Ways to alter Share Capital

Section 61 (1) of the Companies Act, 2013 provides that a company limited by shares or guarantee and having a share capital may, if so authorized by its articles, alter, by an ordinary resolution, its memorandum in the following ways:

(a) The company has the power to increase its authorized share capital by any amount it considers appropriate and necessary, depending on what it deems suitable for its objectives or financial planning.

(b) The company can choose to consolidate and divide some or all of its existing shares into shares of a higher face value than the current denomination. For example, the company may consolidate ten shares of Rs. 10 each into a single share of Rs. 100, thereby increasing the nominal value of the individual share.

(c) The company is permitted to convert all or any of its fully paid-up shares into stock. Furthermore, it also has the authority to reconvert that stock back into fully paid-up shares of any denomination, giving it flexibility in managing its share structure.

(d) The company may decide to sub-divide its existing shares, or any part of them, into smaller denominations than those specified in its Memorandum of Association. However, it is mandatory to maintain the existing proportion between the amount paid and the amount unpaid on those shares. For instance, if a share has a face value of Rs. 100 with Rs. 60 paid up, and it is sub-divided into ten shares of Rs. 10 each, then each new share must show Rs. 6 as paid up to preserve the original ratio.

AA to be amended by Special Resolution:

In order to alter its capital clause in the Memorandum, the company requires authority in its articles. But if the articles give no power to this effect, the articles must be amended by a special resolution before the power to alter the capital clause can be exercised by the company [Re. Patent Invert Sugar Co]

Section 64(1) states that when—

(a) a company alters its share capital u/s 61(1); or

(b) an order made by the Government has the effect of increasing authorized capital of a company; or

(c) a company redeems any redeemable preference shares,

the company shall file a notice in the prescribed form with the Registrar within a period of thirty days of such alteration or increase or redemption, as the case may be, along with an altered memorandum.

Rule 15 of Companies (Share Capital and Debentures) Rules, 2014 states that the notice of such alteration, increase or redemption shall be filed by the company with the Registrar in Form No. SH.7 along with the fee.

Contravention :

Section 64(2) states that contravention in this case will make the company and every officer of the company who is in default liable to a fine extending up to Rs. 1000 per day during which the default continues or Rs. 5 lakh, whichever is less (Section 64).

When Share Capital Stands Automatically Increased?

The share capital of a company stands automatically increased when any Government, by its order made, directs that any debentures issued to, or the loans obtained from the Government by a company or any part thereof shall be converted into shares in the company, on such terms and conditions as are considered by that Government to be reasonable in the circumstances.

Appeal against Govt. Order:

However, where the terms and conditions of such conversion are not acceptable to the company, it may, within sixty days from the date of communication of such order, appeal to the Tribunal which shall after hearing the company and the Government pass such order as it deems fit.

Where appeal is dismissed or not preferred:

Where the Government has, by an order, directed that any debenture or loan or any part thereof shall be converted into shares in a company and where no appeal has been preferred to the Tribunal or where such appeal has been dismissed, the memorandum of such company shall, where such order has the effect of increasing the authorized share capital of the company, stand altered and the authorized share capital of such company shall stand increased by an amount equal to the amount of the value of shares which such debentures or loans or part thereof has been converted into. [Section 62(6)]. This Section 62(6) is yet to be notified.

Judicial Pronouncement about a company’s power to alter its share capital

- The powers can be exercised by the members only if authorized by the articles. [Re North Cheshire Brewery Co.]

- The power should be exercised bona fide in the interest of the company and not for benefiting any group. [Needle Industries (India) Ltd. v. Needle Industries Newey (India) Holding Ltd.]

- The notice convening the meeting to pass the resolution for increase must specify the amount of the proposed increase. [Mac Connell v. E. Prill & Co. Ltd.]

- Consolidation and sub-division may be effected by the same resolution [Re. North Cheshire Borewery Co. Ltd.]

