Journal, Ledger and Trial Balance - Accountancy and Financial Management | Accountancy and Financial Management - B Com PDF Download

| Table of contents |

|

| Introduction |

|

| Definitions of Journal And Ledger |

|

| Trial Balance |

|

| Objectives of Preparing Trial Balance |

|

Introduction

The Double Entry System was developed in the 15th century in Italy by Luca Pocioli. The Double Entry System is the basic framework of present day accounting. Every transaction has two aspects and according to this system, both the aspects are recorded. For example, if a business requires something then either it must have been given by someone or it must have been acquired by giving up something. On purchase of furniture, either the cash balance will be reduced, or a liability to the supplier will arise. This has been made clear already. The Double Entry System is so named since it records both the aspects of a transaction. This system has proved to be systematic, and has been found of great use for recording the financial affairs for all institutions requiring the use of money.

Objectives

After studying this unit, you should be able to:

- understand what is Double Entry System,

- understand how debit and credit are determined for business transactions,

- see classification of account as Personal and Impersonal accounts,

- learn the definitions of journal and ledger, · learn the journalizing process,

- become familiar with the technique of ledger posting and how to balance an account, and

- identify the techniques to prepare Trial Balance and familiarize about accounting cycle.

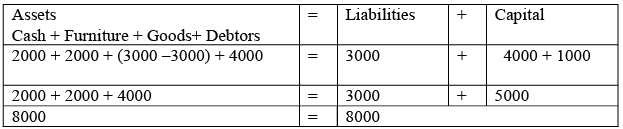

Accounting Equation

- The entire structure of the Double Entry system is founded on the Accounting Equation.

- This equation illustrates the equal relationship between total claims and total assets of a business.

- The accounting equation states that a company's total assets are equal to the combined total of its liabilities and shareholders' equity.

- Total claims encompass the claims made by both outside parties and the business owners.

We can express the same as:

Assets = Total Claims

Assets = Liabilities + Capital

If there is any change in the amount of assets, or of the liability, the owner’s claim or the capital is bound to change correspondingly. It is totally based on Double Entry System principles.

The effect of transactions on Accounting Equation

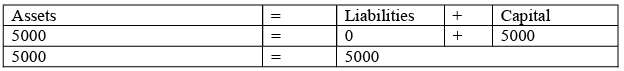

1. Start business with Rs. 5000 as capital

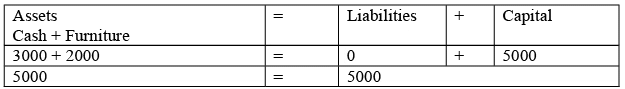

2. Purchase furniture for Rs. 2000 cash

Note: On the purchase of furniture, the cash is reduced but another asset, furniture, is increased by the same value.

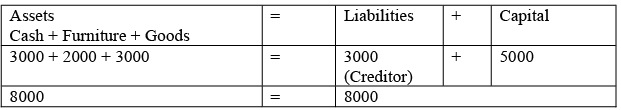

3. Purchase goods for Rs. 3000 on credit

Note: On purchase of goods on credit worth Rs. 3000, goods (another asset) worth Rs. 3000 has come in the business and liability of same value has been increased in the form of creditors

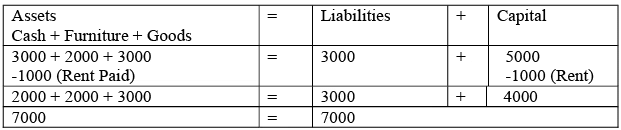

4. Paid Rs. 1000 for rent

Note: Rent as an expense will be charged from capital, because all expenses and incomes are to be finally ‘owned’ by the proprietors as well as deducted from the cash that a firm has.

5. Sold goods of Rs.3000 on credit for Rs. 4000

Note: The net increase in assets (4000-3000 = 1000) will be added to the capital as a profit. Whatever we have done above is suitable only if the number of transactions is small. But, if the number is large, a different procedure – putting increases and decreases in different columns – will be required, and be useful for yielding significant information.

