Class 12 Economics Solved Paper (2013 Delhi Set-II) | Additional Study Material for Commerce PDF Download

Ques 1: Give two examples of variable costs.

Ans: (i) Wages of labourers who work on daily wage rate (ii) Cost of raw material.

Ques 2: A firm's revenue rises from Rs 400 to Rs 500 when the price of its product rises from Rs 20 per unit to Rs 25 per unit. Calculate the price elasticity of supply.

Ans:

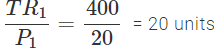

Initial Total Revenue (TR1) = Rs 400

Final Total Revenue (TR2) = Rs 500

Initial Price (P1) = Rs 20

Initial Price (P2) = Rs 25

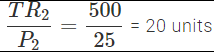

⇒ Change in Price (AP) = Rs (25−20) = Rs 5

Initial Quantity Supplied (Q2) =

Final Quantity Supplied (Q2) =

⇒

Change in Price (ΔQ)=Rs (2020) = Rs 0

Hence, elasticity of supply is zero.

Ques 3:

Complete the following table. | ||

Output (Units) | Average Cost (Rs) | Marginal Cost (Rs) |

1 | 12 | ...... |

2 | 10 | ...... |

3 | ..... | 10 |

4 | 10.5 | ...... |

5 | 11 | ...... |

6 | ..... | 17 |

Ans:

Output (Units) | Average Cost (TC x Q) Rs | Marginal Cost Rs | Total Cost (TC) Rs |

1 | 12 | 12 | 12 |

2 | 10 | 8 | 20 |

3 | 10 | 10 | 30 |

4 | 10.5 | 12 | 42 |

5 | 11 | 13 | 55 |

6 | 12 | 17 | 72 |

Ques 4: Explain any two features of monopoly markets.

Ans:

The following are the two features of a monopoly market.

1. Restricted entry of new firms: The entry into the monopolist market is restricted. In other words, no new firm can enter the monopoly market. There may be various legal barriers such as, patent rights, cartel laws, exclusive rights, etc., to restrict the entry of the new firms.

2. A monopolist is a price maker: Since, a monopolist firm is the single firm in the market, therefore, it enjoys full control over the price and output decisions. The monopolist has the total freedom to fix the price level, which maximizes his profit.

Therefore, it can be said that a monopoly firm is a price-maker.

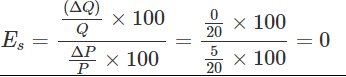

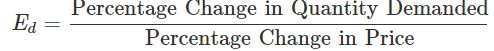

Ques 5: The demand for good rises by 20 percent as a result of all in its price.

its price elasticity of demand (-) 0.8. Calculate the percentage fall in price.

Or

How is price elasticity of demand affected by?

(i) Number of substitutes of available for the good,

(ii) Nature of the good

Ans:

Thus, the percentage fall in the price 25.

Or

(i) Number of Substitutes Available for the Good: The demand for a good that has more number of substitutes available will be relatively more elastic and ed > 1. This is because a slight increase in the price will push the consumers to shift their demand away from the good to its substitutes. On the other hand, with a slight fall in price the consumers would shift their demand from the substitutes towards the good. Thus, the goods having a large number of close substitutes will have elastic demand. On the contrary, if a good has no close substitutes, then it will have an inelastic demand.

(ii) Nature of the good: The price elasticity of demand depends on the nature of a good. The goods and services can be broadly divided into three categories - Necessities, Luxuries, Jointly-demanded goods. The three types of goods have different values of elasticity as discussed below.

(a) Necessity goods: These goods are those goods which a consumer demands for sustaining his life. A consumer cannot reduce the consumption of these goods. The demand for such goods does not change much in response to the changes in their prices. Even when the price rises the consumer cannot reduce their demand. Hence, such goods have an inelastic demand (ed < 1).

(b) Luxury goods: Luxuries are the good which are not essential, rather, are consumed for leisure or comfort purposes. For example, air conditioner, branded garments, etc. The demand for such goods is highly responsive to changes in their prices. A rise in the price, reduces the demand for them and vice-versa. Thus, such goods have high price elasticity.

(c) Jointly-demanded goods: Jointly-demanded goods are those goods that are demanded together. The joint consumption of such goods collectively satisfies wants. For example, sugar and tea. A rise in the price of one good does not reduce its demand if the demand for its complement good has not reduced. For example, a rise in the price of sugar will not reduce its demand if the demand for tea has not decreased. Hence, such goods have an inelastic demand (ed< 1)

Ques 6: How do commercial banks create deposits? Explain.

Ans:

Commercial banks play the important role of 'money creator' in the economy. They have the capacity to generate credit through demand deposits. These demand deposits make credit more than the initial deposits.

The process of money creation can be explained by taking an example of a bank XYZ. A depositor deposit Rs 10,000 in his savings account, which will become the demand deposit of the bank. Based on the assumption that not all customers will turn up at the same day to withdraw their deposits, banks maintains a minimum cash reserve of 10% of the demand deposits, i.e., Rs 1000. It lends the remaining amount of Rs 9000 in the form of credit to other customers. This further creates deposits for the hank XYZ. With the cash reserve of Rs 1000, the credit creation is worth Rs 10,000. So, the credit multiplier is given by:

Credit multiplier = 1/CRR = 1/10% = 10

The money supply in the economy will increase by the amount (rimes) of credit multiplier.

Ques 7: In an economy, S=−100+0.6Y is the saving function, where S is saving and Y is National Income. If investment expenditure is 1100. Calculate:

(i) Equilibrium level of National Income

(ii) Consumption expenditure of equilibrium level of National Income.

Ans:

Saving function, S=−100+0.6Y

Investment, I = 1,100 Y = National Income

(i) We know that S = I Given S=−100+0.6Y

⇒ I=−100+0.6Y ⇒ 1,100=−100+0.6Y

↑⇒1200 = 0.6Y| Y =  = 2000

= 2000

∴ Equilibrium level of National Income, Y= 2,000

(ii) Y=C+I

2,000=C+I ⇒C=2,000−1,100=900

∴ Consumption expenditure at equilibrium level = 900

Ques 8:

Complete the following table: | |||

Income Rs | Saving Rs | Average Propensity to consume | Marginal Propensity to consume |

0 | −40 | ..... | ..... |

50 | −20 | ..... | ..... |

100 | 0 | ..... | 0.6 |

150 | 30 | 0.8 | ..... |

200 | 50 | ..... | ..... |

Ans:

Income Rs | Saving Rs | Consumption | Average Propensity to consume | Marginal Propensity to consume |

0 | −40 | 10 | - | - |

50 | −20 | 70 | 70/50 = 1.4 | 30/50 = 0.6 |

100 | 0 | 100 | 100/100 = 1 | 30/50 = 0.6 |

150 | 30 | 120 | 120/150 = 0.8 | 20/50 = 0.4 |

200 | 50 | 150 | 150/200 = 0.75 | 30/50 = 0.6 |

|

4 videos|168 docs

|