NCERT Solution: Accounting for Not for Profit Organisation - 1 | Accountancy Class 12 - Commerce PDF Download

Quick Recap

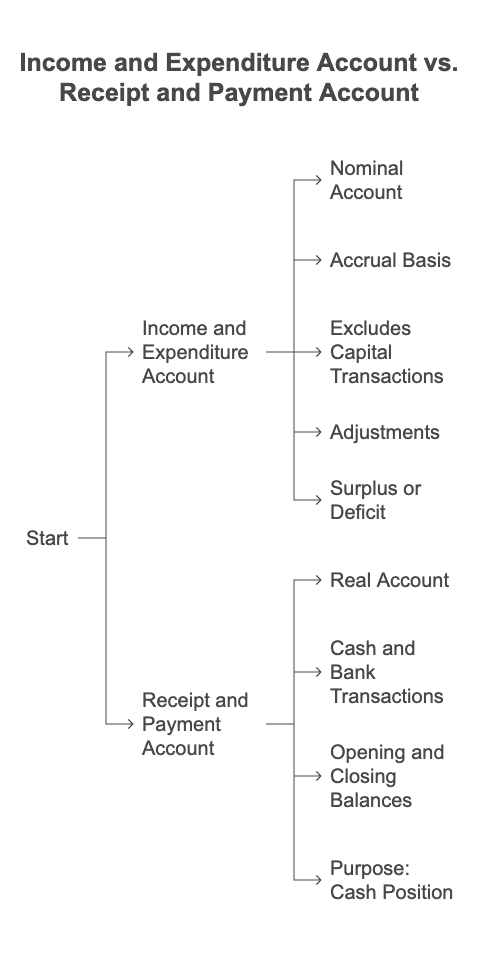

Not-for-profit organisations keep a financial statement every year for legal reasons, as mentioned in the chapter accounting for not-for-profit organisation. A financial statement is necessary for the proper utilization of funds and safekeeping of the general funds from misappropriation. These organisations follow the double-entry system of accounting. The financial statements of such organisations consist of the following:

- Receipt and Payment Account

- Income and Expenditure Account

- Balance Sheet

Page No. 50

Short Answers Type Questions

Q.1. State the meaning of 'Not-for-Profit' Organisations.

Ans. Not-for-Profit Organisations (NPO) are set up with the prime objective of providing services and not to earn profit thereby enhancing the welfare of society. Such organisations include schools, hospitals, trade unions, religious organisations, etc. The persons or the groups of individuals who govern and manage the working of an NPO are known as trustees. NPO's main sources of income are donations, subscriptions, life membership fees, grants etc. As these organisations are not set up with profit motive, they do not prepare Trading and Profit and Loss Account. Instead, they maintain Receipt and Payments Account, Income and Expenditure Account and Balance Sheet.

Q.2. State the meaning of Receipt and Payment Account.

Ans. Receipts and Payments Account is a summary of the Cash Book. All cash receipts are recorded on the Receipts side (i.e. Debit side) and all cash payments are recorded on the Payments side (i.e. Credit side) of Receipts and Payments Account. It is prepared on the basis of cash and bank transactions recorded in the Cash Book. It begins with the opening balance of cash and bank and ends with the closing balances of cash and bank (balancing figure) at the end of the accounting period. It records all cash and bank transactions both of capital and revenue nature. It not only records the cash and bank transactions relating to the current accounting period, but also the cash and bank receipts (or payments) received during the current accounting period that may be related to the previous or next accounting period.

This account only helps us to ascertain the closing balance of the cash and bank and helps in assessing the cash position of an NPO.

Q.3. State the meaning of Income and Expenditure Account.

Ans. Income and Expenditure Account (I&E) is similar to the Profit and Loss Account in the sense that while the former is prepared to ascertain surplus or deficit during an accounting period, the latter is prepared to ascertain net profit or net loss incurred during an accounting period. I&E Account is a nominal account and is prepared on the accrual basis. It records all transactions of revenue nature that are related to the current accounting period (whether outstanding or prepaid) for which the books are maintained. All expenses and losses are recorded on the debit side (Expenditure side) and all income and gains are recorded on the credit side (Income side) of I&E Account. The closing balance or the balancing figure of I&E Account is termed as surplus (or deficit), if the sum total of the Income side exceeds (is lesser than) the sum total of the Expenditure side.

