Reconstitution of a Partnership Firm: Admission of a Partner Chapter Notes | Accountancy Class 12 - Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Modes of Reconstitution of a Partnership Firm |

|

| Admission of a New Partner |

|

| What is Goodwill? |

|

Introduction

- A partnership is an agreement between two or more individuals, known as partners, who come together to run a business and share its profits. This partnership is based on mutual trust, cooperation, and a legal agreement that outlines each partner’s role, contribution, and share in the profits.

- Over time, situations may arise that require changes in the original partnership agreement. This change is known as the reconstitution of the partnership firm. Reconstitution means the existing agreement ends, and a new one is formed, but the business continues to operate under the same name.

- Despite this change, the firm remains operational. Partners may reconstitute the firm in various situations, such as:

- Admitting a new partner,

- Changing the profit-sharing ratio,

- Retiring a partner,

- Dealing with the death or insolvency of a partner, which can be due to health issues, age, or shifting business interests.

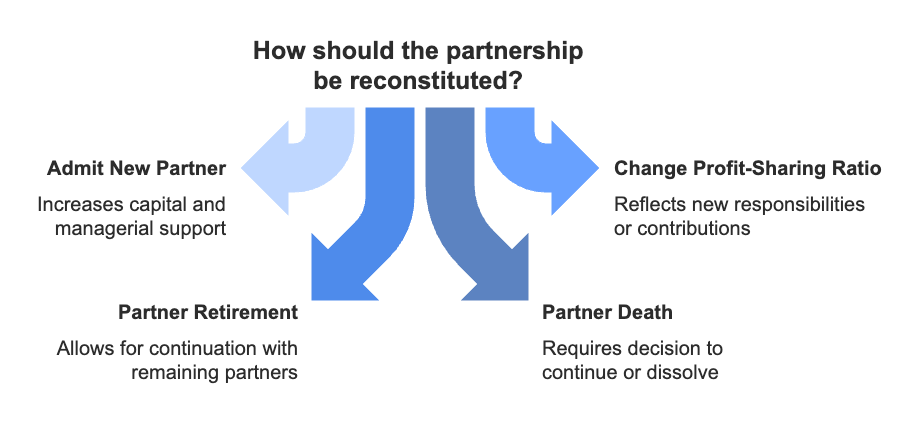

Modes of Reconstitution of a Partnership Firm

Reconstitution of a partnership means changing the existing agreement among partners while the business continues to run. Here are the main situations when reconstitution takes place:1. Admission of a New Partner

A new partner may be admitted when the firm needs more capital or additional managerial support.

According to the Indian Partnership Act, 1932, a new partner can only be admitted with the consent of all existing partners unless the partnership deed states otherwise.

Example:

If Hari and Haqque, who share profits in a 3:2 ratio, decide to admit John as a new partner with a 1/6 share in profits, the original agreement ends, and a new partnership agreement is formed. Now, the firm is reconstituted with three partners.

2. Change in Profit-Sharing Ratio Among Existing Partners

Sometimes, partners may decide to change their profit-sharing ratio due to a shift in responsibilities, capital contribution, or other reasons.

Example:

Suppose Ram, Mohan, and Sohan share profits in a 3:2:1 ratio. If Sohan brings in more capital, and they all agree to share profits equally (1:1:1), this change in ratio leads to the reconstitution of the firm.

3. Retirement of a Partner

When a partner voluntarily leaves the firm, it is called retirement. This may happen due to old age, health concerns, or personal reasons.

In a partnership at will, a partner can retire at any time by giving notice to the other partners.

Example:

If Roy, Ravi, and Rao share profits in a 2:2:1 ratio, and Ravi retires due to illness, a new partnership is formed between Roy and Rao. The firm is said to be reconstituted.

4. Death of a Partner

When a partner passes away, the partnership automatically dissolves unless the remaining partners agree to continue the business. In that case, a new agreement is formed among the surviving partners.

Example:

If X, Y, and Z share profits in a 3:2:1 ratio and X dies, Y and Z may decide to continue the business and share profits equally. This leads to the reconstitution of the firm.

Admission of a New Partner

When a firm needs more capital or management support for its growth, it may admit a new partner to enhance its resources. According to the Partnership Act of 1932, a new partner can only join the firm with the consent of all existing partners unless otherwise agreed. The admission of a new partner leads to the reconstitution of the partnership firm and the creation of a new agreement to continue the business.

