Dissolution of a Partnership Firm Chapter Notes | Accountancy Class 12 - Commerce PDF Download

| Table of contents |

|

| Dissolution of Partnership |

|

| Dissolution of a Partnership Firm |

|

| Distinction between Dissolution of Partnership and Dissolution of Firm |

|

| Journal Entries |

|

Dissolution of Partnership

Dissolution of partnership alters the existing relationship among partners, but the firm can continue its business as usual. The dissolution of a partnership can occur in any of the following ways:

- Change in the existing profit-sharing ratio among partners.

- Admission of a new partner.

- Retirement of a partner.

- Death of a partner.

- Insolvency of a partner.

- Completion of the venture, if the partnership was formed for that purpose.

- Expiry of the partnership period, if the partnership was for a specific duration.

Dissolution of a Partnership Firm

A partnership firm can dissolve in two ways: without court intervention or through a court order. It's important to note that when a firm dissolves, the partnership also ends. However, a partnership can end without the firm dissolving.

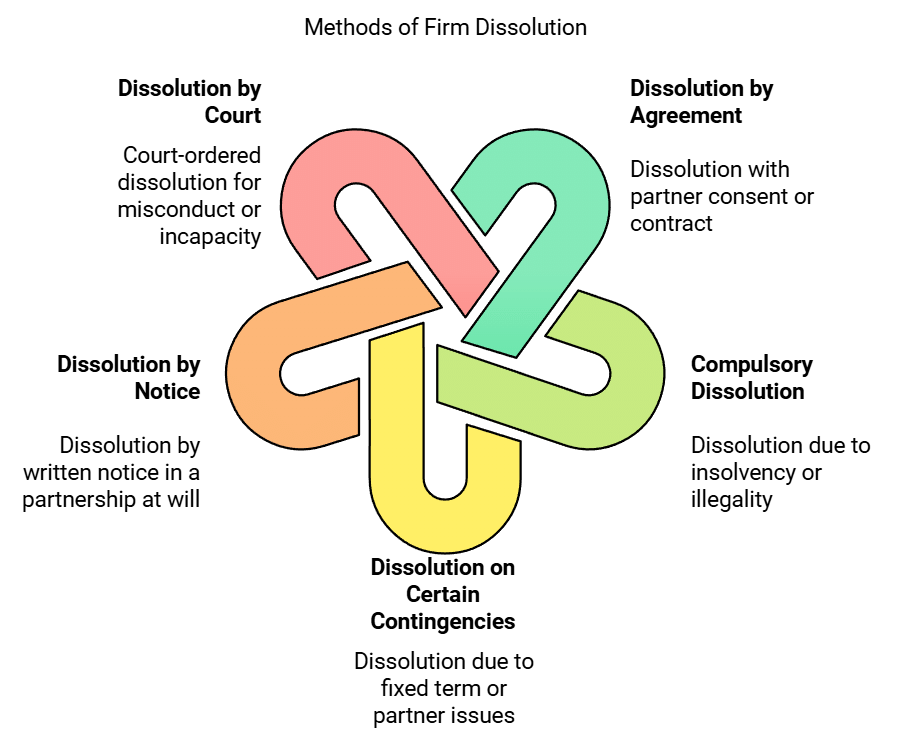

Ways of Dissolving a Firm:

- Dissolution by Agreement: The firm can be dissolved with the consent of all partners or according to a contract between them.

- Compulsory Dissolution: This occurs when all partners or all but one become insolvent, when the firm's business becomes illegal, or when an event makes it unlawful for the partners to continue the business together.

- Dissolution on Certain Contingencies: A firm can be dissolved if it was set up for a fixed term and that term expires, if it was set up for specific ventures and those are completed, upon the death of a partner, or if a partner is declared insolvent.

- Dissolution by Notice: In a partnership at will, any partner can dissolve the firm by giving written notice to the other partners.