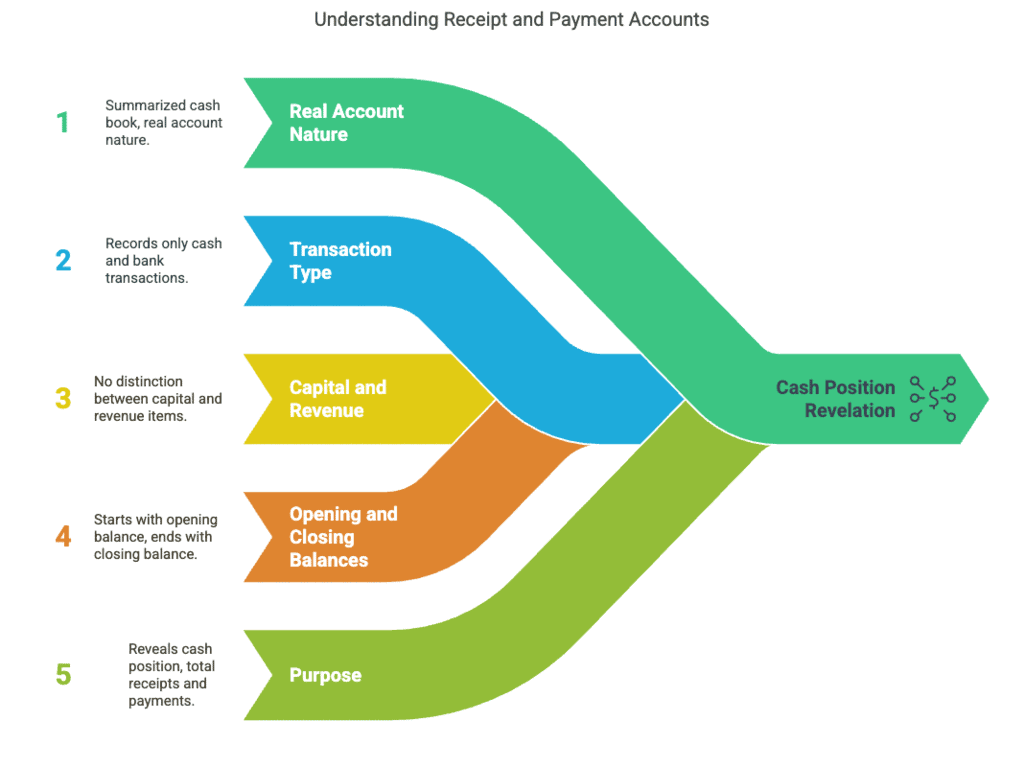

Q.4. What are the features of Receipt and Payment Account?

Ans. The following are the features of Receipt and Payment Account:

- Nature: It is a Real Account. It is a summarized version of Cash Book.

- Nature of Transactions: It records only cash and bank transactions. Transactions other than cash and bank like depreciation, loss/ profit on sale of assets, etc. are not recorded in this account.

- No distinction between Capital and Revenue items: It records all cash and bank receipts and payments of both capital and revenue nature.

- Opening and closing balance: It begins with the opening balance of cash and bank and ends with the closing balance of the cash and bank (balancing figure) at the end of the accounting period.

- Purpose: It reveals the cash position of an organisation. It helps to ascertain the total amount paid and received during an accounting period.

Q.5. What steps are taken to prepare Income and Expenditure Account from a Receipt and Payment Account?

Ans. The following steps are taken to prepare Income and Expenditure Account (I&E) from Receipts and Payment Account (R&P):

Step 1: All the revenue expenditures paid for the current accounting period are transferred from the Payments side of R&P to the Expenditure side of I&E.

Step 2: All the revenue receipts for the current accounting period are transferred from the Receipts side of R&P to the Income side of I&E.

Step 3: Expenses outstanding for the current period and expenses paid in advance (prepaid expenses) for the current period in the preceding accounting periods are to be added (adjusted) to their related expenses in the Step 1.

Step 4: Income outstanding (accrued income) for the current period and income received in advance for the current period in the preceding accounting periods are to be added (adjusted) to their related incomes in Step 2.

Step 5: Non-cash items like depreciation, appreciation for the current accounting period are to be adjusted in the I&E.

Step 6: After adjusting all the revenue items for the current accounting period, the Income and the Expenditure sides are totaled. If the sum total of the Income side exceeds (or is lesser than) the sum total of the Expenditure side, then the balancing figure is termed as surplus (or deficit).

