Final Accounts of General Insurance Companies - Advanced Corporate Accounting | Advanced Corporate Accounting - B Com PDF Download

Concept of Life Fund in an Insurance Company

The Life Fund, also referred to as the Life Assurance Fund, is specifically related to the Life Insurance (Assurance) business. This fund is recorded on the liability side of the company's Balance Sheet. In the context of insurance, a claim is considered an expenditure, while a premium is viewed as income.Understanding Income and Expenditure in Life Insurance

- Income: Premiums are collected periodically (monthly, quarterly, annually) on policies that may mature over a long period.

- Expenditure: Claims need to be paid either upon the maturity of the policy or upon the death of the policyholder.

The key difference is that while claims are definite expenditures, premiums are uncertain incomes. The expected premium from a policy is only received if the policyholder survives until the policy's maturity.

Surplus vs. Profit

- Life insurance companies treat the difference between income (premiums received) and expenditure (claims paid) as a surplus, not profit.

- This surplus from the revenue account is transferred to the Life Fund, where it accumulates.

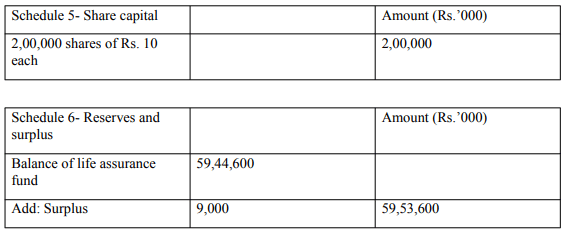

The Life Fund is displayed in Schedule 6 of the balance sheet under the category "Reserves and Surplus."

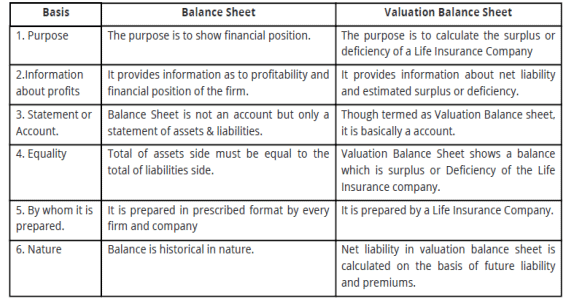

Difference Between Balance Sheet and Valuation Balance Sheet

| Basis | Balance Sheet | Valuation Balance Sheet |

|---|---|---|

| Purpose | To show the financial position of the company. | To calculate the surplus or deficiency of a Life Insurance Company. |

| Information about Profits | Provides information on profitability and financial position. | Provides information about net liability and estimated surplus or deficiency. |

| Statement or Account | Balance Sheet is a statement of assets and liabilities, not an account. | Valuation Balance Sheet is essentially an account, despite its name. |

| Equality | Total assets must equal total liabilities. | Shows a balance which is the surplus or deficiency of the Life Insurance company. |

| By Whom It Is Prepared | Prepared by every firm and company in a prescribed format. | Prepared by a Life Insurance Company. |

| Nature | Historical in nature. | Future liability and premiums are considered to calculate net liability. |

Net Liability

- Net Liability is an important concept in the valuation balance sheet of a life insurance company. It represents the estimated liability on all the policies that are currently in force and is calculated by an actuary.

- The net liability is used to compute the profits of a life insurance business and is based on future liabilities and premiums.

- The difference between the life fund and the net liability represents the profits of the company.

- Life insurance companies typically calculate profits and distribute them among policyholders and shareholders once every two to three years, usually in a ratio of 19:1 or another suitable ratio.

Determining Profit in Life Insurance Business through Valuation Balance Sheet

- Life insurance policies are typically long-term contracts, and the premiums received for these contracts cannot be considered as immediate income for profit assessment. This is because the insurer's obligation extends over many years, and the timing of future premiums and claims is uncertain.

- For instance, in an annuity contract, only a single premium is paid upfront, but the insurer must provide regular payments for the lifetime of the annuitant. Similarly, in life insurance, the claim is triggered by either the death of the insured or the expiration of the policy period, whichever comes first. The future premiums depend on the continued existence of the insured, creating a gap between expected claims and expected premiums.

