Very Short Answers - Not For Profit Organisations | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Q1. What items are shown in Receipts and Payments Account?

Ans. Every Receipt and Payment, whether of capital nature or revenue nature or relating to previous year or following year is shown in the Receipts and Payments Account.

Q2. Why adjustments for outstanding expenses, prepaid expenses or depreciation are not made in the Receipts and Payments Account?

Ans. Because Receipts and Payments Account is prepared on Cash Basis of Accounting.

Q3. Is it necessary to prepare Balance Sheet along with Receipts and Payments Account?

Ans. No, it is not necessary to prepare Balance Sheet along with Receipts and Payments Account because it is prepared on Cash Basis of Accounting.

Q4. Is the balance of Receipts and Payments Account an income for that period?

Ans. No, the balance of Receipts and Payments Account is cash and bank balance at the end.

Q5. Which account gives an idea about the cash position of a Not-For-Profit Organisation?

Ans. Receipts and Payments Account.

Q6. A Not-For-Profit Organisation prepares Receipts and Payments Account in spite of the fact that it maintains Cash Book, which contains all this information. Why’?

Ans. Receipts and Payments Account is a summary of receipts and payments of cash under the appropriate heads of accounts. It provides information at a glance, i.e., the sources and utilisation of cash.

Q7. Non-cash expenditure such as depreciation is not shown in the Receipts and Payments Account. Why?

Ans. Non-cash expenditure is not shown in the Receipts and Payments Account because Receipts and Payments Account is prepared on Cash Basis of Accounting.

Q8. Receipts and Payments Account shows the receipts and payments without distinguishing between capital and revenue and also the period to which they relate. Why?

Ans. It is so because Receipts and Payments Account is prepared on Cash Basis of Accounting.

Q9. Income and Expenditure Account is prepared taking revenue incomes and expenditures relating to the current accounting period. Why?

Ans. It is so because it is prepared on Accrual Basis of Accounting.

Q10. Is it necessary to draw a Balance Sheet with Income and Expenditure Account?

Ans. It is not necessary but better to prepare Balance Sheet with Income and Expenditure Account.

Q11. What is the basis of accounting followed while preparing Income and Expenditure Account?

Ans. Accrual Basis of Accounting is followed while preparing Income and Expenditure Account.

Q12. Anand has instituted a Sports Fund of Rs.1,00,000 in a school. The school kept the funds in a separate Bank Account Out of which it withdrew money every year and spent it on the sports activities. The fund had a balance of Rs.15,000 as on 31st March, 2010. During the financial year ended 31st March, 2011, it spent Rs.17,500 in organising the sports events. How will you account the expense? Give reasons for your answer.

Ans. The expenditure of Rs. 17,500 will be accounted as follows: Rs. 15,000 will be debited to the Sports Fund and Rs. 2,500 to the Income and Expenditure Account. The reason for this is that the Sports Fund has a balance of Rs. 15,000 only whereas the expense is Rs. 17,500. Deficit (Rs. 17,500 – Rs. 15,000) of Rs. 2,500 will be treated as an expense.

Q13. How would you treat the following items in the case of a Not-For-Profit Organisation? Rs.

Poor Girls’ Marriage Fund 5,00,000

Donation received towards the fund 50,000

Expenditure made during the year on poor girls’ marriage 6,00,000

Ans. Rs.50,000, being debit balance in the fund, will be transferred to the debit of Income and Expenditure Account.

Q14. Following amounts relate to a Charitable Hospital: Rs.

Stock of medicines on 1st April, 2011 5,000

Creditors for medicines on 1st April, 2011 10,000

Medicines purchased during 2011-12 12,000

Value of medicines spoiled during the year 500

Stock of medicines on 31st March, 2012 2,500

What amount of medicines consumed during 2011-12 is debited Expenditure Account?

Ans. Rs.

Opening Stock of Medicines during the year 5,000

Add: Medicines purchased during the year 12,000

17,000

Less: Closing Stock of Medicines 2,500

Amount to be debited to Income and Expenditure Account 14,500

Note: Value of medicines spoiled will not be considered because stock already been reduced by this amount.

Q15.

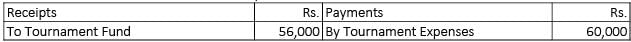

Receipts and Payments Account

for the year ended 31st March 2014

Show the treatment of the above items in the final accounts of Not-For-Profit Organisation.

Ans.

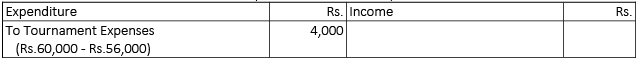

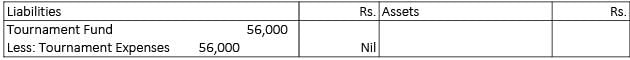

Income and Expenditure Account

for the year ended 31st March, 2014

Balance Sheet as at 31st March, 2014

Q16. Give one similarity between Receipts and Payments Account and Income and Expenditure Account.

Ans. Both are prepared by a Not-For-Profit Organisation.

Q17. State one major feature of Not-For-Profit Organisations’.

Ans. Not-For-Profit Organisations are established for providing services.

Q18. Write one difference between ‘Receipts and Payments Account’ and Income and Expenditure Account.

Ans. Receipts and Payments Account is prepared on cash basis of accounting whereas Income and Expenditure Account is prepared on accrual basis of accounting.

|

79 docs|43 tests

|

FAQs on Very Short Answers - Not For Profit Organisations - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is a not-for-profit organization? |  |

| 2. How is a not-for-profit organization different from a for-profit organization? |  |

| 3. How do not-for-profit organizations raise funds? |  |

| 4. How are the funds of a not-for-profit organization utilized? |  |

| 5. Can employees of a not-for-profit organization receive salaries? |  |