MCQ - Simple and Compound Interest - 1 (Solutions) - CA Foundation PDF Download

Questions Related to Simple Interest

Ans.1: (c)

Solution: A sum of money at Simple Interest amounts to Rs. 815 in 3 years and Rs. 854 in 4 years

Simple interest for 1 year = 854 – 815 = Rs. 39

⇒ Simple interest for 3 year = 39 × 3 = 117

⇒ The sum is = 815 – 117 = Rs. 698

Ans.2: (a)

Solution: Given:

Total principal = Rs. 13900

Rate of interest = 14% and 11%

Time = 2 years

Interest = Rs. 3508

Formula Used:

S.I = Principal × rate × time/100

Calculation:

Let the amount invested in scheme B be Rs 100x.

Amount invested in scheme A = Rs (13900 – 100x)

Rate of interest in scheme A = 14%

Rate of interest in scheme B = 11%

Time = 2 years

Amount of interest earned from scheme A = (13900 – 100x) × 14 × 2/100 = 3892 – 28x

Amount of interest earned from scheme B = 100x × 11 × 2/100 = 22x

According to the question,

⇒ 3892 – 28x + 22x = 3508

⇒ 6x = 384

⇒ x = 64

Amount in scheme B = 100 × 64 = 6400

∴ Amount invested in scheme B = 100 × 64 = Rs 6400

Ans.3: (d)

Solution: By the formula of Simple interest, we know,

S.I. = (Principal x Rate x Time)/100

Principal = (S.I. x 100)/(Rate x Time)

P = (100×4016.25)/9 x 5

P = Rs. 8925.

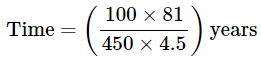

Ans.4: (b)

Solution: Principal = Rs. 450, R = 4.5%,

S.I. = Rs. 81

S.I = P × R × T/100

T = (SI × 100)/(P × R)

T = (81 × 100)/(450 × 4.5)

∴ T = 4 years

Ans.5: (b)

Solution: As the rate of interest is same as the time for which money is invested

So,

Let rate = R% and time = T years

S.I. = P × R × T/100

Then, (1200 × R × R)/100 = 432

⇒ 12R2 = 432

⇒ R2 = 36

∴ R = 6%

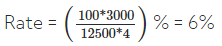

Ans.6: (d)

Solution: S.I. = Rs. (15500 - 12500) = Rs. 3000.

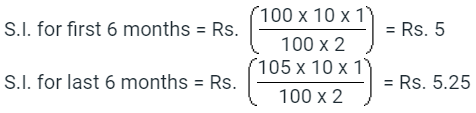

Ans.7: (b)

Solution: Let the sum be Rs. 100. Then,

So, amount at the end of 1 year = Rs. (100 + 5 + 5.25) = Rs. 110.25

Effective rate = (110.25 - 100) = 10.25%

Ans.8: (d)

Solution: Given:

B’s Principal = Rs. 5000

C’s Principal = Rs. 3000

Time for B = 2 years

Time for C = 4 years

Formula used:

S.I. = P × R% × T

Where, P = Principal, R = Rate of interest, T = Time

Calculation:

Let the rate of interest for both B and C be R%.

In the case of B:

S.I. = P × R% × T

⇒ S.I. = 5000 × 2 × R/100

⇒ S.I. = 100 × R

In the case of C

S.I. = P × R% × T

⇒ S.I. = 3000 × 4 × R/100

⇒ S.I. = 120 × R

According to the question,

S.I. for B + S.I. for C = 2200

⇒ 100 × R + 120 × R = 2200

⇒ 220 × R = 2200

⇒ R = 10

∴ Rate of interest per annum is 10%.

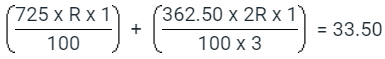

Ans.9: (e)

Solution: Let the original rate be R%. Then, new rate = (2R)%.

Note: Here, original rate is for 1 year(s); the new rate is for only 4 months i.e. 1/3 year(s).

⇒ (2175 + 725) R = 33.50 x 100 x 3

⇒ (2175 + 725) R = 10050

⇒ (2900)R = 10050

⇒ R = 10050/2900 = 3.46

Original rate = 3.46%

Ans.10: (c)

Solution: Given:

The rate of interest is 12%.

Simple interest after 3 years is Rs.5400.