A newly admitted partner gains two primary rights in the firm:

- Right to share the assets of the partnership firm.

- Right to share the profits of the partnership firm.

To acquire a share in the assets and profits of the partnership firm, the new partner contributes an agreed amount of capital, either in cash or in kind. In the case of an established firm earning above the normal rate of return on its capital, the new partner may be required to contribute an additional amount known as a premium or goodwill. This is mainly to compensate the existing partners for the loss of their share in the super profits of the firm.

Here are some other important considerations during the admission of a new partner:

- New profit sharing ratio

- Sacrificing ratio

- Valuation and adjustment of goodwill

- Revaluation of assets and reassessment of liabilities

- Distribution of accumulated profits (reserves)

- Adjustment of partners’ capitals

New Profit Sharing Ratio

- When a new partner is admitted, they acquire their share of profits from the existing partners.

- In other words, the existing partners sacrifice a portion of their profits in favour of the new partner.

- The specific share of the new partner and how they acquire it from the existing partners is determined through mutual agreement among the old partners and the new partner.

- If no specific agreement is made regarding how the new partner acquires their share from the old partners, it is generally assumed that they receive it in the existing partners' profit-sharing ratio.

- Regardless, the profit-sharing ratio among the old partners will change upon the admission of the new partner, taking into account their respective contributions to the new profit-sharing ratio.

- Therefore, it is essential to determine the new profit-sharing ratio for all partners, which depends on how the new partner acquires their share from the old partners, and there are various possibilities for this arrangement.

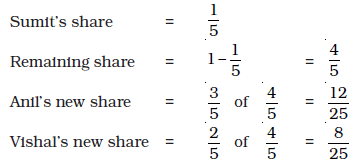

Example: Anil and Vishal are partners sharing profits in the ratio of 3:2. They admitted Sumit as a new partner for 1/5 share in the future profits of the firm. Calculate the new profit-sharing ratio of Anil, Vishal and Sumit.

Ans:

The new profit-sharing ratio of Anil, Vishal and Sumit will be 12:8:5.

The new profit-sharing ratio of Anil, Vishal and Sumit will be 12:8:5.

Sacrificing Ratio

- The sacrificing ratio is the ratio in which old partners agree to give up their share of profits for the benefit of the incoming partner.

- To calculate the sacrifice made by a partner:

Old Share of Profit−New Share of Profit - The new partner compensates the old partners for their loss of share in the super-profits by bringing in an additional amount as a premium for goodwill. This amount is shared by the existing partners according to the sacrificing ratio.

- The sacrificing ratio can be agreed upon among partners and may be based on the old ratio, equal sacrifice, or a specified ratio.

- When the ratio in which the new partner acquires their share from the old partners is not specified, the sacrificing ratio is calculated by subtracting each partner’s new share from their old share.

Example: Rohit and Mohit are partners in a firm sharing profits in the ratio of 5:3. They admit Bijoy as a new partner for 1/7 share in the profit. The new profit-sharing ratio will be 4:2:1. Calculate the sacrificing ratio of Rohit and Mohit

Ans:

Rohit’s old share = 5/8

Rohit’s new share = 4/7

Rohit’s sacrifice

Mohit’s old share = 3/8

Mohit’s new share = 2/7

Mohit’s sacrifice

Sacrificing ratio among Rohit and Mohit will be 3:5.

What is Goodwill?

Goodwill is an important aspect of partnership accounts that requires adjustment, and sometimes valuation, during the reconstitution of a firm. This can occur due to changes in profit-sharing ratios, the admission of a new partner, or the retirement or death of an existing partner.

Meaning of Goodwill

- Over time, a well-established business builds a strong reputation, a good name, and extensive business connections.

- These factors enable the business to earn higher profits compared to a newly established one.

- In accounting, the monetary value of this advantage is referred to as "goodwill."

- Goodwill is considered an intangible asset.

- It represents the value of a firm's reputation in terms of expected future profits that exceed normal profits.

- When someone pays for goodwill, they are essentially paying for the ability to earn super profits compared to other firms in the same industry.

