Document for keynesian liquidity preference and modern theories of interest.. - Commerce PDF Download

Ref: https://edurev.in/question/898087/Needed-a-Document-for-keynesian-liquidity-preference-and-modern-theories-of-interest-Related-Busines

Keynes defines the rate of interest as the reward for parting with liquidity for a specified period of time. According to him, the rate of interest is determined by the demand for and supply of money.

Demand for money: Liquidity preference means the desire of the public to hold cash. According to Keynes, there are three motives behind the desire of the public to hold liquid cash: (1) the transaction motive, (2) the precautionary motive, and (3) the speculative motive.

Transactions Motive: The transactions motive relates to the demand for money or the need of cash for the current transactions of individual and business exchanges. Individuals hold cash in order to bridge the gap between the receipt of income and its expenditure. This is called the income motive.

The businessmen also need to hold ready cash in order to meet their current needs like payments for raw materials, transport, wages etc. This is called the business motive.

Precautionary motive: Precautionary motive for holding money refers to the desire to hold cash balances for unforeseen contingencies. Individuals hold some cash to provide for illness, accidents, unemployment and other unforeseen contingencies. Similarly, businessmen keep cash in reserve to tide over unfavourable conditions or to gain from unexpected deals.

Keynes holds that the transaction and precautionary motives are relatively interest inelastic, but are highly income elastic. The amount of money held under these two motives (M1) is a function (L1) of the level of income (Y) and is expressed as M1 = L1 (Y)

Speculative Motive: The speculative motive relates to the desire to hold one’s resources in liquid form to take advantage of future changes in the rate of interest or bond prices. Bond prices and the rate of interest are inversely related to each other. If bond prices are expected to rise, i.e., the rate of interest is expected to fall, people will buy bonds to sell when the price later actually rises. If, however, bond prices are expected to fall, i.e., the rate of interest is expected to rise, people will sell bonds to avoid losses.

According to Keynes, the higher the rate of interest, the lower the speculative demand for money, and lower the rate of interest, the higher the speculative demand for money. Algebraically, Keynes expressed the speculative demand for money as

M2 = L2 (r)

Where, L2 is the speculative demand for money, and

r is the rate of interest.

Geometrically, it is a smooth curve which slopes downward from left to right.

Now, if the total liquid money is denoted by M, the transactions plus precautionary motives by M1 and the speculative motive by M2, then

M = M1 + M2. Since M1 = L1 (Y) and M2 = L2 (r), the total liquidity preference function is expressed as M = L (Y, r).

Supply of Money: The supply of money refers to the total quantity of money in the country. Though the supply of money is a function of the rate of interest to a certain degree, yet it is considered to be fixed by the monetary authorities. Hence the supply curve of money is taken as perfectly inelastic represented by a vertical straight line.

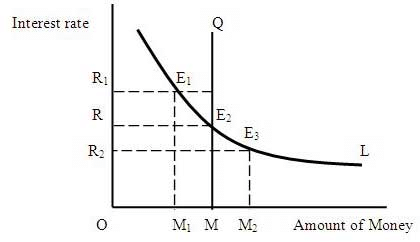

Determination of the Rate of Interest: Like the price of any product, the rate of interest is determined at the level where the demand for money equals the supply of money. In the following figure, the vertical line QM represents the supply of money and L the total demand for money curve. Both the curve intersect at E2 where the equilibrium rate of interest OR is established.

If there is any deviation from this equilibrium position an adjustment will take place through the rate of interest, and equilibrium E2 will be re-established.

At the point E1 the supply of money OM is greater than the demand for money OM1. Consequently, the rate of interest will start declining from OR1 till the equilibrium rate of interest OR is reached. Similarly at OR2 level of interest rate, the demand for money OM2 is greater than the supply of moneyOM. As a result, the rate of interest OR2 will start rising till it reaches the equilibrium rate OR.

It may be noted that, if the supply of money is increased by the monetary authorities, but the liquidity preference curve L remains the same, the rate of interest will fall. If the demand for money increases and the liquidity preference curve sifts upward, given the supply of money, the rate of interest will rise.

Criticisms: Keynes theory of interest has been criticized on the following grounds:

1. It has been pointed out that the rate of interest is not purely a monetary phenomenon. Real forces like productivity of capital and thriftiness or saving by the people also play an important role in the determination of the rate of interest.

2. Liquidity preference is not the only factor governing the rate of interest. There are several other factors which influence the rate of interest by affecting the demand for and supply of investible funds.

3. The liquidity preference theory does not explain the existence of different rates of interest prevailing in the market at the same time.

4. Keynes ignores saving or waiting as a means or source of investible fund. To part with liquidity without there being any saving is meaningless.

5. The Keynesian theory only explains interest in the short-run. It gives no clue to the rates of interest in the long run.

6. Keynes theory of interest, like the classical and loanable funds theories, is indeterminate. We cannot know how much money will be available for the speculative demand for money unless we know how much the transaction demand for money is.

FAQs on Document for keynesian liquidity preference and modern theories of interest.. - Commerce

| 1. What is Keynesian liquidity preference theory? |  |

| 2. How does the liquidity preference theory explain interest rates? |  |

| 3. What are the key components of Keynesian liquidity preference theory? |  |

| 4. How does the liquidity preference theory impact monetary policy? |  |

| 5. What are the criticisms of Keynesian liquidity preference theory? |  |