Accounting from Incomplete Records (Part - 1) - Commerce PDF Download

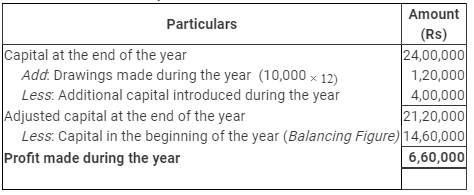

Ques 1:

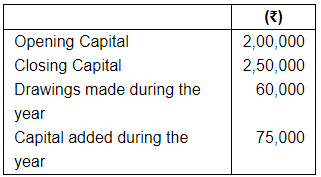

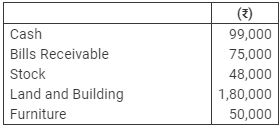

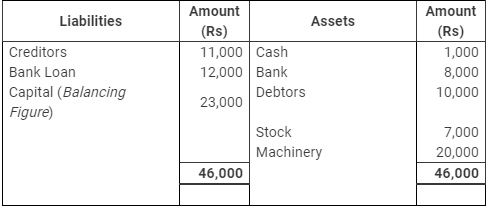

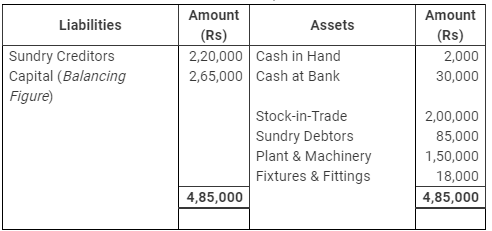

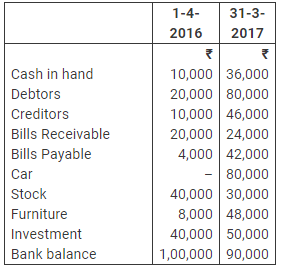

Atul does not keep proper records of his business. He gives you the following information:

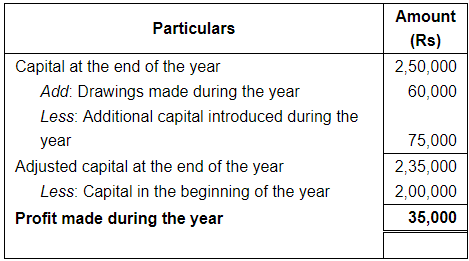

Calculate profit or loss for the year.

Ans:

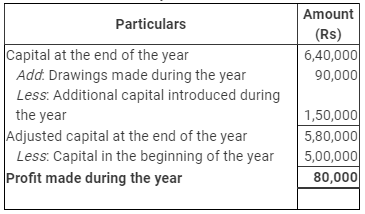

Statement of Profit or Loss

for the year ended ….

Page No 23.43:

Ques 2:

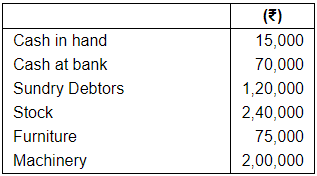

Mr. Joshi started a business with a capital of ₹ 5,00,000. At the end of the year his position was:

Sundry creditors at this date totalled ₹ 80,000. During the year he introduced a further capital of ₹ 1,50,000 and withdrew for household expenses ₹ 90,000. You are required to calculate profit or loss during the year.

Ans:

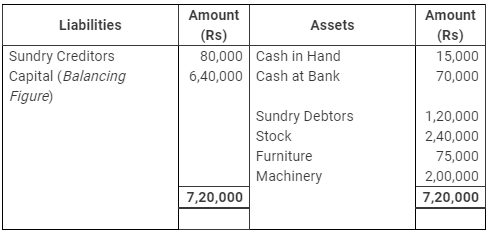

Statement of Affairs

as on March …

Statement of Profit or Loss

for the year ended ….

Ques 3: Mr. Vasudev does not keep proper records of his business. He provided following information. You are required to prepare a statement showing the profit or loss for the year.