- In simpler terms, goodwill can be defined as "the present value of a firm's anticipated excess earnings" or the capitalized value attached to the differential profit capacity of a business.

- Goodwill only exists when a firm is capable of earning super profits.

- If a firm is earning normal profits or incurring losses, it has no goodwill.

Factors Influencing the Value of Goodwill

- Nature of Business: A company that produces high-value-added products or has stable demand tends to earn higher profits, leading to increased goodwill.

- Location: Goodwill is generally higher for businesses that are centrally located or situated in areas with heavy customer traffic.

- Efficiency of Management: Well-managed companies often experience higher productivity and cost efficiency, resulting in greater profits and, consequently, higher goodwill.

- Market Situation: Conditions such as monopoly or limited competition allow businesses to earn elevated profits, contributing to higher goodwill.

- Special Advantages: Firms with special advantages like import licenses, low utility rates, assured supply of resources, long-term contracts, reputable collaborators, patents, and trademarks tend to have higher goodwill.

Reasons for Goodwill Valuation

- Goodwill valuation is typically needed during the sale of a business. In the context of a partnership firm, it may be required in situations such as:

- Change in Profit Sharing Ratio: When existing partners decide to alter the profit-sharing arrangement.

- Admission of a New Partner: When a new partner joins the firm.

- Retirement of a Partner: When a partner decides to retire from the partnership.

- Death of a Partner: In the unfortunate event of a partner's death.

- Dissolution of a Firm: In cases where the firm is dissolved and the business is sold as a going concern.

- Amalgamation of Partnership Firms: When multiple partnership firms merge together.

Methods for Valuing Goodwill

- Valuing goodwill can be challenging since it is an intangible asset. Different methods can yield varying results for goodwill valuation in a partnership firm. Therefore, the specific method for calculating goodwill should be agreed upon by the existing partners and the incoming partner.

- The key methods for valuing goodwill include:

1. Average Profits Method

2. Super Profits Method

3. Capitalisation Method

1. Average Profits Method

- Goodwill is valued based on a certain number of ‘years’ of purchases of the average profits from previous years.

- This method assumes that a new business won’t make any profits in its initial years. Therefore, the buyer of an existing business compensates for this by paying goodwill, which represents the profits they are expected to receive in the early years.

- Goodwill is calculated by multiplying the past average profits by the number of years the anticipated profits are expected to last.

- For instance, if a business has average past profits of Rs. 20,000 and these profits are expected to continue for another three years, the goodwill would be Rs. 60,000(Rs. 20,000 x 3).

Example: The profit for the five years of a firm are as follows – year 2013 Rs. 4,00,000; year 2014 Rs. 3,98,000; year 2015 Rs. 4,50,000; year 2016 Rs. 4,45,000 and year 2017 Rs. 5,00,000. Calculate the goodwill of the firm on the basis of 4 years' purchase of 5 years' average profits.

Ans:

Average Profit = Total Profit of Last 5 Years/ No.of years

= Rs. 21,93,000/5 = Rs. 4,38,600

Goodwill = Average Profits × No. of years purchased

= Rs. 4,38,600 × 4 = Rs. 17,54,400

The calculation of goodwill above assumes that future profits will remain stable, with no significant changes expected. This example uses a simple average. However, if there is a noticeable upward or downward trend in profits, it is often more effective to assign greater weight to recent years' profits compared to earlier ones. Therefore, using a weighted average with specific weights, such as 1, 2, 3, and 4 for each respective year's profit, may be advisable. However, weighted averaging should only be applied when explicitly indicated.

2. Super Profits Method

- The average profits method of calculating goodwill is based on the assumption that a new business will struggle to make profits during its initial years of operation.

- When someone buys an existing business, they pay a sum equal to the total profits expected for the first few years as goodwill.

- However, the real benefit for the buyer lies not in the total profits but in the profits exceeding the normal return on capital employed in similar businesses.

- Therefore, it is better to value goodwill based on excess profits rather than actual profits.

- The difference between actual profits and normal profits is known as super profits.

Firms' capital comprises partners' capital and reserves and surplus. However, it does not include fictitious assets or goodwill.

