Financial Statements - II Chapter Notes | Accountancy Class 11 - Commerce PDF Download

Need for Adjustments

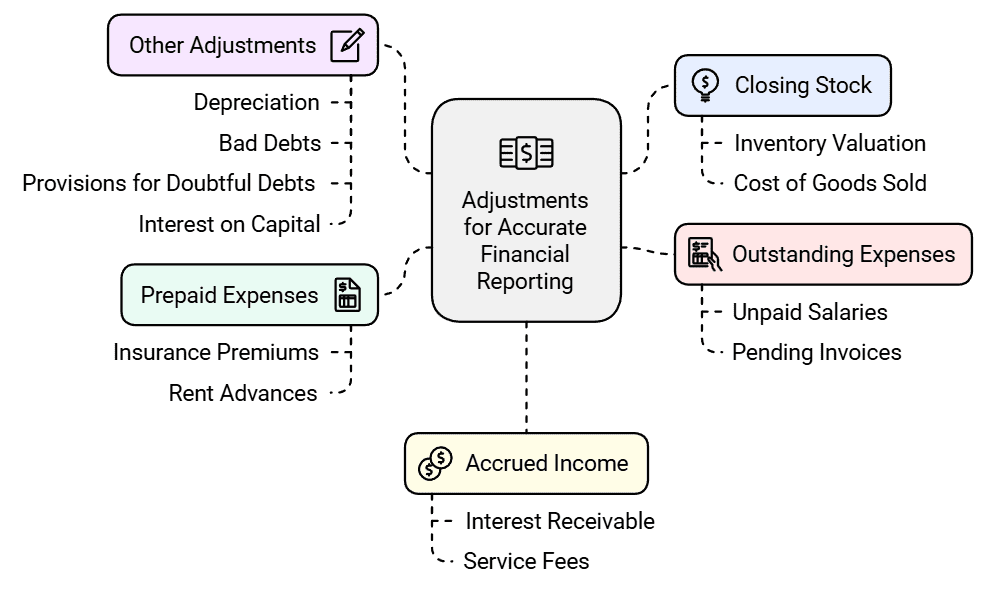

- The profit or loss for an accounting year is not solely based on cash transactions. There may be receipts and expenses that relate to different accounting periods.

- To reflect the true financial position of the business, adjustments are necessary for items like closing stock, outstanding expenses, prepaid expenses, accrued income, and more.

- For example, if an insurance premium covers multiple years, only a portion should be expensed in the current year. Similarly, unpaid salaries need to be accounted for to accurately represent expenses.

- Other adjustments include depreciation, bad debts, provisions for doubtful debts, and interest on capital. These adjustments ensure that the final accounts provide a fair view of the business's profitability and financial health.

Adjustments in Financial Statements

- Closing Stock: Adjust the closing stock figure to reflect the actual inventory on hand at the end of the accounting period.

- Outstanding Expenses: Include any expenses that have been incurred but not yet paid, ensuring they are recorded in the correct accounting period.

- Prepaid/Unexpired Expenses: Adjust for expenses that have been paid in advance but relate to future periods, ensuring they are not counted in the current period's expenses.

- Accrued Income: Include any income that has been earned but not yet received, reflecting it in the current period's income.

- Income Received in Advance: Adjust for income that has been received but relates to future periods, ensuring it is not counted in the current period's income.

- Depreciation: Calculate and include depreciation on fixed assets to reflect the reduction in their value over time.

- Bad Debts: Adjust for any debts that are deemed uncollectible, reflecting a more accurate picture of receivables.

- Provision for Doubtful Debts: Make a provision for debts that may become doubtful in the future, ensuring a conservative approach to receivables.

- Provision for Discount on Debtors: Account for any discounts that may be offered to debtors, reflecting a more accurate figure for receivables.

- Manager’s Commission: Include any commission payable to the manager, ensuring it is accounted for in the correct period.

- Interest on Capital: Adjust for any interest payable on capital, reflecting it in the appropriate period.

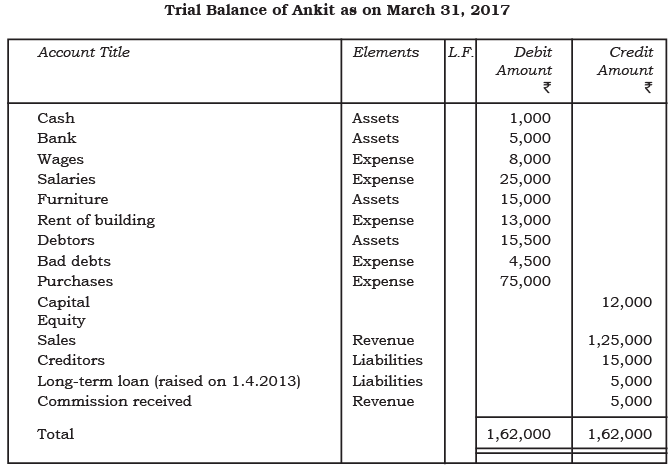

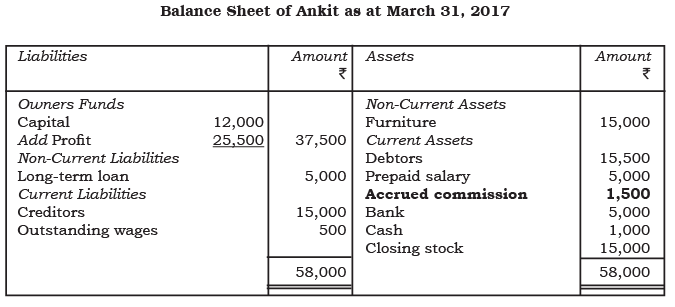

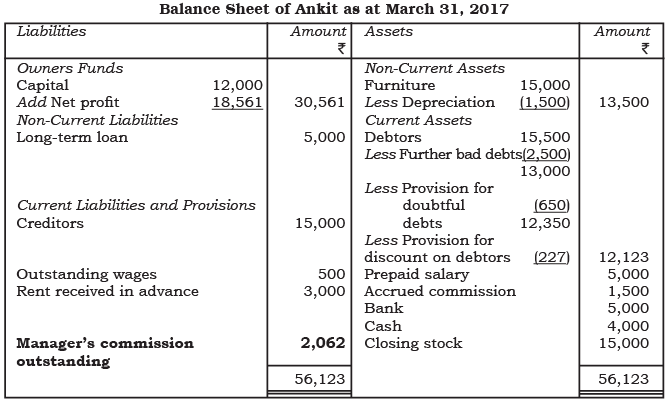

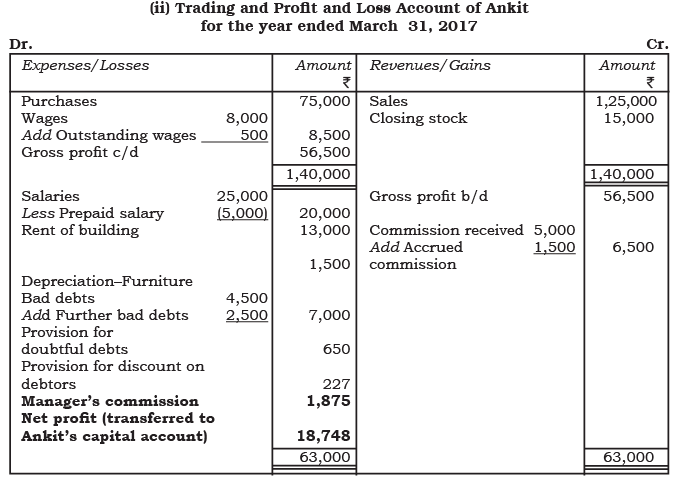

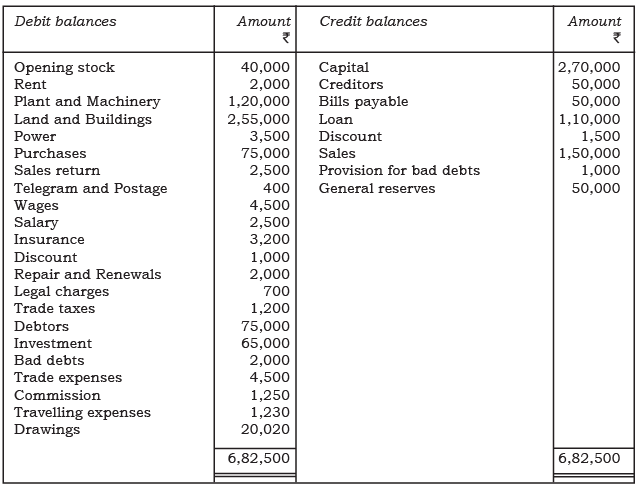

It may be noted that when we prepare the financial statements, we are provided with the trial balance and some other additional information in respect of the adjustments to be made. All adjustments are reflected in the final accounts at two places to complete the double entry. Our earlier example in chapter 8 (Page no. 294) which represents the trial balance of Ankit is reproduced in figure 9.1:

Showing the trial balance of Ankit

Showing the trial balance of Ankit

Additional Information: The stock on March 31, 2017 was ₹ 15,000.

Closing Stock

- Closing stock refers to the value of unsold goods that remain in inventory at the end of an accounting period.

- It is an important component in determining the cost of goods sold and the overall profitability of a business.

Adjustment of Closing Stock

- Closing stock is adjusted by crediting it to the trading and profit and loss account.

- It is also shown on the asset side of the balance sheet.

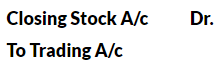

Accounting Entry for Closing Stock

- The adjustment entry for closing stock is:

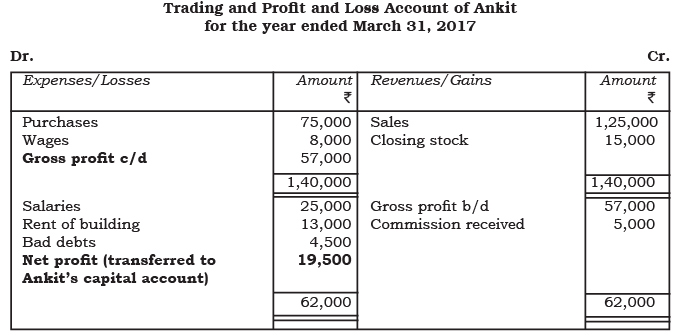

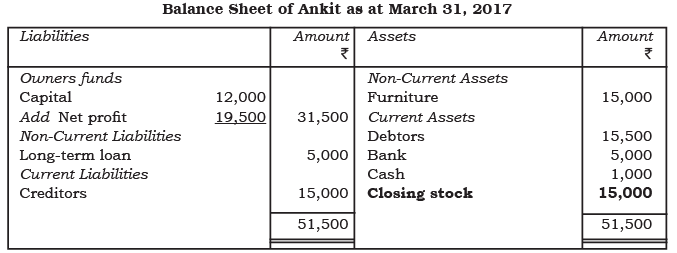

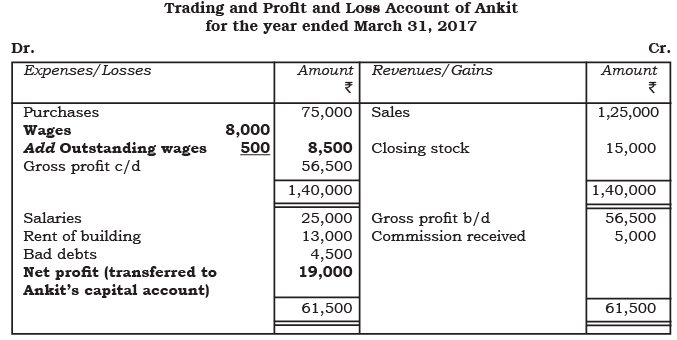

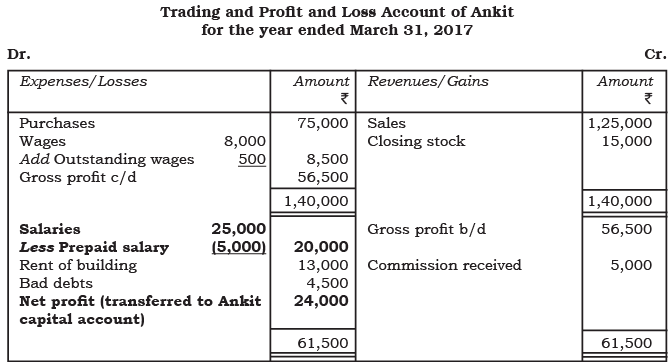

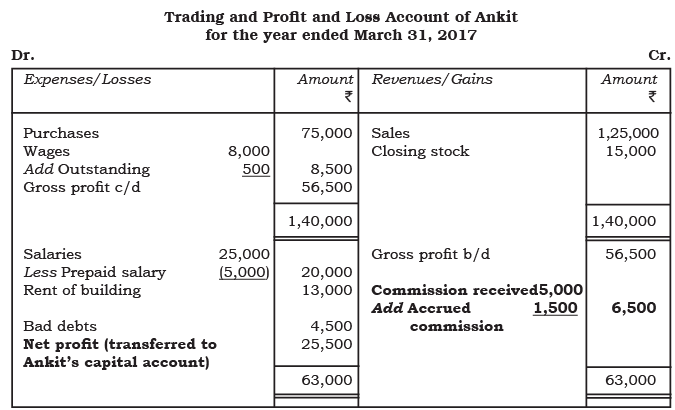

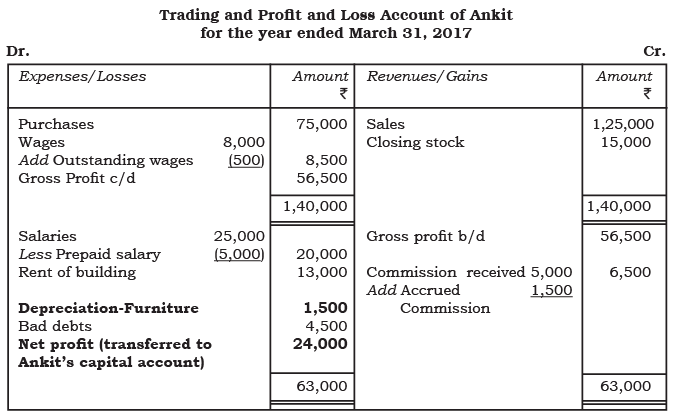

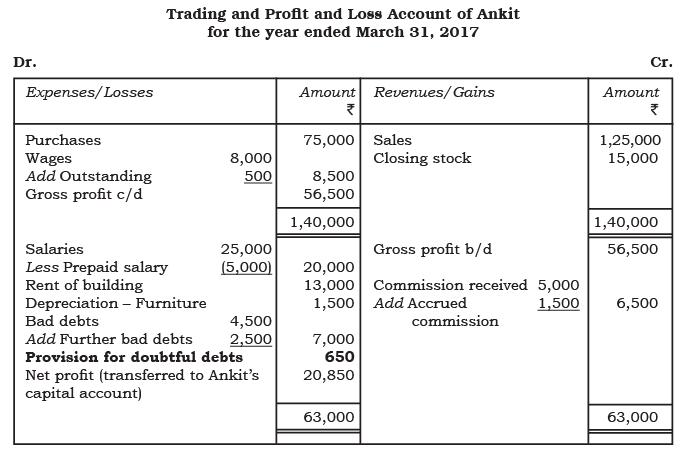

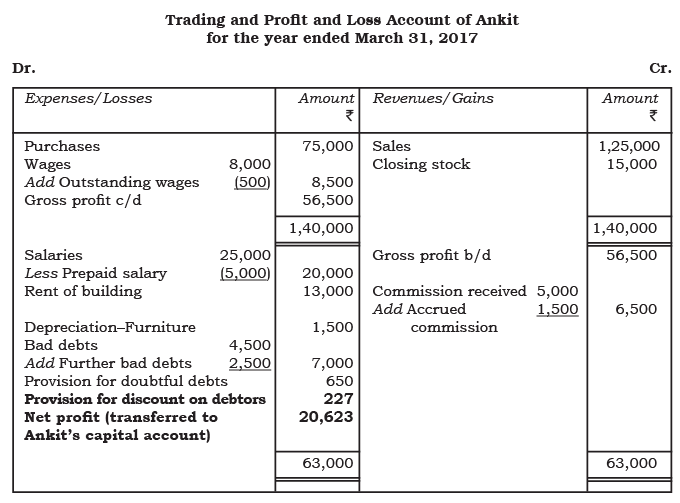

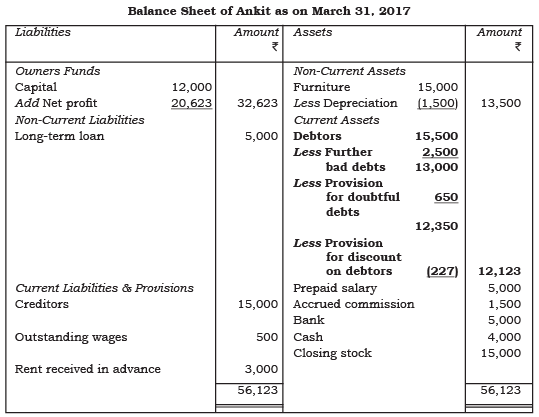

The closing stock of the year becomes the opening stock of the next year and is reflected in the trial balance of the next year. The trading and profit and loss account of Ankit for the year ended March 31, 2017 and his balance sheet as on that date shall appear as follows :

Sometimes the opening and closing stock are adjusted through purchases account. In that case, the entry recorded is as follows :

This entry decreases the amount recorded in the purchases account, referred to as adjusted purchases, and appears on the debit side of the trading and profit and loss account. It is important to note that closing stock is not displayed on the credit side of the trading and profit and loss account because it has already been accounted for through the purchases account. Furthermore, the opening stock is also not separately shown in the trading and profit and loss account, as it is included in the adjustments made to purchases with the following entry:

When opening and closing stocks are modified through purchases, the trial balance will not display any opening stock. Instead, the closing stock will be included in the trial balance directly (not as supplementary information or adjustments), along with the adjusted purchases. In this case, the adjusted purchases should be recorded as debits in the trading and profit and loss account.

The closing stock shall be shown on the assets side of the balance sheet as shown below:

Outstanding Expenses

It is common for businesses to have unpaid expenses at the end of an accounting year, such as wages, salaries, and interest on loans.When expenses for a specific accounting period are unpaid at its conclusion, they are referred to as outstanding expenses. Since these expenses are associated with the revenue earned during the current accounting year, they should be accounted for to accurately determine the profit or loss. The accounting entry to recognize these expenses is as follows:

The entry creates a new account called Outstanding Expenses, categorized as a liability on the balance sheet. The amount for outstanding expenses is included in the total expenses under a specific category for preparing the trading and profit and loss account. For instance, in Ankit’s trial balance, wages are recorded at ₹8,000. If Ankit owes ₹500 in wages for the year 2016-17 to an employee, the actual wage expense should be ₹8,500 instead of ₹8,000. Ankit must report ₹8,500 as the wage expense in the trading and profit and loss account and recognize a current liability of ₹500 for the outstanding wages. This amount will be labeled as wages outstanding and will be adjusted in the wages account through the following journal entry:

The amount of outstanding wages will be added to wages account for the preparation of the trading and profit and loss account as follows :

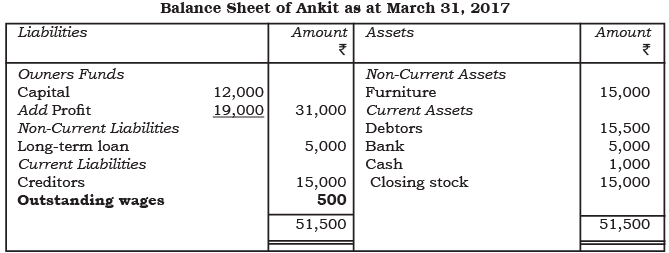

The net profit of Ankit has decreased to ₹19,000 due to outstanding wages. This item will be presented in the balance sheet as follows:

Prepaid Expenses

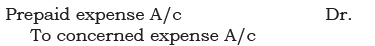

In business operations, some expenses are paid in advance. By the end of the accounting year, it may be determined that the benefits of these expenses are not completely realized, with some benefits extending into the next year. This portion of the expense is carried forward and referred to as prepaid expenses. To account for prepaid expenses, the following entry is recorded:

The adjustment entry reduces the prepaid amount from the total expense, and the new prepaid expense account appears on the asset side of the balance sheet. For instance, in Ankit's trial balance, if he has paid a total salary of ₹25,000, which includes an advance payment of ₹5,000 to an employee, he has effectively overpaid by ₹5,000. Therefore, the correct salary expense for the period should be ₹20,000. Ankit must report ₹20,000 as salary expense in the profit and loss account and recognize ₹5,000 as a current asset for the prepaid salary. This will be recorded as a prepaid salary account through the following journal entry:

Observe how the prepaid salary has resulted in an increase of net profit by ₹ 5,000 making it as ₹ 24,000 Further, the item relating to prepaid salary will be shown in the balance sheet on the assets side as follows :

Accrued Income

Accrued income refers to earnings like interest on loans, commissions, or rent that are recognized in the current accounting year but not yet received by year-end. The adjusting entry for accrued income is:

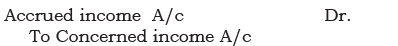

The accrued income will be included in the corresponding income on the profit and loss account, and a new accrued income account will be listed on the asset side of the balance sheet. For example, if Ankit assisted a fellow businessman by introducing parties for a commission, the trial balance will show a commission received of ₹5,000. If an additional ₹1,500 is still owed by the businessman, the total commission income for 2016-17 would be ₹6,500 (₹5,000 + ₹1,500). Ankit must record an adjustment entry to reflect the accrued commission as follows:

The account of accrued income will be recorded in trading and profit and loss account as follows :

The accrued income has led to a net profit increase of ₹1,500, bringing the total to ₹25,500. This amount will be recorded on Ankit's balance sheet under current assets on the assets side.

Income Received in Advance

Income Received in Advance

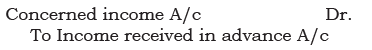

Income received in advance refers to a portion of income that is collected but not earned in the current accounting period. This portion is allocated to the next period and is classified as unearned income. To adjust for this, the following accounting entry is recorded:

The impact of this entry is that the balance in the income account will reflect the income earned for the current accounting period, while the new account for income received in advance will be classified as a liability on the balance sheet.

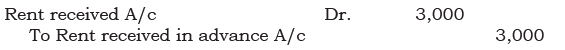

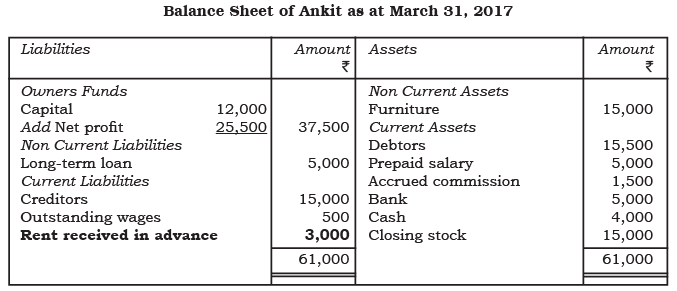

For instance, if Ankit agrees on March 31, 2017, to sublet part of his building to a fellow shopkeeper for ₹1,000 per month, and the shopkeeper pays rent in advance for April, May, and June, totaling ₹3,000, this amount initially credited to the profit and loss account is incorrect. Since this income does not pertain to the current year, it should not be credited to the profit and loss account. Instead, it is classified as income received in advance and recorded as a liability of ₹3,000. Ankit must make an adjustment entry to reflect the income received in advance through the following journal entry:

This will lead a new account of rent received in advance of ₹ 3,000 which will appear as follows :

Depreciation

Depreciation refers to the decrease in asset value due to wear and tear and the passage of time. It is recorded as a business expense and debited to the profit and loss account. This process effectively writes off part of the asset's cost used in generating profits.The journal entry for recording depreciation is:

- Depreciation A/c Dr.

- To Concerned Asset A/c

In the balance sheet, the asset is reported at its cost minus accumulated depreciation. For instance, if Ankit has a furniture account with a balance of ₹15,000 and it depreciates at 10% annually, the value of the furniture at year-end will decrease by ₹1,500 (₹15,000 × 10%). Ankit must record this adjustment as follows:

- Depreciation A/c Dr. ₹1,500

- To Furniture A/c ₹1,500

Depreciation will be shown in the profit and loss account and balance sheet as follows :

The net profit decreases as depreciation is adjusted. Now, let's examine how depreciation as an expense appears on the balance sheet.

Bad Debts

Bad Debts refer to amounts that a firm cannot collect from its debtors, resulting in a loss. The accounting entry for bad debts is:

In Ankit's trial balance, bad debts are reported as ₹4,500, while sundry debtors total ₹15,500. This indicates a recorded loss from bad debts during the year.

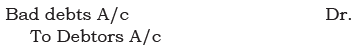

Assuming one debtor, who owes ₹2,500, has become insolvent and is uncollectible, this amount represents additional bad debts for the current year. The adjustment entry for this is:

This adjustment reduces the debtors' value to ₹13,000 (₹15,500 - ₹2,500) and increases the total bad debts to ₹7,000 (₹4,500 + ₹2,500).

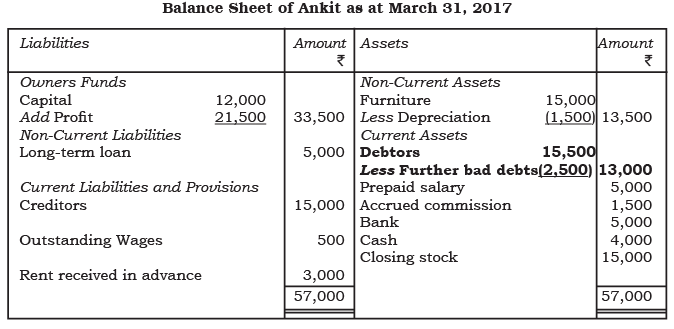

The treatment of further bad debts in profit and loss account and balance sheet is shown below :

Provision for Bad and Doubtful Debts

In the provided balance sheet, debtors are valued at ₹ 13,000, representing their estimated realizable value for the next year. However, it's possible that not all of this amount will be collected. Due to the uncertainty in predicting bad debts accurately, a reasonable estimate is made to account for potential losses. This estimate is referred to as the provision for bad debts, which is recorded by debiting the profit and loss account. The corresponding journal entry is as follows:

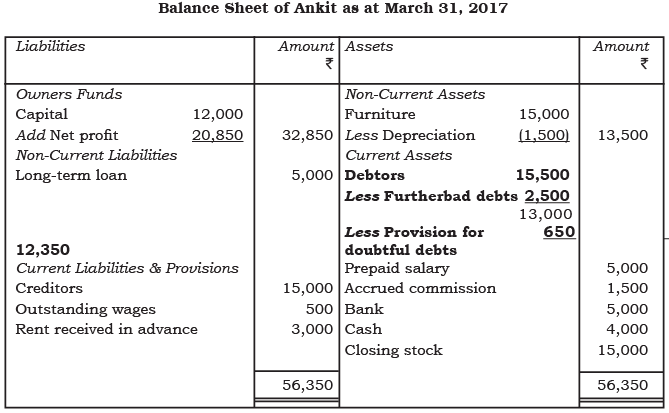

The provision for doubtful debts is also reflected as a deduction from the debtors on the asset side of the balance sheet.

Assuming Ankit estimates that 5% of his debtors as of March 31, 2017, may default, this would result in expected bad debts of ₹ 650 (₹ 13,000 × 5%). Ankit should record the adjusting entry as:

This entry indicates that ₹ 650 will decrease the current year's profit due to anticipated doubtful debts. In the balance sheet, this amount will be shown as a reduction from sundry debtors.

The provision for doubtful debts at the end of a year is carried forward to the next year to cover losses from bad debts incurred in that year. The provision brought forward is referred to as the opening or old provision. If an old provision exists, the current year's bad debt losses are offset against it. The new provision needed at the end of the current year is then calculated, considering the remaining balance of the old provision as shown in the trial balance.

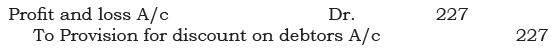

Provision for Discount on Debtors

A business enterprise offers discounts to debtors to encourage prompt payment. The estimated discount for customers in an accounting year can be provided for by creating a provision for discount on debtors. This provision is made on good debtors, calculated by subtracting bad debts and provisions for doubtful debts. The following journal entry is recorded to create the provision for discount on debtors:

As mentioned, the provision for discount on debtors is based only on good debtors, calculated after deducting doubtful debts, resulting in a total of ₹12,350 (₹13,000 - ₹650). Ankit needs to record the adjustment entry as follows:

This entry will decrease the current year profit by ₹227 due to the anticipated discount on prompt payment. In the balance sheet, it will appear as a deduction from the debtors account, accurately reflecting the expected realizable value of debtors as ₹12,123.

In the following year, the discount will be allocated to the provision for discount on debtors account. This account will be managed similarly to the provision for doubtful debts.

Manager’s Commission

The business manager may receive a commission based on the company's net profit. This commission can be calculated either before or after deducting the commission itself. If there is no specific information provided, it is generally assumed that the commission is calculated as a percentage of the net profit prior to deducting the commission.

The net profit of a business is ₹110 before the commission is applied. The manager receives 10% of this profit prior to the commission calculation. Therefore, the commission is calculated as follows: ₹ 110 × 10/10010 = ₹11.

In case the commission is 10% of the profit after charging such commission, it will be calculated as :

= Profit before commission × Rate of commission/ (100 + commission)

= 110 X 10/110 = 10

The manager's commission will be recorded in the accounting books with the following journal entry:

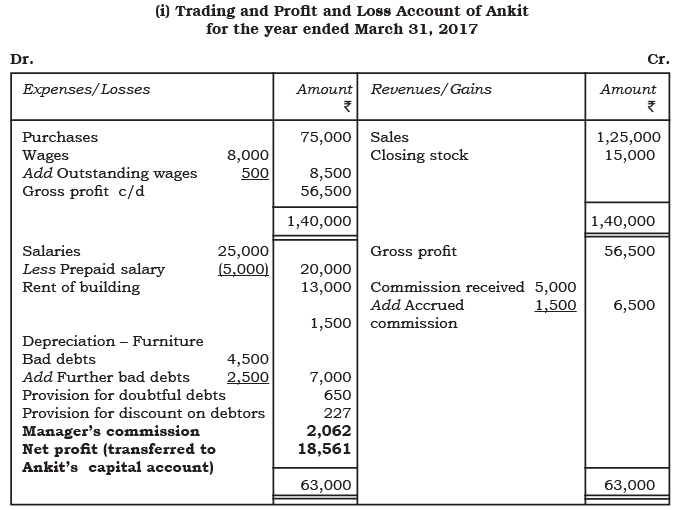

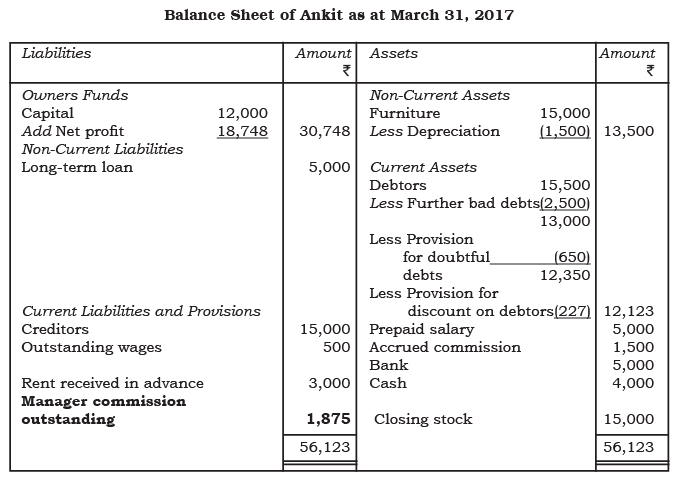

For example, if Ankit's manager is entitled to a 10% commission, consider the following scenarios for the profit and loss account:

(i) Based on net profit before deducting the manager's commission.

(ii)Based on profit after deducting the manager's commission.

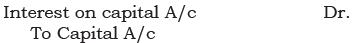

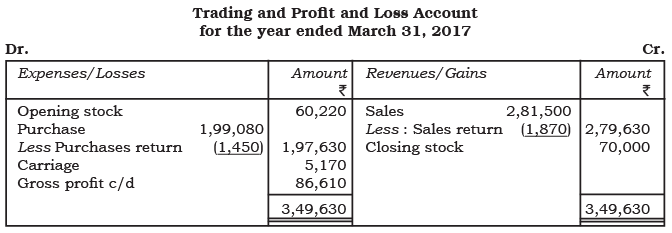

Interest on Capital

Interest on Capital

Sometimes, a business owner wants to know the profit after accounting for interest on capital. Interest is calculated at a specified rate on the capital as of the beginning of the accounting year. If additional capital is introduced during the year, interest can also be computed on that amount from the date it was added. This interest is considered an expense for the business and recorded in the accounts with the following journal entry:

In the final accounts, this amount appears as an expense on the debit side of the profit and loss account and is added to capital in the balance sheet. For example, if Ankit provides 5% interest on his capital, the amount will be ₹600, leading to the following journal entry:

This entry indicates that the net profit will decrease by ₹600. Consequently, the reduced profit amount will be added to the capital in the balance sheet.

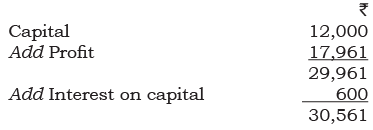

But, when interest on capital shall be added to the capital, this effect shall be neutralised. As shown below : Illustration 1:

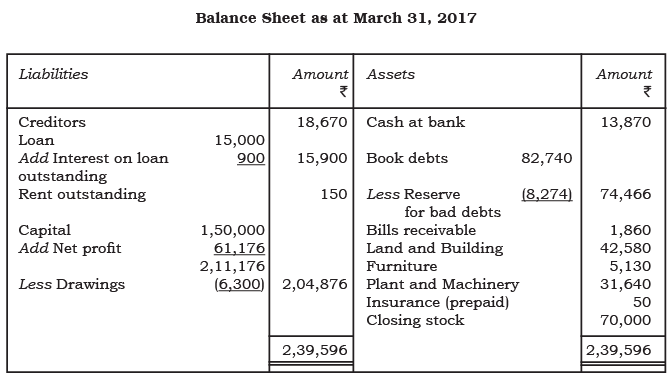

Illustration 1:

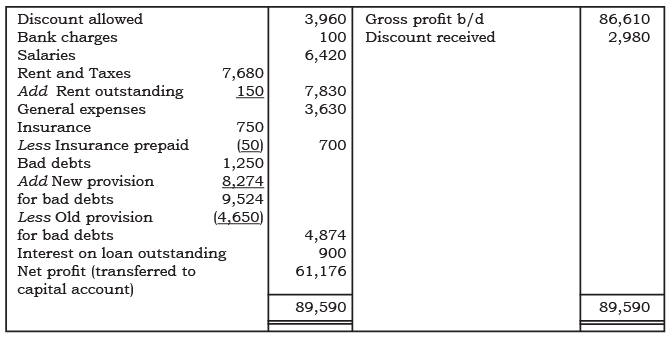

From the following balances, prepare the trading and profit and loss account and balance sheet as on March 31, 2017.

Adjustments

1. Closing stock ₹ 70,000

2. Create a reserve for bad and doubtful debts @ 10% on book debts

3. Insurance prepaid ₹ 50

4. Rent outstanding ₹ 150

5. Interest on loan is due @ 6% p.a.

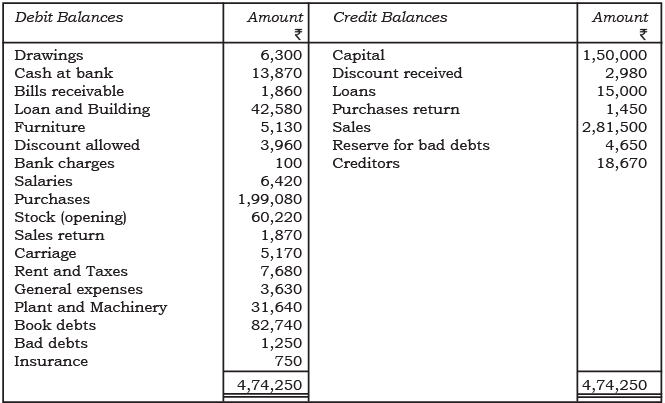

Solution:

Illustration 2:

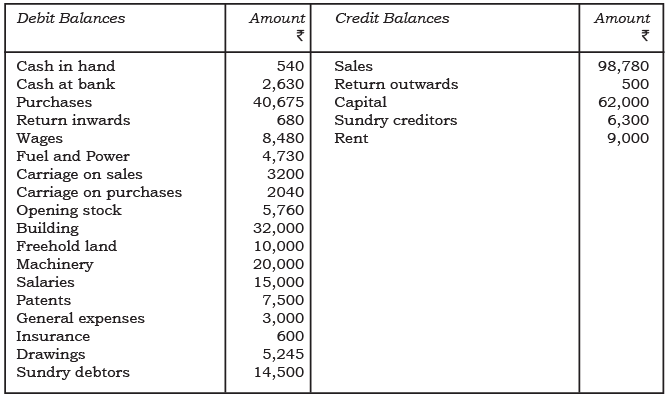

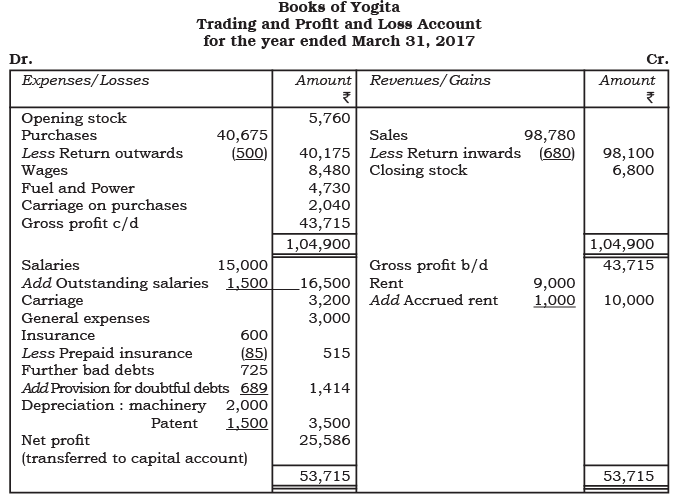

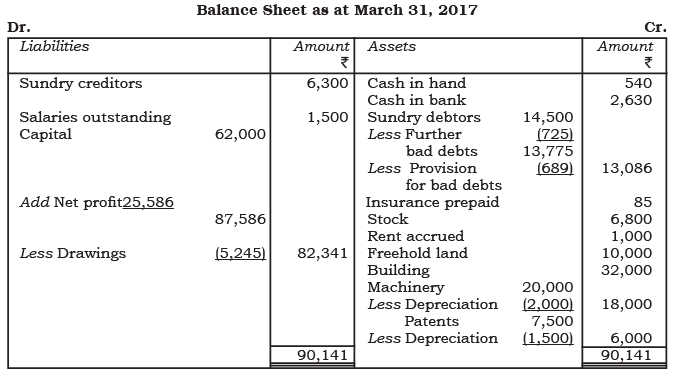

The following were the balances extracted from the books of Yogita as on March 31, 2017:

Taking into account the following adjustments prepare trading and profit and loss account and balance sheet as on March 31, 2017 :

(a) Stock in hand on March 31, 2017, was ₹ 6,800.

(b) Machinery is to be depreciated at the rate of 10% and patents @ 20%.

(c) Salaries for the month of March, 2017 amounting to ₹ 1,500 were outstanding.

(d) Insurance includes a premium of ₹ 170 on a policy expiring on September 30, 2017.

(e) Further bad debts are ₹ 725. Create a provision @ 5% on debtors.

(f) Rent receivable ₹ 1,000.

Solution:

Illustration 3:

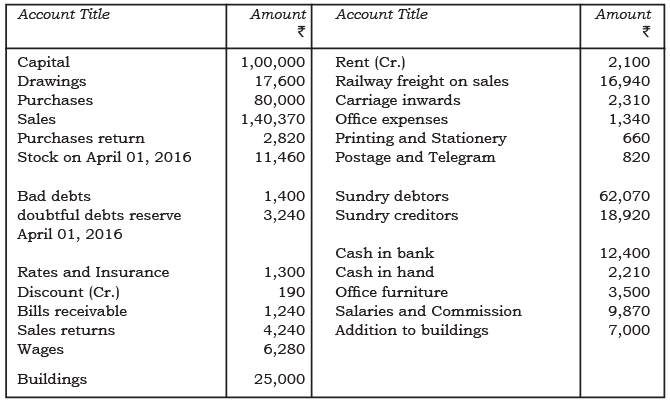

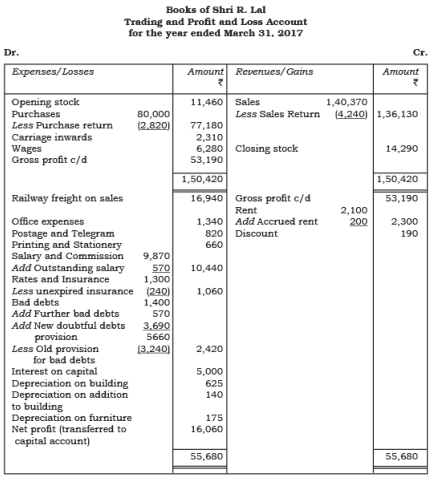

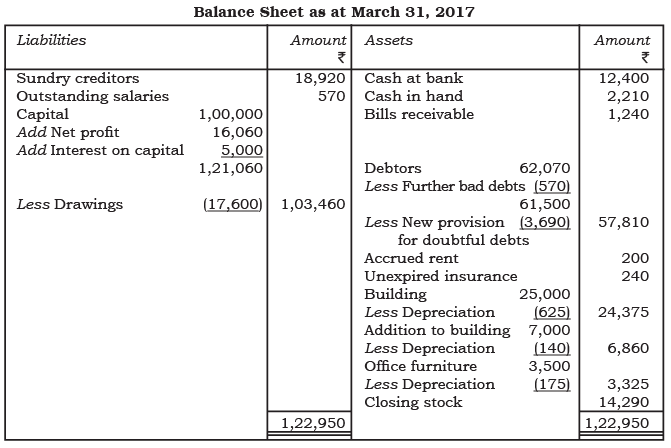

The following balances were extracted from the books of Shri R. Lal on March 31, 2017:

Prepare the trading and profit and loss account and a balance sheet as on March 31, 2017 after keeping in view the following adjustments :

(i) Depreciate old building by ₹ 625 and addition to building at 2% and office furniture at 5%.

(ii) Write-off further bad debts ₹ 570.

(iii) Increase the bad debts reserve to 6% of debtors.

(iv) On March 31, 2017 ₹ 570 are outstanding for salary.

(v) Rent receivable ₹ 200 on March 31, 2017.

(vi) Interest on capital at 5% to be charged.

(vii) Unexpired insurance ₹ 240.

(viii) Stock was valued at ₹ 14,290 on March 31, 2017.

Solutions:

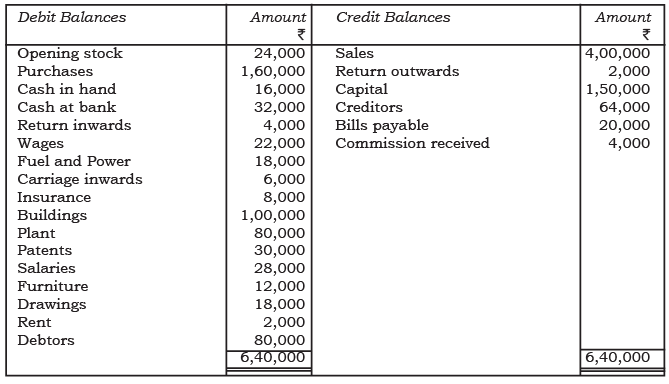

Illustration 4:

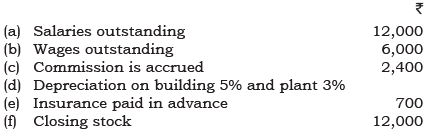

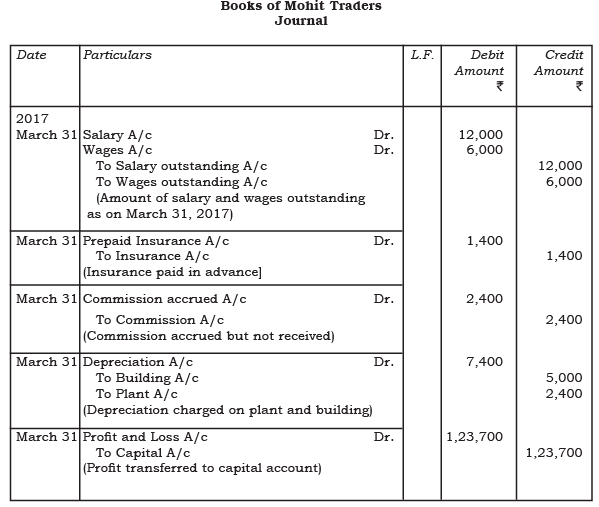

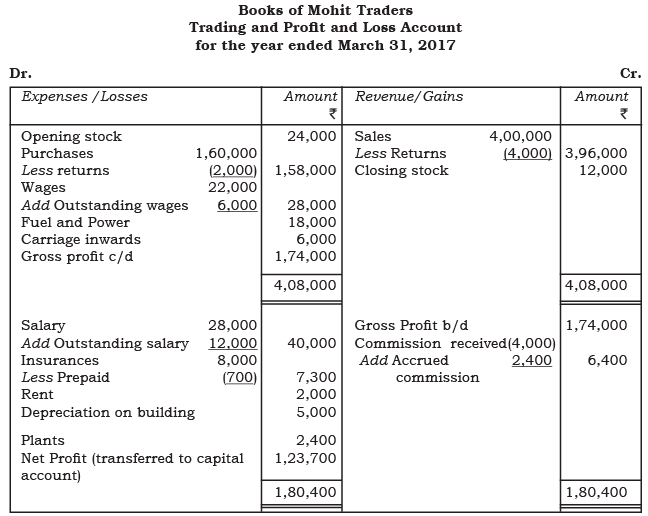

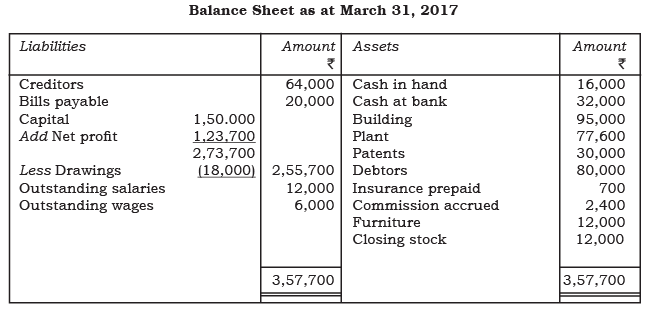

Prepare the trading profit and loss account of M/s Mohit Traders as on 31 March 2017 and draw necessary Journal entries and balance sheet as on that date :

Adjustments

Solution:

Illustration 5:

Illustration 5:

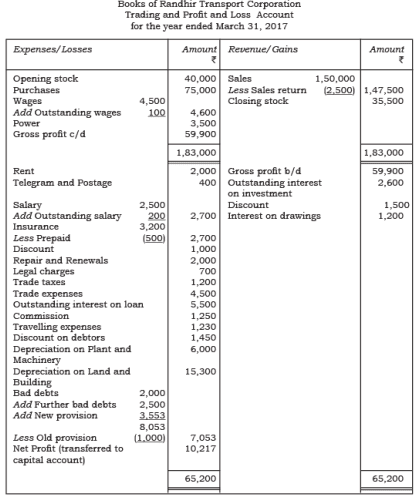

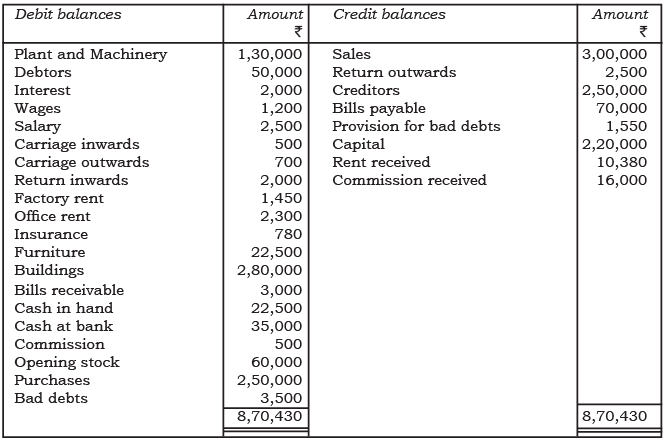

The following information has been extracted from the trial balance of M/s Randhir Transport Corporation.

Adjustments

1. Closing stock for the year was ₹ 35,500.

2. Depreciation charged on plant and machinery 5% and land and building 6%.

3. Interest on drawing @ 6% and Interest on loan @ 5%.

4. Interest on investments @ 4%.

5. Further bad debts 2,500 and make provision for doubtful debts on debtors 5%.

6. Discount on debtors @ 2%.

7. Salary outstanding ₹ 200.

8. Wages outstanding ₹ 100.

9. Insurance prepaid ₹ 500.

You are required to make trading and profit and loss account and a balance sheet on March 31, 2017.

Solution:

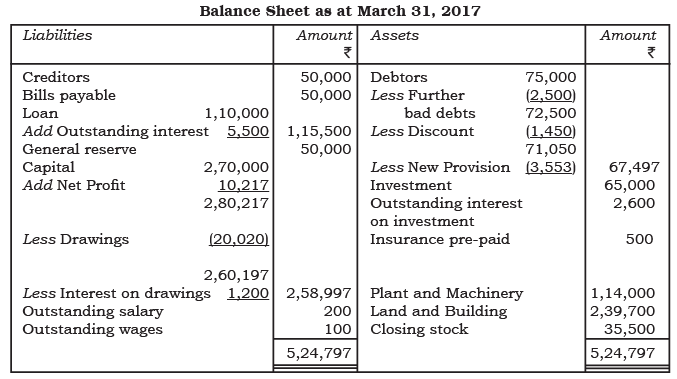

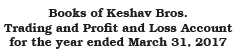

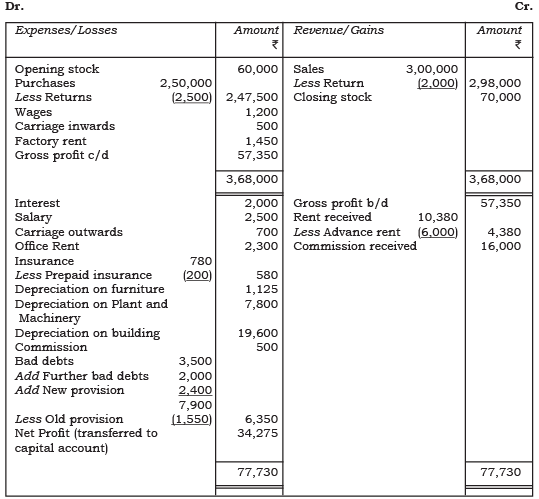

Illustration 6:

From the following balances of M/s Keshav Bros. You are required to prepare trading and profit and loss account and a balance sheet of March 31, 2017. Adjustment

Adjustment

(i) Provision for bad debts @ 5% and further bad debts ` 2,000.

(ii) Rent received in advance ` 6,000.

(iii) Prepaid insurance ` 200.

(iv) Depreciation on furniture @ 5%, plant and machinery @ 6%, building @ 7%.

Solution:

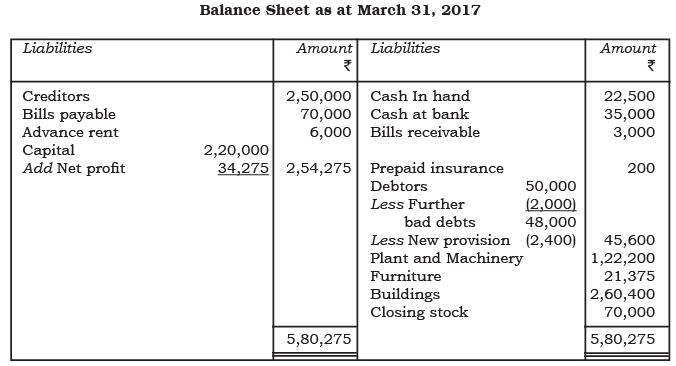

Illustration 7:

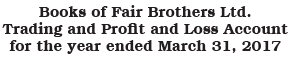

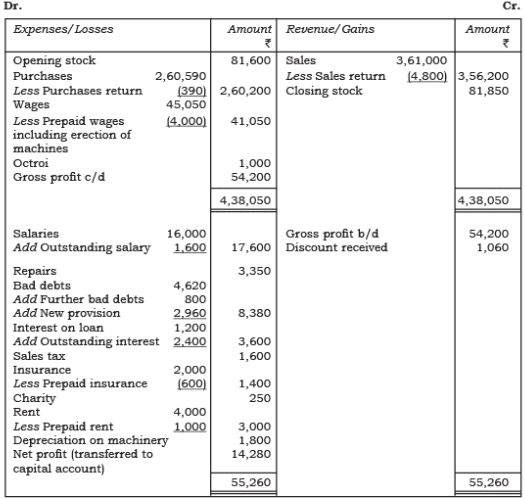

The following information have been taken from the trial balance of M/s Fair Brothers Ltd. You are required to prepare the trading and profit and loss account and a balance sheet as at March 31, 2017. Adjustments

Adjustments

1. Wages include ₹ 4,000 for erection of new machinery on April 01, 2016.

2. Provide 5% depreciation on furniture.

3. Salaries unpaid ₹ 1,600.

4. Closing stock ₹ 81,850.

5. Create a provision at 5% on debtors.

6. Half the amount of bill is recoverable.

7. Rent is paid up to July 30, 2017.

8. Insurance unexpired ₹ 600.

Solution:

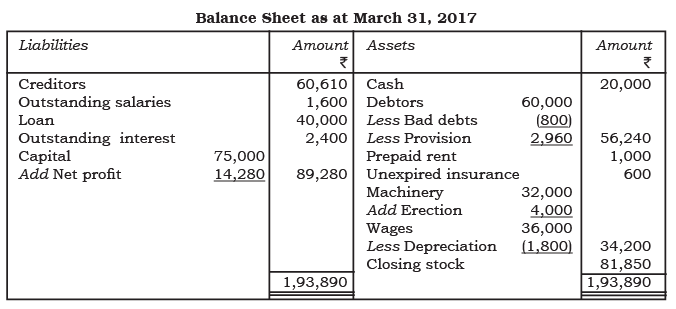

Illustration 8:

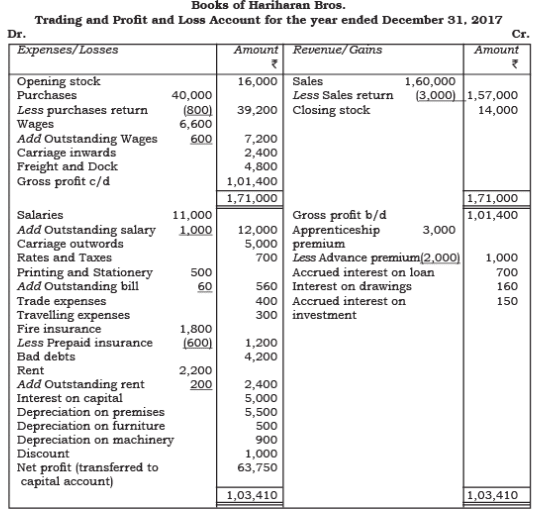

From the following balance extracted from the books of of M/s Hariharan Brother, you are require to prepare the trading and profit and loss account and a balance sheet as on December 31, 2017.

Adjustments

1. Closing stock ₹14,000.

2. Wages outstanding ₹ 600, Salaries Outstanding ₹ 1,000, Rent outstanding ₹ 200.

3. Fire Insurance premium includes ₹ 1,200 paid in July 01, 2016 to run for one year from July 01, 2016 to June 30, 2017.

