B Com Exam > B Com Notes > Accountancy and Financial Management > Statement of Financial Position (Balance Sheet) - Financial Analysis and Management

Statement of Financial Position (Balance Sheet) - Financial Analysis and Management | Accountancy and Financial Management - B Com PDF Download

The Statement of Financial Position

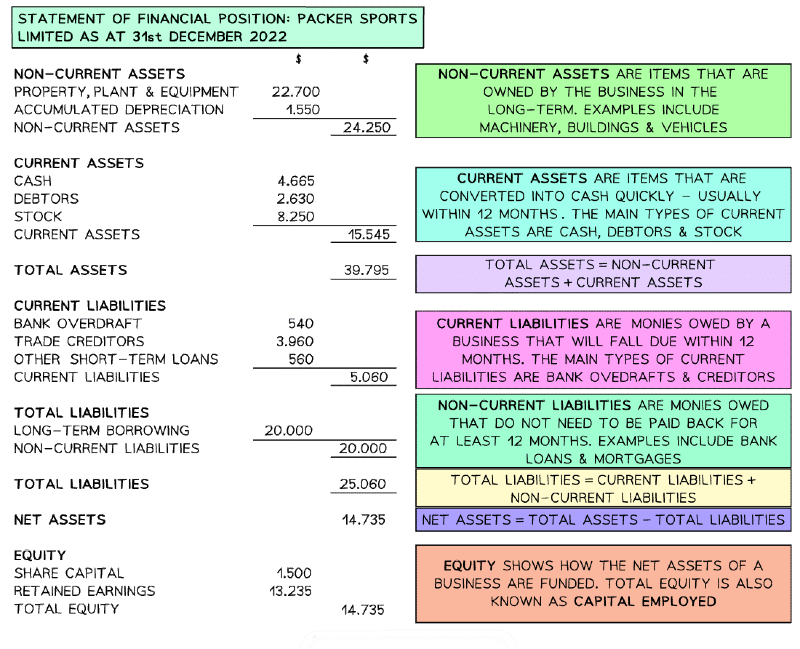

- The Statement of Financial Position shows the financial structure of a business at a specific point in time

- It identifies a businesses assets and liabilities and specifies the capital (equity) used to fund the business

- The Statement of Financial Position is also known as the Balance Sheet

- It is called the balance sheet, as net assets should equal the total equity

The statement of financial position

Calculating the total assets

- On the stated date Packer Sports Ltd owned non-current assets worth $24,250

- It owns property, plant and machinery that is valued at $22,700

- These assets have been depreciated by $1,550

- The value of its current assets was $15,545, comprised of cash, debtors and stock

- Total assets were therefore

$ 24 comma 250 plus $ 15 comma 545 space equals space $ 39 comma 795

Calculating total liabilities

- On the stated date Packer Sports Ltd had current liabilities worth $5,060, comprised of a bank overdraft, trade creditors and other short-term loans

- The value of its long-term liabilities were $20,000

- Total liabilities were therefore

$ 5 comma 060 space plus space $ 20 comma 000 space equals space $ 25 comma 060

Calculating the net assets

- Packer Sports Limited's net assets were therefore

$ 39, 795 - $ 25 comma 060 space equals space $ 14 comma 735

Calculating total equity

- Net assets of $14,735 were funded through share capital of $1,500 and retained earnings of $13,235

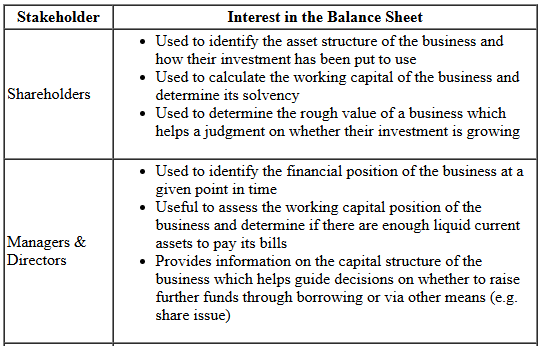

How Stakeholders use the Statement of Financial Position

Stakeholders will use the Statement of Financial Position alongside the Statement of Profit or Loss to perform ratio analysis and compare performance over time or with other businesses

