Accounting from Incomplete Records (Part - 3) - Commerce PDF Download

Page No 23.52

Question 23: Mr. Gopal Das has only a Bank Pass Book and does not keep any other books of accounts. From the following information prepare his Final Accounts for the year ended 31st March, 2015.

An analysis of the Pass Book shows:-

Total amount received from Debtors and deposited with the Bank ₹ 2,20,000; Payment to Creditors ₹ 1,82,000; Salaries ₹ 6,000; Rent paid ₹ 4,800; Advertisement ₹ 2,000;

printing ₹ 800; Personal Expenses ₹ 4,000; Payment for Furniture ₹ 12,000; Balance at Bank on 31st March, 2015, ₹ 21,000.

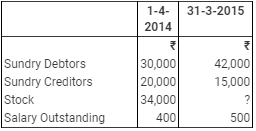

Other Assets and Liabilities were as follows:

Mr. Gopal Das takes 20% profit on sales.

Ans:

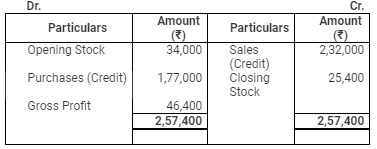

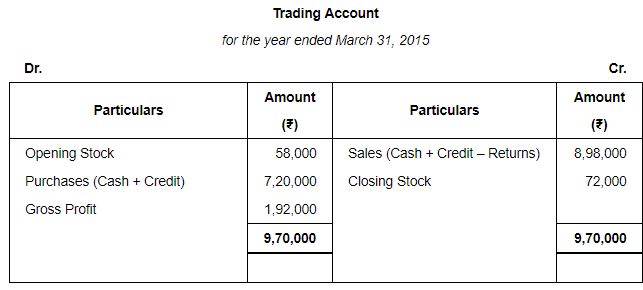

Trading Account

for the year ended March 31, 2015

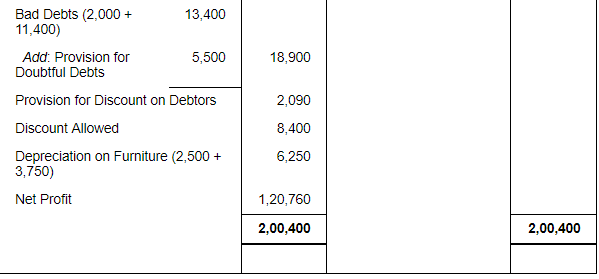

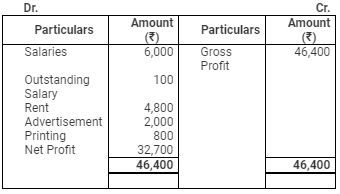

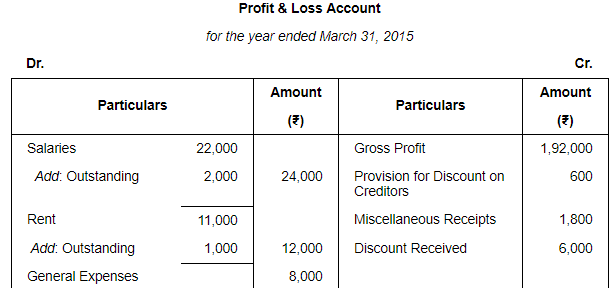

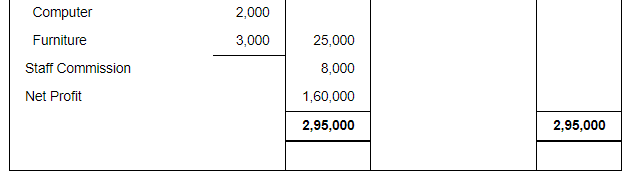

Profit & Loss Account

for the year ended March 31, 2015

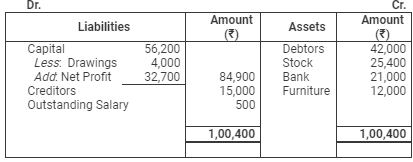

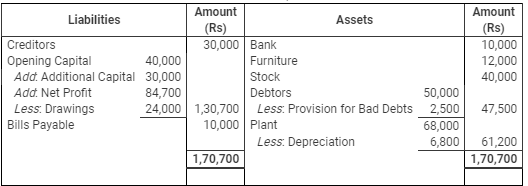

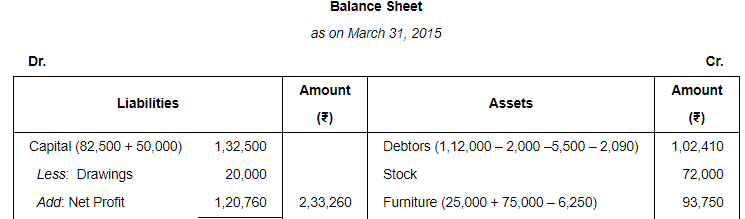