- It is not the function of the Court to interfere with the Company’s power to consider a resolution for cancelling the unissued portion of its share capital. The exercise of power by a company to cancel the unissued shares cannot be restrained by an injunction. [Re. Swindon Town Football Co. Ltd.]

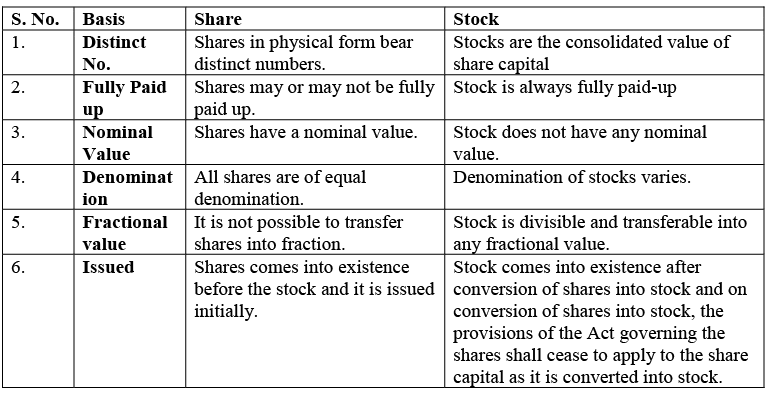

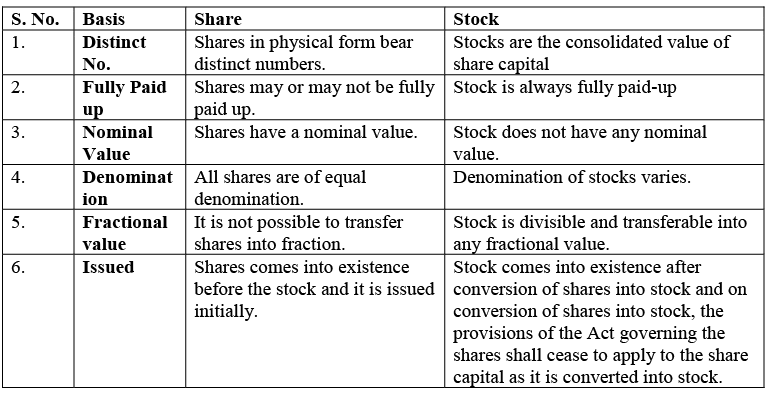

Nature of Stock

Meaning of Share:

Section 2(84) of the Act in defining a share, states that “share means a share in the share capital of a company and includes stock”.

Conversion to stock:

Section 61 allows the company to convert its fully paid-up shares into stock.

NOTE:

(i) only fully paid-up shares can be converted into stock, and

(ii) no direct issue of stock by a company is lawful. It is only the conversion of fully-paid shares into stock, that is allowed by and not a direct issue of stock.

Example: After shares are converted into stock, the stockholder may own Rs.1,000 worth of stock where formerly he held 100 shares of Rs.10 each.

Reduction of Share Capital (Applicable section 66 is yet to be notified)

Sec. 66 (1) Subject to confirmation by the Tribunal on an application by the company, a company limited by shares or limited by guarantee and having a share capital may, by a special resolution, reduce the share capital in any manner and may—

(a) extinguish or reduce the liability on any of its shares in respect of the share capital not paidup; or

(b) either with or without extinguishing or reducing liability on any of its shares, —

- cancel any paid-up share capital which is lost or is unrepresented by available assets; or

- pay off any paid-up share capital which is in excess of the wants of the company, alter its memorandum by reducing the amount of its share capital and of its shares accordingly.

Proviso to Section 66(1)] states that the reduction of capital shall not be made if the company is in arrears in the repayment of any deposits accepted by it, or the interest payable thereon.

Notice by tribunal [Section 66(2)]

The Tribunal shall give notice of application made to it under sub-section (1) to

- the Central Government,

- Registrar

- the Securities and Exchange Board, in the case of listed companies, and

- the creditors of the company within a period of three months from the date of receipt of the notice.

