Worksheet Solutions: Bank Reconciliation Statement | Accountancy Class 11 - Commerce PDF Download

Q1: State the need for the preparation of a bank reconciliation statement.

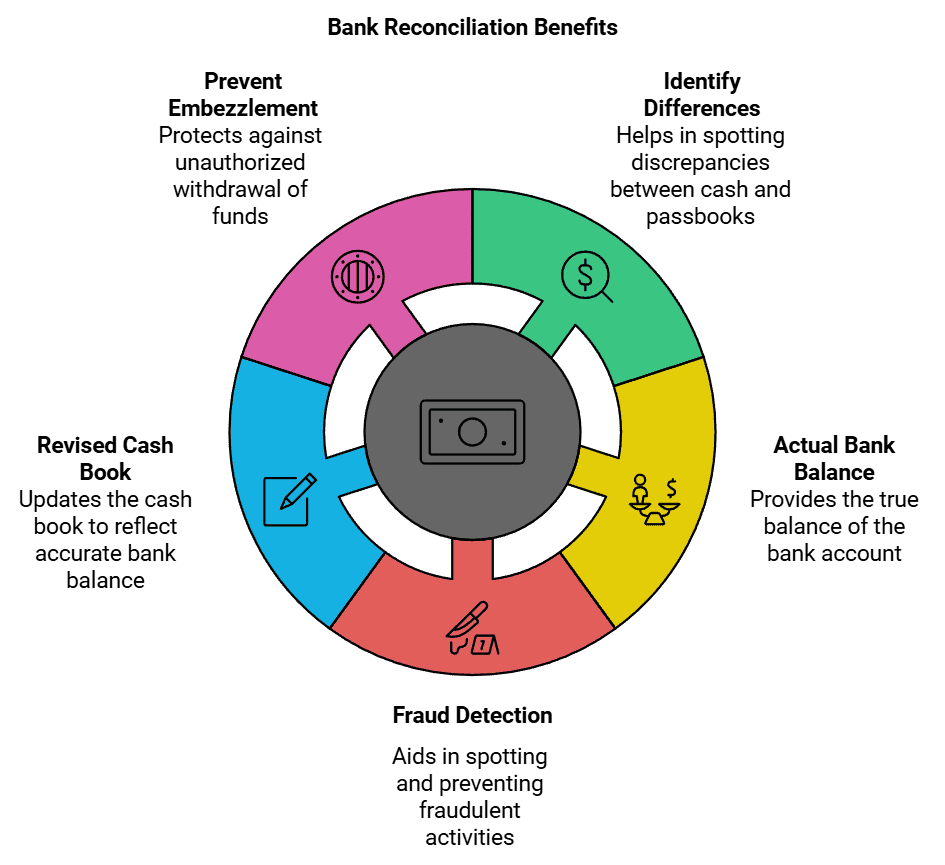

Ans: Preparing a bank reconciliation statement is necessary for:

- It helps in identifying the difference between a cash book and a passbook.

- It helps in knowing the actual bank balance.

- It helps in the detection and prevention of frauds and errors in recording banking transactions

- It helps in knowing the actual bank balance.

- Helps to create a revised Cash Book that reflects true bank balance.

- It helps in preventing the embezzlement of money from the bank account.

Q2: What is a bank overdraft?

Ans: Bank overdraft is created when there is a withdrawal, which is over the bank balance available in the account. It is an obligation to the account holder.

Q3: Briefly explain the statement ‘wrongly debited by the bank’ with the help of an example.

Ans: It means that the bank has debited the amount from the user's account for some invalid reason. The following instance can help in understanding.

Rajesh’s account is charged an overdraft of Rs.5000 even though his account has a sufficient credit balance. It can happen when the cashier has done an incorrect entry into the account.

Q4: State the causes of difference that occurred due to time lag.

Ans: The following are the causes of difference that occurred due to time lag

- The cheque issued by the firm is not yet presented for payment.

- The cheque was deposited into the bank but is yet to be realized.

- Direct debits were done by the bank on behalf of the customer.

- The amount is deposited directly into the bank account.

- Interest and dividends that are not collected by the bank.

- Direct payments made by the bank on behalf of the customers

- Cheques that are deposited or bills discounted which is dishonoured.

Q5: Briefly explain the term favourable balance as per cash book

Ans: When the total of the debit column of the Cash Book is more than the total credit column of the Cash Book, it is known as a debit balance or favourable balance. A favourable balance is an asset to an account holder. A favourable balance can also be defined as a surplus of deposits over withdrawals.

Q6: Enumerate the steps to ascertain the correct cash book balance.

