Reconstitution of a Partnership Firm : Retirement/Death of a Partner Chapter Notes | Accountancy Class 12 - Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Ascertaining the Amount Due to Retiring/Deceased Partner |

|

| New Profit Sharing Ratio |

|

| Hidden Goodwill |

|

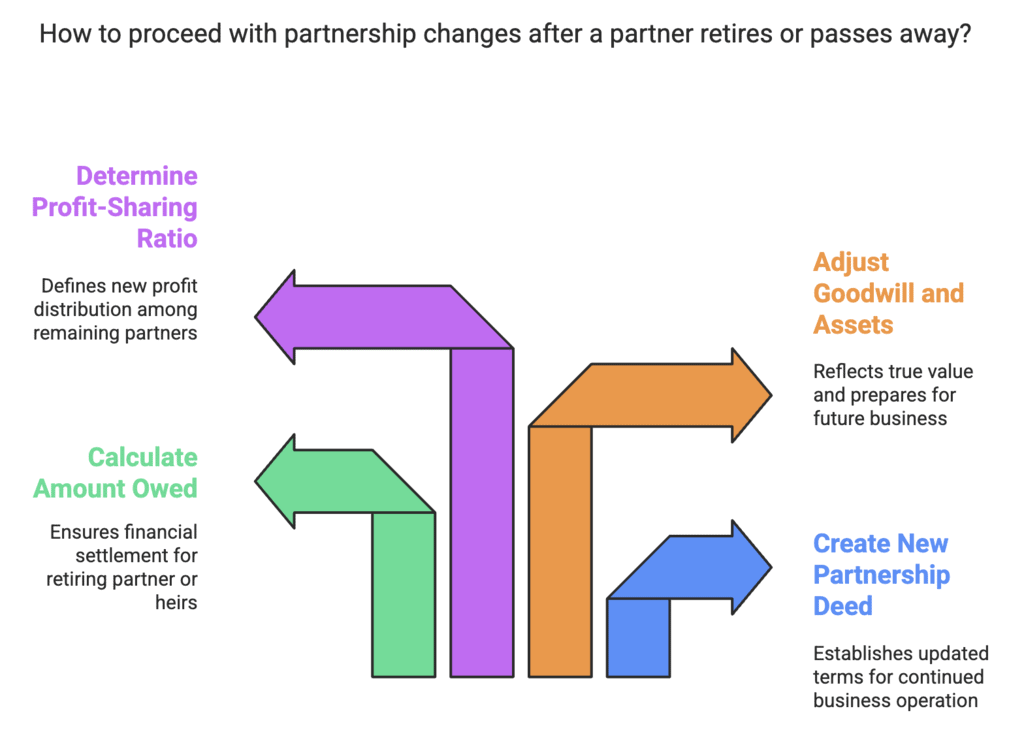

Introduction

When a partner retires or passes away, the existing partnership deed comes to an end, and a new deed is prepared so the business can continue smoothly. In both cases, the accounting treatment is almost the same, as the amount payable to the retiring partner or to the legal representatives of the deceased partner has to be calculated. This includes adjustments for goodwill, revaluation of assets and liabilities, and distribution of accumulated profits and losses. The remaining partners also need to fix a new profit-sharing ratio and calculate the gaining ratio to divide future profits fairly.

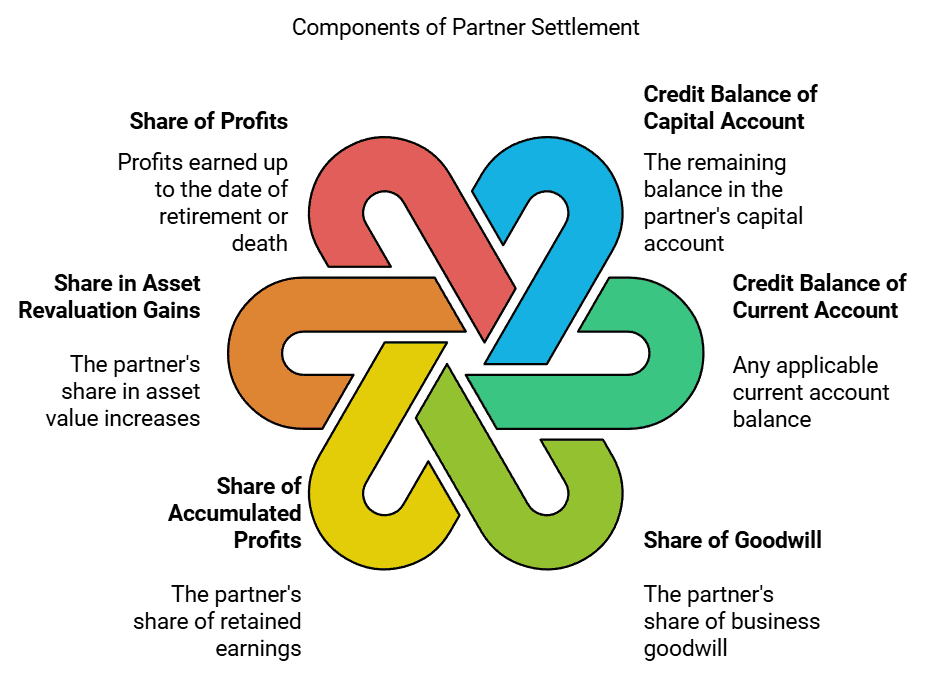

Ascertaining the Amount Due to Retiring/Deceased Partner

The amount owed to a retiring partner (in the case of retirement) or to the legal representatives/executors (in the case of death) includes:

