Sample Questions - Valuation of goodwill & Change in profit sharing ratio | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Valuation of goodwill & Change in profit sharing ratio

Time – 50 mins

M.M. - 30

Q1. What do you understand by capitalization of average profits? (1 mark)

Q2. Capital invested in a firm is Rs. 5,00,000. Normal rate of return is 10%. Average profits of the firm are Rs. 64,000 (after an abnormal loss of Rs. 4,000). Value of goodwill at four times the super profits will be_______ (1 mark)

Q3. If the amount of super profit is negative, what does it indicate? (1 mark)

Q4. X, Y and Z are sharing profits and losses in the ratio of 5 : 3 : 2. They decide to share future profits and losses equally with effect from 1st jan, 2008. At the time of change the goodwill of the firm was valued by 3 years purchase of the average profits of preceding 5 years which were as follows- 2002 Rs. 10000; 2003 Rs. 20,000 (loss); 2004 Rs. 24,000; 2005 Rs. 20,000 , 2006 Rs. 30,000 & 2007 Rs. 50000. pass the journal entry for above effect. (3 marks)

Q5. X, Yand Z are sharing profits and losses in the ratio of 5 : 3 : 2. They decide to share future profits and losses in the ratio of 2 : 3 : 5 with effect from 1st April, 2014. They also decide to record the effect of the following accumulated profits, losses and reserves without affecting their book figures by passing a single entry General Reserve Rs. 30,000 Profit and Loss A/c Rs. 12,000 Advertisement Suspense A/c Rs. 24,000. (3 marks)

Q6. The average net profits of the firm in which A , B & C were partners was Rs. 66,000 per year. The average capital employed in the firm was Rs. 3,00,000 . The rate of return expected from the capital invested was 10%. The remuneration of partners is estimated to be Rs. 500 per month. Find out the value of good will on two year purchase of super profits. (3 marks)

Q7. A , B & C were partners sharing profits in 3:2:1 Pass the entry for the followingWork men compensation fund stood in the balance sheet at Rs. 70,000 and claim for the workmen compensation fund was:

(i) Rs. 25,000,

(ii) Rs. 90,000.

Investment fluctuation fund stood at Rs. 60,000 and investments were valued Rs. 4,00,000.

And the market value of investments was:

(i) 115%

(ii) 85%. (4 marks)

Q8. Calculate the value of goodwill at 3 years' purchase of average profits for past four years. The profits are: 31.12.2008 Rs. 20,200 31.12.2009 Rs. 24,800 31.12.2010 Rs. 20,000 31.12.2011 Rs. 28,980 On 1st September 2010, major repair of plant was charged to revenue as Rs. 6,000. It is agreed to capitalize it subject to depreciation of 10% p.a. on reducing instalment. The closing stock of 2009 was over-valued by Rs. 2,400. To cover partner's remuneration a sum of Rs. 4,800 p.a. shall have to be incurred. (4 marks)

Q9. X, Y & Z are partners sharing profits and losses equally. They mutually decide to change the ratio to 5:3:2. On the date of change in the ratio, goodwill was valued Rs. 75,000 and they had the following undistributed profit and losses, which they need to adjust due to the change in their ratio.

General reserve Rs. 34,000,

Profit & loss A/c Rs. 38,000.

Advertisement suspense Rs. 12,000 Give a single journal entry for the above effect without affecting their book values. (4 marks)

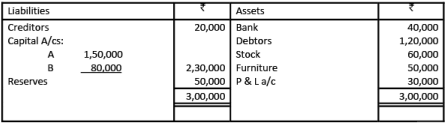

Q10. A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2012, their Balance Sheet was as under:

They decided to share profits and losses equally and Following adjustments are agreed upon:

(i) Stock is to be reduced to Rs. 56,000 and furniture by Rs. 5,000.

(ii) There is an unrecorded asset worth Rs. 20,000.

(iii) One month’s rent of Rs. 15,000 is outstanding.

(iv) A creditor for goods purchased for Rs. 10,000 had been omitted to be recorded although the goods had been correctly included in stock.

(v) Insurance premium amounting to Rs. 8,000 was debited to P & L A/c,of which Rs. 2,000 is related to the period after 31st March, 2012.

Partner decided not to record the revised values and how ever also decided to leave the reserves as undisturbed. You are required to pass the entries for the above arrangement. (6 marks)

|

79 docs|43 tests

|

FAQs on Sample Questions - Valuation of goodwill & Change in profit sharing ratio - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is the valuation of goodwill? |  |

| 2. How is goodwill valued? |  |

| 3. What factors are considered when valuing goodwill? |  |

| 4. What is a change in profit sharing ratio? |  |

| 5. How does a change in profit sharing ratio affect partners? |  |