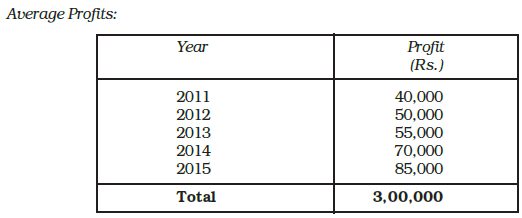

Example: The books of a business showed that the firm’s capital employed on December 31, 2015, Rs. 5,00,000 and the profits for the last five years were: 2011–Rs. 40,000: 2012-Rs. 50,000; 2013-Rs. 55,000; 2014- Rs.70,000 and 2015-Rs. 85,000. You are required to find out the value of goodwill based on 3 years purchase of the super profits of the business, given that the normal rate of return is 10%.

Ans:

Average Profits = Rs. 3,00,000/5 = Rs. 60,000

Average Profits = Rs. 3,00,000/5 = Rs. 60,000

Super Profit = Rs. 60,000 – Rs. 50,000 = Rs. 10,000

Goodwill = Rs. 10,000 x 3 = Rs. 30,000

3. Capitalisation Method

(a) Capitalization of Average Profits: This method involves calculating goodwill by capitalizing the average profits and deducting the actual firm's capital from this value. The steps are as follows:

- Ascertain Average Profits: Calculate the average profits based on the performance of the past few years.

- Capitalize Average Profits: Determine the capitalized value of average profits using the formula:

Capitalized Value of Average Profits = Average Profits × 100 / Normal Rate of Return - Determine Actual Firm's Capital: Calculate the actual firm's capital (net assets) by deducting outside liabilities from total assets, excluding goodwill and fictitious assets.

Firm's Capital = Total Assets (excluding goodwill) – Outside Liabilities - Compute Goodwill: Calculate the value of goodwill by subtracting net assets from the capitalized value of average profits:

Goodwill = Capitalized Value of Average Profits – Net Assets

Example: A business has earned average profits of Rs. 1,00,000 during the last few years and the normal rate of return in a similar business is 10%. Ascertain the value of goodwill by capitalisation average profits method, given that the value of net assets of the business is Rs. 8,20,000.

Ans:

Capitalised Value of Average Profits

Goodwill = Capitalised value – Net Assets

= Rs. 10,00,000 – Rs. 8,20,000

= Rs.1,80,000

(b) Capitalisation of Super Profits: Goodwill can be determined by capitalising super profits directly. This method eliminates the need to calculate the capitalised value of average profits. The process involves several steps:

- Calculate the capital of the firm, which is determined by subtracting outside liabilities from total assets (excluding goodwill and fictitious assets).

- Calculate normal profits based on the capital employed.

- Determine the average profit for the specified past years.

- Calculate super profits by subtracting normal profits from average profits.

- Multiply the super profits by the required rate of return multiplier using the formula:

Goodwill = Super Profits × 100 / Normal Rate of Return.

Treatment of Goodwill

- When a new partner joins a firm, they compensate the existing partners for the loss of their share in super profits.

- This compensation is called their share of goodwill or premium for goodwill.

When the new Partner brings goodwill in cash

- If the new partner brings in goodwill as cash, the amount is distributed among the existing partners according to their ratio of sacrifice.

- If the new partner pays this amount directly to the old partners (privately), no entry is made in the firm’s books.

- However, if the payment is made through the firm, which is usually the case, specific journal entries are recorded.

Alternatively, it is credited to the new partner's capital account and then adjusted in favour of the existing partners according to their sacrificing ratio. The corresponding journal entries will be as follows:

If the partners agree to keep the premium for goodwill credited to their capital accounts within the business, no additional entry is recorded. However, if they decide to withdraw their amounts, either fully or partially, the following additional entry will be made:

Example: Sunil and Dalip are partners in a firm sharing profits and losses in the ratio of 5:3. Sachin is admitted in the firm for 1/5th share of profits. He brings in Rs. 20,000 as capital and Rs. 4,000 as his share of goodwill by cheque. Give the necessary journal entries,

(a) When partners decided to retain goodwill in business.

(b) When the amount of goodwill is fully withdrawn.

(c) When 50% of the amount of goodwill is withdrawn.

Ans:

(a) When the amount of goodwill credited to existing partners is retained in business.

(b) When the amount of goodwill credited to existing partners is fully withdrawn.

(c) When 50% of the amount of goodwill credited to existing partners is withdrawn.