- This gap is referred to as the net liability, which represents the difference between the present value of future claims and the present value of future premiums. To accurately assess profit, life insurance companies need to create a reserve equal to this net liability. The Life Insurance Corporation of India (LIC) performs this valuation annually to determine its profit, a process carried out by actuaries using complex mathematical methods.

- Actuaries calculate the present value of future liabilities for all active policies and compare it with the present value of future premiums to be received. The difference, known as net liability, is crucial for determining the financial health of the insurance company. The balance in the life assurance fund does not automatically indicate profit. To ascertain profit, insurance companies must evaluate their net liability and compare it with the life assurance fund on a specific date. This comparison is done through a valuation balance sheet.

- If the life insurance fund exceeds the net liability, the difference represents a surplus. Conversely, if the net liability surpasses the life insurance fund, it indicates a deficiency for the inter-valuation period.

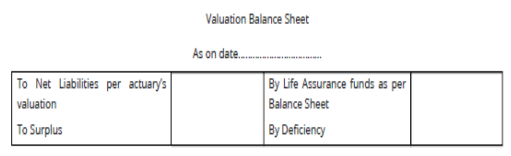

A specimen form of valuation balance sheet is given as follows:

Only surplus, not deficiency, appears on the Balance Sheet. Policyholders are entitled to 95% of the true profit from life insurance business, while shareholders receive the remaining 5%. To calculate true profit, the surplus shown in the valuation Balance Sheet must be adjusted by adding any interim bonus (as it represents an advance payment of bonus) and deducting any outstanding expenses. From the 95% of true profit, any interim bonuses already paid should be subtracted to determine the amount owed to policyholders.

Difference between General Balance Sheet and Valuation Balance Sheet

The Financial Statements of Life Insurance Companies are prepared following the guidelines set by the IRDAI (Insurance Regulatory and Development Authority of India). Financial statements are essential documents that provide a clear picture of a company's financial performance and position.

The IRDAI's regulations ensure transparency, accuracy, and accountability in the financial reporting of life insurance companies.

Objective

- The primary objective of the guidelines is to ensure that the financial statements of life insurance companies are prepared in a manner that reflects the true and fair view of their financial position and performance.

- This is crucial for maintaining the trust of policyholders, investors, and other stakeholders in the insurance sector.

General Instructions for Preparation of Financial Statements

- Previous Year Figures: The financial statements must include the corresponding amounts for the immediately preceding financial year for all items shown in the Balance Sheet, Revenue Account, Profit and Loss Account, and Receipts and Payments Accounts.

- Rounding Off: The figures in the financial statements may be rounded off to the nearest thousands.

- Gross Reporting: Interest, dividends, and rentals receivable in connection with an investment should be stated at gross amount. The income tax deducted at source should be included under 'advances taxes paid and taxes deducted at source'.

- Provision Definition: For financial statement purposes, 'provision' refers to any amount set aside for depreciation, renewals, or diminution in value of assets, or for any known liability or loss with uncertain amount.

- Reserve Definition: 'Reserve' does not include amounts set aside for depreciation, renewals, or known liabilities.

- Capital Reserve:. 'capital reserve' does not include amounts free for distribution through the profit and loss account.

- Revenue Reserve:. 'revenue reserve' is any reserve other than a capital reserve.

- Liability Definition: 'Liability' includes all liabilities for contracted expenditure and disputed or contingent liabilities.

- Excess Provision: If a provision for depreciation, renewals, or known liability is in excess of what is reasonably necessary, the excess shall be treated as a reserve.

- Lawsuit Provisions: Companies must make provisions for damages under lawsuits where management believes the award may go against the insurer.

- Risk Disclosure: The extent of risk retained and re-insured must be disclosed separately.

- Profit & Loss Account Balances: Any debit balance of the Profit & Loss Account should be shown as a deduction from uncommitted reserves, with any remaining balances shown separately.

Explanation of Various Items Appearing in the Revenue Account

1) Claims:- Claims refer to any amount that an insurance company is obligated to pay. In the context of life insurance, claims can arise due to death or maturity.

- When calculating claims, all notified claims, whether accepted or not, at the end of the year need to be considered. Expenses related to claims should be added.