- Credit balance of capital account

- Credit balance of current account(if applicable)

- Share of goodwill

- Share of accumulated profits(reserves)

- Share in the gain from the revaluation of assets and liabilities

- Share of profits up to the date of retirement/death

- Interest on capital, if applicable, up to the date of retirement/death

- Salary/commission, if any, due up to the date of retirement/death

Deductions that may need to be made from the partner's share include:

- Debit balance of current account(if applicable)

- Share of goodwill to be written off, if necessary

- Share of accumulated losses

- Share of loss from the revaluation of assets and liabilities

- Share of loss up to the date of retirement/death

- Drawings up to the date of retirement/death

- Interest on drawings, if applicable, up to the date of retirement/death

Similar to admission, the accounting aspects involved in the retirement or death of a partner include:

- Determining the new profit-sharing ratio and gaining the ratio

- Treating goodwill

- Revaluing assets and liabilities

- Adjusting for unrecorded assets and liabilities

- Distributing accumulated profits and losses

- Calculating the share of profit or loss up to the date of retirement/death

- Adjusting capital, if necessary

- Settling amounts due to the retired/deceased partner

New Profit Sharing Ratio

The new profit-sharing ratio determines how the remaining partners will share future profits after the retirement or death of a partner. Each remaining partner's new share will include their original share plus the share from the retiring or deceased partner.

Situations:

(a)

- Typically, the continuing partners take the share of the retiring or deceased partner in the old profit-sharing ratio.

- There is no need to calculate a new profit-sharing ratio among them, as it remains the same.

- If there is no specific information about the ratio in which the remaining partners will acquire the share, it is assumed they will do so in the old ratio.

- For instance, if Asha, Deepti, and Nisha share profits in the ratio of 3:2:1, and Deepti retires, Asha and Nisha will share the profits in the ratio of 3:1, unless they decide otherwise.

(b)

- In some cases, the continuing partners may acquire the share of the retiring or deceased partner in a different proportion than their old ratio.

- In such instances, it becomes necessary to compute a new profit-sharing ratio among them.

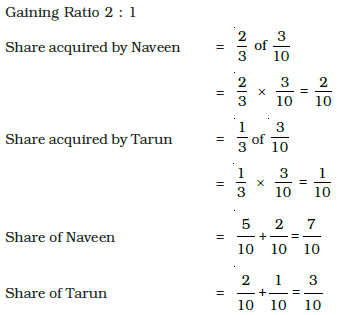

- For example, if Naveen, Suresh, and Tarun share profits in the ratio of 5:3:2, and Suresh retires, if his share is taken by Naveen and Tarun in the ratio of 2:1, a new profit-sharing ratio needs to be calculated.

In such a case, the new share of profit will be calculated as follows:

New share of Continuing Partner = Old Share + Acquired share from the Outgoing Partner

Thus, the new profit-sharing ratio of Naveen and Tarun will be = 7 : 3.

(c) When partners in a business decide to change how they share profits, they can agree on a specific new ratio. This agreed-upon ratio will become the new way they share profits.

Gaining Ratio

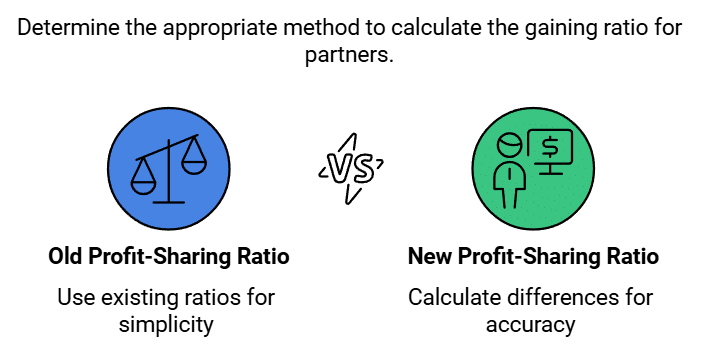

- The gaining ratio refers to the proportion in which the continuing partners acquire the share from the retiring or deceased partner.

- Typically, the continuing partners take the share of the retiring or deceased partner according to their old profit-sharing ratio. In such cases, the gaining ratio remains the same as their old profit-sharing ratio, and there is no need to calculate it separately.

- If the continuing partners specify the proportion in which they acquire the share of the retiring or deceased partner, there is no need to compute the gaining ratio, as it will be the same as the specified proportion.

- The need to calculate the gaining ratio arises primarily when the new profit-sharing ratio of the continuing partners is given. In this situation, the gaining ratio is determined by subtracting each continuing partner's old share from their new share.

- This means calculating the difference between the new profit share and the old profit share.

For example, Amit, Dinesh and Gagan are partners sharing profits in the ratio of 5:3:2.

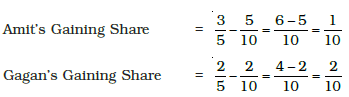

Dinesh retires. Amit and Gagan decide to share the profits of the new firm in the ratio of 3:2. The gaining ratio will be calculated as follows :

Thus, Gaining Ratio of Amit and Gagan = 1:2

This implies Amit gains 1/3 and Gagan gains 2/3 of Dinesh’s share of profit.

