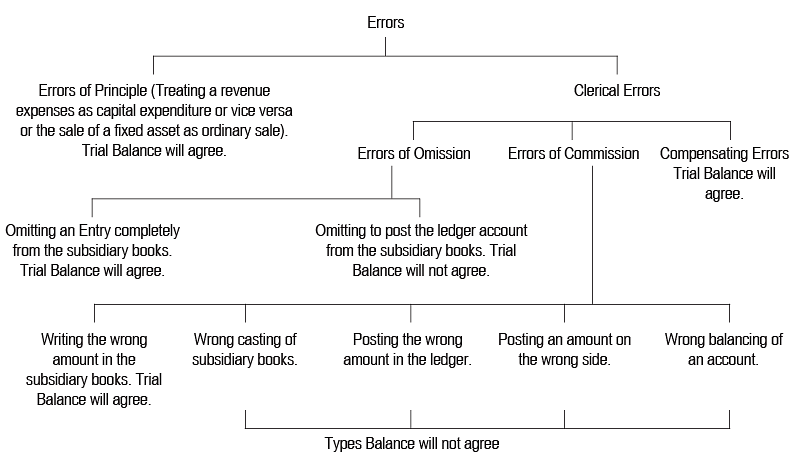

(ii) ₹ 100 received from Kamal Kishore has been credited in the account of Krishan Kishore. The error is that there is a wrong credit in the account of Krishan Kishore and omission of credit in the account of Kamal Kishore; Krishan Kishore should be debited and Kamal Kishore be credited. The following three entries make this clear:

(ii) ₹ 100 received from Kamal Kishore has been credited in the account of Krishan Kishore. The error is that there is a wrong credit in the account of Krishan Kishore and omission of credit in the account of Kamal Kishore; Krishan Kishore should be debited and Kamal Kishore be credited. The following three entries make this clear:

(iii) The sale of old machinery, ₹1,000 has been entered in the sales book. By this entry the account of the buyer has been correctly debited by ₹1,000. But instead of crediting the Machinery Account. Sales Account has been credited. To rectify the error this account should be debited and the Machinery Account credited. See the three entries given below:

(iii) The sale of old machinery, ₹1,000 has been entered in the sales book. By this entry the account of the buyer has been correctly debited by ₹1,000. But instead of crediting the Machinery Account. Sales Account has been credited. To rectify the error this account should be debited and the Machinery Account credited. See the three entries given below:

ILLUSTRATION 2

ILLUSTRATION 2

The following errors were found in the book of Ram Prasad & Sons. Give the necessary entries to correct them.

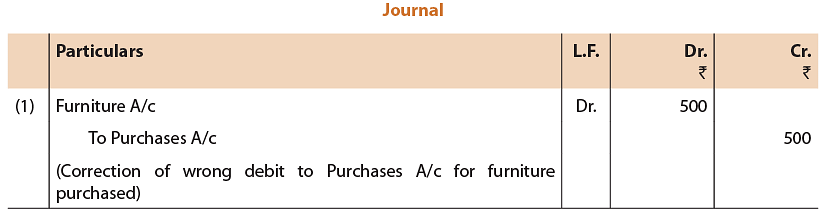

(1) ₹ 500 paid for furniture purchased has been charged to ordinary Purchases Account.

(2) Repairs made were debited to Building Account for ₹ 50.

(3) An amount of ₹ 100 withdrawn by the proprietor for his personal use has been debited to Trade Expenses Account.

(4) ₹ 100 paid for rent debited to Landlord's Account.

(5) Salary ₹ 125 paid to a clerk due to him has been debited to his personal account.

(6) ₹100 received from Shah & Co. has been wrongly entered as from Shaw & Co.

(7) ₹ 700 paid in cash for a typewriter was charged to Office Expenses Account.

