Introduction: Not For Profit Organisations | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Meaning of NPO:

• Not-for-profit organisations are also known as non-trading organisations. These are formed not to earn the profits but to render the services to its members and to the society.

• These organisations include clubs, hospitals, educational societies, public libraries, religious institutions, schools and colleges, sports institutions and association of doctors, advocates and teachers etc.

Accounts of not -for-profit organisations include the following:

1. Receipts and Payments Account.

2. Income and Expenditure Account.

3. Balance Sheet.

Characteristics of Not-for-Profit Organisations:

1. Social Service is Chief Goal.

2. Separate EntityJust like any business form, it is also considered as a separate entity.

3. Management of the Organisation.

4. Sources of FundsThe main sources of income of such organisations are subscriptions from members, donations, legacies, grant-in-aid, income from investments, etc.

5. No Profit Motive.

Difference between Not-for-Profit Organisations and Profit Earning Organisations:

| Basic | Not-for-Profit Organisations | Profit Earning Organisations (Business Firm) |

| 1. Objective | Its main objective is to render services to its members and to the society. | Its main objective is to earn profit. |

| 2. Capital Vs Capital Fund | It receives its funds in the form of donations, subscriptions, etc., known as Capital Fund. | It receives its funds from its owners or partners, known as Capital. |

| 3. Financial Statements | Financial Statements include Receipts and Payments Account, Income and Expenditure Account and Balance Sheet. | Financial Statements include Trading Account, Profit and Loss Account and Balance Sheet. |

| 4. Surplus / Profit | Balance of the Income and Expenditure Account is either Surplus or Deficit. | Balance of Profit and Loss Account is either Net Profit or Net Loss. |

| 5. Distribution of Surplus / Profit | Surplus is added to the Capital Fund, i.e. it is not distributed amongst its members. | Profit is distributed among the owners or partners in the profit-sharing ratio. |

Receipts and Payments Account:

• This account is prepared in the same manner of the cash book. Receipts and Payments Account is a summary of cash and bank transactions related to a particular period which further helps in the preparation of Income and Expenditure Account.

• Cash payments and receipts related to the previous or future periods are recorded in Receipts and Payments Account.

Characteristics of Receipts and Payments Account:

• It is a real account and therefore, the rule of ' debit what comes in and credit what goes out' is followed. Accordingly, receipts are recorded on the debit side whereas the payments are recorded on the credit side.

• It follows the cash basis system and thus, only cash transactions are recorded in it. Credit transactions are not shown in this account.

• It records all cash receipts and cash payments, irrespective of nature of the transaction i.e., capital nature or revenue nature and irrespective of time factor i.e., receipts of current year, previous year or next year.

• Non-cash transactions like depreciation on machinery, outstanding expenses, accrued income, etc. are not included in this account.

Difference between Receipts and Payments Account and Cash Book

| Basis | Receipts and Payments Account | Cash Book |

| 1. Basis | It is prepared on the basis of Cash Book. | It is prepared on the basis of cash receipts and payments recorded in chronological order. |

| 2. Period | It is prepared at the end of accounting. | It is recorded on daily basis. |

| 3. Date | It is not recorded date wise as it is a summary of transactions of Cash Book. | Transactions are recorded date wise. |

| 4. Ledger Folio | It has no column of Ledger Folio. | It has a column of Ledger Folio. |

| 5. Side | It has Receipts and Payments side instead of debit and credit sides. | Cash Book is divided into debit and credit sides. |

| 6. Institutions | It is prepared by Not-For-Profit Organisation. | Cash Book is prepared by both Not-For-Profit Organisations and Profit Making Institutions. |

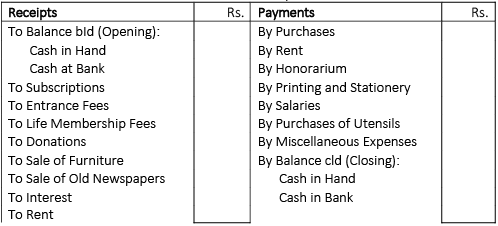

Format of Receipts and Payments Account

Receipts and Payments Account

for the year ended

Income and Expenditure Account:

• Income and Expenditure Account is similar to that of Profit and Loss Account and nominal in nature.

• It is a nominal account and therefore, the rule 'debit all the expenses and losses and credit all incomes and gains' is followed.

• It is prepared on accrual basis i.e., while preparing this account not only cash incomes and cash expenses are considered but adjustments relating to that period are also taken into account.

• It is prepared on the same principles on which the Trading and Profit and Loss Account are prepared.

• It must be noted here that only revenue items are considered while preparing the account.

Salient Features of Income and Expenditure Account:

• All expenses and losses are shown on the debit side and all incomes and gains are shown on the credit side of this account relating to current year.

• It records only revenue items and capital items are not recorded in it. For instance, sale of an asset will not be taken into account while preparing this account but the loss or profit on sale of asset will be considered.

• Opening and closing cash or bank balances are ignored while preparing this account.

• Depreciation on fixed assets, provision for bad and doubtful debts and other adjustments are taken into account like Profit and Loss Account.

• The main purpose of the preparation of this account is to know the net result at the end of the year.

• The credit balance of this account shows excess of incomes over expenditures then it is called as surplus.

• And debit balance shows excess of expenditures over incomes then it is called as deficit.

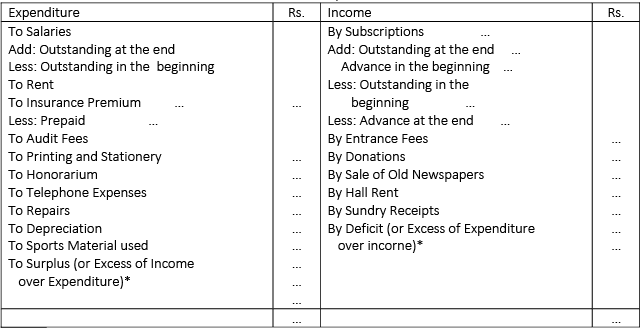

Income and Expenditure Account

for the period ended …

Difference Between income and Expenditure Account and Profit and Loss Account

| Basis | Income and Expenditure Account | Profit and Loss Account |

| 1. Prepared by | This account is prepared by 'Not-For-Profit Organisations. | This account is prepared by business organisations. |

| 2. Objective | Its objective is to ascertain excess of income over expenditure(i.e. surplus) or excess of expenditure over income (i.e. deficit) of an accounting period. | Its objectives is to ascertain net profit or net loss during an accounting year. |

| 3. Basis of Preparation | It is prepared on the basis of Receipts and Payments Account and other information. | It is prepared on the basis of Trial Balance and other information. |

| 4. Balance | The balance of this account represents Surplus or Deficit. | The balance of this account represents Net Profit or Net Loss. |

Difference Between Receipts and Payments Account and Income and Expenditure Account

| Basis | Receipts and Payments Account | Income and Expenditure Account |

| 1. Nature | It is a summary of the Cash Book. | It is similar to Profit and Loss Account of a Business Enterprise. |

| 2. Basis of Accounting | It is prepared on Cash Basis of Accounting. | It is prepared on Accrual Basis of Accounting. |

| 3. Nature of Account | It is a real account. | It is a nominal account. |

| 4. Balance | It starts with the opening balance of cash and bank. Balance at the end represents cash and bank balance at the end. | It has no opening balance. Balance at the end means either surplus or deficit. |

| 5. Sides | Debit side of the account records cash receipts and credit side records cash payments. | Debit side of this account records expenses and losses and credit side records incomes and gains. |

| 6. Period | It includes receipts and payments made during the year, irrespective of the fact whether they relate to current, previous or future periods. | It includes incomes and expenditures of the current year only. |

| 7. Capital and Revenue Items | It records receipts and payments of items of both capital and revenue nature. | It records income and expenditure of revenues items only. |

| 8. Adjustments | It is based on cash basis of accounting. So, no adjustments are made. | It is based on accrual basis of accounting. So, adjustments are made. |

| 9. Non-cash items | It does not record non-cash items like depreciation. | It records non-cash items like depreciation. |

Balance Sheet

Opening Balance Sheet

As at......

| Liabilities | Amt. (Rs.) | Assets | Amt. (Rs.) |

| Advance Subscription | Fixed Assets | ||

| Outstanding Expenses | Investments | ||

| Capital Fund (Balancing Figure) | Subscription Outstanding | ||

| Accrued Interest | |||

| Prepaid Expenses | |||

| Cash in Hand | |||

| Cash at Bank | |||

Important Points to be Considered while Preparing Balance Sheet

Deduct Sale of Fixed Assets

Deduct Depreciation Charged

Format of closing Balance Sheet as at......

| Liabilities | Amt. (Rs.) | Assets | Amt. (Rs.) |

| Capital Fund: | Fixed Assets: | ||

| Opening Balance | Opening Balance | ||

| Add: Surplus (or Less: Deficit) | Add: Additions | ||

| Specific Funds (Building Fund, Prize/Match Fund, etc.) | Less: Depreciation | ||

| Opening Balance | Investments | ||

| Add: Donations / Income related to such Funds | Specific Fund Investments | ||

| Less: Expenses related to such Funds | Subscriptions Outstanding | ||

| Subscriptions Received in Advance | Accrued Interest | ||

| Outstanding Expenses (Salary, Rent, Taxes, etc.) | Prepaid Expenses | ||

| Cash in Hand | |||

| Cash at Bank |

Important Items Related to Income and Expenditure Account:

1. Entrance Fees / Admission Fees: Entrance Fees is the amount paid by the new members at the time of joining the organisation. It is treated as a revenue receipt and is credited to the Income and Expenditure Account.

2. Life Membership Fee: It is the amount received as one time subscription from the life members. It is a receipt of nonrecurring nature. So, it is treated as capital receipt and added to the Capital Fund on the liabilities side of the Balance Sheet.

3. Donations: It is a sort of gift in cash or property received from some person or organisation.

(i) General Donation: When the donor does not specify the purpose for which the donation has to be used, then it is a General Donation. It is treated as an income and is credited to the Income and Expenditure Account.

(ii) Specific Donation: When the donor specifies the purpose for which the donation has to be used, then it is a Specific Donation. It will be capitalised and is shown on the liabilities side of the Balance Sheet.

4. Legacies: It is the amount received as per the will of a deceased person. It appears on the receipts side of the Receipts and Payments Account. It is capitalised and is shown on the liabilities side of the Balance Sheet.

5. Receipts and Expenses for Special Occasions: Sometimes, the Not-For-Profit Organisation make arrangements for certain special occasions, like, Drama, Annual Dinner, Cultural Meet, etc. The net amount (receipts less payments) from such occasions is transferred to the Income and Expenditure Account.

- When receipts from such occasions is more than the payments, then the excess receipts are shown on the credit side of Income and Expenditure Account.

- When payments are more than the receipts, then the excess payments are shown on the debit side of Income and Expenditure Account.

6. Sale of Old Newspapers / Magazines: The amount realised from sale of old newspapers or magazines is accounted as an income and credited to the Income and Expenditure Account.

7. Sale of Sports Materials: Sale of sports materials (used materials like old balls, bats, nets, etc) is the regular feature with any Sports Club. It is usually shown as an income in the Income and Expenditure Account.

8. Payment of Honorarium: Honorarium is a token payment given in honour of the services rendered by a person, who is not an employee of the organisation. For example, payment made to an invited doctor for delivering a lecture. As it is an expense, it is debited to the Income and Expenditure Account.

9. Sale of old asset: The amount received from the sale of an old asset appears on the debit side of Receipts and Payments Account. Any gain or loss on the sale of asset is taken to the Income and Expenditure Account of the year.

10. Subscriptions: Subscription is the amount paid by the members of Not-For-Profit Organisations on periodical basis so that their membership remains alive.

- It is a recurring and main source of income of such organisations so it is shown on the credit side of income and expenditure a/c.

11. Endowment Fund: It is a fund arising from a bequest or gift, the income of which is devoted for a specific purpose. Thus, Endowment Fund is a donation, in which the donor puts a condition that only the income earned from the investment of such funds can be used for the specified purpose and not the principal amount.

|

79 docs|43 tests

|

FAQs on Introduction: Not For Profit Organisations - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is a not-for-profit organization in commerce? |  |

| 2. How do not-for-profit organizations in commerce generate revenue? |  |

| 3. Are not-for-profit organizations in commerce exempt from taxes? |  |

| 4. Can individuals receive salaries or compensation from not-for-profit organizations in commerce? |  |

| 5. How can someone get involved with a not-for-profit organization in commerce? |  |