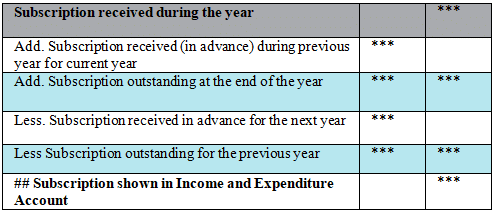

Q.6. What is subscription? How is it calculated?

Ans. Subscription is the main source of income for an NPO besides entrance fees, donations, grants, etc. Subscriptions refer to the amount of money paid by the members on periodic basis for keeping their membership with the organisation alive. It is paid monthly, quarterly, half yearly or annually by the members.

It is shown in the debit side of the Receipt and Payment Account with the total amount received during the year that may be related to the current period and to the previous and next accounting period.

While calculating subscription for the current period, advance subscription received for the current period in the previous period and outstanding subscription for the current period are added to the subscription received during the current period. Whereas, on the other hand, advance subscription received for the next accounting period during the current period and outstanding subscription for the preceding period are deducted from the subscription received during the current period.

Calculation of Subscription:

## This subscription is related to the current accounting period and is shown in the Income side of the Income and Expenditure Account.

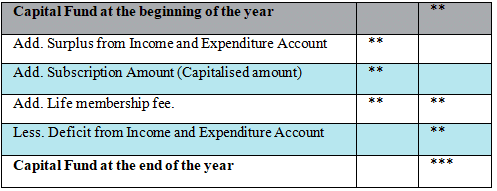

Q.7. What is Capital Fund? How is it calculated?

Ans. Capital fund is the excess of NPO's assets over its liabilities. In other words, the excess of assets over the liabilities for a profit earning organisation is termed as capital and the same for an NPO is termed as capital fund. Any surplus or deficit ascertained from Income and Expenditure account is added to (deducted from) the capital fund. It is also termed as Accumulated Fund.

Calculation of Capital Fund:

Page No. 51

Long Answer Type Questions

Q.1. Explain the statement: “Receipt and Payment Account is a summarized version of Cash Book”.

Ans. Receipts and Payments Account is a summary of the Cash Book. This account is prepared by those organisations which maintain their books on cash basis. All cash receipts are recorded on the Receipts side (i.e. Debit side) and all cash payments are recorded on the Payments side (i.e. Credit side) of Receipts and Payments Account. It is prepared on the basis of cash and bank transactions recorded in the Cash Book.

It begins with the opening balance of cash and bank and ends with the closing balances of cash and bank (balancing figure) at the end of the accounting period. It records all the cash and bank transactions both of capital and revenue nature. It not only records the cash and bank transactions relating to the current accounting period, but also cash and bank receipts (or payments) received during the current accounting period that may be related to the previous or next accounting period.

This account only helps us to ascertain the closing balance of the cash and bank and helps in assessing the cash position of an NPO. It also forms the basis for the preparation of Income and Expenditure Account.

Similarities between Receipt and Payments Account and Cash Book

The following are the features of Receipt and Payment Account that are common to those of Cash Book:

- Nature: It is a summarized version of the Cash Book. Similar to the Cash Book, the Receipt and Payment Account is also a Real Account.

- Nature of Transactions: It records only cash and bank transactions similar to a Two-Column Cash Book. Transactions other than cash and bank like depreciation, loss/ profit on sale of assets, etc. are not recorded in this account.

- No distinction between Capital and Revenue items: It records all the cash and bank receipts and payments of both capital and revenue nature. Likewise, the transactions recorded in the Cash Book are also of both capital and revenue nature.

- Opening and closing balance: It begins with the opening balance of cash and bank and ends with the closing balance of the cash and bank (balancing figure) at the end of the accounting period.

- Purpose: It reveals the cash position of an organisation. It helps to ascertain the total amount paid and received during an accounting period. Similarly, a Cash Book also helps us to assess the cash position of an organisation.

Thus, on the basis of the above mentioned points and similarities, the statement 'Receipt and Payment Account is a summarized version of Cash Book' is justified.

Q.2. “Income and Expenditure Account of a Not-for-Profit Organisation is akin to Profit and Loss Account of a business concern”. Explain the statement.

Q.2. “Income and Expenditure Account of a Not-for-Profit Organisation is akin to Profit and Loss Account of a business concern”. Explain the statement.

Ans. Income and Expenditure Account (I&E) is similar to Profit and Loss Account (P&L), in the sense that the former is prepared by Not-for-profit-Organisations and the latter is prepared by profit earning organisations. Both the accounts are prepared on the accrual basis.

