Introduction - Origin of transactions: Source Documents of Accountancy - Commerce PDF Download

Origin of transactions: Source Documents of Accountancy

Source documents:

The documents that support the authenticity of business transactions are called as source documents. Every business transactions must be supported by documentary evidence like cash memo, invoice, bill, debit note etc. Such documents report the date, the amount, parties involved and the nature of transactions.

1. Cash memo: When a trader sells goods for cash he gives a cash memo and whenever purchases goods for cash he receives a cash memo. It shows the details of the items, quantity, rate and the total price is mentioned in cash memo.

CASH MEMO CUTE SILK & SAREES Wholesale and Retail Wedding Saree Specialists CTC Plaza, Ring Road, Maharani Bagh, New Delhi No.......................................................................................................................................................... Dated: 3.2.2013 | ||||||

Quantity | Description | Rate Rs. | Amount | |||

Rs. | P. | |||||

10 4 | Sarees Add: VAT @ 12,5% No.340 | 1,000 1,040 | 10,000 4,160 | |||

14,160 1,770 | ||||||

15,930 | ||||||

Goods once sold will not be taken back. | ||||||

2. Invoice: When a trader sells goods on credit he prepares a invoice which shows the details about the name of the party, the date, the quantity, the rate and the total amount of sales.(3 colored bill/ challan book of yellow, white and pink color).

No. 3978 | MAST ELECTRIC SUPPLIERS LTD. Dealers in Everything Electrical 131, Nowhere Street, Utopian City 110 001 | Date: 3.2.2013 | ||||

Ideal Customer Everywhere Road, Fine City...................................... Dr. | ||||||

Quantity | Particulars | Rate | Amount | |||

Rs. | Rs. | P. | ||||

2 10 | Refrigerators (167 Lts.) Automatic Irons | 8,000 1,100 | 16,000 11,000 | |||

VAT @ 12.5% | 27,000 3,375 | |||||

Forwarding and Delivery Charges | 30,375 585 | |||||

Total | 30,960 | |||||

Rupees thirty thousand nine hundred and sixty only E.&O.E. | Sales Manager | |||||

3. Bill: When a trader purchases goods on credit he receives a credit bill from the supplier, which shows the details about the name of the party, the date, the quantity, the rate and the total amount of purchases.

4. Receipt: Whenever a trader receives a payment from the customers he issues a receipt signifying that he had received the payment from the customer which shows the date, amount and name of the customer.

MAST ELECTRIC SUPPLIERS LTD. Dealers in Everything Electrical 131, Nowhere Street, Utopian City 110 001 No. 15137 Date: 5.2.2013 Received with thanks from M/s. Ideal Customer, Fine City a sum of Rupees Thirty Thousand Nine Hundred and Sixty only in Cash/ Cheque No.559891 dated 5.2.2013 drawn onCanara Bank, VivekVihar, Delhi on |

account of Invoice No.3978dated3.2.2013. Authorised Signatory Note: Cheques are subject to realisation. |

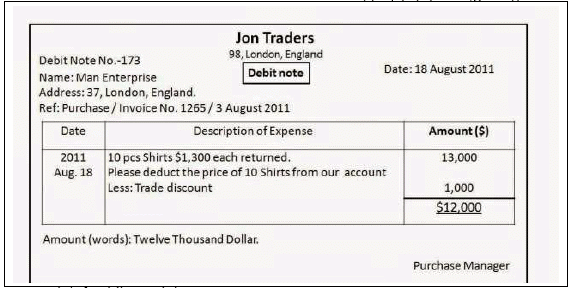

5. Debit note: When we return the goods to a supplier, we prepare a debit note and send it to the supplier with the returned goods, which shows that the supplier account has been debited.

6. Credit note: When a customer returns the goods to us, we prepare a credit note indicating that the suppliers account has been credited.