- From the total, claims outstanding at the beginning of the year and reinsurance recoveries should be deducted.

2) Annuity:

- An annuity is an annual payment that a life insurance company guarantees to make in exchange for a lump sum received upfront.

- This is considered an expense and is listed under benefits paid in the revenue account.

3) Surrender Value:

- The surrender value is applicable when an insured individual is unable to continue paying premiums. In such cases, the policyholder can receive a cash value for the policy from the insurance corporation.

- It represents the present cash value of the policy that the holder receives upon surrendering all rights to the policy.

4) Bonus in Cash:

- If the insurer holds a with-profit policy, they are entitled to receive a bonus from the corporation.

- When the bonus is paid in cash, it is recorded on the debit side of the revenue account as an expense.

5) Bonus in Reduction of Premium:

- Instead of paying a bonus in cash, the insurer may choose to deduct the bonus from the premium due from the insured.

- This practice is known as a bonus in reduction of premium.

6) Premium:

- Premium earned (Net) includes:

- Premium received during the accounting period

- Outstanding premium at the end of the period

- Bonus in reduction of premium

- Minus: Outstanding premium at the beginning of the period

- Minus: Reinsurance premium

7) Registration Fees:

- Registration fees are considered income and are recorded as other income in the revenue account.

8) Reinsurance:

- Reinsurance occurs when a company, after accepting a business of higher value, passes on a portion of that business to another company to mitigate risk.

Books Maintained by All Insurance Companies

Under the Insurance Act of 1938, all insurance companies, including general insurance firms, are required to maintain certain statutory books.

The Registrar of Policies:

- This book contains details of each policy issued, including:

- Policyholder’s name and address

- Date of policy inception

- Record of any policy assignments

The Registrar of Claims:

- This book should include details for each claim such as:

- Date of claim

- Claimant’s name and address

- Date of claim discharge

- For rejected claims, the date and reason for rejection

The Register of Licensed Insurance Agents:

- This book should contain information about each insurance agent, including:

- Agent’s name and address

- Date of appointment

- Date of termination, if applicable

Subsidiary Books Maintained by Insurance Companies

- In addition to the statutory books, insurance companies maintain several subsidiary books for transaction recording, including:

- Proposal Register

- New Premium Cash Book

- Renewal Premium Cash Book

- Agency and Branch Cash Book

- Petty Cash Book

- Claims Cash Book

- General Cash Book

- Agency Credit Journal

- Agency Debit Journal

- Lapsed and Cancelled Policies Book

- Chief Journal

- Commission Book

- Agency Ledger

- Policy Loan Ledger

- General Loan Ledger

- Investment Ledger

Types of Bonuses Offered by Life Insurance Companies

Life insurance companies offer various types of bonuses to policyholders, each with distinct characteristics and methods of calculation. Here are the different types of bonuses explained in detail:

a) Simple Reversionary Bonus (SRB)

- The Simple Reversionary Bonus is calculated based solely on the sum assured.

- This bonus is declared annually and is added to the policy, becoming payable at the time of a claim or upon maturity.

b) Compound Reversionary Bonus (CRB)

- The Compound Reversionary Bonus is calculated as a percentage of the sum assured along with all previously accrued bonuses.

- Each year's bonus is added to the sum assured, and the following year's bonus is calculated on this enhanced amount.

c) Terminal Bonus

- Also known as a persistency bonus, the Terminal Bonus reflects the overall performance of a participating policy.

- This bonus is paid at the time of maturity or upon the death of the life assured.

- It may be awarded after a predetermined period of policyholding and is at the insurer's discretion.

d) Interim Bonus

- The Interim Bonus is applicable to policies that mature or result in a death claim between two bonus declaration dates.

- It ensures that policyholders receive credit for the period between the last declared bonus and the maturity or claim date on a pro-rata basis.

e) Cash Bonus

- In some cases, the insurance company may choose to pay the bonus in cash.

- This means that the bonus accrued in a year will be paid to the policyholder at the end of that year.

- This option allows policyholders to receive bonuses annually rather than accumulating them until maturity.