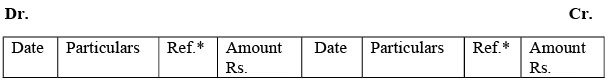

The procedure for large number is followed for a form, which is called the T form. In this form, the two sides are put together. The left-hand side is called the Debit-side and the right-hand side is called the Credit-side. It is called an account. When in an account a record is made on the debit, or left hand side, one says the one has debited that account; similarly to record an amount on the right side is to credit it.

The proper form of an account is as follows:

*Ref. indicates the sources where information about the entry is available.

*Ref. indicates the sources where information about the entry is available.

To put the entries in ‘T’ form account, we have to follow some standard rules of debit and credit:

- When there is an increase in the amount of assets, its account is debited; and when there is a decrease in the amount of an asset, its account is credited. For example, on the purchase of furniture, the assets have increased and the furniture account will be debited. But if cash is paid for the purchase, the asset has decreased and the cash account will be credited.

- When there is an increase in the amount of liability, its account will be credited; and when there is a decrease in the amount of liability, its account will be debited. For example, if we borrow some money from “A”; A’s account will be credited. But if we pay the money back to “A”, A’s account will be debited since the liability no longer exists.

- When there is an increase in the owner’s capital; the capital account will be credited, and when there is a decrease in owner’s capital, it will be debited. For example, if a proprietor introduces additional capital, the capital account will be credited. But, if the owner withdraws some money, the capital account will be debited.

- Profit leads to an increase in the capital, and a loss leads to reduction. Since the impact of profit or loss can directly be seen on the capital, it is clear that the rule of capital will be applicable on profit / loss also. Profits may be directly credited, and losses may be similarly debited.

These rules can be summaries as below:

- 1. Increase in assets are debits; decrease in credits

- 2. Increase in liabilities are credits; decrease in debits

- 3. Increase in owner’s capital are credits; decrease in debits

- 4. Increase in expenses/losses are debits; decrease in credits

- 5. Increase in revenue/income are credits; decrease in debits.

It should be noted that an increase in assets is favourable to the firm, but an increase in expenses is not so, even though, in both cases, the increase will be recorded on the debit side. Similarly, an increase in liabilities is not favourable, but an increase in revenue is, even though both will be recorded on the credit side.

The terms "debit" and "credit" should not be interpreted as indicating something favorable or unfavorable; rather, they simply represent the two sides of an account. The recording of transactions using debits and credits follows the fundamental accounting principle known as the Dual Aspect Concept. According to this concept, every transaction has two aspects—one impacting the debit side and the other affecting the credit side. For instance, if a company purchases machinery worth Rs. 20,000 in cash, this transaction has a dual effect: the Machinery Account is debited (indicating an increase in assets), while the Cash Account is credited (reflecting a decrease in assets). The key takeaway from this concept is that the total of all debits will always be equal to the total of all credits.

Classification Of Accounts

As per the accounting equation, the broad categories of the account are:

- Assets: Includes all the resources which the firm has.

- Liabilities: Amounts that the firm owes to outsiders.

- Capital: Amounts that the firm owes to the owners and proprietor who have invested in the firm.

- Expenses: Amounts that have been spent, or even lost, in carrying on operations.

- Incomes: Amounts earned by the firm.

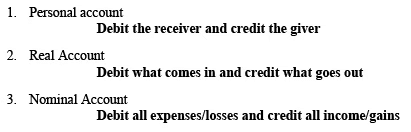

Accounts may be classified in another manner:

- Personal Account : Personal accounts relate to personal, debtors, or creditors. Example ABC & Co., Ram Account, etc.

- Real Account : Accounts which relate to assets of the firm. For example, Machinery, Furniture, Cash, Plant, Land etc.

- Nominal Account : Accounts, which related to expenses, losses, gains, revenue etc. like wages, salary, interest, commission etc. The net result of all the nominal accounts is reflected as profit or loss which is transferred to the capital account. Nominal accounts are, therefore, temporary.