Gaining share of Continuing Partner = New share – Old share

Example: Madhu, Neha and Tina are partners sharing profits in the ratio of 5:3:2. Calculate new profit sharing ratio and gaining ratio if

1. Madhu retires

2. Neha retires

3. Tina retires.

Ans:

Given the old ratio among Madhu : Neha : Tina as 5 : 3 : 2

1. If Madhu retires, the new profit sharing Ratio between Neha and Tina will be

Neha : Tina = 3:2 and Gaining Ratio of Neha and Tina =3:2

2. If Neha retires the new profit-sharing Ratio between Madhu and Tina will be

Madhu : Tina = 5:2

Gaining Ratio of Madhu and Tina = 5:2

3. If Tina retires, the new profit-sharing ratio between Madhu and Neha will be:

Madhu : Neha = 5:3

Gaining ratio of Madhu and Neha = 5:3

Treatment of Goodwill

- When a partner retires or passes away, they are entitled to their share of goodwill because it has been earned by the efforts of all partners. Goodwill is valued based on the agreement among the partners at the time of retirement or death.

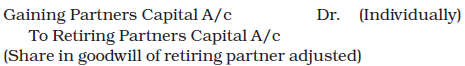

- The continuing partners compensate the retiring or deceased partner for their share of goodwill in their gaining ratio, as they benefit from the acquired share of profits.

- The accounting treatment for goodwill depends on whether it is already recorded in the firm’s books.

When Goodwill Does Not Appear in the Books:

- If goodwill is not recorded in the firm’s books, the retiring partner is credited for their share of goodwill.

- This is done by debiting the goodwill account and crediting the gaining partners’ capital accounts individually, in their gaining ratio.

The journal entry is :

Let us take an example to understand the treatment of goodwill.

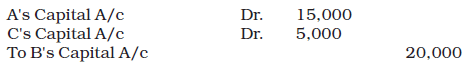

A, B and C are partners in a firm sharing profits in the ratio of 3:2:1 B retired and the value of goodwill of the firm in valued at Rs. 60,000. A and C continue the business sharing profits in the ratio of 3:1. The journal entry for adjustment of goodwill will be :

(B's share of goodwill adjusted to remaining partners' capital accounts in their gaining ratio)

Adjustment of Capital Accounts in Profit Sharing Ratio Changes:

When there’s a change in the profit-sharing ratio among the remaining partners, sometimes a continuing partner might also give up a portion of their share in future profits. In this scenario:

- The capital account of the continuing partner who sacrifices will be credited, similar to the capital account of the retiring or deceased partner.

- The accounts of the other continuing partners will be debited based on their gain in the new profit-sharing ratio.

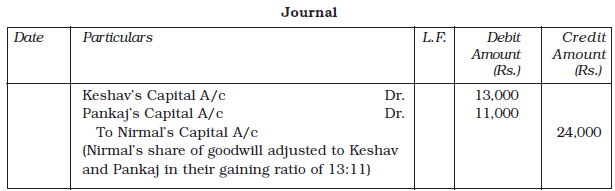

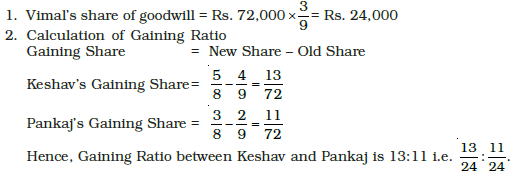

Example: Keshav, Nirmal and Pankaj are partners sharing profits and losses in the ratio of 4 : 3 : 2. Nirmal retires and the goodwill is valued at Rs. 72,000. Keshav and Pankaj decided to share future profits and losses in the ratio of 5 : 3. Record necessary journal entries.

Ans:

Working Notes:

Hidden Goodwill

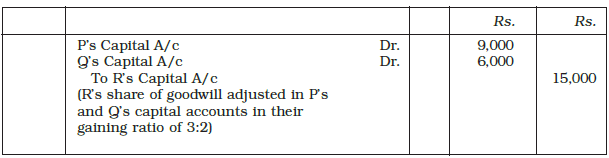

- When a firm agrees to settle the account of a retiring or deceased partner by paying a lump sum amount, any excess amount paid over what is due to the partner is considered their share of goodwill. This is known as hidden goodwill.

- The amount due to the partner is calculated based on the balance in their capital account after making necessary adjustments for accumulated profits and losses, revaluation of assets and liabilities, etc.

- For example, in a partnership where P, Q, and R share profits in the ratio of 3:2:1, if R retires and the adjusted balance in his capital account is Rs. 60,000, but P and Q agree to pay him Rs. 75,000, the excess Rs. 15,000 represents R's share of hidden goodwill.

- This hidden goodwill amount will be debited from the capital accounts of P and Q in their gaining ratio (3:2) and credited to R's capital account.

Adjustment for Revaluation of Assets and Liabilities

- When a partner retires or passes away, some assets might not be recorded at their current values.

- Similarly, certain liabilities may be recorded at a value different from what the firm actually owes.

- There could also be unrecorded assets and liabilities that need to be added to the firm’s books.

- Just like in the case of a new partner joining, a Revaluation Account is created to determine the net gain or loss from revaluing assets and liabilities and to bring in any unrecorded items.

- The result from the Revaluation Account is then transferred to the capital accounts of all partners, including the retiring or deceased partner, in their old profit-sharing ratio.