When Goodwill Already Exists in the Books

- If goodwill is already recorded in the books of the firm, it is written off at the time of a partner's admission.

When a new partner joins a partnership without bringing in cash for goodwill, partially or fully

- The amount of goodwill not brought by the new partner is debited to their current account. At the same time, the capital accounts of the sacrificing partners are credited with their respective shares of goodwill.

- There are two scenarios when the new partner does not bring their share of goodwill:

- Goodwill does not exist in the books: In this case, the sacrificing partners are credited with their share of goodwill, and the new partner is debited with the amount of goodwill they did not bring.

The journal entry in this case is :

In some cases, the new partner may contribute a portion of the premium for goodwill in cash. In this scenario, the new partner's current account will be debited by the amount that has not been contributed.

Example: Ahuja and Barua are partners in a firm sharing profits and losses in the ratio of 3:2. They decide to admit Chaudhary into partnership for 1/5 share of profits, which he acquires equally from Ahuja and Barua. Goodwill is valued at Rs. 30,000. Chaudhary brings in Rs. 16,000 as his capital but is not in a position to bring any amount for goodwill. No goodwill account exists in books of the firm. Goodwill account is to be raised at full value. Record the necessary journal entries.

Ans:

When goodwill exists in the books:

- When a change occurs in the partnership, any goodwill recorded in the books will be eliminated by debiting the old partners' capital accounts.

- This is done in their old profit-sharing ratio.

- After this adjustment, the new value of goodwill will be reflected by crediting the capital accounts of the sacrificing partners and debiting the current account of the new partners.

The journal entries will be as under:

Hidden Goodwill

- When a new partner joins a firm and the value of goodwill is not specified, it can be inferred from the capital and profit-sharing arrangements.

- For example, if partners A and B have equal capital of Rs. 45,000 each and admit partner C with a one-third profit share, the total capital can be calculated based on C's contribution.

- C brings in Rs. 60,000 as capital, indicating a total capital of Rs. 1,80,000 (Rs. 60,000 x 3).

- However, the actual total capital from A, B, and C is Rs. 1,50,000 (Rs. 45,000 + Rs. 45,000 + Rs. 60,000).

- The difference of Rs. 30,000 (Rs. 1,80,000 - Rs. 1,50,000) represents goodwill, which is to be shared equally by A and B based on their old ratio.

- This adjustment increases A and B's capital accounts to Rs. 60,000 each and raises the total capital of the firm to Rs. 1,80,000.

- In this process, C's current account will be debited by Rs. 10,000 (representing his share of goodwill), while A and B's capital accounts will be credited by Rs. 5,000 each.

Example: Hem and Nem are partners in a firm sharing profits in the ratio of 3:2. Their capitals were Rs. 80,000 and Rs. 50,000 respectively. They admitted Sam on Jan. 1, 2017 as a new partner for 1/5 share in the future profits. Sam brought Rs. 60,000 as his capital. Calculate the value of goodwill of the firm and record necessary journal entries on Sam’s admission, if:

(a) Sam brings his share of goodwill

(b) Sam does not bring his share of goodwill

Ans:

(a) Sam brings his share of goodwill

(b) Sam does not bring his share of goodwill

Working Notes :

Value of Firm's goodwill

Sam's Capital = Rs. 60,000

Sam's Share = 1/5

Total capital of Firm = Rs. 60,000 × 5 = Rs. 3,00,000

Hem + Nem + Sam = Rs. 80,000 + Rs. 50,000 + Rs. 60,000 = Rs. 1,90,000

Goodwill of the firm = Rs. 3,00,000 - Rs. 1,90,000 = Rs. 1,10,000

Sam's Share = Rs. 1,10,000 × 1/5 = Rs. 22,000

Adjustment for Accumulated Profits and Losses

- When a firm has accumulated profits that haven't been transferred to the partners' capital accounts, these profits are usually found in accounts like the general reserve, reserve, and/or Profit and Loss Account.

- A new partner is not entitled to a share of these accumulated profits. Instead, these profits are distributed among the existing partners by transferring them to their capital current accounts in the old profit-sharing ratio.

- If there are accumulated losses, such as a debit balance in the profit and loss account or deferred revenue expenditure on the balance sheet, these losses should be transferred to the old partners' capital accounts.