On the basis of the above, three classifications of accounts, three basic rules about recording transactions are:

Hence, a Debit denotes

- In case of a person, that s/he has received some benefit against which s/he has already rendered some service, or will render service in future. When a person becomes liable to do something in favour of the firm, the fact is recorded by debiting that person’s account.

- In case of goodsor properties, that the stock and value of such goods or properties has increased; and

- In case of other accounts like salary or rent, that the firm has enjoyed some benefit, or has lost money.

A Credit denotes

- In the case of a person, if they have received some kind of benefit from the firm, they can ask for something in return, which could be cash, goods, or services. This means that when someone is entitled to receive money or something that has value, this is noted by giving them a credit.

- Regarding goods or properties, the amount and value of these items has decreased.

- For other accounts, such as commission, it indicates that the firm has made a profit.

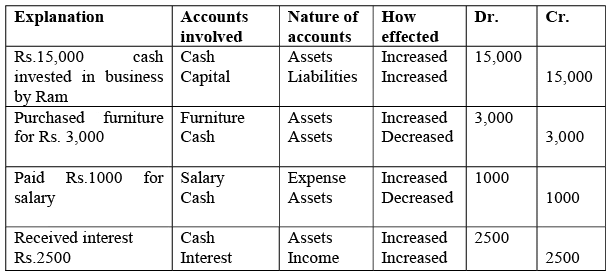

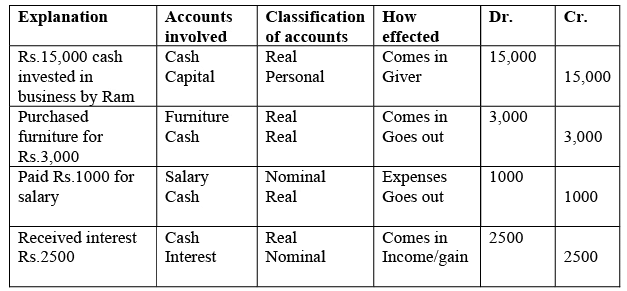

Illustration 1

- Ram started business with Rs.15,000

- He purchased furniture for Rs.3,000

- Salary paid for Rs.1000

- Received interest Rs.2500.

Solution as per debit/ credit rules of accounting equation

Solution as per three basic rules of classification of accounts

Definitions of Journal And Ledger

Journal: Transactions are first entered in this book to show which account should be debited, and which should be credited. Journal is also called primary book, as it is a book of first entry. Transactions are recorded in it in chronological order.

Ledger: Accounts are prepared on the basis of entries made in the journal. The book that contains the accounts is called a ‘ledger’. A ledger is also called secondary book, as the entries in the ledger are made subsequent to the journal.

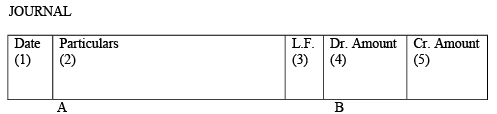

The Journalizing Process

Transactions are either written as they occur in the various documents, or papers, are filed, in the order in which transactions occur (chronological). On the basis of these records, first, one writes out which accounts are to be credited, and which accounts are to be debited. This is done in the Journal, the format of which is given below:

Note: The columns have been numbered for reference only.

- In the first column, the date of the transaction is entered. The year is written at the top, then the month and in the narrow part of the column the date is entered.

- In the second column, the name of the account to be debited is written first, and it is written close to the line marked (A). The word “Dr.” is written near the line marked (B). In the next line the name of the account to be credited is written preceded by the word “To”. This is written a few spaces away from the line (A). There must be an explanation of the entry and this should be recorded. This is known as narration. Narration records the facts leading to the entry and facilitates quick understanding.

- In the third column, the number of the page in the ledger on which the account is written up is entered.

- In the fourth column, the amounts to be debited to the various accounts concerned are entered. The amount is written in the extreme right hand side of the column.

- In the fifth column, the amount to be credited to various accounts is entered in the extreme right hand side of the column.