Formula Used:

Simple interest = Principal × Rate × Time/100

Calculation:

Let the principal amount be x.

⇒ SI = x × 12 × 3/100

⇒ 5400 = x × 12 × 3/100

⇒ x = Rs.15000

∴ The principal amount borrowed by him was Rs.15000.

Ans.11: (c)

Solution: SI for 3 years = 12005 - 9800 = Rs. 2205

⇒ SI for 1 years = 2205/3 = Rs. 735

SI for 5 years = 5 × 735 = Rs. 3675

⇒ Principal = 9800 - 3675 = Rs. 6125

As we know, SI = Prt/100

⇒ 3675 = (6125 × r × 5)/100

⇒ r = (3675 × 100) / (5 × 6125)

∴ r = 12%

Ans.12: (c)

Solution: Let the principal be P and rate of interest be R%.

Therefore Required ratio

= 2 : 3

Ans.13: (d)

Solution: Since the principal amount nor original interest rate is not mentioned it is not possible to determine the interest generated.

Ans.14: (a)

Solution: Short trick:

Difference of rate for 1 years = 6.25% - 4% = 2.25%

The gain in the transaction for 1 years = 5000 × 2.25/100 = 112.5

Detailed Solution

P = Rs. 5000 and time = 2 years

First rate = 4% and Second rate = 6.25%

As we know,

SI = Prt/100

⇒ [5000 × (6.25 - 4) × 1]/100

⇒ [5000 × 2.25 × 1]/100

⇒ 112.5

Ans.15: (a)

Solution: Given:

P = 5000

R = x

T = 3 years

SI = 300 = 5000x × 3/100

Then R = x = (300 × 100/ 3)/ 5000 = 2%

Ans.16: (b)

Solution:

= 4 years

Ans.17: (d)

Solution: Given:

B’s Principal = Rs. 5000

C’s Principal = Rs. 3000

Time for B = 2 years

Time for C = 4 years

Formula used:

S.I. = P × R% × T

Where, P = Principal, R = Rate of interest, T = Time

Calculation:

Let the rate of interest for both B and C be R%.

In the case of B:

S.I. = P × R% × T

⇒ S.I. = 5000 × 2 × R/100

⇒ S.I. = 100 × R

In the case of C:

S.I. = P × R% × T

⇒ S.I. = 3000 × 4 × R/100

⇒ S.I. = 120 × R

According to the question,

S.I. for B + S.I. for C = 2200

⇒ 100 × R + 120 × R = 2200

⇒ 220 × R = 2200 ⇒ R = 10

∴ Rate of interest per annum is 10%.

Ans.18: (c)

Solution: Given:

First case:

P = Rs. 5000, R = 4%, T= 2 years

Second case:

P = Rs 5000, R = 25/4 %, T = 2 years

Formula used:

S.I = (P × R × T)/100

Where, S.I = Simple interest, R = Rate %, T = Time

Calculation:

Interest paid by Sachin = (5000 × 4 × 2)/100 = Rs. 400

Interest recieved by Sachin = (5000 × 25/4 × 2)/100 = Rs. 225

His gain for two years = Rs. 625 − Rs. 400 = Rs. 225

His gain per two years = Rs. 225/2 = Rs. 112.50

∴ The gain of one year by Sachin is Rs. 112.50

Ans.19: (b)

Solution: As the rate of interest is same as the time for which money is invested

So, Let rate = R% and time = T years

S.I. = P × R × T/100

Then, (1200 × R × R)/100 = 432

⇒ 12R2 = 432

⇒ R2 = 36

∴ R = 6%

Ans.20: (a)

Solution: Principal = Rs. (1230 x 100/5 x 6) = 4100

Questions Related to Compound Interest

Ans.1: (b)

Solution: Total amount = 1600 ( 1 + 5/2 × 100 )2 + 1600 ( 1 + 5/2 × 100)

= 1600 ((41/400 × 14/40 + 41/40))

= 1600 × 41/40(41/40 + 1)

= 1600 × 41 × 81/40 × 40

= 3321

CI earned = 3321 - 3200 = 121

Ans.2: (a)

Solution: Let the sum be x.

