Introduction - Bank Reconciliation Statement - Commerce PDF Download

There are two types of books:

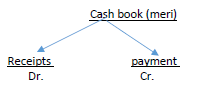

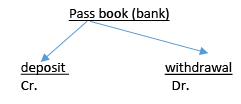

• Cash book (meri book)

• Pass book ( bank ki book)

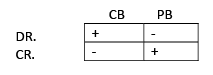

Now there is a difference in both the books which is to be reconcilied by preparing a Bank Reconciliation Statement.

Meaning of BRS:

BRS is prepared mainly to reconcile the difference between the bank balance shown by the cash book and bank pass book.

Need and Impotance of Bank Reconciliation Statement:

Bank Reconciliation Statement is prepared because of the following reasons:

1. It brings to light errors that may have been committed either in the Cash Book or in the Bank Statement or Pass Book.

2. Undue delay in the clearance of cheques deposited is known from the reconciliation.

3. Regular reconciliation discourages embezzlements.

4. Reconciliation helps the management to verify the accuracy of entries recorded in the Cash Book.

5. It shows actual bank balance.

Reasons of Difference Between Balances as per Cash Book and Bank Statement or Bank Pass Book:

1. Difference Due to Timing: There is always a time gap between recording a transaction in the books of accounts and it being recorded by the bank.

For example-

a cheque issued is recorded in the Cash Book immediately but the bank records it when it is presented for payment. Similarly, a cheque deposited is recorded in the Cash Book immediately whereas the bank credits it when it is cleared, i.e., bank has collected the amount.

2. Transactions Recorded by the Bank: Sometimes transactions are recorded by the bank, which are not known to the account holder. The account holder records it in his/ her books of accounts after receiving the Bank Statement or Pass Book.

For example-

interest charged or allowed, bank charges, transfer of balance from one account to another.

3. Errors: Errors may be committed by the bank or the account holder and these errors result in difference in the balances of Cash Book and Bank Statement or Pass Book.

For example-

wrong balance may be carried forward, a transaction may not have been recorded in the Cash Book or a transaction may have been wrongly recorded in an account.

Proforma of bank reconcitiation statement:

| Particulars | Amount Rs (+) | Amount Rs (+) | |

| Balance as per Cheques issues but not presented interest credited by the bank Cheque deposited but not reedited by the bank Bank charges not recorded in the cash book Balance as per the passbook. |

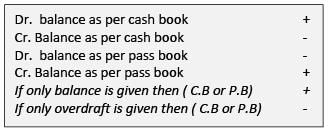

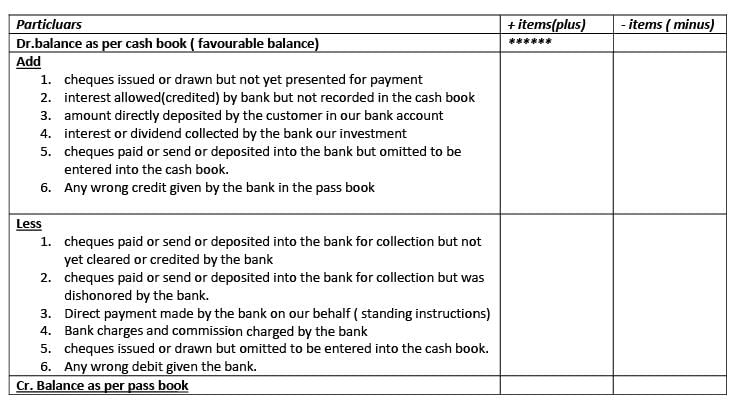

Format of BRS when Dr. bal. as per cash book is taken as the starting point : Bank reconciliation statement

As on ……

FAQs on Introduction - Bank Reconciliation Statement - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is it important to reconcile bank statements? |  |

| 3. What are the steps involved in preparing a bank reconciliation statement? |  |

| 4. What are the common reasons for differences between the company's records and the bank statement? |  |

| 5. How frequently should bank reconciliation statements be prepared? |  |