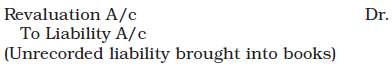

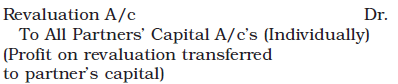

The Journal entries to be passed for this purpose are as follows:

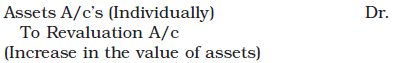

1. For an increase in the value of assets:

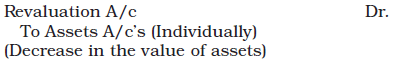

2. For decrease in the value of assets:

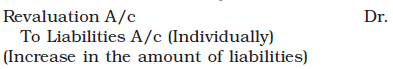

3. For an increase in the amount of liabilities:

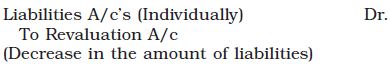

4. For a decrease in the amount of liabilities:

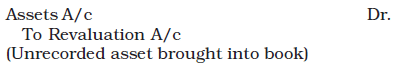

5. For an unrecorded asset:

6. For an unrecorded liability:

7. For distribution of profit or loss on revaluation:

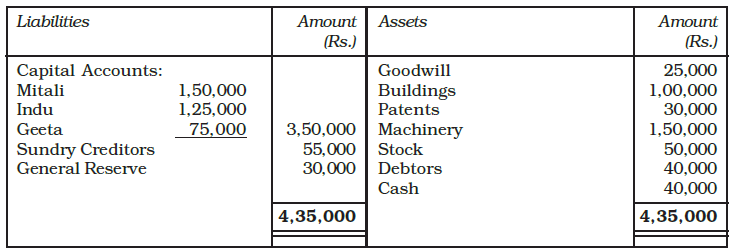

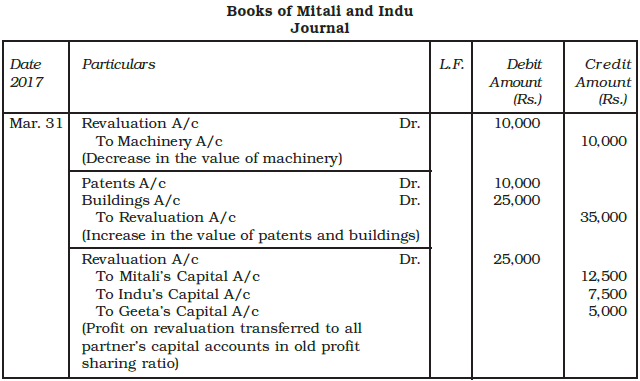

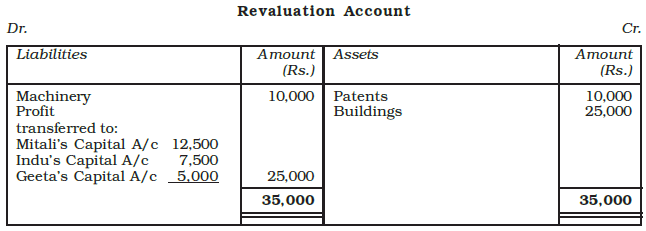

Example: Mitali, Indu and Geeta are partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. On March 31, 2017, their Balance Sheet was as under:

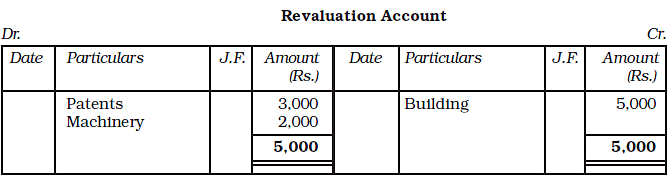

Geeta retires on the above date. It was agreed that Machinery be valued at Rs.1,40,000; Patents at Rs. 40,000; and Buildings at Rs. 1,25,000. Record the necessary journal entries for the above adjustments and prepare the Revaluation Account.

Ans:

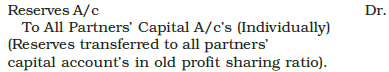

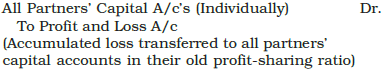

Adjustment of Accumulated Profits and Losses

- When a firm's Balance Sheet displays accumulated profits as a general reserve and/or accumulated losses as a debit balance in the profit and loss account, it indicates the financial standing of the partners.

- The retiring or deceased partner is entitled to their share of the accumulated profits but is also responsible for sharing any accumulated losses.

- Accumulated profits and losses are the collective property of all partners. Therefore, these amounts should be transferred to the capital accounts of all partners based on their old profit-sharing ratio.

- To facilitate this adjustment, specific journal entries are recorded.

(i) For transfer of accumulated profits (reserves):

(ii) For transfer of accumulated losses:

When a Partner Retires Mid-Year

- Typically, a partner retires at the end of the accounting period. However, there are instances when a partner may choose to retire in the middle of the year.

- In such cases, the retiring partner's claim includes their share of profit or loss, interest on capital, and interest on drawings (if any) from the date of the last balance sheet to the date of retirement.

- The main challenge in this scenario is calculating the profit for the intervening period, which is the time between the last balance sheet date and the retirement date.

- To illustrate this, let's consider an example:

- Maira, Shabnam, and Vipul are partners in a firm sharing profits in the ratio of 5:4:1. The profits for the year ending March 31, 2019, amount to Rs. 1,00,000.

- Vipul decided to retire on June 30, 2019. After his retirement, the new profit-sharing ratio for the remaining partners becomes 1:1.