- Dissolution by Court: A court can order the dissolution of a partnership firm on grounds such as a partner becoming insane, permanently incapable of performing their duties, guilty of misconduct affecting the business, breaching the partnership agreement, transferring their interest to a third party, or if the business cannot be carried on without incurring losses.

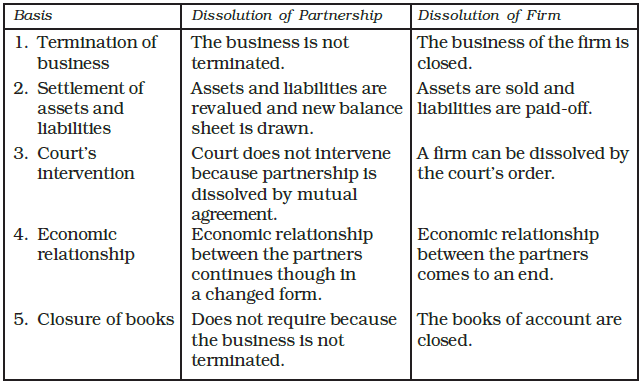

Distinction between Dissolution of Partnership and Dissolution of Firm

Settlement of Accounts

When a partnership firm dissolves, it stops its business activities and needs to settle its accounts. This involves selling off all its assets to pay off any claims against the firm. According to Section 48 of the Partnership Act 1932, the following rules apply unless the partners agree otherwise:

(a) Treatment of Losses:

Losses and capital deficiencies are to be paid in the following order:

- First from profits.

- Next from the partners' capital.

- Lastly, if needed, the partners individually in their profit-sharing ratio.

(b) Application of Assets:

- The firm's assets, including any contributions from partners to cover capital deficiencies, should be applied in the following order:

- To pay the firm's debts to third parties.

- To pay each partner what is due to them for advances (loans) made to the firm, proportionately.

- To pay each partner what is due to them on account of capital, proportionately.

- Any residue should be divided among the partners in their profit-sharing ratio.

- The money obtained from selling assets, along with any necessary contributions from partners, will first be used to pay off external liabilities such as creditors, loans, bank overdrafts, and bills payable.

- Secured loans take priority over unsecured loans.

- The remaining amount will be used to repay loans made by partners to the firm.

- If there isn't enough to cover these loans and advances, they will be paid proportionately.

- The leftover amount will settle capital account balances, and any surplus will be divided among partners according to their profit-sharing ratio.

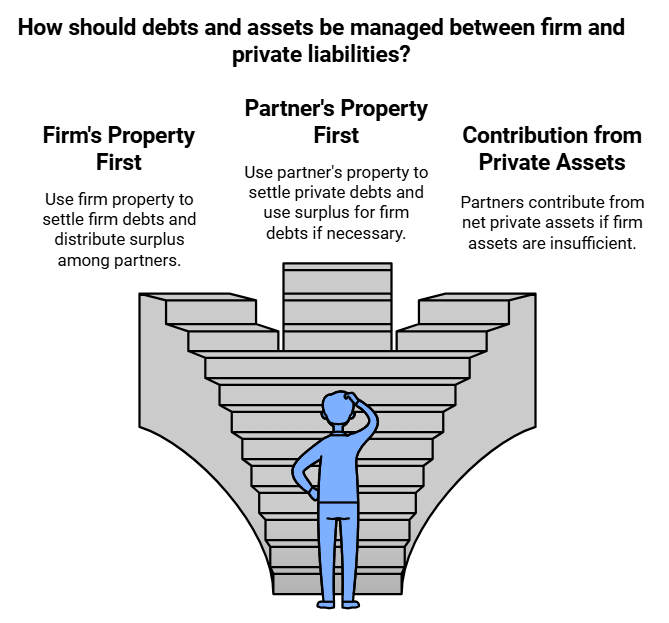

Private Debts and Firm’s Debts

- When both the firm’s debts and a partner’s private debts exist, the following rules from Section 49 of the Act apply:

- The firm’s property is used first to pay the firm’s debts. Any surplus is divided among the partners according to their claims, which can be used to pay their private liabilities.

