Trial Balance and Errors (Part - 2) - Commerce PDF Download

Page No 14.29:

Question 6:

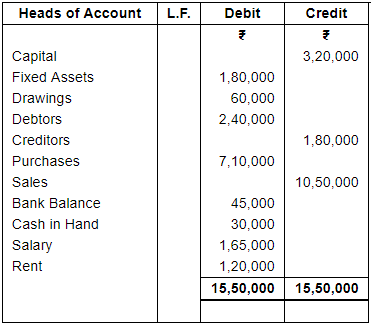

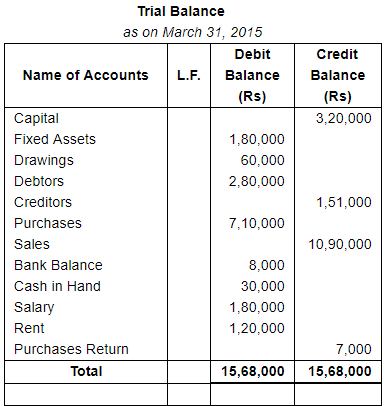

Following is the Trial Balance as at 31st March, 2015:

Having prepared the Trial Balance, it was discovered that following transactions remained unrecorded:

(i) Goods were sold on credit amounting to ₹ 40,000.

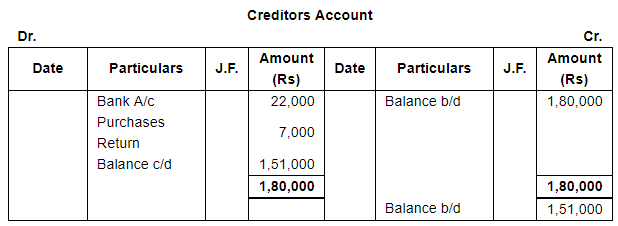

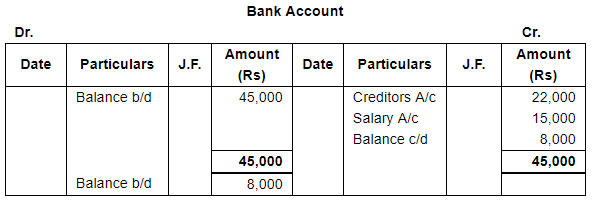

(ii) Paid to creditors ₹ 22,000 by cheque.

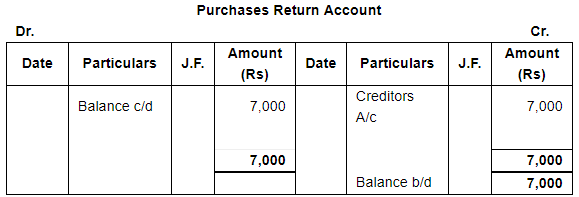

(iii) Goods worth ₹ 7,000 were returned to a supplier.

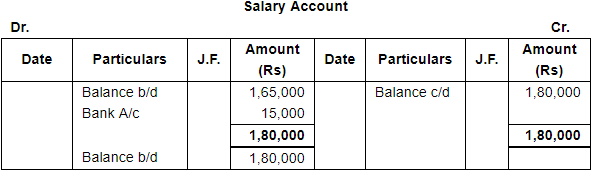

(iv) Paid salary ₹ 15,000 by cheque.

Required:

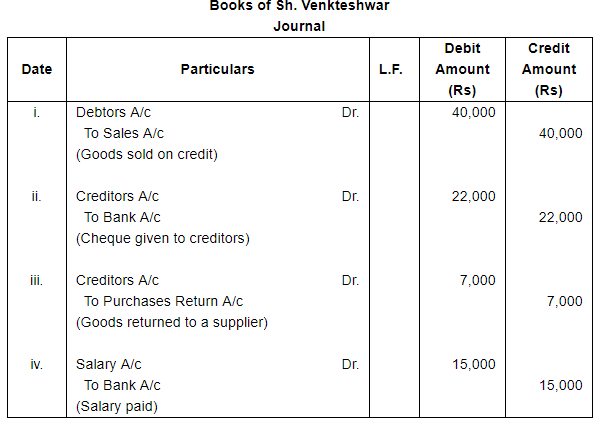

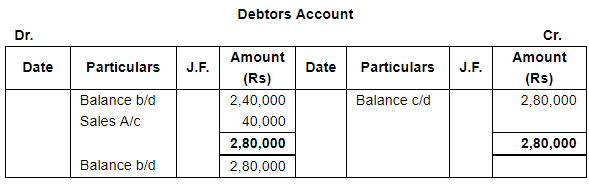

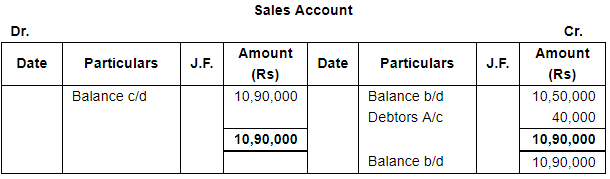

(i) Pass Journal entries for the above mentioned transactions and post them into Ledger

(ii) Redraft the Trial Balance.