Similar to the P&L, all the expenses and losses pertaining to the current accounting period are recorded on the debit side (Expenditure side) and all the gains and income of the current accounting period are recorded on the credit side (Income side) of the I&E. The balancing figure of the I&E is surplus or deficit and that of the P&L is net profit or net loss. Both the accounts record only revenue items which are related to the current accounting period.

Similarities between Income and Expenditure Account and Profit and Loss Account

I&E Account of an NPO is akin to the Profit and Loss Account of a profit earning business in the following manners.

- Nature of Account: Both the concerned accounts are nominal in nature.

- Basis of Recording: Both the accounts record only revenue expenses and revenue income related to the current accounting period. The items of capital nature are not ignored while preparing these accounts.

- Period: Transactions related to current year are recorded in Income and Expenditure account in the same manner in which profit and loss account is prepared. Transactions related to previous year or next year are excluded.

- Adjustments: The treatment of adjustments like, outstanding expenses, prepaid expenses, income received in advance, income due but not received, depreciation, bad debts etc. is same as that in Profit and Loss Account. Thus, both the accounts are prepared on the accrual basis.

Q.3. Explain the basic features of Income and Expenditure Account and of Receipt and Payment Account.

Ans. Income and Expenditure Account (I&E) Account is a Nominal Account and is prepared on the accrual basis. It records all transactions of revenue nature that are related to the current accounting period (whether outstanding or prepaid) for which the books are maintained. All expenses and losses are recorded on the debit side (Expenditure side) and all income and gains are recorded on the credit side (Income side) of I&E Account. The closing balance or the balancing figure of I&E Account is termed as surplus (or deficit), if the sum total of the Income side exceeds (is lesser than) the sum total of the Expenditure side.

The following are the basic features of Income and Expenditure Account:

- Nature: It is a Nominal Account. The debit side of I&E records all expenses and losses and the credit side records all incomes and gains related to the current accounting period.

- Basis: It is prepared on the basis of Receipt and Payment Account (R&P). All the revenues items whether incomes or expenditures are transferred from R&P.

- Excludes Capital Transactions: The transactions those are capital in nature are excluded from this account. For example, only profit or loss on sale of fixed assets is recorded but the total amount of sales is not recorded since sale of fixed asset is considered as a capital receipt.

- Akin to Profit and Loss Account: Income and Expenditure Account (I&E) is similar to the Profit and Loss Account in the sense that while the former is prepared to ascertain surplus or deficit during an accounting period the latter is prepared to ascertain net profit or net loss incurred during an accounting period.

- Records only Current Year’s items: This account records only those transactions that are related to current accounting year. In other words, transactions related to the preceding or succeeding accounting period are excluded even if these transactions are realized in the current period.

- Adjustments: Various cash and non-cash items like, outstanding expenses, prepaid expenses, income received in advance, income due but not received, depreciation, bad debts, etc. can be adjusted in this account.

- Balancing Figure: The balancing figure of this account is expressed in terms of either surplus (if incomes > expenses) or deficit (if expenses > incomes). The surplus balance, if any, is added to the Capital Fund, whereas, the deficit balance, if any, is deducted from the Capital Fund.

Receipts and Payments Account is a summary of the Cash Book. All the cash receipts are recorded on the Receipts side (i.e. Debit side) and all the cash payments are recorded on the Payments side (i.e. Credit side) of Receipts and Payments Account. It is prepared on the basis of cash and bank transactions recorded in the Cash Book. It begins with the opening balance of cash and bank and ends with the closing balances of cash and bank (balancing figure) at the end of the accounting period. It records all the cash and bank transactions both of capital and revenue nature. It not only records the cash and bank transactions relating to the current accounting period but also cash and bank receipts (or payments) received during the current accounting period that may be related to the previous or next accounting period.

The following are the features of Receipt and Payment Account:

- Nature: It is a Real Account. It is a summarized version of the Cash Book.

- Nature of Transactions: It records only cash and bank transactions. Transactions other than cash and bank like depreciation, loss/ profit on sale of assets, etc. are not recorded in this account.

- No distinction between Capital and Revenue items: It records all cash and bank receipts and payments of both capital and revenue nature.

- Opening and closing balance: It begins with the opening balance of cash and bank and ends with the closing balance of the cash and bank (balancing figure) at the end of the accounting period.

- Purpose: It reveals the cash position of an organisation. It helps to ascertain the total amount paid and received during an accounting period.

