Worksheet: National Income Accounting- 1 | Economics Class 12 - Commerce PDF Download

MCQ Questions

Q1: Which of the following is an example of normal residents of India?

(a) Foreign worker working in WHO located in India

(b) The German working as director in IMD office located in India

(c) Ambassador in India from the rest of the world

(d) Ambassador of India in rest of the world

Q2: . Which of the given pair is incorrectly matched?

Column I Column II

A. Land (i) Rent

B. Labour (ii) Wages and salaries

C. Capital (iii) Interest

D. Entrepreneur (iv) Dividend

Codes

(a) A – (i)

(b) B – (ii)

(c) C – (iii)

(d) D – (iv)

Q3:. Factor payment received by the households for rendering their services as employees of the producing unit is called

(a) Compensation of employees

(b) Rent

(c) Interest

(d) Profit

Q4: Operating Surplus =

(a) Compensation of Employees + Rent + Interest +Profit

(b) Rent + Interest + Profit

(c) Compensation of Employees + Mixed Income of Self-employed

(d) Compensation of Employees + Rent + Interest + Profit +Mixed Income of Self-employed

Q5. Which of the following is included in the estimation of national income?

(a) Expenses on electricity by a factory

(b) Gifts from abroad

(c) Free services by the government

(d) Financial help to earthquake victims

Q6: Which of the following statements is/are correct?

(i) Value added and value of output are identical concepts.

(ii) Sum total of value added by all the producing units within the domestic territory of the country is equal to national product.

Alternatives

(a) Both are true

(b) Both are false

(c) (i) is true, but (ii) is false

(d) (i) is false, but (ii) is true

Q7. Which of the following is not included in the estimation of national income?

(a) Brokerage on sale of bonds

(b) Imputed value of production for self-consumption

(c) Leisure-time activities

(d) Employer’s contribution to provident fund

Q8: Inventory investment is used as a component to calculate national income in which of the following methods?

(a) Product method and income method

(b) Income method and expenditure method

(c) Product method and expenditure method

(d) Product method, income method and expenditure method

Q9: National income is the sum of factor incomes accruing to

(a) nationals

(b) economic territory

(c) residents

(d) Both residents and non-residents

Q10: If gross domestic capital formation is R.s.3,000, net domestic fixed capital formation is R.s. 2,000 and inventory investment is R.s.150, what will be the value of consumption of fixed capital?

(a) R.s. 1,000

(b) R.s. 850

(c) R.s. 150

(d) Can’t be determined

Q11: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Real GDP shows change in the level of economic activity and facilitates inter-regional and international comparison.

Reason (R) It is an inflation adjusted index and account for an increase in the level of production in response to the price changes.

Q12: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Payment of uniforms for nurses by a hospital is not included in the estimation of national income.

Reason (R) Uniforms are provided by the hospital at the time of work. It is to be treated as an intermediate consumption.

Q13: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) GDP as an index of welfare may underestimate or overestimate the welfare.

Reason (R) It does not consider the non-monetary exchanges and does not take into consideration the positive or negative aspects associated with an economic activity.

Q14: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Financial help received by the flood victims should not be included while estimating national income.

Reason (R) Financial help is a transfer payment and should not be included.

Q15: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Money received from the sale of second hand car will be considered while estimating national income.

Reason (R) Their value is already included and it does not contribute to the current flow of goods and services.

Q16. Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Imputed value of owner-occupied lands are a part of both domestic income and national income.

Reason (R) Factors of production are bound to give its services regardless of the fact that it is giving its services to the owner or an outsider.

Q17: Assertion-Reasoning MCQs

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Assertion (A) Public goods possess the characteristics of non-rivalry and non-excludability.

Reason (R) Non-rival means consumption by one person does not reduces consumption for another person whereas non-excludability implies that no one can be excluded in terms of benefitting from the consumption of public goods.

Short Answer Type Questions

Q1: ‘Subsidies to the producers, should be treated as transfer payments’. Defend or refute the given statement with valid reason.

Q2: Suppose the GDP at market price of a country in a particular year was R.s. 1,100 crore. Net factor income from abroad was R.s.100 crore. The value of Indirect taxes – Subsidies was R.s.150 crore and national income was R.s.850 crore. Calculate the aggregate value of depreciation.

Q3: ‘Domestic services (household services) performed by a woman are not considered as an economic activity. Defend or refute the given statement with valid reason.

Q4: In a single day Raju, the barber collects R.s. 500 from haircuts; over this day, his equipment depreciates in value by R.s. 50. Of the remaining R.s. 450, Raju pays sales tax worth R.s.30, takes home 200 and retains 220 for improvement and buying of new equipment. He further pays R.s.20 as income tax from his income. Based on this information, complete Raju’s contribution to the following measures of income (i) Gross domestic product, (ii) NNP at market price and (iii) NNP at factor cost.

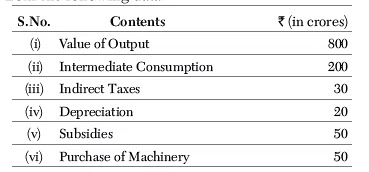

Q5: Calculate Net Value Added at Factor Cost (NVA FC) from the following data.

Q7: GNP is the estimated value of the total worth of production and services earned by the normal residents of a country. But to find out NNP, GNP deducts depreciation, why should we deduct depreciation from GNP?

Q8: Which of the following factor incomes be included in domestic factor income of India? Give reasons for your answer.

(i) Compensation of employees to the residents of Japan working in Indian embassy in Japan.

(ii) Rent received by an Indian resident from Russian embassy in India.

(iii) Profits earned by a branch of State Bank of India in England.

Q9: How will the following be treated while estimating national income of India? Give reasons.

(i) Value of bonus shares received by shareholders of a company.

(ii) Capital gains to Indian residents from sale of shares of a foreign company.

(iii) Fees received from students.

Q10: Giving reason state how the following are treated in estimation of national income.

(i) Payment of interest by banks to its depositors.

(ii) Expenditure on old age pensions by government.

(iii) Expenditure on engine oil by car service station.

Q10: “Management of a water polluting oil refinery says that it (oil refinery) ensures welfare through its contribution to gross domestic product.” Defend or refute the argument of management with respect to GDP as a welfare measure of the economy.

Q11: Social welfare may not increase even when real GDP increases. Explain.

Q12: Sale of petrol and diesel cars is rising particularly in big cities. Analyse its impact on gross domestic product and welfare.

Long Answer Type Questions

Q1: Define the problem of double counting in the estimation of national income. Discuss two approaches to correct the problem of double counting.

Q2: Explain the treatment assigned to the following while estimating national income. Give reasons.

(i) Family members working free on the farm owned by the family.

(ii) Rent free house from an employer.

(iii) Expenditure on free services provided by the government.

You can access the solutions to this worksheet here.

|

64 videos|308 docs|51 tests

|

FAQs on Worksheet: National Income Accounting- 1 - Economics Class 12 - Commerce

| 1. What is national income accounting and why is it important? |  |

| 2. What are the main components of national income? |  |

| 3. How is Gross Domestic Product (GDP) different from Gross National Product (GNP)? |  |

| 4. What is the significance of the GDP growth rate as an economic indicator? |  |

| 5. How does national income accounting impact government policy-making? |  |