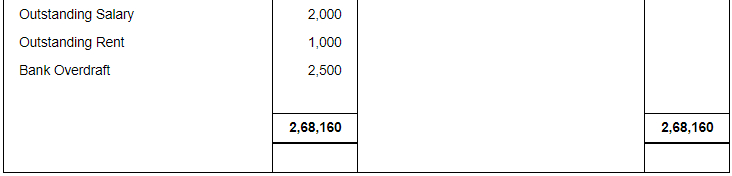

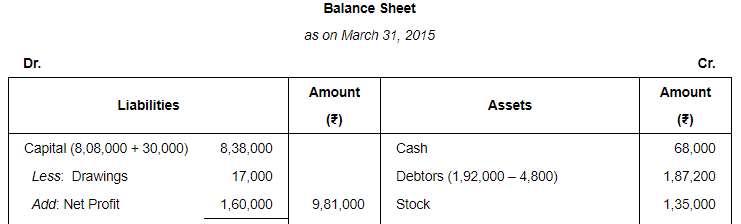

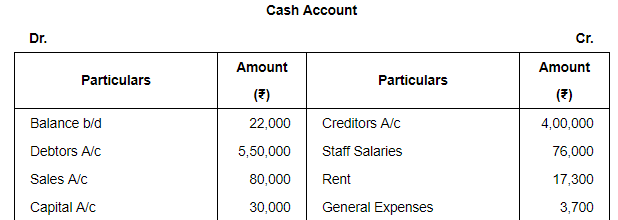

Balance Sheet

as on March 31, 2015

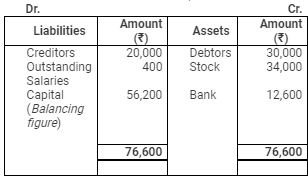

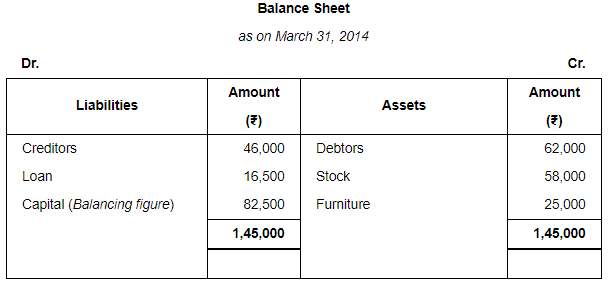

Balance Sheet

as on March 31, 2014

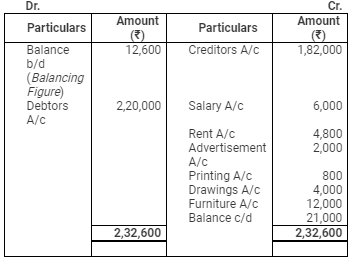

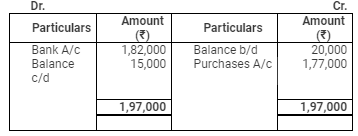

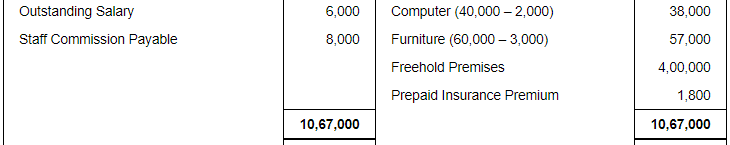

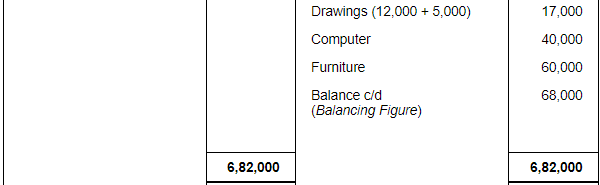

Bank Account

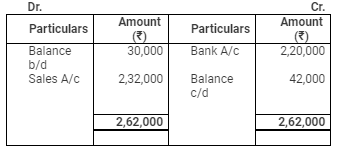

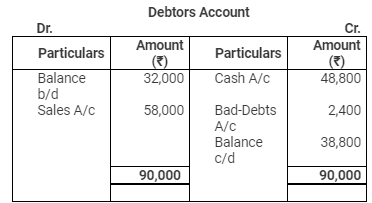

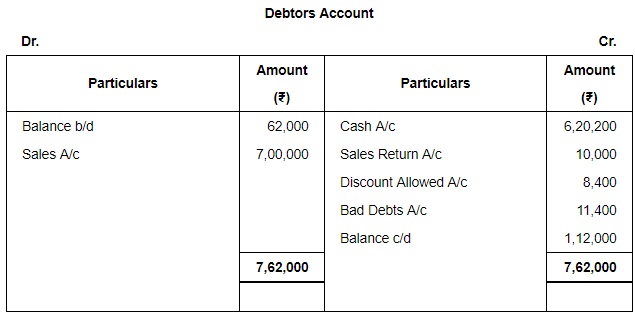

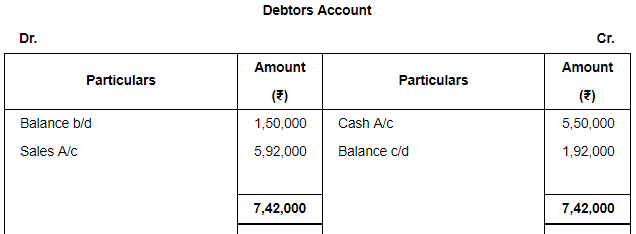

Debtors Account

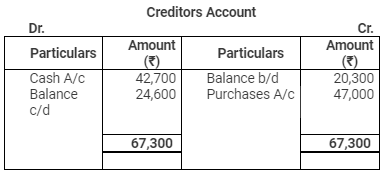

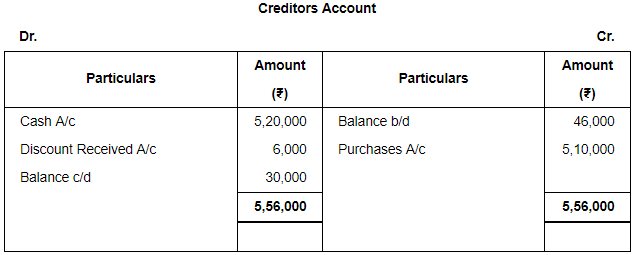

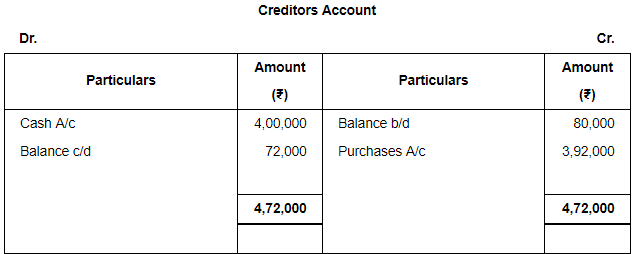

Creditors Account

Rate of Gross Profit (on sales) = 20%

Gross Profit = 20% of 2,32,000 = 46,400

Gross Profit = Net Sales – Cost of Goods Sold

46,400 = 2,32,000 – Cost of Goods Sold

Cost of Goods Sold = 2,32,000 – 46,400 = ₹ 1,85,600

Cost of Goods Sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

1,85,600 = 34,000 + 1,77,000 – Closing Stock

Closing Stock = 34,000 + 1,77,000 – 1,85,600 = ₹ 25,400