Proviso to Section 66(2) states that if no representation has been received from the Central Government, Registrar, the SEBI or the creditors within the said period, it shall be presumed that they have no objection to the reduction.

Confirmation of Reduction of Capital [Section 66(3)]:

The Tribunal may, if it is satisfied that the debt or claim of every creditor of the company has been discharged or determined or has been secured, or his consent is obtained, make an order confirming the reduction of share capital on such terms and conditions as it deems fit.

Publication of Tribunal’s Order [Section 66(4)]:

The order of confirmation of the reduction of share capital by the Tribunal shall be published by the company in such manner as the Tribunal may direct.

Deliver a Copy of Order of Tribunal to ROC [Section 66(5)]:

The company shall deliver a certified copy of the order of the Tribunal showing:

(a) The amount of share capital.

(b) The number of shares into which it is to be divided.

(c) The amount of each share.

(d) The amount, if any, at the date of registration deemed to be paid-up on each share, to the Registrar within thirty days of the receipt of the copy of the order, who shall register the same and issue a certificate to that effect.

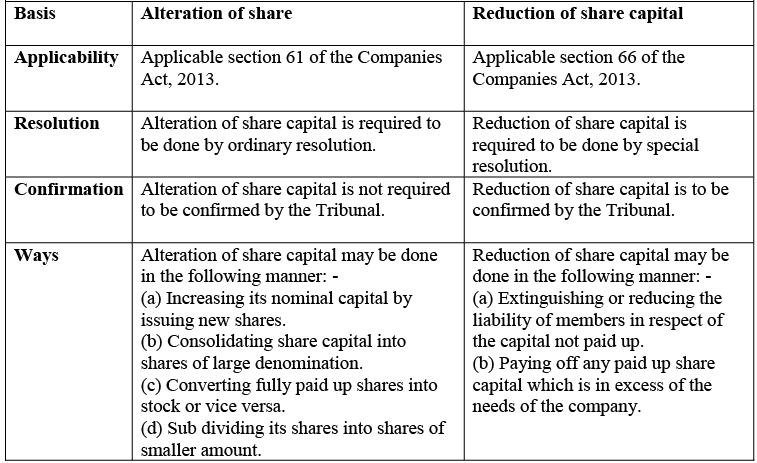

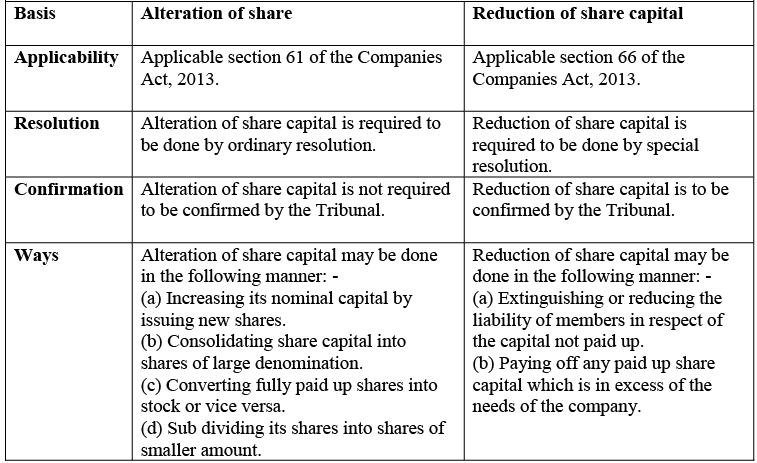

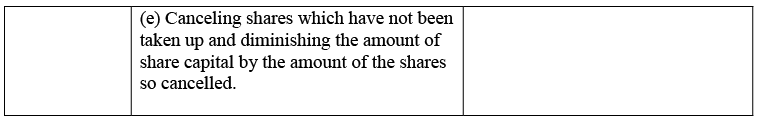

Difference in Alteration of share capital and reduction of share capital

Diminution of share capital is not a reduction of capital

Diminution of Capital:

As per Section 61(1)(e) of the Companies Act, 2013 (currently in force), diminution of capital refers to the cancellation of the portion of the issued capital that has not been subscribed by shareholders. This reduction can be carried out through the passing of an ordinary resolution, provided that the company’s Articles of Association permit such an action. Unlike certain other forms of capital reduction, this process does not require the approval or confirmation of the Tribunal under Section 66.

