Worksheet Solutions: Recording of Transactions - II | Accountancy Class 11 - Commerce PDF Download

Q1: Which balance of the bank column in the cash book signifies bank overdraft?

Ans: Credit balance in the bank column of the cash book signifies bank overdraft. An overdraft is an extension of credit from a lending institution when an account reaches zero.

- Opening entry

- Recording of Depreciation

Q2: Mention two transactions which are recorded in journal proper.

Ans: Yes, as the source documents for recording entries in the sales book are invoices

Q3: Is it correct to say, sales book is a record prepared from invoices issued to customers?

Ans: Cash book. A cash discount is a reduction in the amount of an invoice that the seller allows the buyer. This discount is given in exchange for the buyer paying the invoice earlier than the normal payment date of the invoice.

Q4: In which book of original entry, a discount of Rs. 50 offered for an early payment of cash of Rs. 1,050 be recorded?

Ans: In small concerns only one journal and one ledger may serve the purpose, because the number of transactions is very small. But in large business concerns the number of transactions are numerous, just one journal and one ledger will not do the job. That will cause much inconvenience i.e., if we have only one journal in a large scale business, it is not possible for one bookkeeper to record all the transactions in time. So the journal is sub divided. The various advantages of subsidiary books are as follows

- Division of Work: In place of one journal, many special journals are prepared. This results in division of work among various executives.

- Specialization: If a particular task is handled by a particular executive. This leads to specialization and increases efficiency.

- Time Saving: Dividing journal into different categories means different executives can work simultaneously on different journals which will increase the speed of work and will save time.

- Easy Access to Desired Information: Transactions are recorded on the basis of their nature i.e., purchase transactions in purchase book, sales transactions in sales book, etc. This facilitates easy and quick accessibilities to particular type of transactions.

- Quick Checking: In case of errors in recording, it is easier to find out the reasons of errors.

Q5: Described the advantages of sub-dividing the journal?

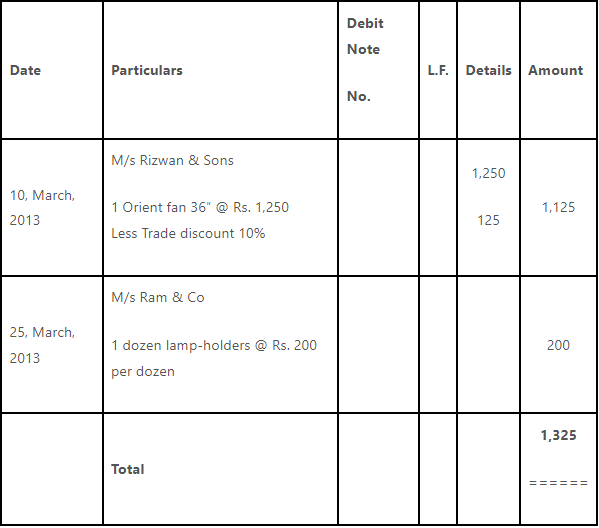

Ans: Total of Purchases Return Book – Rs. 1,325

Purchase Return Book

Q6: Prepare the purchases return book in the book of Abdulla Stores from the following transactions:

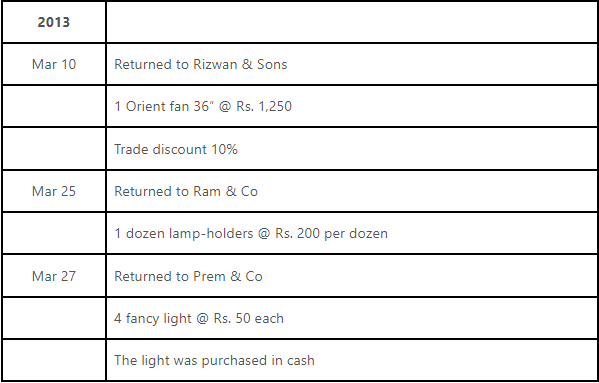

Ans: Cash Book

| Bank | Bank | ||||||||||

| Date | Particulars | L/F | Cash | ICICI | Axis | Date | Particulars | L/F | Cash | ICICI | Axis |

