Class 12 Accountancy sample paper Test - 1 (with solution) | Additional Study Material for Commerce PDF Download

Ques 1: Why is goodwill considered as an intangible asset but not a fictitious asset?

Ans: Goodwill is an intangible asset (i.e. an asset which can neither be seen nor touched) but not a fictitious asset because it has a realisable value subject to fluctuations.

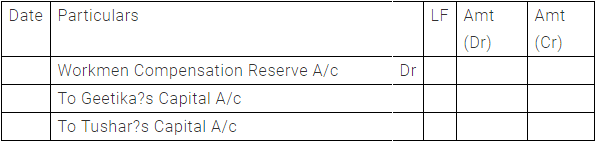

Ques 2: The accountant of GT Ltd having two partners Geetika and Tushar passed a journal entry to distribute workmen compensation reserve as credit workmen compensation reserve account and debit partners' capital account. Is the treatment correct?

Ans: No, the treatment is incorrect. Correct Entry

Ques 3: Pass necessary journal entry to transfer 10% of profits to general reserves, if Profit is given Rs. 5,00,000.

Ans: JOURNAL

Date | Particular | LF | Amt (Dr) | Amt (Cr) | |

Profit and Loss Appropriation A/c | Dr | 50,000 | |||

To General Reserves A/c | 50,000 | ||||

| (Being 10% of Profits transferred to general reserves) |

Ques 4: In case of change in profit sharing ratio, how can the gaining partner compensate the sacrificing partner.

Ans: On change in profit sharing ratio, the gaining partner compensates the sacrificing partner by paying him goodwill which is equal to the share gained by him.

Ques 5: What do you understand by the term legacy?

Ans: Legacy is the amount received by a non-trading concern as per the will of a deceased person. It is like a donation. It appears on the receipt side of the receipts and payments account and is directly added to the capital fund in the balance sheet because it is not of recurring nature.

Ques 6: Goel Ltd invited applications for issuing 6,000, 12% debentures of Rs. 100 each at a premium of Rs. 50 per debenture. The full amount was payable on application. Applications were received for 8,000 debentures. Applications for 2,000 debentures. were rejected and application money was refunded. Debentures were allotted to the remaining applicants. Pass necessary journal entries for the above transactions in the books of Goel Ltd.

Ans: JOURNAL

Date | Particulars | LF | Amt (Cr) | Amt (Cr) | |

Bank A/c (8,000×150) | Dr | 12,00,000 | |||

To Debenture Application and Allotment A/c | 12,00,000 | ||||

(Being application money received on 8,000 debentures) | |||||

Debenture Application and allotment A/c | Dr | 12,00,000 | |||

To 12% Debentures A/c (6,000×100) | 6,00,000 | ||||

To Securities Premium Reserve A/c (6,000×50) | 3,00,000 | ||||

To Bank a/c (2,000×150) | 3,00,000 | ||||

(Being application money transferred to 12% debentures account and excess money refunded) |

|

4 videos|168 docs

|

FAQs on Class 12 Accountancy sample paper Test - 1 (with solution) - Additional Study Material for Commerce

| 1. What are the key topics covered in Class 12 Accountancy sample paper Test - 1? |  |

| 2. How can I prepare for the Class 12 Accountancy exam effectively? |  |

| 3. Are there any specific formulas or equations that I should remember for the Class 12 Accountancy exam? |  |

| 4. Can you provide some tips for improving my understanding of partnership accounts? |  |

| 5. How can I analyze a cash flow statement effectively for the Class 12 Accountancy exam? |  |