Difference between Whole Life Policy and Endowment Policy

- Whole Life Policy: In this type of policy, premiums are paid for the entire lifetime of the insured, and the sum insured is only paid out upon the death of the insured. The policy remains active for the whole life of the policyholder, and they continue to pay premiums until their death. This is the most affordable policy because the premiums are the lowest under this plan. It is also known as an “ordinary life policy.” This policy is suitable for individuals who want to cover estate duties, contribute to charitable causes, and provide for their families after their passing.

- Endowment Policy: This policy is in effect for a limited period or until a specific age. The sum assured is payable if the insured reaches a certain age, after a fixed period known as the endowment period, or upon the death of the insured, whichever occurs first. Premiums for this policy are paid until its maturity, which is when the policy becomes payable. Generally, the premiums for endowment policies are higher than those for whole life policies. Endowment policies are currently very popular as they serve the dual purposes of providing for family and old age pension.

Problems:

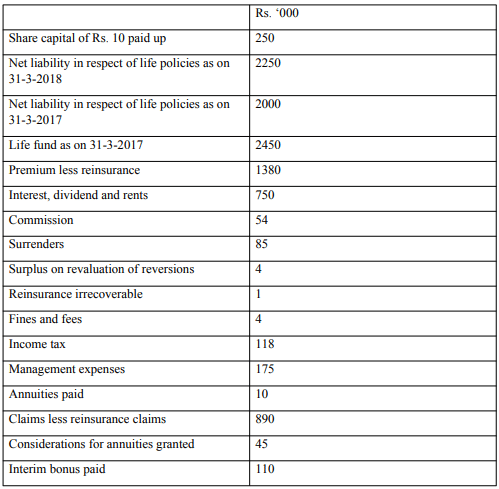

Life Insurance:1. He following are the balances extracted from the books of New Bharat Life insurance co. Ltd., as on march 31st 2018. you are required to prepare its revenue account as on 31st March 2018.

Transfer 20% of the surplus to shareholders

Transfer 20% of the surplus to shareholders

Allocate 10% of surplus to catastrophe reserve

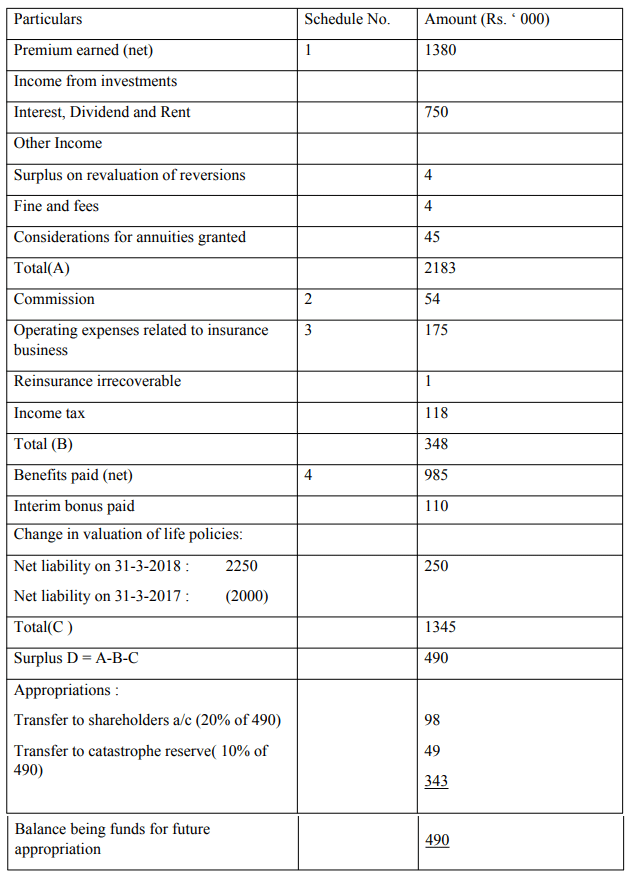

Solution:

The New Bharat Life Insurance co. Ltd.

