Bank Reconciliation Statement Chapter Notes | Accountancy Class 11 - Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Need for Reconciliation |

|

| Timing Differences |

|

| Preparation of Bank Reconciliation Statement |

|

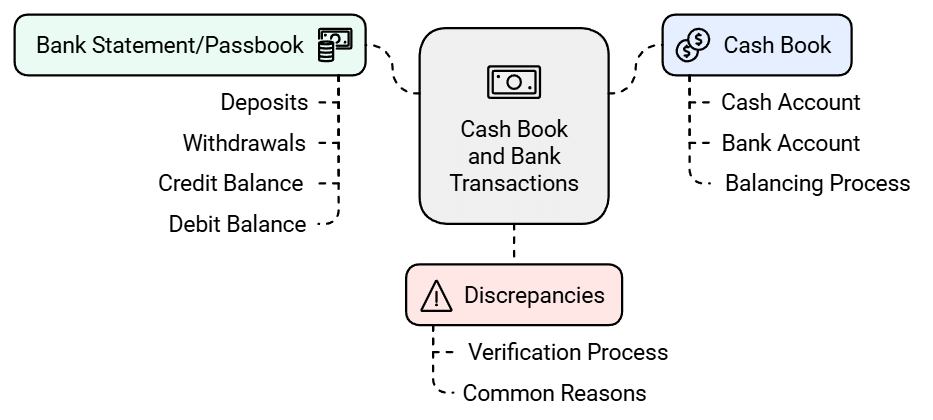

Introduction

Business organisations keep a cash book to record all cash and bank transactions. The cash book works like both a cash account and a bank account, showing their balances at the end of a period. These balances are then compared with the bank statement (or passbook) provided by the bank. The bank statement records all deposits and withdrawals made in the account.

Ideally, the balance in the cash book and the bank statement should match. However, this is often not the case, due to delays, missing entries, or errors. In a bank statement, deposits are shown as credit and withdrawals as debit. If deposits are more, it shows a credit balance; if withdrawals are more, it shows a debit balance (overdraft).

Need for Reconciliation

- When comparing the bank balance shown in a firm's cash book, it is common for the two balances not to match.

- To resolve this issue, we must first identify the reasons for the differences.

- These differences are then recorded in a document called a Bank Reconciliation Statement, which helps to align (or tally) the two balances.

To create a bank reconciliation statement, we need:

- The bank balance is according to the cash book.

- The bank statement for a specific date.

- Details from both the cash book and the bank statement.

- If the two balances do not match, we compare the entries in both records.

- We identify the items that caused the discrepancy, noting the respective amounts involved.

- This allows us to prepare the bank reconciliation statement.

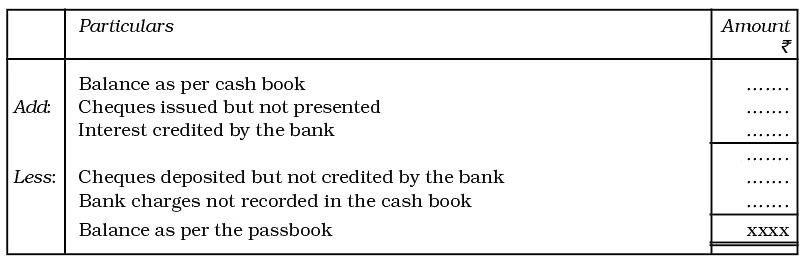

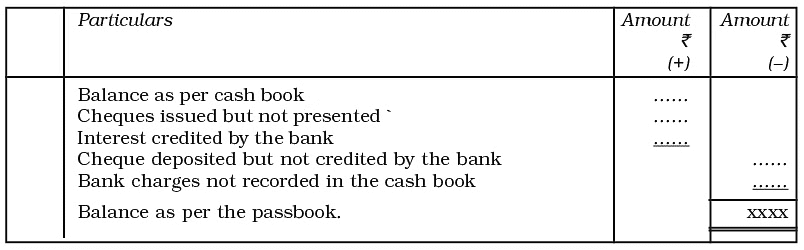

- The statement can also be structured with two columns:

1. One column for additions (+)

2. Another column for deductions (-) - This two-column format is often more convenient for understanding the differences.

