Redemption of Preference Shares (Accounting Entries) - Commerce PDF Download

It may be noted here that the term ‘proceeds of fresh issue’ does not include share premium money if fresh issue is being made at a premium. The premium on redemption of preference shares may be adjusted against the securities premium account or the profit and loss account. It is only fully paid preference shares which can be redeemed. Partly paid preference shares cannot be redeemed unless they are fully paid.

Accounting Entries on Redemption:

When the preference shares are redeemed out of undistributed profits, it is necessary, as per provisions of Companies Act, that an amount equal to the face value of the preference share redeemed is transferred to capital redemption reserve.

This is necessary in order to immobilise profit from being used for any other purpose such as declaration of dividend, redemption of debentures, etc. Capital redemption reserve can be utilised for the purpose of issuing fully paid-up bonus shares.

The accounting entry for the transfer of amount of profits to capital redemption reserve a/c is as follows:

To capital redemption reserve a/c

Illustration 1:

Bharat Limited invited applications for 1,00,000 shares of Rs. 100 each at a price of Rs. 110, payable Rs. 40 on application (including premium Rs. 10), Rs. 45 on allotment and balance on first and final call.

Applications were received for 1,20,000 shares.

Allotment was made as:

To applicants of 80,000 shares: 100%

To applicants of 40,000 shares: pro-rata to all applicants

Prepare the following ledger accounts in the books of Bharat Ltd.:

(i) Equity share capital account

(ii) Share allotment account

(iii) Share call account

(iv) Securities premium account

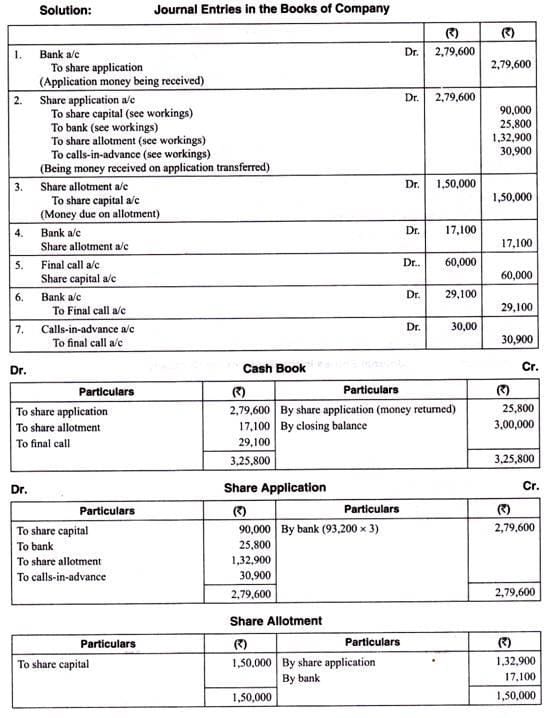

Illustration 4:

A company made an issue of 30,000 shares of Rs. 10 each, payable Rs. 3 on application. Rs. 5 on allotment and Rs. 2 on call. A total of 93,200 shares were applied for and owing to this heavy oversubscription allotments were made as follows:

Applicants for 21,500 (in respect of applications for 2,000 or more) received 10,200 shares.

Applicants for 50,000 (in respect of application for 1,000 or more but less than 2,000) received 12,600 shares.

Applicants for 21,100 (in respect of applications for less than 1,000) received 7,200 shares. Cash then received after satisfying amount due on application was applied towards allotment and call money and any balance was returned. All moneys due on allotment and call were realised. Give journal entries including that of cash and write up the cash account and ledger accounts relating to this issue of shares in the books of the company.

Illustration 2:

A company has decided to increase its existing share capital by making a rights issue to the existing shareholders in the proportion of one new share for every two old shares held. You are required to calculate the price of right if the market value of share at the time of announcement of right issue is Rs. 240. The company has decide to give one share of Rs. 100 each at a premium of Rs. 20 each.

Illustration 3:

X Co. Ltd. had issued 2, 00,000 6% redeemable preference shares of Rs. 100 each. Under the terms of the issue of shares, redemption was to take place on April 1, 2012. A general reserve of Rs. 1, 25, 00,000 had already been built up out of past profits. For the purpose of the redemption, 75,000 new 5% preference shares of Rs. 100 each were offered to the public at a premium of Rs. 50, payable in full on application. The new issue was fully subscribed and paid for. Thereupon 6% redeemable preference shares were redeemed. Make journal entries to record the above transactions.

Note:

Note:

The above redemption of preference shares is said to be (i) out of profit otherwise available for dividend to the extent of Rs. 1,25,00,000 and (ii) out of proceeds of fresh issue to the extent of Rs. 75,00,000.

FAQs on Redemption of Preference Shares (Accounting Entries) - Commerce

| 1. What are preference shares? |  |

| 2. What is redemption of preference shares? |  |

| 3. How are preference shares redeemed? |  |

| 4. What are the accounting entries for the redemption of preference shares? |  |

| 5. What are the implications of redeeming preference shares for the company? |  |