Vipul's share of profit for the period of from April 01 to June 30, 2019 shall be calculated as:

Total profit for the year ending on 31st March, 2017 = Rs. 1,00,000

Vipul's share of profit:

Proceeding Years × Proportionate Period × Share of Deceased Partner

The journal entry will be recorded as follows:

The journal entry will be recorded as follows:

Vipul's share of profit transferred to his capital account

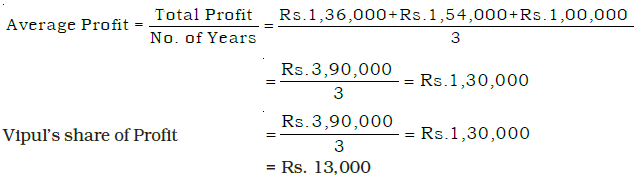

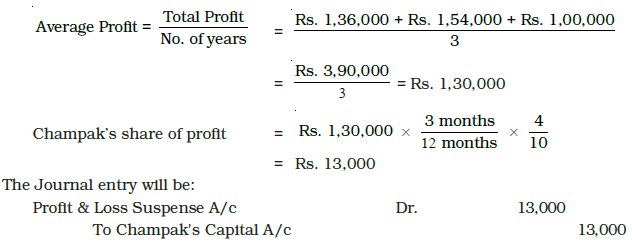

Alternatively, if Vipul's profit share were calculated using the average profits from the past three years—Rs. 1,36,000 for 2016–17, Rs. 1,54,000 for 2017–18, and Rs. 1,00,000 for 2018–19—his profit share for the period from April 7, 2019, to June 30, 2019, would be determined using the average profit calculated based on the profits from the previous year, as shown below:

The Journal entry will be:

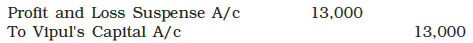

If the agreement states that the retiring partner’s profit share should be based on sales, and it specifies that sales for the year 2018-19 were Rs. 8,00,000 and sales from April 1, 2019, to June 30, 2019, totalled Rs. 1,50,000, then Vipul's profit share for the period starting April 1, 2019, will be calculated as follows:

For being retiring partners share of profit for the intervening period to books of account, the following journal entry is recorded.

Later, Profit and Loss suspense account is closed by transferring the amount to the gaining partners capital account in their gaining ratio. The journal entry is:

Disposal of Amount Due to Retiring Partner

- The outgoing partner's account is settled according to the terms specified in the partnership deed.

- This can involve payment in a lump sum immediately, in various instalments with or without interest, or a combination of cash and instalments.

- If there is no specific agreement, Section 37 of the Indian Partnership Act, 1932 applies.

- This section gives the outgoing partner the option to receive either interest at 6% per annum until the date of payment or a share of profits earned with their capital (based on the capital ratio).

- The total amount due to the retiring partner, determined after all adjustments, should be paid immediately.

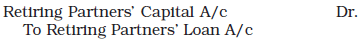

- If the firm cannot make the payment right away, the amount due is transferred to the retiring partner's Loan Account.

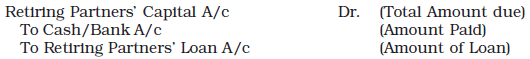

- When the payment is made, it is debited to their account.

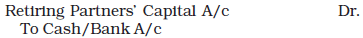

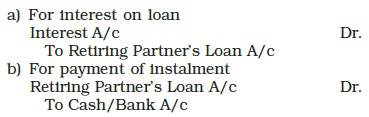

The necessary journal entries recorded are as follows.

