CA Foundation Exam > CA Foundation Notes > ICAI Notes- Unit 1: Index Numbers- 2

ICAI Notes- Unit 1: Index Numbers- 2 - CA Foundation PDF Download

Summary

- An index number is a ratio or an average of ratios expressed as a percentage, Two or more time periods are involved, one of which is the base time period.

- Issues Involved in index numbers

(a ) Selection of Data

(b) Base period

(c) Selection of Weights:

(d) Use of Averages:

(e) Choice of Variables

Construction of Index Number

Price Index numbers

(a) Simple aggregative price index =

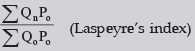

(b) Laspeyres’ Index: In this Index base year quantities are used as weights:

Laspeyres Index =

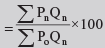

(c) Paasche’s Index: In this Index current year quantities are used as weights:

Passche’s Index  (d) The Marshall-Edgeworth index uses this method by taking the average of the base year and the current year

(d) The Marshall-Edgeworth index uses this method by taking the average of the base year and the current year

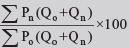

Marshall-Edgeworth Index =

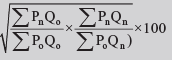

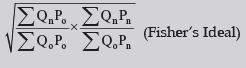

- Fisher’s ideal Price Index: This index is the geometric mean of Laspeyres’ and Paasche’s.

Fisher’s Index =

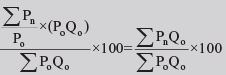

- Weighted Average of Relative Method:

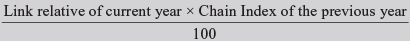

- (h) Chain Index =

Quantity Index Numbers:

- Simple aggregate of quantities:

- The simple average of quantity relatives:

- Weighted aggregate quantity indices:

(i) With base year weight :

(ii) With current year weight :

(iii) Geometric mean of (i) and (ii) :

- Base-year weighted average of quantity relatives. This has the formula

- Value Indices

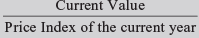

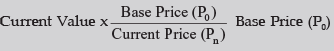

- Deflated Value =

or

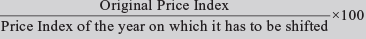

- Shifted Price Index =

- Test of Adequacy

(1) Unit test (2) Time reversal Test (3) Factor reversal test (4) Circular Test

The document ICAI Notes- Unit 1: Index Numbers- 2 - CA Foundation is a part of CA Foundation category.

All you need of CA Foundation at this link: CA Foundation

FAQs on ICAI Notes- Unit 1: Index Numbers- 2 - CA Foundation

| 1. What are index numbers and why are they important in economics? |  |

Ans. Index numbers are statistical measures used to track changes in a specific variable or a group of variables over time. They are important in economics as they provide a way to compare and analyze changes in prices, production, or any other economic data over different periods. Index numbers help in understanding the direction and magnitude of changes and are widely used in economic forecasting and policy-making.

| 2. How is a price index calculated and what is its significance? |  |

Ans. A price index is calculated by taking the ratio of the current cost of a bundle of goods and services to the cost of the same bundle in a base period, and then multiplying it by 100. The formula is (Current Cost/Base Period Cost) x 100.

Price indexes are significant as they help measure inflation and changes in purchasing power. They are used to track and compare price levels over time, helping individuals, businesses, and policymakers understand the impact of price changes on the economy.

| 3. What are the limitations of using index numbers in economic analysis? |  |

Ans. While index numbers are useful in economic analysis, they have some limitations. One limitation is the selection of the base period, which can influence the interpretation of changes in the index. Another limitation is the inclusion or exclusion of certain items in the index, which may not accurately represent the overall economy. Additionally, index numbers do not capture qualitative aspects of changes and may not reflect individual preferences or regional variations.

| 4. How are index numbers used in measuring GDP and economic growth? |  |

Ans. Index numbers play a crucial role in measuring GDP (Gross Domestic Product) and economic growth. GDP is a measure of the total value of all goods and services produced in an economy. Index numbers are used to calculate the real GDP by adjusting the nominal GDP for changes in prices over time, providing a more accurate measure of economic growth.

By using index numbers, economists can compare GDP over different periods, account for the effects of inflation, and analyze the contribution of different sectors to overall economic growth.

| 5. How can index numbers be used to analyze stock market performance? |  |

Ans. Index numbers are widely used in analyzing stock market performance. Stock market indices, such as the S&P 500 or Dow Jones Industrial Average, are constructed using index numbers. These indices represent a basket of stocks that are chosen to represent the overall market or a specific sector.

By tracking changes in the index numbers of these stock market indices, investors and analysts can evaluate the performance of the stock market as a whole or specific sectors. Index numbers help in assessing trends, comparing different time periods, and making investment decisions based on market performance.

Related Searches