Shares | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Meaning of Shares:

• Total Capital of the Company is divided into units of small denominations. Each such unit is called ‘share’.

• For example, if the total capital of the Company is Rs. 10,00,000, divided into Rs. 1,00,000 units of Rs. 10 each, each unit of Rs. 10 will be called a share (of Rs.10 each).

Nature of Shares:

• The shares of a Company are movable property, transferable in the manner provided by the Articles of Association of the Company.

Types of Shares:

Under Section 43 of the Companies Act, 2013, a Company may issue two types of shares: (1) Preference Shares

(2) Equity Shares

(1) Preference Shares: Preference Shares are those which carry the following two rights:

(i) They have a right to receive dividend at a fixed rate before any dividend is paid on the equity shares.

(ii) When the company is wound up, they have a right to the return of capital before that of equity shares.

Types of Preference Shares:

(i) Cumulative Preference Shares:

• Cumulative preference shares are those preference shares, the holders of which are entitled to recover the arrears of preference dividend, before any dividend is paid on equity shares.

• This means that if in any year, the profits of the company are insufficient to pay dividend on these shares, the dividend keeps on accumulating until it is fully paid.

(ii) Non-cumulative Preference Shares:

• The holders of such shares get a fixed amount of dividend out of the profits of each year.

• If no dividend is declared in any year due to any reason, such shareholders get nothing, nor can they claim unpaid dividend of any year in any subsequent year.

(iii) Participating Preference Shares:

• Such shares, in addition to the fixed preference dividend, carry a right to participate in the surplus profits, if any, after dividend at a stipulated rate has been paid to equity shareholders.

• Similarly, in the event of winding up, if after paying back both the preference and equity shareholders, there is still some surplus left, such shareholders are entitled to receive a pre-determined proportion of surplus.

(iv) Non-participating Preference Shares:

• Such shares get only a fixed rate of dividend every year and do not carry a right to participate in the surplus profits or in any surplus on winding up.

(v) Redeemable Preference Shares:

• Such shares are those which will be repaid by the Company within a stipulated period in accordance with the terms of issue and the fulfilment of certain conditions laid down in Section 55 of the Companies Act 2013.

(vi) Irredeemable Preference Shares:

• Irredeemable preference shares are those, the capital of which cannot be refunded before winding up.

(vii) Convertible Preference Shares:

• Holders of these shares have a right to get their preference shares converted into equity shares at’ their option according to the terms of issue.

(viii) Non-Convertible Preference Shares:

• When the holders of preference shares have not been conferred the right of getting their preference shares converted into equity shares, such shares are called non-convertible preference shares.

(2) Equity Shares:

• Equity shares are those shares which are paid dividends only when profits are left after the preference shareholders have been paid fixed rate of dividends.

Distinction Between Preference Shares and Equity Shares:

| S.No. | Basis of Distinction | Preference Shares | Equity Shares |

| 1 | Rate of Dividend | Preference Shares are paid dividend at a fixed rate. | The rate of dividend on equity shares is not fixed. It may vary from year to year depending upon the availability of profits. |

| 2 | Arrears of dividend | If dividend is not paid on these shares in any year, the arrears of dividend may accumulate. | In case of equity shares, dividend cannot accumutate. |

| 3 | Preferential right as to the payment of dividend | They have a right to receive dividend before any dividend is paid on equity shares. | Payment of dividend on equity shares is made after the payment of preference dividend. |

| 4 | Preferential right as to the payment of capital | They have a right to return of capital in the case of winding up, before any capital is returned to equity shareholders. | Equity share capital is paid only when preference share capital is paid out fully. |

| 5 | Voting rights | Preference Shareholders do not have any voting rights. | Equity Shareholders enjoy voting rights. |

| 6 | Right to participate in management | They do not have a right to participate in management of the Company. | They have full right to participate in management of the Company. |

Incoporation of a Company:

The procedure for incorporating a company can be divided into four principal stages:

1. Promotion;

2. Incorporation or Registration of a Company;

3. Capital Subscription; and

4. Commencement of Business.

1. Promotion: It is the first stage of the company's incorporation. A person or a group of persons agree to start business in the form of a company. These persons are called Promoters.

2. Incorporation or Registration of a Company: A company is incorporated following the procedure prescribed in the Companies Act, 2013. The promoters after getting the name of the proposed company approved from the Registrar of Companies submit Memorandum of Association, Articles of Association, consent of first directors to act as directors and a declaration that the requirements of the Companies Act have been complied with.

The Registrar of Companies, thereafter, issues Certificate of Incorporation, if he is satisfied that the requirements of the Companies Act, 2013 have been complied with. The Company, thereafter, comes into existence.

3. Capital Subscription and Commencement of Business: A company cannot commence its business or exercise borrowing powers unless:

(i) a declaration is filed by a director with the Registrar of Companies to the effect that every subscriber to the Memorandum of Association has paid the value of the shares, if any, agreed to be taken by him.

(ii) the company has filed with the Registrar of Companies a verification of its registered office.

Prospectus: A public company issues a document called 'Prospectus' in which terms and conditions of the issue are stated along with the purpose for which the proceeds of the issue of securities shall be used. "Prospectus" means any document described or issued as a prospectus and includes a red herring prospectus of shelf prospectus or any notice, circular, advertisement or other document inviting offers from the public for the subscription or purchase of any securities of a body corporate. [Section 2(70) of the Companies Act, 2013]

Minimum Subscription [Section 39(1)]: Minimum subscription is the amount that must be subscribed. Unless the sum payable on application for the sum so stated (minimum subscription) has been paid to and received by the company by cheque or any other banking instrument, security cannot be allotted.

The Companies Act, 2013 has not prescribed the amount of minimum subscription. However, SEBI (Securities and Exchange Board of India) has prescribed that a company must receive subscription of at least 90% of shares issued before it can allot shares.

Preliminary Expenses: Preliminary Expenses are the expenses incurred for incorporating the company, such as registration fee paid to the Registrar of Companies, legal expenses, public issue expenses, etc. These expenses may be written off against Securities Premium Reserve (permitted by Section 52(2) of the Companies Act, 2013) or to the Statement of Profit and Loss in the year they are incurred.

Share Capital:

Meaning:

Share Capital means the Capital raised by a Company by the issue of shares.

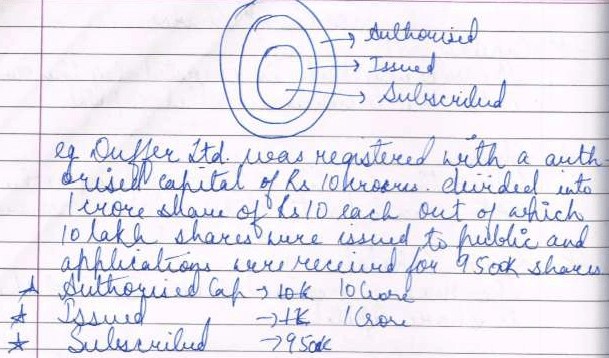

Kinds of Share Capital:

(1) Authorised, Registered or Nominal Capital: Authorised Capital refers to that amount which is stated in the Memorandum of Association. This is the maximum Capital for which a Company is authorised to issue shares during its lifetime.

(2) Issued Capital: Issued Capital is that part of Authorised Capital which is actually offered to the public for subscription. The remaining part of the Authorised Capital is known as the 'Unissued Capital' which can be issued later on.

(3) Subscribed Capital: Subscribed Capital is that part of Issued Capital which has been subscribed for by the public. If, say, 10,000 shares of Rs. 100 each are offered to the public and the public applies for 9,000 shares, the Subscribed Capital will be Rs. 9,00,000.

Subscribed capital is shown in the Balance Sheet under two heads:

(a) Subscribed and fully paid up; and

(b) Subscribed but not fully paid up.

Two terms 'Called-up' and 'Paid-up' are also referred in case of 'Share Capital':

"Called-up capital": it refers to the part of the face value of a share called by the directors from shareholders.

For example, if the directors call at the rate of Rs. 60 per share on 12,000 shares of Rs. 100 each, Rs. 7,20,000 will be the called up Capital. The remaining amount of Rs. 40 per share will be uncalled Capital.

"Paid-up capital": it refers to that portion of called up capital which has been actually received from the shareholders.

For example, If a shareholder has paid Rs. 50 against the called-up amount of Rs. 60, then Rs. 50 is paid-up amount. Paid up Capital .

(4) Reserve Capital: As per Section 65 of the Companies Act, 2013.

• Only an unlimited company having a share capital while converting into a limited company, may have reserve capital.

• Provide that a specified portion of its uncalled share capital shall not be called except in the event of winding up of the company.

• It is available only for the creditors on the winding up of the company.

Difference between reserve capital and capital reserve:

| s.no. | Basis | Reserve capital | Capital reserve |

| 1 | Meaning and creation | It refers to that portion of increased nominal capital or uncalled share capital which shall not be called up. except in the event on winding up. | Capital Reserve is that reserve which is created out of Capital profits such as profit 010 sa/c of fixed assets, profit on revaluation of fixed assets, premium on of issue of shares and debentures, profit redemption of debentures etc. These profits are not earned in the normal course of business. |

| 2 | Necessity | It is not necessary to create reserve capital. | It is necessary to create capital reserve. |

| 3 | Resolution | A special is required for its creation. | No resolution is required for the creation of capital reserve. |

| 4 | Realised not realised | It refers to the amount which has which has not been received. | It refers to the amount which has which has been received. |

Difference between Authorised or Nominal Capital and Issued Capital:

| s.no. | Basis | Authorised or Nominal Capital | Issued Capital |

| 1 | Meaning | It is the amount stated in the Memorandum of Association which a company can raise as share capital of the company. | It is the nominal value of that part of Authorised Share Capital which is issued for subscription. |

| 2 | Disclosure in Memorandum of Association | The amount is stated in Memorandum of Association. | It is not stated in the Memorandum of Association. |

| 3 | Whether one can exceed the other | It is equal to or more than the Issued Share Capital. | It is equal to or less than the Authorised Share Capital. |

Issue of Shares:

Shares may be issued in any of the following ways:

(i) For Cash: By Private Placement of shares.

(ii) For Cash: By Public Subscription of shares.

(iii) For Consideration other than Cash.

Private Placement of shares:

• As per Section 42 of the Companies Act, 2013 a Company may issue shares on private placement basis also.

• Sometimes the promoters of a public company are confident of raising capital through private sources and contacts.

• In such a case the Company does not invite the public to subscribe for its shares, but make private placement of shares to promoters, their friends, relatives, shareholders of group companies, Mutual Funds, Non-Resident Indians (NRIs), financial institutions like Life Insurance Corporation ofIndia (LIC), Unit Trust ofIndia (UTI), Industrial Credit and Investment Corporation of India (lCICI) etc.

• When the shares are not offered to the public, the Company need not issue a prospectus. Instead of issuing a prospectus, the promoters are required to prepare a draft prospectus known as a 'Statement in Lieu of Prospectus.

Sweat Equity Shares:

• A Company may issue sweat equity shares as per Sec. 54 of Companies Act, 2013.

• Sweat equity shares means equity shares issued by the Company to its employees or directors at a discount or for consideration other than cash for providing know-how or making available intellectual property rights.

• Such shares cannot be resold by their holders within a period of3 years, called lock-in period'.

Public Subscription of Shares:

Following steps are to be taken by a Public Company for the issue of shares to public:

(1) To Issue Prospectus.

(2) To Receive Applications.

(3) To Make Allotments.

(4) To Make Calls.

Minimum Subscription:

Minimum Subscription means the amount which, in the opinion of the Directors, is the minimum to be raised by the issue of shares so as to provide for the following requirements:

(i) For the payment of purchase price of any property purchased or agreed to be purchased;

(ii) For the payment of preliminary expenses, including underwriting commission and brokerage on issue of shares;

(iii) For the repayment of any moneys borrowed by the Company for the above purposes;

(iv) For Working Capital; and

(v) For any other expenditure required for the usual conduct of business operations · • According to SEBI guidelines minimum subscription has been fixed at 90% of the issued amount.

• As per Section 39 (3), the company has to get minimum subscription within 30 days from the date of the issue of the prospectus.

• If the company fails to receive the minimum subscription within the said period, the company cannot proceed for the allotment of shares and the entire application money must be returned within next 15 days.

• If there is a delay in refund of such amount by more than 15 days, the Company shall be liable to repay it with interest at the rate of 12% per annum for the delayed period.

Preliminary Expenses:

Expenses incurred on the formation of a Company are termed as 'Preliminary Expenses'. These include the following:

1. Expenses incurred on the preparation and printing of various documents needed for the registration of a Company.

2. Stamp duty and registration fees on these documents.

3. Duty payable on Authorised Capital.

4. Cost of preliminary books and the Common Seal.

5. In case the Company has been formed to purchase a running business, the fees charged by Accountant or Valuer valuing the assets and liabilities of that business.

I. Issue of Shares at Par:

When a share of Rs.10 i.e. face value is issued for Rs.10 is called as issue of shares at par.

(i) Shares Payable in Lump Sum: When shares issued are payable in one instalment, the shares are said to have been issued against lump sum payment.

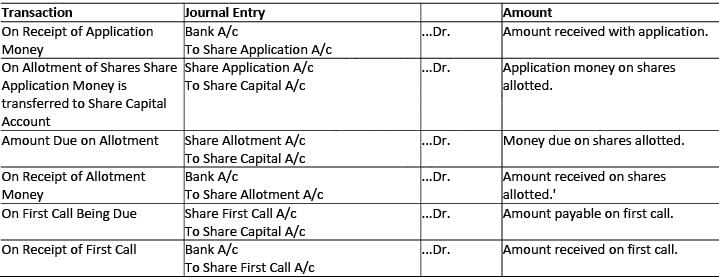

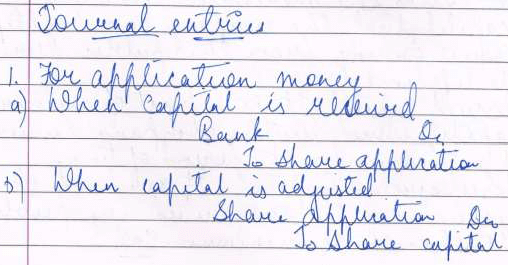

Accounting Entries for Issue of Shares Payable in Lump Sum

For Receiving Share Application Money:

Bank A/c ...Dr.

To Share Application A/c (Being the application money received)

For Allotment of Shares:

Share Application A/c ...Dr.

To Share Capital A/c

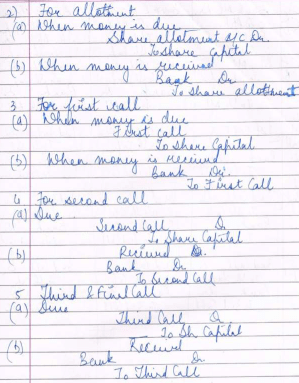

(ii) Shares Payable in Instalments:

√ The word 'Equity' or Preference’ is used before the word share as the case may be, e.g., Equity Application, Equity Share Allotment or Preference Share Application, Preference Share Capital, etc.

√ If calls are more than one, the entries are same as in case of first call but the title Is changed as Second or Final call.

Issue of shares at premium: means shares have been issued M a value that is more than the nominal (face) value of the share, i.e., issue price is more than the j nominal (face) value. For example, a share with face value of Rs. 10 is issued at Rs. 15, premium being Rs. 5.

Journal

For Receiving Share Application Money:

Bank A/c ...Dr.

To Share Application and Allotment A/c

(Being the application money received)

For Allotment of Shares:

Share Application and Allotment A/c ...Dr.

To Share Capital A/c [With Nominal (face) Value]

To Securities Premium Reserve A/c [With Premium Amount, if issued at Premium] (Being the shares allotted against share application and allotment money received)

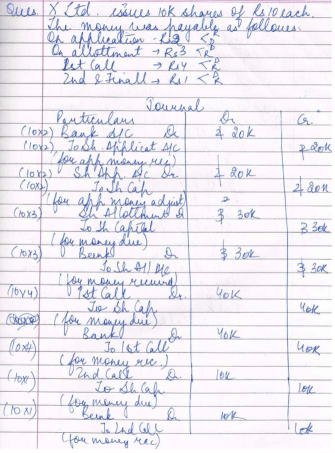

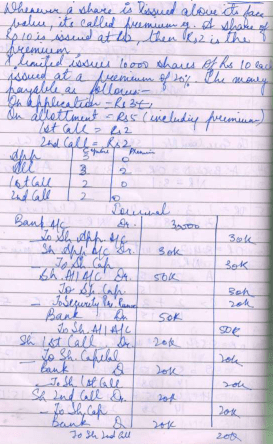

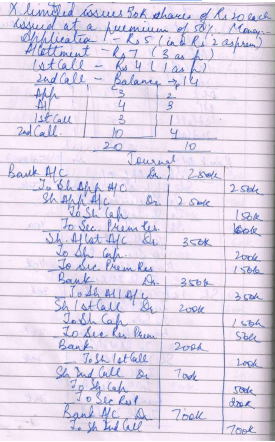

Example 1.

Example 2.

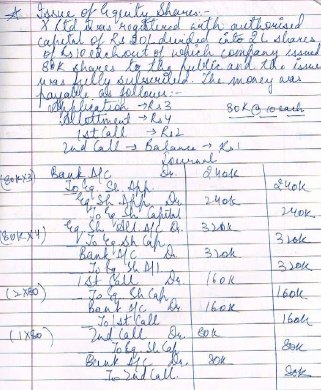

Issue of equity shares:

The word 'Equity' or Preference’ is used before the word share as the case may be, e.g., Equity Application, Equity Share Allotment or Preference Share Application, Preference Share Capital, etc.

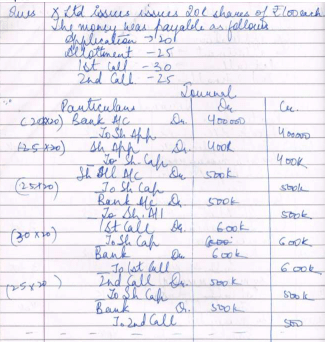

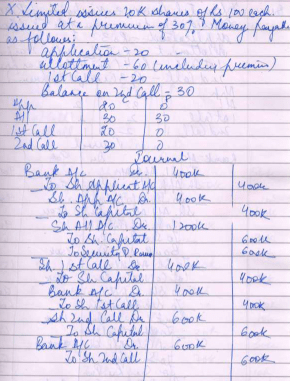

Example 3.

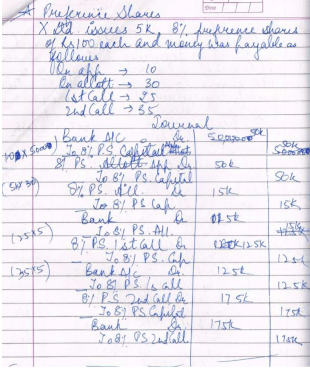

Issue of Preference shares:

The word 'Equity' or Preference’ is used before the word share as the case may be, e.g., Equity Application, Equity Share Allotment or Preference Share Application, Preference Share Capital, etc.

Example 4.

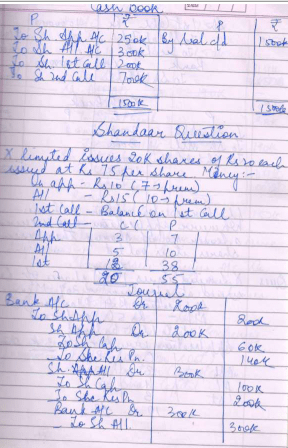

Issue of shares at pemium:

When premium is on all the calls:

Use of cash book:

Issue of shares:

Issue of shares at par, premium and consideration other than cash:

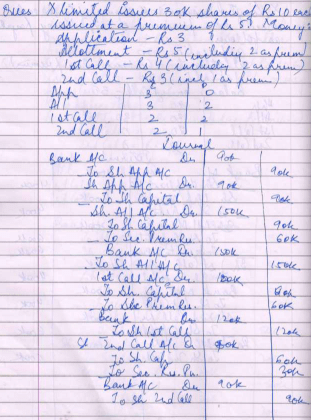

1. X Ltd. was registered with a capital of Rs.. 6,00,000 in shares of Rs. 10 each. issued a prospectus inviting applications for 6,000 shares at 40% premium payable 'follows:

On Application Rs. 5 (including Rs..1 Premium),

On Allotment Rs. 4 (including Rs..1 Premium),

On First Call Rs. 3 (including Rs..1 Premium),

On Second Call Rs.. 2 (including Rs..1 Premium)

Applications were received for 5,800 shares. All money was duly received.

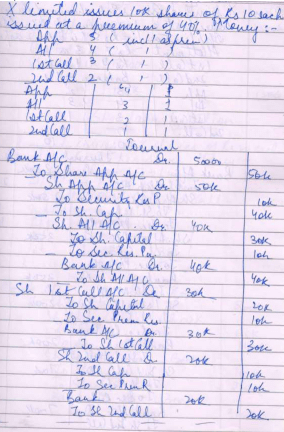

2. X Ltd. was registered with a capital of Rs. 6,00,000 in shares of Rs. 10 each. It issued a prospectus inviting applications for 6,000 shares at 10% premium payable as follows:

On Application Rs. 4 On Allotment Rs. 3 ( including premium)

On First Call Rs. 2 On Second Call Balance

Applications were received for 5,500 shares. All money was duly received. Pass the necessary Journal entries.

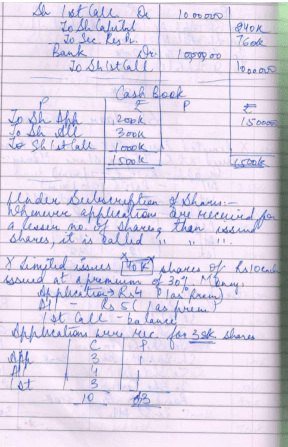

3. X Ltd. invited applications for 6,000 Equity Shares of Rs. 10 each issued at 10% premium. The whole amount was payable on application. The issue was fully subscribed. Pass the necessary Journal entries.

4. X Ltd. was registered with a capital of Rs. 6,00,000 in shares of Rs. 10 each. It issued a prospectus inviting applications for 6,000 shares at Rs.40 and money was payable as follows: On Application Rs. 14(including Rs..10 Premium) On Allotment Rs. 9 (including Rs.7 Premium) On First Call Rs. 2 On Second Call Balance Applications were received for 5,400 shares. All money was duly received. Pass the necessary Journal entries.

5. X Ltd. invited applications for 6,000 Equity Shares of Rs. 10 each issued at 40% premium. The whole amount was payable on application. The issue was under subscribed by 500 shares. Pass the necessary Journal entries.

6. X Ltd. took over the Assets of Rs. 4,08,000 and Creditors of Rs. 48,000 of Y Ltd. payable 10% by a cheque and the balance by the issue of fully paid Equity Shares of Rs. 100 each at a premium of 20%. Pass the necessary journal entries.

7. X Ltd. purchased a running business from y Ltd. for a sum of Rs. 3,60,000 payable 10% by a cheque and the balance by the issue of fully paid Equity Shares of Rs. 100 each at a premium of 20%. The assets and liabilities consisted of the following: Building Rs. 1,80,000, Plant and Machinery Rs. 60,000, Stock Rs. 1,20,000, Sundry Debtors Rs. 60,000, Sundry Creditors Rs. 48,000. Pass the necessary journal entries.

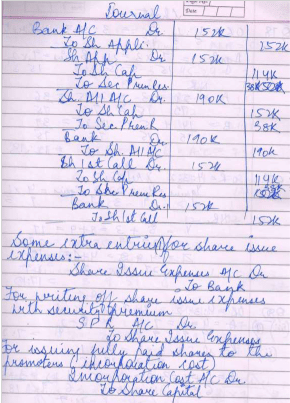

8. X Ltd. purchase a running business from y Ltd. for a sum of Rs. 3,60,000 payable 10% by a cheque and the balance by the issue of fully paid Equity Shares of Rs. 100 each at a discount of 10%. The assets and liabilities consisted of the following: Building Rs.. 1,56,000, Plant and Machinery Rs.. 60,000, Stock Rs. 1,20,000, Sundry Debtors Rs. 60,000, Sundry Creditors Rs. 48,000. Pass the necessary journal entries.

9. Pass necessary Journal entries in the books of the company. Ram & Co. purchased machinery from Mona & Co. for Rs. 4,00,000. A sum of Rs. 1,75,000 was paid by means of a bank draft and for the balance due Ram & Co. issued Equity Shares of Rs. 10 each at a discount of 10%. Journalise the above transactions in the books of the company. (AI 2004)

10. ABC Limited purchased assets of Rs. 3,80,000 from Ram Traders. It issued shares of Rs. 100 each fully paid at a discount of 5% in satisfaction of purchase consideration. Journalise the above.

11. R Ltd. purchased the assets of Krishan Ltd. for Rs. 5,00,000 payable 16% in cash and the balance in fully paid shares of Rs. 100 each. Give necessary Journal entries if such shares are to be issued at a premium of,Rs.40 per share.

12. R Ltd. purchased business of Murari Ltd. for Rs. 4,50,000 payable in fully paid shares of Rs. 10 each. Give necessary Journal entries if such shares are to be issued at a discount of 10%.

13. Kiran Textiles Ltd. issued 50,000 Equity Shares of Rs. 10 each at a premium of Rs.4 per shar e and 2,000, 6% Preference Shares of 100 each at par payable as follows:

Equity Shares Rs. Pref. Shares

Application 3.50 30

Allotment 6.50 (including premium) 20

1st call 2 25

Final call 2 25

All these shares were fully subscribed, called-up and paid. Record these transactions in journal and cash book.

14. Tagore Ltd. purchased a running business from Tulsi Bros. for a sum of Rs.48,00,000 payable by the issue of fully paid equity shares of Rs25 each at a discount of 4%. The assets and liabilities consisted of the following:

Rs.

Plant and Machinery 25,00,000

Stock 15,00,000

Sundry Debtors 8,60,000

Sundry Creditors 3,00,000

Pass the necessary journal entries in the books of Tagore Ltd.

15. R Ltd. purchased the running business of MIs Mukerjee Bros. for a sum of Rs. 60,00,000 payable by the issue of equity shares of Rs. 1O each at Rs. 40. The assets and liabilities consisted of the following:

Land and Building 32,00,000 debtors 6,00,000

Plant and Machinery 16,00,000 creditors 4,00,000

Stock 15,00,000

Pass the necessary journal entries in the books of R Ltd.

|

79 docs|41 tests

|

FAQs on Shares - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is Shares Commerce? |  |

| 2. How does Shares Commerce work? |  |

| 3. Can Shares Commerce be used for any type of business? |  |

| 4. Does Shares Commerce provide analytics and insights? |  |

| 5. Is Shares Commerce secure for online transactions? |  |