Solution

ILLUSTRATION 3

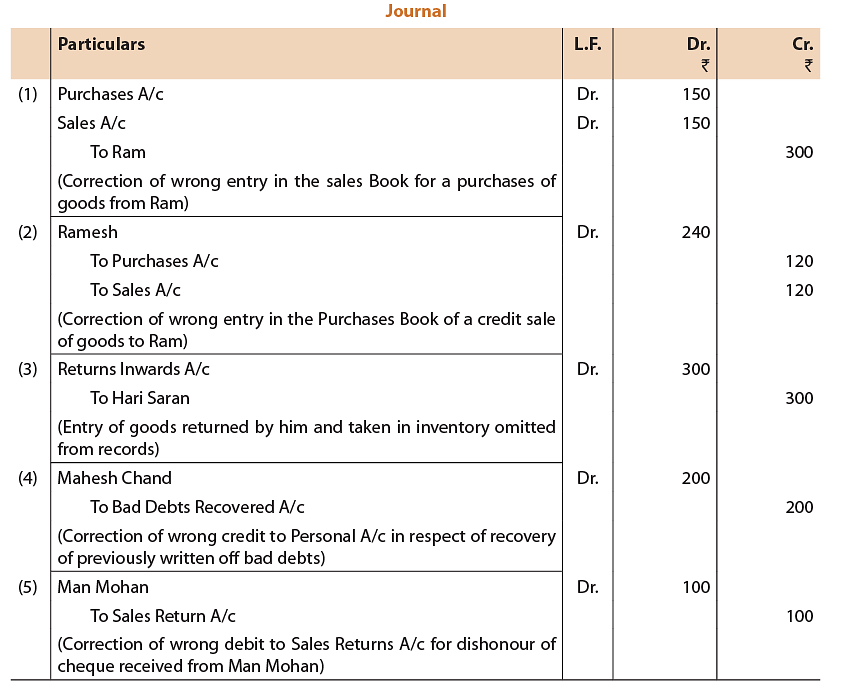

Give journal entries to rectify the following:

(1) A purchase of goods from Ram amounting to ₹ 150 has been wrongly entered through the Sales Book.

(2) A Credit sale of goods amounting ₹120 to Ramesh has been wrongly passed through the Purchase Book.

(3) On 31st December, 2016 goods of the value of ₹300 were returned by Hari Saran and were taken inventory on the same date but no entry was passed in the books.

(4) An amount of ₹ 200 due from Mahesh Chand, which had been written off as a Bad Debt in a previous year, was unexpectedly recovered, and had been posted to the personal account of Mahesh Chand.

(5) A Cheque for ₹ 100 received from Man Mohan was dishonoured and had been posted to the debit of Sales Returns Account.

Solution:

Thus it can be said that errors detected before the preparation of trial balance can be rectified either through rectification statements (not entries) or through rectification entries.

Thus it can be said that errors detected before the preparation of trial balance can be rectified either through rectification statements (not entries) or through rectification entries.

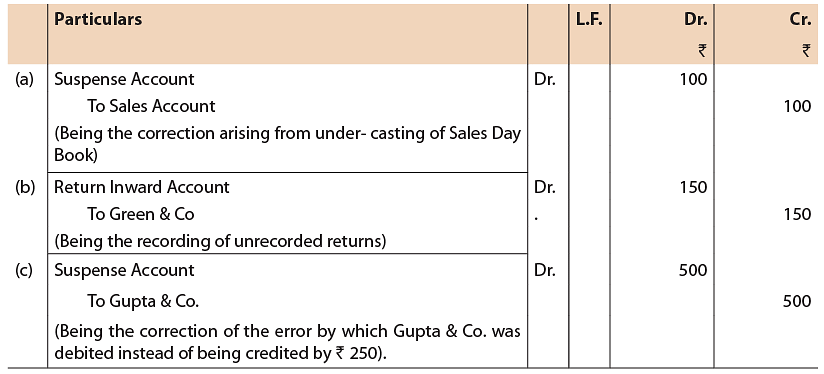

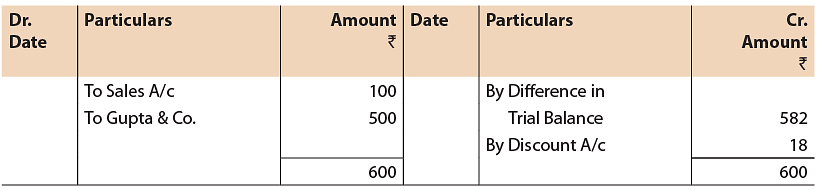

6.5.2 After Trial Balance but before Final Accounts

The method of correction of error indicated so far is appropriate when the errors have been located before the end of the accounting period. After the corrections the trial balance will agree. Sometimes the trial balance is artificially made to agree inspire of errors by opening a suspense account and putting the difference in the trial balance to the account - the suspense account will be debited if the total of the credit column in the trial balance exceeds the total of the debit column; it will be credited in the other case. One must note that such agreement of the trial balance will not be real. Effort must be made to locate the errors.

