A Developing Economy: Nature of Indian Economy | Indian Economy for UPSC CSE PDF Download

| Table of contents |

|

| Basic Features |

|

| Remember the Facts |

|

| Predominance of Agriculture |

|

| Unemployment |

|

| Scarcity and Low Rate of Capital Formation |

|

| Rise in Per Capita Income |

|

Basic Features

India has an underdeveloped economy. Certain basic features which characterize it as an underdeveloped economy are discussed below.

Mumbai, Maharashtra is the financial centre of IndiaLow Per Capita Income:

Mumbai, Maharashtra is the financial centre of IndiaLow Per Capita Income:

- Underdeveloped economies are associated with low per capita income. Hence the bulk of their population lives under conditions of misery.

According to the World Bank Report (2019), India’s GDP per capita (Current US$) is 2099.6.

Inequitable Distribution of Income and Poverty.Compared to developed countries income inequalities are larger in underdeveloped countries.

Inequitable income distribution results from private ownership of the means of production, which leads to the concentration of wealth and capital in a few hands.

Inequalities are inevitable in mixed capitalist economies since their constitution allows the 'right to private property'.

The logical corollary to this inequality is mass poverty.

The Planning Commission in the Sixth Five Year Plan (1981-85) acknowledge the existence of widespread poverty in the country.

According to the data shown by NSSO, 39% of the rural population possesses only 5% of all the rural assets while 8% of top households possess 46% of total rural assets.

Remember the Facts

- The Bonded Labour System (Abolition), Act was passed in 1976.

- The Zamindari system was abolished in our country in 1952.

- What does the Dear money policy do? It controls inflation.

- The industry which suffers the most from sickness in our country is Cotton textiles.

- The tax called Octroi is imposed by Municipal bodies.

- What per cent of the total export earnings of India is contributed by the cottage and small-scale industries? 25%.

- In the world, India is the seventh largest producer of cement.

- The Tea Trading Corporation of India was established in 1971.

- The Sick Industrial Companies (Special Provisions) Act was passed in 1985.

- The authorized capital of the EXIM bank is Rs. 20,000 crores.

- The Indian National Trade Union Congress was started in 1947.

- The Payment of Gratuity Act was passed in 1972.

- The beginning of industrial licensing in our country was marked by the Industries (Development and Regulation) Act of 1951.

- Which was the first to recognise the mutual dependence between the private and public sectors? Industrial Policy Resolution, 1956.

- The RBI can vary the minimum cash reserves maintained with it in respect of time liabilities from 2% to 8%.

- The RBI can vary the minimum cash reserves maintained with it in respect of demand liabilities from 5% to 20%.

- The USA provides the largest share of our external debt.

- The National Shipping Board is a statutory body set up under the Merchant Shipping Act of 1958.

- The Air Transport Licensing Board was set up by the Government in 1946.

- The Railway Mail Service was started in 1907.

- The third airline Vayudoot was incorporated in 1981 as a Private Limited Company.

- The Helicopter Corporation of India was set up in 1985.

Predominance of Agriculture

Underdeveloped economies are predominantly agrarian, whereas in developed countries the importance of agriculture is much less. The state of Punjab led India's green revolution and earned the distinction of being the country's breadbasket

The state of Punjab led India's green revolution and earned the distinction of being the country's breadbasket

Also in underdeveloped countries, the proportion of income in agriculture is less than the proportion of employment in agriculture thus reflecting relatively low productivity per unit labour.

Moreover, agriculture in underdeveloped economies is far more backward than in developed countries.

In considering the working population also, in 1951 about 69.7 per cent of the working population was employed in agriculture which declined only marginally to 64.9 percent in 1991.

Several total workers in the country in 2011 was 48.17 million out of this 72.36 were in rural areas.

In terms of the proportion of agriculture in national income in 1994, it was 30 per cent of GDP as against 50 per cent in 1950-51.

For 2014-15, the share of agriculture and allied sectors in total GDP has been estimated to be 18 per cent.

Population Pressure and High Dependency Ratio.

In under-developed countries, the population growth rate is as high as 2 per cent per annum. According to the 1991 census, estimate of India's population is 844 million as against 349 million in 1961.