| (Rs.) | (Rs.) | (Rs.) | (Rs.) | (Rs.) | (Rs.) | ||||||

| 2013 | 2013 | ||||||||||

| Mar 1 | To Balanced b/d | 85,000 | 2,50,000 | Mar 1 | By Balance b/d | 1,75,000 | |||||

| Mar 3 | To Sales A/c | 70,000 | Mar 5 | By Salaries A/c | 1,00,000 | ||||||

| Mar 8 | To Raj | 90,000 | Mar 10 | By ICICI | C | 50,000 | |||||

| Mar 10 | To Cash A/c | C | 50,000 | Mar 12 | By Axis | C | 30,000 | ||||

| Mar 12 | To ICICI | C | 30,000 | Mar 15 | By Cash A/c | C | 80,000 | ||||

| Mar 15 | To ICICI | C | 80,000 | Mar 15 | By Balance c/d | 1,85,000 | 90,000 | ||||

| Mar 15 | To Balance c/d | 55,000 | |||||||||

| 2,35,000 ======= | 3,00,000 ======= | 1,75,000 ======= | 2,35,000 ======= | 3,00,000 ====== | 1,75,000 ====== | ||||||

| Mar 16 | To Balance c/d | 1,85,000 | 90,000 | Mar 16 | By Balance c/d | 55,000 | |||||

The cash book is used to record receipts and payments of cash. It works as a book of original entry as well as a ledger account. The entries related to receipt and payment of cash are first recorded in the cash book and then posted to the relevant ledger accounts.

Q7: From the following particulars provided by Rishi, prepare a cash book with suitable column.

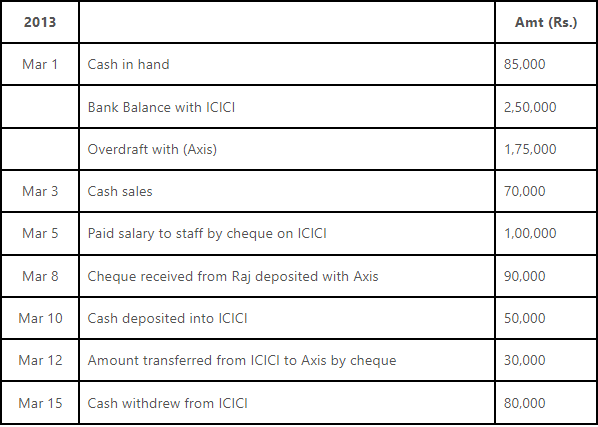

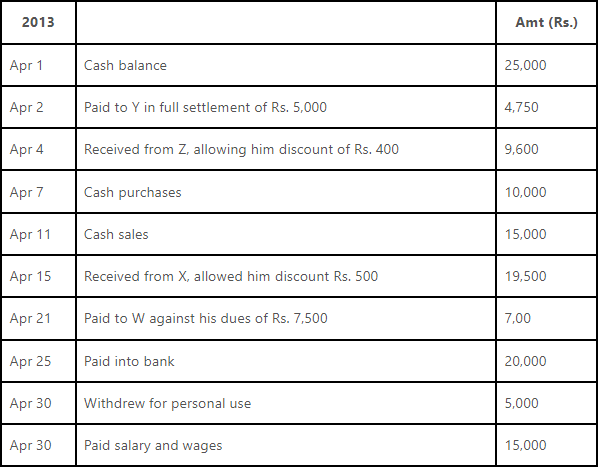

Ans: Cash Book

| Date | Particulars | V.No. | Cash | Discount | Date | Particulars | V.No. | Cash | Discount |

| April 01, 2013 | To Balance b/d | 25,000 | April 02, 2013 | By Y | 4,750 | 250 | |||

| April 04, 2013 | To Z | 9,600 | 400 | April 07, 2013 | By Purchases | 10,000 | |||

| April 11, 2013 | To Sales | 15,000 | April 21, 2013 | By W | 7,000 | 500 | |||

| April 15, 2013 | To X | 19,500 | 500 | April 25, 2013 | By Bank | 20,000 | |||

| April 30, 2013 | By Drawing | 5,000 | |||||||

| April 30, 2013 | By Salary & Wages | 15,000 | |||||||

| April 30, 2013 | By Balance c/d | 7,350 | |||||||

| 69,100 ===== | 900 ===== | 69,100 ====== | 750 ===== | ||||||

| May 1, 2013 | To Balance b/d | 7,350 |

Q8: Prepare two column cash book from the following transactions for the month of April, 2013