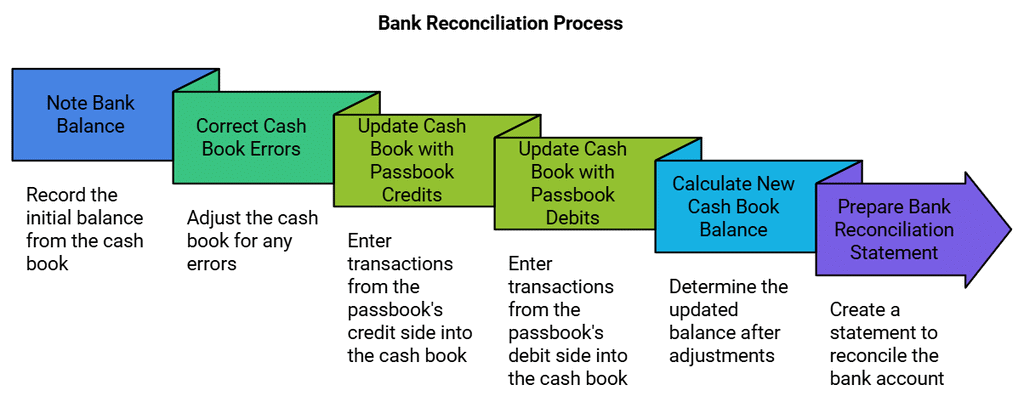

Ans: The difference between the cash book and passbook can arise due to some transactions that are recorded in the passbook not being present in the cash book. This can be rectified by recording those transactions in the cash book. The balance thus obtained is called an adjusted balance or amended balance. The following steps describe this process.

- Note bank balance as per cash book.

- Make corrections for errors committed in the cash book.

- Transactions present only on the passbook’s credit side must be updated on the debit side of the cashbook

- Transactions present only on the passbook’s debit side must be updated on the debit side of the cashbook

- Calculate the new cash book balance and use it to prepare a Bank Reconciliation Statement.

Q7: Explain the process of preparing a bank reconciliation statement with an amended cash balance.

Ans: The process involves addressing differences between the cash book and the passbook, often caused by transactions recorded in the passbook but missing in the cash book. To reconcile these, the missing transactions are entered into the cash book, resulting in an amended cash balance. The following steps describe this process:

- Note bank balance as per cash book.

- Make corrections for errors committed in the cash book.

- Transactions present only on the passbook’s credit side must be updated on the debit side of the cashbook

- Transactions present only on the passbook’s debit side must be updated on the debit side of the cashbook

- Calculate the new cash book balance and use it to prepare a Bank Reconciliation Statement.

Q8: What is a bank reconciliation statement? Why is it prepared?

Ans: A statement that is prepared to rectify or tally the difference that exists between the user passbook and the cashbook of the firm, so that the cause of the difference can be determined and rectified is known as Bank Reconciliation Statement. The following are the reasons for its preparation:

- To determine if the balance reported by the company’s cashbook is the correct amount.

- Rectifying any errors present in the cash book so that proper statements can be generated.

- Prevents fraudulent activities like embezzlement and improves accountability.

- To discover any errors made by the bank and apply corrective measures.

- Helps check the accuracy of information recorded in both books.

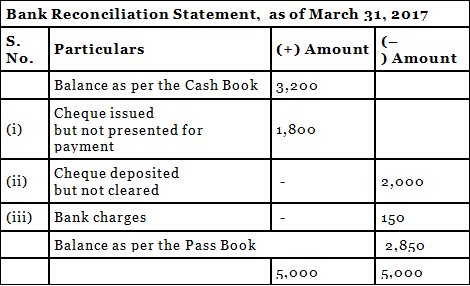

Q9: From the following particulars, prepare a bank reconciliation statement as of March 31, 2017.

(i) Balance as per cash book ₹ 3,200

(ii) Cheque issued but not presented for payment ₹ 1,800

(iii) Cheque deposited but not collected up to March 31, 2017, ₹ 2,000

(iv) Bank charges debited by bank ₹ 150

Ans: The reconciliation statement is shown below:

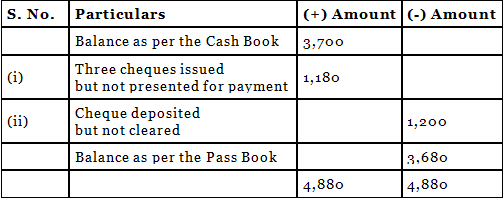

Q10: On March 31 2017 the cash book showed a balance of ₹ 3,700 as cash at the bank, but the bank passbook made up to the same date showed that cheques for ₹ 700, ₹ 300, and ₹ 180 respectively had not been presented for payment, Also, cheque amounting to ₹ 1,200 deposited into the account had not been credited. Prepare a bank reconciliation statement.