Thus, Indian demography has expanded roughly by 2.2 per cent per annum.

India now has a population of 1.21 billion an increase of 181 million people since the census 2001.

The high rate of population growth has been because the death rate has led to population explosion which is both a cause and effect of underdevelopment.

The rapid growth of the population has created pressure on land and it has also led to a high dependency ratio.

The dependency ratio is about one-half of the population in underdeveloped countries as against one-third in developed countries.

Remember the Facts

- Coal mining in India first started in 1774.

- The Housing and Urban Development Corporation was set up in 1970.

- Who has recommended the constitution of National Economic and Development Council? Sarkaria Commission.

- The Expenditure Tax Act is applicable to certain hotels. It was passed in 1987.

- Expenditure on which item is not considered investment in the income determination theory? The stocks or the shares in a joint stock company.

- When was National Textile Corporation established? 1968.

- Gift Tax was introduced in our country in 1958.

- What is the term used for tenants enjoying permanent rights on land and who cannot be evicted from land as long as they pay rent? Occupancy tenant.

- The Employee’s Provident Fund Act was passed in 1961.

- Which group of industries are included in the core sector? The basic industries, the industries catering to defence requirement, or of national importance.

- India’s first newsprint factory is in M.P.

Unemployment

Unemployment

Unemployment

- A majority of labour in India is employed by the unorganised sector (unincorporated). These include family-owned shops and street vendors. Above is a self-employed child labourer in the unorganised retail sector of India

- Widespread unemployment particularly among unskilled workers is a common feature of underdeveloped economies.

- In India, chronic and large open unemployment due to structural defects in its economy is perhaps the most striking symptom of underdevelopment in India.

- Slow economic growth rate together with rapid growth of population has accentuated the problem of unemployment in India. In 1951, the number of unemployed was 3.3 million which rose to 28 million in 1990.

- In rural areas, unemployment rate is 4.7 per cent whereas in urban areas, the unemployment rate is 5.5 per cent under the UPS approach in 2013-14.

- Indian agriculture exhibits a considerable amount of underemployment and disguised unemployment.

- Urban unemployment has resulted from the failure of the industrial sector to grow rapidly enough to absorb the growing urban population and from the expansion of general education which has created enormous demand for no-existent white collar jobs.

Scarcity and Low Rate of Capital Formation

Capital accumulation is one of the important factors for removing the economic backwardness of a country. According to Kuznets, low capital formation means a low rate of growth of national product, unless cor declines (or more output per unit of capital).

But in underdeveloped countries there has been a continuous shift in favour of capital-intensive techniques, hence COR cannot be expected to fall. So for these countries to grow there is no choice but to raise their rates of capital formation.

Moreover, underdeveloped countries are poor and their capacity to save is low. Thus, their rate of capital formation is also low. This is the problem faced by India also. In 1950-51, the net saving-investment rate of this country was 7 per cent which was very low for realizing any significant economic growth.

This low rate of capital formation in India was due to various social, economic and political reasons of which the most prominent were the small size of the capitalist sector and the conspicuous consumption of land land-owning class.

According to W.A. Lewis, a net saving rate of 10 per cent of national income is enough to push a stagnant economy to the takeoff stage and every country of the world is capable of saving 10 per cent of its national income. Gross domestic savings which were 23.1% of GDP in 1990-91, increased to 32.3% in 2013-14.

Backward TechnologyTechnological progress is the heart of the development process. But in India techniques of production are backward. Agriculture, which provides subsistence to about two-thirds of the population, still depends on obsolete technology.

The average annual growth rate of the industrial sector was 3.5% in the 6th five-year plan, 8.5% in the 7th 8.1% in the 8th, 4.3% in the 9th, 9.4% in the 10th, and 7.9% in the 11th.

The latest GDP estimates show that industry grew at 1.1% in 2012-13 and a negative growth rate of 0.1% in 2013-14.

Lack of Entrepreneurs

Entrepreneurs transform or revolutionize the pattern of production by dynamically taking up new challenges: This may include exploiting an invention, using an untried technological possibility for producing a new commodity, opening of a new course of supply of raw materials or a new outlet for products.