The rule of rectifying errors detected at this stage is simple. Those errors for which complete journal entries were not possible in the earlier stage of rectification (i.e., before trial balance) can now be rectified by way of journal entry(s) with the help of suspense account, for it these errors which gave rise to the suspense account in the trial balance. The rectification entry for other type of error i.e. error affecting more than one account in such a way that a complete journal entry is possible for its rectification, can be rectified in the same way as in the earlier stage (i.e. before trial balance). In a nutshell, it can be said that each and every error detected at this stage can only be corrected by a complete journal entry. Those errors for which journal entries were not possible at the earlier stage will now be rectified by a journal entry(s), the difference or the unknown side is being taken care of by suspense account.

Those errors for which entries were possible even at the first stage will now be rectified in the same way. Suppose, the sales book for November, 2015 is cast '100 short; as a consequence the trial balance will not agree. The credit column of the trial balance will be '100 short and a Suspense Account will be credited by '100. To rectify the error the Sales Account will be credited (to increase the credit to the right figure. Since now one error remains, the Suspense Account must be closed- it will be debiting the Suspense Account. The entry will be:

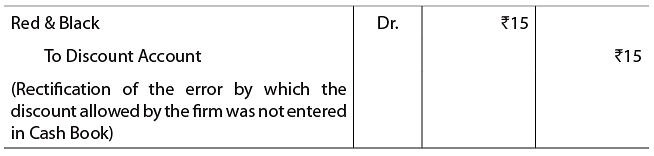

ILLUSTRATION 4

Correct the following errors (i) without opening a Suspense Account and (ii) opening a Suspense Account:

(a) The Sales Book has been totalled ₹ 100 short.

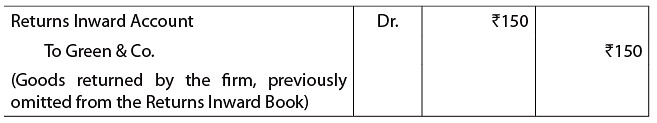

(b) Goods worth ₹ 150 returned by Green & Co. have not been recorded anywhere.

(c) Goods purchased ₹ 250 have been posted to the debit of the supplier Gupta & Co.

(d) Furniture purchased from Gulab & Bros,₹ 1,000 has been entered in Purchases Day Book.

(e) Discount received from Red & Black ₹ 15 has not been entered in the Discount Column of the Cash Book.

(f) Discount allowed to G. Mohan & Co. ₹ 18 has not been entered in the Discount Column of the Cash Book. The account of G. Mohan & Co. has, however, been correctly posted.

Solution:

If a Suspense Account is not opened.

(a) Since sales book has been cast ₹100 short, the Sales Account has been similarly credited ₹ 100 short. The correcting entry is to credit the Sales Account by ₹100 as "By wrong totalling of the Sales Book ₹100".

(b) To rectify the omission, the Returns Inwards Account has to be debited and the account of Green & Co. credited. The entry:

(c) Gupta & Co. have been debited ₹ 250 instead of being credited. This account should now be credited by 500 to remove the wrong debit and to give the correct debit. The entry will be on the credit side... "By errors in posting ₹ 500".

(c) Gupta & Co. have been debited ₹ 250 instead of being credited. This account should now be credited by 500 to remove the wrong debit and to give the correct debit. The entry will be on the credit side... "By errors in posting ₹ 500".

(d) By this error Purchases Account has to be debited by ₹ 1,000 whereas the debit should have been to the Furniture Account. The correcting entry will be:

(e) The discount of ₹ 15 received from Red & Black should have been entered on the credit side of the cash book. Had this been done, the Discount Account would have been credited (through the total of the discount column) and Red & Black would have been debited. This entry should not be made:

(e) The discount of ₹ 15 received from Red & Black should have been entered on the credit side of the cash book. Had this been done, the Discount Account would have been credited (through the total of the discount column) and Red & Black would have been debited. This entry should not be made:

(f) In this case the account of the customer has been correctly posted; the Discount Account has been debited ₹18 short since it has been omitted from the discount column on the debit side of the cash book. The discount account should now be debited by the entry; "To Omission of entry in the Cash Book ₹ 18".

(f) In this case the account of the customer has been correctly posted; the Discount Account has been debited ₹18 short since it has been omitted from the discount column on the debit side of the cash book. The discount account should now be debited by the entry; "To Omission of entry in the Cash Book ₹ 18".

If a Suspense Account is opened :

Suspense Account

Suspense Account

Notes:

Notes:

(i) One should note that the opening balance in the Suspense Account will be equal to the difference in the trial balance.

(ii) If the question is silent as to whether a Suspense Account has been opened, the student should make his assumption, state it clearly and then proceed.

