Verification and Valuation of Assets and Liabilities | Crash Course for UGC NET Commerce PDF Download

Verification and Valuation of Assets and Liabilities in Auditing

The process of verifying and valuing assets and liabilities in auditing is crucial for ensuring the accuracy and reliability of financial information.

Verification of Assets and Liabilities

When auditors verify assets, they confirm ownership, possession, and existence. To do this effectively, they may collaborate with experts from various fields to ensure accurate valuation and verification of assets. Here are some important aspects of asset verification:

- Verification of Existing Assets: This involves tracking changes in assets, such as comparing the number of assets before and after a certain period. By doing so, companies can assess their profit and loss over time.

- Valuable Assets: These are assets that significantly contribute to the growth and efficiency of a company. Auditors identify assets crucial for the organization's development.

- Authority of Existence: This pertains to ownership and legal rights associated with an asset. By verifying deeds, contracts, and other documents, auditors ensure that assets are legally owned and that the organization has full control to utilize and benefit from them.

Valuation of Assets and Liabilities

Valuing assets and liabilities is a crucial part of the audit process, ensuring that a company's financial statements accurately reflect its financial standing. Auditors confirm that assets and liabilities are valued correctly and disclosed according to accounting standards and regulations.

Objectives for Verification and Valuation of Assets and Liabilities

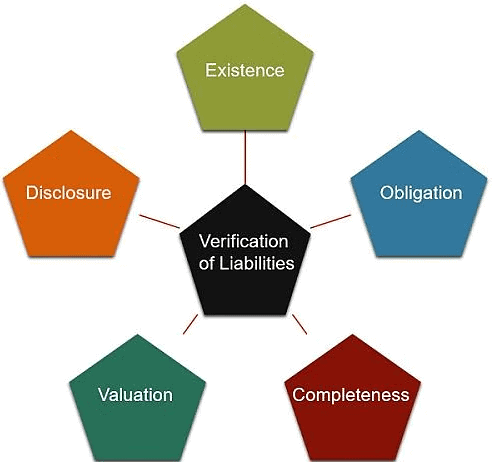

The goal of verifying liabilities is to ensure the balance sheet displays the correct value of a company's liabilities. Let's explore the key objectives:

- Accurate and Fair View: The main goal of asset and liability verification is to ensure that the information presented in a company's financial statements is both trustworthy and reliable, benefiting stakeholders.

- Existence and Possession: This process focuses on confirming the presence of assets and liabilities in a company's financial records, ensuring they exist and are rightfully owned by the organization.

- Fraud and Irregularity: Detecting any signs of fraudulent activities or irregularities within financial statements is essential during the verification process to maintain transparency and integrity.

- Arithmetical Accuracy: Ensuring the mathematical accuracy of assets and liabilities listed in the balance sheet is crucial to eliminate any errors that could misrepresent the financial standing of the company.

- Ownership and Title: This aspect involves verifying the ownership and rightful title of assets, determining the actual owners and ensuring proper documentation of ownership details.

- Disclosure: Disclosing relevant and significant information about assets and liabilities in financial statements, including details on amounts, time periods, and associated risks, is vital for informed decision-making by stakeholders.

Principles of Verification of Asset and Liability

When we talk about verifying assets and liabilities, it involves following specific rules or principles. Let's break down some of the key principles of asset and liability verification:

- Determining Ownership and Possession: The process of verification aims to establish who owns and possesses the assets and liabilities.

- Accurate Recording and Disclosure: It ensures that all assets and liabilities are correctly recorded and disclosed in line with accounting standards and regulations.

- Consistent Methods: Companies should employ consistent methods for verifying and valuing their assets and liabilities.

- Focusing on Balance Sheet Items: Verification pertains to the assets and liabilities listed in the company's balance sheet.

- Correct Valuation: It involves accurately valuing the assets and liabilities of the company.

- Examining Company Debts: Verification includes assessing any loans the company has taken to calculate associated charges.

Method of Valuation of Asset and Liability

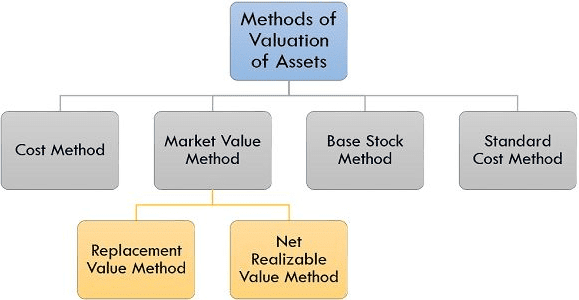

There are several methods to follow when verifying assets and liabilities. Below are some key methods for the verification and valuation of assets and liabilities:

- Book Value: Under this method, an asset's value is recorded in a company's accounting books after subtracting depreciation.

- Market Value: This method determines the worth of assets and liabilities based on their current market value or fair value.

- Replacement Value: The replacement cost method calculates the expense of replacing assets with similar ones at current market prices. It is particularly useful for valuing unique or hard-to-evaluate assets.

- Historical Cost Method: Assets and liabilities are valued based on their original cost under this approach. However, any changes in market conditions affecting asset values are not considered.

- Scrap Value Method: Companies utilize this method for assets they no longer use and wish to sell at a significantly reduced price.

- Amortized Cost Method: This method assesses a company's liabilities considering the borrowing cost, including interest and other fees over the loan's duration. It is primarily used for valuing long-term liabilities such as bonds and long-term loans.

- Discounted Cash Flow Method: Utilized for valuing long-term investments, this method takes into account the time value of money and expected future growth. It calculates the present value of future cash flows.

Difference Between Verification and Valuation of Assets and Liabilities

Verification and valuation of assets and liabilities may sound similar, but they serve different purposes. Let's delve into the key distinctions between the two processes:

Verification of Assets and Liabilities:

- Verification confirms the existence and accuracy of assets and liabilities listed in financial records through methods like physical checks and third-party confirmations.

- For assets, this involves physically verifying assets and seeking confirmations from entities like banks and customers.

- For liabilities, it entails reviewing contracts and ensuring balances align with creditors.

- By verifying assets and liabilities, discrepancies in financial statements can be identified, risks mitigated, and regulatory compliance ensured.

- This process also furnishes crucial insights to stakeholders, aiding them in making informed decisions.

Valuation of Assets and Liabilities:

- Valuation assigns monetary values to assets and liabilities, reflecting their true worth in financial terms.

- This process is essential for accurately representing the financial health and position of an organization.

- It involves techniques like market comparisons, income projections, and cost assessments to determine the fair value of assets and liabilities.

- Accurate valuation is crucial for making strategic decisions, financial reporting, and ensuring transparency.

Conclusion

Verification and valuation of assets and liabilities play a pivotal role in upholding the credibility and reliability of an organization's financial statements. By conducting thorough verification and precise valuation, discrepancies can be unearthed, risks minimized, and regulatory compliance maintained. These processes also offer valuable insights to stakeholders, empowering them to make well-informed choices.

|

157 videos|236 docs|166 tests

|

FAQs on Verification and Valuation of Assets and Liabilities - Crash Course for UGC NET Commerce

| 1. What are the objectives of verification and valuation of assets and liabilities in auditing? |  |

| 2. What are the principles of verification of assets and liabilities? |  |

| 3. What is the method of valuation of assets and liabilities in auditing? |  |

| 4. Why is verification and valuation of assets and liabilities important in auditing? |  |

| 5. How does verification and valuation of assets and liabilities help in preventing fraud in auditing? |  |