Ans:

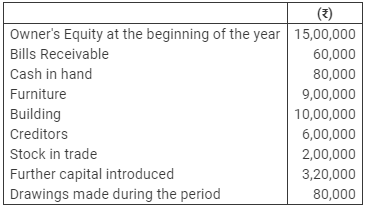

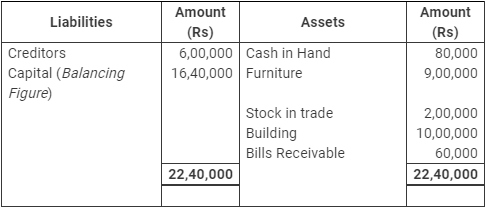

Statement of Affairs

as on March …

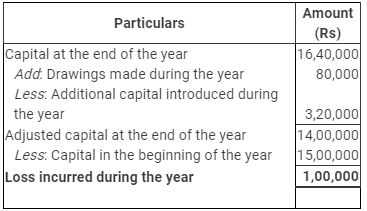

Statement of Profit or Loss

for the year ended ….

Page No 23.44

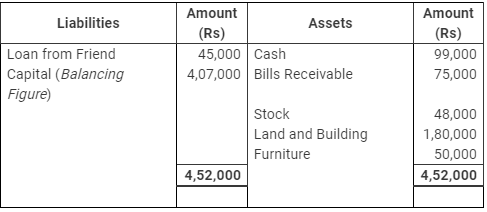

Ques 4: Tulsi started business on 1st April, 2016 with a capital of ₹ 4,50,000. On 31st March, 2017 her position was as under:

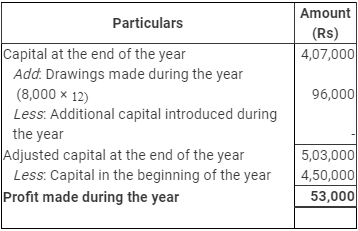

She owed ₹ 45,000 to her friend Parvati on that date. She withdrew ₹ 8,000 per month for household purposes. Ascertain her profit or loss for the year ended 31st March, 2017.

Ans:

Statement of Affairs

as on March 31, 2017

Statement of Profit or Loss

for the year ended March 31, 2017

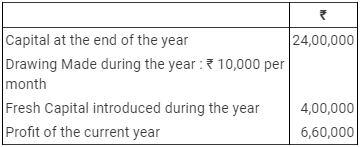

Ques 5(A): From the following information, calculate capital at the beginning :

Ans:

Statement of Profit or Loss

for the year ended December 31, 2005

Ques 5(B):

Calculate Closing Capital:

Opening Capital ₹ 90,000; Profit for the year ₹ 25,000; Drawings ₹ 17,000. During the year proprietor sold ornaments of his wife for ₹ 40,000 and invested the same in business.

Ans 5(B):

Closing Capital + Drawings - Additional Capital - Opening Capital = Profits

Closing Capital = Opening Capital+ Additional Capital + Profits - Drawings

Closing Capital = 90,000 + 40,000 + 25,000 - 17,000

Closing Capital = Rs 1,38,000

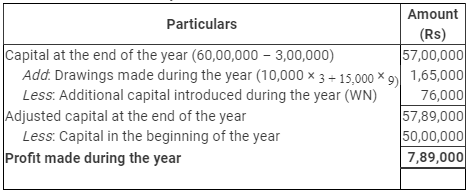

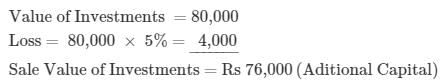

Question 6: Suchitra started a business on 1st April, 2013 with a Capital of ₹ 50,00,000. On 31st March, 2014 her total Assets were ₹ 60,00,000 and Creditors were 3,00,000. She withdrew during the year for her personal expenses ₹ 10,000 per month upto 30th June, 2013 and thereafter ₹ 15,000 per month upto 31st March, 2014. During the year she sold her personal investments of ₹ 80,000 at 5% loss and introduced that amount in the business.

You are required to prepare a Statement of Profit or Loss for the year ending 31st March, 2014.

