RD Sharma Solutions (Part - 2) - Ex-13.1, Simple Interest, Class 7, Math | RD Sharma Solutions for Class 7 Mathematics PDF Download

QUESTION 12:

Mr Garg lent Rs 15000 to his friend. He charged 15% per annum on Rs 12500 and 18% on the rest. How much interest does he earn in 3 years?

ANSWER 12:

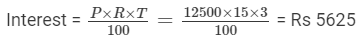

Principal amount (P) = Rs 12500

Time period (T) = 3 years

Rate of interest (R) = 15% p.a.

Rest of the amount lent = Rs 15000 − Rs 12500 = Rs 2500

Rate of interest = 18 % p.a.

Time period = 3 years

Total interest earned = Rs 5625 + Rs 1350 = Rs 6975

Question 13:

Shikha deposited Rs 2000 in a bank which pays 6% simple interest. She withdrew Rs 700 at the end of first year. What will be her balance after 3 years?

Answer 13:

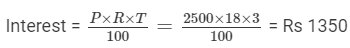

Principal amount deposited (P) = Rs 2000

Time period (T) = 1 year

Rate of interest (R) = 6% p.a.

Interest after 1 year =

So amount after 1 year = Principal amount + Interest = 2000 + 120 = Rs 2120

After 1 year, amount withdrawn = Rs 700

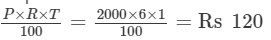

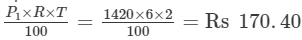

Principal amount left (P1) = Rs 2120 − Rs 700 = Rs 1420

Time period (T) = 2 years

Rate of interest (R) = 6% p.a.

Interest after 2 years =

Total amount after 3 years = Rs 1420 + Rs 170.40 = Rs 1590.40

Question 14:

Reema took a loan of Rs 8000 from a money lender, who charged interest at the rate of 18% per annum. After 2 years, Reema paid him Rs 10400 and wrist watch to clear the debt. What is the price of the watch?

Answer 14:

Principal amount (P) = Rs 8,000

Rate of interest (R) = 18%

Time period (T) = 2 years

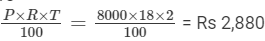

Interest after 2 years =

Total amount payable by Reema after 2 years = Rs 8,000 + Rs 2,880 = Rs 10,880

Amount paid = Rs 10,400

Value of the watch = Rs 10,880 − Rs 10,400 = Rs 480

Question 15:

Mr Sharma deposited Rs 20000 as a fixed deposit in a bank at 10% per annual. If 30% is deducted as income tax on the interest earned, find his annual income.

Answer 15:

Amount deposit (P) = Rs 20,000

Rate of interest (R) = 10% p.a.

Time period (T) = 1 year

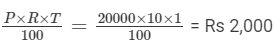

Interest after 1 year =

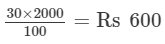

Amount deducted as income tax = 30% of Rs 2,000 =

Annual interest after tax deduction = Rs 2,000 − Rs 600 = Rs 1,400

FAQs on RD Sharma Solutions (Part - 2) - Ex-13.1, Simple Interest, Class 7, Math - RD Sharma Solutions for Class 7 Mathematics

| 1. What is the formula for calculating simple interest? |  |

| 2. How is simple interest different from compound interest? |  |

| 3. How can I calculate the amount after simple interest is added? |  |

| 4. Can you give an example to understand simple interest better? |  |

| 5. Is simple interest always calculated in years? |  |