In the following cases, the diminution of share capital is not to be treated as reduction of the capital:

Where the company cancels share which have not been taken or agreed to be taken by any person.

Redemption of redeemable preference shares.

Where the company buys-back its own shares under Section 68.

Purchase of shares of a member by the Company on order of the Tribunal u/s 242 of Companies Act, 2013 (yet to be enforced).

Judicial Pronouncement relating to reduction of Share capital of a company

- Re. SIEL Ltd., reduction of the share capital of a company is a domestic concern of the company and the decision of the majority would prevail. If the majority by special resolution decides to reduce the share capital of the company, it has the right to decide to reduce the share capital of the company and it has the right to decide how this reduction should be effected.

- Re Indian National Press (Indore) Ltd., The need for reducing capital may arise in various circumstances for example trading losses, heavy capital expenses and assets of reduced or doubtful value. As a result, the original capital may either have become lost.

- British and American Trustee Corp. vs. Couper When exercising its discretion, the Court shall consider the following, while sanctioning the reduction:

(i) The interests of creditors must be safeguarded;

(ii) The interests of shareholders must be considered; and (iii) Lastly, the public interest must be considered as well. - Re. Borough Commercial and Bldg. Society, In case of reduction in shares capital of an unlimited company: An unlimited company to which section 66 of the Companies Act, 2013) does not apply, can reduce its capital in any manner that its Memorandum and Articles of Association allow.

- Great Universal Stores Ltd., In case of Reduction of capital when company is defunctThe Registrar of Companies has been empowered under Section 248 of the Companies Act, 2013) to strike off the name of the company from register on the ground of non-working.

Therefore, where the company has ceased to trade, and Registrar exercises his power u/s 248, a reduction of capital cannot be prevented. - Marwari Stores Ltd. vs. Gouri Shanker Goenka, In case of Equal Reduction of Shares of One Class: Where there is only one class of shares, prima facie, the same percentage should be paid off or cancelled or reduced in respect of each share, but where different amounts are paid-up on shares, the reduction can be effected by equalizing the amount so paid-up.

Reduction of Share Capital Without Sanction of the Court

In the following cases regarding reduction of share capital, no confirmation by the Tribunal is necessary:

Surrender of Shares

“Surrender of shares” means the surrender to the company by the registered holder of shares already issued. Where shares are surrendered to the company, whether by way of settlement of a dispute or for any other reason, it will have the same effect as a transfer in favor of the company and amount to a reduction of capital.

But if, under any arrangement, such shares, instead of being surrendered to the company, are transferred to a nominee of the company then there will be no reduction of capital [Collector of Moradabad v. Equity Insurance Co. Ltd.].

Surrender may be accepted by the company under the same circumstances where forfeiture is justified.

The Companies Act contains no provision for surrender of shares. Thus, surrender of shares is valid only when Articles of Association provide for the same and:

(i) Where forfeiture of such shares is justified; or

(ii) When shares are surrendered in exchange for new shares of same nominal value.

Forfeiture of Shares

- A company has the authority, if such power is granted by its Articles of Association, to forfeit shares in the event of non-payment of calls made on those shares. This action of forfeiture does not require any confirmation or approval from the Tribunal.

- However, when the Articles of Association provide this power to the company, it is essential that the company exercises this power strictly in accordance with the specific procedure outlined in those articles. Any deviation from the prescribed procedure would render the forfeiture invalid and legally void.

- The process of forfeiting shares must be formally carried out by passing a resolution at a meeting of the Board of Directors. The forfeiture becomes effective only through such a Board resolution.

Both forfeiture and surrender lead to termination of membership. Forfeiture is at the initiative of company and surrender is at the initiative of member or shareholder.