It may even mean re-organizing an industry and so on.

These activities require aptitudes that are present only in the minuscule minority.

Even in the later phase of British rule, the private enterprise did not fulfil any of the basic conditions of economic growth.

The role of private enterprise in development since independence has been most disappointing.

Remember The Facts

- Ratio of expenditure on agriculture was highest in First Plan.

- In 2000 AD, agriculture’s share in our national income is estimated to fall to about 25%.

- Administered prices refer to the prices of goods fixed by the Government.

- The main function of Unit Trust of India is to mobilise small savings.

- Under which list does family planning fall? - State and Concurrent Lists.

- Facilities for investment of NRI’s were first announced at the time of presentation of the Union Budget in 1982-83.

- Which tax does not directly increase the commodity’s price to the buyers? - Income Tax.

- About what per cent of our country’s fresh borrowing go towards repayment of old loans? - 50%.

- The Marginal revenue will be positive if elasticity of demand is greater than one.

- Surgical instruments are manufactured at the plant at Madras.

- When was the Lead Bank Scheme introduced? 1969.

- Food, Work and Productivity was the slogan of Seventh Plan.

- Depreciation is the loss of the capital assets.

- What causes cost-push inflation? Scarcity of basic raw materials in the world.

India : A Developing Economy

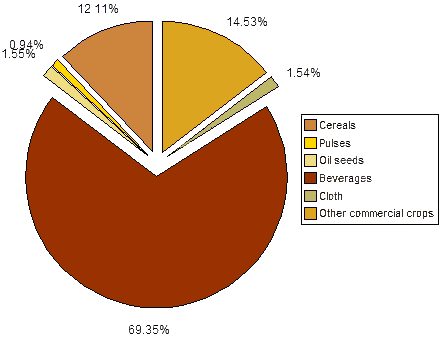

Composition of India's total production of food grains and commercial crops, in 2003–04, by weight

The Indian economy has the basic features of an underdeveloped economy. But it is not a stagnant economy. It has achieved modest growth.

The long spell of stagnation suffered by the country during British rule has been broken after independence.

In fact, with the beginning of the planning process in 1950-51, an era of economic development was ushered in.

Over the seven decades of planning (1950-51 to 2015-16) the Indian economy has made significant development both in quantitative and structural terms. Indian economy can be, thus rightly termed as a developing economy as it has set itself on the path of development.

Rise in Net National ProductThe economic development of any country is measured by an increase in national income.

In 1950-51, India’s net national product (NNP) at cost factor (national income) at 1980-81 prices was Rs. 40,454 crore which has risen to Rs. 2,36,738 crore in 1995-96.

The rate of growth of national income during this period was around 4 per cent.

Nominal Net National Income (NNS) for the year 2012-13 and 2013-14 are Rs. 88.4 lakh crores and Rs. 100.6 lakh crores, showing an increase of 12.7 per cent and 13.7 per cent during 2012-13 and 2013-14 respectively.

Rise in Per Capita Income

A rise in per capita income rather than a rise in NNP is considered to be a better indicator of growth.

In 1950-51. India's per capita income at 1980-81 prices was 1,126.9 which has risen to Rs. 2,573.2 in 1995-96 - an increase of 128.3 percent.

The Planning Commission had expected to double per capita income in 20 years beginning from 1950-51. However, there was only a 34.9 per cent increase in per capita income from 1950-51 to 1970-71.

After that, the rate of increase was only marginally higher.

The per capita net national income during 2014-15 is estimated to be Rs. 88,538, up 10.1 per cent as compared to Rs. 80,388 during 2013-14.

|

108 videos|425 docs|128 tests

|

FAQs on A Developing Economy: Nature of Indian Economy - Indian Economy for UPSC CSE

| 1. What are the basic features of a developing economy? |  |

| 2. What is the significance of agriculture in a developing economy? |  |

| 3. Why is unemployment a common issue in developing economies? |  |

| 4. What is meant by scarcity and low rate of capital formation in a developing economy? |  |

| 5. How does a rise in per capita income reflect the progress of a developing economy? |  |