Ans:

Statement of Profit or Loss

for the year ended March 31, 2014

Working Note: Calculation of additional capital introduced during the year

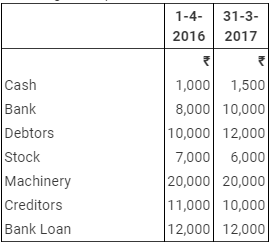

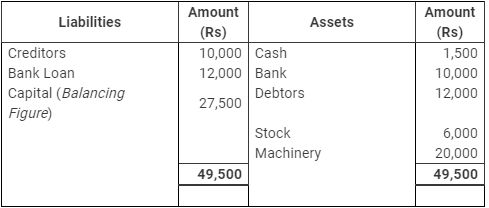

Ques 7:

Following incomplete information is available from records maintained by Mr. X:

During the year Mr. X introduced in the business the amount realised on sale of ₹ 10,000 investments at the premium of 5%. Personal expenses of Mr. X paid from business account amounted to ₹ 1,250 per month. Prepare a statement to calculate Profit (or Loss) during the year.

Ans:

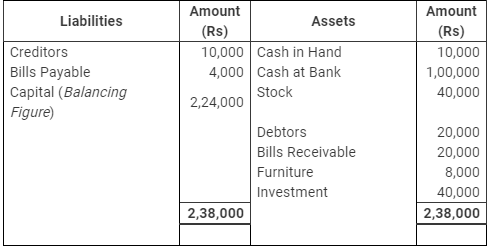

Statement of Affairs

as on April 01, 2016

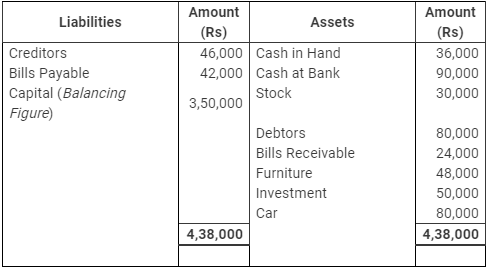

Statement of Affairs

as on March 31, 2017

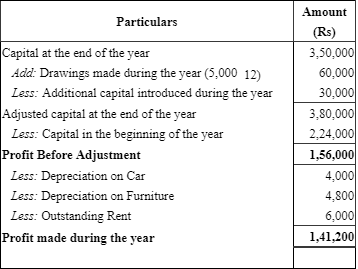

Statement of Profit or Loss

for the year ended March 31, 2017

Working Note: Calculation of additional capital introduced during the year

Value of Investments = 10,000

Premium = 500 (10,000 × 5%)

Sale Value of Investments = Rs 10,500(Aditional Capital)

Value of Investments = 10,000 Premium = 500 (10,000 × 5%)

Sale Value of Investments = Rs 10,500(Aditional Capital)

Page No 23.44

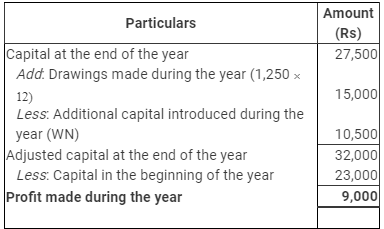

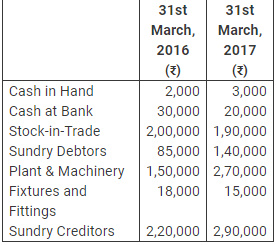

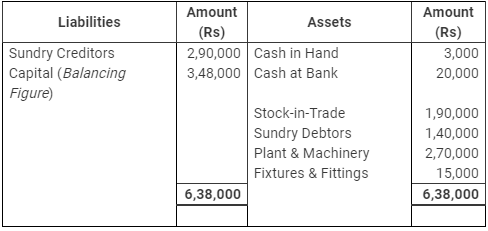

Question 8: Raghuveer keeps incomplete records. His position was as follows:

During the year, Raghuveer introduced ₹ 50,000 as further capital in the business and withdrew ₹ 7,500 per month. From the above information, show Profit or Loss for the year ended 31st March, 2017.

