B Com Exam > B Com Notes > Cost Accounting > FIFO, LIFO & Weighted Average - Material Cost, Cost Accounting

FIFO, LIFO & Weighted Average - Material Cost, Cost Accounting | Cost Accounting - B Com PDF Download

| Table of contents |

|

| Materials Costing Methods |

|

| First-In-Out (FIFO) |

|

| Last-In First-Out (LIFO) |

|

| Weighted Average Method (WAM) |

|

| Need for Material Control |

|

| Requirements of a System of Material Control |

|

Materials Costing Methods

- First-In-First-Out (FIFO) Costing Methods

- Average Costing Methods

- Last-In-First-Out (LIFO) Costing Method

- Other Materials Costing Methods—Month end average cost, last purchase price or market price at date of issue and standard cost.

First-In-Out (FIFO)

- This methods assumes that the goods purchased first or manufactured first are issued/sold first.

- That is the goods issued or sold currently are those which represent the earliest purchases amongst the goods held in inventory. This would mean that the goods which remain in stock after the sales, are those which represent the most recent purchases.

Last-In First-Out (LIFO)

- This methods is just the opposite if FIFO methods. This method assumes that the goods issued or sold out of the inventory are the ones most recently purchased manufactured.

- Therefore the goods held in stock represent the earlier purchases productions.

Weighted Average Method (WAM)

- This method assumes that all inventory available are best represented by a weighted average cost.

- The average cost of goods held in inventory is recalculated every time a fresh purchase is made and goods issued or sold out of inventory are priced at such average price till such time as the next lot is purchased.

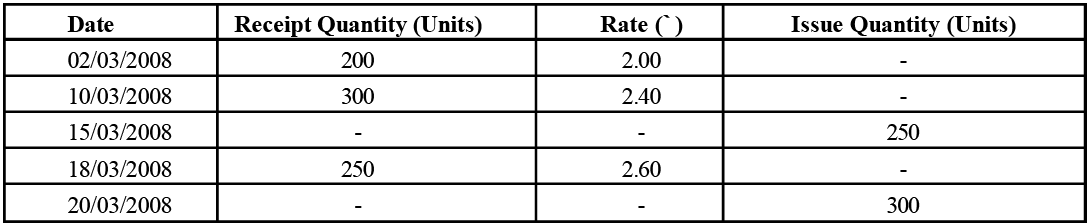

Example 1: The following transaction took place in respect of a material. Prepare a Stock register as per:

Prepare a Stock register as per:

(a) Simple Average Method

(b) Weighted Average Method.

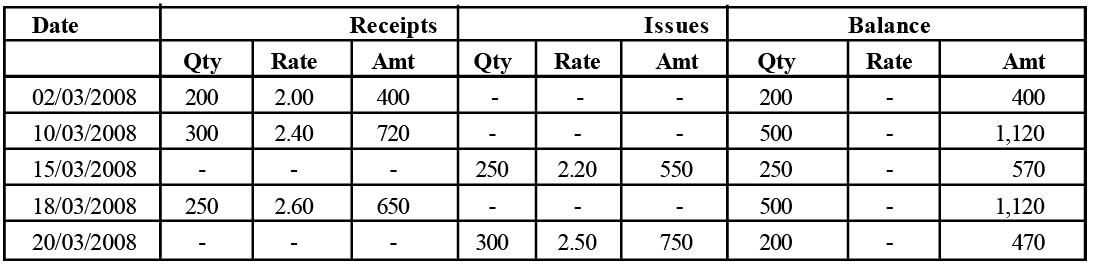

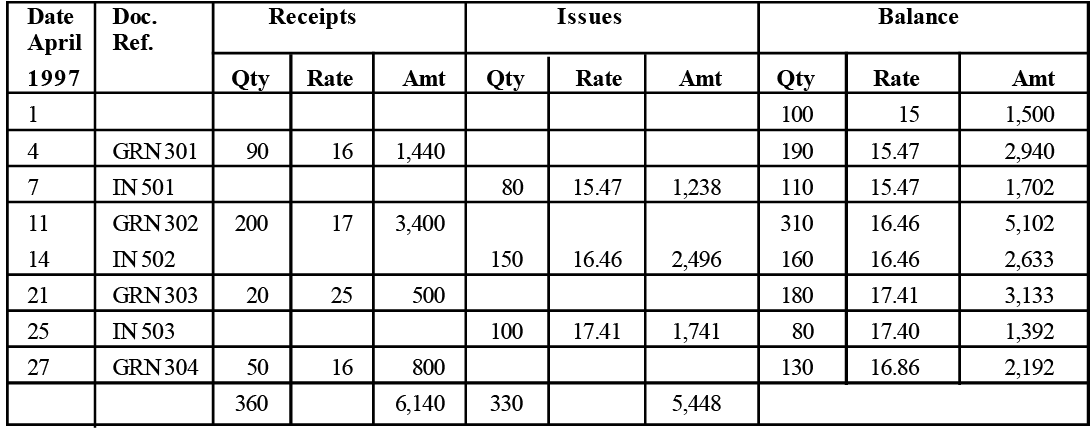

Sol: Stock Register (Simple Average Method)