Before one can journalize transactions, one must think from the basis of the rules, either from the five accounting equation rule, or from the three basic classifications of accounts rules given above. In accordance with the rules/effects, the accounts to be debited, or credited will be determined. Then, the entry will be made in the journal as indicated above.

Ledger Posting

The ledger is the most essential book in accounting, often referred to as the principal book of accounts, as it contains all financial information related to the business. Without a ledger, preparing final accounts would be challenging. It provides key details about various accounts.

- Personal accounts indicate the amounts owed by debtors to the firm and the amounts payable to creditors.

- Real accounts represent the value of assets and stock.

- Nominal accounts record income sources and expenditures.

While journal entries help determine which accounts should be debited or credited and the amounts involved, ledger posting organizes these transactions into a classified and summarized format for better financial analysis.

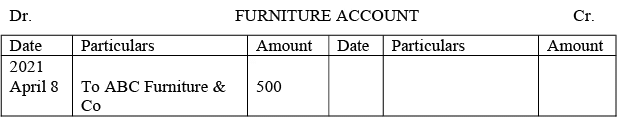

Consider the following entry

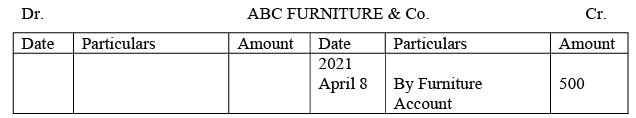

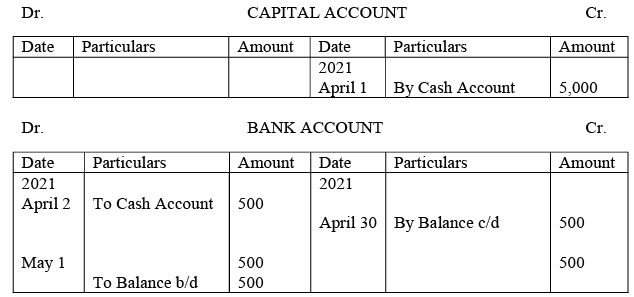

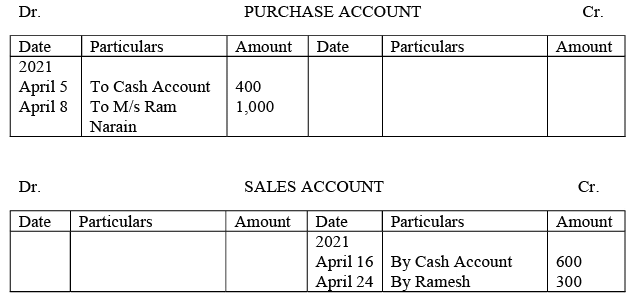

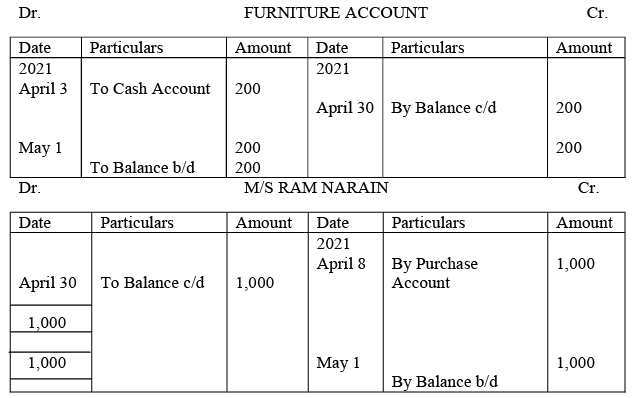

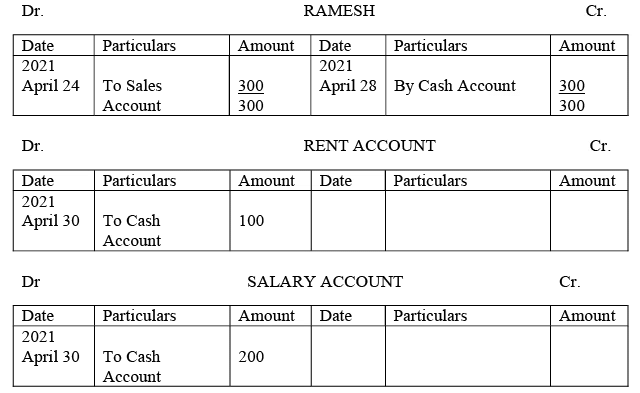

From the above journal entry, we will prepare two ledger accounts: the Furniture Account, and the ABC Furniture & Co. While posting entries from journal to ledger, we have to remember the following:

- Nowhere in a given account, will the name of that account will appear. For example, if we are in a journal entry, then its ledger account will be credited with the name of the debited account of journal entry.

Using the above rules, the posting of the given journal entry into the furniture account is done as follows:

Since the furniture account is debited in the journal entry, the furniture account is debited, but by writing the name of ABC Furniture & Co. , appearing as credit item in journal entry. This ledger posting will be read as – The Furniture Account is debited by ABC Furniture & Co. just, as ABC Furniture & Co. Account is credited in the journal entry, the same will find an entry in its ledger account on credit side but with the name of Furniture Account; and it is shown below:

The above ledger posting will be read as: The ABC Furniture & Co. is credited by Furniture account.

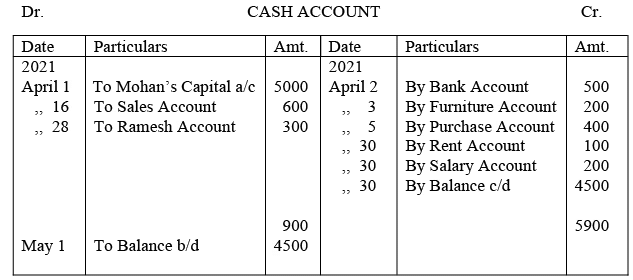

The transactions, which have been journalized in illustration 2, are posted below.

Balancing an Account

At the end of each month, year, or a specific day, it may be necessary to determine the balance in an account. The difference between the total of the debit and credit sides is known as the balancing figure. Balancing an account involves summing both sides and recording the difference on the side with the lower total.

For example, if the debit side totals Rs.1,000 and the credit side totals Rs.850, the balancing figure is Rs.150. Since the debit side is greater, this amount is termed a debit balance. It is recorded on the credit side as “By Balance C/d” (carried down) to equalize both sides. In the next period, this balance is brought forward on the debit side as “To Balance B/d” (brought down). A similar but opposite method is used for a credit balance.

It is important to note that nominal accounts, such as rent and salary, are not balanced. Instead, their balances are transferred to the profit and loss account at the end of the financial year. Only personal and real accounts carry balances forward.

Trial Balance

A Trial Balance is a statement that presents the debit and credit balances of all accounts separately. It is prepared after posting transactions in the ledger and determining the balance of each account. The process involves listing all accounts and recording their balances under separate debit and credit columns.

For accuracy, the total of both columns in the trial balance must be equal. This equality confirms that there are no arithmetic errors in the records. Since the Double Entry System ensures that every debit entry has a corresponding credit entry, the sum of debit balances should always match the sum of credit balances.

When the trial balance agrees, it provides reasonable assurance that the accounting records are free from mathematical mistakes. However, it does not guarantee complete accuracy, as errors related to principles or compensating errors may still exist.

Errors which are Undetectable by a Trial Balance

A trial balance can trace the mathematical inaccuracy of the general ledger. However, there are a number of errors that cannot be detected by the Trial balance: Let us discuss those errors in brief:

- Error of complete omission: The transaction was not entered into the system.

- Error of original entry: The double-entry transaction includes the wrong amounts on both sides.

- Error of reversal: When a double-entry transaction was entered with the correct amounts, but the account to be debited is credited and the account to be credited is debited

- Error of Principle: The entered transaction violates the fundamental principles of accounting. For example, the amount entered was correct and the appropriate side was chosen, but the type of an account was wrong (e.g., expense account instead of liability account).

