B Com Exam > B Com Notes > Auditing and Secretarial Practice > Principles Governing an Audit - Auditing Concepts, Auditing & Secretarial Practice

Principles Governing an Audit - Auditing Concepts, Auditing & Secretarial Practice | Auditing and Secretarial Practice - B Com PDF Download

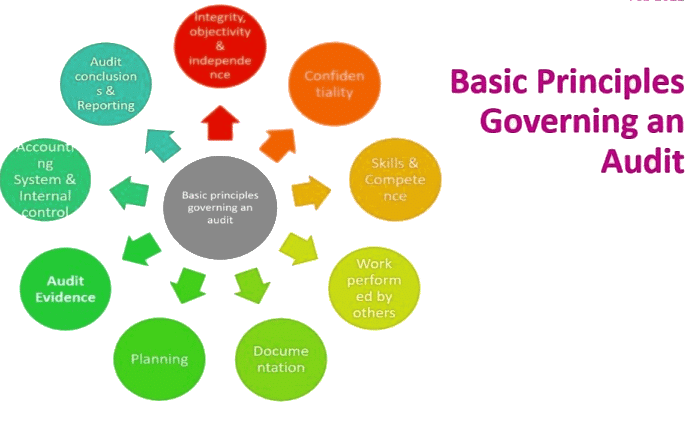

Basic Principles Governing an Audit

Audit and Assurance standards outline the fundamental principles that auditors must adhere to when conducting an audit of an organization's financial statements.

1. Integrity, Objectivity, and Independence

- Auditors must be honest, straightforward, and sincere in their approach. They have access to the entire financial records of the organization being audited and are entrusted with funds for the purpose of the audit.

- Auditors should maintain a high standard of integrity, keeping a separate account for any funds entrusted to them. Their opinions should be based on evidence rather than personal intuition, and their independence should not be questioned by the organization.

2. Confidentiality

- Auditors must maintain strict confidentiality regarding the information obtained during the audit. This information should not be disclosed to third parties unless there is a legal or professional obligation to do so with specific authority.

- Auditors should not use the information for personal gain or for the benefit of third parties.

3. Skill and Competence

- Auditors require specialized skills and competence to perform their work effectively. The audit report must be prepared with due care, and auditors should constantly update their knowledge and skills in accounting and auditing.

- The skills and competence acquired by auditors should be applied with care and diligence.

4. Work Performed by Others

- Auditors can delegate work to assistants or rely on the work of others, but they must provide proper directions and supervise the work appropriately.

- When relying on the work of another auditor, auditors should ensure the adequacy of the nature and purpose of the work and exercise caution when relying on the opinion or work of an expert.

5. Documentation

- Adequate documentation serves as evidence of the audit performed and supports the fact that the audit was conducted in accordance with basic principles.

- Maintaining working papers is useful for planning, performance, supervision, and review of the audit, and auditors are required to document matters supporting their audit work.

6. Planning

- Proper planning is essential for conducting an effective audit in an efficient and timely manner. Plans should include:

- Understanding the client's accounting system, policies, and internal control procedures.

- Establishing the expected degree of reliance on internal control.

- Determining and scheduling the nature, timing, and extent of audit procedures.

- Coordinating the work to be performed.

- Plans should be flexible and revised as needed based on audit requirements.

7. Audit Evidence

- Auditors collect evidence through tests and audit techniques to evaluate the financial statements. This includes compliance procedures to assess internal control effectiveness and substantive procedures to test transaction details and analyze ratios and trends.

- Audit evidence can be categorized into:

- Tests of details of transactions and balances.

- Analysis of ratios and trends, including inquiries into unusual fluctuations.

8. Accounting System and Internal Control

- Management should maintain an adequate accounting system with appropriate internal controls based on the size and nature of the business.

- The choice of audit techniques and extent of substantive procedures depend on the reliability of the internal control system, which is determined by its effectiveness.

- Auditors are responsible for evaluating the effectiveness of internal controls related to the accounting system to identify potential areas of material misstatement.

9. Audit Conclusions and Reporting

- Conclusions are drawn from the collected audit evidence and the auditor's understanding of the entity's business.

- Auditors should review and assess the conclusions before forming an opinion.

- The audit opinion is communicated in the audit report, which should comply with relevant statutory requirements or agreements.

There are three types of audit reports: unqualified report, qualified report, and adverse report.

Unqualified Report

- The auditor issues an unqualified report when satisfied that:

- The financial statements are prepared in accordance with generally accepted accounting principles (GAAP).

- The accounting policies have been consistently followed.

- All material matters are adequately disclosed as required by law.

Qualified Report

- A qualified report is issued when the auditor finds minor deviations from the above requirements.

Adverse Report

- An adverse report is given when there are material deviations that adversely affect the financial statements.

Disclaimer of Opinion

- If the information and explanations provided to the auditor are inadequate to form a conclusion, the auditor may disclaim from giving any opinion.

The document Principles Governing an Audit - Auditing Concepts, Auditing & Secretarial Practice | Auditing and Secretarial Practice - B Com is a part of the B Com Course Auditing and Secretarial Practice.

All you need of B Com at this link: B Com

|

54 videos|65 docs|22 tests

|

FAQs on Principles Governing an Audit - Auditing Concepts, Auditing & Secretarial Practice - Auditing and Secretarial Practice - B Com

| 1. What are the principles governing an audit? |  |

Ans. The principles governing an audit include independence, integrity, objectivity, professional competence and due care, confidentiality, and professional behavior. These principles ensure that auditors perform their duties with the highest level of ethics, competency, and confidentiality.

| 2. Why is independence important in an audit? |  |

Ans. Independence is important in an audit because it ensures that auditors are free from any bias or undue influence that could compromise their objectivity and professional judgment. It allows auditors to provide an unbiased and objective opinion on the financial statements and enhances the credibility of the audit process.

| 3. What is the role of integrity in auditing? |  |

Ans. Integrity is a fundamental principle in auditing that requires auditors to be honest, fair, and credible in their professional conduct. Auditors with integrity adhere to ethical standards, maintain professional skepticism, and provide reliable and trustworthy audit opinions.

| 4. How does professional competence and due care contribute to an effective audit? |  |

Ans. Professional competence and due care require auditors to possess the necessary knowledge, skills, and expertise to perform their audit engagements effectively. It ensures that auditors stay updated with the latest auditing standards, regulations, and industry practices to provide high-quality audit services.

| 5. Why is confidentiality important in auditing? |  |

Ans. Confidentiality is crucial in auditing as it ensures that auditors keep all the information obtained during the audit process confidential. It helps to maintain the trust of the audited entity and protects sensitive financial and non-financial information from unauthorized disclosure. Confidentiality also promotes open communication between auditors and their clients.

Related Searches