Ans: Subsidiary Books are those books of original entry in which transactions of similar nature are recorded at one place and in chronological order. In a big concern, recording of all transactions in one Journal and posting them into various ledger accounts will be very difficult and involve a lot of clerical work. In this question there is a need to draw Purchase Book, Sales Book, Sales Return Book, & Purchase Return Book. Purchase Book is that book in which we record all the business credit transactions related to the purchase of goods only. It is an original entry book like a Cash Book. It is also known as purchase register, purchase day book, purchase journal and purchase invoice book. Sales book is a book in which non-cash sales are recorded with details of customer, invoice, amount and date; these details are later posted to each customer’s account in the sales ledger. At times the buyer may return goods due to poor quality, inaccurate quantity, untimely delivery or other reasons. It is also called returns inwards and an appropriate sales return or a returns inward book is maintained. Purchases returns book is a book in which the goods returned to suppliers are recorded. It is also called returns outward book or purchases returns day book. Goods may be returned because they are of the wrong kind or not up to sample or because they are damaged etc. The above mentioned all books are prepared as follows:-

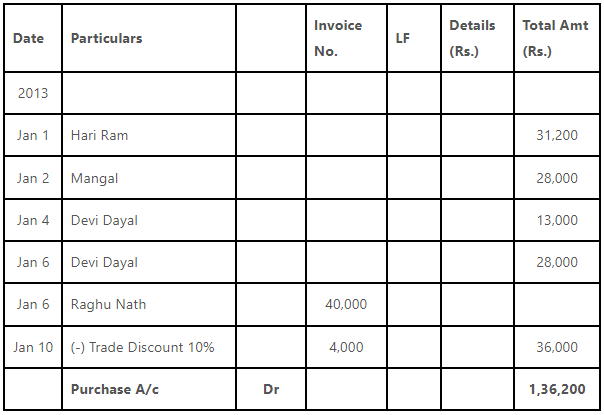

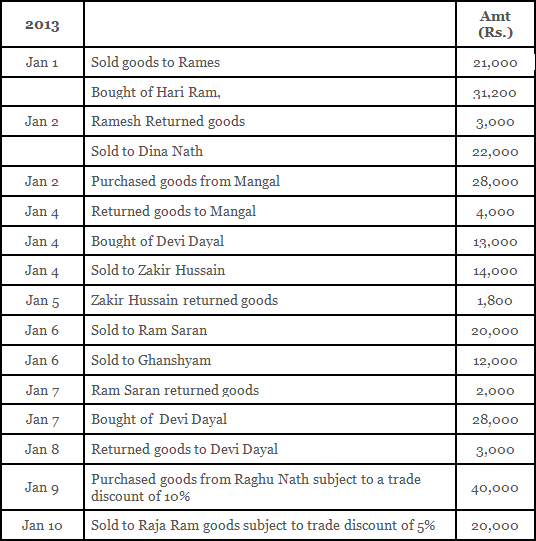

Purchase Book

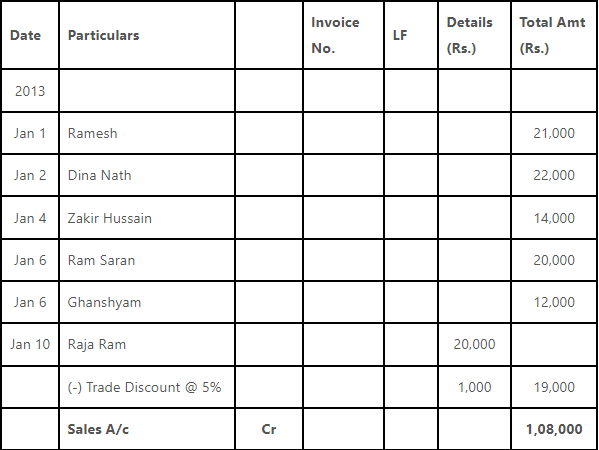

Sales Book

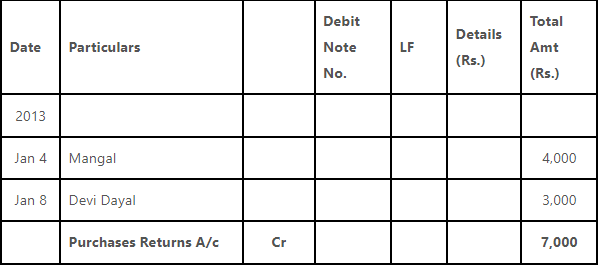

Purchase Returns Book

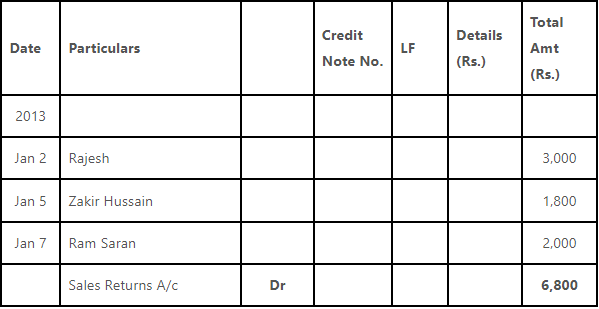

Sales Returns Book

Q9: Enter the following transactions in proper subsidiary books of Balram