- A partner’s private property is used first to pay their private debts. Any surplus may be used to pay the firm’s debts if the firm’s liabilities exceed its assets.

- It’s important to note that a partner’s private property does not include the personal properties of their spouse and children. If the firm’s assets are insufficient to cover its liabilities, partners must contribute from their net private assets (private assets minus private liabilities).

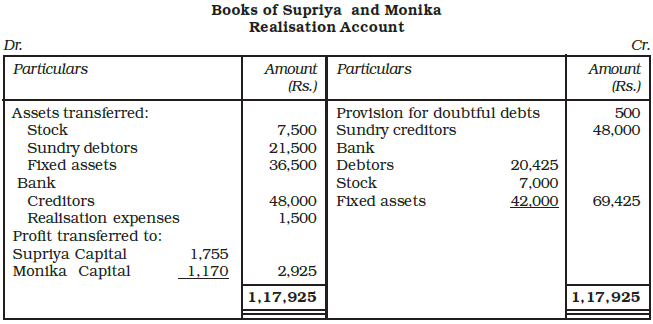

Accounting Treatment

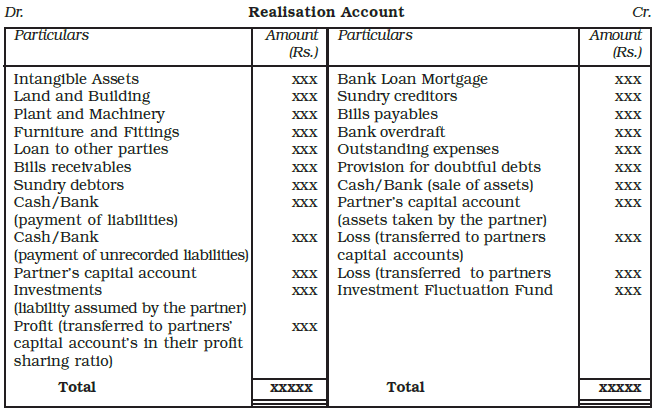

- When a firm is dissolved, its financial records are closed, and the profit or loss from the sale of assets and settlement of liabilities is calculated. This is done using a Realisation Account.

- The Realisation Account helps determine the net effect (profit or loss) from selling assets and paying off liabilities. The resulting profit or loss is then distributed to the partners' capital accounts according to their profit-sharing ratio.

- All assets (except cash in hand, bank balance, and any fictitious assets) and all external liabilities are transferred to the Realisation Account.

- The account also records the sale of assets, payment of liabilities, and any realisation expenses.

- The final balance in the Realisation Account represents the profit or loss on realisation, which is then allocated to the partners' capital accounts based on their agreed profit-sharing ratio.

