Unit 3: Question & Answer - Admission of a New Partner | Accounting for CA Foundation PDF Download

(Question with Answer)

Ques 1: A and B are partners sharing profits and losses in the ratio 5:3. They admitted C and agreed to give him 3/10th of the profit. What is the new ratio after C’s admission?

(a) 35:42:17.

(b) 35:21:24.

(c) 49:22:29.

Ans: (b)

Ques 2: A and B are partners sharing profits in the ratio 5:3, they admitted C giving him 3/10th share of profit. If C acquires 1/5 from A and 1/10 from B, new profit sharing ratio will be:

(a) 5:6:3.

(b) 2:4:6.

(c) 17:11:12

Ans: (c)

Ques 3: C was admitted in a firm with 1/4th share of the profits of the firm. C contributes Rs 15,000 as his capital, A and B are other partners with the profit sharing ratio as 3:2. Find the required capital of A and B, if capital should be in profit sharing ratio taking C’s as base capital:

(a) Rs 27,000 and Rs 16,000 for A and B respectively.

(b) Rs 27,000 and Rs 18,000 for A and B respectively.

(c) Rs 32,000 and Rs 21,000 for A and B respectively.

Ans: (b)

Ques 4: A, B and C are partners sharing profits and losses in the ratio 6:3:3, they agreed to take D into partnership for 1/8th share of profits. Find the new profit sharing ratio.

(a) 12:27:36:42.

(b) 14:7:7:4.

(c) 1:2:3:4.

Ans: (b)

Ques 5: A and B are partners sharing profits and losses in the ratio of 3:2 (A’s Capital is Rs 30,000 and B’s Capital is Rs 15,000). They admitted C and agreed to give 1/5th share of profits to him. How much C should bring in towards his capital?

(a) Rs 9,000.

(b) Rs 12,000.

(c) Rs 11,250.

Ans: (c)

Ques 6: A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who brings in Rs 25,000 against capital and Rs 10,000 against goodwill. New profit sharing ratio is 1:1:1. In what ratio will this amount will be shared among the old partners A & B.

(a) Rs 8,000: Rs 2,000.

(b) Rs 5,000: Rs 5,000.

(c) Old partners will not get any share in the goodwill brought in by C.

Ans: (a)

Ques 7: A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs 25,000 against capital and Rs 10,000 against goodwill. New profit sharing ratio is 1:1:1. C brought cash for his share of Capital and agreed to compensate to A and B outside the firm. How this will be treated in the books of the firm.

(a) Cash brought in by C will only be credited to his capital account.

(b) Goodwill will be raised to full value in old ratio.

(c) Goodwill will be raised to full value in new ratio.

Ans: (a)

Ques 8: X and Y are partners sharing profits in the ratio of 3: 1. They admit Z as a partner who pays Rs 4,000 as Goodwill the new profit sharing ratio being 2:1: 1 among X, Y and Z respectively. The amount of goodwill will be credited to:

(a) X and Y as Rs 3,000 and Rs 1,000 respectively.

(b) X only

(c) Y only.

Ans: (b)

Practical questions

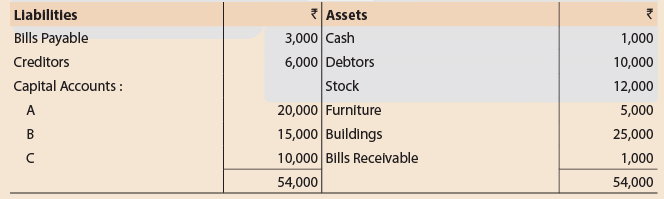

Ques 1: The following was the balance sheet of A, B and C who were equal partners on January 1, 2017

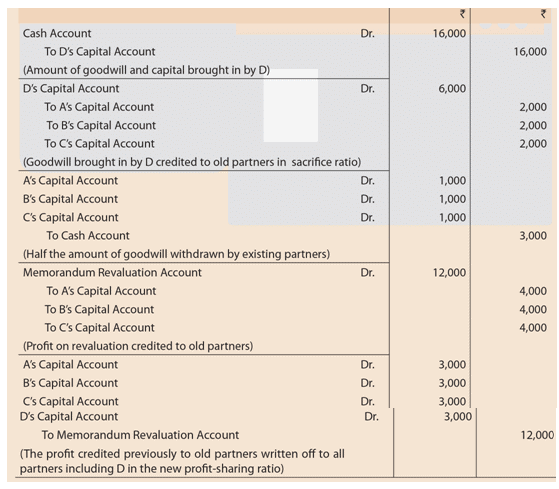

They agree to take D into partnership and give him a 1/4 share in the profits on the following terms:

(1) that D should bring in Rs 6,000 for goodwill and Rs 10,000 as capital;

(2) that one-half of the goodwill shall be withdrawn by old partners;

(3) that stock and furniture be depreciated by 10%.

(4) that a liability of Rs 1,300 be created against bills discounted;

(5) that the building be valued at Rs 40,000;

(6) that the values of liabilities and assets other than cash are not to be altered.

Give the necessary entries to give effect to the above arrangement; prepare revaluation account and opening balance sheet of the firm as newly constituted.