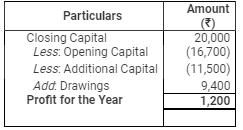

Ques 24: Ravi, who keeps his books on Single Entry System, had his capital on 31st March, 2016 ₹ 20,000 and on 1st April, 2015 was ₹ 16,700. He further informs that during the year, he withdrew for his personal expenses ₹ 9,400. He also sold his personal investment of ₹ 10,000 at 15% premium and brought that money into the business.

Prepare a statement of Profit or Loss.

Ans :

Statement of Profit/Loss

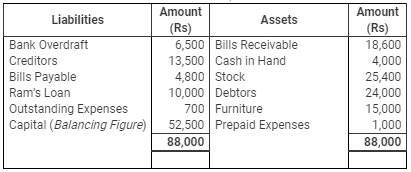

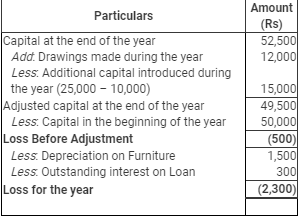

Question 25: Mohan commenced business on 1st April, 2012 with a capital of ₹ 50,000. On 1st January, 2013, he introduced ₹ 25,000 into business of which ₹ 10,000 was borrowed from Ram. His position on 31st March, 2013 was as under:

Assets: Cash in hand ₹ 4,000; Bank (Cr.) ₹ 6,500; Debtors ₹ 24,000; B/R ₹ 18,600.

Stock ₹ 25,400; Furniture ₹ 15,000; Prepaid expenses ₹ 1,000.

Liabilities : Creditors ₹ 13,500; B/P ₹ 4,800; Ram's Loan ₹ 10,000; Outstanding expenses ₹ 700.

Actual drawings were not known but his living expenses are ₹ 1,000 p.m. Depreciate furniture by 10%. Interest on loan is due @ 12% p.a.

Ascertain his profit or loss for the year 2012-13 & prepare final statement of affairs.