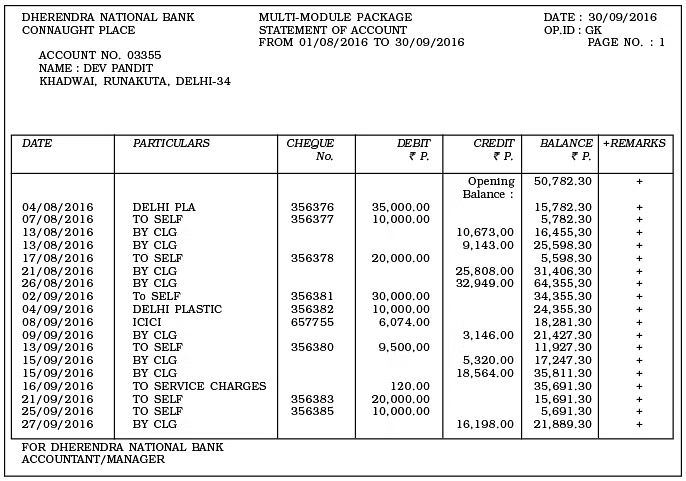

Specimen of bank statement (current account)

Specimen of bank statement (current account)

Timing Differences

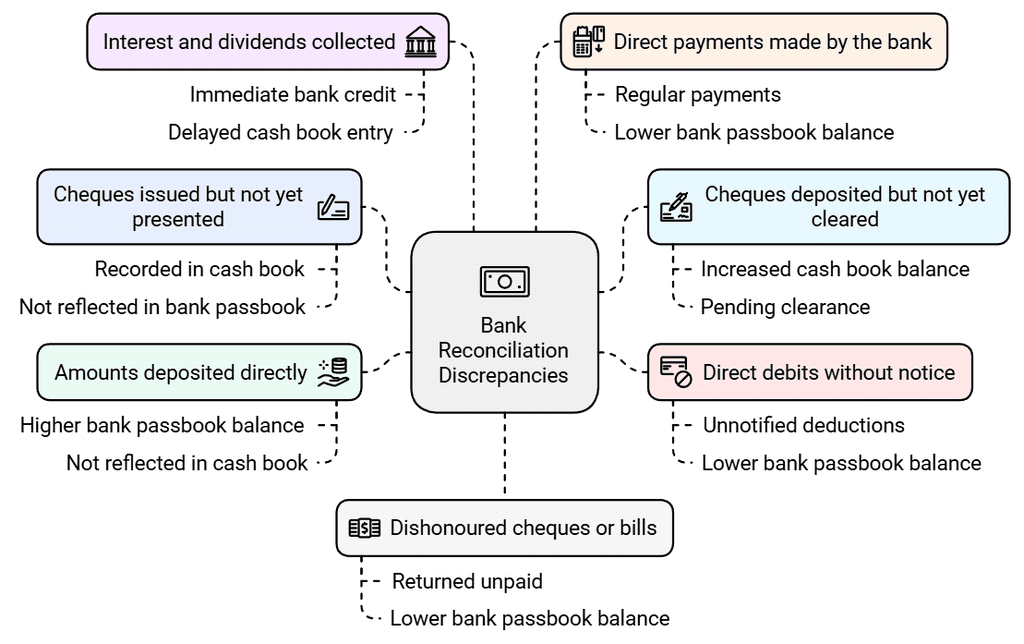

When a business checks its cash book balance against the balance in its bank passbook, there can often be a difference. This difference usually happens because of delays in recording transactions for payments or receipts. Here are some reasons for these delays:

- Cheques issued but not yet presented: When a business writes cheques to suppliers or creditors, these are recorded immediately on the cash book's credit side. However, the payee may not cash the cheque right away. The bank will only take the amount from the firm's account when the cheque is cashed. This delay can lead to a difference between the cash book and the bank passbook.

- Cheques deposited but not yet cleared: When a business receives cheques from its customers, these are recorded on the debit side of the cash book, which shows an increase in the bank balance. However, the bank only credits the firm’s account once the cheques are cleared, which can take a few days, especially for outstation cheques. This can create a gap between the cash book's balance and the bank's balance.

- Direct debits without notice: Sometimes, the bank deducts fees for services from the account without informing the business. The firm learns about these deductions only when it receives its bank statement. Examples include charges for cheque collections, incidental fees, or interest on overdrafts. This causes the bank passbook balance to be lower than the cash book balance.

- Amounts deposited directly: Occasionally, customers may deposit money directly into the firm’s bank account without notifying the business. The bank records these deposits, but the firm may not reflect them in its cash book until it receives the bank statement. This results in the bank passbook showing a higher balance than the cash book.

- Interest and dividends collected: When the bank collects interest or dividends for the business, it credits these amounts to the firm’s account right away. However, the business will only record these amounts when it sees the bank statement. Until then, there will be a difference between the cash book and the passbook balances.

- Direct payments made by the bank: Some businesses give the bank instructions to make regular payments, such as bills or taxes, on specific dates. These payments are deducted directly from the firm's account. This can cause the bank passbook balance to be lower than what the cash book shows.

- Dishonoured cheques or bills: If a cheque that a business deposited is returned unpaid, or if a bill discounted with the bank is not paid on time, the bank will debit the firm’s account. The business may not be aware of this until it receives a bank statement, leading to the bank passbook balance being lower than the cash book balance.

Difference Caused by Errors

- Sometimes the difference between the two balances can be due to a mistake made by the bank or an error in the business's cash book.