Creditors’ Right to Object to Reduction

After passing the special resolution for the reduction of capital, the company is required to apply to the Court by way of petition for the confirmation of the resolution. If the Court so directs, the following provisions shall have effect:

Consent of Creditors:

The creditors having a debt or claim admissible in winding up are entitled to object. To enable them to do so, the Court will settle a list of creditors entitled to object. If any creditor objects, then either his consent to the proposed reduction should be obtained or he should be paid off or his payment be secured.

Confirmation and Registration of Reduction of Share Capital:

If the Court is satisfied that either the creditors entitled to object have consented to the reduction, or that their debts have been paid or secured, it may confirm the reduction.

The Court may also direct that the words “and reduced” be added to the company’s name for a specified period, and that the company must publish the reasons for the reduction.

Conclusiveness of Certificate for Reduction of Capital:

The Court’s order confirming the reduction of the company’s share capital should be delivered to the ROC. The reduction takes effect only on registration of the order, and not before. The Registrar will then issue a certificate of registration which will be conclusive evidence that the requirements of the Act have been complied with.

Where the Registrar had issued his certificate confirming the reduction, the same was held to be conclusive although it was discovered later that the company had no authority under its articles to reduce capital. [Re Walkar & Smith Ltd.]

Buy Back of Shares [Section 68]

Sources:

According to Section 68(1) of the Companies Act, 2013 a company may purchase its own shares (referred to as “buy-back”) out of:

(i) its free reserves; or

(ii) the securities premium account; or

(iii) the proceeds of any shares.

However, no buy-back of any kind of shares can be made out of the proceeds of an earlier issue of the same kind of shares.

The company must have at the time of buy-back, sufficient balance in account to accommodate the total value of the buy-back.

Authorization Section 68(2)

- The main requirement is that the articles of association of the company should authorize buyback.

- In case, such a provision is not available, it would be necessary to alter the articles of association to authorize buyback.

- Buy-back can be made with the approval of the Board of directors at a board meeting and/or by a special resolution passed by shareholders in a general meeting, depending on the quantum of buy back.

- In case of a listed company, approval of shareholders shall be obtained only by postal ballot.

Quantum Section 68(2)

(a) Board of directors can approve buy-back up to 10% of the total paid-up equity capital and free reserves of the company and such buy back has to be authorized by the board by means of a resolution passed at the meeting.

(b) Shareholders by a special resolution can approve buy-back up to 25% of the total paid-up capital and free reserves of the company.

In respect of any financial year, the shareholders can approve by special resolution up to 25% of total equity capital in that year

Notice to be accompanied by Explanatory Statement Section 68(3)

The notice of the meeting at which the special resolution is proposed to be passed shall be accompanied by an explanatory statement stating—

(a) a full and complete disclosure of all material facts;

(b) the necessity for the buy-back;

(c) the class of shares or securities intended to be purchased under the buyback;

(d) the amount to be invested under the buy-back; and

(e) the time-limit for completion of buy-back.

Letter of Offer to be Filed with Registrar of Companies before Buy-Back [Rule 17(2)]

The company which has been authorized by a special resolution shall, before the buy-back of shares, file with the ROC a letter of offer in Form No SH 8, along with the fee as prescribed.

Such letter of offer shall be dated and signed on behalf of the Board of directors of the company by not less than two directors of the company, one of whom shall be the Managing Director.

Dispatch of letter of offer to shareholders [Rule 17(4)]:

The letter of offer shall be dispatched to the shareholders immediately after filing the same with the Registrar of Companies but not later than 21 days from its filing with the ROC.

Offer for buy back open for [Rule 17(5)]:

The offer for buy-back shall remain open for a period of not less than 15 days and not exceeding 30 days from the date of dispatch of the letter of offer.

Post buy-back debt-equity ratio not to exceed 2:1 [Section 68(2)(d)]:

The ratio of the aggregate of secured and unsecured debts owed by the company after buy-back is not more than twice the paid-up capital and its free reserves.

