Very Short Type Questions - Entrepreneurial Planning, Entrepreneurship, Class 12 - Commerce PDF Download

Q1. How can activities be classified ? (1 mark)

Ans. Activities can be classified into

(i) Economic activities and

(ii) Non-Economic Activities.

Q2. Give two examples of economic activities. (1 mark)

Ans.

(i) Working in a factory,

(ii) Distribution of goods by a wholesaler or retailer.

Q3. Give two examples of non-economic activities. (1 mark)

Ans.

(i) Social service,

(ii) Going to temple.

Q4. Give one example of an activity which can be both economic and non-economic and how. (1 mark)

Ans. Farming. When a farmer is producing crop for selling in market, it is called economic activity but when he is cultivating crop for self consumption then it is called non-economic activity.

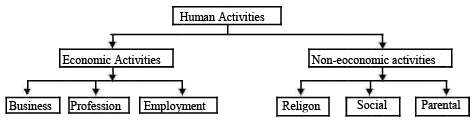

Q5. With a digram explain how are human activities divided. (2 marks)

Ans.

Q6. What are the different categories of business enterprises. (2 marks)

Ans. Business enterprises can be classified into three broad categories :

(i) Private sector enterprises.

(ii) Public sector enterprises.

(iii) Joint sector enterprises.

Q7. Define sole proprietorship organization. (1 mark)

Ans. A business owned, managed and controlled by a single individual is known as sole proprietorship organization.

Q8. Write any four legal formalities involved in sole proprietorship. (2 marks)

Ans.

(i) Business Name.

(ii) Service Tax Registration.

(iii) VAT/CST Registration.

(iv) Payment of Taxes.

Q9. What is a HUF ? (1 mark)

Ans. HUF stands for Hindu Undivided Family. This kind of business is not governed by Industrial or Company Act, but it is governed by the Hindu Succession Act, which exists under Hindu Law.

Q10. What are the two conditions for existence of Joint Hindu Family Business ? (1 mark)

Ans. The two conditions are :

(i) Minimum two male members must be there in the family.

(ii) Existence of some ancestral property.

Q11. What are the systems of inheritance under the Hindu Law ? (2 marks)

Ans. Under the Hindu Law there are two systems of inheritance :

(i) Dayabhaya : This system prevails only in West Bengal.

(ii) Mitakashara : This system prevails all over India except West Bengal.

Q12. Explain Dayabhaya system under Hindu Law. (1 mark)

Ans. Under this system the son acquires the right in the family property after death of his father. This system prevails only in West Bengal.

Q13. Explain Mistakashara system of inheritance under Hindu Law. (1 mark)

Ans. Under this system the son acquires the right in the family property, right from his birth. This system prevails all over India except West Bengal.

Q14. What is a Partnership Deed ? (1 mark)

Ans. Partnership Deed is a document containing the agreement among partners.

Q15. What is a Certificate of Registration of a Partnership Firm ? (1 mark)

Ans. The Certificate of Registration is an evidence of firm issued by the Registrar.

Q16. Define co-operative organization ? (1 mark)

Ans. Co-operative organization is a voluntary association of persons to carry on business with the main purpose of providing service to its members.

Q17. List out the basic features of co-operative societies. (2 marks)

Ans. The common features of co-operative societies are given below :

(i) Service Notice.

(ii) Voluntary Association.

(iii) Equal Voting Rights.

(iv) Seperate Legal Entity.

Q18. On which type of industries is EPF and ESI scheme applicable ? (2 marks)

Ans. EPF is applicable for an establishment, employing 20 or more persons and engaged in industy.

ESI is applicable to non-seasonal factories employing 10 or more persons.

Q19. What is TAN ? (2 marks)

Ans. TAN (tax deduction and collection account number) is a 10 digit alphanumeric number required to be obtained by the persons who are responsible for deducting or collecting tax.

Q20. Differentiate between a private company and a public company on the basis of minimum and maximum number of members required ? (1 mark)

Ans. A private company has a minimum of two and a maximum of 50 members excluding its part and present employees. A public company has minimum seven people to commence it with no upper limit to membership.

Q21. What is a common seal ? (1 mark)

Ans. A common seal acts as an official signature of a company. Being an artificial person, company cannot sign the documents. Hence it uses a common seal on which its name is engraved.