Ans :

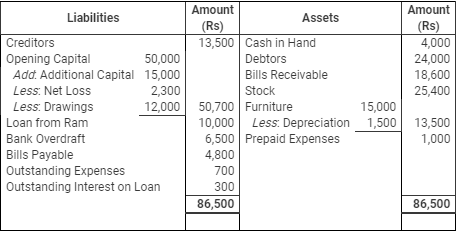

Statement of Affairs

as on March 31, 2013

Statement of Profit or Loss

for the year ended March 31, 2013

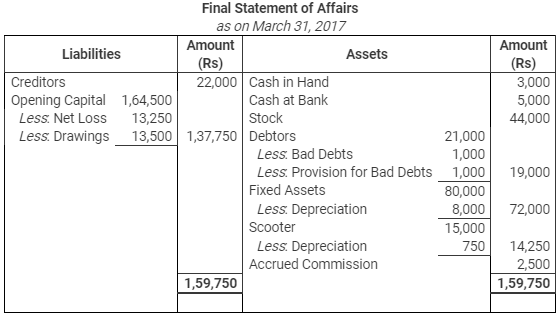

Final Statement of Affairs

as on March 31, 2013

Page No 23.53

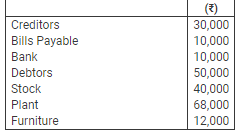

Ques 26: On April 1st, 2016, X started a business with ₹ 40,000 as his capital. On March 31st, 2017, his position was as follows:

During the year 2016-17 X drew ₹ 24,000. On 1st October 2016, he introduced further capital amounting to ₹ 30,000. You are required to ascertain profit or loss made by him during the year 2016-17.

Adjustments:

(a) Plant is to be depreciated at 10%.

(b) A Provision of 5% is to be made against debtors.

Also prepare the Statement of Affairs as on March 31st 2017.

Ans:

Statement of Affairs

as on March 31, 2017

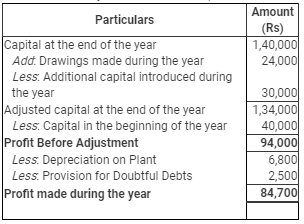

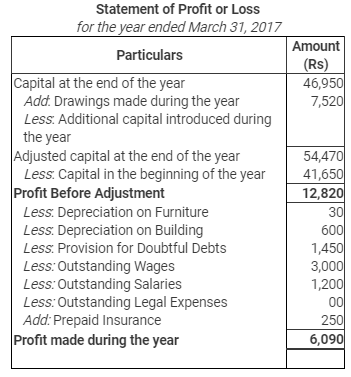

Statement of Profit or Loss

for the year ended March 31, 2017

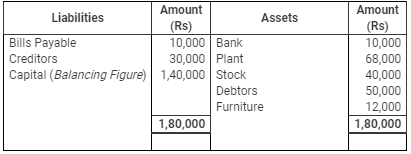

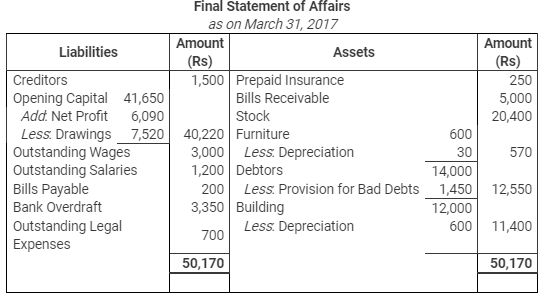

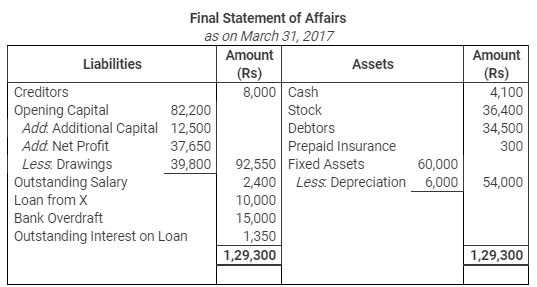

Final Statement of Affairs

as on March 31, 2017

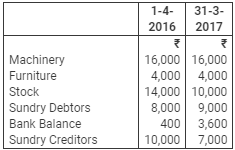

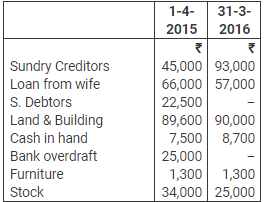

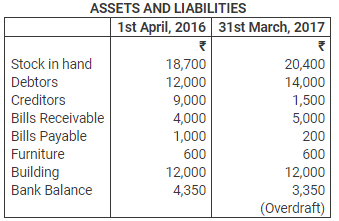

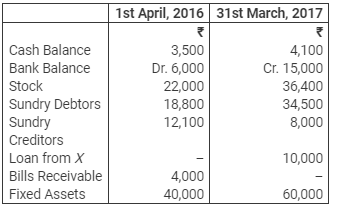

Ques 27: From the following information relating to the business of Mr. X who keeps books by single entry ascertain the profit or loss for the year ended 31st March, 2017:

Mr. X withdrew ₹ 4,100 during the year to meet his household expenses. He introduced ₹ 600 as fresh capital. Machinery and furniture to be depreciated by 10% and 5% per annum respectively.