ANSWER:

Page No 14.30:

Question 7:

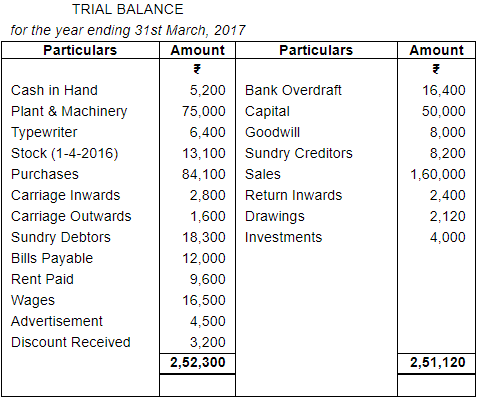

The following is the Trial Balance prepared by an inexperienced accountant. Redraft it in a correct form and give necessary notes : −

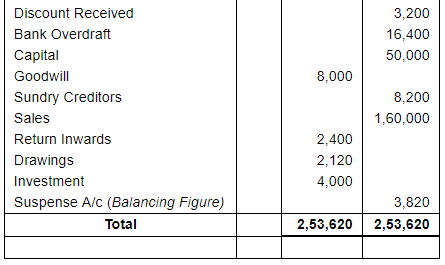

ANSWER:

Note: Since, the Trial Balance does not tally, thus, the difference of Rs 3,820 is transferred to the Credit Balance Column of Trial Balance

Page No 14.30:

Question 8:

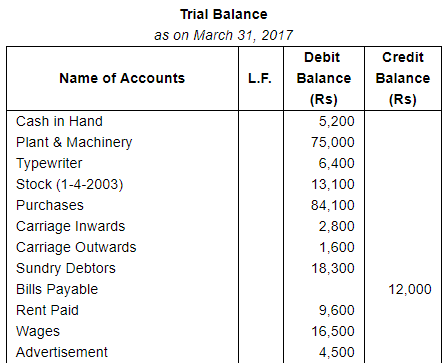

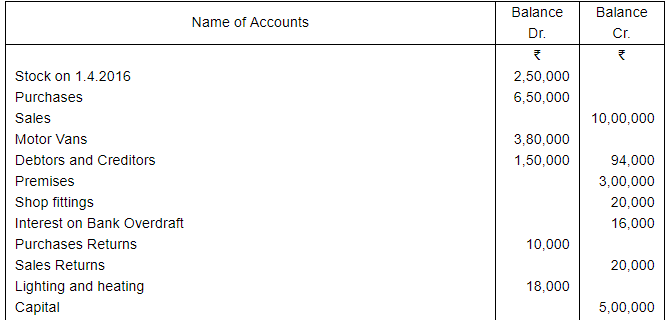

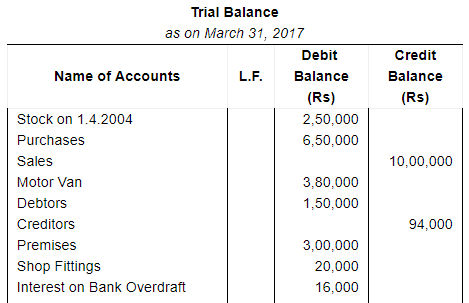

A book-keeper extracted the following Trial Balance as at 31st March, 2017 :

You are required to redraft the trial balance correctly.

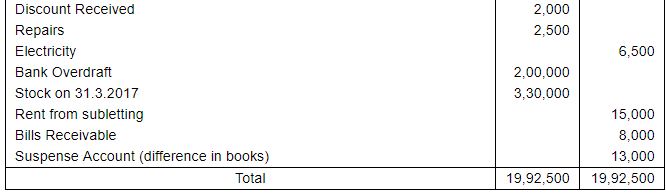

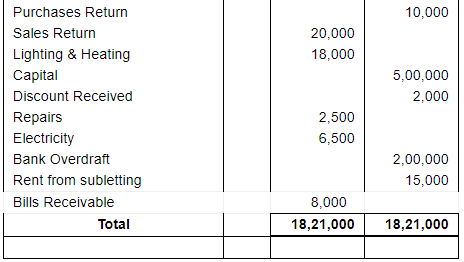

ANSWER:

Note: Closing Stock of Rs 3,30,000 will not appear in Trial Balance, because it has not been accounted yet.

Page No 14.31:

Question 9:

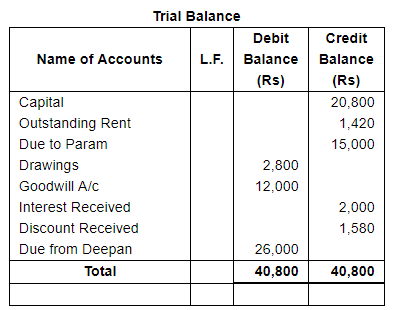

From the following ledger balances prepare trial balance :

Capital ₹ 20,800, Rent outstanding ₹ 1,420, Amount due to Param, ₹ 15,000, Drawing ₹ 2,800, Goodwill ₹ 12,000, Interest received ₹ 2,000, Discount received ₹ 1,580, Amount due from Deepan ₹ 26,000.

ANSWER:

FAQs on Trial Balance and Errors (Part - 2) - Commerce

| 1. What is a trial balance? |  |

| 2. What are the types of errors that can occur in a trial balance? |  |

| 3. How do you identify errors in a trial balance? |  |

| 4. What are some common causes of errors in a trial balance? |  |

| 5. How can trial balance errors be rectified? |  |