1. When the retiring partner is paid cash in full.

2. When retiring partners’ whole amount is treated as a loan.

3. When retiring partner is partly paid in cash and the remaining amount is treated as a loan.

4. When the loan account is settled by paying in instalments including principal and interest.

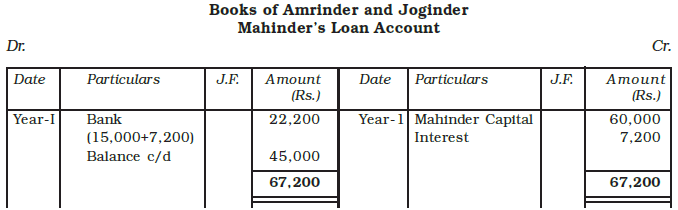

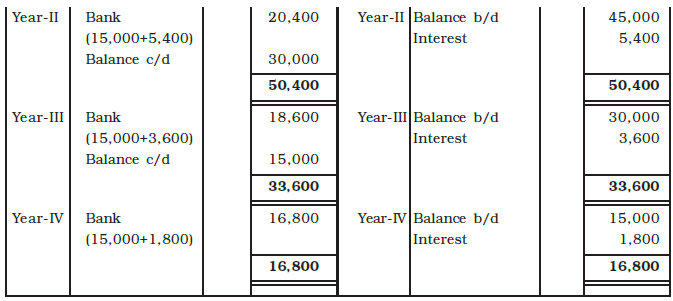

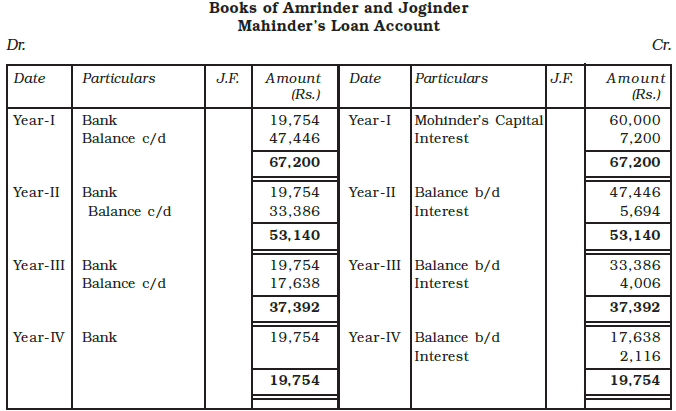

Example: Amrinder, Mahinder and Joginder are partners in a firm. Mahinder retires from the firm. On his date of retirement, Rs. 60,000 becomes due to him. Amrinder and Joginder promised to pay him in instalments every year at the end of the year to which he agreed. Prepare Mahinder’s Loan Account in the following cases:

1. When payment is made four yearly instalments plus interest @ 12% p.a. on the unpaid balance.

2. When payment is made in three yearly instalments of Rs. 20,000 including interest @ 12% p.a on the outstanding balance during the first three years and the balance including interest in the fourth year.

3. When payment is made in 4 equal yearly instalment’s including interest @ 12% p.a. on the unpaid balance.

Ans:

(a) When payment is made in four yearly instalments plus interest

(b) When payment is made in three yearly instalments of Rs. 20,000 each including interest.

(c) When payment is made in four equal yearly instalments including interest @12% (Annually).

Adjustment of Partners' Capitals

- When a partner retires or passes away, the remaining partners might choose to adjust their capital contributions according to their profit-sharing ratio.

- The total capital of the new firm is often considered to be the sum of the capital balances of the continuing partners unless stated otherwise.

- To determine the new capital for each continuing partner, the total capital is divided among them based on the new profit-sharing ratio.

- If a partner has excess or deficient capital compared to the new calculation, this difference will be adjusted by withdrawing or contributing cash.

- The necessary journal entries will be made to reflect these adjustments.

(i) For excess capital withdrawn by the partner :

(ii) For the amount of capital to be brought in by the partner:

Consider the following situations:

Consider the following situations:

The adjustment of the continuing partner’s capital may involve any one of the three ways as illustrated as follows :

1. When the capital of the new firm as decided by the partners is specified.

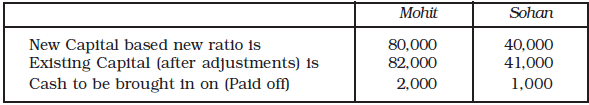

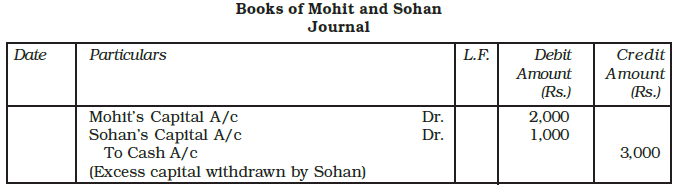

Example: Mohit, Neeraj and Sohan are partners in a firm sharing profits in the ratio of 2 : 1 : 1. Neeraj retires and Mohit and Sohan decided that the capital of the new firm will be fixed at Rs. 1,20,000. The capital accounts of Mohit and Sohan show a credit balance of Rs. 82,000 and Rs. 41,000 respectively after making all the adjustments. Calculate the actual cash to be paid off or to be brought in by the continuing partners and pass the necessary journal entries.

Ans: The New Profit Sharing Ratio between Mohit and Sohan = 2 : 1

2. When the total capital of new firm is not specified.

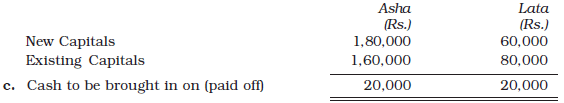

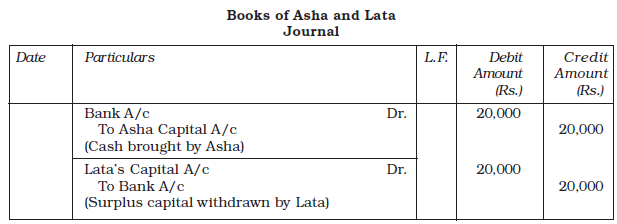

Example: Asha, Deepa and Lata are partners in a firm sharing profits in the ratio of 3 : 2 : 1. Deepa retires. After making all adjustments relating to revaluation, goodwill and accumulated profit etc., the capital accounts of Asha and Lata showed a credit balance of Rs. 1,60,000 and Rs. 80,000 respectively. It was decided to adjust the capitals of Asha and Lata in their new profit sharing ratio. You are required to calculate the new capitals of the partners and record necessary journal entries for bringing in or withdrawal of the necessary amounts involved.