Ans:

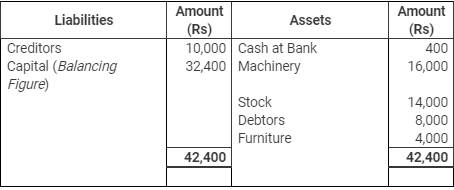

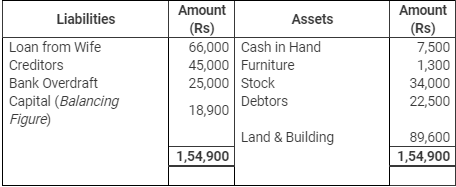

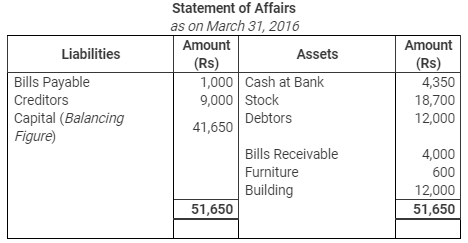

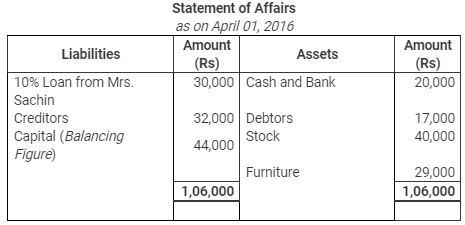

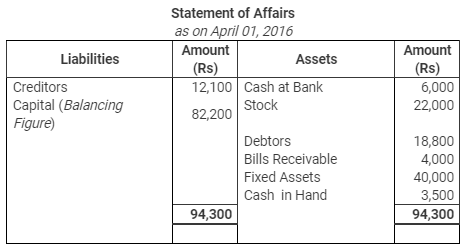

Statement of Affairs

as on April 01, 2016

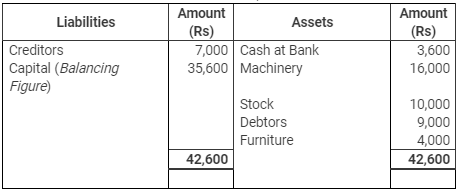

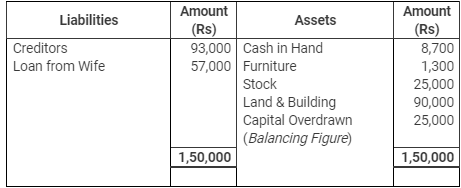

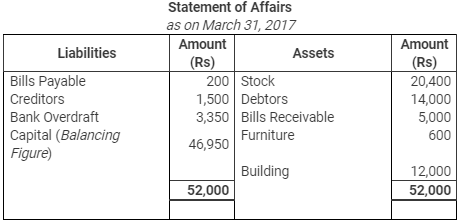

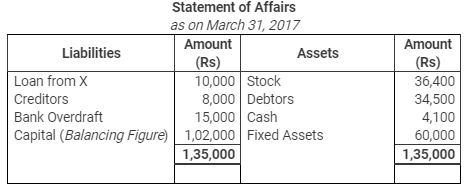

Statement of Affairs

as on March 31, 2017

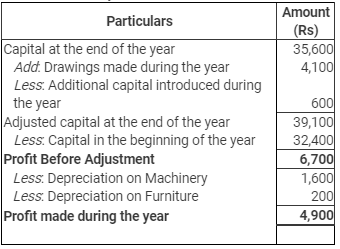

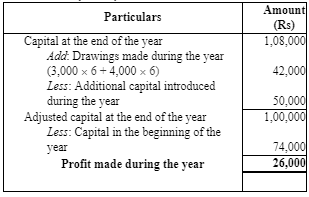

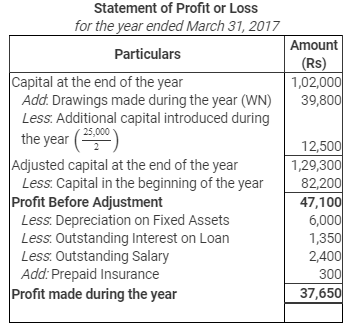

Statement of Profit or Loss

for the year ended March 31, 2017

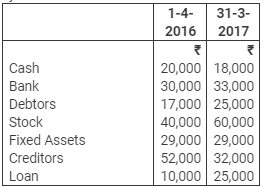

Ques 29: Mr. White does not keep his books properly. Following information is available from his books.

During the year Mr. White sold his private car for ₹ 50,000 and invested this amount into the business. He withdrew from the business ₹ 1,500 per month upto 31st October, 2015 and thereafter ₹ 4,500 per month as drawings. You are required to prepare a statement of profit or loss and a statement of affairs as at March 31, 2016.

Ans:

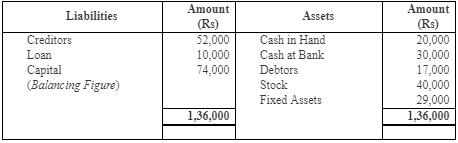

Statement of Affairs

as on April 01, 2015

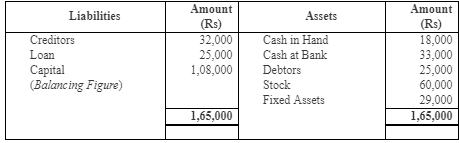

Statement of Affairs

as on March 31, 2016

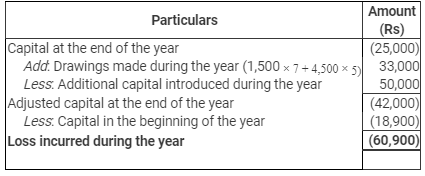

Statement of Profit or Loss

for the year ended March 31, 2016

Ques 28: Mr. A does not keep proper records of his business. Following information is available from records kept by him:

Mr. A withdrew from the business ₹ 3,000 per month upto 30th September 2016 and thereafter ₹ 4,000 per month as drawings. ₹ 50,000 realised by the proprietor as maturity value of National Saving Certificates was invested in the business.