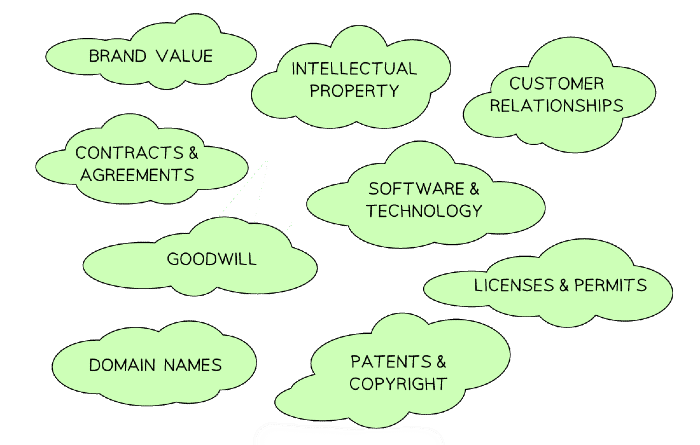

Different types of Intangible Assets

- Intangible assets are non-physical assets that cannot physically be held but hold value for a business

- Businesses need to account for intangible assets in their annual reports as it adds to the value of the business

Intangible assets

Intellectual property

- This includes patents, trademarks, patents and copyrights which protect unique ideas, inventions, artistic works, and brand names

Brand value

- The reputation and recognition associated with a brand has a value

- It includes the brand name, logo, slogans, and customer loyalty to the brand

Customer relationships

- Long-term relationships with customers including customer lists, contracts, and customer loyalty programs

- These relationships can provide recurring revenue and a competitive advantage

Software and technology

- Proprietary software, computer programs and technology systems that are crucial to a business's operations or provide a competitive advantage

Contracts and agreements

- Long-term contracts, lease agreements, licensing agreements and franchise agreements that have value and contribute to future cash flows

- Agreements with employees or business partners that restrict them from competing with the company for a specific period which protect the company's interests and market position (non compete contract)

Goodwill

- The value of a company's reputation, customer base and brand

- Goodwill often represents the premium paid when one business takes over or merges with another business

Domain names and other online assets

- Valuable domain names, websites, social media accounts and online platforms that drive customer engagement, traffic, and online presence

Licenses and permits

- Licenses, permits, and regulatory approvals that grant exclusive rights or access to certain markets or resources, often issued by governments

The document Statement of Financial Position (Balance Sheet) - Financial Analysis and Management | Accountancy and Financial Management - B Com is a part of the B Com Course Accountancy and Financial Management.

All you need of B Com at this link: B Com

|

61 videos|79 docs|12 tests

|

FAQs on Statement of Financial Position (Balance Sheet) - Financial Analysis and Management - Accountancy and Financial Management - B Com

| 1. What is a Statement of Financial Position (Balance Sheet)? |  |

Ans. A Statement of Financial Position, also known as a Balance Sheet, is a financial statement that provides a snapshot of a company's financial health at a specific point in time. It presents the company's assets, liabilities, and shareholders' equity, representing what the company owns, owes, and the residual interest of its owners, respectively. This statement helps in assessing the company's financial stability and measuring its ability to meet its financial obligations.

| 2. What is the purpose of financial analysis and management? |  |

Ans. Financial analysis and management involve evaluating a company's financial performance, making informed decisions, and implementing strategies to maximize profitability, liquidity, and efficiency. The purpose is to assess the company's financial health, identify areas for improvement, and make sound financial decisions for the long-term success of the business. Financial analysis and management help stakeholders understand the company's financial position, make investment decisions, and plan for the future.

| 3. What does the "B Com" qualification refer to in the article title? |  |

Ans. "B Com" refers to the Bachelor of Commerce degree, which is an undergraduate program focused on developing a strong foundation in various areas of business, finance, accounting, and economics. The article title indicates that the content is related to financial analysis and management within the context of the Bachelor of Commerce program. Students pursuing this degree gain knowledge and skills in financial analysis, accounting principles, and financial management, enabling them to understand and interpret financial statements like the Statement of Financial Position.

| 4. What are some common items found in a Statement of Financial Position? |  |

Ans. A Statement of Financial Position includes various items that provide insights into a company's financial status. Some common items found in this statement include:

- Current assets: Cash, accounts receivable, inventory, prepaid expenses, etc.

- Non-current assets: Property, plant, and equipment, intangible assets, long-term investments, etc.

- Current liabilities: Accounts payable, accrued expenses, short-term loans, etc.

- Non-current liabilities: Long-term debt, deferred tax liabilities, etc.

- Shareholders' equity: Common stock, retained earnings, additional paid-in capital, etc.

| 5. How can a Statement of Financial Position be used for financial decision making? |  |

Ans. The Statement of Financial Position provides crucial information for financial decision making. It helps stakeholders assess a company's liquidity, solvency, and financial stability, guiding their decisions. For example, potential investors can analyze the statement to evaluate the company's financial health before making investment decisions. Lenders use this statement to assess creditworthiness and determine the interest rates for loans. Managers use the statement to track financial performance, identify areas of improvement, and make informed decisions about resource allocation, investments, and financing options.

Related Searches