Financial Statements with Adjustments (Part - 3) - Commerce PDF Download

Page No 22.100:

Question 22:

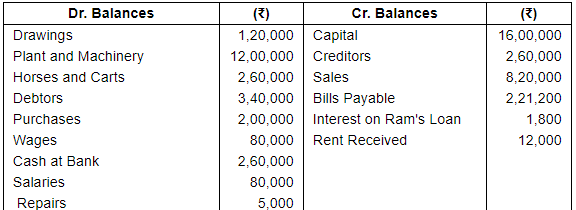

From the following Trial Balance extracted from the books of Sh. Pawan Kumar, prepare a Trading Account, Profit & Loss Account for the year ended 31st March, 2014 and a Balance Sheet as at that date :

Adjustments:-

1. Plant and Machinery includes a new machinery purchased on 1st October, 2013 for ₹ 2,00,000.

2. Depreciate Plant and Machinery by 10% p.a. and Horses and Carts by 20% p.a.

3. Salaries for the month of February and March 2014 are outstanding.

4. Goods worth ₹ 15,000 were sold and dispatched on 27th March but no entry was passed to this effect.

5. Make a provision for Doubtful Debts at 5% on Debtors.

ANSWER:

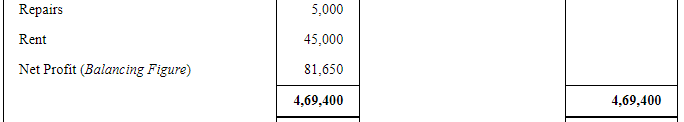

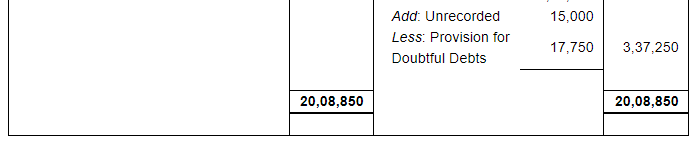

Financial Statement of Sh. Pawan Kumar

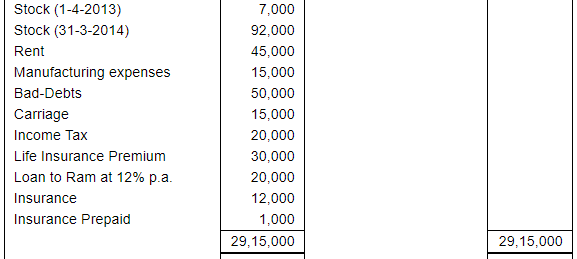

Trading Account

for the year ended March 31, 2014

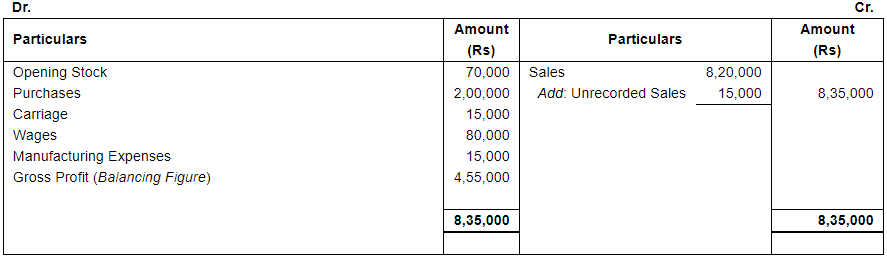

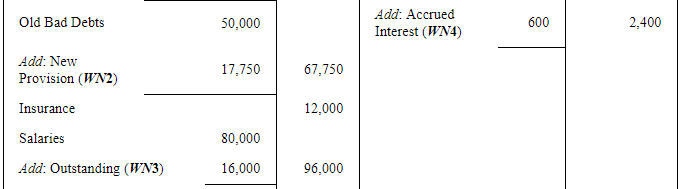

Profit and Loss Account

for the year ended March 31, 2014

Working Notes:

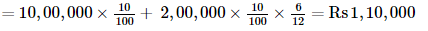

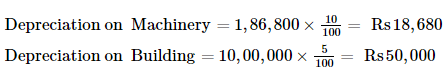

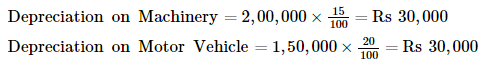

WN1: Calculation of Amount of Depreciation

Depreciationon Plant & Machinery

Depreciationon Horse &Carts =

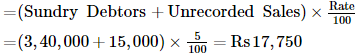

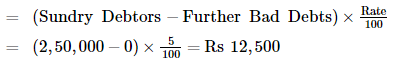

WN2: Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts

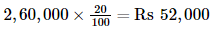

WN3: Calculation of Outstanding Expenses

WN4: Calculation of Accrued Interest on Ram’s Loan

Page No 22.101:

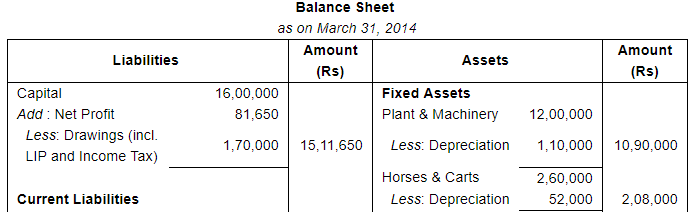

Question 23:

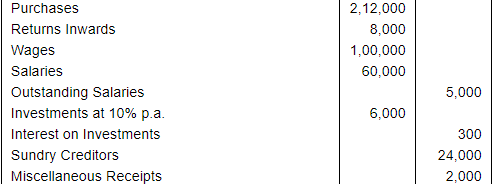

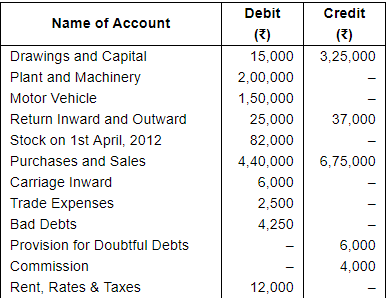

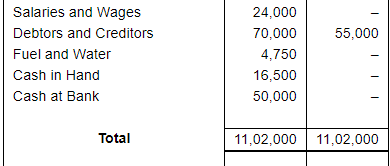

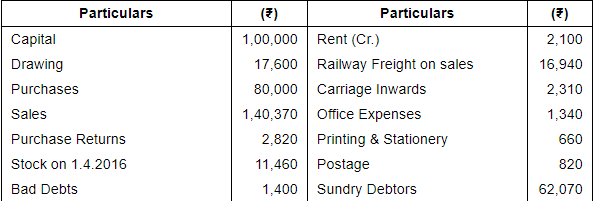

The following balances were extracted from the books of Modern Traders as at 31st March, 2017:-

Prepare Final Accounts for the year ended 31st March, 2017 after taking into account the following:

(i) Stock on 31st March, 2017 was valued at ₹ 15,000.

(ii) Goods costing ₹ 6,000 were sent to a customer on "Sale on Return basis" for ₹ 7,200 on 26th March, 2017 and had been recorded in the books as actual sales.

(iii) Provision for Doubtful Debts is to be maintained at 5% of the Debtors.

(iv) Prepaid Insurance was ₹ 100.

