Class 1 Exam > Class 1 Notes > Worksheets with solutions for Class 1 > Worksheet: How Much Can We Spend? - 1

How Much Can We Spend? - 1 Class 1 Worksheet Maths

Solve these real life money situations

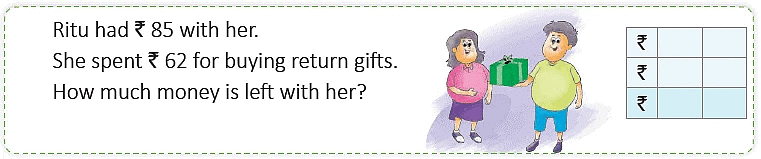

Q1:

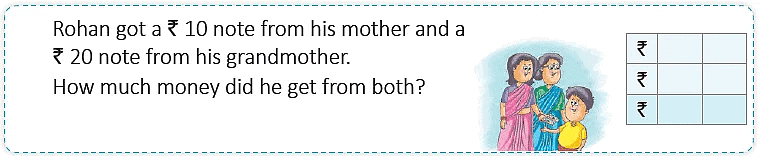

Q2:

Q3:

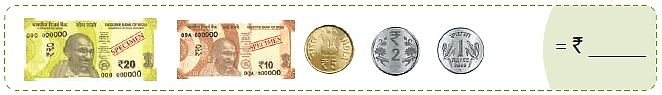

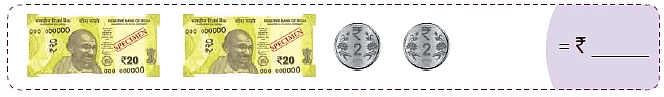

Add and write the answer

(a)

(b)

(c)

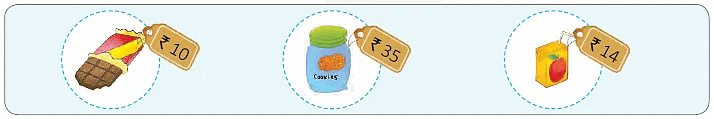

Fill in the Blanks - Price Tags

Look at the items and their costs on the price tags and fill in the blanks. (a) Cost of

(a) Cost of  and

and  are ___________.

are ___________.

(b) Cost of

and

and  are ___________.

are ___________.

(c) Cost of  ,

, and

and  are ___________.

are ___________.

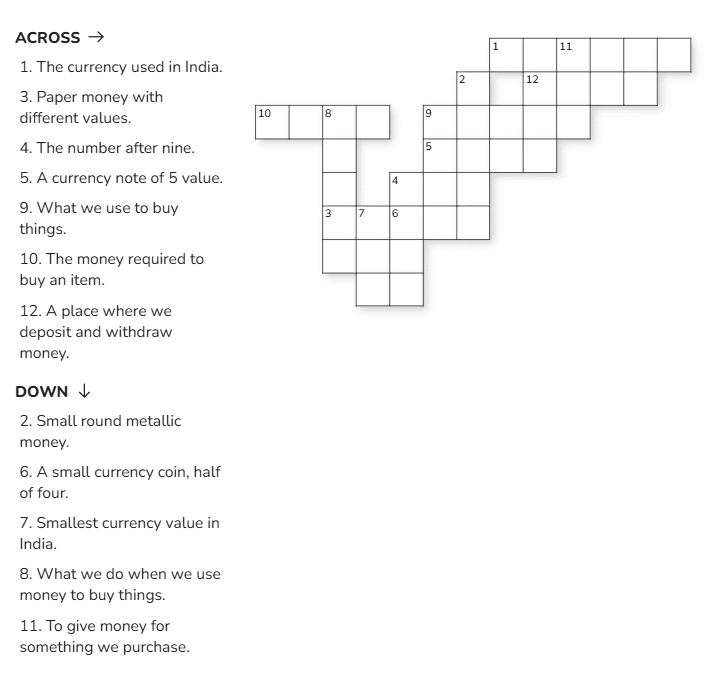

Crossword Puzzle

(Fill in the boxes using the clues given below to complete the crossword.)

Fill in the Blanks - Number of Coins

(Fill in the number of coins in the blanks. One is done for you.)

Five 2 rupee coins make 10 rupees.

(a) ___________ 10 rupee coins make 50 rupees.

(b) ___________ 5 rupee coins make 20 rupees.

(c) ___________ 10 rupee coins make 20 rupees.

Use the Correct Symbol <, = or >

(a) ₹ 85

₹58

₹58(b) ₹ 50

₹50

₹50(c) 90 paise

₹1

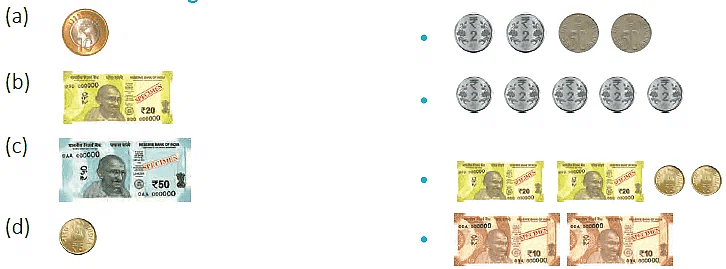

₹1Match the following

You can access the solutions to this worksheet here.

The document How Much Can We Spend? - 1 Class 1 Worksheet Maths is a part of the Class 1 Course Worksheets with solutions for Class 1.

All you need of Class 1 at this link: Class 1

FAQs on How Much Can We Spend? - 1 Class 1 Worksheet Maths

| 1. What are some effective budgeting techniques for managing personal finances? |  |

Ans. Some effective budgeting techniques include the envelope system, zero-based budgeting, and the 50/30/20 rule. The envelope system involves allocating cash into envelopes for different spending categories. Zero-based budgeting requires you to assign every dollar of your income to expenses, savings, or debt repayment, ensuring that your income minus your expenses equals zero. The 50/30/20 rule suggests that you spend 50% of your income on needs, 30% on wants, and 20% on savings or debt repayment.

| 2. How can I start saving money effectively? |  |

Ans. To start saving money effectively, begin by setting clear financial goals, such as saving for an emergency fund, a vacation, or retirement. Create a budget to track your income and expenses, and identify areas where you can cut back. Consider automating your savings by setting up a direct deposit into a savings account. Also, explore high-interest savings accounts or investment options to make your money work for you.

| 3. What should I do if I have debt? |  |

Ans. If you have debt, start by assessing your financial situation, including the total amount owed and interest rates. Create a budget to manage your expenses and allocate funds towards debt repayment. Consider strategies like the snowball method, where you pay off the smallest debts first for motivation, or the avalanche method, where you focus on debts with the highest interest rates. Additionally, explore options such as debt consolidation or speaking with a financial advisor for personalized assistance.

| 4. How can I improve my credit score? |  |

Ans. To improve your credit score, pay your bills on time, keep your credit utilization ratio below 30%, and avoid opening too many new credit accounts at once. Regularly check your credit report for errors and dispute any inaccuracies. Consider becoming an authorized user on a responsible person's credit card to benefit from their positive credit history. Lastly, diversify your credit types, such as having a mix of credit cards, installment loans, and mortgages.

| 5. What are some common financial mistakes to avoid? |  |

Ans. Common financial mistakes to avoid include living beyond your means, not having an emergency fund, ignoring retirement savings, and failing to track expenses. Additionally, making impulsive purchases without a budget can lead to financial strain. It's also important to avoid relying solely on credit cards for everyday expenses, as this can accumulate debt. Lastly, not shopping around for the best rates on loans or insurance can cost you more in the long run.

Related Searches