Example: Rajinder and Surinder are partners in a firm sharing profits in the ratio of 4:1. On April 15, 2017 they admit Narender as a new partner. On that date there was a balance of Rs. 20,000 in general reserve and a debit balance of Rs. 10,000 in the profit and loss account of the firm. Pass necessary journal entries regarding adjustment of a accumulate a profit or loss.

Ans:

Revaluation of Assets and Reassessment of Liabilities

- When a new partner joins a firm, it is important to check if the assets are accurately valued in the books. If they are not, a revaluation is necessary.

- A Revaluation Account is prepared to record gains or losses from revaluing assets and reassessing liabilities.

- Any unrecorded assets or liabilities should also be included in the books during this process.

- The gains or losses from revaluation are transferred to the Revaluation Account.

- The final balance of the Revaluation Account is distributed to the capital accounts of the old partners based on their original profit-sharing ratio.

- An increase in asset value or a decrease in liability is considered a gain and credited to the Revaluation Account.

- A decrease in asset value or an increase in liability is considered a loss and debited to the Revaluation Account.

- Unrecorded assets are credited, and unrecorded liabilities are debited to the Revaluation Account.

- A credit balance in the Revaluation Account indicates a net gain, while a debit balance indicates a net loss.

- The net gain or loss is transferred to the capital accounts of the old partners in their original profit-sharing ratio.

The journal entries recorded for the revaluation of assets and reassessment of liabilities are as follows:

(i) For an increase in the value of an asset:

(ii) For reduction in the value of an asset:

(iii) For appreciation in the amount of a liability:

(iv) For reduction in the amount of a liability:

(v) For an unrecorded asset:

(vi) For an unrecorded liability:

(vii) For transfer of gain on Revaluation if credit balance

(viii) For transferring loss on revaluation

Adjustment of Capitals

- When a new partner joins a business, existing partners may decide to adjust their capital contributions to align with the new profit-sharing ratio.

- If the capital contribution of the new partner is specified, it can serve as a basis for calculating the adjusted capital for the existing partners.

- The newly calculated capitals should be compared with the old capitals after making adjustments for factors like goodwill reserves and the revaluation of assets and liabilities.

- If an existing partner's adjusted capital is less than their old capital, they will need to contribute additional funds to cover the shortfall.

- Conversely, if a partner's adjusted capital is more than their old capital, they will withdraw the excess amount.

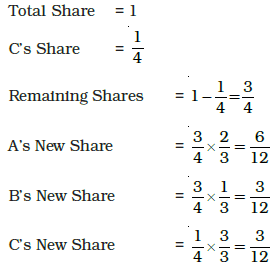

Example: A and B are partners sharing profits in the ratio of 2:1. C is admitted into the firm for 1/4 share of profits. C brings in Rs. 20,000 in respect of his capital. The capitals of old partners A and B, after all adjustments relating to goodwill, revaluation of assets and liabilities, etc., are Rs. 45,000 and Rs. 15,000 respectively. It is agreed that partners’ capitals should be according to the new profit sharing ratio. Determine the new capitals of A and B and record the necessary journal entries assuming that the partner whose capital falls short, brings in the amount of deficiency and the partner who has an excess, withdraws the excess amount.

Ans:

1. Calculation of new profit sharing ratio: Assuming the new partner C choirs his share from A and B in their old profit sharing ratio, i.e. 2:1.

Thus, the new profit-sharing ratio between A, B and C is 6:3:3 or 2:1:1.

Thus, the new profit-sharing ratio between A, B and C is 6:3:3 or 2:1:1.

2. Required Capital of A and B

C’s capital (who has 1/4 share in profits) is Rs. 20,000. B’s new share in profits is 1/4. Hence his capital will also be Rs. 20,000. A’s new share is 2/4 which is double of C’s share. Hence his capital will be Rs. 40,000.