Ans:

a. Calculation of new capital of the existing partners

Balance in Asha’s Capital (after all adjustments) = 1,60,000

Balance in Lata’s Capital = 80,000

Total Capital of the New Firm = 2,40,000

Based on the new profit-sharing ratio of 3:1

Asha’s New Capital = Rs. 2,40,000 x 3/4 = 1,80,000

Lata’s New Capital = Rs. 2,40,000 x 1/4 = 60,000

b. Calculation of cash to be brought in or withdrawn by the continuing partners :

3. When the amount payable to retiring partner will be contributed by continuing partners in such a way that their capitals are adjusted proportionate to their new profit sharing ratio:

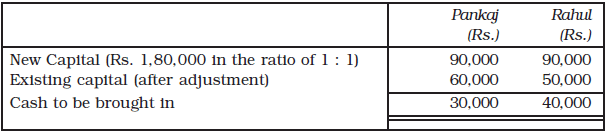

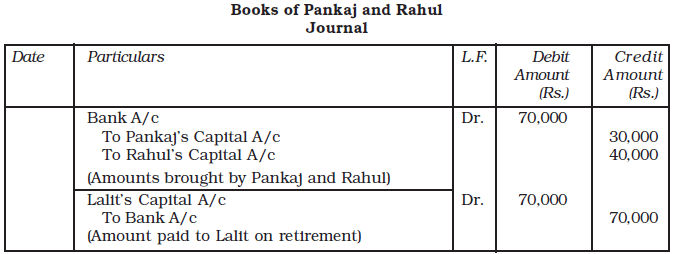

Example: Lalit, Pankaj and Rahul are partners sharing profits in the ratio of 4 : 3 : 3. After all adjustments, on Lalit’s retirement with respect to general reserve, goodwill and revaluation etc., the balances in their capital accounts stood at Rs. 70,000, Rs. 60,000 and Rs. 50,000 respectively. It was decided that the amount payable to Lalit will be brought by Pankaj and Rahul in such a way as to make their capitals proportionate to their profit sharing ratio. Calculate the amount to be brought by Pankaj and Rahul and record necessary journal entries for the same. Also record necessary entry for payment to Lalit.

After Lalit’s retirement, the new profit sharing ratio between Pankaj and Rahul is 3 : 3, i.e. 1 : 1.

Ans:

a. Calculation of the total capital of the new firm

Balance in Pankaj’s Capital account (after adjustment) = 60,000

Balance in Rahul’s Capital account (after adjustment) = 50,000

The amount payable to Lalit (Retiring partner) = 70,000

Total capital of new firm (i) + (ii) + (iii) = 1,80,000

b. Calculation of new capitals of the continuing partners

Pankaj’s New Capital = Rs. 1,80,000 x (1/2) = Rs. 90,000

Rahul’s New Capital = Rs. 1,80,000 x (1/2) = Rs. 90,000

c. Calculation of the amounts to be brought in or withdrawn by the continuing partners

Death of a Partner

- Similar Treatment: The accounting treatment for the death of a partner is similar to that of a retiring partner. In the case of death, the deceased partner's claim is transferred to their executors and settled in the same manner as that of a retired partner.

- Timing Difference: The key difference is that while retirement usually occurs at the end of an accounting period, the death of a partner can happen at any time. Therefore, the deceased partner's claim includes their share of profit or loss, interest on capital, and interest on drawings (if any) from the date of the last Balance Sheet to the date of death.

- Profit Calculation Challenge: The main challenge is calculating the profit for the intervening period (the time between the last Balance Sheet and the partner's death). Closing the books and preparing final accounts for this period is considered cumbersome.

- Profit Estimation Methods: The deceased partner's share of profit may be estimated based on:

- Last year's profit

- Average profit of the past few years

- Sales during the intervening period

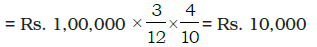

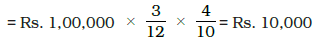

For example, Bakul, Champak and Darshan were partners in a firm sharing profits in the ratio of 5:4:1. The profit of the firm for the year ending on March 31, 2017 was Rs.1,00,000. Champak died on June 30, 2017. Bakul and Darshan decided to share profits equally. Champak’s share of profit for the period from April 1 to June 30, 2017, shall be calculated as follows:

Total profit for the year ending on 31st March 2017 = Rs.1,00,000

Champak’s share of profit :

Proceeding Year’s Profit × Proportionate Period × Share of Deceased Partner

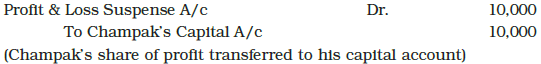

The journal entry will be recorded as follows :

Alternatively, if Champak’s profit share were to be calculated using the average profits of the past three years—Rs. 1,36,000 for 2014-15, Rs. 1,54,000 for 2015-16, and Rs. 1,00,000 for 2016-17—then Champak's profit share for the period from April 7, 2017, to June 30, 2017, would be determined using the average profit based on the profits from the last year, calculated as follows:

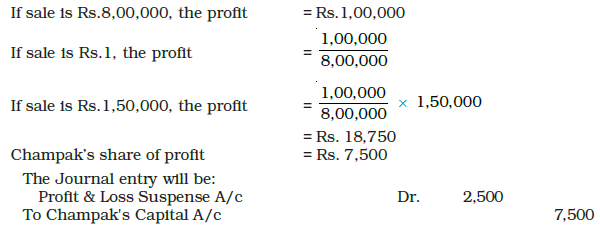

If the agreement specifies that the deceased partner’s profit share should be based on sales, and it is noted that sales for the year 2015-16 were Rs. 8,00,000, with sales from April 1, 2017, to June 30, 2017, totalling Rs. 1,50,000, then Champak’s profit share for the period from April 1, 2017, to June 30, 2017, will be calculated as follows.