ILLUSTRATION 5

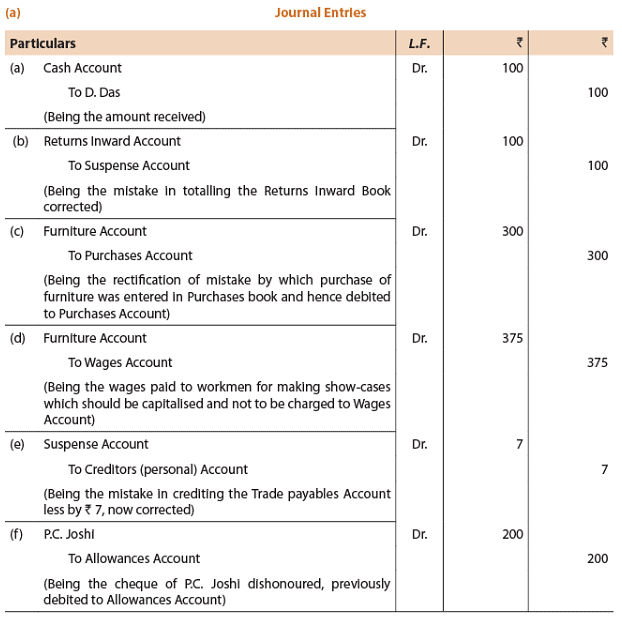

Correct the following errors found in the books of Mr. Dutt. The Trial Balance was out by ' 493 excess credit. The difference thus has been posted to a Suspense Account.

(a) An amount of ₹100 was received from D. Das on 31st December, 2015 but has been omitted to enter in the Cash Book.

(b) The total of Returns Inward Book for December has been cast' 100 short.

(c) The purchase of an office table costing ₹ 300 has been passed through the Purchases Day Book.

(d) ₹ 375 paid for Wages to workmen for making show-cases had been charged to "Wages Account".

(e) A purchase of ₹ 67 had been posted to the trade payables' account as ₹ 60.

(f) A cheque for ₹ 200 received from P. C. Joshi had been dishonoured and was passed to the debit of "Allowances Account".

(g) ₹ 1,000 paid for the purchase of a motor cycle for Mr. Dutt had been charged to "Miscellaneous Expenses Account".

(h) Goods amounting to ₹ 100 had been returned by customer and were taken in to inventory, but no entry in respect there of, was made into the books.

(i) A sale of ₹ 200 to Singh & Co. was wrongly credited to their account. Entry was made correctly made in sales book.

Solution:

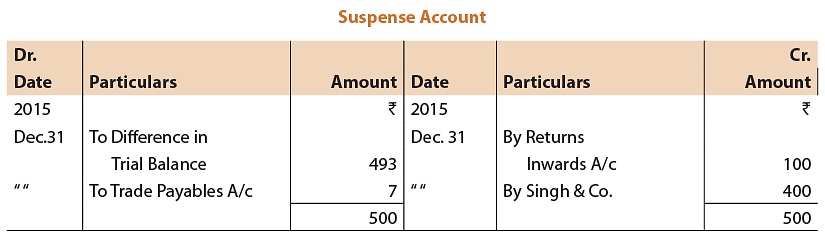

ILLUSTRATION 6

The following errors, affecting the account for the year 2015 were detected in the books of Jain Brothers, Delhi:

(1) Sale of old Furniture ₹150 treated as sale of goods.

(2) Receipt of ₹ 500 from Ram Mohan credited to Shyam Sunder.

(3) Goods worth ₹ 100 brought from Mohan Narain have remained unrecorded so far.

(4) A return of'120 from Mukesh posted to his debit.

(5) A return of ₹ 90 to Shyam Sunder posted as ₹ 9 in his account.

(6) Rent of proprietor's residence, ₹ 600 debited to rent A/c.

(7) A payment of ₹ 215 to Mohammad Sadiq posted to his credit as ₹ 125.

(8) Sales Book added ₹ 900 short.

(9) The total of Bills Receivable Book ₹ 1,500 left unposted.

You are required to pass the necessary rectifying entries and show how the trial balance would be affected by the errors.

Solution:

N.B. : For 4, 5, 7, 8, 9 no journal entry can be passed as they affect a single account. The correction will be as under:

N.B. : For 4, 5, 7, 8, 9 no journal entry can be passed as they affect a single account. The correction will be as under:

(4) Credit Mukesh's Account with ₹ 240.

(5) Debit the account of Shyam Sunder by ₹ 81.