Alternatively, based on C’s capital, the total capital of the firm works out at Rs. 80,000 (4/1 × Rs.20,000). Hence, based on their share in profits, the capital of A and B will be:

A’s capital = 2/4 of 80,000 = Rs. 40,000

B’s capital = 1/4 of 80,000 = Rs. 20,000

The capital of A and B after all adjustments have been made, are Rs. 45,000 and Rs. 15,000 respectively. Hence, A will withdraw Rs. 5,000 (Rs. 45,000–Rs.40,000) from the firm whereas B will contribute an additional amount of Rs. 5,000 (Rs. 20,000–Rs.15,000). The journal entries will be :

At times, the total capital of the firm may be explicitly defined, and it may be agreed that each partner's capital should be proportional to their share of the profits. In this case, each partner's capital, including that of the new partner, is calculated based on their profit share. By contributing additional amounts or withdrawing excess funds, each partner's final capital can be adjusted to meet the required level. It is important to note that, with the partners' agreement, any surplus or deficiency in the capital accounts of the existing partners can also be addressed by simply transferring amounts to their respective current accounts.

Change in Profit Sharing Ratio among the Existing Partners

- Occasionally, partners in a firm may choose to alter their existing profit-sharing ratio without admitting a new partner or having any partner retire.

- This change leads to some partners gaining an additional share of future profits, while others may experience a reduction in their share.

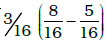

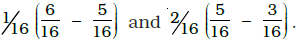

- For instance, A, B, and C are partners in a firm sharing profits in the ratios of 8:5:3.

- It is anticipated that A will no longer be able to actively engage in the firm's operations.

- Hence, with effect from April 1, 2007, they decided that, in future, they will share the profits in the ratio of 5 : 6 : 5.

- This results in A losing

share in profits while B and C gaining

share in profits while B and C gaining

- In such cases, any loss or gain in the value of goodwill must be adjusted.

- This involves crediting the sacrificing partners and debiting the gaining partner with the appropriate amounts, as previously explained in the context of admitting a new partner.

- Additionally, any changes in the profit-sharing ratio, such as the admission of a partner, may require adjustments related to the revaluation of assets and liabilities.

- The transfer of accumulated profits and losses to the partners' capital accounts in the old profit-sharing ratio is necessary.

- The adjustment of partners' capitals, if necessary, to align them with the new profit-sharing ratio is also required.

- All of this is carried out in the same manner as it would be during the admission of a new partner.

Example: Dinesh, Ramesh and Suresh are partners in a firm sharing profits and losses in the ratio of 3:3:2. They decided to share the profits equally w.e.f. April 1, 2015. Their Balance Sheet as on March 31, 2016 was as follows :

It was also decide that :

- The fixed assets should be valued at Rs. 3,31,000.

- A provisions of 5% on sundry debtors be made doubtful debts.

- The goodwill of the firm at this date be valued at

years purchase of the average net profits of last, five years which were Rs. 14,000; Rs. 17,000; Rs. 20,000; Rs. 22,000 and Rs. 27,000 respectively.

years purchase of the average net profits of last, five years which were Rs. 14,000; Rs. 17,000; Rs. 20,000; Rs. 22,000 and Rs. 27,000 respectively. - The value of stock be reduced to Rs. 1,12,000.

- Goodwill was not to appear in the books. Pass the necessary journal entries and prepare the revised Balance sheet of the firm.

Ans:

Working Notes:

1. Gain or sacrifice of partners

2. Goodwill

Total Profits : Rs. 14,000 + Rs. 17,000 + Rs. 20,000 + Rs. 22,000 + Rs. 27,000 = Rs. 1,00,000

Average Profits = Rs. 1,00,000/5 = Rs. 20,000

Goodwill  = Rs. 90,000

= Rs. 90,000

Suresh in expected to bring in Rs. 7,500 as he gain 2/24 share in profits.

Dinesh in expected to receive Rs. 3,750 as he sacrifices 1/24 share in profits.

Ramesh is expected to receive Rs. 3,750 as he sacrifices 1/24 share in profits.

|

42 videos|199 docs|43 tests

|

FAQs on Reconstitution of a Partnership Firm: Admission of a Partner Chapter Notes - Accountancy Class 12 - Commerce

| 1. What are the different modes of reconstitution of a partnership firm? |  |

| 2. How is goodwill calculated when a new partner is admitted to a partnership firm? |  |

| 3. What is the significance of goodwill in the admission of a new partner? |  |

| 4. What entries are made in the books of accounts when a new partner is admitted? |  |

| 5. Can a partnership firm continue to operate if a partner retires or passes away? |  |