(v) Provide Depreciation on Plant and Machinery @ 10% and on Furniture @ 5%.

ANSWER:

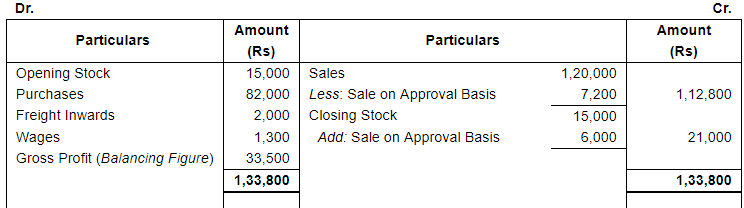

Financial Statements of Modern Traders

Trading Account

for the year ended March 31, 2017

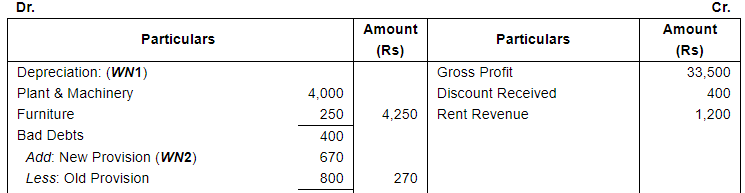

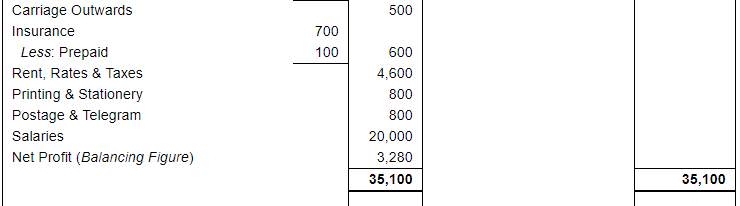

Profit and Loss Account

for the year ended March 31, 2017

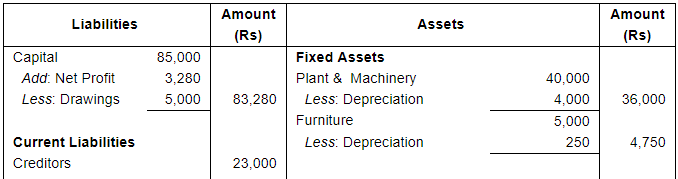

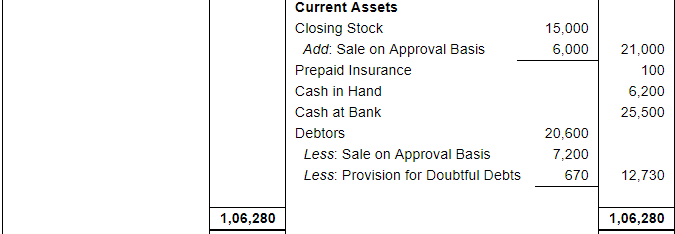

Balance Sheet

as on March 31, 2017

Working Notes:

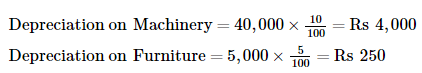

WN1: Calculation of Amount of Depreciation

WN2: Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts

Page No 22.101:

Question 24:

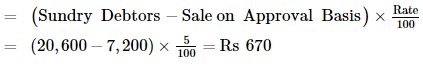

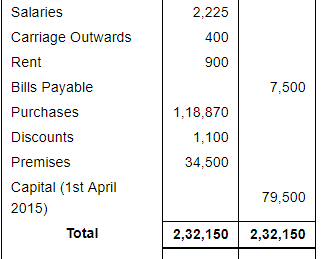

The following Trial Balance has been extracted from the books of Shri Santosh Kumar as at 31st March, 2017:-

The following additional information is available:-

(I) Stock on 31st March, 2017 was ₹ 30,800.

(II) Depreciation is to be charged on Plant and Machinery at 5% and Furniture at 6%. Loose Tools are revalued at ₹ 16,000.

(III) Create a provision of 2% for Discount on Debtors.

(IV) Salary of ₹ 2,000 paid to Shri B. Barua, a temporary employee, stands debited to his personal account and it is to be corrected.

(V) Write off 1/5th of advertisement expenses.

You are to prepare Trading and Profit & Loss Account for the year ended 31st March, 2017 and a Balance Sheet as at that date.

ANSWER:

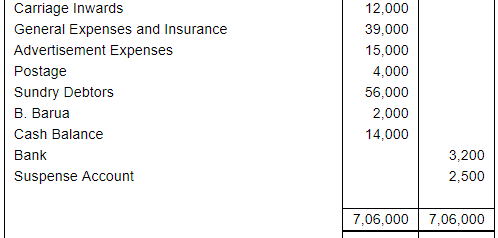

Financial Statements of Shri Santosh Kumar

Trading Account

for the year ended March 31, 2017

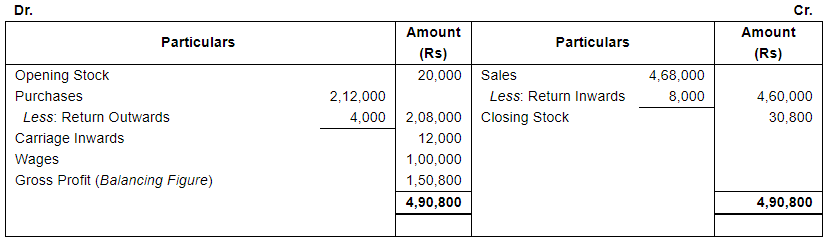

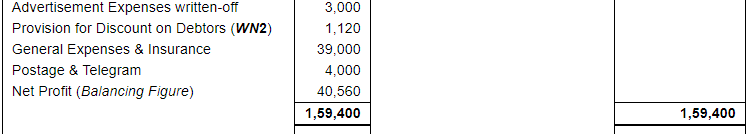

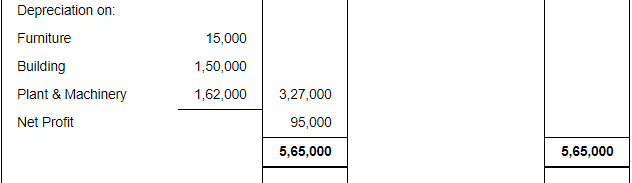

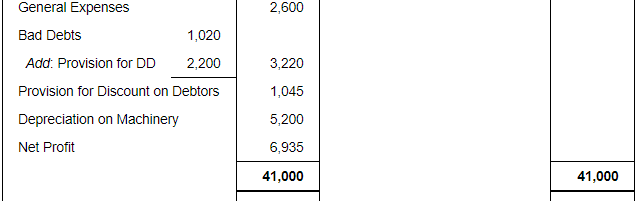

Profit and Loss Account

for the year ended March 31, 2017

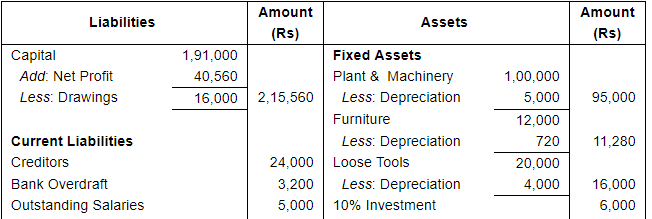

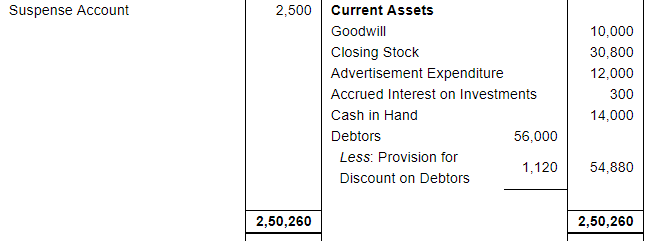

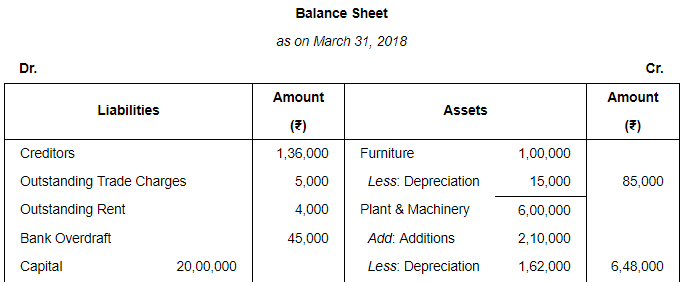

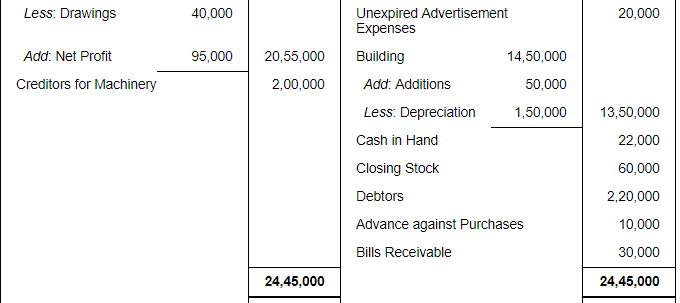

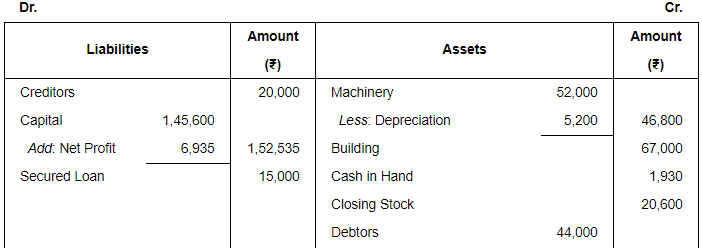

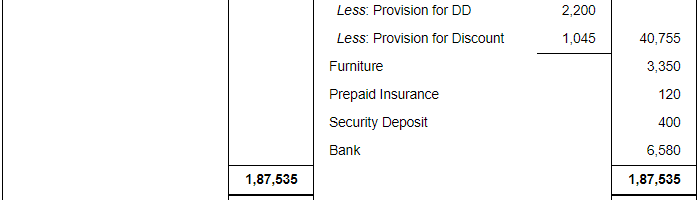

Balance Sheet

as on March 31, 2017

Working Notes:

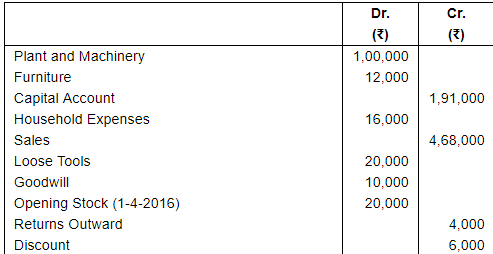

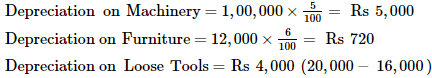

WN1: Calculation of Amount of Depreciation

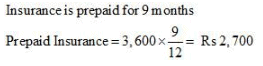

WN2: Calculation of Provision for Discount on Debtors

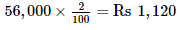

Provision for Discounton Debtors =

WN3: Calculation of Accrued Interest on Investment

Page No 22.102:

Question 25:

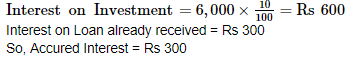

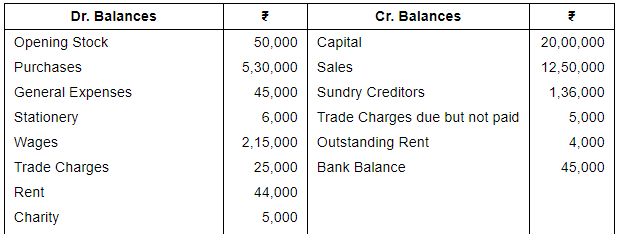

From the following Trial Balance of Sh. Swamy Narain, prepare Trading and Profit & Loss Account for the year ended 31st March 2018 and a Balance Sheet as at that date:

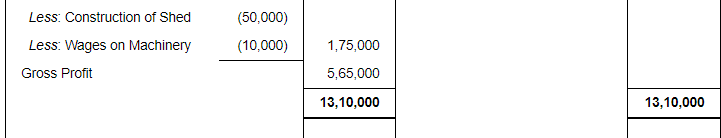

Adjustments:

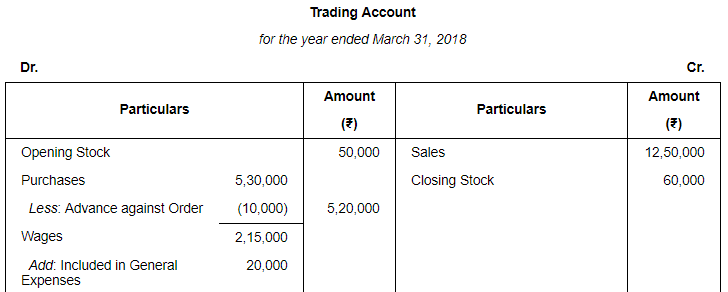

(i) Stock on 31 March, 2018 was valued at ₹ 60,000.

(ii) A new machine was installed during the year costing ₹ 2,00,000 but it was not recorded in the books. Wages paid for its installation ₹ 10,000 have been debited to Wages Account.

(iii) An advance of ₹ 10,000 given alongwith purchase order was wrongly recorded in purchases.

(iv) General expenses include ₹ 20,000 paid for Wages.

(v) Wages include a sum of ₹ 50,000 spent on the erection of a Scooter Stand for employees.

(vi) Advance for Furniture is for furniture at proprietor's residence.

(vii) Depreciate Furniture at 15%, Plant & Machinery at 20% and Building at 10%.

(viii) Carry forward 2/3 of Advertisement Expenses as unexpired.

(ix) A B/R of ₹ 20,000 was discounted with bank on 15 Nov. 2017, but not yet matured.