(7) Debit the account of Mohammad Sadiq by ₹ 340.

(8) Credit Sales Account by ₹ 900.

(9) Debit Bills Receivable Account with ₹ 1,500.

Effect of the Errors on Trial Balance

1. No effect

2. No effect

3. No effect

4. Trial Balance credit total short by ₹ 240.

5. Trial Balance debit total short by ₹ 81.

6. No effect

7. Trial Balance debit total short by ₹ 340.

8. Trial Balance credit total short by ₹ 900.

9. Trial Balance debit total short by ₹ 1,50i

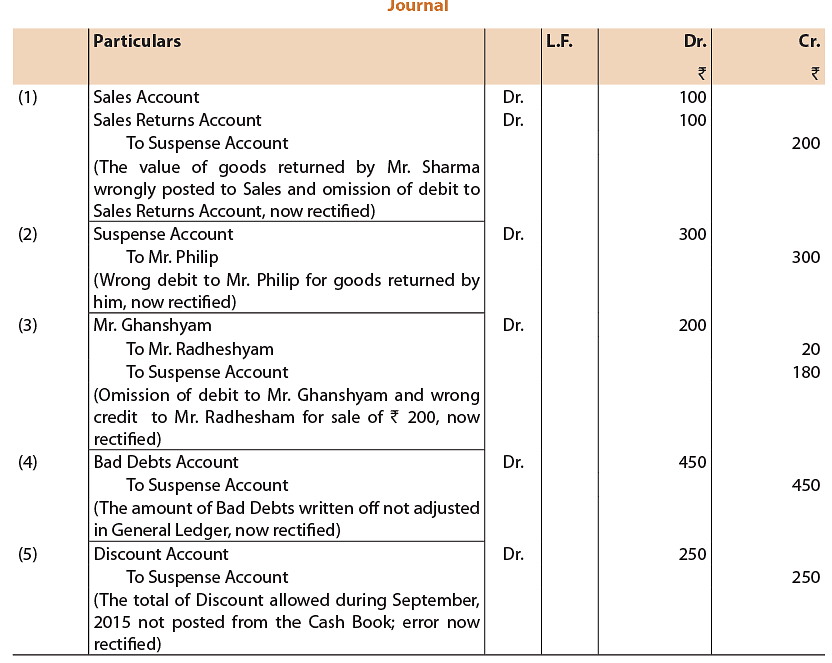

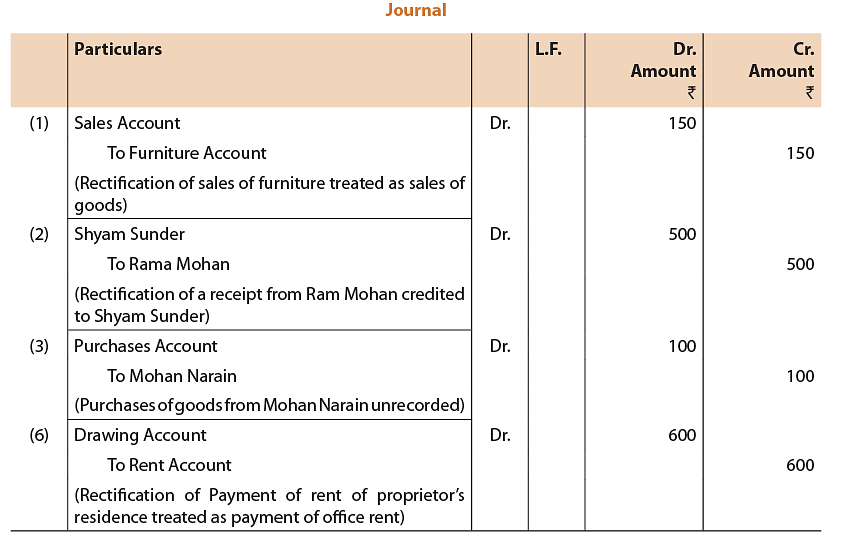

ILLUSTRATION 7

Write out the Journal Entries to rectify the following errors, using a Suspense Account.

(1) Goods of the value of ₹ 100 returned by Mr. Sharma were entered in the Sales Day Book and posted therefrom to the credit of his account;

(2) An amount of ₹150 entered in the Sales Returns Book, has been posted to the debit of Mr. Philip, who returned the goods;

(3) A sale of ₹ 200 made to Mr. Ghanshyam was correctly entered in the Sales Day Book but wrongly posted to the debit of Mr. Radheshyam as ₹ 20;

(4) Bad Debts aggregating ₹ 450 were written off during the year in the Sales ledger but were not adjusted in the General Ledger; and

(5) The total of "Discount Allowed" column in the Cash Book for the month of September, 2015 amounting to ₹ 250 was not posted.