4. Apprenticeship Premium is for three years paid in advance on January 01, 2016.

5. Stationery bill for ₹ 60 remain unpaid.

6. Depreciation on Premises @ 5%, furniture @ 10%, Machinery @ 10%.

7. Interest on loan given accrued for one year @ 7%.

8. Interest on investment @ 5% for half year to December 31, 2016 has accrued.

9. Interest on capital to be allowed at 5% for one year.

10. Interest on drawings to be charged to him ascertained for the year ₹ 160.

Solution:

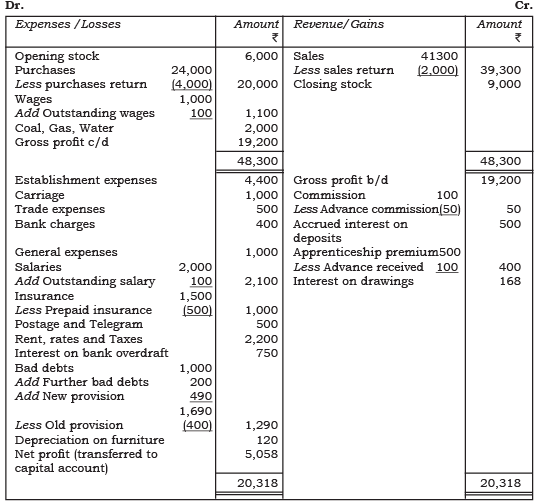

Illustration 9:

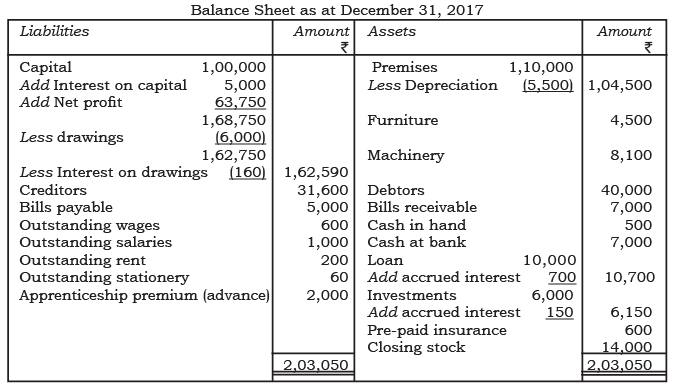

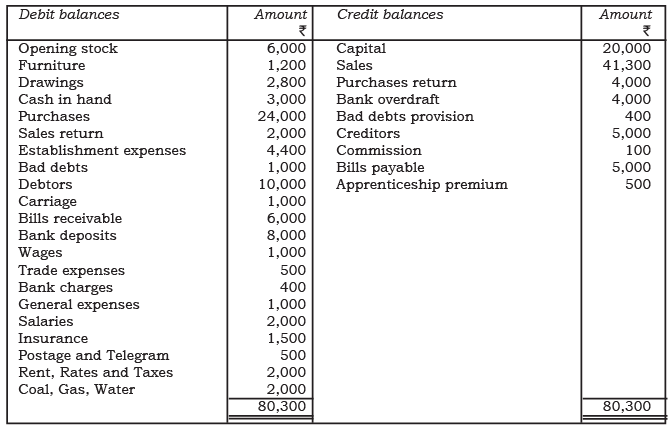

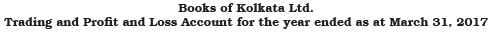

The following balances have been extracted from the trial balance of M/s Kolkata Ltd. You are required to prepare the trading and profit and loss account on dated March 31, 2017.

Also prepare balance sheet on that date.

Adjustments

1. Outstanding salaries ₹ 100. Rent and taxes ₹ 200, Wages ₹ 100.

2. Unexpired insurance ₹ 500.

3. Commission is received in advances ₹ 50.

4. Interest ₹ 500 is to be received on bank deposits.

5. Interest on bank overdraft ₹ 750.

6. Depreciation on furniture @ 10%.

7. Closing stock ₹ 9,000.

8. Further bad debts ` 200 New provision @ 5% on debtors.

9. Apprenticeship premium received in advance ₹100.

10. Interest on drawings @ 6%.

Solution:

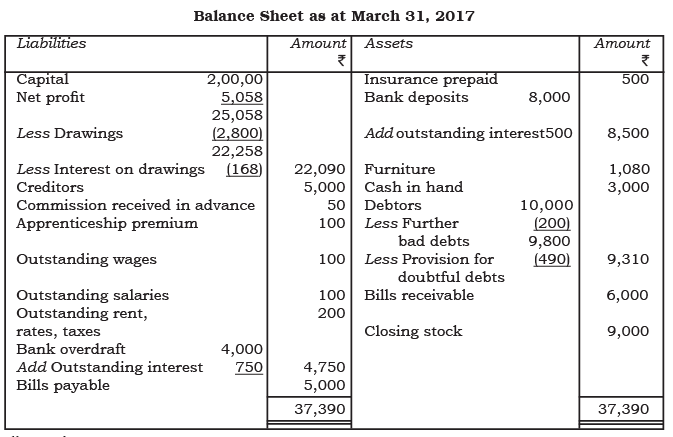

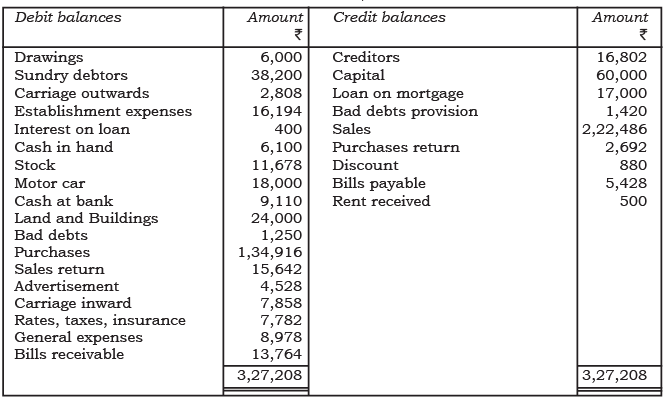

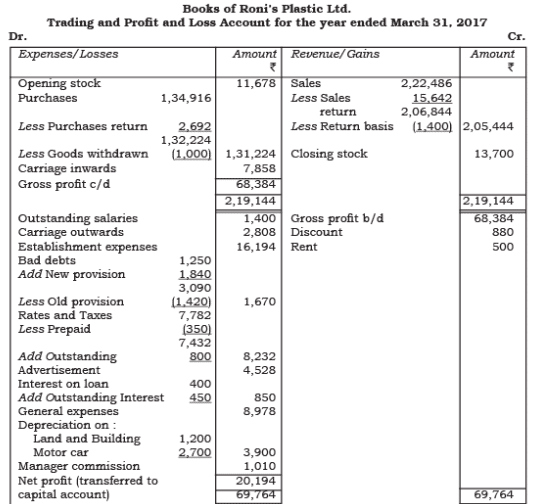

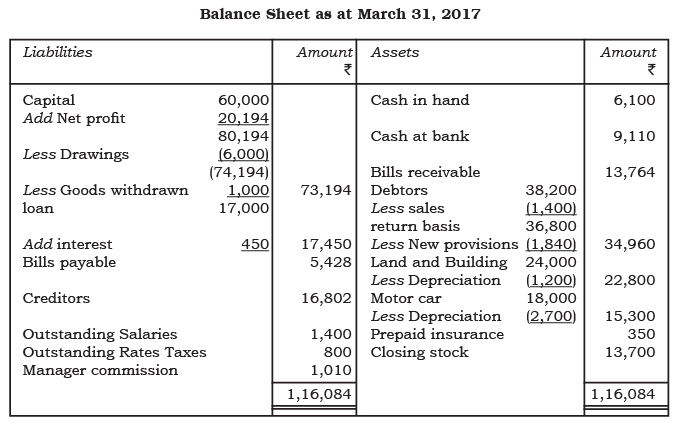

Illustration 10:

Illustration 10:

Prepare the trading and profit and loss account of M/s Roni Plastic Ltd. from the following trial balance and a balance sheet as at March 31, 2017.

Adjustments

Adjustments

1. Depreciation on land and building at @ 5% and Motor vehicle at @ 15%.

2. Interest on loan is @ 5% taken on April 01, 2016.

3. Goods costing Rs1,200 were sent to a customer on sale on return basis for ₹ 1,400 on March 30, 2017 and has been recorded in the books as actual sales.

4. Salaries amounting to ₹ 1,400 and Rates amounting to ₹ 800 are due.

5. The bad debts provision is to be brought up to @ 5% on sundry debtors.

6. Closing stock was ₹ 13,700.

7. Goods costing ₹ 1,000 were taken away by the proprietor for his personal use but not entry has been made in the books of account.

8. Insurance pre-paid ₹ 350.

9. Provide the manager’s commission at @ 5% on Net profit after charging such commission.

Solution:

|

64 videos|152 docs|35 tests

|

FAQs on Financial Statements - II Chapter Notes - Accountancy Class 11 - Commerce

| 1. What is the importance of adjusting closing stock in financial statements? |  |

| 2. How do outstanding expenses affect the financial statements? |  |

| 3. Why is it necessary to account for prepaid expenses in financial statements? |  |

| 4. What is the significance of accruing income in accounting? |  |

| 5. How do provisions for bad debts and doubtful debts impact financial statements? |  |