ANSWER:

Page No 22.103:

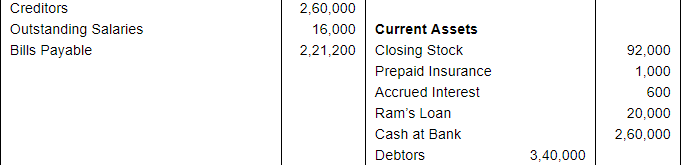

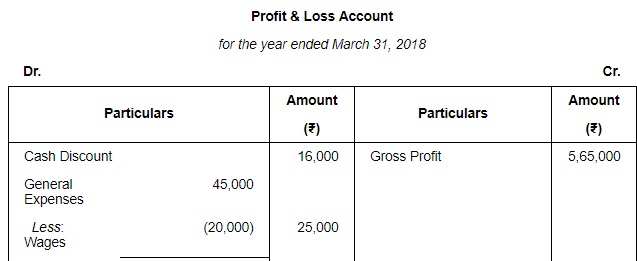

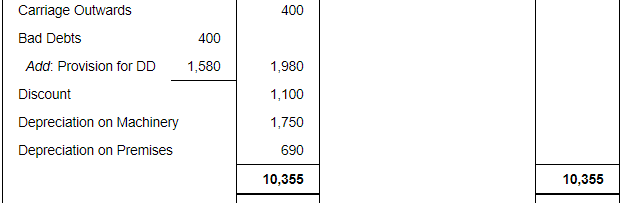

Question 26:

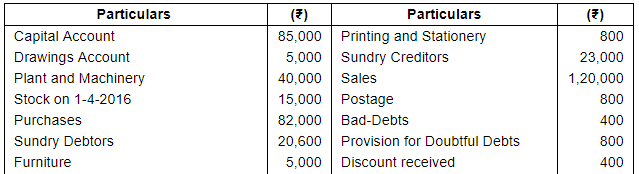

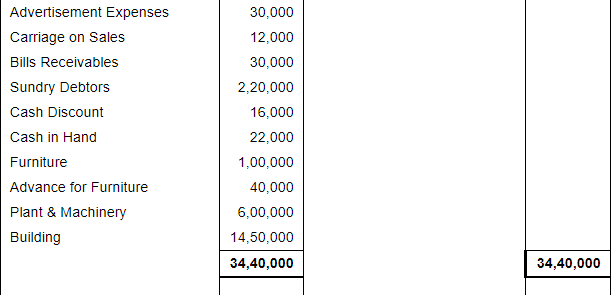

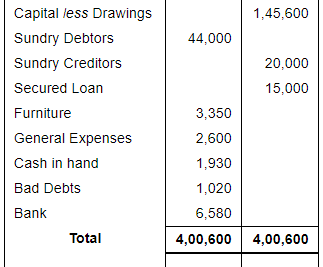

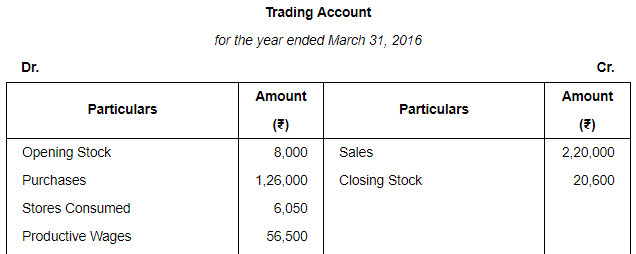

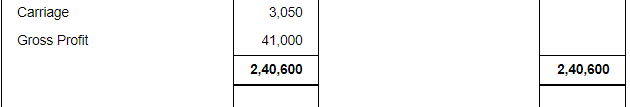

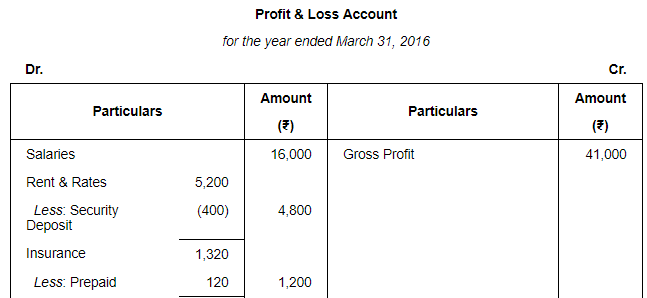

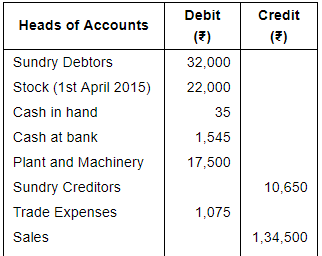

Following is the Trial Balance as on 31st March 2016. Prepare Trading and Profit and Loss Account and Balance Sheet :-

Additional Information :

(a) Stock on 31st March 2016 is ₹ 20,600.

(b) Depreciate machinery @ 10% p.a.

(c) Make a Provision @ 5% for Doubtful Debts.

(d) Provide  for discount on sundry debtors.

for discount on sundry debtors.

(e) Rent and Rates include security deposit of ₹ 400.

(f) Insurance prepaid ₹ 120.

ANSWER:

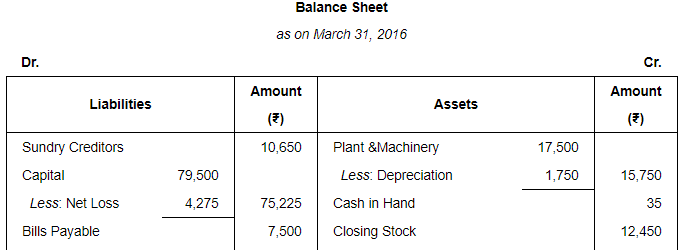

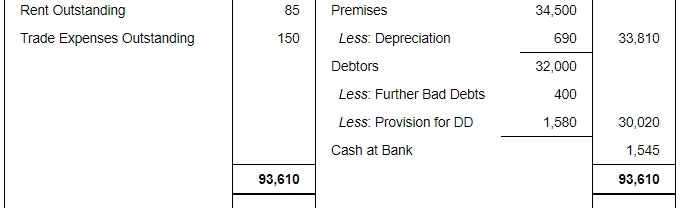

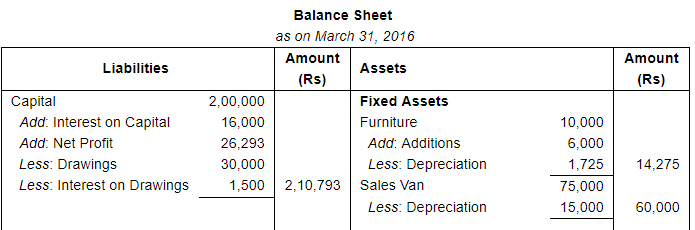

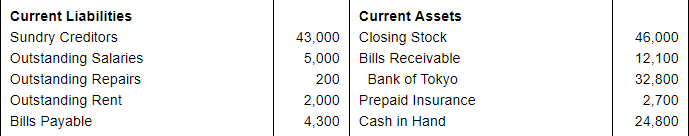

Balance Sheet

as on March 31, 2016

Page No 22.104:

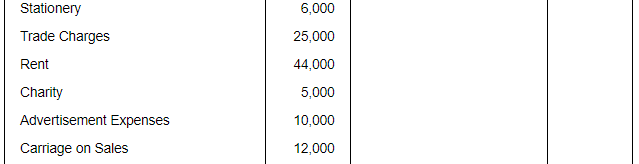

Question 27:

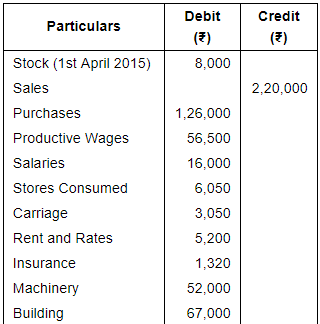

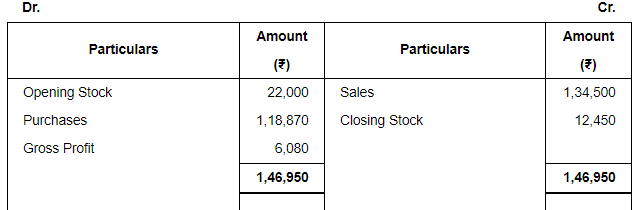

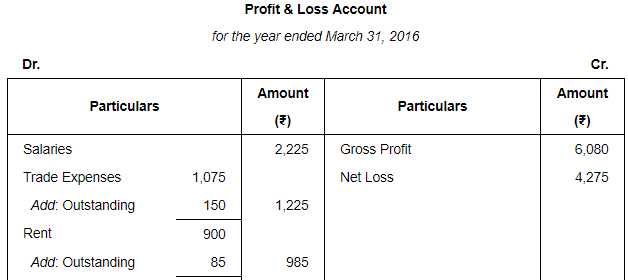

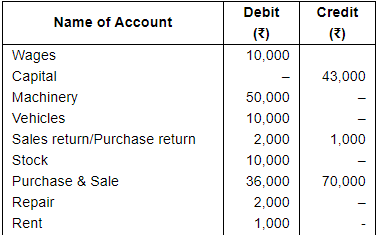

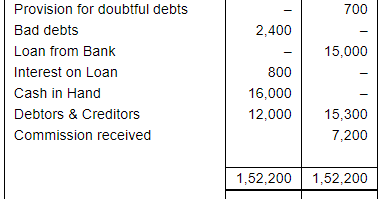

From the following Trial Balance and other information prepare Trading and Profit and Loss Account for the year ended 31st March 2016 and Balance Sheet as at that date.

Additional Information:

Stock on 31st March 2016 was ₹ 12,450. Rent was unpaid to the extent of ₹ 85 and ₹ 150 were outstanding for Trade Expenses. ₹ 400 are to be written off as bad debts out of the above debtors, and 5% is to be provided for doubtful debts. Depreciate plant and machinery 10% and premises by 2%. Manager is entitled a commission of 5% on net profit after charging his commission.

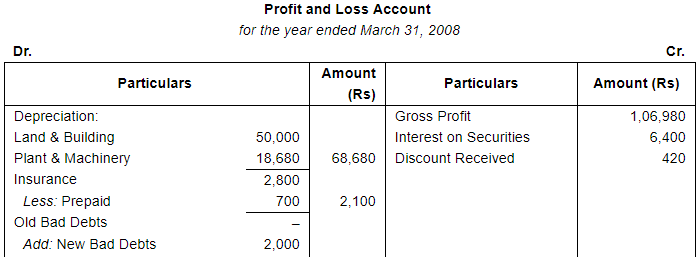

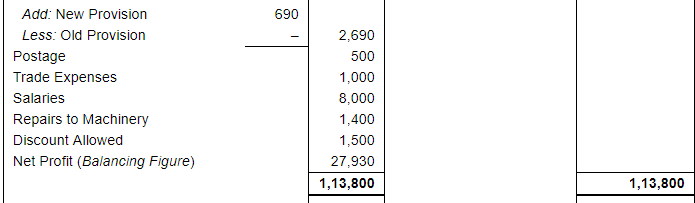

ANSWER:

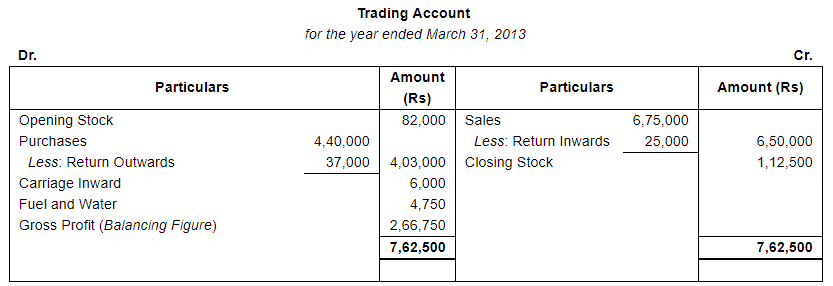

Trading Account

for the year ended March 31, 2016

Page No 22.105:

Question 28:

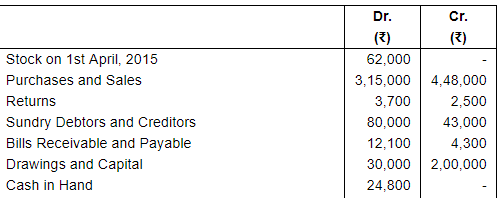

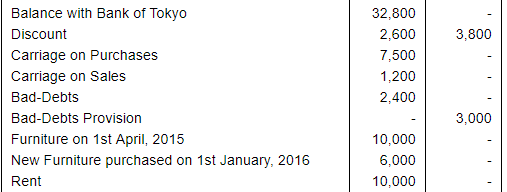

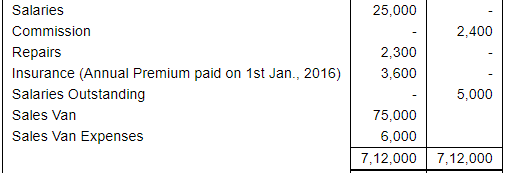

The following is the Trial Balance of Pankaj as on 31st March, 2015:

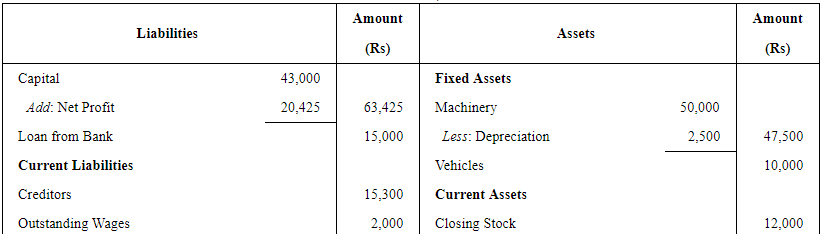

Adjustment:-

(i) Closing stock was valued at ₹ 12,000.

(ii) Wages have been paid for 10 months.

(iii) Write off ₹ 500 as further bad debts and provide 5% provision for doubtful debts.

(iv) Outstanding interest on loan ₹ 700.

(v) Depreciate machinery @ 5%

(b) Does question depict any value?

ANSWER:

(a)

Financial Statement of….