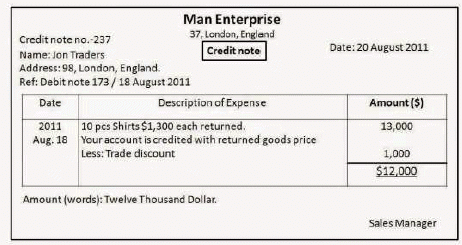

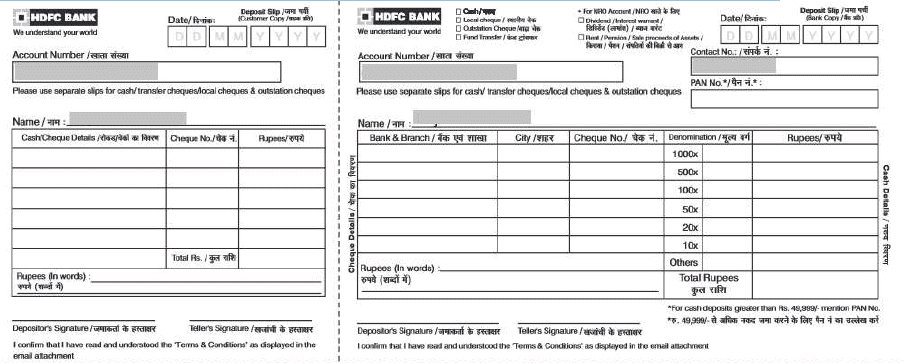

7. Pay in slip: This is a form available from the bank and is used to deposit the money in the bank. Each pay in slip carries a counterfoil which is returned depositor duly stamped and signed by cashier of the bank.

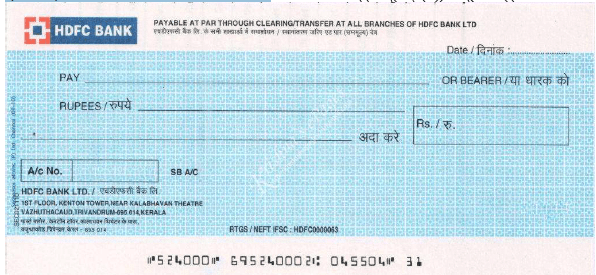

8. Cheque: A cheque is an order in writing drawn upon the bank to pay a specified sum on a specified date to a specified person or to the bearer of the instrument.

9. Vouchers: A voucher is a document which provides authorization to pay and on the basis of which transactions are recorded in the books of original entry.

- A separate voucher is prepared for every transaction.

- It specifies the accounts to be debited or credited.

Difference between source documents and vouchers

| S.no | Source documents | Vouchers | |

| 1. | It is a support to voucher. | Voucher is supported by a source document. | |

| 2. | It is not prepared to record transactions. | It is prepared for the purpose of recording the transactions. | |

| 3. | It contains the full details of transactions. | It specifies the accounts to be debited or credited. | |

| 4. | It is a evidence of the transaction. | It is a document of correct recording of transaction. |

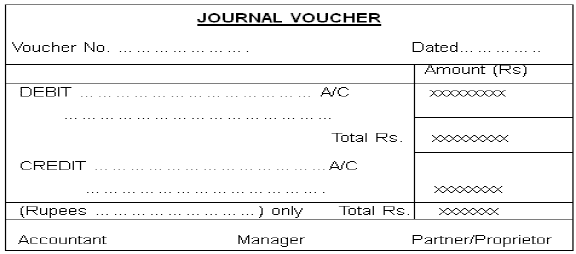

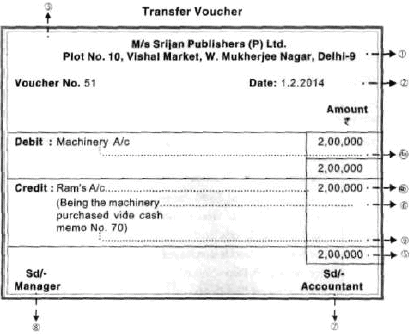

Specimen of a Voucher

Types of vouchers:

1. Cash vouchers:

Cash vouchers are prepared for cash payments and cash receipts

Debit voucher (cash payments)

For cash payment of expenses

For cash purchases of goods.

Credit vouchers (cash receipts)

For cash receipts of incomes.

For cash sale of goods.

2. Non cash vouchers/ transfer vouchers:(non cash transactions)

For credit purchases and sales.

For return of goods sold on credit.

Compound vouchers:

A document that shows multiple debits and one credit or which contains multiple credits and one debit is called as compound vouchers.

Difference Between Debit Note and Credit Note

1. Prepared by | It is prepared by the customer on supplier. | It is prepared by the supplier. |

2. Recording of Transactions | It is the basis of recording transactions in the Purchases Return Book. | It is the basis of recording transactions in the Sales Return Book. |

3. Contents | It contains all the information related to return of goods to the supplier, like name of supplier, description of goods returned, reason for return, etc. | It contains all the information related to name of the customer, description of the goods received back, amount of return, etc. |

4. Purpose | It is prepared to intimate the supplier that a debit has been made in the account. | It is prepared to intimate the customer that a credit has been made in the account. |

FAQs on Introduction - Origin of transactions: Source Documents of Accountancy - Commerce

| 1. What are source documents in accounting? |  |

| 2. Why are source documents important in accounting? |  |

| 3. What are some examples of source documents? |  |

| 4. How are source documents used in the accounting cycle? |  |

| 5. What happens if source documents are lost or destroyed? |  |