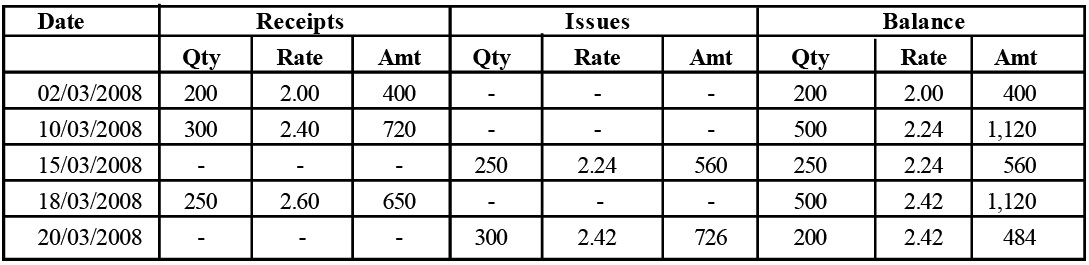

Stock Register (Weighted Average Method)

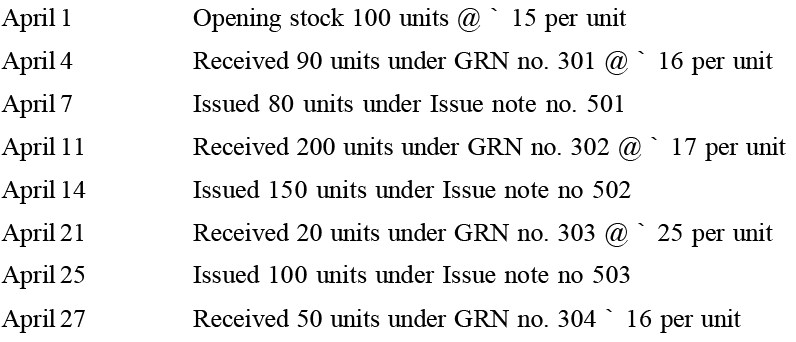

Example 2: From the following data you are required to compile a valued stock card in respect of material ‘Mikytoya’ for the month of April 2007 and value the closing stock by:

(a) Weighted average method

(b) First In First Out methnd

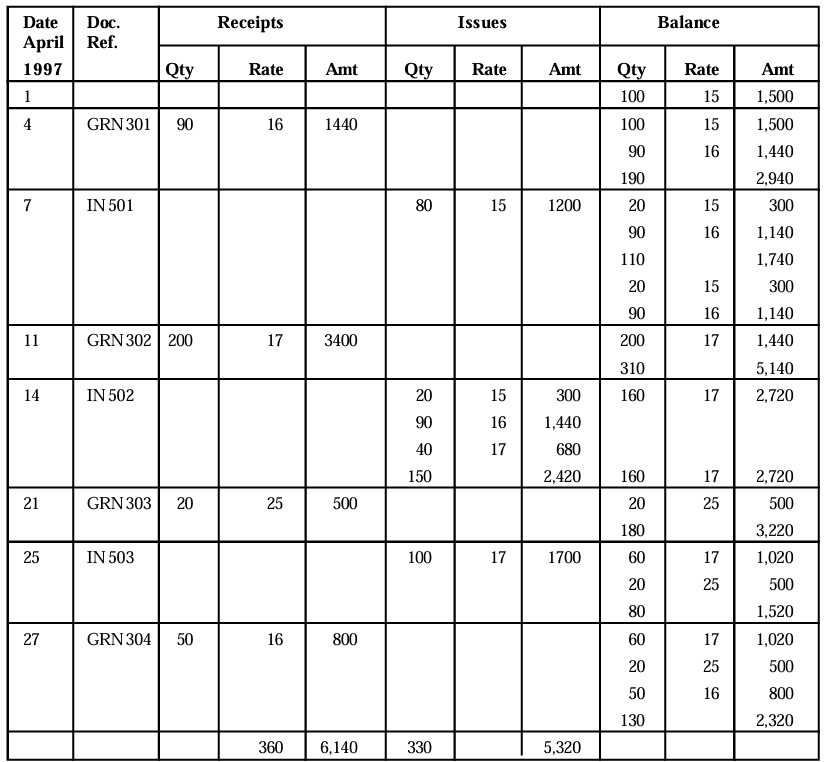

Sol: Stock Card (Weighted Average Method) FIFO Method

FIFO Method

Need for Material Control

- A crucial initial step in installing a cost and management accounting system is establishing proper control over materials and supplies from the moment they are ordered from suppliers until they are used in operations or sold as merchandise.

- Materials represent a significant asset and often constitute the largest expense in most businesses. Consequently, the efficiency of purchasing, storing, tracking, utilizing, and controlling materials can greatly influence a company’s success or failure.

- Without effective material control, surplus stock of certain items may accumulate, leading to unnecessary capital being tied up and potential losses due to deterioration and obsolescence. At the same time, shortages of other materials may occur at critical moments, causing production delays.