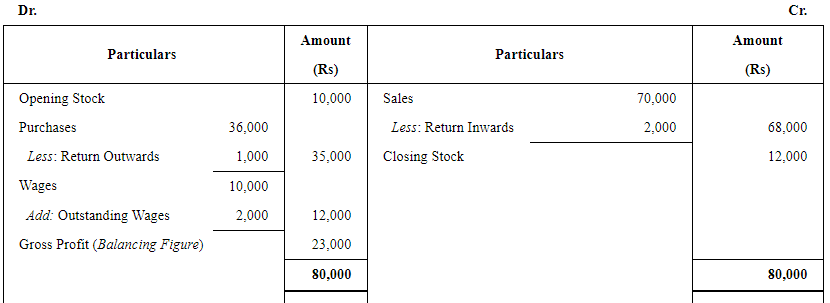

Trading Account

for the year ended 31 March,2015

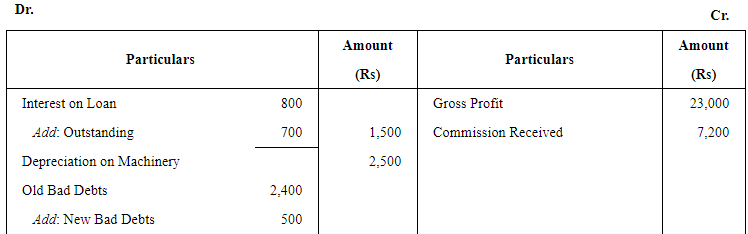

Profit and Loss Account

for the year ended March 31,2015

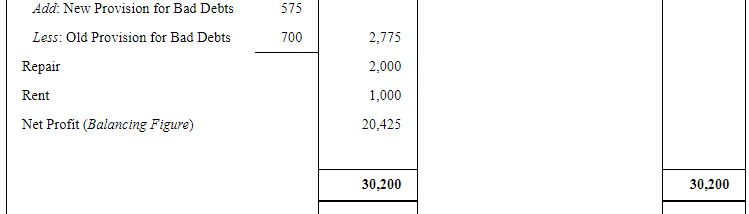

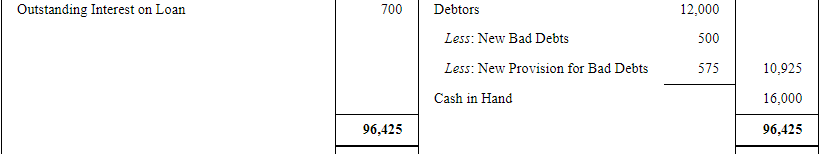

Balance Sheet

as on March 31, 2015

(b) Values Involved:

(i) Matching principle has been adopted (outstanding wages and depreciation)

(ii) Prudence principle has been adopted (provision for bad and doubtful debts)

Page No 22.106:

Question 29:

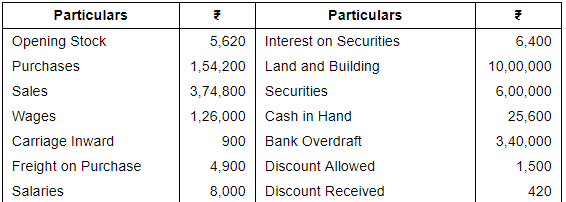

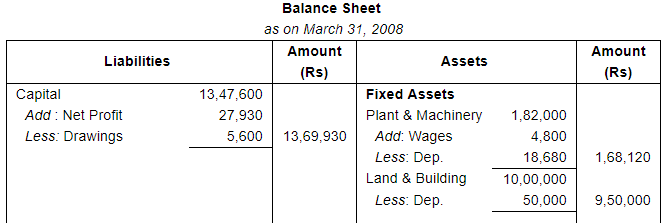

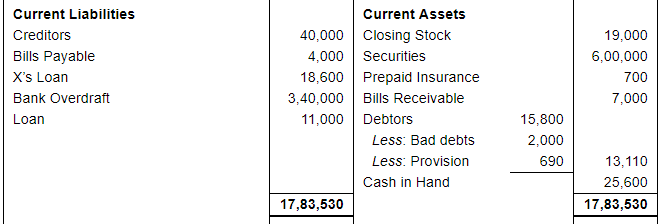

Following are balances from the trial balance of Ritesh Traders as at 31st March 2008:

Prepare Trading and Profit & Loss Account for the year ended 31st March 2008 and Balance Sheet as at that date after taking into account the following adjustments:

(i) Closing Stock was valued at ₹ 19,000.

(ii) Depreciation to be provided on Land and Building @ 5% p.a. and on Plant & Machinery @ 10% p.a.

(iii) Write off ₹ 2,000 as Bad debt.

(iv) Insurance was prepaid ₹ 700.

(v) Create provision for doubtful debts @ 5% on debtors.

(vi) Wages include ₹ 4,800 for installation of a new machinery.

ANSWER:

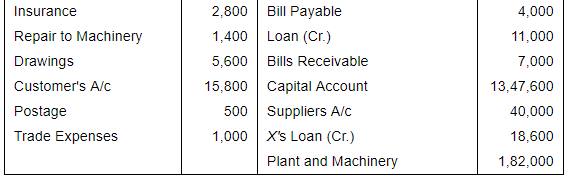

Financial Statement of Ritesh Traders

Trading Account

for the year ended March 31, 2008

Working Note:

WN1: Calculation of Depreciation

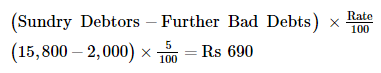

WN2: Calculation of Provision for Doubtful Debts

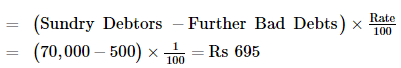

Provisionfor Doubtful Debts =

Page No 22.107:

Question 30:

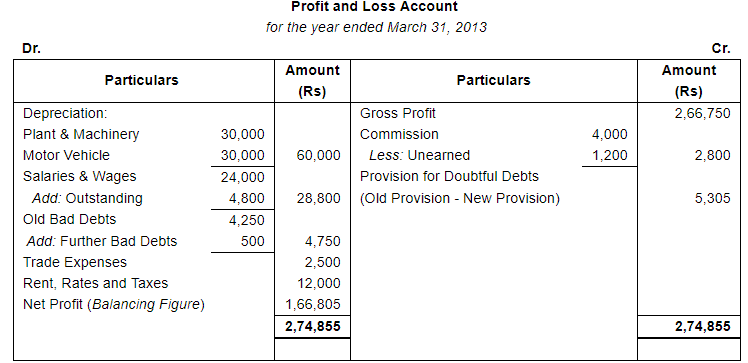

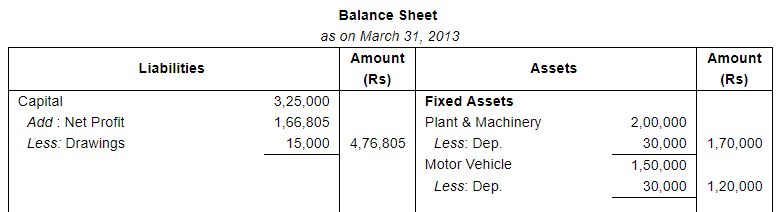

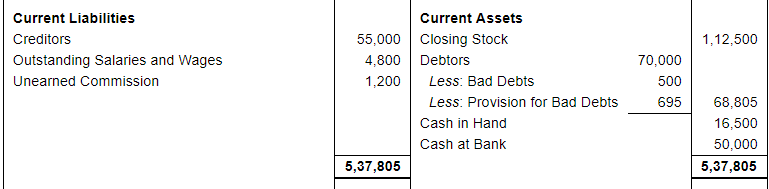

Prepare Trading and Profit and Loss Account and Balance Sheet from the following Trial Balance and information as on 31st March, 2013:

Adjustments:-

(i) Closing Stock was valued at ₹ 1,12,500.