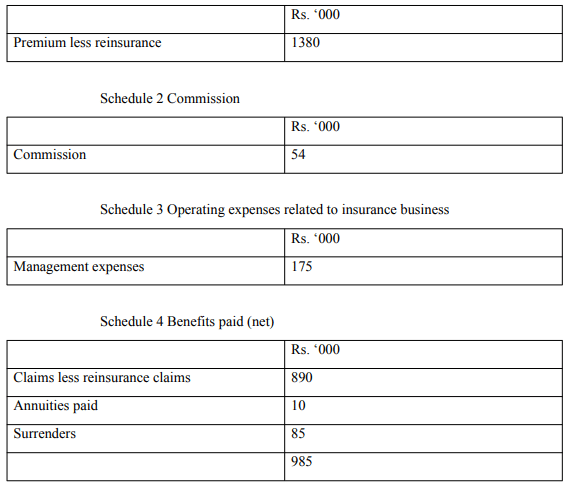

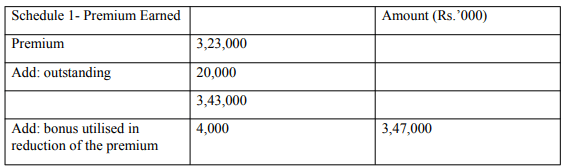

Revenue account for the year ending 31-3-2018 Schedules forming part of financial statements:

Schedules forming part of financial statements:

Schedule 1 premium earned (net)

