Sample Questions - Issue of Debentures | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Issue of Debentures

Time – 50 mins

M.M. - 30

Q1. Globe Ltd. issues 20,000, 9% debentures or 100 each at a discount of 5% redeemable at the end of 5 years at a premium of 6%. For what amount loss on Issue of Debentures Account' will be debited? (1 mark)

Q2. 1,000, 14% debentures of 100 each issued at a discount of 5% to a supplier of machinery, find the amount of purchase consideration? (1 mark)

Q3. What are zero coupon bonds? (1 mark)

Q4. Explain with an imaginary example how issue of debenture as collateral security is shown in the balance sheet of a company when it is recorded in the books of accounts. (3 marks)

Q5. King Ltd took over Assets of 25,00,000 and liabilities of 6,00,000 of Queen Ltd. King Ltd paid the purchase consideration by issuing 10,000 debentures of 100 each at a premium of 10% and 11,00,000 by Bank Draft. Pass necessary journal entries. (3 marks)

Q6. On 1-1-2005, Fast Computers Ltd. issued 20,00,000, 6% debentures of 100 each at a discount of 4% redeemable at a premium of 5% after three years. The amount was payable as follows: On application 50 per debenture.

Balance on allotment. Record the necessary journal entries for issue of debentures. (3 marks)

Q7. X Ltd. took over the Assets of Rs. 3,60,000 and Creditors of Rs. 42,000 of Y & Co. for an agreed amount of Rs. 3,30,000 by the issue of fully paid 12% Debentures of Rs. 100 each at a premium of 10%.These Debentures are redeemable at a premium of 5% after 3 years. Pass the necessary journal entries in the books of X. Ltd. (4 marks)

Q8. A Ltd. Company issued debentures of ₹1,00,000 which were issued as follows:

(1) For cash at 90% 50,000 (Nominal)

(2) For creditor for 20,000 Capital Expenditure in satisfaction of his claim 25,000 (Nominal)

(3) To Bankers for a loan of 15,000 as collateral security 25,000 (Nominal) The issue (1) and (2) are redeemable at the end of 10 years at premium of 10%.pass entries? (4 marks)

Q9. X ltd. issued 6,000, 12% debentures of Rs. 200 each on April 01, 2010 at a discount of 15% redeemable at a premium of 20%. Give journal entries relating to the issue of debentures and debentures interest for the period ending March 31, 2011 assuming that interest is paid half yearly on September 30 and March 31 and tax deducted at source is 20%. Pass necessary journal entries. (4 marks)

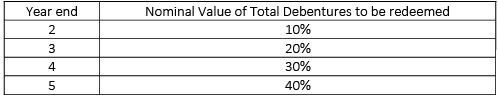

Q10. On 1.4.2015, X Ltd. issued 1,20,000 15% Debentures of Rs. 100 each at 95% redeemable at par and redeemable at a premium of 10% as follows:

Pass entries and prepare loss on issue of debentures account also. (6 marks)

|

79 docs|43 tests

|

FAQs on Sample Questions - Issue of Debentures - Crash Course of Accountancy - Class 12 - Commerce

| 1. What are debentures in commerce? |  |

| 2. How are debentures different from shares? |  |

| 3. What is the process of issuing debentures? |  |

| 4. What are the advantages of investing in debentures? |  |

| 5. What are the risks associated with investing in debentures? |  |