- Material purchasing is a specialized function that requires careful attention. A skilled buyer ensures that the right quantity and quality of materials are procured at the best price and delivered at the appropriate time. This contributes significantly to a business's overall efficiency and profitability. Effective material control helps eliminate waste and unnoticed losses.

- Proper control mechanisms minimize theft, mismanagement, deterioration, breakage, and excessive storage costs. Additionally, ensuring materials are readily available prevents unnecessary downtime in production.

- Finally, from a cost accounting perspective, accurate cost calculations depend on reliable records of material usage. If material issuance records are inadequate, cost statements will lack accuracy, undermining financial decision-making.

Requirements of a System of Material Control

The important requirements or essentials of adequate satisfactory system of materials control are as follows.

- Proper Coordination – Effective coordination among all departments involved in material purchasing, receiving, inspection, approval, storage, issuance, and accounting is crucial for efficient material management.

- Competent Purchasing Agent – Centralizing the purchasing function under a well-trained and competent purchasing agent ensures proper oversight and efficiency in procurement.

- Use of Standard Forms – Utilizing standardized forms for purchase orders, requisitions, and related documents with written and authorized instructions is essential for maintaining proper control over materials.

- Control through Budgeting – Implementing material, supply, and equipment budgets helps ensure cost efficiency in procurement and material usage.

- Storage Location – Materials and supplies should be stored in designated locations under strict supervision, with well-planned storage and issuance procedures.

- Perpetual Inventory System – A perpetual inventory system should be maintained to provide real-time tracking of stock levels and values, enabling comparisons between recorded and actual physical inventory.

- Setting Stock Levels – Minimum and maximum stock levels should be established to prevent inventory shortages or excessive stock accumulation. Additionally, reorder levels and economic order quantities should be determined for optimal purchasing.

- Storage Control and Issuance – A well-structured stores control system ensures materials are issued in the correct quantities and at the right time, based on departmental requisitions.

- Internal Checks – A system of internal checks should be in place to ensure that all material and equipment transactions are verified by reliable and independent officials.

- Controlling Accounts and Subsidiary Records – Maintaining controlling accounts and subsidiary records provides a detailed summary of material costs from procurement to consumption.

- Regular Reports – Periodic reports should be prepared for management, covering material purchases, stock issues, inventory balances, obsolete items, returned goods, and defective units, ensuring informed decision-making.

The document FIFO, LIFO & Weighted Average - Material Cost, Cost Accounting | Cost Accounting - B Com is a part of the B Com Course Cost Accounting.

All you need of B Com at this link: B Com

|

103 videos|133 docs|14 tests

|

FAQs on FIFO, LIFO & Weighted Average - Material Cost, Cost Accounting - Cost Accounting - B Com

| 1. What are FIFO, LIFO, and Weighted Average, and how are they related to material cost and cost accounting? |  |

Ans. FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and Weighted Average are inventory costing methods used in cost accounting. These methods determine the value of ending inventory and cost of goods sold (COGS) based on the cost of materials or products. FIFO assumes that the first items purchased are the first items sold, LIFO assumes that the last items purchased are the first items sold, and Weighted Average assumes that all items have the same cost per unit regardless of when they were purchased.

| 2. What are the advantages and disadvantages of using FIFO, LIFO, and Weighted Average? |  |

Ans. The advantages of using FIFO are that it generally results in higher net income during periods of inflation and better matches the physical flow of inventory. The disadvantages are that it can increase taxes and does not accurately reflect the current cost of inventory. The advantages of using LIFO are that it better matches the current cost of inventory and can result in lower taxes. The disadvantages are that it can result in lower net income during periods of inflation and does not accurately reflect the physical flow of inventory. The advantage of using Weighted Average is that it is simple and easy to calculate. The disadvantage is that it does not accurately reflect the physical flow of inventory or the current cost of inventory.

| 3. How does the choice of inventory costing method affect financial statements and income tax expense? |  |

Ans. The choice of inventory costing method affects the value of ending inventory and cost of goods sold, which in turn affects the balance sheet and income statement. The method used can also affect income tax expense. For example, using FIFO during periods of inflation can result in higher net income and higher taxes, while using LIFO during the same period can result in lower net income and lower taxes.

| 4. Can a company switch inventory costing methods? |  |

Ans. Yes, a company can switch inventory costing methods. However, the switch must be disclosed in the financial statements and the new method must be applied consistently going forward. In addition, the effect of the change on prior periods must be disclosed.

| 5. What factors should a company consider when choosing an inventory costing method? |  |

Ans. A company should consider factors such as the nature of the business, the type of inventory, the stability of prices, the impact on financial statements, and tax implications. For example, a company with perishable goods may prefer FIFO to avoid spoilage, while a company with non-perishable goods may prefer LIFO to better match the current cost of inventory. Additionally, a company in an industry with stable prices may choose Weighted Average, while a company in an industry with fluctuating prices may choose FIFO or LIFO to better reflect the current cost of inventory.

Related Searches