Solution:

The following Cash Book entries are passed:

The following Cash Book entries are passed: Wrong entries and wrong casting are shown in bold prints. However, errors of cash entries generally are not carried. Usually cash balances are tallied daily. So errors are identified at an early stage. But bank balance cannot be checked daily and thus errors may be carried until bank reconciliation is made. In the above example, there are four wrong entries and one wrong casting. Bank and cash balances are affected by these errors.

Wrong entries and wrong casting are shown in bold prints. However, errors of cash entries generally are not carried. Usually cash balances are tallied daily. So errors are identified at an early stage. But bank balance cannot be checked daily and thus errors may be carried until bank reconciliation is made. In the above example, there are four wrong entries and one wrong casting. Bank and cash balances are affected by these errors. *While casting the credit side an error has been committed and so the account is wrongly balanced.

*While casting the credit side an error has been committed and so the account is wrongly balanced. In the Day Book both the transactions are entered wrongly but the first error has been compensated by the second. Even if these errors are not rectified Trial Balance would tally.

In the Day Book both the transactions are entered wrongly but the first error has been compensated by the second. Even if these errors are not rectified Trial Balance would tally.

(ii) ₹ 100 received from Kamal Kishore has been credited in the account of Krishan Kishore. The error is that there is a wrong credit in the account of Krishan Kishore and omission of credit in the account of Kamal Kishore; Krishan Kishore should be debited and Kamal Kishore be credited. The following three entries make this clear:

(ii) ₹ 100 received from Kamal Kishore has been credited in the account of Krishan Kishore. The error is that there is a wrong credit in the account of Krishan Kishore and omission of credit in the account of Kamal Kishore; Krishan Kishore should be debited and Kamal Kishore be credited. The following three entries make this clear: (iii) The sale of old machinery, ₹1,000 has been entered in the sales book. By this entry the account of the buyer has been correctly debited by ₹1,000. But instead of crediting the Machinery Account. Sales Account has been credited. To rectify the error this account should be debited and the Machinery Account credited. See the three entries given below:

(iii) The sale of old machinery, ₹1,000 has been entered in the sales book. By this entry the account of the buyer has been correctly debited by ₹1,000. But instead of crediting the Machinery Account. Sales Account has been credited. To rectify the error this account should be debited and the Machinery Account credited. See the three entries given below: ILLUSTRATION 2

ILLUSTRATION 2

Thus it can be said that errors detected before the preparation of trial balance can be rectified either through rectification statements (not entries) or through rectification entries.

Thus it can be said that errors detected before the preparation of trial balance can be rectified either through rectification statements (not entries) or through rectification entries.

(c) Gupta & Co. have been debited ₹ 250 instead of being credited. This account should now be credited by 500 to remove the wrong debit and to give the correct debit. The entry will be on the credit side... "By errors in posting ₹ 500".

(c) Gupta & Co. have been debited ₹ 250 instead of being credited. This account should now be credited by 500 to remove the wrong debit and to give the correct debit. The entry will be on the credit side... "By errors in posting ₹ 500". (e) The discount of ₹ 15 received from Red & Black should have been entered on the credit side of the cash book. Had this been done, the Discount Account would have been credited (through the total of the discount column) and Red & Black would have been debited. This entry should not be made:

(e) The discount of ₹ 15 received from Red & Black should have been entered on the credit side of the cash book. Had this been done, the Discount Account would have been credited (through the total of the discount column) and Red & Black would have been debited. This entry should not be made: (f) In this case the account of the customer has been correctly posted; the Discount Account has been debited ₹18 short since it has been omitted from the discount column on the debit side of the cash book. The discount account should now be debited by the entry; "To Omission of entry in the Cash Book ₹ 18".

(f) In this case the account of the customer has been correctly posted; the Discount Account has been debited ₹18 short since it has been omitted from the discount column on the debit side of the cash book. The discount account should now be debited by the entry; "To Omission of entry in the Cash Book ₹ 18".

Suspense Account

Suspense Account Notes:

Notes:

N.B. : For 4, 5, 7, 8, 9 no journal entry can be passed as they affect a single account. The correction will be as under:

N.B. : For 4, 5, 7, 8, 9 no journal entry can be passed as they affect a single account. The correction will be as under: