Important Questions - Valuation of goodwill | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Q1.

From the following information, calculate the value of goodwill of a firm of C and D

(a) At 3 years purchase of Average Profits.

(b) At 3 years purchase of Super Profits.

(c) On the basis of capitalization of Super Profits.

(d) On the basis of capitalization of Average Profits:

(i) Average capital employed in the business Rs. 7,00,000.

(ii) Net trading results of the firm for the past years- profit 2002 Rs. 1,47,600; Loss 2003 Rs. 1,48,100; Profit 2004, Rs. 4,48,700.

(iii) Rate of interest expected from capital having regard to the risk involved 18%.

(iv) Remuneration to each partner for his service Rs. 500 p.m.

(v) Assets (excluding goodwill) Rs. 7,54,762. Liabilities Rs. 31,329.

Q2.

A, B and C are partners sharing profits and losses in the ratio of 2:3:4. They decided to share profits and losses in the ratio of 4:3:2. They also decided to record the effect of the following without affecting their book values:

Rs.

General Reserve 40,000

Profit & Loss A/c 20,000

Advertisement Suspense A/c 15,000

You are required to give the necessary single journal entry.

Q3. A and B have been carrying on business in partnership since 1991 with fixed capitals of Rs. 2,40,000 and Rs. 1,20,000 respectively and sharing profits in the same proportion. They decided that with effect from Jan. 1, 2003 they would share profits and losses in the ratio of 3:2. For this purpose goodwill is to be valued at three year’s purchase of the average of preceding three year’s profits. The profits were 1999: Rs. 75,000; 2000: Rs. 60,000; 2001 Rs. 80,000 and 2002 Rs. 1,30,000. Give the necessary journal entry.

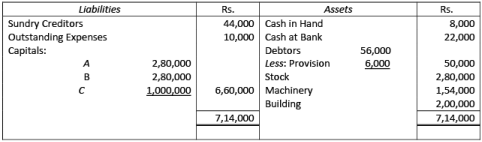

Q4. The following is the balance sheet of a firm as at 31st December, 2002:

On 1st January, 2003, the assets and liabilities were revalued as under:

Rs.

Building 8,00,000

Plant and Machinery 3,20,000

Stock 2,60,000

Creditors 84,000

A provision of 5% was required on debtors. Goodwill of the firm is valued at Rs. 1,70,000. Partners agreed that from 1.1.2003 they will share profits in the ratio of 4:3:2:1 instead of their former ratio of 5:4:2:1. They do not want to record the goodwill and revised values of assets and liabilities in the books. They also do not want to disturb the reserves.

Pass a single journal entry to give effect to the above.

Q5. A, B and C are partners sharing profits and losses in the ratio of 5:3:2. Their position on 31st March 2003 was as follows:

It was decided that with effect from 1st April 2003, profit and loss sharing ratio will be 3:3:1. They agreed on the following terms:

(i) Goodwill of the firm be valued at two year’s purchase of the average super profits of last three years. Average profits of the last three years are Rs. 1,08,000, while the normal profits may be taken at Rs. 66,000.

(ii) Provision on debtors be reduced by Rs. 2,000.

(iii) Value of stock be increased by 10% and machinery be valued at Rs. 1,00,000.

(iv) An item of Rs. 3,000 included in sundry creditors is not likely to be claimed.

Case 1. Partners do not want to record the altered values of assets and liabilities in the books and also do not want to record the goodwill. Pass an entry to give effect to the above and prepare the revised balance sheet.

Case 2. Partners want to record the altered values of assets and liabilities in the books but do not want to record the goodwill. Pass an entry to give effect to the above and prepare the revised balance sheet.

Q6. X, Y and Z are sharing profits & losses in the ratio of 5 : 3 : 2. They decide to share future profits & losses in the ratio of 2 : 3: 5 with effect from 1st April, 2014. The following items appear in the Balance Sheet as at 31st March, 2014:

General Reserve 30,000

Contingencies Reserve 5,000

Advertisement Suspense A/c (Dr.) 20,000

Profit & Loss A/c (Cr.) 15,000

Required: Pass the necessary Journal Entries.

Q7. X, Y and Z are sharing profits & losses in the ratio of 5 : 3 : 2. They decide to share future profits & losses in the ratio of 2: 3: 1 with effect from 1st April, 2014. The following items appear in the Balance Sheet as at 31st March, 2014:

General Reserve 30,000

Contingencies Reserve 5,000

Advertisement Suspense A/c 20,000

Profit & Loss A/c (Dr.) 45,000

Required: Pass the necessary Journal Entries.

Q8. X, Y and Z who are presently sharing profits & losses in the ratio of 5 : 3 : 2, decide to share future profits & losses in the ratio of 2 : 3 : 5. Give the journal entry to distribute 'Workman Compensation Reserve' of Rs. 60,000 at the time of change in profit sharing ratio, when there is claim of Rs. 40,000 against it.

Q9. X, Y and Z who are presently sharing profits & losses in the ratio of 5 : 3 : 2, decide to share future profits & losses in the ratio of 2 : 3 : 5. Give the journal entry to distribute 'Investment Fluctuation Reserve' of Rs. 4,000 at the time of change in profit sharing ratio, when Investments (market value Rs.19,000) appear at Rs. 20,000.

Q10. A business has earned average profit of Rs. 4,00,000 during the last few years and the normal rate of return in similar business is 10%. Find value of goodwill by

(i) Capitalisation of Super Profit Method,

(ii) Super Profit Method if the goodwill is valued at 3 years' purchase of super profits.

Assets of the business were ^ 40,00,000 and its external liabilities Rs. 7,20,000.

Q11. Calculate the value of goodwill at 3 years' purchase of average profits for past four years. The profits are: 31.12.2008 Rs. 20,200 31.12.2009 Rs. 24,800 31.12.2010 Rs. 20,000 31.12.2011 Rs. 28,980 On 1st September 2010, major repair of plant was charged to revenue as Rs. 6,000. It is agreed to capitalise it subject to depreciation of 10% p.a. on reducing instalment. The closing stock of 2009 was over-valued by Rs. 2,400. To cover partner's remuneration a sum of Rs. 4,800 p.a. shall have to be incurred.

Q12. A, B and C are sharing profits and losses in the ratio of 5 :3 : 2. They decided to share future profits and losses in the ratio of 2 : 3 : 5 with effect from 1st April, 2016. They also decide to record the effect of the following revaluations without affecting the book value of the assets and liabilities by passing a Single Adjustment Entry:

Book Figure Revised Figure

Rs. Rs.

Land and Building 5,00,000 5,50,000

Plant and Machinery 2,50,000 2,40,000

Trade Creditors 60,000 55,000

Outstanding Expenses 60,000 75,000

Pass necessary Single Adjustment Entry.

Q13. On 1st April 2014, an existing firm had assets of Rs. 3,00,000, including cash of Rs. 20,000. Its creditors amounted to Rs. 20,000 on that date. The firm had a Reserve Fund of Rs. 40,000 while Partner’s Capital accounts showed a balance of Rs. 2,40,000. If the normal rate of return is 20% and the goodwill of the firm is valued at Rs.96,000 at four year’s purchase of super profits, find the average profits per year of the existing firm.

Q14. Ajit and Baljit were sharing profits in the ratio of 3:2. They decided to admit Chaman into the partnership for 1/6th share of the future profits. Goodwill, valued at 4 times the average super profits of the firm, was Rs. 18,000. The firm had Assets worth Rs. 15,00,000 and Liabilities Rs. 12,00,000. The normal earning capacity of such firms is expected to be 10% p.a. Find the average Profits/Actual Profits earned by the firm during the last 4 years.

Q15. A partnership firm earned net profit during the last three years as follows:

Year Net profit

I 1,90,000

II 2,20,000

III 2,50,000

The capital employed in the firm throughout the above mentioned period has been Rs. 4,00,000. Having regard to the risk involved, 15% is considered to be a fair return on the capital. The remuneration of all the partners during this period is estimated to be Rs. 1,00,000 per annum.

Calculate the value of goodwill on the basis of

(i) two year’s purchase of super profits earned on average basis during the above mentioned three years and

(ii) by capitalization Method.

Q16. Total capital of A and B is Rs. 3,00,000 and the market rate of interest is 10% p.a. Partner are entitled to receive salary of Rs. 12,000 each. Profits (before partners' salaries) for the years 2008, 2009, 2010, 2011 and 2012 were Rs. 65,000, Rs. 62,000; Rs. 80,500, Rs. 90,200 and Rs. 1,05,000 respectively. Goodwill is to be valued at 3 years' purchase of super profits based on the average profits. Calculate the goodwill of the firm.

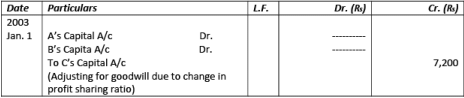

Q17. A, B and C were partners sharing profits and losses in the ratio of 7 : 5 : 4. From 1st January, 2003, they decided to share profits and losses in the ratio of 3 : 2 :1.

You are required to fill up the following Journal entry:

Journal

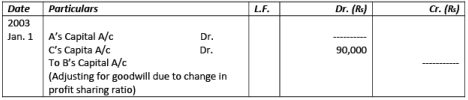

Q18. A, B and C were partners sharing profits and losses in the ratio of 2 : 5 : 5. From 1st January, 2015, they decided to share profits and losses in the ratio of 3 : 5 :7.

You are required to fill up the following Journal entry:

Q19. Kumar, Gupta and Kavita were partners in a firm sharing profits and losses equally. The firm was engaged in the storage and distribution of canned juice and its godowns were located at three different places in the city. Each godown was being managed individually by Kumar, Gupta and Kavita. Because of increase in business activities at the godown managed by Gupta, he had devote more time. Gupta demanded that his share in the profits of the firm be increased, to which Kumar and Kavita agreed. The new profit sharing ratio was agreed to be 1 : 2 : 1. For this purpose the goodwill of the firm was valued at two years purchase of the average profits of last five years. The profits of the last five years were as follows :

Year Profit (Rs)

I 4,00,000

II 4,80,000

III 7,33,000

IV (Loss) 33,000

V 2,20,000

You are required to:

(i) Calculate the goodwill of the firm.

(ii) Pass necessary Journal Entry for the treatment of goodwill on change in profit sharing ratio of Kumar, Gupta and Kavita.

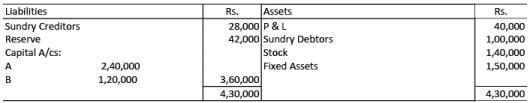

Q20. A and B are partners sharing profits in the ratio of 2: 3. Their Balance Sheet as at 31st March, 2016 stood as:

They decided that with effect from 1st April, 2016, they will share profits and losses in the ratio of 2:1., for this purpose the goodwill of the firm was valued by 2 year purchase of the average profit of last 4 years , the profits of the firm were:

31st march 2015- Rs. 1,00,000.

31st march 2014- Rs. 1,80,000.

31st march 2013- Rs. 60,000.

|

79 docs|41 tests

|

FAQs on Important Questions - Valuation of goodwill - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is the concept of goodwill valuation in commerce? |  |

| 2. How is goodwill valued in commerce? |  |

| 3. Why is the valuation of goodwill important in commerce? |  |

| 4. How does the valuation of goodwill affect a business's financial statements? |  |

| 5. Are there any limitations or challenges in the valuation of goodwill in commerce? |  |