(ii) Commission include ₹ 1,200 being commission received in advance.

(iii) Salaries and wages is outstanding for the month of Feb. & March, 2013.

(iv) Depreciate Plant & Machinery by 15% and Motor Vehicle by 20%.

(v) Write off ₹ 500 as further Bad Debts and maintain provision for doubtful debts at 1% on debtors.

ANSWER:

Working Note:

WN1: Calculation of Amount of Depreciation

WN2: Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts

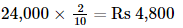

WN3: Calculation of Outstanding Salaries and Wages

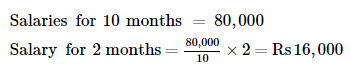

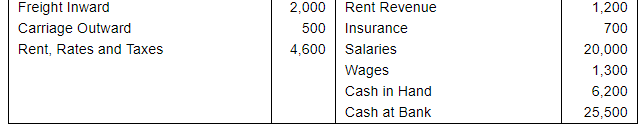

Salaries and Wages paid for 10 months = 24,000

Salaries and Wages outstanding for 2 months =

Page No 22.107:

Question 31:

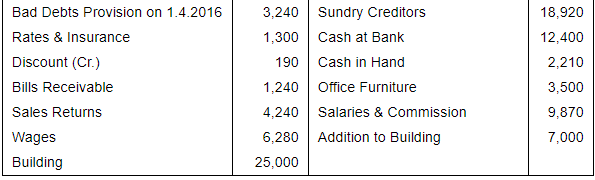

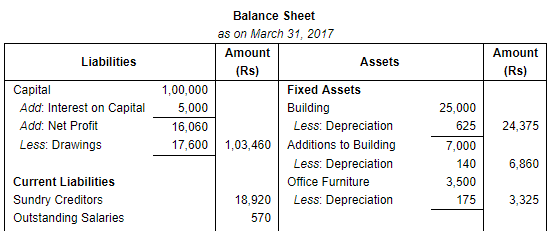

The following balances were taken from the books of Shri R. Lal as at 31st March, 2017.

Prepare Trading and Profit & Loss A/c and a Balance Sheet as at 31st March, 2017, after keeping in view the following adjustments:

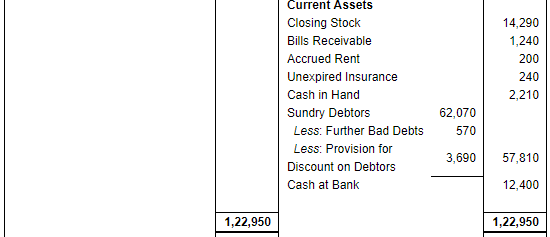

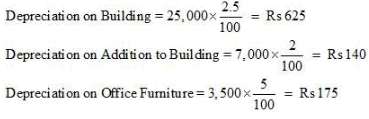

(i) Depreciate old Building at 2 1/2% and addition to Building at 2% and Office Furniture at 5%.

(ii) Write off further Bad-debts ₹ 570.

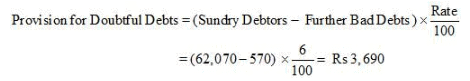

(iii) Increase the Bad-debts Provision to 6% of Debtors.

(iv) On 31st March, 2017 ₹ 570 are outstanding for salary.

(v) Rent receivable ₹ 200 on 31st March, 2017.

(vi) Interest on capital at 5% to be charged.

(vii) Unexpired Insurance ₹ 240.

(viii) Stock was valued at ₹ 14,290 on 31st March, 2017.

ANSWER:

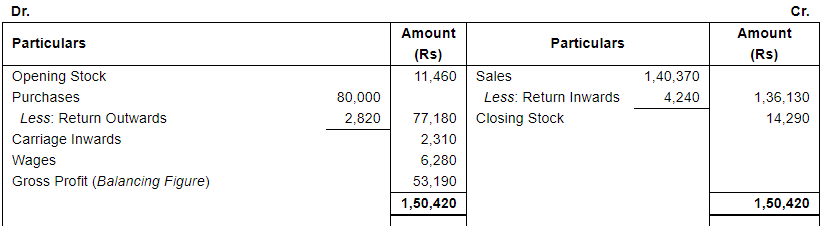

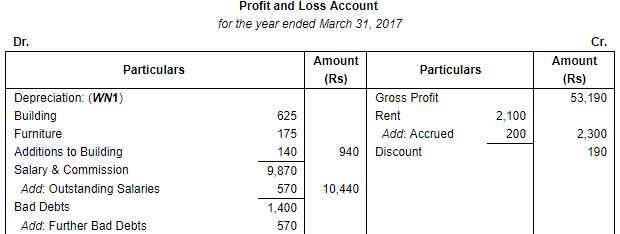

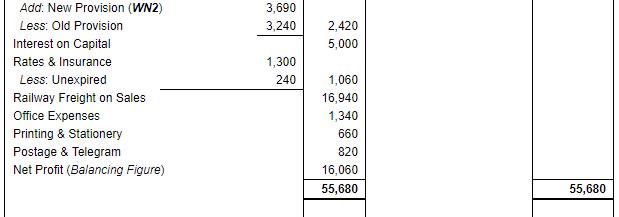

Financial Statements of Shri R. Lal

Trading Account

for the year ended March 31, 2017

Working Notes:

WN1: Calculation of Amount of Depreciation

WN2: Calculation of Provision for Doubtful Debts

Page No 22.108:

Question 32:

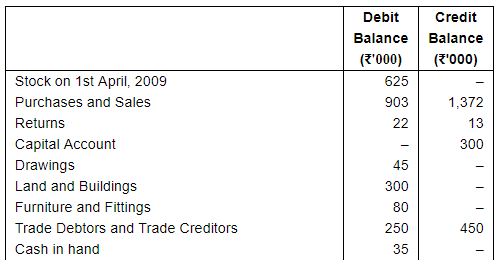

From the following balances extracted from the books of Karan and the additional information, prepare the trading and profit and loss account for the year ended 31st March, 2010 and also show the balance sheet as at that date:

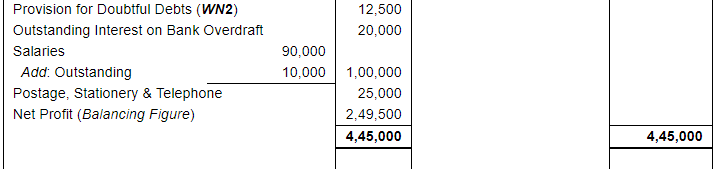

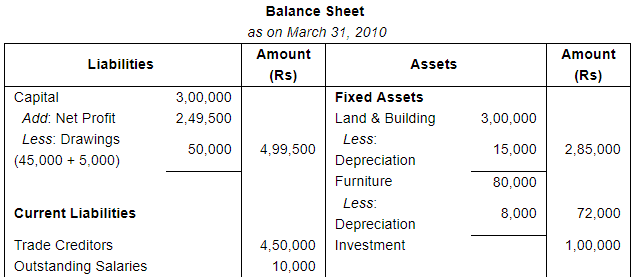

Additional Information:

(i) Closing stock on 31st March, 2010 is valued at ₹ 6,50,000. Goods worth ₹ 5,000 are reported to have been taken away by the proprietor for his personal use at home during the year.