We know, Amount = Principal (1 + Rate/100)n

Compound interest = Amount - Principal

CI = x (1 + 4/100)2 - x

CI = 51x/625

We know, Simple interest = (P × R × T)/100

SI = (x × 4 × 2)/100 = 2x/25

It is given that CI - SI = 1

⇒ 51x/625 - 2x/25 = 1

⇒ (51x - 50x)/625 = 1

⇒ x = Rs. 625

∴ The sum is Rs. 625.

Ans.3: (c)

Solution: Given:

Increase in salary after 6 years = 60%

Formula Used:

A = P(1 + r/100)t

Simple Interest = (principal × rate × time)/100

Calculation:

Let the salary at 1st year be 100x

Increased in salary = 60% of 100x = 60x

⇒ 60x = (100x × 6 × R)/100

⇒ R = 10%

Compound Interest after 3 years = P(1 + r/100)t - P

⇒ 12000(1 + 10/100)3 - 12000

⇒ 12000 × (11/10)3 - 12000

⇒ 15972 - 12000 = Rs. 3972

∴ The required answer is Rs 3972.

Ans.4: (a)

Solution: As we know that:

The formula for annual compound interest, including principal sum, is:

A = P (1 + r/n) (nt)

Where: A = the future value of the investment/loan, including interest

P = the principal investment amount (the initial deposit or loan amount)

r = the annual interest rate (decimal)

n = the number of times that interest is compounded per year

t = the number of years the money is invested or borrowed for

C.I. when interest compounded yearly = Rs. 5000 × (1 + 4/100) × (1 + (4/2) /100)

= Rs.(5000 × 26/25 × 51/50) = Rs. 5304.

C.I. when interest is compounded half-yearly = Rs. 5000 × (1 + 2/100) 3

= Rs.(5000 × 51/50 × 51/50 × 51/50) = Rs. 5306.04

Difference = Rs.(5306.04 - 5304) = Rs. 2.04

Ans.5: (a)

Solution: It is given that principal = Rs. 30000

Rate = 7%

Let time period = n

Compound Interest = Rs. 4347

Amount = Principal + Compound interest = Rs. 34347

We know, Amount = Principal (1 + Rate/100)n

⇒ 34347 = 30000 (1 + 7/100)n

⇒ 11449/10000 = (107/100)n

⇒ (107/100)2 = (107/100)t

Time period = 2 years

Ans.6: (c)

Solution: Given:

Principal = Rs. 25000

Rate of interest = 12% p.a.

Time period = 3 years

Formula Used:

C.I. = P × ((1 + r/100)t - 1)

Calculations:

Principal = Rs. 25000

Rate of interest = 12% p.a.

Time period = 3 years

C.I. = P × ((1 + r/100)t - 1)

⇒ C.I. = Rs. 25000 × ((1 + 12/100)3 - 1)

⇒ C.I. = Rs. 10123.20

∴ The compound interest is Rs. 10123.20.

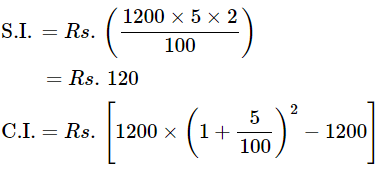

Ans.7: (a)

Solution: Principal = Rs. 1200

Amount = Rs. 1348.32

Time period = 2 years

Let the rate of interest = x%

We know, Amount = Principal (1 + Rate/100)n

⇒ 1348.32 = 1200 (1 + x/100)2

⇒ (106/100)2 = (1 + x/100)2

⇒ 106/100 = 1 + x/100

⇒ x = 6%

∴ The rate should be 6%.

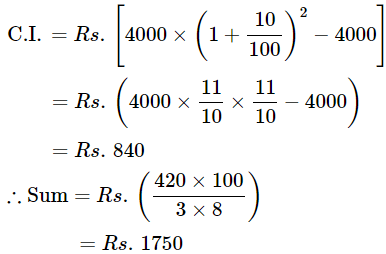

Ans.8: (b)

Solution:

Ans.9: (c)

Solution: Amount =Rs.[8000 x (1 + 5/100)2]

= Rs.[8000 x 21/20 x 21/20] = Rs.8820.