Time gap between two buybacks [proviso to Section 68(2)]:

No offer of buy-back under Section 68(2) shall be made within a period of one year reckoned from the date of the closure of the preceding offer of buy-back, if any.

Shares being Bought Back are to be Fully Paid up (Section 68(2):

All the shares for buy-back are to be fully paid-up.

Time limit for completion of buyback (Section 68(4)) :

Every buy-back shall be completed within a period of one year from the date of passing of the special resolution, or as the case may be, the resolution passed by the Board.

Methods of buy-back (Section 68(5))

The buy-back may be—

(a) from the existing shareholders on a proportionate basis;

(b) from the open market;

(c) by purchasing the shares issued to employees of the company pursuant to a scheme of stock option or sweat equity.

Filing Declaration of Solvency with SEBI/ROC as the case may be

Rule 17(3) of Companies Share Capital & Debentures) Rules, 2014

When a company intends to carry out a buy-back of its own shares based on the approval granted through either a special resolution or a board resolution, as applicable, it is required to fulfill a specific procedural obligation prior to executing the buy-back. The company must file a declaration of solvency with the Registrar of Companies and, in the case of listed companies, also with the Securities and Exchange Board of India (SEBI).

This declaration must be submitted in Form No. SH.9 and must be signed by a minimum of two directors of the company. Among these signatories, one must be the Managing Director, if the company has appointed one. Additionally, the declaration must be supported by an affidavit affirming that the Board of Directors has conducted a thorough examination of the company’s financial and operational affairs. Based on this detailed inquiry, the Board must form a firm opinion that the company will be able to meet its financial obligations and liabilities and that the proposed buy-back will not lead to the company becoming insolvent within a period of one year from the date on which the declaration is adopted by the Board.

Extinguishment of securities bought back Section 68(7):

When a company buys back its own shares, it shall extinguish and physically destroy the shares or securities so bought back within seven days of the last date of completion of buy-back.

Prohibition of further issue of shares (Section 68(8)):

When a company completes a buy-back of its shares it shall not make a further issue of the same kind of shares including allotment of new shares within a period of six months except by way of a bonus issue or in the discharge of subsisting obligations such as conversion of warrants, stock option schemes, sweat equity or conversion of preference shares or debentures into equity shares.

Register of buy-back (Section 68(9)):

When a company buys back its shares, it shall maintain a register of the shares so bought, the consideration paid for the shares bought back, the date of cancellation of shares, the date of extinguishing and physically destroying the shares and such other particulars as may be prescribed.

Return of buy back (Section 68(10)):

A company shall, after the completion of the buy-back under this section, file with the Registrar and the Securities and Exchange Board (in case of listed companies) a return containing such particulars relating to the buy-back within thirty days of such completion.

Rule 17(14) of Companies (Share Capital and Debentures) Rules 2014 States that there shall be annexed to the return filed with the Registrar in Form No. SH.11, a certificate in Form No. SH.15 signed by two directors of the company including the Managing Director, if any, certifying that the buy-back of securities has been made in compliance with the provisions of the Act and the rules made thereunder.

Punishments (Section 68(11)):

If a company makes any default in complying with the provisions of this section or any regulation made by the Securities and Exchange Board, in case of listed companies, the company shall be punishable with fine which shall not be less than one lakh rupees but which may extend to three lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to three years or with fine which shall not be less than one lakh rupees but which may extend to three lakh rupees, or with both.

Circumstances prohibits buy-back [Section 70(1)]:

No company shall directly or indirectly purchase its own shares —

- through any subsidiary company including its own subsidiary companies;

- through any investment company or group of investment companies; or

- if a default, is made by the company, in the repayment of deposits accepted, interest payment thereon, redemption of debentures or preference shares or payment of dividend to any shareholder, or repayment of any term loan or interest payable thereon to any financial institution or banking company:

However, the buy-back is not prohibited, if the default is remedied and a period of three years has lapsed after such default ceased to subsist. [Proviso to Section 70(i)]