Q.4. Show the treatment of the following items by a Not-for-Profit Organisation:

(i) Annual subscription

(ii) Specific donation

(iii) Sale of fixed assets

(iv) Sale of old periodicals

(v) Sale of sports materials

(vi) Life membership fee

Ans.

(i) Annual Subscription

- Subscriptions received during an accounting year (whether related to the current year or previous and subsequent year) are shown on the debit side of the Receipts and Payments Account.

- Subscription amount related to the current accounting year only, whether received or yet to be received are shown on the credit side of the Income and Expenditure Account.

- Subscriptions received in advance for the subsequent year are shown on the Liabilities side of the Balance Sheet.

- Subscriptions due but not received are shown in the Assets side of the Balance Sheet.

(ii) Specific donation

- The amount received for specific donation is shown on the debit side of the Receipts and Payments Accounts.

- The amount received for specific donation is shown on the Liabilities side of the Balance Sheet as it is used for the specific purpose for which it is received.

(iii) Sale of fixed assets

- The amount received from the sale of fixed assets are recorded on the debit side of the Receipts and Payments Account.

- Profit (or loss) on the sale of fixed assets is credited (or debited) to the Income and Expenditure Account.

- The book-value of the fixed assets sold is deducted from its respective assets on the Assets side of the Balance Sheet.

(iv) Sale of old periodicals

- The amount received from the sale of old periodicals are shown on the debit side of the Receipts and Payments Account.

- As the sale of old periodicals by any organisation is considered as revenue receipts, so it is shown on the credit side of the Income and Expenditure Account.

(v) Sale of sport Materials

- The amount received from the sale of sport materials are debited to the Receipt and Payments Account.

- As the sale of sport materials by any sport club is considered as revenue income, so it is shown on the credit side of the Income and Expenditure Account.

(vi) Life Membership Fees

- The amount paid by a person to become a member of an organisation is called life membership fees. As this is a receipt for an NPO, so it is debited to the Receipt and Payment Account.

- Life Membership fees is not recurring in nature and received once for a whole life from a member. Thus, as Life Membership Fees are capital receipts, so these are added to the Capital Fund on the Liabilities side of the Balance Sheet.

Q.5. Show the treatment of items of Income and Expenditure Account when there is a specific fund for those items.

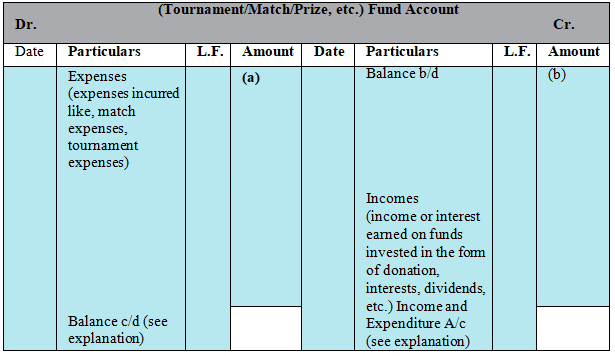

Ans. There are various sources of receipts like donations, subscriptions, government grants, etc. to an NPO. Some receipts are specific while others are general. While the former can only be used for the specific purpose for which they are received, the latter can be used for any purpose.

For Example: If donation is received for construction of buildings, then this donation is a specific donation and thereby can only be used for construction of the building.

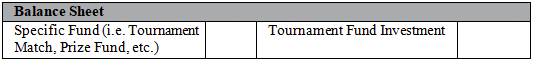

The specific receipts are not considered as revenue income for the NPO and hence are not shown in the Income and Expenditure Account. In fact, such receipts are considered as liabilities to the NPO as these amounts are received for specific purpose and cannot be used for any other purpose. Specific receipts are shown in the Liabilities side of the Balance Sheet, until and unless they are fully set off against the purpose for which they are received.

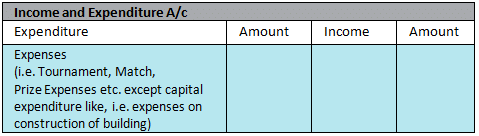

On the other hand, if these amounts are invested outside the organisations (in the form of shares, debentures, etc.), then these are called funds like, match funds, prize fund, etc. The interest and income earned on such investments are not credited to the Income and Expenditure Account but in fact are credited to the respective Fund Account. Similarly, the expenses incurred for such funds are not debited to the Income and Expenditure Account but, in fact, are debited to the respective Fund Account. These special funds are shown in the Liabilities side of the Balance Sheet. In case, if the related expenses exceed the related receipts of the fund, then the difference is shown in the income and Expenditure Account.