Prepare a statement showing net profit (or net loss) for the year.

Ans:

Statement of Affairs

as on April 01, 2016

Statement of Affairs

as on March 31, 2017

Statement of Profit or Loss

for the year ended March 31, 2017

Page No 23.55

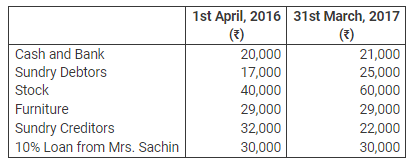

Ques 30: X who keeps incomplete records, gives you the following information:

You are also given the following information:

(i) A provision of ₹ 1,450 is required for bad and doubtful debts.

(ii) Depreciation @ 5% is to be written off on Building and furniture.

(iii) Wages outstanding ₹ 3,000; salaries outstanding ₹ 1,200.

(iv) Insurance has been prepaid to the extent of ₹ 250.

(v) Legal Expenses outstanding ₹ 700.

(vi) Drawings of Mr. X during the year were ₹ 7,520.

Prepare a statement of Profit as on 31st March, 2017, and a final statement of affairs as at that date.

Ans:

Page No 23.56

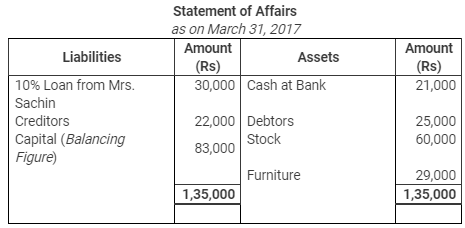

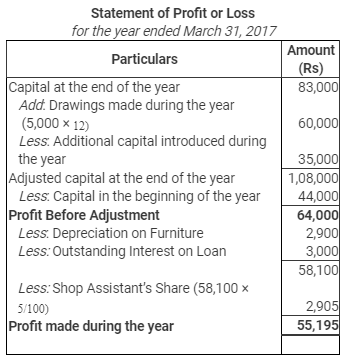

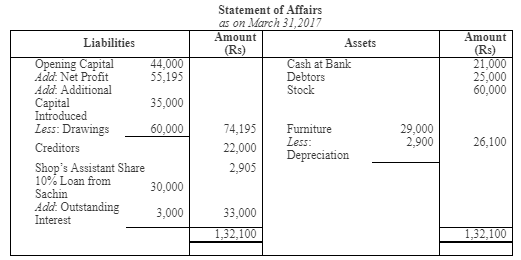

Ques 31: The following information is available from Sachin, who maintains books of accounts on single entry system:

Sachin withdrew ₹ 5,000 from the business every month for meeting his household expenses. During the year, he sold investments held by him privately for ₹ 35,000 and invested the amount in his business.

At the end of the year 2016-17, it was found that full year's interest on loan from Mrs. Sachin had not been paid. Depreciation @ 10% per annum was to be provided on furniture for the full year. Shop assistant was to be given a share of 5% on the profits ascertained before charging such share.

Calculate profit earned during the year ended 31st March, 2017 by Sachin.

Ans:

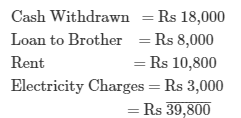

Ques 32: A retail Trader has not kept proper books of accounts. Ascertain his profit or loss for the year ending 31st March, 2017, and prepare a final statement of affairs from the following information:

He withdrew from the business ₹ 1,500 per month for his personal use and ₹ 8,000 for giving a personal loan to his brother. He also used a house for his personal purposes, the rent of which at the rate of ₹ 900 per month and electricity charges at an average rate of ₹ 250 per month were paid from the business account.

He had received a lottery prize of ₹ 25,000, out of which he invested half the amount in business.

He has not paid two months' salary to his clerk @ ₹ 1,200 per month, but insurance premium @ ₹ 600 per annum was paid on 1st October, 2016 to run for one year.

Loan from X was taken on 1st July, 2016 on which interest was unpaid @ 18% p.a.

Fixed assets are to be depreciated @ 10% p.a.