Ans:

Statement of Affairs

as on March 31, 2016

Statement of Affairs

as on March 31, 2017

Statement of Profit or Loss

for the year ended March 31, 2017

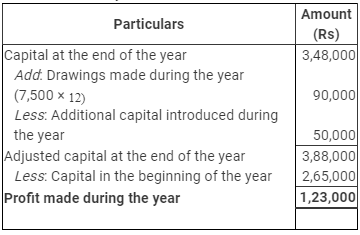

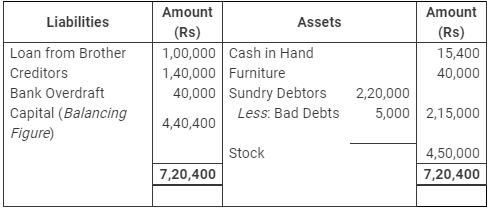

Ques 9:

On 1st April 2014, Mr, Ghosh started business with a capital of ₹ 5,00,000. He kept his books on single entry basis. Soon after he purchased furniture for ₹ 40,000 and purchased goods for ₹ 3,00,000. During the year he borrowed ₹ 1,00,000 from his brother and introduced further capital of his own amounting to ₹ 80,000.

On 31st March, 2015, there were sundry debtors amounting to ₹ 2,20,000 and creditors amounted to ₹ 1,40,000. Stock was valued at ₹ 4,50,000. Cash in hand ₹ 15,400 and Bank Overdraft ₹ 40,000

During the year Mr. Ghosh withdrew ₹ 2,000 per week for his family expenses. You are informed that included in sundry debtors is an irrecoverable amount of ₹ 5,000. He also took goods from the business for his personal use amounting to ₹ 4,000. You are required to calculate his profit or loss during the year.

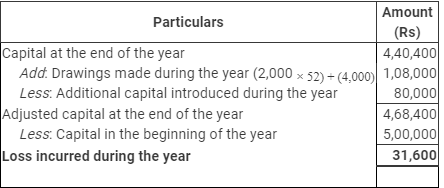

Ans:

Statement of Affairs

as on March …

Statement of Profit or Loss

for the year ended March 31, 2015

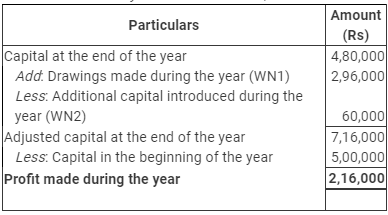

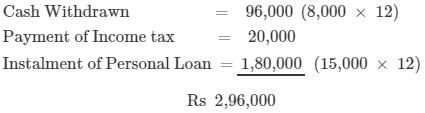

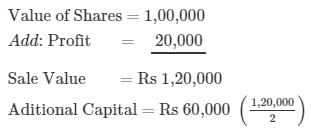

Ques 10: The Capital of Sh. Madhusudan on 1st April, 2016 was ₹ 5,00,000 and on 31st March, 2017 was ₹ 4,80,000. He has informed you that he withdrew from the business ₹ 8,000 per month for his private use. He paid ₹ 20,000 for his income-tax and the installment of the loan of his personal house at the rate of ₹ 15,000 per month from the business. He had also sold his shares of Reliance Company costing ₹ 1,00,000 at a profit of 20% and invested half of this amount in the business. Calculate the profit or loss of the business.

Ans:

Statement of Profit or Loss

for the year ended March 31, 2017

Working Note:

WN 1: Calculation of Drawings

WN 2: Calculation of additional capital

Page No 23.46

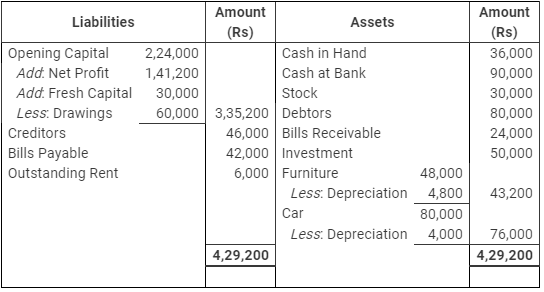

Ques 11: Charu do not keep proper books of accounts. Prepare the statement of profit or loss for the year ending 31-3-2017 from the following information:

Ans:

The following adjustments are to be made:

(a) Proprietor withdrew cash ₹ 5,000 per month for private use.

