Accounting from Incomplete Records (Part - 4) - Commerce PDF Download

Page No 23.60:

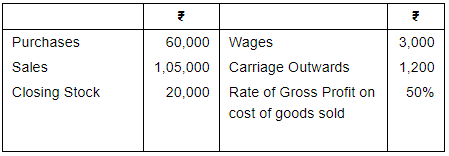

Question 37:

From the following particulars, ascertain the value of Opening Stock:-

ANSWER:

Rate of Gross Profit (on cost) = 50%

Rate of Gross Profit (on sales) = 33.33%

Gross Profit = 33.33% of (1,05,000) = 35,000

Gross Profit = Net Sales – Cost of Goods Sold

35,000 = 1,05,000 – Cost of Goods Sold

Cost of Goods Sold = 1,05,000 – 35,000 = ₹ 70,000

Cost of Goods Sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

70,000 = Opening Stock + 60,000 + 3,000 – 20,000

Opening Stock = 70,000 – 60,000 – 3,000 + 20,000 = ₹ 27,000

Page No 23.60:

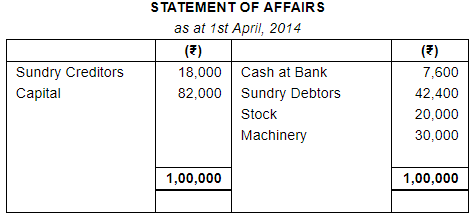

Question 38:

Mr. Bhardwaj has kept incomplete records. He submits to you the following information:

Bhardwaj banks all receipts and makes all payments only by means of cheques. Following is the analysis of his bank transactions:

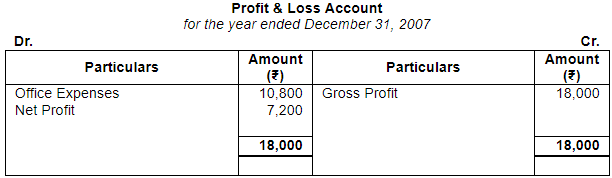

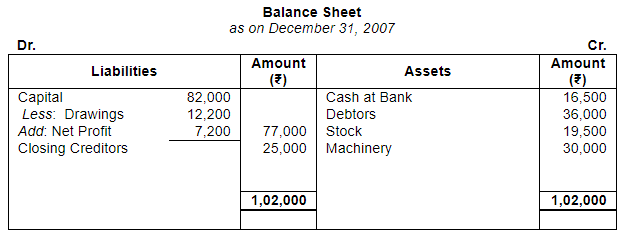

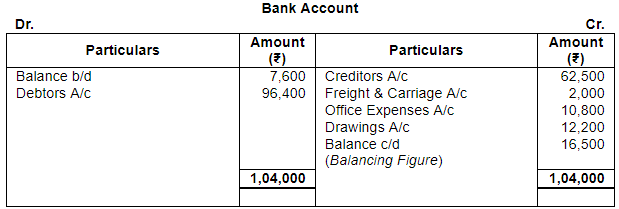

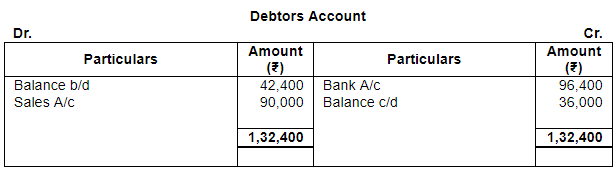

ANSWER:

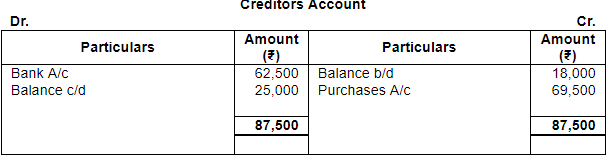

Working Notes:

Rate of Gross Profit (on sales) = 20%

Gross Profit = 20% of 90,000 = 18,000

Gross Profit = Net Sales – Cost of Goods Sold

18,000 = 90,000 – Cost of Goods Sold

Cost of Goods Sold = 90,000 – 18,000 = ₹ 72,000

Cost of Goods Sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

72,000 = 20,000 + 69,500 + 2,000 – Closing Stock

Closing Stock = 20,000 + 69,500 + 2,000 – 72,000 = ₹ 19,500

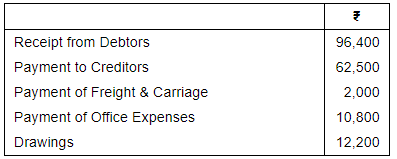

Page No 23.61:

Question 39:

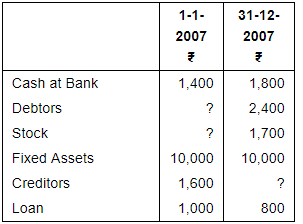

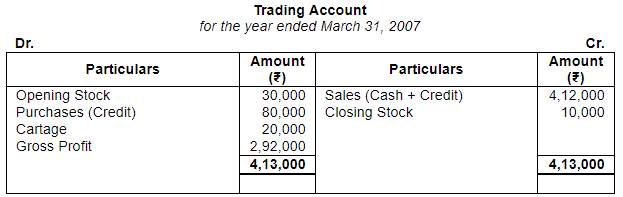

From the following records kept on single entry basis, prepare final accounts assuming that ratio of gross profit to sales is 25%:

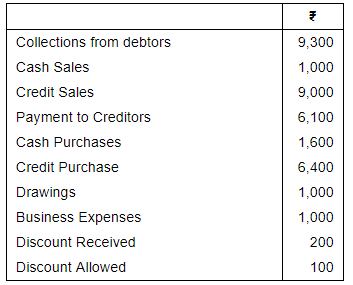

Transactions during the year 2007:

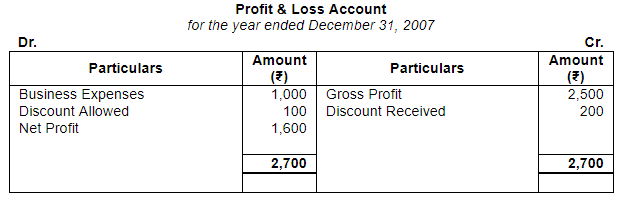

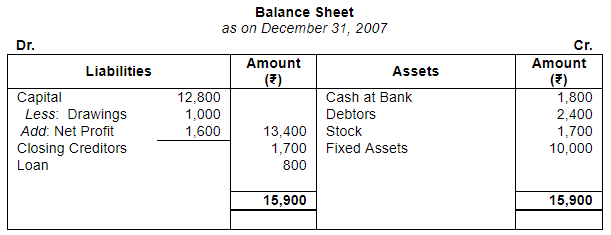

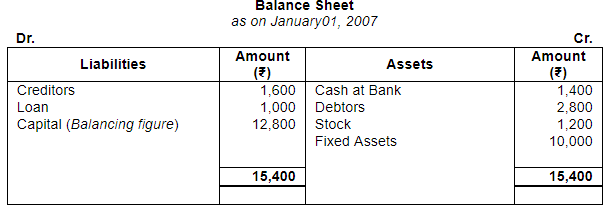

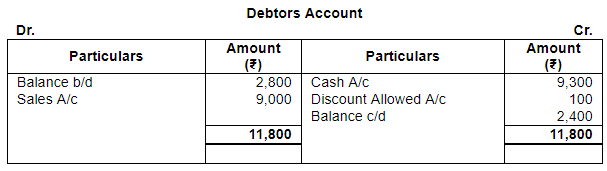

ANSWER:

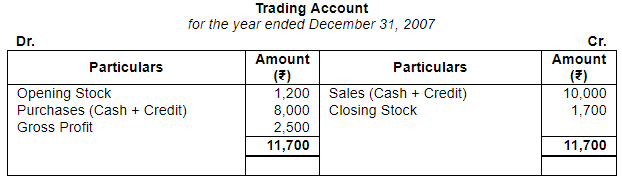

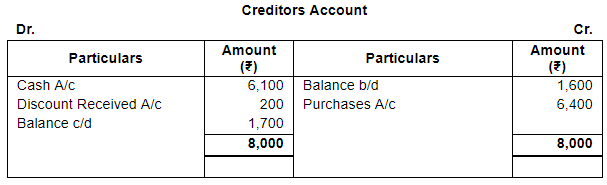

Working Notes:

Rate of Gross Profit (on sales) = 25%

Gross Profit = 25% of (1,000 + 9,000) = 2,500

Gross Profit = Net Sales – Cost of Goods Sold

2,500 = 10,000 – Cost of Goods Sold

Cost of Goods Sold = 10,000 – 2,500 = ₹ 7,500

Cost of Goods Sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

7,500 = Opening Stock + (1,600 +6,400) + 0 – 1,700

Opening Stock = 7,500 – 8,000 + 1,700 = ₹ 1,200

Page No 23.62:

Question 40:

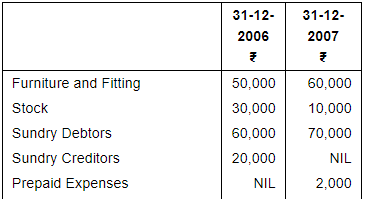

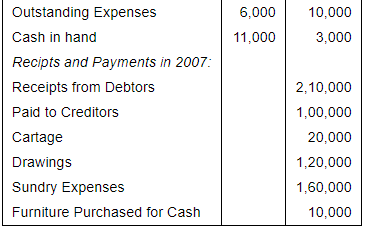

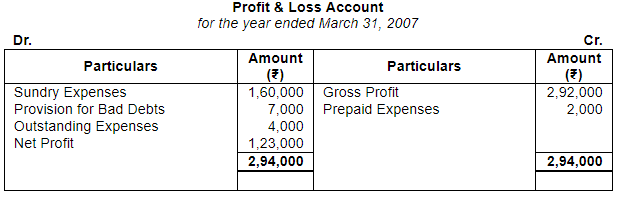

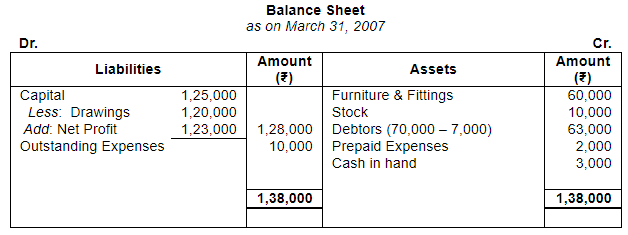

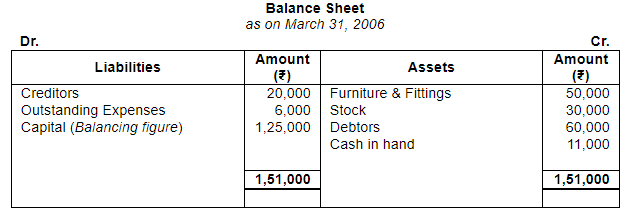

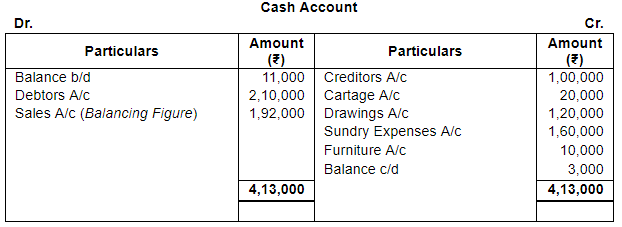

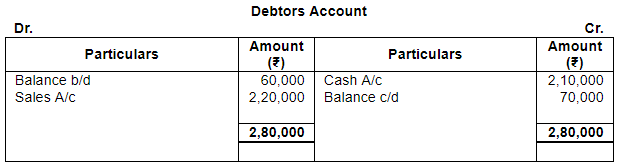

Sonam keeps his books on single entry and provides you with the following information:

ANSWER:

Working Notes:

Page No 23.62:

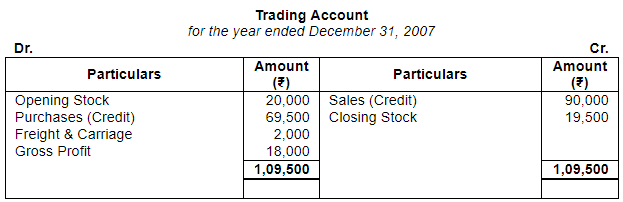

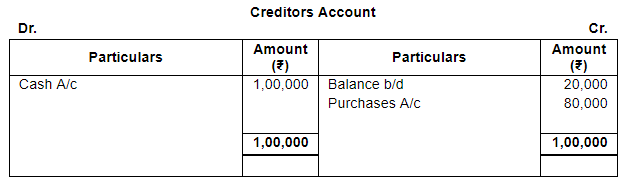

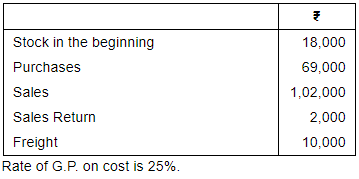

Question 41:

Ascertain the value of Closing Stock from the following:

ANSWER:

Rate of Gross Profit (on cost) = 25%

Rate of Gross Profit (on sales) = 20%

Gross Profit = 20% of 1,00,000 = 20,000

Gross Profit = Net Sales – Cost of Goods Sold

20,000 = 1,00,000 – Cost of Goods Sold

Cost of Goods Sold = 1,00,000 – 20,000 = ₹ 80,000

Cost of Goods Sold = Opening Stock + Purchases + Direct Expenses – Closing Stock

80,000 = 18,000 + 69,000 + 10,000 – Closing Stock

Closing Stock = 18,000 + 69,000 + 10,000 – 80,000 = ₹ 17,000

FAQs on Accounting from Incomplete Records (Part - 4) - Commerce

| 1. What is accounting from incomplete records? |  |

| 2. What are the challenges of accounting from incomplete records? |  |

| 3. How can accounting from incomplete records be done? |  |

| 4. What are the limitations of accounting from incomplete records? |  |

| 5. How can accounting from incomplete records affect business decisions? |  |