- This leads to a difference between the bank balance in the cash book and the balance shown on the bank statement.

Errors made by the firm:

- Mistakes like missing or incorrectly recording transactions for issued cheques, deposited cheques, and incorrect totals in the cash book can create differences between the cash book and the passbook balances.

Errors made by the bank:

- If the bank omits or incorrectly records transactions for deposited cheques or makes wrong totals while updating the passbook, this can also lead to differences between the passbook and cash book balances.

Preparation of Bank Reconciliation Statement

After finding the reasons for differences, the bank reconciliation can be done in two main ways:- Creating a bank reconciliation statement without adjusting the cash book balance.

- Creating a bank reconciliation statement after adjusting the cash book balance.

- Typically, the bank reconciliation statement is prepared after adjusting the cash book balance, which will be discussed later in this chapter.

Preparation of Bank Reconciliation Statement without adjusting Cash Book Balance:

- In this method, the starting point is the balance shown in either the cash book or the passbook.

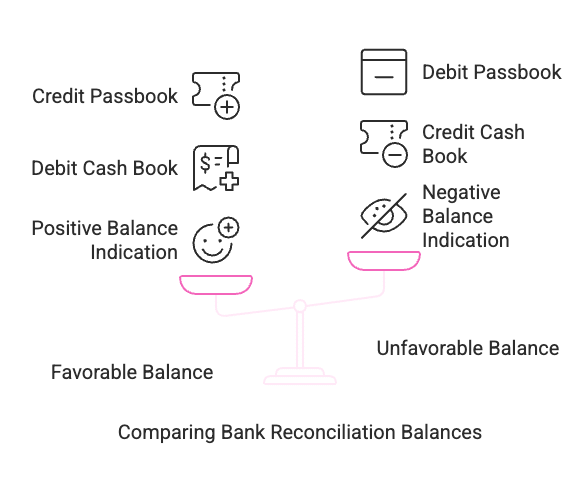

- A debit balance in the cash book indicates the amount of money deposited in the bank, which will show as a credit balance in the passbook.

- This situation arises when the deposits made by the business exceed the withdrawals, leading to a favourable balance in both the cash book and the passbook.

- Conversely, if there is a credit balance in the cash book, it indicates a bank overdraft, meaning more money has been withdrawn than deposited. This is referred to as an unfavourable balance in both the cash book and the passbook.

- While preparing the bank reconciliation statement, there are four possible scenarios:

1. When a debit balance (favourable balance) from the cash book is provided, the passbook balance needs to be determined.

2. When a credit balance (favourable balance) from the passbook is provided, the cash book balance needs to be determined.

3. When a credit balance from the cash book (unfavourable balance or overdraft) is given, the passbook balance needs to be established.

4. When a debit balance from the passbook (unfavourable balance or overdraft) is provided, the cash book balance needs to be determined.

Handling Favorable Balances:

- Date: Write the date at the top of the bank reconciliation statement as part of the heading.

- Starting Balance: Begin with the balance shown in the cash book. Alternatively, you can start with the balance from the passbook.

- Deductions: Subtract any cheques that have been deposited but not yet collected.

- Additions: Add all cheques that have been issued but not yet cashed, as well as any amounts that have been directly deposited into the bank account.

- Charges: Deduct all charges, including interest on overdrafts, payments made by the bank according to standing instructions, and any bills or cheques that were dishonoured, which have been debited in the passbook but not recorded in the cash book.

- Credits: Add any credits given by the bank, such as interest from dividends collected and direct deposits made into the bank.

- Error Adjustments: Make adjustments for any errors based on the rules for correcting mistakes. (The details on correcting errors are discussed in Chapter 6.)

- Final Check: The final net balance shown in the statement should match the balance shown in the passbook.

Dealing with Overdrafts:

- Understanding Overdrafts: Previously, we focused on bank reconciliation statements with a positive balance, meaning there was money in the bank account. However, sometimes businesses have overdrafts, where the bank account balance is negative, indicating that the business has borrowed money from the bank.

- Cash Book Representation: In the cash book, an overdraft appears as a credit balance. In the bank statement, if the balance is followed by "Dr." (or sometimes "OD"), it indicates an overdraft, which is referred to as a debit balance in the passbook.

- Negative Figure: An overdraft is represented as a negative figure on a bank reconciliation statement.

- Illustration: The following example will help clarify how to prepare a bank reconciliation statement when dealing with an overdraft.

|

65 videos|230 docs|39 tests

|

FAQs on Bank Reconciliation Statement Chapter Notes - Accountancy Class 11 - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is a bank reconciliation statement important? |  |

| 3. What are the steps involved in preparing a bank reconciliation statement? |  |

| 4. What are some common reasons for discrepancies between the bank statement and accounting records? |  |

| 5. What is the impact of not preparing a bank reconciliation statement? |  |