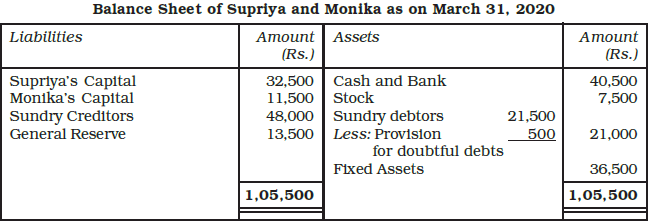

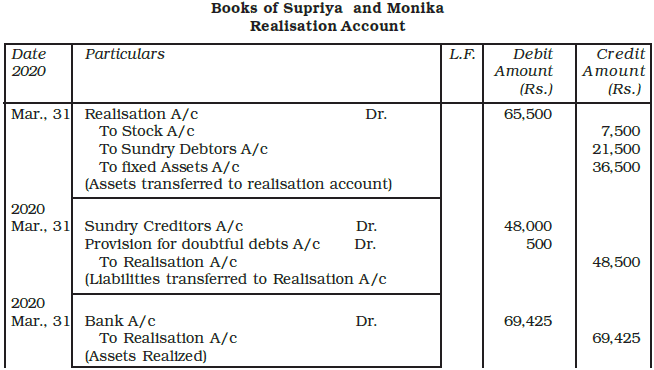

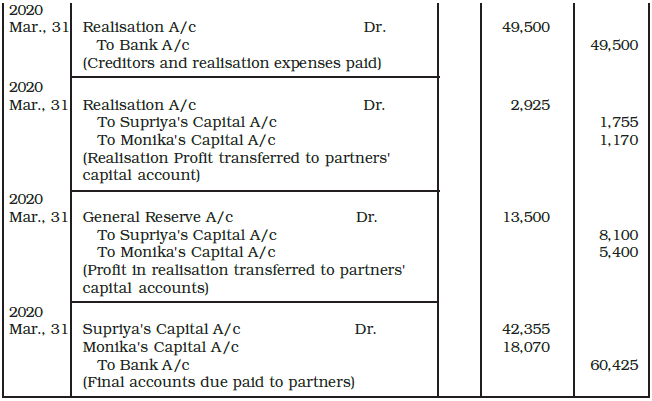

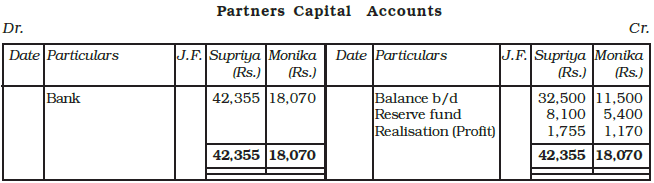

Example: Supriya and Monika are partners, who share profit in the ratio of 3:2. Following is the balance sheet as on March 31, 2020.

The firm was dissolved on March 31, 2020. Close the books of the firm with the following information:

(i) Debtors realised at a discount of 5%,

(ii) Stock realised at Rs.7,000,

(iii) Fixed assets realised at Rs.42,000,

(iv) Realisation expenses of Rs.1,500,

(v) Creditors are paid in full.

Record necessary journal entries at the time of dissolution of a firm.

Ans:

Working Notes

Journal Entries

1. For Transfer of Assets

- All asset accounts, except for cash, bank, and any fictitious assets, are closed by transferring them to the debit side of the Realisation Account at their book values.

- Sundry debtors are transferred at their gross value, while the provision for doubtful debts is transferred to the credit side of the Realisation Account along with liabilities.

- If a provision for a depreciation account is maintained, the same procedure applies to fixed assets.

2. For transfer of liabilities

- All accounts related to external liabilities, including any provisions that may exist, are finalized by moving their balances to the credit of the Realisation account.

3. For sale of assets

4. For an asset taken over by a partner

5. For payment of liabilities

6. For a liability which a partner takes responsibility to discharge

7. Settlement with Creditors through Asset Transfer

- When a creditor agrees to settle their account by accepting an asset, no journal entry is required if the asset represents a full and final settlement.

- However, if the creditor accepts the asset as a part payment, a journal entry is needed for the cash portion only.

For example, if a creditor is owed Rs. 10,000 and accepts office equipment worth Rs. 8,000 along with Rs. 2,000 in cash, the journal entry would be made only for the cash payment of Rs. 2,000. However, when a creditor accepts an asset whose value is more than the due amount he/she pay cash to the firm for the difference for which the entry will be:

However, when a creditor accepts an asset whose value is more than the due amount he/she pay cash to the firm for the difference for which the entry will be:

8. For payment of realisation expenses

(a) When some expenses are incurred and paid by the firm in the process of realisation of assets and payment of liabilities:

(b) When realisation expenses are paid by a partner on behalf of the firm:

(c) When a partner has agreed to bear the realisation expenses:

(i) if payment of realisation expenses is made by the firm

(ii) if the partner himself pays the realisation expenses, no entry is required

9. For agreed remuneration to such partner who agrees to undertake the dissolution work

10. For realisation of any unrecorded assets including goodwill, if any

11. For settlement of any unrecorded liability

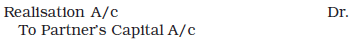

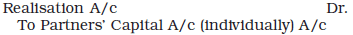

12. For transfer of profit and loss on realisation (Cr. Balance)

(a) In case of profit on realisation

(b) In case of loss on realisation

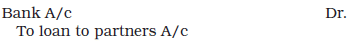

13. For settlement of loan by a firm to a partner

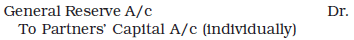

14. For transfer of accumulated profits in the form of general reserve to partners’ capital accounts in their profit-sharing ratio

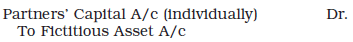

15. For transfer of fictitious assets, if any, to partners’ capital accounts in their profit-sharing ratio

16. For payment of loans due to partners

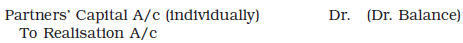

17. For settlement of partners’ accounts

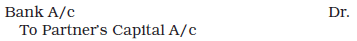

If the partner’s capital account shows a debit balance after the posting of rebound entries firms, he brings in the necessary cash for which the entry will be:

It may be noted that the aggregate amount finally payable to the partners must equal to the amount available in bank and cash accounts. Thus, all accounts of a firm are closed in case of dissolution.

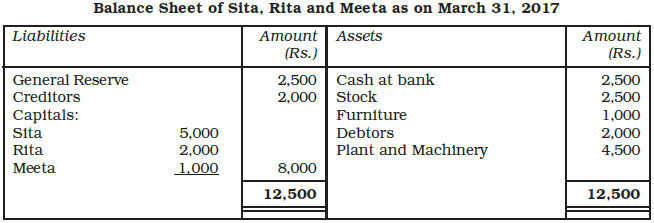

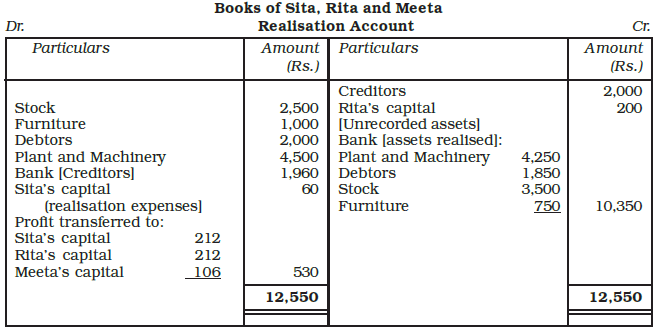

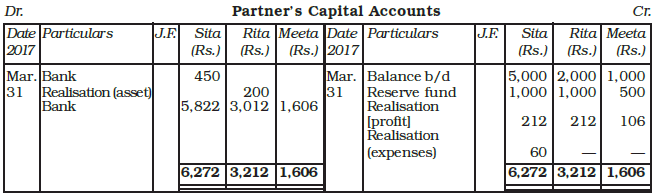

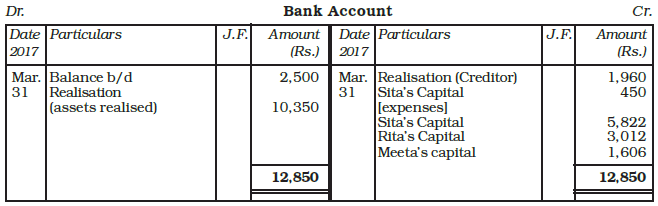

Example: Sita, Rita and Meeta are partners sharing profit and losses in the ratio of 2:2:1. Their balance sheet as on March 31, 2017 is as follows:

They decided to dissolve the business. The following amounts were realised:

Plant and Machinery Rs.4,250, Stock Rs.3,500, Debtors Rs.1850, Furniture 750. Sita agreed to bear all realisation paid by the firm expenses. For the service, Sita is paid Rs.60.