Ans:

Page No 23.57

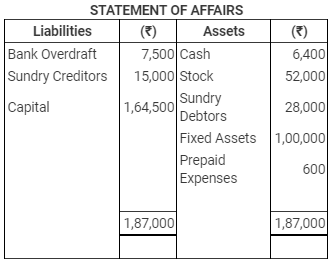

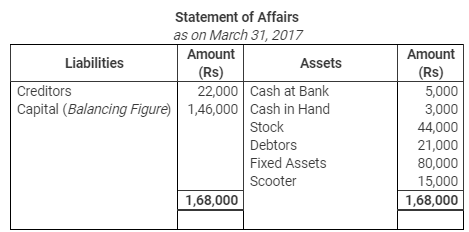

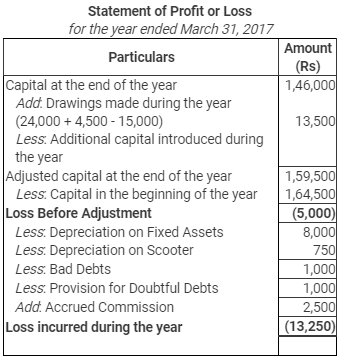

Ques 33: Gopal keeps incomplete records. On 1st April, 2016, his position was as follows:

His position on 31st March, 2017 was as follows:

Cash in hand ₹ 3,000; Cash at Bank ₹ 5,000; Stock ₹ 44,000; Debtors ₹ 21,000; Fixed Assets ₹ 80,000; Creditors ₹ 22,000.

You are informed that Gopal has taken stocks worth ₹ 4,500 for his private use and that he has been regularly transferring ₹ 2,000 per month from his business banking account by way of drawings. Out of his drawings he spent ₹ 15,000 for purchasing a Scooter for the business on 1st October, 2016.

You are requested to find out his profit or loss and to prepare the Statement of Affairs after considering the following :

1. Depreciate Fixed Assets and Scooter by 10% p.a.

2. Write off Bad-Debts ₹ 1,000 and provide 5% for doubtful debts on Sundry Debtors.

3. Commission earned but not received by him was ₹ 2,500.

Ans:

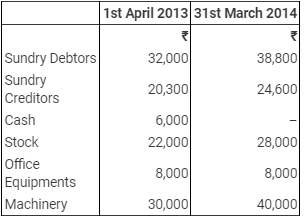

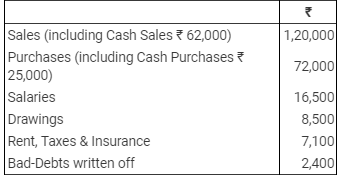

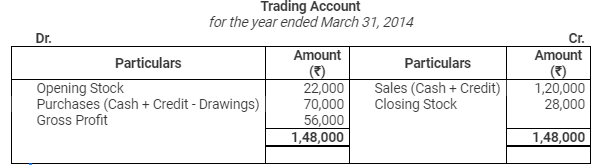

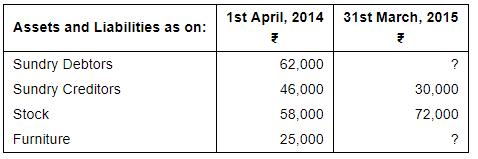

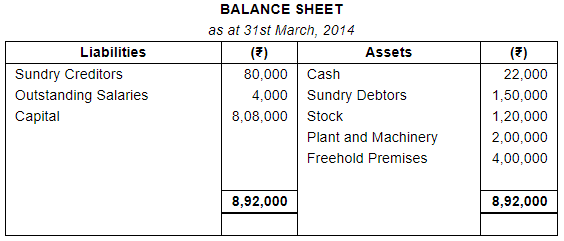

Ques 34: A retail trader did not keep his books on the double entry system. Following balances were obtained from his books:

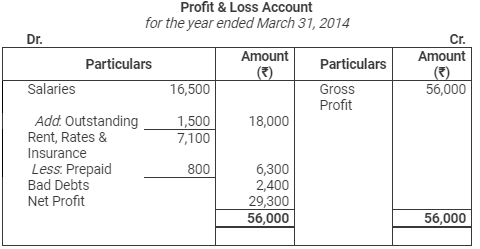

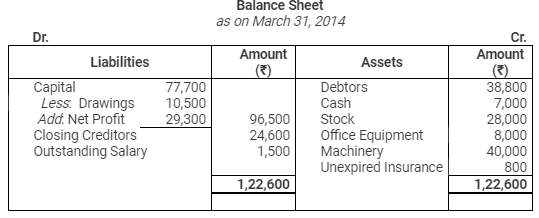

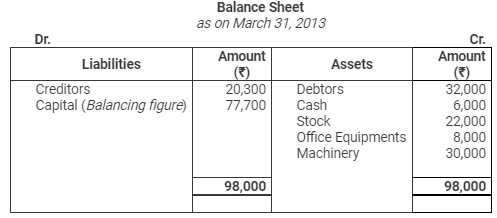

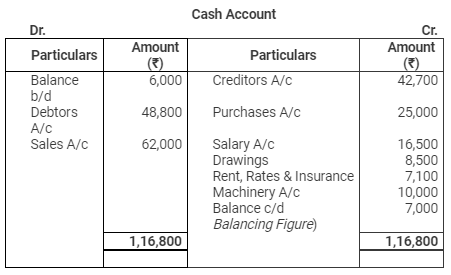

Following further details of the transactions for the year ended 31st March, 2014 are available from his incomplete records:

You are required to prepare his Trading, P & L A/c and Balance Sheet after considering the following:

1. ₹ 1,500 are outstanding for salaries.