Ans:

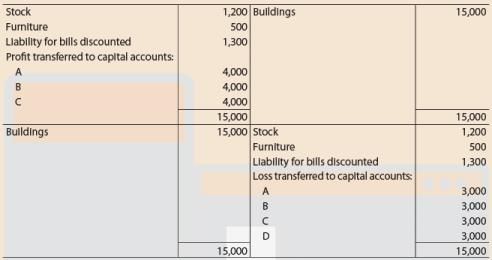

Memorandum Revaluation Account

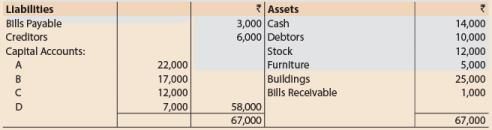

Balance Sheet of M/s. A, B, C and D As at 1st January, 2017

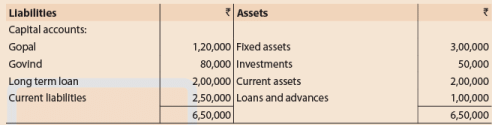

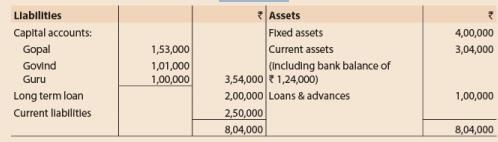

Ques 2: Gopal and Govind are partners sharing profits and losses in the ratio 60:40. The firms’ balance sheet as on 31.03.2016 was as follows:

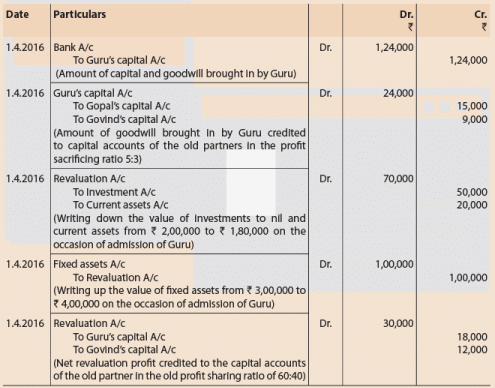

Due to financial difficulties, they have decided to admit Guru as partner in the firm from 01.04.2016 on the following terms:

Guru will be paid 40% of the profits. Guru will bring in cash Rs 1,00,000 as capital. It is agreed that goodwill of the firm will be valued at 2 years’ purchase of 3 years’ normal average profits of the firm and Guru will bring in cash his share of goodwill. It was also decided that the partners will not withdraw their share of goodwill nor will the goodwill appear in the books of account.

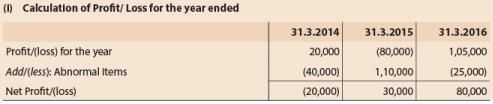

The profits of the previous three years were as follows:

For the year ended 31.3.2014: profit Rs 20,000 (includes insurance claim received of Rs 40,000).

For the year ended 31.3.2015: loss Rs 80,000 (includes voluntary retirement compensation paid Rs 1,10,000).

For the year ended 31.3.2016: profit of Rs 1,05,000 (includes a profit of Rs 25,000 on the sale of assets).

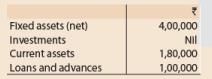

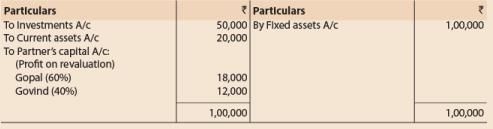

It was decided to revalue the assets on 31.03.2016 as follows:

The new profit sharing ratio after the admission of Guru was 35:25:40,

Pass journal entries on admission, show goodwill calculation and prepare revaluation account, partners’ capital accounts and balance sheet as on 01.04.2016 after the admission of Guru.

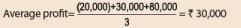

Ans: (i) Calculation of Profit/ Loss for the year ende

Two years’ purchase of average profits= 30,000 x 2=Rs 60,000

Goodwill to be brought in by Guru=Rs 60,000 x 40%=Rs 24,000

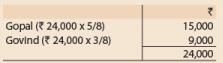

Goodwill brought in by Guru shared (at the profit sacrificing ratio) by:

(ii) Journal Entries

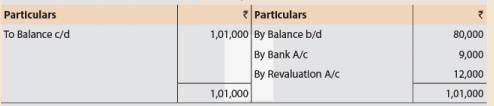

(iii) Revaluation Account

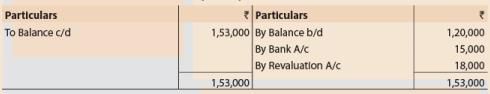

(iv) Partner’s Capital Accounts: Gopal’s Capital Account

Govind’s Capital Account

Guru’s Capital Account

Balance Sheet (after admission of Guru) as on 1.4.2016

Working Notes:

1. Calculation of profit sacrificing ratio Profit sacrificed by Gopal=60%-35%=25% Profit sacrificed by Govind =40%-25%=15% Sacrificing ratio =25%: 15% or 5:3

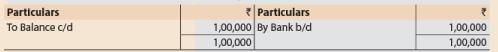

2. Bank balance after admission of Guru:

Bank Account

|

68 videos|265 docs|83 tests

|

FAQs on Unit 3: Question & Answer - Admission of a New Partner - Accounting for CA Foundation

| 1. What is admission of a new partner in a business? |  |

| 2. What are the reasons for admitting a new partner in a business? |  |

| 3. How is the admission of a new partner recorded in the books of accounts? |  |

| 4. What are the legal requirements for admitting a new partner in a business? |  |

| 5. How does the admission of a new partner affect the financial statements of a business? |  |