Actual expenses on realisation paid by the firm amounted to Rs.450.Creditors paid 2% less. There was an unrecorded assets of Rs.250, which was taken over by Rita at Rs.200. Prepare the necessary accounts to close the books of the firm.

Ans:

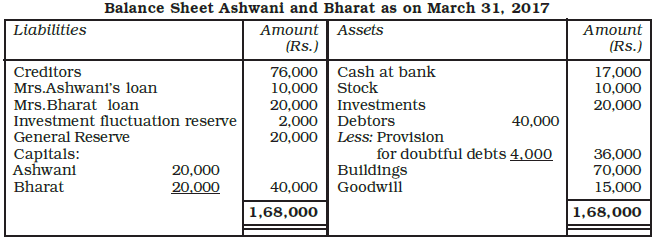

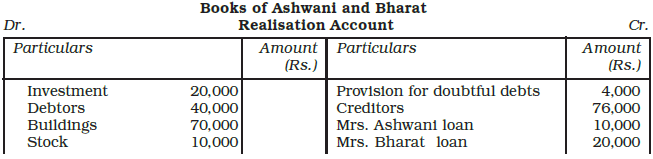

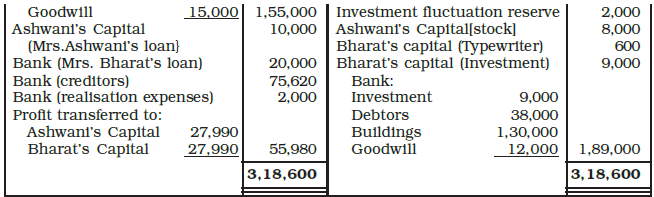

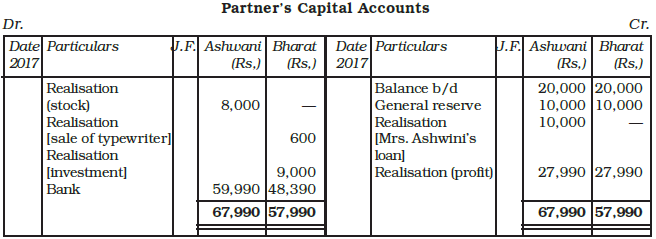

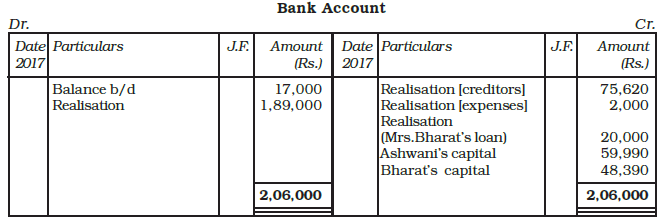

Example: Following is the Balance Sheet of Ashwani and Bharat on March 31, 2017.

The firm was dissolved on that date. The following were agreed transactions that took place.

(i) Aswhani promised to pay Mrs. Ashwani’s loan and took away stock for Rs.8,000.

(ii) Bharat took away half of the investment at 10% less. Debtors realised for Rs.38,000. Creditors were paid at less than Rs.380. Buildings realised for Rs.1,30,000, Goodwill Rs.12,000 and the remaining Investment were sold at Rs.9,000. An old typewriter not recorded in the books was taken over by Bharat for Rs. 600. Realisation expenses amounted to Rs. 2,000. Prepare Realisation Account, Partner’s Capital Account and Bank Account.

Ans:

|

42 videos|199 docs|43 tests

|

FAQs on Dissolution of a Partnership Firm Chapter Notes - Accountancy Class 12 - Commerce

| 1. What are the primary reasons for the dissolution of a partnership firm? |  |

| 2. What is the process for dissolving a partnership firm? |  |

| 3. How are the assets and liabilities of a partnership firm settled during dissolution? |  |

| 4. What are the legal implications of dissolving a partnership firm? |  |

| 5. Can a partnership firm be dissolved unilaterally by one partner? |  |