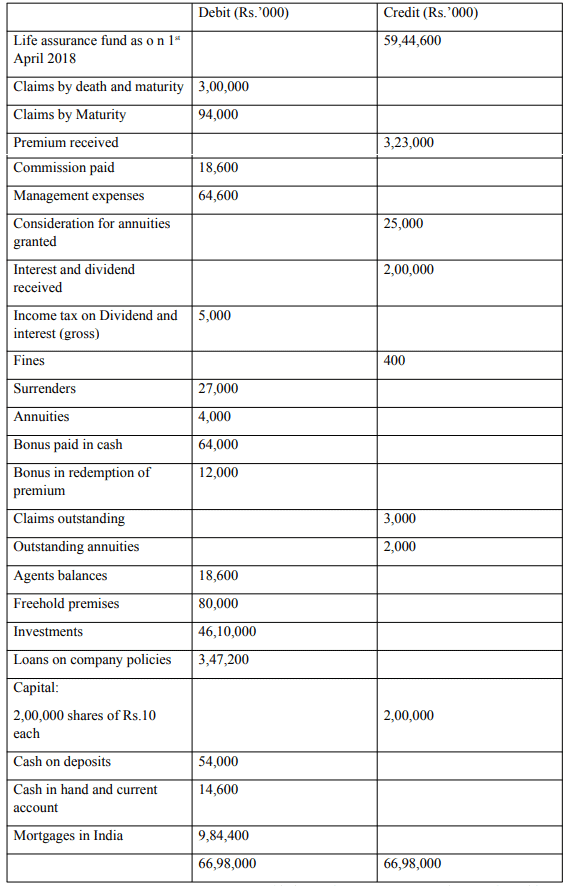

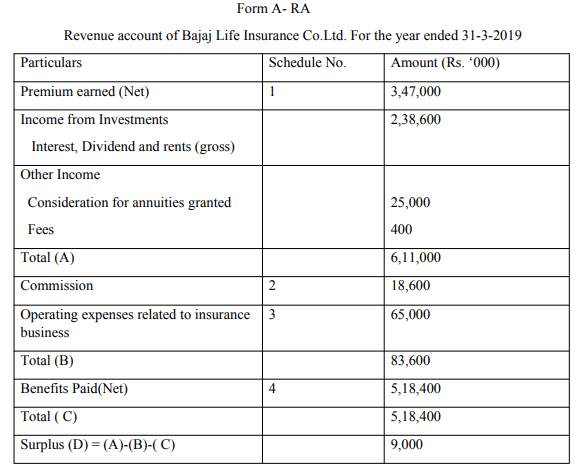

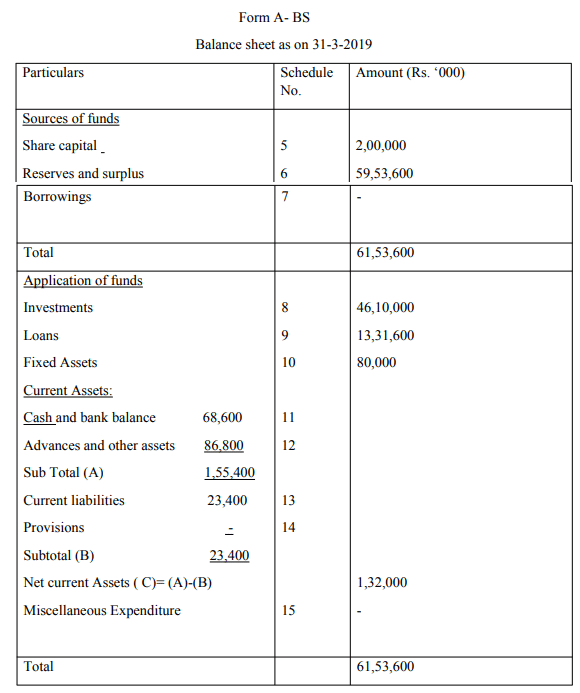

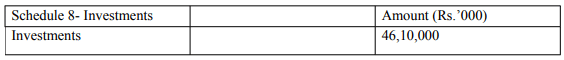

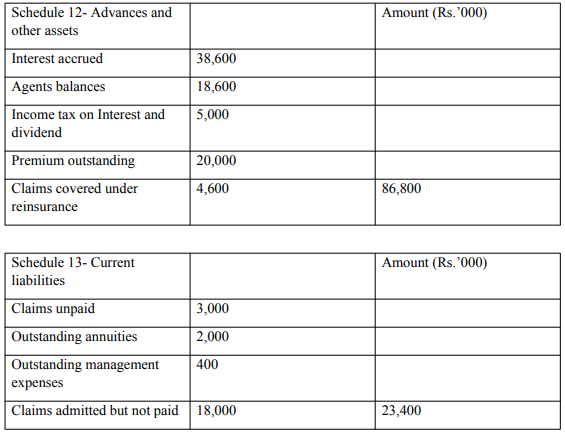

2. Following trial balance was taken from the Bajaj life insurance corporation as on 31-3-2019. Prepare a revenue account and balance sheet as on 31st March 2019after taking into consideration the following information:

Prepare a revenue account and balance sheet as on 31st March 2019after taking into consideration the following information:

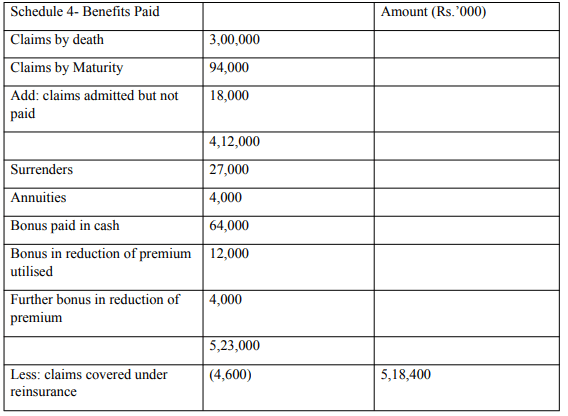

Claims admitted but not paid - 18,000

Management expenses due - 400

Interest accrued - 18,600

Premium outstanding - 20,000

Bonus utilised in reduction of premium - 4,000

Claims covered under reinsurance - 4,600 (in Rs. ‘000)

Solution:

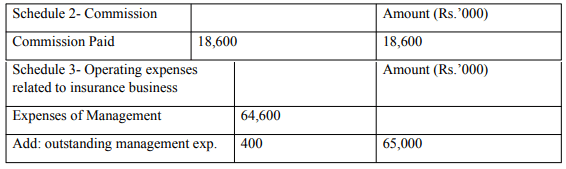

Schedules forming part of financial statements

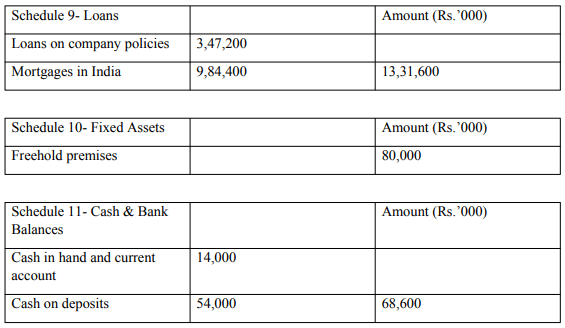

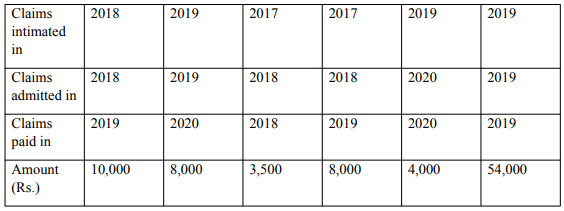

3. From the following information you are required to calculate the claims to be debited to revenue account for the year ended 31st March 2019 Solution:

Solution:

Outstanding claims as on 31st March 2019:

All the claims paid after 2019 should be taken as outstanding claims i .e.= 8,000 + 4,000 = 12,000

Claims charged to revenue account for the year 2019:

All claims intimated in 2019 should be charged to revenue account = 8,000 + 4,000 + 54,000 = 66,000

General Insurance:

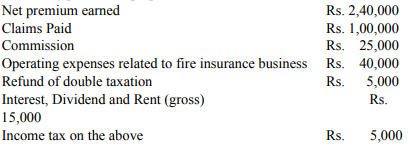

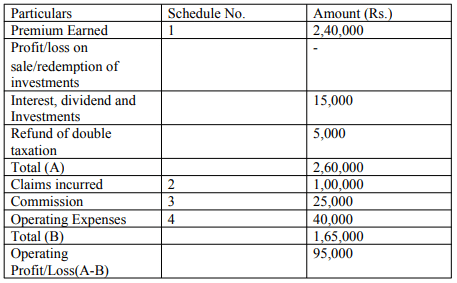

1. From the following particulars prepare Revenue account of ABC Fire insurance ltd. Solution:

Solution:

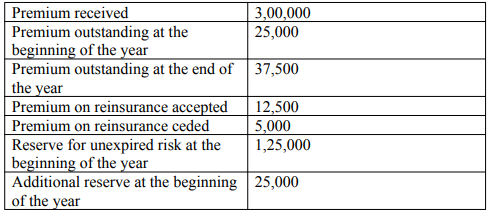

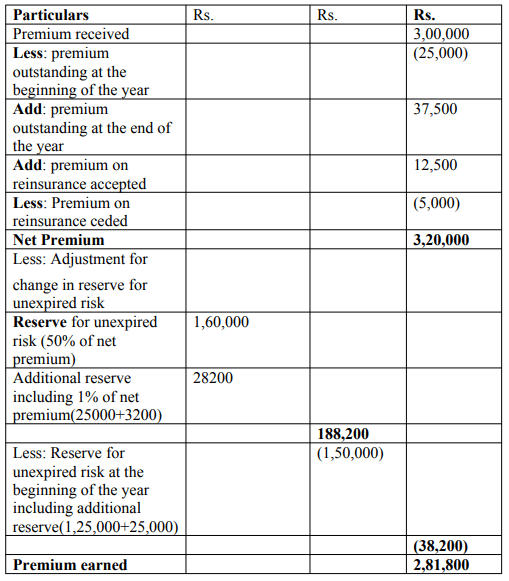

1. From the following, prepare Schedule 1 Premium earned for a fire insurance company Additional reserve for unexpired risk @1%of the net premium in addition to opening balance is to be provided.

Additional reserve for unexpired risk @1%of the net premium in addition to opening balance is to be provided.