Ans.10: (d)

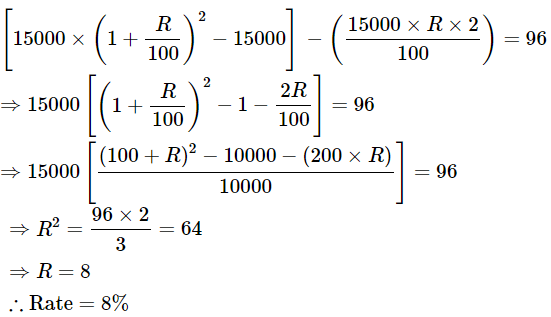

Solution: Given:

Rate = 6%

Formula:

Amount = P(1 + R/100)n

Calculations:

Amount of Rs.100 for 1 year when compounded half-yearly

⇒ Rs.[100 × (1 + 3/100)2]

⇒ Rs.106.09

Effective rate = (106.09 − 100)%

⇒ 6.09%

∴ The effective annual rate of interest is 6.09%.

Ans.11: (c)

Solution:

Ans.12: (a)

Solution: Given:

S.I on money for 2 year at 5% = Rs. 50

Formula used:

SI = P * R * T / 100

CA = P(1 + R/n)nT

where,

P = principal

R = Rate

T = Time

SI = Simple Interest

CA= Compound Interest

Calculation:

SI = P * R * T/100

50 = P * 5 * 2/100 ; on solving get

P = 500

CA = P(1 + R/n)nT

CA = 500 (1 + .05)2 then CA with principal = Rs. 551.25

So CA without principal = 551.25 - 500 = Rs. 51.25

Compound Interest = Rs. 51.25

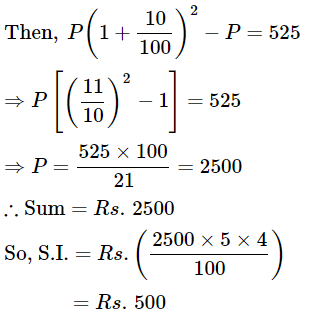

Ans.13: (b)

Solution:

= Rs.123

∴ Difference = Rs.(123 − 120) = Rs.3

Ans.14: (a)

Solution:

Ans.15: (b)

Solution: Let the sum be Rs. P

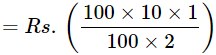

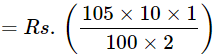

Ans.16: (b)

Solution: Let the sum be Rs.100.

Then, S.I. for first 6 months

= Rs. 5

S.I. for last 6 months

= Rs.5.25 So, amount at the end of 1 year

= Rs. (100 + 5 + 5.25)

= Rs. 110.25

∴ Effective rate = (110.25 - 100) = 10.25%.

Ans.17: (c)

Solution: Since the money becomes Rs. 13380 after 3 years and Rs. 20070 after 6 years

⇒ 20070/13380 = 1.5

That means the money becomes 1.5 times after 3 more years.

∴ Principal = 13380/1.5 = Rs. 8920.

Ans.18: (b)

Solution: As per given question,

Formula: Amount = Principal (1 + Rate/100)Time

P(1 + r/100)4 = 3P

⇒ (1 + r/100)4 = 3

P(1 + r/100)n = 27P

⇒ (1 + r/100)n = 27

⇒ (1 + r/100)n = 33

⇒ (1 + r/100)n = [(1 + r/100)4]3

∴ n = 4 × 3 = 12.

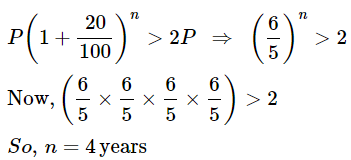

Ans.19: (b)

Solution: Here we need to make a comparison on the amount.

Let the principal = P

Rate = 20%

Let time period = n

We know, Amount = Principal (1 + Rate/100)n

Amount = P (1 + 20/100)n

We need to know the maximum value of ‘n’ for this amount being more than twice the principal (> 2P)

P (1 + 20/100)n > 2P

(6/5)n > 2

If we take n = 1, we get (6/5)1 = 1.2

If we take n = 2, we get (6/5)2 = 1.44

If we take n = 3, we get (6/5)3 = 1.728

If we take n = 4, we get (6/5)4 = 2.0736

∴ The time period is 4 years.

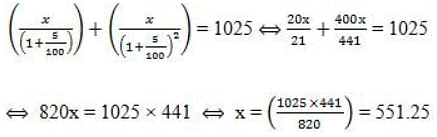

Ans.20: (a)

Solution: Let each installment be Rs. x. Then,

So, value of each installment = Rs. 551.25.