(b) Depreciation @ 5% on Car and @ 10% on furniture.

(c) Outstanding Rent ₹ 6,000.

(d) Fresh Capital introduced during the year ₹ 30,000.

Ans:

Statement of Affairs

as on March 31, 2016

Statement of Affairs

as on March 31, 2017

Statement of Profit or Loss

for the year ended March 31, 2017

Final Statement of Affairs

as on March 31, 2017

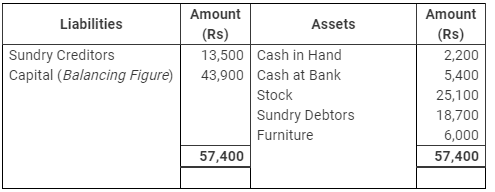

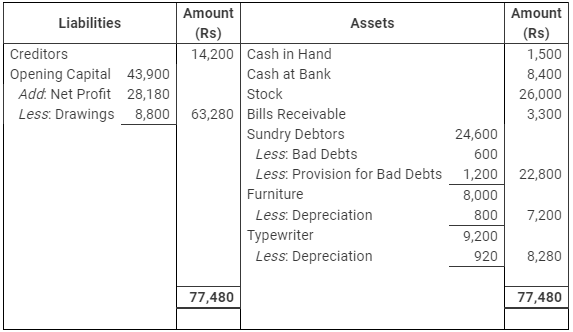

Question 12: Ashok keeps incomplete records. The position of his business on 1st April, 2016 was as follows:

Cash in Hand ₹ 2,200; Cash at Bank ₹ 5,400; Stock ₹ 25,100; Sundry Debtors ₹ 18,700; Furniture ₹ 6,000; Sundry Creditors ₹ 13,500.

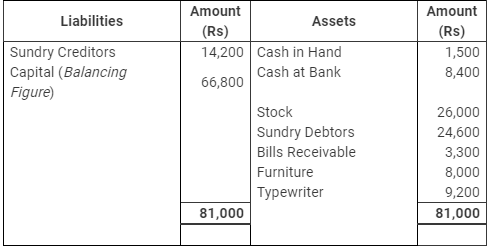

His position on 31st March, 2017 was as follows:

Cash in Hand ₹ 1,500; Cash at Bank ₹ 8,400; B/R ₹ 3,300; Stock ₹ 26,000;

Sundry Debtors ₹ 24,600; Furniture ₹ 8,000; Sundry Creditors ₹ 14,200.

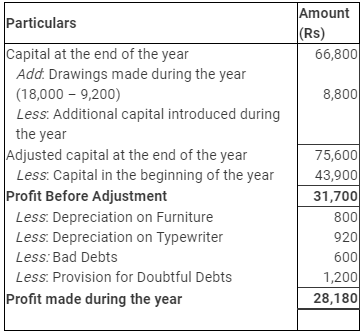

During the year he had withdrawn from the business ₹ 18,000, of which ₹ 9,200 were spent in purchasing a Typewriter for the business.

(a) Depreciate furniture and typewriter by 10%.

(b) Write off ₹ 600 as Bad-Debts.

(c) Make a provision of 5% on Debtors for doubtful debts.

Calculate the profit or loss of his business for the year ended 31st March, 2017 and prepare a final statement of affairs, after the above adjustments.

Ans:

Statement of Affairs

as on March 31, 2016

Statement of Affairs

as on March 31, 2017

Statement of Profit or Loss

for the year ended March 31, 2017

Final Statement of Affairs

as on March 31, 2017

FAQs on Accounting from Incomplete Records (Part - 1) - Commerce

| 1. What is accounting from incomplete records? |  |

| 2. What are the challenges of accounting from incomplete records? |  |

| 3. How can one reconstruct missing information in accounting from incomplete records? |  |

| 4. What are the limitations of accounting from incomplete records? |  |

| 5. How does accounting from incomplete records affect financial analysis and decision-making? |  |