Ans: The reconciliation statement is shown below:

The balance as per pass book as of 31st March is ₹3, 680

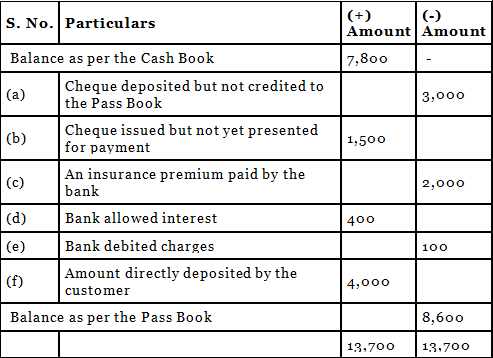

Q11: The cash book shows a bank balance of ₹ 7,800. On comparing the cash book with the passbook the following discrepancies were noted:

(a) Cheque deposited in the bank but not credited ₹ 3,000

(b) Cheque issued but not yet present for payment ₹ 1,500

(c) Insurance premium paid by the bank ₹ 2,000

(d) Bank interest credit by the bank ₹ 400

(e) Bank charges ₹ 100

(f) Directly deposited by a customer ₹ 4,000

Ans: The bank reconciliation statement is shown below:

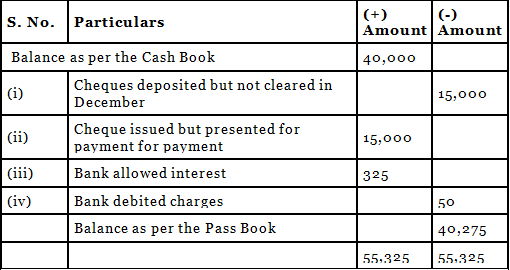

Q12: Bank balance of ₹ 40,000 showed in the cash book of Atul on December 31, 2016. It was found that three cheques of ₹ 2,000, ₹ 5,000, and ₹ 8,000 deposited during the month of December were not credited in the passbook till January 02, 2017. Two cheques of ₹ 7,000 and ₹ 8,000 issued on December 28, were not presented for payment till January 03, 2017. In addition to it, bank had credited Atul for ₹ 325 as interest and had debited him with ₹ 50 as bank charges for which there were no corresponding entries in the cash book.

Prepare a bank reconciliation statement as of December 31, 2016.

Ans: The bank reconciliation statement is shown below:

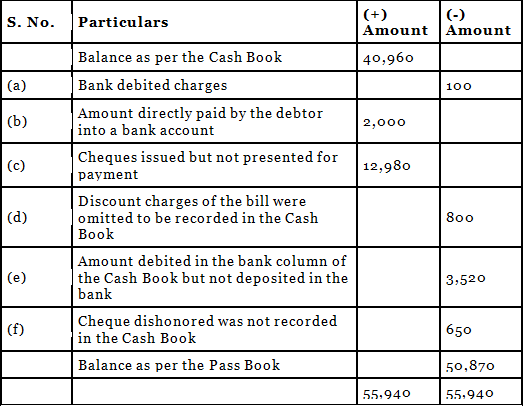

Q13: On comparing the cash book with the passbook of Naman it is found that on March 31, 2017, the bank balance of ₹ 40,960 shown by the cash book differs from the bank balance with regard to the following:

(a) Bank charges ₹ 100 on March 31, 2017, are not entered in the cash book.

(b) On March 21, 2017, a debtor paid ₹ 2,000 into the company’s bank in settlement of his account, but no entry was made in the cash book of the company in respect of this.

(c) Cheques totalling ₹ 12,980 were issued by the company and duly recorded in the cash book before March 31, 2017, but had not been presented at the bank for payment until after that date.

(d) A bill for ₹ 6,900 discounted with the bank is entered in the cash book with a recording of the discount charge of ₹ 800.

(e) ₹ 3,520 is entered in the cash book as paid into the bank on March 31st, 2017, but not credited by the bank until the following day.

(f) No entry has been made in the cash book to record the dishonour or on March 15, 2017, of a cheque for ₹ 650 received from Bhanu.

Prepare a reconciliation statement as of March 31, 2017.

Ans: The reconciliation statement is shown below:

|

61 videos|154 docs|35 tests

|

FAQs on Worksheet Solutions: Bank Reconciliation Statement - Accountancy Class 11 - Commerce

| 1. What is a bank reconciliation statement and why is it important? |  |

| 2. How often should a business perform a bank reconciliation? |  |

| 3. What are common reasons for discrepancies in bank reconciliation? |  |

| 4. What steps are involved in preparing a bank reconciliation statement? |  |

| 5. Can bank reconciliation help identify fraudulent activity? |  |