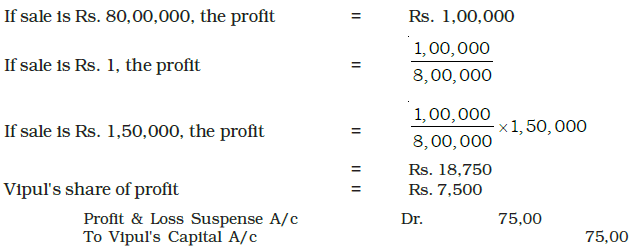

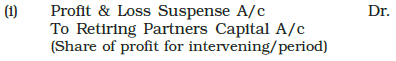

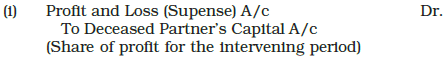

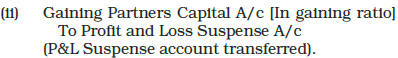

For being deceased partner’s share of profits for the intervening period to books of account, the following journal entry is recorded.

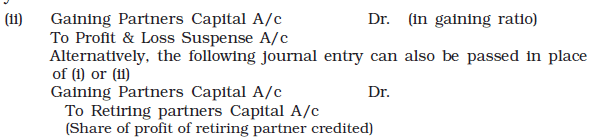

Later Profit and Loss Suspense account is closed by transferring the account to Gaining Partners' Capital Account in their gaining ratio. The journal entry is:

Alternatively, the following journal entry can also be passed in Place of (i) & (ii)

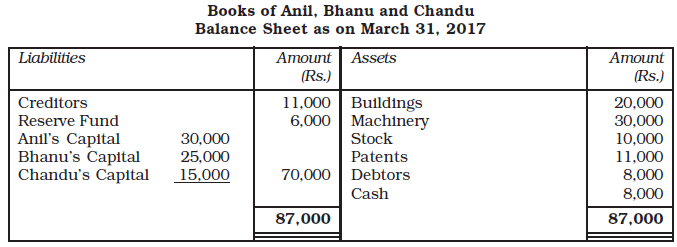

Example: Anil, Bhanu and Chandu were partners in a firm sharing profits in the ratio of 5:3:2. On March 31, 2017, their Balance Sheet was as under:

Anil died on October 1, 2017. It was agreed between his executors and the remaining partners that :

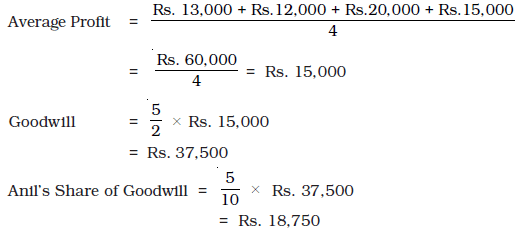

(a)Goodwill to be valued at  year’s purchase of the average profits of the previous four years which were :

year’s purchase of the average profits of the previous four years which were :

- Year 2013-14 – Rs.13,000, Year 2014-15 – Rs. 12,000,

- Year 2015-16 – Rs.20,000, Year 2016-17 – Rs.15,000

(b) Patents be valued at Rs.8,000; Machinery at Rs.28,000; and Building at Rs.25,000.

(c) Profit for the year 2017-18 be taken as having accrued at the same rate as that of the previous year.

(d) Interest on capital be provided at 10% p.a.

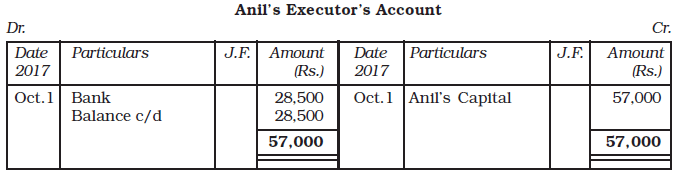

(e) Half of the amount due to Anil be paid immediately.

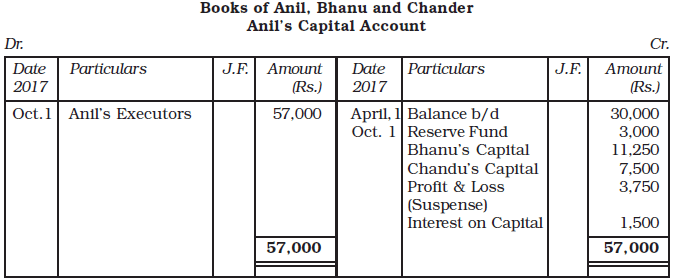

Prepare Anil’s Capital Account and Anil’s Executor’s Account as on October 1, 2017.

Ans:

Working Notes:

1.

2. Goodwill = 2½ years’ purchase × Average Profit

3. Profit from the date of the last balance sheet to the date of death

(April 1, 2017 to October 1, 2017) = 6 months

Profit for 6 months = Rs. 15,000 x (6/12) = Rs. 7,500

Anil’s share of profit = Rs. 7,500 x (5/10) = = Rs. 3,750

4. Interest on Capital

(April 1, 2017 to October 1, 2017)

= Rs. 30,000 x (10/100) x (6/12)

= Rs.1,500

|

42 videos|199 docs|43 tests

|

FAQs on Reconstitution of a Partnership Firm : Retirement/Death of a Partner Chapter Notes - Accountancy Class 12 - Commerce

| 1. What is meant by the 'amount due to retiring or deceased partner'? |  |

| 2. How is the new profit sharing ratio determined after the retirement or death of a partner? |  |

| 3. What is hidden goodwill, and how is it accounted for during the reconstitution of a partnership? |  |

| 4. What steps are involved in the process of valuing a partner's share upon retirement or death? |  |

| 5. How does the retirement or death of a partner affect the partnership agreement? |  |