Treatment for items received for specific purpose

Explanation (a)

If the receipts exceed the expenses for specific purpose then the difference between the two is shown in the Liabilities side of the Balance Sheet

Explanation (b)

If the expenses exceed the receipts for the specific purpose then the difference between the two is shown in the Expenditure side of the Income and Expenditure Account.

Q.6. What is Receipt and Payment Account? How is it different from Income and Expenditure Account?

Ans. Receipts and Payments Account is a summary of the Cash Book. All the cash receipts are recorded on the Receipts side (i.e. Debit side) and all the cash payments are recorded on the Payments side (i.e. Credit side) of Receipts and Payments Account. It is prepared on the basis of cash and bank transactions recorded in the Cash Book. It begins with the opening balance of cash and bank and ends with the closing balances of cash and bank (balancing figure) at the end of the accounting period. It records all cash and bank transactions both of capital and revenue nature. It not only records cash and bank transactions relating to the current accounting period, but also cash and bank receipts (or payments) received during the current accounting period that may be related to the previous or next accounting period.

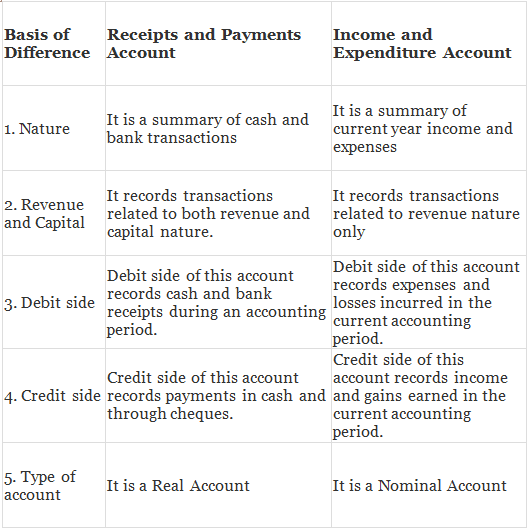

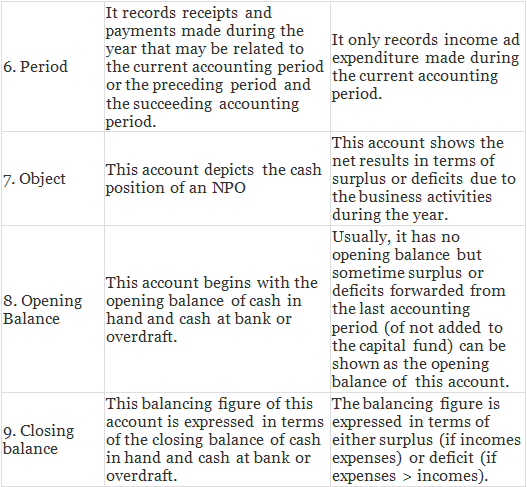

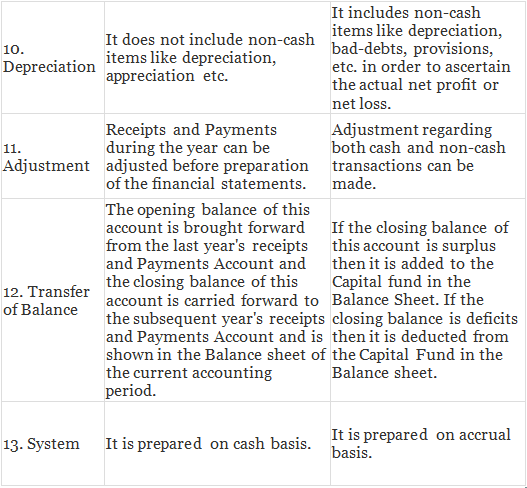

Distinguish between Receipts and Payments Account and Income and Expenditure Account

|

42 videos|199 docs|43 tests

|

FAQs on NCERT Solution: Accounting for Not for Profit Organisation - 1 - Accountancy Class 12 - Commerce

| 1. What is a not-for-profit organisation? |  |

| 2. How are not-for-profit organisations different from for-profit organisations? |  |

| 3. What are the sources of income for a not-for-profit organisation? |  |

| 4. How are not-for-profit organisations accountable to their donors and members? |  |

| 5. What is the role of accounting in a not-for-profit organisation? |  |