Ans: A cash book is a financial journal that contains all cash receipts and payments, including bank deposits and withdrawals. Entries in the cash book are then posted into the general ledger. Larger firms usually divide the cash book into two parts: the cash disbursement journal that records all cash payments, such as accounts payable and operating expenses, and the cash receipts journal, which records all cash receipts, such as accounts receivable and cash sales. In this question it is to be maintained as follows:-

Cash book (Single Column)

| Date | Particulars | LF | Rs. | Date | Particulars | LF | Rs. |

| 2018 | 2018 | ||||||

| Mar.1 | To Capital A/c | 65,000 | Mar.3 | By Purchase A/c | 6,850 | ||

| Mar.9 | To Sales A/c | 30,000 | By Input CGST A/c | 411 | |||

| To Output CGST A/c | 1,800 | By Input SGST A/c | 411 | ||||

| To Output SGST A/c | 1,800 | Mar.4 | By Mr. Mohan | 950 | |||

| Mar.15 | To Sales A/c | 25,000 | Mar.6 | By Bank A/c | 40,000 | ||

| To Output CGST A/c | 1,500 | Mar.6 | By Office Furn. A/c | 4,650 | |||

| To Output SGST A/c | 1,500 | By Input CGST A/c | 279 | ||||

| Mar.19 | To Mr. Trilok Chand | 4,850 | By Input SGST A/c | 279 | |||

| Mar.12 | By Wages A/c | 1,200 | |||||

| Mar.13 | By Stationery A/c | 400 | |||||

| By Input CGST A/c | 24 | ||||||

| By Input SGST A/c | 24 | ||||||

| Mar.17 | By Mise. Exp. A/c | 450 | |||||

| Mar.22 | By Purchase A/c | 2,500 | |||||

| By Input CGST A/c | 150 | ||||||

| By Input SGST A/c | 150 | ||||||

| Mar.22 | By Salary A/c | 4,000 | |||||

| Mar.25 | By Rent A/c | 900 | |||||

| By Input CGST A/c | 54 | ||||||

| By Input SGST A/c | 54 | ||||||

| Mar.28 | By Electricity bill | 350 | |||||

| Mar.29 | By Advertising A/c | 400 | |||||

| By Input CGST A/c | 24 | ||||||

| By Input SGST A/c | 24 | ||||||

| Mar.31 | By Bank A/c | 25,000 | |||||

| Mar.31 | By Balance c/d | 41,916 | |||||

| 1,31,450 | Total | 1,31,450 | |||||

| Apr. 1 | To Balance c/d | 41,916 |

|

64 videos|152 docs|35 tests

|