- Error of Commission: The transaction amount is correct, but the account debited or credited is wrong. It is similar to the principle error described above, but commission error is usually a result of oversight, while principle error is a consequence of a lack of knowledge of accounting principles.

Objectives of Preparing Trial Balance

- The trial balance enables one to establish whether the posting and other accounting processes have been carried out without committing arithmetical errors.

- Financial statements are normally prepared on the basis of agreed trial balance, otherwise the work may be cumbersome.

- The trial balance serves as a summary of what is contained in the ledger.

- Trial balance helps in locating errors in book-keeping work.

The format of Trial Balance is as follow:

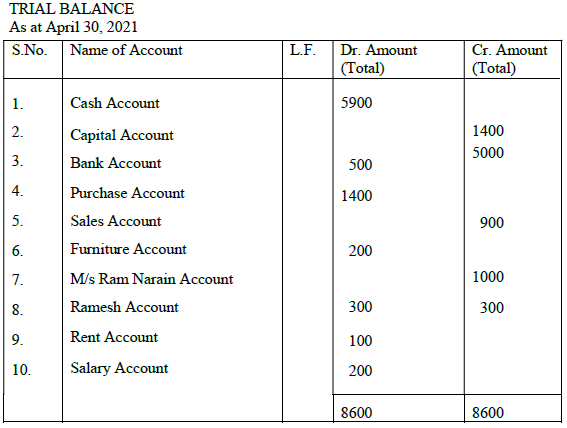

The Total Method of Preparing the Trial Balance

In this, the total of each side of the account is entered respectively in the debit and credit columns of the Trial Balance. This is known as the Gross Trial Balance.

The Balance Method of Preparing the Trial Balance

In this, balances are entered separately in the debit and credit columns of the Trial Balance. This is known as the Net Trial Balance.

TRIAL BALANCE

As at April 30, 2021

The Limitations of Trial Balance

One should note that the agreement of trial balance is not conclusive proof of accuracy. In simple words, in spite of the agreement of the trial balance some errors may remain. These may be of the following types:

- The transactions have not been entered at all in the journal.

- An incorrect amount has been written in both column of the journal.

- An incorrect account has been mentioned in the journal.

- An entry has not been completely posted in the ledger.

- Entry is posted twice in the ledger.

The Accounting Cycle

The accounting cycle is a systematic process that involves identifying, analyzing, and recording a company's financial transactions. It typically consists of 7 to 8 steps, starting from the occurrence of a transaction and concluding with its reflection in the financial statements. Below is an outline of the steps involved in the accounting cycle. Let us discuss them in brief:

- Financial transactions take place, such as selling products, purchasing raw materials, or making lease payments.

- These transactions are recorded in the appropriate financial journal based on their nature. Debits represent expenses, while credits indicate received funds.

- The recorded transactions are then transferred to the general ledger, which contains all financial accounts affected, such as rent, wages, or marketing expenses.

- A trial balance is prepared at the end of the accounting period to verify if the debit and credit totals match.

- If there is an imbalance, the cause is identified and necessary corrections are made.

- Adjusting entries for accruals and deferrals are recorded before finalizing the accounts.

- Once all accounts are balanced, financial statements are generated.

- At the end of the period, the books are closed out and new revenue and expense accounts created with zero balances. These are used for the next accounting period.

Similar to information technology process (input – process – output), the accountingcycle accepts data input- monetary transactions

- which is processed according to pre-defined accounting principles, and the output is in the form of final statements.

|

61 videos|79 docs|12 tests

|

FAQs on Journal, Ledger and Trial Balance - Accountancy and Financial Management - Accountancy and Financial Management - B Com

| 1. What are the rules of Debit and Credit in accounting? |  |

| 2. What is the purpose of a Ledger in accounting? |  |

| 3. What are Ledger Accounts and how are they different from a Ledger? |  |

| 4. What is the difference between a Journal and a Ledger in accounting? |  |

| 5. What is the purpose of a Trial Balance in accounting? |  |