2. Insurance was unexpired to the extent of ₹ 800.

3. Goods worth ₹ 2,000 were used by the proprietor for personal use.

Ans:

Page No 23.58:

Question 35:

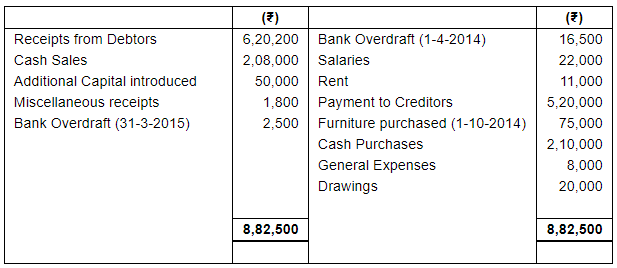

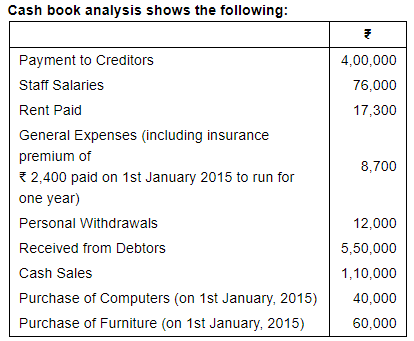

Mr. Manoj keeps incomplete records. During the year 2014-15 the analysis of his cash book was as under:-

Other Informations:

(i) Credit sales during the year were ₹ 7,00,000

(ii) Sales Returns were ₹ 10,000

(iii) Discount allowed to debtors ₹ 8,400

(iv) Discount received from creditors ₹ 6,000

(v) Bad-debts written off during the year ₹ 11,400

Adjustments:

(i) Write off further bad-debts ₹ 2,000.

(ii) Provide 5% for doubtful debts and 2% for discount on debtors and creditors.

(iii) Charge 10% p.a. depreciation on furniture.

(iv) One month salaries and one month rent was outstanding.

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2015 and a Balance Sheet as at that date.

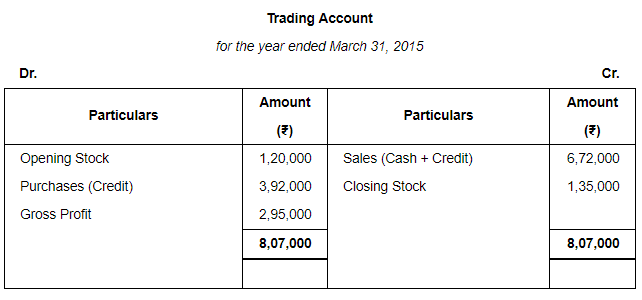

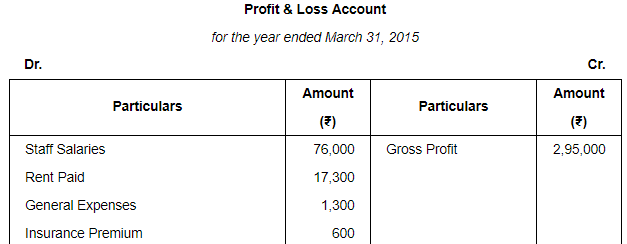

ANSWER:

Working Notes:

Page No 23.59:

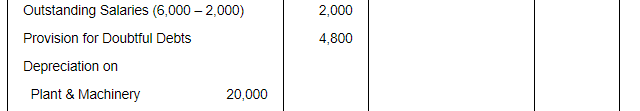

Question 36:

Sh. Param Bhushan does not maintain proper books of accounts. From the following, prepare his trading and profit & loss account for the year ended 31st March, 2015, together with balance sheet as at that date:

Closing Stock ₹ 1,35,000; Closing Debtors ₹ 1,92,000; Closing Creditors ₹ 72,000; Outstanding Salaries at the end ₹ 6,000; General Expenses include ₹ 5,000 for house rent of Sh. Param Bhushan and Cash Sale include ₹ 30,000 for sale of his personal jewellery.

Create a provision of

for doubtful debts and depreciate plant and machinery by 10% p.a. and computers and furniture by 20% p.a. Also provide 5% for group incentive commission to staff on net profit after charging such commission.

for doubtful debts and depreciate plant and machinery by 10% p.a. and computers and furniture by 20% p.a. Also provide 5% for group incentive commission to staff on net profit after charging such commission.ANSWER:

Working Notes:

FAQs on Accounting from Incomplete Records (Part - 3) - Commerce

| 1. What is accounting from incomplete records? |  |

| 2. How can accounting from incomplete records be done effectively? |  |

| 3. What are the limitations of accounting from incomplete records? |  |

| 4. What are the advantages of accounting from incomplete records? |  |

| 5. What are the commonly used estimation techniques in accounting from incomplete records? |  |