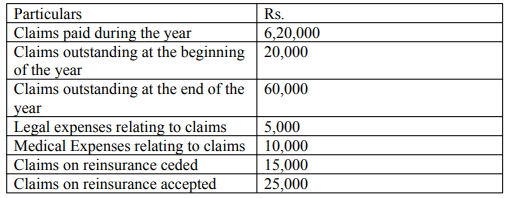

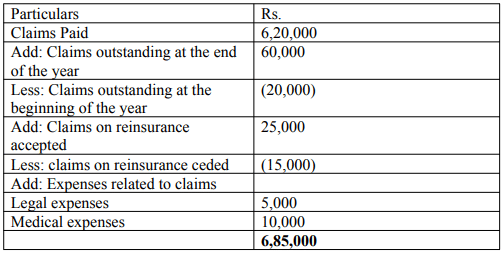

Solution: 2. From the following information prepare Schedule 2 – Claims

2. From the following information prepare Schedule 2 – Claims Solution:

Solution:

Insurance Claims:

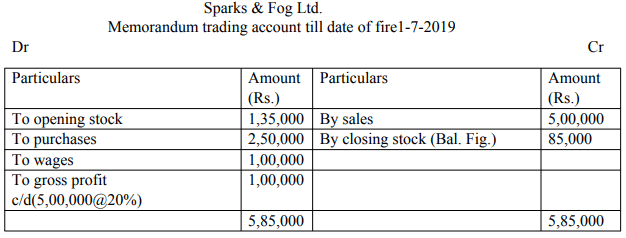

1. There was a fire in the godown of sparks & fog Ltd., on 1-7-2019, stock salvaged was Rs.32,000.The goods were insured and fully covered:

a. Gross profit is 20% of sales

b. Stock was valued at 10% above the cost

c. Purchases till date of fire were Rs. 2,50,000 and sales amounted to Rs. 5,00,000 for the first 6 months. Stock on 1-1-2019 amounted to Rs.1,35,000. wages amounted to Rs. 1,00,000. find out the cost of stock burnt.

Solution:  Computation of amount of claim from the insurance company:

Computation of amount of claim from the insurance company:

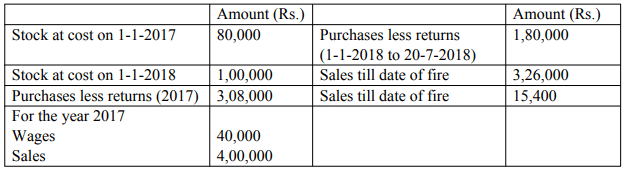

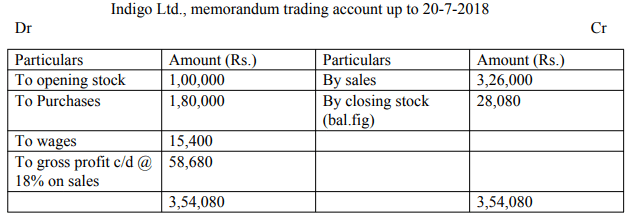

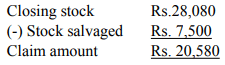

2. The godown of Indigo ltd., caught fire on 20th July 2018. Information from the records saved were as follows. Gross profit remained at uniform level, the stock salvaged was Rs.7,500 and was retained by the company. The godown was insured, show the amount of claim.

Gross profit remained at uniform level, the stock salvaged was Rs.7,500 and was retained by the company. The godown was insured, show the amount of claim.

Solution:

Working notes:

Calculation of rate of gross profit:

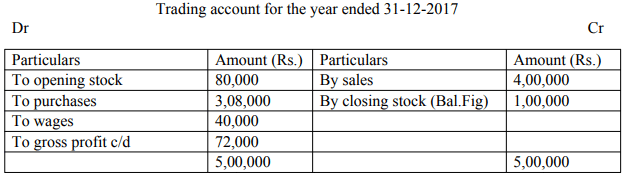

When sales were Rs 4,00,000 in 2017, the gross profit was Rs.72,000

To calculate the percentage of gross profit:

Assume sales as 100. therefore, the gross profit rate will be 72000/4,00,000X100 = 18%

Amount to be claimed:

|

89 videos|82 docs|20 tests

|

FAQs on Final Accounts of General Insurance Companies - Advanced Corporate Accounting - Advanced Corporate Accounting - B Com

| 1. What are the key components of the final accounts of general insurance companies? |  |

| 2. How is the underwriting profit calculated in the final accounts of general insurance companies? |  |

| 3. What is the significance of the solvency margin in the final accounts of general insurance companies? |  |

| 4. How are investments accounted for in the final accounts of general insurance companies? |  |

| 5. What are the regulatory frameworks governing the final accounts of general insurance companies? |  |