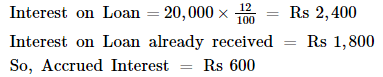

(ii) Interest on investments ₹ 5,000 is yet to be received while ₹ 10,000 of the commission received is yet to be earned.

(iii) ₹ 5,000 of the fire insurance premium paid is in respect of the quarter ending 30th June, 2010.

(iv) Salaries ₹ 10,000 for March, 2010 and bank overdraft interest estimated at ₹ 20,000 are yet to be recorded as outstanding charges.

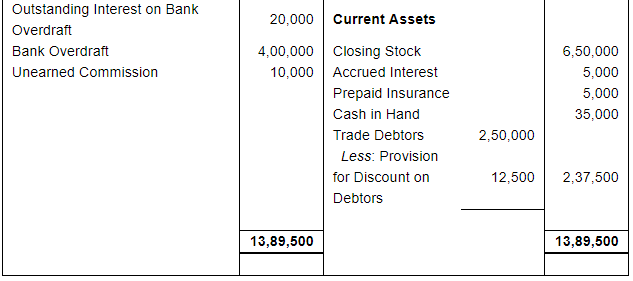

(v) Depreciation is to be provided on land and buildings @ 5% per annum and on furniture and fittings @ 10% per annum.

(vi) Make a provision for doubtful debts @ 5% of trade debtors.

ANSWER:

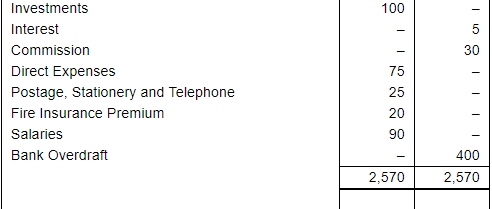

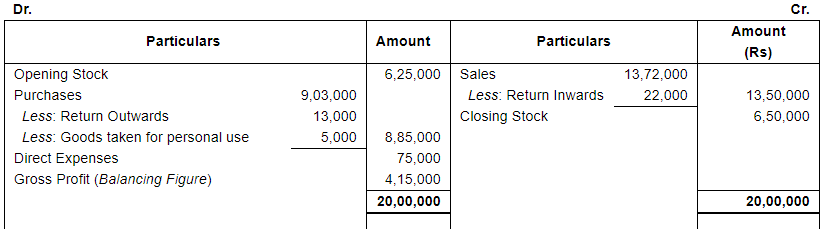

Financial Statements of Karan

Trading Account

for the year ended March 31, 2010

Working Notes:

WN1: Calculation of Amount of Depreciation

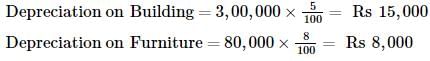

WN2: Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts

Page No 22.109:

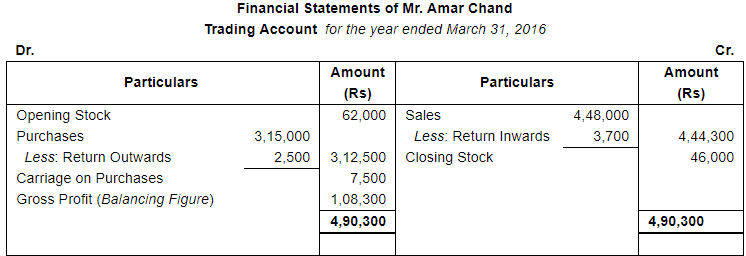

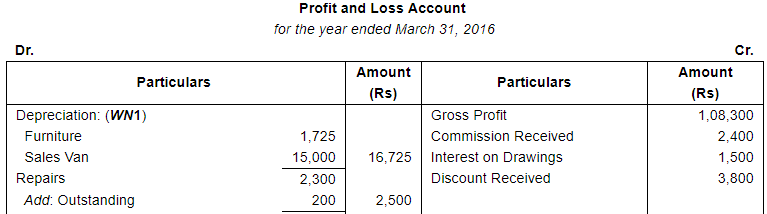

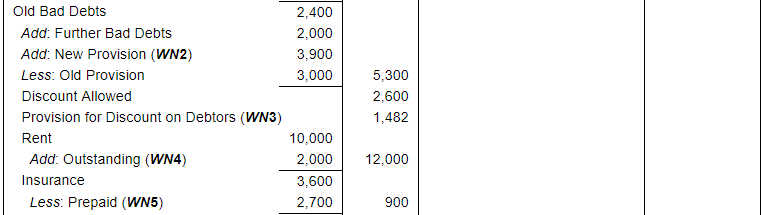

Question 33:

The following is the trial balance of Mr. Amar Chand as at 31st March, 2016:-

Taking into account the following adjustments, prepare Trading and Profit & Loss Account and the Balance Sheet as at 31st March, 2016:-

1. Stock on 31st March, 2016 was valued at ₹ 46,000.

2. Depreciate Furniture at 15% p.a. and Sales Van at 20% p.a.

3. A sum of ₹ 200 is due for repairs.

4. Write off ₹ 2,000 as further bad-debts and create a provision for doubtful debts @ 5% on Debtors. Also provide 2% for discount on Debtors.

5. Rent is paid at the rate of ₹ 1,000 per month.

6. Allow 8% interest on Capital and charge ₹ 1,500 as interest on Drawings.

ANSWER:

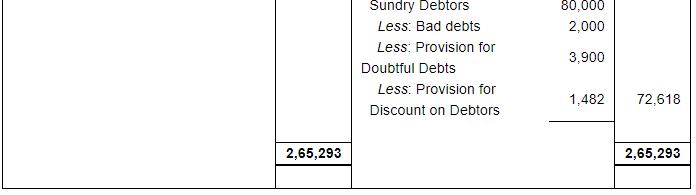

Working Notes:

WN1: Calculation of Amount of Depreciation

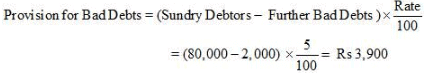

WN2: Calculation of Provision for Bad Debts

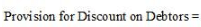

WN3: Calculation of Provision for Discount on Debtors

WN4: Calculation of Outstanding Rent

Rent is paid @ Rs 1,000 per month

Annual Rent = 1,000 × 12 = Rs 12,000

Rent Already Paid = Rs 10,000

Therefore, Outstanding Rent = Rs 2,000

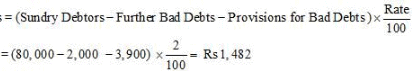

WN5: Calculation of Prepaid Insurance

FAQs on Financial Statements with Adjustments (Part - 3) - Commerce

| 1. What are financial statements with adjustments? |  |

| 2. Why are adjustments made to financial statements? |  |

| 3. What types of adjustments can be made to financial statements? |  |

| 4. How are adjustments reflected in financial statements? |  |

| 5. Who prepares financial statements with adjustments? |  |