Combined Leverage - Capital Structure, Accountancy and Financial Management | Accountancy and Financial Management - B Com PDF Download

Combined Leverage

When the company uses both financial and operating leverage to magnification of any change in sales into a larger relative changes in earning per share. Combined leverage is also called as composite leverage or total leverage.

Combined leverage express the relationship between the revenue in the account of sales and the taxable income.

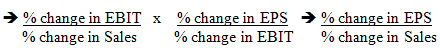

Combined leverage can be calculated with the help of the following formulas:

Where,

CL = Combined Leverage

OL = Operating Leverage

FL = Financial Leverage

C = Contribution

OP = Operating Profit (EBIT)

PBT = Profit Before Tax

Degree of Combined Leverage

The percentage change in a firm’s earning per share (EPS) results from one percent change in sales. This is also equal to the firm’s degree of operating leverage (DOL) times its degree of financial leverage (DFL) at a particular level of sales.

Degree of contributed coverage = Percentage change in EPS/Percentage change in sales

Formula

Combined leverage, as the name implies shows the total effect of the operating and financial leverages. In other words, combined leverage shows the total risks associated with the firm. It is the product of both the leverages.

Degree of Combined Leverage (DOL) = DOL * DFL

Example 1:

Kumar company has sales of Rs. 25,00,000. Variable cost of Rs. 12,50,000 and fixed cost of Rs. 50,000 and debt of Rs. 12,50,000 at 8% rate of interest. Calculate combined leverage.

Solution:

Sales | 25,00,000 |

Less: Variable cost | 15,00,000 |

Contribution | 10,00,000 |

Less: Fixed cost | 5,00,000 |

Operating Profit | 5,00,000 |

Combined leverage = Operating leverage x Financial leverage

Calculation of financial leverage

Contribution/Operating Profit = 10,00,000/5,00,000 = 2

Calculation of financial leverage

Earning before Interest and Tax (EBIT) | 5,00,000 |

Less: Interest on Debenture ( 8% of 12,50,000) | 1,00,000 |

Earnings before Tax | 4,00,000 |

Operating leverage= Operating Profit /Earning Before Tax = 5,00,000/4,00,000 = 1.25

Combined leverage = 2 x 1.25 = 2.5

Example 2 :

Calculate the operating, financial and combined leverage under situations 1 and 2 and the financial plans for X and Y respectively from the following information relating to the operating and capital structure of a company, and also find out which gives the highest and the least value ? Installed capacity is 5000 units. Annual Production and sales at 60% of installed capacity.

Selling price per unit Rs. 25

Variable cost per unit Rs. 15

Fixed cost:

Situation 1 : Rs. 10,000

Situation 2 : Rs. 12,000

Capital structure:

Solution.

Annual production and sales 60% of 5,000 = 3000 Unit

Contribution per Unit | Rs. |

Selling Price | 25 Per Unit |

Variable Price | 15 Per Unit |

| 10 Per Unit |

Total contribution is 3000 Units x Rs. 10 = Rs. 30,000

Computation of leverage.

Example 3:

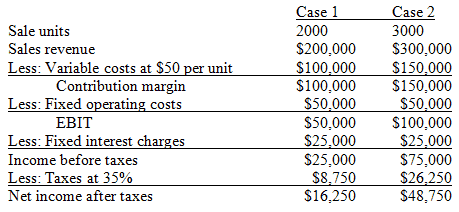

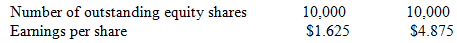

A firm selling price of its product is $100 per unit. The variable cost per unit is $50 and the fixed operating costs are $50,000 per year. The fixed interest expenses (non-operating) are $25,000 and the firm has 10,000 shares outstanding. Let us evaluate the combined leverage resulting from sale of 1) 2000 units & 2) 3000 units. Tax rate = 35%.

Solution.

Percentage change in EPS = ($4.875 - $1.625)/$1.625 x 100 → 200%

Percentage change in Sales = ($300,000 - $200,000)/$200,000 x 100 → 50%

DCL = 200%/50% → 4

A combined leverage (total risk) of 4 indicates that for every $1 change in sales, there would be a $4 change in the Earnings per share in either direction.

|

44 videos|75 docs|18 tests

|

FAQs on Combined Leverage - Capital Structure, Accountancy and Financial Management - Accountancy and Financial Management - B Com

| 1. What is combined leverage in capital structure? |  |

| 2. How is combined leverage calculated? |  |

| 3. What is the difference between operating leverage and financial leverage? |  |

| 4. How does combined leverage affect a company's risk and return? |  |

| 5. How can a company manage its combined leverage? |  |