Q22. What is an association of two or more persons called ? (1 mark)

Ans. Partnership.

Q23. What is PAN ? (2 marks)

Ans. PAN stands for Permanent Account Number. PAN is a ten digit alpha numeric number, issued by the Income Tax Department.

Q24. What are the four C’s of Credit ? (2 marks)

Ans. Character, Cash flow, Collateral, Contribution (equity).

Q25. A male becomes member of ................. from his birth : (1 mark)

Ans.

(i) Private Sector Enterprise.

(ii) Sole Proprietorship Firm.

(iii) HUF.

(iv) Partnership Firm Ans.

Q26. What is Value Added Tax (VAT) ? (2 marks)

Ans. VAT is a multi-point destination based system of taxation with tax being levied on value addition at each stage of transaction in the production/distribution chair. VAT is a tax on the final consumption of goods or services and is ultimately borne by the consumer.

Q27. Who must apply for TAN ? (1 mark)

Ans. All persons who are required to deduct tax at source or collect tax at source on behalf of Income Tax Department are required to apply and obtain TAN.

Q28. What are the 4 P’s of marketing strategy ? (2 marks)

Ans. Product, Price, Promotion and Place.

Q29. What are economic activities ? (1 mark)

Ans. All those activities related to the production and/or distribution of goods and services, with economic motive.

Q30. What is Business ? (1 mark)

Ans. Business may be defined an “an activity in which different persons exchange something of value whether goods and services for mutual gain or profit”.

Q31. Entrepreneurial activities can be divided into which major categories ? (1 mark)

Ans. It can be divided into three major categories : Manufacturing, Trading and Service.

Q32. What keeps an entrepreneur vigilant and going ? (1 mark)

Ans. Risk element keeps entrepreneurs vigilant and going.

Q33. Various forms of business venture has important implications in which areas or aspects ? (2 marks)

Ans. Various forms of business has implication on :

(i) Taxes.

(ii) Liabilitiy.

(iii) Continuity.

(iv) Financing.

(v) Ownership.

Q34. What is Service Tax ? (1 mark)

Ans. Service Tax is a tax on service and is levied on the transaction of certain services specified by the Central Government under the Finance Act, 1994.

Q35. What is meant by Target Market ? (1 mark)

Ans. Target Market means the specific group of potential customers whose needs the enterprise aims to fullfil.

Q36. What is Custom Duty ? (1 mark)

Ans. Custom Duty is a type of indirect tax levied on goods imported into India as well as on goods exported from India.

Q37. What is abatement cost ? (1 mark)

Ans. Abatement cost is the cost of controlling the environmental damage by a firm.

Q38. Who is liable to pay Service Tax ? (2 marks)

Ans. Normally, the person who provides the taxable service on receipt of service charge is responsible for paying the Service Tax to the Government.

Q39. What is TIN ? (2 marks)

Ans. Tax Payer’s Identification Number (TIN) consists of 11 digit numericals. Its first two characters represent the state code and the setup of the next nine characters can vary in different states. It is as per identification/registration of dealers under VAT.

Q40. What is the full form of ESI ? When this scheme is applicable ? (2 marks)

Ans. Employee’s State Insurance Scheme. The said scheme is applicable to non-seasonal factories employing 10 or more persons. This scheme has been extended to shops, hotels, restaurants, cinemas, etc., employing 20 or more persons.

Q41. When is it compulsory for an enterprise to take service tax registration ? (1 mark)

Ans. Registration of a business enterprise is compulsory under the service tax where the annual gross receipts are exceeding ten lakhs rupees.

Q42. Which form of organization is considered to be the simplest form of organization ? (1 mark)

Ans. Sole Proprietorship Firm.

Q43. Which form of business gives all the rights even to the minor member ? (1 mark)

Ans. Joint Hindu Family Business.

Q44. Give any two contents of a business. (2 marks)

Ans.

(i) Describing all necessary inputs for the enterprise.

(ii) Explaining the mode of utilization of the resources.

(iii) Detailing the strategies for the execution of the project.

(iv) Outlining the desired goals.

(v) Assessing market sensitivity and the profitability of the venture. (Any two)